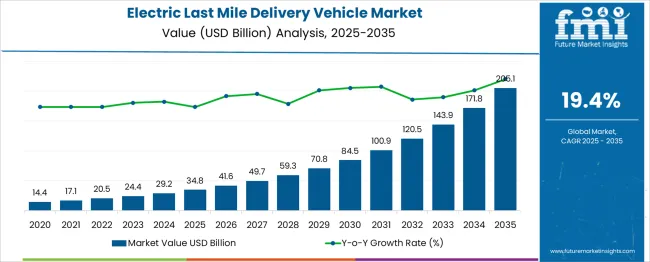

The global electric last mile delivery vehicle market is projected to grow from USD 34.8 billion in 2025 to approximately USD 205.1 billion by 2035, recording an absolute increase of USD 170.3 billion over the forecast period. This translates into a total growth of 489.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 19.4% between 2025 and 2035. The overall market size is expected to grow by nearly 5.89X during the same period, supported by increasing e-commerce penetration, rising environmental consciousness, stringent emission regulations, and growing urbanization driving demand for sustainable last-mile delivery solutions.

Between 2025 and 2030, the electric last mile delivery vehicle market is projected to expand from USD 34.8 billion to USD 84.5 billion, resulting in a value increase of USD 49.7 billion, which represents 29.2% of the total forecast growth for the decade. This phase of growth will be shaped by rapid e-commerce expansion, increasing government incentives for electric vehicle adoption, declining battery costs, and growing consumer preference for sustainable delivery options. Logistics companies are expanding their electric vehicle fleets to address mounting pressure for carbon-neutral delivery operations.

From 2030 to 2035, the market is forecast to grow from USD 84.5 billion to USD 205.1 billion, adding another USD 120.6 billion, which constitutes 70.8% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of autonomous delivery vehicles, integration of advanced telematics and route optimization systems, and development of comprehensive charging infrastructure. The maturation of electric vehicle technology and achievement of cost parity with conventional vehicles will drive mass market adoption across diverse delivery applications.

Between 2020 and 2025, the electric last mile delivery vehicle market experienced unprecedented expansion, driven by the COVID-19 pandemic accelerating e-commerce growth and increasing demand for contactless delivery services. The market developed as logistics companies recognized the operational cost advantages and environmental benefits of electric delivery vehicles. Government regulations targeting emission reductions and urban air quality improvement began mandating the transition to electric delivery fleets in major metropolitan areas worldwide.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 34.8 billion |

| Forecast Value in (2035F) | USD 205.1 billion |

| Forecast CAGR (2025 to 2035) | 19.4% |

Market expansion is being supported by the exponential growth of e-commerce and on-demand delivery services, creating unprecedented demand for efficient last-mile delivery solutions. Modern consumers increasingly expect rapid, convenient delivery options, driving logistics companies to optimize their delivery networks with electric vehicles that offer lower operating costs, reduced maintenance requirements, and improved route flexibility in urban environments. The proven efficiency of electric vehicles in stop-and-go delivery applications makes them ideal for last-mile operations.

The growing emphasis on sustainability and carbon footprint reduction is driving corporate and consumer demand for environmentally responsible delivery options. Government initiatives, including emission standards, low-emission zones, and financial incentives for electric vehicle adoption, are accelerating market transition. The improving economics of electric vehicles, supported by declining battery costs and increasing energy efficiency, are making electric delivery vehicles cost-competitive with traditional internal combustion engine alternatives across various payload and range requirements.

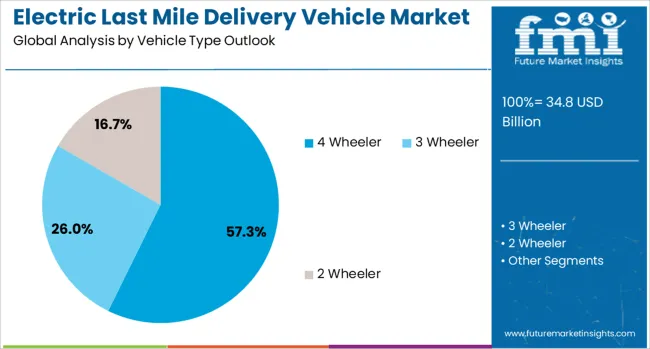

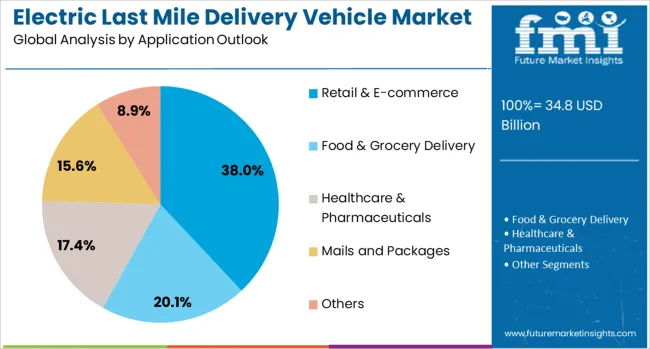

The market is segmented by vehicle type, payload capacity, application, region, and channel. By vehicle type, the market is divided into 4 Wheeler, 3 Wheeler, and 2 Wheeler categories. Based on payload capacity, the market is categorized into Above 500 Kg, 50 to 500 Kg, and Less than 50 Kg segments. In terms of application, the market is segmented into Retail & E-commerce, Food & Grocery Delivery, Healthcare & Pharmaceuticals, Mails and Packages, and Others. By region, the market is classified into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. The market serves various end-users including logistics companies, e-commerce platforms, food delivery services, and courier companies.

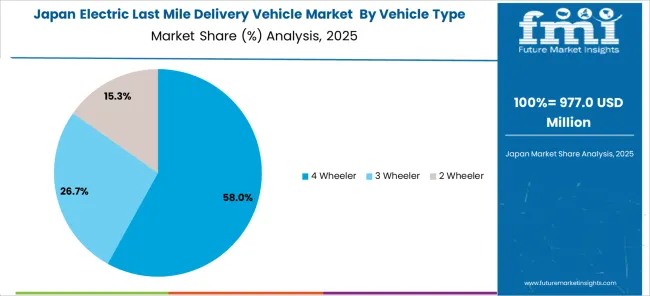

The 4 Wheeler vehicle type is projected to account for 57.3% of the electric last mile delivery vehicle market in 2025, reflecting its versatility and capacity advantages for diverse delivery applications. These vehicles offer optimal balance between payload capacity, range, and operational flexibility, making them suitable for various delivery scenarios from small packages to bulky items. Their enclosed cargo compartments provide weather protection and security for valuable shipments, while their stability and safety features make them preferred choices for professional delivery operations.

This segment benefits from established manufacturing infrastructure, wider model availability, and proven reliability in commercial applications. Major automotive manufacturers are investing heavily in electric van and light truck development, providing logistics companies with multiple vehicle options to meet specific operational requirements. The segment's dominance is reinforced by regulatory preferences for larger electric vehicles in urban delivery applications and their ability to replace conventional delivery vehicles without significant operational modifications.

Vehicles with Above 500 Kg payload capacity are projected to represent 42% of electric last mile delivery vehicle demand in 2025, underscoring their importance for high-volume delivery operations and bulk shipments. These vehicles serve the growing demand for furniture delivery, appliance transportation, and consolidated delivery routes that require substantial cargo capacity. Their ability to handle multiple delivery stops with diverse package sizes makes them essential for efficient last-mile operations.

The segment is supported by the increasing prevalence of heavy e-commerce items, including home goods, electronics, and industrial supplies that require robust delivery vehicles. Logistics companies utilize these vehicles for route consolidation strategies that reduce the number of delivery trips and optimize operational efficiency. Advanced electric powertrains in this category are achieving sufficient range and performance to meet demanding delivery schedules while providing significant cost savings compared to diesel alternatives.

The Retail & E-commerce application is forecasted to contribute 38.0% of the electric last-mile delivery vehicle market in 2025, reflecting the massive growth in online shopping and consumer expectations for rapid delivery services. This segment encompasses traditional retail deliveries, direct-to-consumer shipments, and same-day delivery services that require flexible, efficient vehicle solutions. The diversity of package sizes and delivery requirements in e-commerce drives demand for various vehicle types and configurations.

Major e-commerce platforms and retailers are investing in electric delivery fleets to reduce operational costs, meet sustainability commitments, and comply with urban emission regulations. The segment benefits from predictable delivery volumes, established route networks, and strong consumer preference for environmentally responsible delivery options. Integration with digital logistics platforms and real-time tracking systems enhances the value proposition of electric vehicles in retail and e-commerce applications.

The electric last mile delivery vehicle market is advancing rapidly due to exponential e-commerce growth, strengthening environmental regulations, and improving electric vehicle economics. However, the market faces challenges, including charging infrastructure limitations, battery technology constraints, and higher upfront capital costs. Innovation in battery technology, autonomous systems, and charging solutions continues to influence product development and market expansion patterns.

The rapid development of charging infrastructure is enabling widespread adoption of electric delivery vehicles by addressing range anxiety and operational constraints. Fast-charging networks, workplace charging stations, and depot-based charging solutions are providing logistics companies with flexible charging options that support various operational models. Advanced battery technologies, including solid-state batteries and improved lithium-ion systems, are extending vehicle range while reducing charging times and overall operational costs.

Modern electric delivery vehicle manufacturers are incorporating autonomous driving capabilities, advanced telematics, and artificial intelligence to enhance operational efficiency and reduce labor costs. These technologies enable optimized route planning, predictive maintenance, and autonomous delivery capabilities that improve service quality while reducing operational expenses. Smart logistics platforms are integrating electric vehicles into comprehensive delivery networks that maximize efficiency and customer satisfaction.

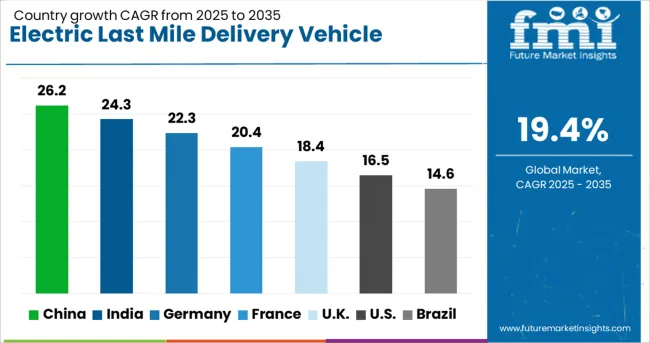

| Countries | CAGR (2025 to 2035) |

| China | 26.2% |

| India | 24.3% |

| Germany | 22.3% |

| France | 20.4% |

| UK | 18.4% |

| USA | 16.5% |

The electric last mile delivery vehicle market is experiencing exceptional growth globally, with China leading at a 26.2% CAGR through 2035, driven by massive e-commerce expansion, government electric vehicle mandates, and comprehensive manufacturing capabilities. India follows at 24.3%, supported by rapid urbanization, growing middle class, and government initiatives promoting electric mobility. Germany shows strong growth at 22.3%, emphasizing premium electric vehicle technology and sustainable logistics solutions. France records 20.4%, focusing on urban emission regulations and logistics innovation. The UK demonstrates 18.4% growth, prioritizing clean air initiatives and electric vehicle adoption incentives.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from electric last mile delivery vehicles in China is projected to exhibit exceptional growth with a CAGR of 26.2% through 2035, driven by the world's largest e-commerce market and comprehensive government support for electric vehicle adoption. The country's advanced manufacturing capabilities and established supply chain ecosystem are creating cost-effective electric delivery solutions that serve diverse market segments. Major Chinese companies including BYD, SAIC, and numerous specialized manufacturers are developing innovative electric delivery vehicles tailored for urban logistics operations.

Revenue from electric last mile delivery vehicles in India is expanding at a CAGR of 24.3%, supported by rapid e-commerce expansion, increasing environmental awareness, and government initiatives promoting electric mobility. The country's diverse delivery requirements spanning urban centers, suburban areas, and rural regions are driving demand for versatile electric vehicle solutions. Domestic manufacturers and international companies are establishing production facilities to serve the growing demand for cost-effective electric delivery vehicles.

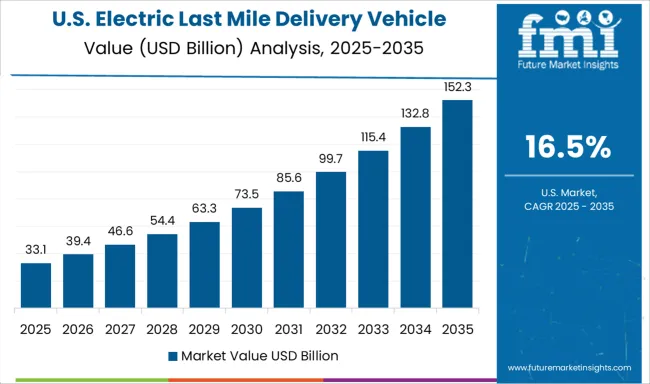

Demand for electric last mile delivery vehicles in the USA is projected to grow at a CAGR of 16.5%, supported by major logistics companies committing to carbon-neutral delivery operations and increasing consumer preference for sustainable delivery options. American companies are leading innovation in electric delivery vehicle technology, autonomous systems, and smart logistics solutions. The market is characterized by significant investments from major corporations including Amazon, FedEx, and UPS in electric delivery fleets.

Revenue from electric last mile delivery vehicles in Germany is projected to grow at a CAGR of 22.3% through 2035, driven by the country's strong automotive engineering capabilities and commitment to eco-efficient transportation. German manufacturers are developing premium electric delivery vehicles that emphasize reliability, efficiency, and advanced technology integration. The market benefits from strong government support for electric mobility and comprehensive charging infrastructure development.

Revenue from electric last mile delivery vehicles in the UK is projected to grow at a CAGR of 18.4% through 2035, supported by stringent emission regulations in major cities and increasing corporate sustainability commitments. British logistics companies are rapidly transitioning to electric delivery fleets to comply with Low Emission Zones and meet customer expectations for environmentally responsible services.

Revenue from electric last mile delivery vehicles in France is projected to grow at a CAGR of 20.4% through 2035, supported by the country's focus on sustainable urban logistics and innovative delivery solutions. French companies are developing electric delivery vehicles specifically designed for historic city centers and congested urban environments. The market benefits from government support for clean transportation and growing consumer preference for environmentally responsible delivery services.

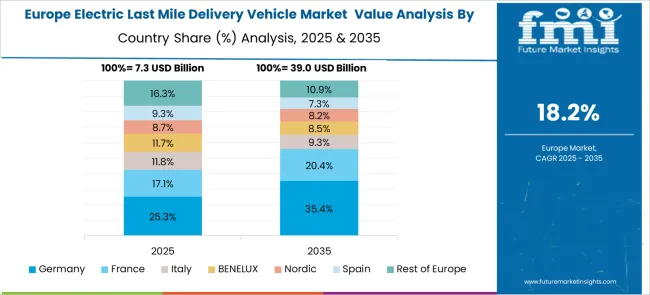

The European electric last mile delivery vehicle market demonstrates sophisticated development across major economies with Germany leading through its precision automotive engineering excellence and advanced electric vehicle manufacturing capabilities, supported by companies like Ford Motor Company and local manufacturers pioneering comprehensive electric delivery solutions with focus on commercial applications while emphasizing sustainability and energy efficiency. The UK shows strength in regulatory compliance and clean air initiatives, with companies specializing in electric delivery vehicles that meet strict emission standards and provide consistent operational outcomes for urban logistics.

France contributes through companies developing electric delivery solutions specifically designed for historic city centers and integrated urban logistics systems. Italy, Spain, and Nordic countries demonstrate growth in specialized electric vehicles for diverse delivery applications and premium logistics services. The market benefits from stringent EU emission regulations, established automotive infrastructure, and growing emphasis on eco-efficient delivery methods and carbon-neutral transportation solutions. Strong engineering capabilities and focus on innovation position Europe as a key center for advanced electric delivery technologies requiring superior performance, regulatory compliance, and environmental responsibility.

The Japanese electric last mile delivery vehicle market demonstrates steady growth driven by precision manufacturing focus, advanced automation technologies, and consumer preference for high-quality electric delivery systems that ensure superior operational consistency and safety compliance throughout logistics operations. Companies establish presence through cutting-edge electric vehicle technologies that align with Japan's sophisticated automotive industry and stringent quality standards while incorporating IoT integration and smart logistics capabilities. The market emphasizes automated fleet management systems, precision electric powertrains, and thermal management innovations that reflect Japanese manufacturing excellence and attention to detail in commercial vehicle production processes.

Growing investment in Industry 4.0 technologies supports intelligent delivery systems with real-time monitoring, predictive analytics, and optimized vehicle performance for enhanced operational efficiency. Japanese manufacturers prioritize vehicle reliability, consistent delivery performance, and energy efficiency, creating opportunities for premium electric delivery solutions that deliver exceptional operational value and long-term cost effectiveness across urban logistics, e-commerce delivery, and commercial transportation requiring the highest reliability standards.

The South Korean electric last mile delivery vehicle market shows emerging growth potential driven by expanding e-commerce industry, increasing adoption of electric mobility technologies, and growing consumer demand for efficient delivery services requiring sustainable and technologically advanced transportation solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on export competitiveness that drives investment in modern electric vehicle manufacturing meeting international quality standards and environmental regulations.

Korean manufacturers increasingly adopt automatic operation modes, precision electric powertrains, and integrated battery management systems to improve delivery efficiency and operational consistency while ensuring environmental compliance. The growing influence of Korean technology companies in global markets supports demand for sophisticated electric delivery vehicles that ensure quality performance while maintaining cost-effectiveness and operational reliability. The integration of smart city principles and advanced manufacturing technologies creates opportunities for intelligent delivery systems with IoT connectivity, predictive maintenance capabilities, and real-time fleet optimization. Rising environmental awareness and urban logistics modernization drive the adoption of advanced electric delivery solutions that combine operational efficiency with comprehensive sustainability assurance across diverse commercial transportation applications.

The electric last mile delivery vehicle market is characterized by competition among established automotive manufacturers, specialized electric vehicle companies, and emerging technology startups. Companies are investing in battery technology advancement, charging infrastructure development, autonomous systems integration, and comprehensive service networks to deliver efficient, reliable, and cost-effective electric delivery solutions. Product innovation, strategic partnerships, and market expansion are central to strengthening competitive positioning and market presence.

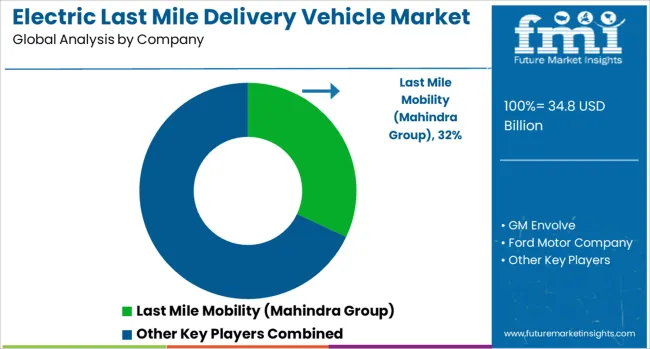

Last Mile Mobility (Mahindra Group), India-based, leads the market with significant presence in electric three-wheelers and light commercial vehicles, focusing on cost-effective solutions for emerging markets. GM Envolve, USA, provides comprehensive electric delivery vehicle solutions with emphasis on fleet management and charging infrastructure. Ford Motor Company, USA, delivers proven electric van solutions with focus on commercial applications and established dealer networks. GreenPower Motor Company, Canada, specializes in zero-emission commercial vehicles with customizable configurations for diverse delivery applications.

Workhorse, USA, focuses on last-mile delivery vehicles with integrated drone technology and telematics systems. Star EV Corporation provides specialized electric vehicles for various commercial applications with emphasis on customization and service support. Rivian, USA, offers innovative electric delivery vehicles with advanced technology integration and strategic partnerships with major logistics companies. Chevrolet, operating globally, provides comprehensive electric vehicle solutions across multiple market segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 34.8 billion |

| Vehicle Type | 4 Wheeler, 3 Wheeler, 2 Wheeler |

| Payload Capacity | Above 500 Kg, 50 to 500 Kg, Less than 50 Kg |

| Application | Retail & E-commerce, Food & Grocery Delivery, Healthcare & Pharmaceuticals, Mails and Packages, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, United States, Germany, United Kingdom, France, Japan, South Korea, Brazil, Canada, Australia and 40+ countries |

| Key Companies Profiled | Last Mile Mobility (Mahindra Group), GM Envolve, Ford Motor Company, GreenPower Motor Company, Workhorse, Star EV Corporation, Rivian, Chevrolet, Gogoro Inc., Honda, and Tata Motors |

| Additional Attributes | Revenue analysis by vehicle type and payload capacity, regional adoption trends, competitive landscape analysis, fleet operator preferences, integration with autonomous technology, charging infrastructure requirements, battery technology developments, and sustainable logistics solutions |

The global electric last mile delivery vehicle market is estimated to be valued at USD 34.8 billion in 2025.

The market size for the electric last mile delivery vehicle market is projected to reach USD 205.1 billion by 2035.

The electric last mile delivery vehicle market is expected to grow at a 19.4% CAGR between 2025 and 2035.

The key product types in electric last mile delivery vehicle market are 4 wheeler, 3 wheeler and 2 wheeler.

In terms of payload capacity outlook , above 500 kg segment to command 42.0% share in the electric last mile delivery vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA