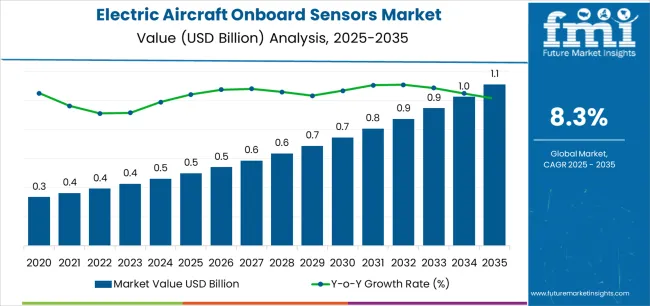

The global electric aircraft onboard sensors market is projected to reach USD 1.1 billion by 2035, recording an absolute increase of USD 628.2 million over the forecast period. The market is valued at USD 0.5 billion in 2025 and is set to rise at a CAGR of 8.3% during the assessment period. The overall market size is expected to grow by nearly 2.2 times during the same period, supported by increasing demand for electric and hybrid electric aircraft worldwide, driving demand for efficient sensor systems and increasing investments in sustainable aviation technology projects globally.

Electric aviation represents a fundamental shift in aerospace propulsion technology, where traditional jet engines and combustion systems give way to battery-powered electric motors and hybrid configurations. This transformation creates demand for specialized sensing solutions that monitor critical parameters across electric propulsion systems. Battery packs require continuous thermal monitoring to prevent thermal runaway events that could compromise flight safety. Electric motors demand precise torque and speed sensing for optimal power management and efficiency optimization. Power distribution networks need real-time current and voltage measurements to ensure stable electrical system operation throughout flight envelopes.

The transition toward electrified aircraft architectures is accelerating across multiple aviation segments. Urban air mobility vehicles, designed for short-distance passenger transport within metropolitan areas, rely entirely on electric propulsion systems where sensor reliability directly impacts autonomous flight capabilities and passenger safety. Regional electric aircraft programs from established manufacturers target 50-100 seat configurations for routes under 500 miles, requiring sensor networks that can validate propulsion system performance throughout certification testing. General aviation training aircraft are adopting electric propulsion to reduce operating costs and emissions, creating demand for sensors that enable predictive maintenance and extend component service life.

Aviation certification authorities worldwide are establishing new regulatory frameworks for electric aircraft approval, with sensor systems playing a central role in demonstrating airworthiness compliance. Real-time health monitoring requirements demand sensor networks that can detect anomalies before they progress to system failures. Flight test programs generate massive datasets from sensor arrays, validating performance models and establishing operational limits for electric propulsion systems. The certification process timeline for novel electric aircraft depends heavily on sensor data quality and reliability, making advanced sensing capabilities essential for commercial success.

Government support for sustainable aviation accelerates market expansion through research funding, certification pathway development, and operational incentive programs. China's Made in China 2025 initiative allocates substantial resources toward electric aviation technology development, including sensor manufacturing localization. NASA's electric aircraft research programs advance sensor integration techniques and validation methodologies that inform industry standards. European Union sustainable aviation mandates create market pull for electric propulsion systems equipped with comprehensive monitoring capabilities.

Between 2025 and 2030, the electric aircraft onboard sensors market is projected to expand from USD 0.5 billion to USD 767.4 million, resulting in a value increase of USD 252.3 million, which represents 40.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for electric propulsion monitoring systems and battery management solutions, product innovation in sensor miniaturization and wireless sensing technologies, as well as expanding integration with digital flight control systems and predictive maintenance platforms. Companies are establishing competitive positions through investment in advanced sensor fusion algorithms, multi-parameter sensing solutions, and strategic partnerships with electric aircraft manufacturers and aviation technology integrators.

From 2030 to 2035, the market is forecast to grow from USD 767.4 million to USD 1.1 billion, adding another USD 375.9 million, which constitutes 59.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized sensing architectures, including integrated health monitoring systems and autonomous flight sensor networks tailored for urban air mobility and regional electric aircraft applications, strategic collaborations between sensor manufacturers and airframe producers, and an enhanced focus on weight reduction and power efficiency. The growing emphasis on flight safety certification and real-time data analytics will drive demand for advanced, high-reliability sensor solutions across diverse electric aviation applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.5 billion |

| Market Forecast Value (2035) | USD 1.1 billion |

| Forecast CAGR (2025-2035) | 8.3% |

The electric aircraft onboard sensors market grows by enabling aircraft operators to achieve superior propulsion system monitoring and flight safety while meeting regulatory requirements for electric aviation certification. Aviation manufacturers face mounting pressure to develop reliable electric and hybrid electric aircraft, with onboard sensor solutions typically providing 20-30% improvement in system diagnostics compared to conventional monitoring approaches, making advanced sensing capabilities essential for electric aircraft commercialization. The aviation electrification movement creates demand for specialized sensor networks that can monitor battery temperature gradients, electric motor vibration signatures, and power distribution integrity across diverse operating conditions.

Government initiatives promoting sustainable aviation and emissions reduction targets drive adoption in urban air mobility, regional transport, and general aviation applications, where sensor reliability has a direct impact on flight safety and certification timelines. The global shift toward zero-emission aviation accelerates sensor demand as aircraft manufacturers seek real-time monitoring solutions for battery systems, electric motors, and thermal management networks. However, limited standardization of electric aircraft architectures and stringent aviation certification requirements may constrain adoption rates among smaller manufacturers and experimental aircraft developers operating with limited engineering resources.

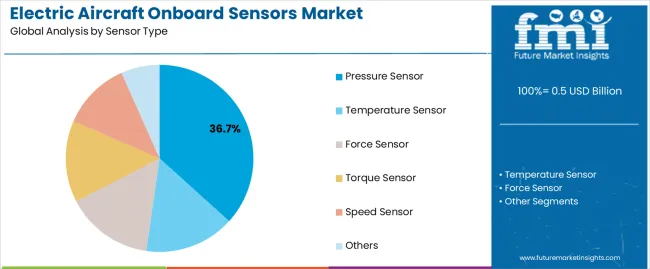

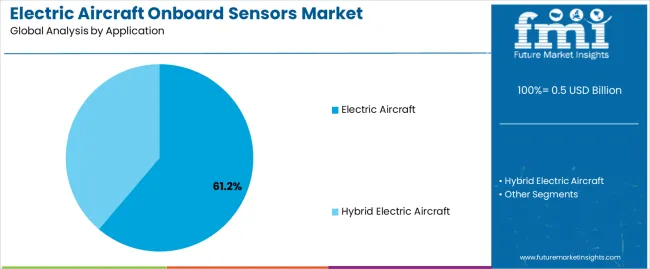

The market is segmented by sensor type, application, and region. By sensor type, the market is divided into pressure sensor, temperature sensor, force sensor, torque sensor, speed sensor, and others. Based on application, the market is categorized into electric aircraft and hybrid electric aircraft. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

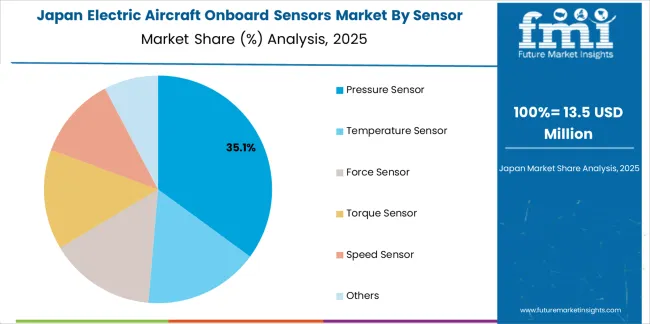

The pressure sensor segment represents the dominant force in the electric aircraft onboard sensors market, capturing approximately 36.7% of total market share in 2025. This advanced category encompasses sensors for hydraulic system monitoring, cabin pressurization control, fuel tank pressure measurement, and pneumatic system diagnostics, delivering comprehensive pressure data essential for flight safety and system optimization. The pressure sensor segment leads through its critical role in multiple aircraft subsystems, proven reliability in aviation applications, and compatibility with both electric and hybrid electric aircraft architectures requiring precise pressure monitoring across propulsion and environmental control systems.

The temperature sensor segment maintains a substantial 24.5% market share, serving manufacturers who require thermal monitoring solutions for battery packs, electric motors, and power electronics. The force sensor segment accounts for 16.3% market share, while torque sensor represents 11.0%, speed sensor holds 6.1%, and other sensors collectively account for 5.4% market share.

Key advantages driving the pressure sensor segment include:

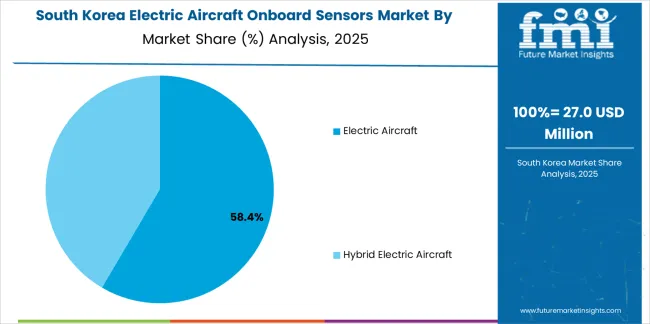

Electric aircraft applications dominate the onboard sensors market with approximately 61.2% market share in 2025, reflecting the rapid development of fully electric propulsion systems for urban air mobility, regional transport, and general aviation platforms. The electric aircraft segment leads through deployment in battery electric vertical takeoff and landing aircraft, electric training aircraft, and electric regional aircraft programs requiring comprehensive sensor networks for propulsion monitoring, battery management, and flight control optimization. This segment benefits from increasing investment in zero-emission aviation technology and regulatory support for sustainable aircraft development.

The hybrid electric aircraft segment represents 38.8% market share through applications in parallel hybrid systems, series hybrid configurations, and turboelectric propulsion architectures. This segment gains traction in larger aircraft categories where battery energy density limitations require hybrid solutions combining electric motors with conventional engines.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to aviation electrification and safety requirements. First, urban air mobility development creates increasing requirements for reliable sensor systems, with projected air taxi markets requiring thousands of electric aircraft deployments by 2030, demanding proven sensor solutions for autonomous and piloted operations. Second, battery safety regulations drive demand for comprehensive thermal and electrical monitoring, with aviation authorities requiring real-time battery health assessment systems that detect thermal runaway conditions before safety limits are exceeded. Third, electric motor efficiency optimization requires precise torque, speed, and vibration sensing, with aircraft manufacturers targeting 5-10% efficiency improvements through closed-loop control systems enabled by high-accuracy sensor feedback.

Market restraints include certification timeline uncertainties affecting sensor qualification requirements, particularly for novel sensing technologies without established aviation heritage or regulatory approval pathways. Integration complexity with distributed electric propulsion architectures poses technical challenges, as sensor networks must operate reliably across multiple electric motors while maintaining electromagnetic compatibility in electrically noisy environments. Weight and power consumption constraints create additional barriers, since electric aircraft operations demand sensor solutions that minimize parasitic loads while delivering measurement accuracy comparable to conventional aircraft systems operating with greater power margins.

Key trends indicate accelerated adoption in Asia Pacific markets, particularly China where government programs support electric aviation development through research funding and certification pathway establishment. Technology advancement trends toward wireless sensor networks, fiber optic sensing systems, and integrated smart sensors with onboard processing capabilities enable next-generation aircraft architectures. However, the market faces potential disruption if hydrogen fuel cell propulsion gains momentum as an alternative zero-emission technology, which would shift sensor requirements toward hydrogen system monitoring and away from battery-centric sensing solutions currently driving market growth.

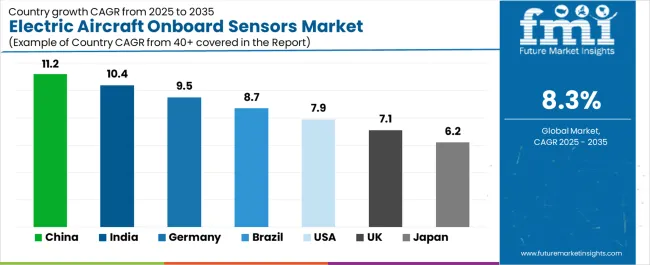

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| Brazil | 8.7% |

| USA | 7.9% |

| UK | 7.1% |

| Japan | 6.2% |

The electric aircraft onboard sensors market is gaining momentum worldwide, with China taking the lead thanks to aggressive electric aviation development programs and urban air mobility initiatives. Close behind, India benefits from growing aerospace manufacturing capabilities and government support for electric aircraft research, positioning itself as a strategic growth hub in the Asia Pacific region. Germany shows strong advancement, where established aerospace industry and electric propulsion research strengthen its role in European aviation technology supply chains. The USA demonstrates robust growth through NASA electric aircraft programs and urban air mobility development, signaling continued investment in sustainable aviation infrastructure. Meanwhile, Japan stands out for its focus on regional electric aircraft development with government research support, while UK continues to record consistent progress driven by aerospace innovation programs and electric propulsion startups. Together, China and India anchor the global expansion story, while established markets build stability and technical expertise into the market growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

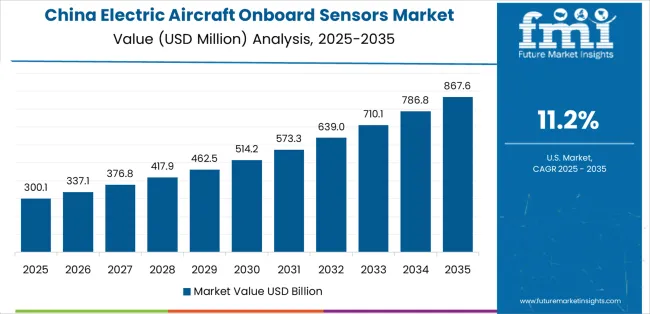

China demonstrates the strongest growth potential in the Electric Aircraft Onboard Sensors Market with a CAGR of 11.2% through 2035. The country leads through comprehensive electric aviation development programs, urban air mobility demonstration projects, and aggressive electrification targets driving adoption of advanced sensing systems. Growth is concentrated in major aerospace manufacturing regions, including Beijing, Shanghai, Chengdu, and Xi'an, where aircraft manufacturers and research institutes are implementing electric propulsion programs for commercial and military applications. Distribution channels through aerospace industrial parks, government research partnerships, and direct manufacturer relationships expand deployment across electric aircraft development programs and flight test operations. The country's Made in China 2025 initiative provides policy support for aviation technology development, including subsidies for electric aircraft research and sensor technology localization.

Key market factors:

In the Bangalore, Hyderabad, and Pune aerospace clusters, the adoption of electric aircraft onboard sensor systems is accelerating across urban air mobility research programs, electric aircraft prototypes, and defense aviation modernization projects, driven by indigenous aerospace development initiatives and government support for sustainable aviation technologies. The market demonstrates strong growth momentum with a CAGR of 10.4% through 2035, linked to comprehensive aerospace manufacturing expansion and increasing focus on electric propulsion research solutions. Indian aerospace companies are implementing sensor integration programs and flight test validation platforms to develop indigenous electric aircraft capabilities while meeting stringent safety standards in collaboration with international technology partners. The country's National Aerospace Policy creates sustained demand for advanced aviation sensors, while increasing emphasis on defense modernization drives adoption of electric propulsion systems that require comprehensive monitoring solutions.

Germany's advanced aerospace sector demonstrates sophisticated implementation of electric aircraft onboard sensor systems, with documented case studies showing integration in electric propulsion research programs at DLR facilities and electric aircraft demonstrators through Airbus innovation initiatives. The country's aerospace infrastructure in major aviation clusters, including Bavaria, Hamburg, and Baden-Württemberg, showcases integration of sensor technologies with existing aircraft development systems, leveraging expertise in precision manufacturing and aviation safety standards. German aerospace companies emphasize certification compliance and technical excellence, creating demand for reliable sensor sources that support sustainable aviation commitments and regulatory approval requirements. The market maintains strong growth through focus on electric propulsion innovation and international aerospace collaboration, with a CAGR of 9.5% through 2035.

Key development areas:

The Brazilian market leads in aviation technology development based on integration with established aerospace manufacturing capabilities and sophisticated electric propulsion research programs for enhanced aircraft performance. The country shows solid potential with a CAGR of 8.7% through 2035, driven by Embraer electric aircraft initiatives and increasing urban air mobility interest across major metropolitan areas, including São Paulo, Rio de Janeiro, and Belo Horizonte. Brazilian aerospace companies are adopting electric propulsion sensors for compliance with sustainable aviation development goals, particularly in regional aircraft applications requiring operational efficiency and in segments with regulatory support for emissions reduction. Technology deployment channels through aerospace research centers, university partnerships, and direct manufacturer relationships expand coverage across diverse electric aviation development operations.

Leading market segments:

The USA market leads in advanced electric aircraft sensor innovation based on integration with NASA research programs and sophisticated urban air mobility development initiatives for enhanced flight safety. The country shows solid potential with a CAGR of 7.9% through 2035, driven by urban air mobility investment and increasing electric aircraft development across major aerospace regions, including California, Washington, Texas, and the Northeast aerospace corridor. American aerospace companies are adopting certified aviation sensors for compliance with FAA certification standards, particularly in urban air mobility applications requiring autonomous flight capabilities and in research programs with government funding for sustainable aviation. Technology deployment channels through aerospace research partnerships, venture-backed startups, and established aircraft manufacturer relationships expand coverage across diverse electric aviation operations.

Leading market segments:

The UK market demonstrates sophisticated implementation focused on electric propulsion research programs and urban air mobility development, with documented integration of sensor networks achieving advanced monitoring capabilities in electric aircraft prototypes. The country maintains steady growth momentum with a CAGR of 7.1% through 2035, driven by aerospace innovation funding and research partnerships with established aviation companies aligned with sustainable aviation development goals. Major aerospace regions, including England's aerospace corridor, Scotland's aviation clusters, and Wales' aerospace facilities, showcase advanced deployment of electric aircraft sensors that integrate seamlessly with existing aerospace research infrastructure and certification validation programs.

Key market characteristics:

In Tokyo, Nagoya, and Gifu aerospace manufacturing regions, aerospace companies are implementing electric aircraft onboard sensor programs to enhance propulsion monitoring and meet aviation safety requirements, with documented case studies showing integration in regional aircraft electric propulsion research programs. The market shows solid growth potential with a CAGR of 6.2% through 2035, linked to Japanese aerospace quality standards, precision manufacturing capabilities, and government research funding for sustainable aviation technologies. Japanese aerospace companies are adopting specialized sensor formulations and precision measurement systems to maintain aviation reliability standards while complying with certification requirements in collaboration with international aerospace research programs.

Market development factors:

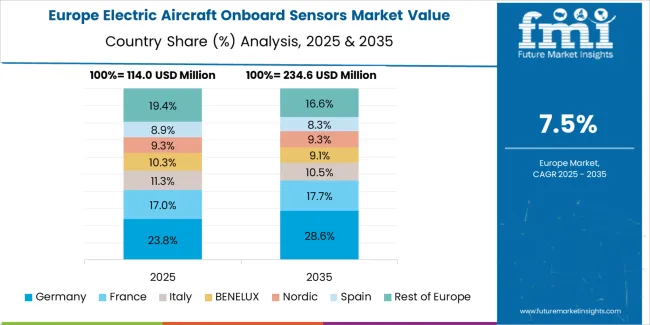

The electric aircraft onboard sensors market in Europe is projected to grow from USD 189.1 million in 2025 to USD 426.2 million by 2035, registering a CAGR of 8.5% over the forecast period. Germany is expected to maintain its leadership position with a 26.8% market share in 2025, declining slightly to 25.4% by 2035, supported by its advanced aerospace industry and major aviation research centers including DLR facilities and electric aircraft programs. France follows with a 18.9% share in 2025, projected to reach 19.2% by 2035, driven by comprehensive electric propulsion research at ONERA and Airbus electric aircraft initiatives. The United Kingdom holds a 17.3% share in 2025, expected to decrease to 16.8% by 2035 through established aerospace sensor suppliers and electric aviation startups. Italy commands a 14.2% share, while Spain accounts for 11.6% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 11.2% to 12.4% by 2035, attributed to increasing sensor development in Nordic countries and emerging Eastern European aerospace manufacturing implementing electric aircraft programs.

The Japanese electric aircraft onboard sensors market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of pressure sensing and temperature monitoring systems with existing precision aerospace manufacturing infrastructure across regional aircraft programs, business aviation applications, and experimental electric aircraft development. Japan's emphasis on quality and reliability drives demand for high-precision sensor solutions that support electric aircraft certification requirements and performance optimization in demanding aviation environments. The market benefits from strong partnerships between international sensor providers and domestic aerospace companies including Mitsubishi Heavy Industries and Kawasaki Heavy Industries, creating comprehensive technology ecosystems that prioritize sensor accuracy and flight safety standards. Aerospace manufacturing centers in Nagoya, Tokyo, and other major industrial areas showcase advanced electric propulsion research where sensor systems achieve precision measurement capabilities supporting both electric motor control and battery thermal management programs.

The South Korean electric aircraft onboard sensors market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical integration and certification support capabilities for urban air mobility and electric regional aircraft applications. The market demonstrates increasing emphasis on autonomous flight systems and electric propulsion monitoring, as Korean aerospace companies increasingly demand advanced sensor networks that integrate with domestic flight control development and electric motor manufacturing capabilities deployed across major aerospace programs. Regional sensor manufacturers are gaining market share through strategic partnerships with international aerospace suppliers, offering specialized services including Korean aviation certification support and application-specific sensor customization for electric aircraft operations. The competitive landscape shows increasing collaboration between multinational sensor companies and Korean aerospace technology specialists, creating hybrid development models that combine international sensor expertise with local electric aircraft integration knowledge and flight test capabilities.

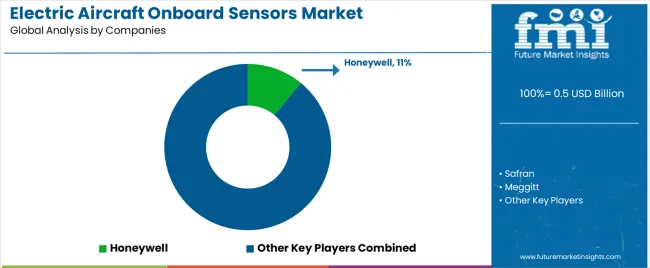

The electric aircraft onboard sensors market features approximately 20-25 meaningful players with moderate fragmentation, where the top three companies control roughly 24-28% of global market share through established aviation certification credentials and comprehensive sensor portfolios. Competition centers on certification heritage, measurement accuracy, and weight reduction capabilities rather than price competition alone. Honeywell leads with approximately 11.0% market share through its comprehensive aerospace sensing solutions portfolio spanning pressure, temperature, and flight control sensors with proven aviation pedigree.

Market leaders include Honeywell, Safran, and Meggitt, which maintain competitive advantages through decades of aviation sensor experience, established certification relationships with regulatory authorities, and deep integration expertise with aircraft manufacturers, creating trust and reliability advantages in safety-critical electric aircraft applications. These companies leverage research capabilities in sensor miniaturization and multi-parameter sensing technologies alongside ongoing technical support relationships to defend market positions while expanding into urban air mobility and electric regional aircraft programs.

Challengers encompass TE Connectivity and AMETEK, which compete through specialized sensing technologies and strong positions in industrial and aerospace markets. Product specialists, including Lockheed Martin, RTX, and Thales, focus on integrated avionics systems incorporating sensor networks, offering differentiated capabilities in system integration, data fusion algorithms, and certification management.

Regional players and emerging sensor startups create competitive pressure through innovative sensing approaches and rapid adaptation to evolving electric aircraft architectures, particularly in urban air mobility applications where established aviation protocols face disruption from new entrants pursuing simplified certification pathways. Market dynamics favor companies that combine reliable aviation certification compliance with comprehensive technical support offerings that address the complete sensor integration cycle from specification through flight certification.

Electric aircraft onboard sensors represent critical safety and performance monitoring systems that enable aircraft operators to achieve 20-30% improvement in system diagnostics compared to conventional monitoring approaches, delivering superior propulsion oversight and predictive maintenance capabilities in demanding electric aviation applications. With the market projected to grow from USD 0.5 billion in 2025 to USD 1.1 billion by 2035 at a 8.3% CAGR, these sensing systems offer compelling advantages for electric aircraft (61.2% market share) and hybrid electric aircraft (38.8% share), making them essential for urban air mobility operations, regional electric transport, and aviation manufacturers seeking certification approval for electric propulsion systems. Scaling market adoption and certification acceptance requires coordinated action across aviation regulators, sensor manufacturers, aircraft developers, research institutions, and sustainable aviation investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.5 billion |

| Sensor Type | Pressure Sensor, Temperature Sensor, Force Sensor, Torque Sensor, Speed Sensor, Others |

| Application | Electric Aircraft, Hybrid Electric Aircraft |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Honeywell, Safran, Meggitt, TE Connectivity, AMETEK, Lockheed Martin, RTX, Thales, L3Harris Technologies, Amphenol |

| Additional Attributes | Dollar sales by sensor type and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with sensor manufacturers and aerospace integrators, certification facility requirements and specifications, integration with electric aircraft development programs and sustainable aviation initiatives, innovations in sensing technology and wireless networks, and development of specialized sensors with enhanced accuracy and reliability capabilities. |

The global electric aircraft onboard sensors market is estimated to be valued at USD 0.5 billion in 2025.

The market size for the electric aircraft onboard sensors market is projected to reach USD 1.1 billion by 2035.

The electric aircraft onboard sensors market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in electric aircraft onboard sensors market are pressure sensor, temperature sensor, force sensor, torque sensor, speed sensor and others.

In terms of application, electric aircraft segment to command 61.2% share in the electric aircraft onboard sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA