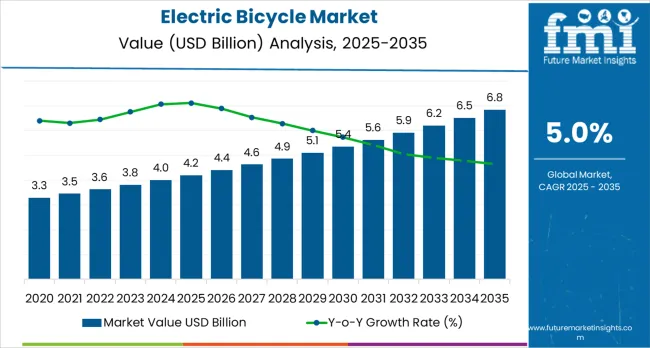

The electric bicycle market is valued at USD 4.2 billion in 2025 and is projected to reach USD 6.8 billion by 2035, advancing at a 5.0% CAGR. This growth is driven by the increasing demand for eco-friendly and affordable transportation solutions in urban environments, growing urbanization, and the rising emphasis on health and sustainability. Electric bicycles offer easy mobility, reduced traffic congestion, and zero emissions, making them ideal for city commuting and recreational use. With advancements in battery technology, motor efficiency, and lightweight frame designs, the electric bicycle market is poised for steady expansion.

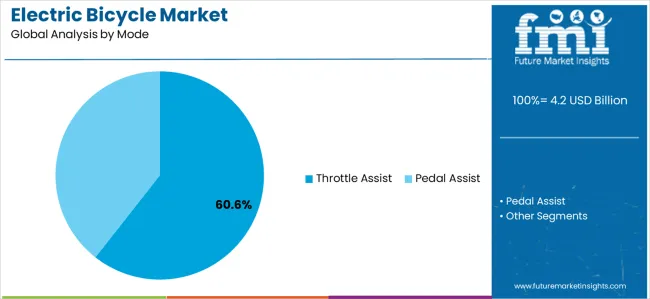

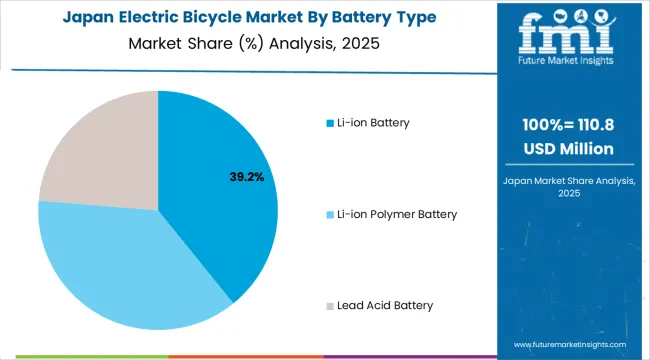

The Li-ion battery segment leads with a 40.6% share, owing to its superior energy density, long lifespan, and lighter weight compared to other battery types. The throttle assist mode holds the dominant share of 60.4% in the market due to its simplicity, convenience, and popularity among urban commuters. City/urban applications account for the largest demand, followed by mountain/trekking and cargo e-bikes.

As urban populations grow and traffic congestion worsens, more consumers are turning to e-bikes as an alternative to traditional vehicles. E-bikes are seen as an efficient, eco-friendly, and affordable solution to reduce dependence on cars, particularly for short trips within cities. With the rising concerns about air pollution and carbon emissions, the growing adoption of e-bikes aligns with global sustainability initiatives and government efforts to promote cleaner forms of transportation. E-bikes offer the flexibility to navigate through crowded streets, reduce traffic congestion, and contribute to improved air quality in urban environments.

The rising cost of fuel is another significant factor contributing to the growth of the electric bicycle market. As fuel prices continue to fluctuate, many consumers are seeking alternative transportation options that offer lower operating costs. E-bikes, with their low energy consumption and minimal maintenance costs compared to traditional motor vehicles, offer a more affordable option for daily commuting. Additionally, government incentives, subsidies, and tax rebates for electric vehicle adoption in several regions further promote the growth of the e-bike market. These financial incentives make e-bikes more accessible to a broader demographic, encouraging more people to make the switch to electric bicycles.

The market sees significant growth in Asia Pacific, especially in China and India, driven by massive urban populations, government incentives, and expanding cycling infrastructure. North America and Europe also contribute to the market with increasing environmental awareness, government policies supporting electric mobility, and growing consumer adoption of electric bicycles. Competition in the electric bicycle market remains high, with companies like Accell Group, Giant Manufacturing Co., and Merida Industry Co. Ltd. focusing on product innovation, performance, and consumer reach to strengthen market presence.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.20billion |

| Market Forecast Value (2035) | USD 6.8 billion |

| Forecast CAGR (2025–2035) | 5.0% |

Market expansion is being supported by the rapid urbanization across developing economies and the corresponding need for affordable and eco-friendly transportation solutions in congested urban environments. Modern cities face challenges of traffic congestion, air pollution, and inadequate parking infrastructure, creating demand for compact and efficient personal mobility options. The superior convenience and environmental benefits of electric bicycles make them essential components in sustainable urban transportation systems where accessibility and carbon emission reduction are critical priorities.

The growing emphasis on health and wellness combined with environmental sustainability is driving demand for electric bicycles from manufacturers with proven track records of quality, safety, and technological innovation. Consumers are increasingly investing in e-bikes that offer pedal-assist features for fitness benefits, extended battery range for longer commutes, and smart connectivity features for enhanced user experience. Regulatory support through purchase incentives and infrastructure development are establishing favorable conditions that encourage electric bicycle adoption and market expansion.

The shift from traditional bicycles and motorized two-wheelers to electric bicycles is accelerating due to advantages such as reduced physical effort for elderly and less fit riders, zero emissions contributing to cleaner air quality, significantly lower operational costs compared to motorcycles and cars, and ability to navigate through traffic congestion efficiently. The electric bicycles require minimal maintenance compared to motorized vehicles, offer health benefits through optional pedal assistance, and provide flexible transportation solutions for diverse user needs ranging from daily commuting to recreational cycling activities.

The market is segmented by battery type, mode, application, and region. By battery type, the market is divided into Li-ion battery, Li-ion polymer battery, and lead acid battery configurations. Based on mode, the market is categorized into throttle assist and pedal assist. By application, the market includes city/urban, mountain/trekking, cargo, and others. Regionally, the market is divided into North America, East Asia, Western Europe, South Asia, Latin America, and Middle East &Africa.

Li-ion battery configurations are projected to account for 40.6% of the electric bicycle market in 2025. This leading share is supported by the superior energy density, longer lifespan, and lighter weight characteristics of lithium-ion technology compared to alternative battery types. Li-ion batteries provide extended range capabilities, faster charging times, and enhanced durability, making them the preferred choice for premium and mid-range electric bicycle manufacturers. The segment benefits from declining battery costs, technological improvements in battery management systems, and increasing consumer preference for reliable and long-lasting power sources.

Modern lithium-ion batteries for electric bicycles incorporate advanced cell chemistry, sophisticated battery management systems, and thermal management technologies that optimize performance and extend operational life. These innovations have significantly improved range per charge, reduced charging times to 3-5 hours, and enhanced safety through protection against overcharging and overheating. Premium electric bicycle manufacturers particularly drive demand for Li-ion battery solutions, as discerning consumers prioritize performance, reliability, and total cost of ownership over initial purchase price considerations.

The fitness and sports cycling segments increasingly adopt Li-ion powered e-bikes due to their lightweight properties, consistent power delivery, and ability to support high-performance riding conditions. Environmental consciousness and recycling infrastructure development further accelerate market adoption, as Li-ion batteries offer superior recyclability compared to lead acid alternatives and contribute to sustainable product lifecycle management.

Throttle assist mode is expected to represent 60.4% of electric bicycle demand in 2025. This dominant share reflects consumer preference for convenience and ease of use, particularly in markets where riders seek motorized assistance without pedaling effort. Throttle-controlled e-bikes provide instant power delivery, intuitive operation similar to motorcycles or scooters, and simplified riding experience suitable for diverse user groups including elderly riders and those with limited physical fitness. The segment benefits from strong adoption in Asian markets and growing acceptance in urban commuting applications worldwide.

Throttle assist systems offer operational simplicity that appeals to first-time e-bike users and riders transitioning from traditional motorized two-wheelers. These systems require minimal learning curve, provide consistent power delivery regardless of pedaling cadence, and enable riders to control speed and acceleration precisely through handlebar-mounted throttle controls. The growing emphasis on last-mile connectivity solutions, particularly in emerging markets with inadequate public transportation infrastructure, drives consistent demand for throttle-assist configurations that offer motorcycle-like convenience with bicycle classification benefits.

Urban delivery services and commercial applications contribute significantly to throttle assist segment growth, as businesses adopt electric bicycles for food delivery, courier services, and short-distance logistics operations. The segment also benefits from regulatory frameworks in many markets that permit throttle-controlled e-bikes within bicycle infrastructure, providing access to dedicated cycling lanes and pathways unavailable to motorcycles and scooters.

The electric bicycle market is advancing steadily due to increasing environmental awareness and growing recognition of e-bikes as practical transportation solutions for urban mobility challenges. The market faces challenges including high initial purchase costs compared to traditional bicycles, concerns about battery lifespan and replacement expenses, and varying regulatory standards across different countries. Innovation in battery technology, motor efficiency, and connected features continues to influence product development and market evolution patterns.

The growing awareness of climate change and air pollution is driving consumer interest in zero-emission transportation alternatives that reduce personal carbon footprint. Electric bicycles offer sustainable mobility solutions that combine the environmental benefits of traditional cycling with enhanced accessibility for longer distances and challenging terrain. Government initiatives promoting clean transportation through purchase subsidies, tax incentives, and dedicated cycling infrastructure development create favorable market conditions supporting e-bike adoption across diverse consumer segments.

Rapid urban population growth and increasing vehicle ownership are creating severe traffic congestion in major cities worldwide, driving demand for alternative transportation solutions that offer time savings and cost efficiency. Electric bicycles provide practical answers to urban mobility challenges by enabling riders to bypass traffic congestion, access restricted zones unavailable to motorized vehicles, and eliminate parking difficulties. Smart city initiatives and urban planning programs increasingly incorporate cycling infrastructure that supports e-bike adoption as integral components of sustainable transportation ecosystems.

Manufacturers are developing enhanced battery technologies featuring higher energy density, faster charging capabilities, and extended lifecycle performance that address primary consumer concerns about e-bike practicality. Integration of brushless motors, regenerative braking systems, and intelligent power management enables improved efficiency and range optimization. Advanced connectivity features including GPS navigation, smartphone integration, anti-theft systems, and ride analytics transform electric bicycles into smart mobility devices that appeal to technology-oriented consumers seeking enhanced functionality beyond basic transportation.

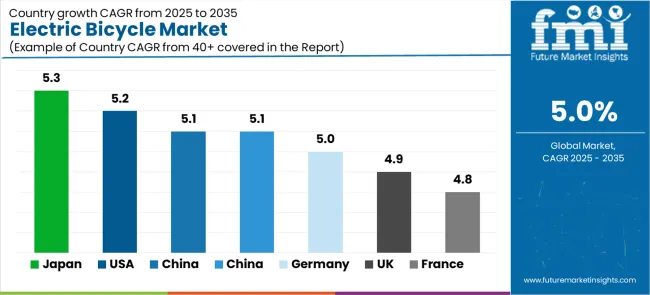

| Country | CAGR (2025–2035) |

|---|---|

| Japan | 5.3 |

| United States | 5.2 |

| China | 5.1 |

| India | 5.1 |

| Germany | 5.0 |

| United Kingdom | 4.9 |

| France | 4.8 |

The electric bicycle market is growing steadily, with Japan leading at a 5.3% CAGR through 2035, driven by aging population seeking mobility solutions, advanced technology adoption, and comprehensive cycling infrastructure. The United States follows at 5.2%, supported by increasing environmental awareness, rising fuel costs, and growing interest in outdoor recreational activities. China demonstrates robust expansion at 5.1%, benefiting from government support for electric vehicles and massive urban commuting needs. India maintains strong growth at 5.1%, driven by traffic congestion challenges and affordability considerations for urban transportation. The United Kingdom shows solid growth at 4.9%, focusing on sustainable transportation policies and cycling infrastructure investments. Germany demonstrates steady expansion at 5.0%, supported by environmental consciousness and premium product preferences. France maintains consistent growth at 4.8%, driven by urban mobility initiatives and cycling culture development.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The electric bicycle market in Japan is projected to exhibit the highest growth rate with a CAGR of 5.3% through 2035, driven by the country's aging population seeking mobility solutions that reduce physical exertion while maintaining independence. Japan's well-developed cycling infrastructure and cultural acceptance of bicycles as primary transportation create favorable conditions for e-bike adoption. Senior citizens increasingly adopt electric bicycles for shopping, medical appointments, and social activities, driving demand for comfortable and easy-to-use models with enhanced safety features. The country's advanced manufacturing sector produces technologically sophisticated e-bikes incorporating features such as automatic transmission systems, fall detection sensors, and ergonomic designs specifically tailored for elderly users. Major cities have implemented senior-friendly cycling infrastructure including wider bike lanes, dedicated parking areas near medical facilities, and charging stations at community centers. Japanese consumers demonstrate strong preference for domestically manufactured products from trusted brands like Yamaha, Panasonic, and Bridgestone, which offer comprehensive after-sales service networks and reliable warranty support.

The electric bicycle market iin the United States is expanding at a CAGR of 5.2%, supported by increasing environmental consciousness among urban consumers and growing recognition of e-bikes for recreational and commuting applications. Rising fuel prices and parking costs in major metropolitan areas are encouraging consumers to explore alternative transportation options. The market benefits from expanding cycling infrastructure in cities like Portland, San Francisco, and New York, along with state-level incentive programs supporting e-bike purchases. California, Colorado, and Vermont have implemented rebate programs offering $500-$1,500 per e-bike purchase, significantly reducing acquisition barriers for middle-income consumers. The COVID-19 pandemic accelerated interest in personal transportation alternatives, with e-bike sales experiencing triple-digit growth rates during 2020-2022. American consumers demonstrate growing preference for cargo e-bikes for family transportation and shopping, mountain e-bikes for trail riding, and commuter models for urban travel. Direct-to-consumer brands like Rad Power Bikes and Aventon have gained significant market share by offering affordable, feature-rich models with online sales channels and home delivery.

The electric bicycle market in China is growing at a CAGR of 5.1%, driven by massive urban populations requiring affordable transportation solutions for daily commuting in congested cities. Government policies supporting electric vehicle adoption extend to e-bikes through favorable regulations and infrastructure investments. The market is characterized by diverse product offerings spanning budget-friendly basic models priced under $300 to premium imported brands exceeding $3,000 serving affluent consumers seeking quality and advanced features. China represents the world's largest e-bike market with over 300 million units in operation, supported by extensive domestic manufacturing capabilities and established supply chains for batteries, motors, and components. Major cities including Beijing, Shanghai, and Shenzhen have implemented comprehensive cycling lane networks, dedicated e-bike parking facilities, and battery swapping stations supporting convenient usage. The market features intense competition among domestic brands like Yadea, Aima, and Xinri, which dominate the mass market segment, while international brands target premium consumers seeking superior quality and brand prestige.

Demand for electric bicycle systems in India is projected to grow at a CAGR of 5.1%, supported by severe traffic congestion in major cities and growing middle-class interest in affordable personal mobility solutions. Rising fuel costs and increasing environmental awareness among urban youth are driving consideration of electric bicycles as practical alternatives to traditional transportation. The market benefits from expanding domestic manufacturing capabilities and government initiatives promoting electric mobility across all vehicle categories. India's FAME II (Faster Adoption and Manufacturing of Electric Vehicles) subsidy scheme includes provisions for e-bikes, providing financial incentives for consumers and manufacturers. Major metropolitan areas like Bangalore, Mumbai, Delhi, and Pune experience severe traffic congestion with average commute speeds below 20 km/h, creating strong demand for nimble transportation alternatives. Domestic manufacturers including Hero Electric, Lectro, and EMotorad are developing products specifically designed for Indian conditions, featuring robust construction for poor road conditions, waterproofing for monsoon seasons, and pricing strategies targeting middle-class consumers.

Demand for electric bicycle systems in the United Kingdom is expanding at a CAGR of 4.9%, driven by government commitments to carbon neutrality and extensive investments in cycling infrastructure across major cities. Cycle-to-work schemes and purchase incentive programs reduce acquisition costs for employees considering e-bike commuting. Urban congestion charging zones and low emission areas create financial incentives favoring zero-emission transportation modes including electric bicycles. London's Ultra Low Emission Zone (ULEZ) and similar programs in other cities impose daily charges on polluting vehicles while exempting bicycles, creating significant cost savings for e-bike commuters. The UK government's £2 billion cycling and walking investment plan includes dedicated funding for expanding cycling infrastructure, improving safety, and promoting active transportation. British consumers demonstrate strong preference for quality European brands like Raleigh, Brompton, and Specialized, with growing interest in cargo e-bikes for family transportation and folding e-bikes for multimodal commuting combining cycling with public transportation.

Demand for electric bicycle systems in Germany is projected to grow at a CAGR of 5.0%, supported by strong cycling culture, environmental consciousness, and consumer preference for high-quality engineered products. German consumers demonstrate willingness to invest in premium e-bikes featuring advanced components, superior build quality, and comprehensive warranty coverage. The market is characterized by strong domestic manufacturing capabilities and leadership in electric bicycle technology development. Germany accounts for approximately 30% of European e-bike sales, with over 2 million units sold annually and average selling prices exceeding €2,500, significantly higher than global averages. Leading German brands including Riese &Müller, Haibike, and Cube have established international reputations for engineering excellence, innovation, and quality. The country's extensive cycling infrastructure includes over 75,000 kilometers of dedicated bike paths, secure parking facilities at train stations and public buildings, and integration with public transportation systems through bike-friendly trains and buses. German employers increasingly offer company bike programs similar to company car schemes, providing tax-advantaged e-bike leasing for employees.

Demand for electric bicycle systems in France is expanding at a CAGR of 4.8%, driven by government programs promoting cycling as sustainable urban transportation and financial incentives supporting e-bike purchases. Major cities including Paris, Lyon, and Marseille are investing in cycling infrastructure and implementing car-restrictive policies that favor bicycle transportation. The market benefits from growing consumer interest in active lifestyle choices combined with environmental responsibility. France's national e-bike purchase subsidy program provides up to €400 for eligible consumers, with additional local subsidies in Paris and other cities bringing total incentives to €600-€1,000 per purchase. Paris Mayor Anne Hidalgo's ambitious cycling infrastructure expansion includes creating 1,000 kilometers of new bike lanes, eliminating 70,000 parking spaces, and restricting vehicle access to city center areas. French consumers demonstrate growing interest in elegant, design-focused e-bikes that combine functionality with aesthetic appeal, supporting success of brands like Moustache Bikes, Angell, and Cowboy which emphasize style alongside performance.

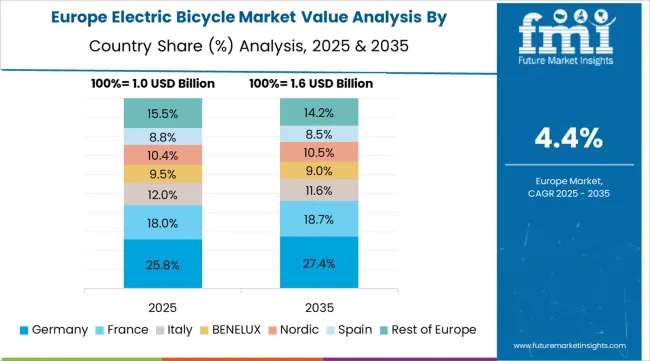

The electric bicycle market in Western Europe is projected to grow from USD 1.18 billion in 2025 to USD 1.91 billion by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain its leadership with a 30.0% share in 2025, supported by its strong cycling culture, environmental consciousness, and consumer preference for premium quality products. France follows with 18.0% market share, driven by government incentives for e-bike purchases and extensive urban cycling infrastructure development. The United Kingdom holds 16.0% of the European market, benefiting from sustainable transportation policies and increasing investments in cycling networks across major cities. The Netherlands represents 12.0% of regional demand, leveraging its well-established cycling culture and comprehensive bike-friendly infrastructure. Italy accounts for 10.0% of the market, with growing focus on urban mobility solutions and recreational cycling applications. Spain holds 7.0% market share, supported by tourism-related e-bike rentals and expanding urban commuting adoption. The Rest of Western Europe region accounts for 7.0% of the market, supported by growing adoption in Nordic countries, Belgium, Austria, and Switzerland where cycling infrastructure and environmental awareness drive market development.

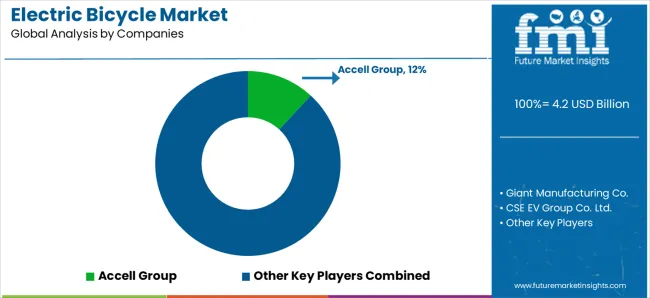

The electric bicycle market is driven by 12–15 key players, with the top five companies holding around 50–55% of global market share, driven by their innovation, brand recognition, and expansive distribution networks in regions like Europe, North America, and Asia. Competition in the market focuses on battery efficiency, motor power, design innovation, and integration of smart features, rather than just price alone. Accell Group leads the market with an 12% share, benefiting from its wide product range and established presence in both the European and North American e-bike markets.

Market leaders such as Accell Group, Giant Manufacturing Co., CSE EV Group Co. Ltd., and Merida Industry Co. Ltd. maintain dominance through their extensive product portfolios, offering a range of e-bikes for various end-user segments, including commuting, sports, and leisure. These companies leverage their strong distribution channels, technological innovations in battery management systems, and partnerships with cycling organizations to strengthen their market positions globally.

Challengers like Trek Bicycle Corporation, Yamaha Motor Co., Panasonic Corporation, and Robert Bosch GmbH differentiate by offering specialized e-bikes with advanced features like integrated GPS, smart connectivity, and high-performance motors for urban commuting and off-road adventures. Companies like Shimano Inc., Specialized Bicycle Components, Riese & Müller, and Pon Holdings focus on high-end, performance-driven electric bicycles, catering to enthusiasts and professional riders, and pushing the boundaries of e-bike technology to meet the growing demand for premium models.

The electric bicycle market underpins sustainable urban mobility, personal health improvement, environmental emission reduction, and transportation accessibility. With urbanization pressures, climate change concerns, and demand for flexible transportation solutions, the sector must balance affordability, performance, safety, and sustainability. Coordinated contributions from governments, industry bodies, manufacturers, suppliers, and investors will accelerate the transition toward widespread electric bicycle adoption as mainstream transportation.

| Item | Details |

|---|---|

| Quantitative Units (2025) | USD 4.20 billion |

| Battery Type | Li-ion Battery, Li-ion Polymer Battery, Lead Acid Battery |

| Mode | Throttle Assist, Pedal Assist |

| Application | City/Urban, Mountain/Trekking, Cargo, Others |

| Regions Covered | North America, East Asia, Western Europe, South Asia, Latin America, Middle East &Africa |

| Countries Covered | United States, Japan, China, India, United Kingdom, Germany, France, and 40+ additional countries |

| Key Companies Profiled | Accell Group, Giant Manufacturing Co., CSE EV Group Co. Ltd., Merida Industry Co Ltd, Trek Bicycle Corporation, Yamaha Motor Co., Panasonic Corporation, Robert Bosch GmbH, Shimano Inc., Specialized Bicycle Components, Riese & Müller, and Pon Holdings |

| Additional Attributes | Dollar sales by battery type and mode;regional demand trends across North America, East Asia, and Europe;competitive landscape with established manufacturers and emerging direct-to-consumer brands;consumer preferences for throttle vs pedal assist systems;integration with smart technologies and connectivity features;innovations in battery technology and motor efficiency for extended range and performance;adoption of lightweight materials and design excellence for enhanced user experience and market differentiation |

The global electric bicycle market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the electric bicycle market is projected to reach USD 6.8 billion by 2035.

The electric bicycle market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in electric bicycle market are li-ion battery, li-ion polymer battery and lead acid battery.

In terms of mode, throttle assist segment to command 60.6% share in the electric bicycle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA