About The Report

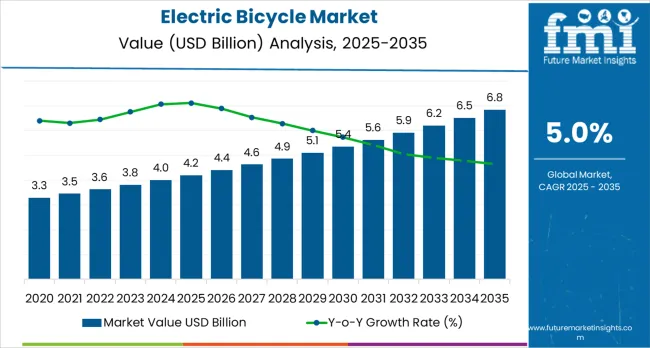

The global electric bicycle market is projected to reach USD 4.4 billion in 2026 and grow to USD 7.2 billion by 2036, registering a CAGR of 5%. This steady expansion reflects the growing consumer shift toward eco-friendly, sustainable transportation solutions, particularly in urban mobility. The demand for electric bicycles is being driven by factors such as increased environmental awareness, technological advancements, and government incentives supporting green transportation. As the market matures, it presents substantial opportunities for investors to capitalize on emerging trends like improved battery technologies, smart connectivity, and the growing popularity of shared mobility solutions.

The capital intensity of electric bicycle manufacturing, particularly around battery production and advanced motor systems, will shape the investment landscape between 2026 and 2036. Companies must balance high upfront capital expenditure with longer return timelines, especially for those targeting premium and innovative e-bike models. Investment selectivity will be critical, with funds focusing on firms demonstrating strong scalability, competitive product differentiation, and robust distribution networks. Strategic investments in R&D and local partnerships will be crucial for companies seeking to gain a foothold in emerging markets, while those targeting mature markets will need to prioritize cost efficiency and technological innovation to maintain long-term profitability.

| Metric | Value |

|---|---|

| Industry Value (2026) | USD 4.4 Billion |

| Forecast Value (2036) | USD 7.2 Billion |

| Forecast CAGR (2026 to 2036) | 5% |

The global electric bicycle (e-bike) market is witnessing steady growth, driven by the increasing demand for eco-friendly, cost-effective, and sustainable transportation solutions. Electric bicycles offer a combination of traditional cycling benefits and electric assistance, making them an attractive option for urban commuters, recreational riders, and individuals seeking a healthier and more environmentally friendly mode of transport. As cities increasingly focus on reducing traffic congestion and pollution, e-bikes are becoming a popular alternative to cars, particularly in densely populated areas.

The growth of the market is fueled by several factors, including the rise in environmental awareness, government incentives for green transportation, and improvements in e-bike technology. Advancements in battery technology have resulted in lighter, more efficient, and longer-lasting batteries, improving the overall performance and range of e-bikes. The rising cost of fuel and the increasing awareness of the health benefits of cycling are encouraging more consumers to opt for electric bicycles over traditional vehicles.

With the continued shift toward sustainable urban mobility, the e-bike market is expected to expand further, particularly in regions like Europe, North America, and Asia-Pacific, where demand for green transportation is rapidly growing. As manufacturers innovate with more affordable, user-friendly, and feature-rich e-bike models, the market is likely to witness continued expansion in the coming years.

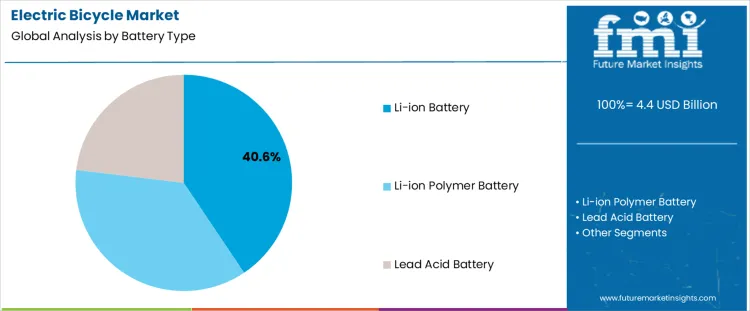

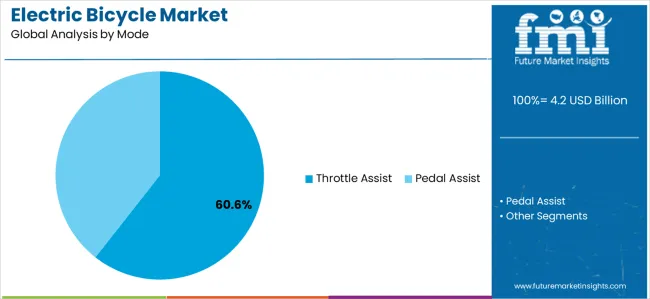

The electric bicycle market is segmented by battery type and mode. Li-ion batteries lead the market with a 40.60% share, followed by Li-ion polymer batteries and lead acid batteries. These batteries are integral to the performance and range of electric bicycles. In terms of mode, throttle assist dominates with a 60.40% share, followed by pedal assist. These modes of operation are essential in determining how power is delivered to the bike, affecting overall performance, user experience, and battery efficiency.

Li-ion batteries account for 40.60% of the electric bicycle market share due to their superior energy density, longer cycle life, and lighter weight compared to other battery types. They provide a longer range and faster charging, making them ideal for electric bicycles used for daily commutes and longer trips. These batteries allow for better overall performance, making them the preferred choice for both manufacturers and consumers. As electric bicycle technology continues to evolve, Li-ion batteries remain at the forefront due to their efficiency, durability, and cost-effectiveness, further solidifying their dominant position in the market as the go-to power source for modern e-bikes.

Throttle assist mode makes up 60.40% of the mode segment in the electric bicycle market due to its ease of use and convenience. It allows riders to power the bike with the push of a button or twist of the throttle, offering a more relaxed and effortless ride compared to pedal assist. This feature is especially popular among urban commuters and recreational riders who prefer an additional boost in speed without continuous pedaling. Throttle assist provides a simple, direct power delivery system, contributing significantly to the growth of the electric bicycle market, where convenience and efficiency are key driving factors for consumer adoption.

The electric bicycle market is shaped by the growing need for efficient, affordable, and flexible urban mobility solutions. As cities face traffic congestion and parking limitations, e bikes offer a viable personal transport alternative that blends convenience with cost savings. Rising environmental awareness and policy support for low emission transport options further encourage adoption. Technological improvements in battery capacity and motor efficiency extend range and usability. Diverse product offerings from commuter e bikes to cargo and mountain variants broaden appeal across riders of different ages and use cases, expanding market reach in both developed and emerging regions.

Despite strong growth potential, the electric bicycle market faces several restraints. High upfront costs, particularly for premium models with advanced features, may deter cost sensitive buyers when subsidies are limited. Battery replacement costs and concerns about long term maintenance can also influence purchase decisions. Inadequate cycling infrastructure in many regions, including limited bike lanes and secure parking, reduces user convenience and safety. Regulatory discrepancies in e bike classifications and standards across countries complicate manufacturing and compliance. Concerns about theft and the need for secure storage can slow adoption in urban areas with limited safety measures.

Key trends in the electric bicycle market include increasing integration of smart and connected features such as GPS tracking, app based ride data, and remote diagnostics that improve overall rider experience. There is rising demand for lightweight, high efficiency battery systems that enhance range without adding excess weight. Customized e bike models for specific segments such as cargo transport, recreational riding, and last mile delivery is expanding product portfolios. Subscription and rental models are gaining traction, especially in shared mobility programs. Collaboration between manufacturers and logistics firms is accelerating adoption for commercial use, particularly in urban last mile delivery networks.

| Country | CAGR (%) |

|---|---|

| India | 5.1% |

| China | 5.1% |

| USA | 5.2% |

| Japan | 5.3% |

| Germany | 5% |

The electric bicycle market is witnessing steady growth across key regions, with India and China leading at 5.1%, driven by increasing urbanization, pollution concerns, and the growing demand for affordable, eco-friendly transportation options. Japan’s market grows at 5.3%, supported by a focus on sustainability and an aging population seeking easier transportation solutions. The USA grows at 5.2%, driven by the increasing popularity of electric bicycles as an alternative to cars, coupled with expanding cycling infrastructure and government incentives. Germany’s market grows at 5%, fueled by its focus on green mobility, strong cycling infrastructure, and the growing demand for electric bikes among both younger and older generations.

Japan’s electric bicycle market is growing at 5.3%, driven by the country’s strong focus on sustainable transportation and increasing environmental awareness. With urbanization and the need for efficient, eco-friendly commuting solutions, electric bicycles are becoming a popular mode of transportation in cities. Japan's aging population is also contributing to the growth, as electric bicycles provide an easier and less strenuous way for older adults to travel. The government’s support for green initiatives, coupled with advancements in electric bicycle technology, such as longer battery life and improved motor performance, is driving market growth. The popularity of electric bicycles is further supported by Japan’s efficient public transportation systems, which make it easier to integrate bikes into daily commuting. As the demand for sustainable and cost-effective transportation solutions continues to rise, Japan’s electric bicycle market is expected to expand steadily.

The electric bicycle market in the USA is growing at 5.2%, fueled by the increasing shift towards sustainable transportation solutions and a growing focus on health and fitness. As cities become more congested and environmental concerns rise, electric bicycles are emerging as an efficient, eco-friendly alternative to cars. The USA’s expanding urban areas and the rise in cycling infrastructure are making electric bicycles a more attractive option for commuting and leisure. The growing popularity of outdoor activities and the desire for an environmentally friendly, low-maintenance mode of transportation are contributing to market growth. Government incentives and policies aimed at reducing carbon emissions and promoting green alternatives are also supporting the adoption of electric bicycles. With advancements in technology, affordability, and convenience, the market for electric bicycles in the USA is expected to continue expanding.

China’s electric bicycle market is growing at 5.1%, driven by the country’s large population, increasing urbanization, and rising demand for affordable, eco-friendly transportation solutions. Electric bicycles offer a practical alternative to cars in China’s dense cities, helping alleviate traffic congestion and reduce pollution. With a growing middle class and rising disposable incomes, consumers are increasingly turning to electric bicycles for short-distance commuting. China’s well-developed cycling infrastructure and government support for green transportation initiatives are contributing to the market’s growth. The increasing focus on reducing carbon emissions and promoting sustainable mobility is further propelling the adoption of electric bicycles. As battery technology continues to improve and production costs decrease, electric bicycles are expected to become even more accessible to the average consumer. With the expansion of urban mobility solutions, China’s electric bicycle market is set to continue its steady growth.

India’s electric bicycle market is growing at 5.1%, driven by the country’s increasing focus on sustainable transportation and the growing need for efficient, cost-effective mobility solutions. With rapid urbanization and rising pollution levels, electric bicycles are becoming an attractive option for commuters looking for eco-friendly alternatives to traditional vehicles. The growing middle class and higher disposable incomes are driving demand for electric bicycles, especially in urban centers where traffic congestion and air pollution are significant issues. The Indian government’s push towards clean energy and sustainable transportation is supporting the adoption of electric bicycles. As infrastructure for cycling and electric vehicle charging continues to improve, the market is expected to grow. Furthermore, advancements in battery technology and a rise in consumer awareness of electric bicycles’ environmental benefits are further fueling the market’s expansion in India.

Germany’s electric bicycle market is growing at 5%, supported by the country’s increasing focus on sustainability and reducing carbon emissions. The growing popularity of electric bicycles in Germany is driven by the rise in demand for green transportation solutions in urban areas. As cities face traffic congestion and environmental concerns, electric bicycles offer a practical, eco-friendly alternative to traditional modes of transportation. Germany’s robust cycling infrastructure and policies promoting clean mobility are further contributing to market growth. The demand for electric bicycles is also rising among the older population, who find them easier to ride compared to traditional bicycles. Germany’s strong consumer interest in health and fitness, along with growing awareness of the benefits of electric bicycles, is fueling market expansion. As technology improves and prices become more affordable, Germany’s electric bicycle market is expected to continue growing steadily.

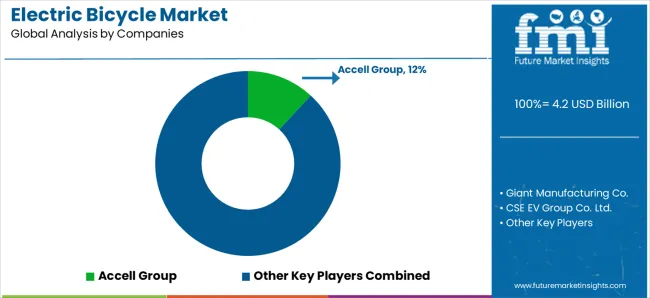

Competition in the electric bicycle market is shaped by technology integration, motor performance, battery efficiency, design versatility, and brand positioning. Accell Group leverages its diverse brand portfolio to offer e bikes that blend comfort and performance, emphasizing ride quality and ergonomic design in product materials that help riders across urban and leisure segments. Giant Manufacturing Co. competes with a broad range of e bikes that balance power, durability, and value, and its brochures underscore global service networks and high volume manufacturing expertise.

CSE EV Group Co. Ltd. and Merida Industry Co Ltd focus on cost effective yet feature rich models that appeal to both entry level riders and seasoned cyclists. Their materials highlight responsive motor systems and battery range reliability, helping customers match performance to daily commuting or recreational needs. Trek Bicycle Corporation and Yamaha Motor Co. differentiate through premium engineering and integrated systems; Trek emphasizes smart connectivity and frame innovation, while Yamaha’s product collateral focuses on motor responsiveness and proven reliability drawn from its long history in powered mobility.

Panasonic Corporation and Robert Bosch GmbH compete primarily as component providers, equipping e bikes with high efficiency motors, advanced battery packs, and control electronics that enhance ride smoothness and range. Their documentation stresses energy efficiency, system integration, and diagnostics support that help OEMs deliver superior performance. Across all players, product literature is crafted to highlight ride performance, system reliability, and user experience as key factors that help brands differentiate in this fast growing, technology driven market.

| Items | Values |

|---|---|

| Quantitative Unit (2026) | USD Billion |

| Battery Type | Li-ion Battery, Li-ion Polymer Battery, Lead Acid Battery |

| Mode | Throttle Assist, Pedal Assist |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | USA, Canada, Mexico, China, Japan, South Korea, India, Australia and New Zealand, ASEAN, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Brazil, Chile, Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union |

| Key Companies Profiled | Accell Group, Giant Manufacturing Co., CSE EV Group Co. Ltd., Merida Industry Co Ltd, Trek Bicycle Corporation, Yamaha Motor Co., Panasonic Corporation, Robert Bosch GmbH |

| Additional Attributes | Dollar sales segmented by battery type, mode, and region. Regional CAGR and growth outlook with emphasis on throttle assist adoption, li ion battery penetration, urban mobility use cases, and component level value contribution across motors and battery systems. |

The global electric bicycle market is estimated to be valued at USD 4.4 billion in 2026.

The market size for the electric bicycle market is projected to reach USD 7.2 billion by 2036.

The electric bicycle market is expected to grow at a 5.0% CAGR between 2026 and 2036.

The key product types in electric bicycle market are li-ion battery, li-ion polymer battery and lead acid battery.

In terms of mode, throttle assist segment to command 60.4% share in the electric bicycle market in 2026.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Electric Soap Dispenser Market is segmented by Product Type (Automatic, Semi-automatic), Material (Plastic, Steel, Glass, Others), Application (Commercial, Residential, Institutional), Sales Channel (Online, Offline), and Region. Forecast for 2026 to 2036.

The Electric Fabric Shaver Market is segmented by Product Type (Rechargeable, Battery-operated, Corded), End Use (Residential, Commercial Laundry/Dry Cleaning), Distribution Channel (Online Retail, Hypermarkets/Supermarkets, Specialty Stores), and Region. Forecast for 2026 to 2036.

The Electric Tiffin Market is segmented by Product Type (Single Container, Multi-Container, Insulated Models, and Smart Electric Tiffins), Distribution Channel (Home Appliance Stores, Online Retail, Supermarkets and Hypermarkets, and Direct Sales), Application (Personal Use, Office and Workplace, Travel and Commuting, and Student Use), and Region. Forecast for 2026 to 2036.

The Electric Toothbrush Market is segmented by Product Type (Rotary Electric Toothbrushes, Sonic Electric Toothbrushes, Ultrasonic Electric Toothbrushes, and Dual-Action Electric Toothbrushes), Distribution Channel (Supermarkets and Hypermarkets, Pharmacy and Drugstores, Online Retail, and Specialty Stores), End User (Adults, Children, and Geriatric Population), and Region. Forecast for 2026 to 2036.

The Electric Shoe Dryer Market is segmented by Product Type (Portable Shoe Dryers, Fixed Installation Dryers, Boot Dryers, and Multi-Shoe Dryers), Distribution Channel (Online Retail, Specialty Sports Stores, Department Stores, and Direct Sales), Application (Residential Use, Commercial Facilities, Sports Equipment Rental, and Industrial Workplaces), and Region. Forecast for 2026 to 2036.

The Electric Power Steering Motors Market is segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Off-Highway Vehicles), Product Type (AC Motors and DC Motors), Sales Channel (Original Equipment Manufacturers and Aftersales), Motor Power (Less Than 300 Watts, 300–600 Watts, and More Than 600 Watts), and Region. Forecast for 2026 to 2036.

The Electric Vehicle Battery Conditioners Market is segmented by Voltage (12 to 24 Volts, 24 to 48 Volts, Others), Vehicle Type (BEV, HEV/PHEV), Technology (Active Thermal Conditioning, Passive), and Region. Forecast for 2026 to 2036.

Electric Linear Actuator Market Trends – Growth & Forecast 2026 to 2036

Electric Dental Handpiece Market - Size, Trends & Forecast 2026 to 2036

Electric Wheelchair Market Forecast and Outlook 2026 to 2036

Electric Fireplace Market Size and Share Forecast Outlook 2026 to 2036

Electric Grills Market Forecast and Outlook 2026 to 2036

Electric Stakebed Truck Market Size and Share Forecast Outlook 2026 to 2036

Electric Low Entry Bus Market Size and Share Forecast Outlook 2026 to 2036

Electric Dump Truck Market Size and Share Forecast Outlook 2026 to 2036

Bicycle Components Aftermarket Analysis Size and Share Forecast Outlook 2026 to 2036

Electrical Testing Services Market Size and Share Forecast Outlook 2026 to 2036

Electric Sub-Meter Market Analysis Size and Share Forecast Outlook 2026 to 2036

Electric Propulsion Thruster Test Equipment Market Size and Share Forecast Outlook 2026 to 2036

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.