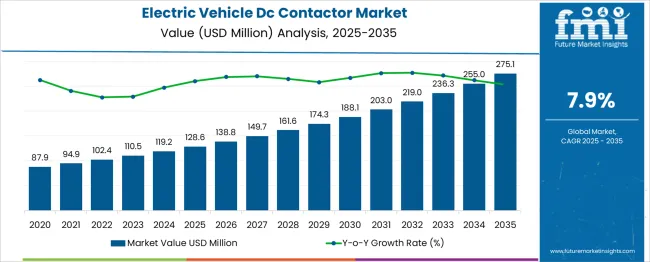

The electric vehicle DC contactor market is estimated to be valued at USD 128.6 million in 2025 and is projected to reach USD 275.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period. This expansion can be segmented into three distinct phases based on market dynamics. From 2025 to 2030, the market grows from USD 87.9 million to USD 138.8 million, driven by rising global EV adoption, advancements in battery technology, and increased demand for high-voltage safety solutions in electric drivetrains. This phase reflects foundational growth, where OEMs and tier-one suppliers focus on integrating advanced DC contactors that ensure efficiency, thermal stability, and safety compliance.

The subsequent phase from 2030 to 2035 marks an acceleration in demand, with the market moving from USD 161.6 million to USD 275.1 million as electric vehicle penetration deepens across passenger and commercial fleets globally. Rising government incentives, stricter emission reduction mandates, and rapid infrastructure development for EV charging characterize this period. Innovation in contactor design, incorporating solid-state switching, higher current capacity, and compact architectures, enhances reliability while meeting lightweight vehicle requirements. Digital monitoring features and predictive maintenance tools gain prominence to align with smart EV systems. The overall trend reflects a market transitioning from early adoption to mainstream integration, reinforced by technological evolution and sustained global investments in electric mobility, ensuring significant opportunities for manufacturers and component suppliers throughout the next few years.

| Metric | Value |

|---|---|

| Electric Vehicle DC Contactor Market Estimated Value in (2025 E) | USD 128.6 million |

| Electric Vehicle DC Contactor Market Forecast Value in (2035 F) | USD 275.1 million |

| Forecast CAGR (2025 to 2035) | 7.9% |

The electric vehicle (EV) DC contactor market secures a significant niche within several core automotive and power electronics domains. In the overall electric vehicle components market, DC contactors account for approximately 2–3%, reflecting their critical role in managing high-voltage connections within battery systems. Within the EV power distribution and safety systems category, their share rises to 10–12%, as these components enable secure switching and circuit isolation in traction batteries and fast-charging setups. In the broader automotive electrical components sector, DC contactors hold about 1–2%, given the presence of numerous auxiliary and low-voltage components. For the high-voltage EV protection segment, the share strengthens to 15–18%, driven by safety compliance requirements for battery packs and energy storage modules. In the EV fast-charging infrastructure category, DC contactors represent nearly 5%, as advanced designs capable of handling rapid current transfer become essential for ultra-fast charging stations.

The component’s relevance is underscored by its function in preventing short circuits, reducing thermal risks, and enhancing operational stability across electric mobility platforms. Despite their relatively small share in the broader automotive landscape, DC contactors are indispensable to the safe and efficient operation of EV powertrains. Ongoing developments such as solid-state designs, integrated sensing technologies, and lightweight architectures further reinforce their market importance. This sustained adoption trajectory ensures that EV DC contactors will remain a critical enabler of safety and performance in next-generation electric mobility ecosystems.

The market has been influenced by technological advancements in battery systems, increasing production of electric vehicles, and a sharp focus on safety and power efficiency in high-voltage applications. DC contactors are serving as a critical component in electric drivetrains by ensuring safe power transmission and protection within high-energy circuits.

With governments worldwide enforcing strict emission regulations and offering incentives for electric vehicle adoption, the demand for reliable and high-performance contactors has risen significantly. Manufacturers are focusing on developing lightweight, compact, and highly durable contactors to meet the evolving requirements of EV platforms.

Furthermore, the integration of advanced energy management systems and rapid improvements in battery technologies are expected to support long-term demand. The market outlook remains strong, with innovation and production scale driving cost efficiencies and expanding the application scope across commercial and passenger EVs..

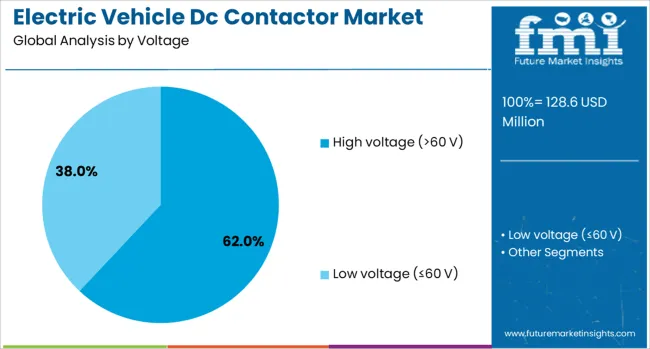

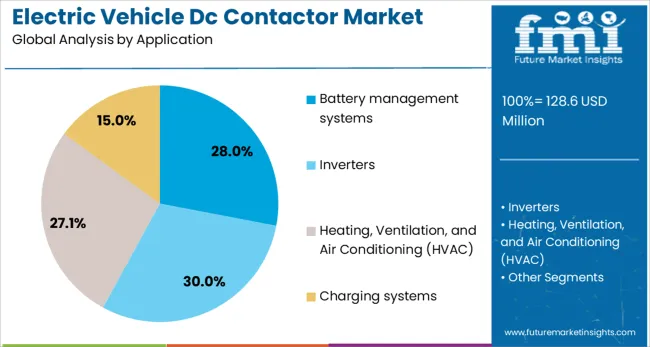

The electric vehicle DC contactor market is segmented by voltage, application, and geographic regions. The voltage of the electric vehicle DC contactor market is divided into High voltage (>60 V) and Low voltage (≤60 V). In terms of application, the electric vehicle DC contactor market is classified into Battery management systems, Inverters, Heating, Ventilation, and Air Conditioning (HVAC), and Charging systems. Regionally, the electric vehicle DC contactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high voltage segment, defined as operating above 60 V, is expected to account for 62% of the Electric Vehicle DC Contactor market revenue share in 2025, making it the dominant voltage category. This segment has seen increased adoption due to the widespread integration of high-voltage battery systems in electric vehicles, which are essential for delivering extended range and efficient power delivery.

High voltage systems enable improved acceleration, reduced charging times, and enhanced thermal management, all of which are critical for the performance and reliability of electric vehicles. The use of DC contactors in these systems has been prioritized for their role in safely managing current flow, disconnecting circuits during faults, and ensuring thermal stability under demanding conditions.

Furthermore, the growing production of heavy-duty electric vehicles and fast-charging infrastructure has further amplified the demand for contactors that can operate reliably at higher voltages. This has positioned the high voltage segment as the most strategic area for innovation and deployment in the evolving electric vehicle landscape..

The battery management systems segment is projected to represent 28% of the Electric Vehicle DC Contactor market revenue share in 2025, making it the leading application area. This growth has been supported by the essential role of contactors within battery management systems, where precise control over current flow and circuit protection is critical. As electric vehicles continue to adopt more complex and high-capacity lithium-ion battery configurations, the reliability and safety of battery management systems have become paramount.

DC contactors are being increasingly used to isolate batteries during faults, manage pre-charge circuits, and enable safe start-up and shutdown procedures. Their integration within intelligent battery systems helps in ensuring optimal energy usage, extending battery life, and enhancing vehicle safety.

The need for real-time diagnostics, thermal monitoring, and high-voltage switching within battery management systems has led to increased investment in contactors with advanced control capabilities. This has solidified the segment’s position as a key driver of demand in the overall market for electric vehicle DC contactors..

The EV DC contactor market is growing rapidly, driven by rising EV adoption, fast-charging infrastructure, and stringent safety standards. However, cost optimization and material durability challenges remain key hurdles for manufacturers.

The adoption of high-voltage battery systems in electric vehicles has amplified the demand for DC contactors as essential safety and control components. These contactors are crucial for managing high-current circuits, ensuring proper isolation during charging and discharging processes. With the growing preference for high-capacity batteries and faster charging capabilities, automakers are prioritizing reliable switching solutions that offer superior thermal stability and arc suppression. Manufacturers are developing compact and lightweight designs to meet EV efficiency goals, while maintaining robust performance under varying load conditions. This integration of advanced high-voltage systems is driving the need for durable DC contactors capable of supporting evolving powertrain architectures across passenger and commercial electric vehicle segments.

Stringent safety regulations for electric vehicles have reinforced the role of DC contactors in ensuring electrical integrity and preventing hazards such as short circuits and thermal runaways. These components enable rapid circuit isolation during faults, protecting battery systems and enhancing passenger safety. Automakers and tier-one suppliers are embedding advanced diagnostic capabilities within contactors to support real-time monitoring and predictive maintenance. Compliance with global automotive standards such as ISO 26262 for functional safety has become mandatory, pushing manufacturers to deliver products that meet high reliability benchmarks. This regulatory-driven demand is fueling continuous innovation in contactor designs to enhance fault tolerance and overall vehicle safety performance.

The proliferation of fast-charging and ultra-fast charging networks globally has significantly impacted the DC contactor market. These charging systems operate at higher voltages and require components that can handle elevated current levels without compromising operational safety. DC contactors play a critical role in managing power flow during rapid charging cycles, reducing downtime and ensuring compatibility with diverse battery chemistries. As governments and private players invest heavily in charging infrastructure, the requirement for robust and long-lasting contactors has intensified. Manufacturers are focusing on designs capable of handling frequent switching operations under high electrical stress, aligning with the accelerated adoption of fast-charging solutions worldwide.

Despite strong growth drivers, the EV DC contactor market faces challenges associated with cost optimization and material durability. High-performance contactors often involve expensive materials and advanced manufacturing techniques, impacting overall vehicle cost structures. Additionally, ensuring consistent performance across extreme temperature ranges and vibration conditions adds complexity to product design. Competitive pressure among suppliers has intensified, leading to price-based differentiation while maintaining stringent quality requirements. Companies are exploring modular designs and scalable production models to address cost concerns without compromising safety and performance standards. Balancing affordability with technological upgrades remains a critical challenge as EV adoption scales globally.

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

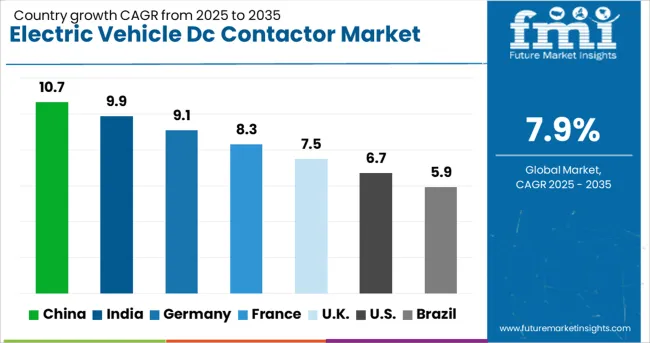

The electric vehicle (EV) DC contactor market is forecasted to grow at a global CAGR of 7.9% between 2025 and 2035, driven by rising EV penetration, fast-charging infrastructure development, and advancements in high-voltage safety systems. China leads with an estimated CAGR of 10.7%, supported by its dominant EV manufacturing ecosystem and aggressive government incentives for clean mobility. India follows at 9.9%, propelled by domestic EV production, expanding charging infrastructure, and localization of critical components to reduce imports. Germany records a CAGR of 9.1%, reflecting strong demand for premium EVs and technological upgrades in battery safety systems.The United Kingdom grows at 7.5%, fueled by electrification targets and investments in battery technology, while the United States posts 6.7%, influenced by increased adoption of long-range EVs and steady rollout of high-power charging networks across key urban corridors. The report includes in-depth insights from over 40 countries, with these leading markets setting critical benchmarks for global growth and strategic investments in advanced EV contactor technologies.

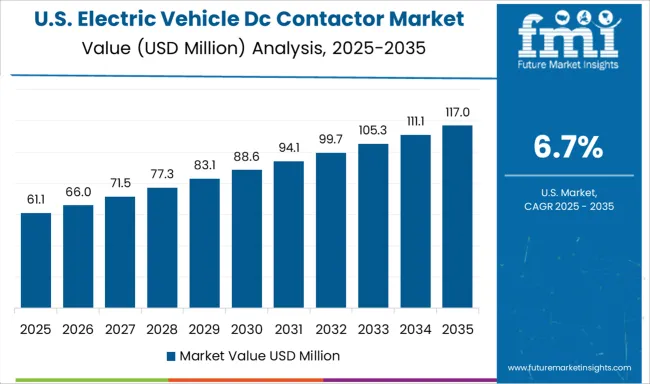

The CAGR of the electric vehicle DC contactor market in the United States was approximately 5.8% during 2020–2024 and rose to 6.7% for 2025–2035, indicating a clear upward trend. The earlier phase saw restrained growth due to slower EV adoption rates and limited high-voltage infrastructure penetration. The surge in the following decade is driven by federal policies encouraging EV manufacturing, tax incentives for buyers, and investments in ultra-fast charging networks. Automakers have accelerated the use of advanced contactors that ensure thermal stability and safety under higher voltage demands. These dynamics have positioned the U.S. market as a growing but competitive landscape for suppliers.

The CAGR for the United Kingdom EV DC contactor market transitioned from 6.0% during 2020–2024 to 7.5% between 2025 and 2035, reflecting significant progress in EV readiness initiatives. The early phase was influenced by regulatory uncertainty and delayed charging infrastructure projects, which constrained growth. Post-2024, the surge in EV registrations under zero-emission vehicle mandates, combined with large-scale battery manufacturing programs, strengthened demand for high-performance DC contactors. Enhanced safety compliance requirements under ISO 26262 standards further drove supplier innovation. Increased funding for fast-charging corridors and partnerships between automakers and energy companies underpinned market expansion throughout the forecast period.

China recorded a CAGR of 9.4% during 2020–2024, which climbed to 10.7% for 2025–2035, underscoring its leadership in the global EV ecosystem. The earlier period benefitted from strong domestic manufacturing and favorable policy frameworks but was limited by slower adoption in rural markets. The next decade reflects a structural leap supported by giga-factory expansions, advanced battery technologies, and state-led fast-charging rollouts. Local suppliers have increased investments in next-gen contactors featuring arc suppression and lightweight designs. This positions China as a dominant sourcing hub and a center of EV component innovation for global OEMs.

The CAGR in India shifted from 8.3% in 2020–2024 to 9.9% for 2025–2035, reflecting the rapid transition to EV adoption under national electrification strategies. Early-stage growth was constrained by infrastructure bottlenecks and high vehicle costs, but government-led schemes and private investments improved market momentum post-2024. Large-scale introduction of two- and three-wheeler EVs spurred high-volume demand for compact, cost-effective contactors. Safety compliance under Bharat Stage standards and increased deployment of DC fast chargers strengthened supplier portfolios, creating a strong base for long-term growth.

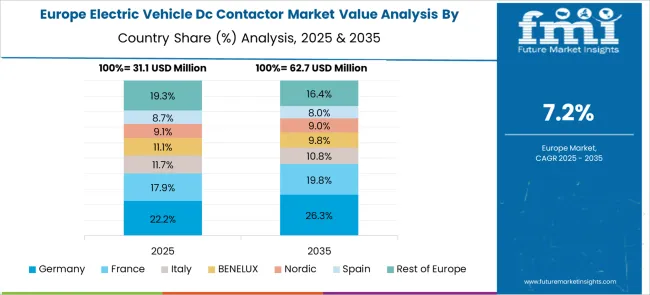

Germany’s CAGR advanced from 8.2% during 2020–2024 to 9.1% between 2025 and 2035, supported by automotive OEM in EV innovation and rapid deployment of high-voltage platforms. The earlier phase focused on compliance with EU emission targets, driving moderate EV adoption. Post-2024, strong funding for battery R&D, digital monitoring features in safety components, and performance-based designs positioned Germany as a premium EV hub. Increased penetration of 800V charging systems demanded contactors capable of ultra-fast switching and thermal resilience, creating new avenues for component suppliers in the European market.

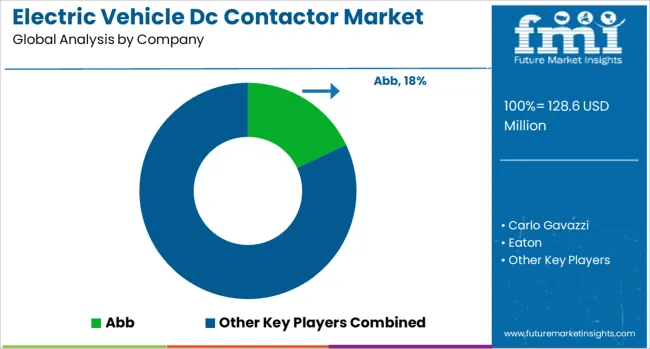

The electric vehicle DC contactor market is highly competitive, featuring global leaders and specialized component manufacturers offering advanced switching solutions for high-voltage EV systems. ABB maintains a strong position through its extensive portfolio of high-current contactors designed for superior thermal management and arc suppression, serving both automotive and charging infrastructure applications. Carlo Gavazzi focuses on compact and energy-efficient designs tailored for EV platforms and industrial automation, delivering performance-driven solutions for OEMs. Eaton leverages its expertise in power management systems to provide robust DC contactors with enhanced fault protection and compliance with global safety standards, ensuring long lifecycle performance. Fuji Electric brings innovation through high-durability components optimized for fast-charging networks and battery pack integration, enabling secure operations under extreme voltage loads.

Geya, an emerging player, targets cost-effective solutions for regional markets with modular contactor designs suitable for small and mid-sized EV applications, positioning itself as a competitive alternative in price-sensitive segments. Competitive strategies in this space revolve around miniaturization, solid-state switching capabilities, and integration of smart diagnostics to enable real-time monitoring of thermal and electrical performance. Leading companies are investing in material innovation to improve current-carrying capacity and arc-quenching properties while reducing weight for EV applications. The market’s growth trajectory will favor suppliers that deliver scalable, high-reliability solutions adaptable to evolving EV architectures, ultra-fast charging technologies, and stringent automotive safety regulations. Future opportunities lie in performance-based contracting, localized manufacturing hubs, and partnerships with major EV OEMs to strengthen supply chain security and accelerate product development cycles.

In May 2025, Carlo Gavazzi launched the RSLS series with ultra-slim plug-in solid-state relays designed for arc-free switching of small DC and AC loads, relevant for EV charging controllers and power modules.

| Item | Value |

|---|---|

| Quantitative Units | USD 128.6 Million |

| Voltage | High voltage (>60 V) and Low voltage (≤60 V) |

| Application | Battery management systems, Inverters, Heating, Ventilation, and Air Conditioning (HVAC), and Charging systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abb, Carlo Gavazzi, Eaton, Fuji Electric, and Geya |

| Additional Attributes |

The global electric vehicle dc contactor market is estimated to be valued at USD 128.6 million in 2025.

The market size for the electric vehicle dc contactor market is projected to reach USD 275.1 million by 2035.

The electric vehicle dc contactor market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in electric vehicle dc contactor market are high voltage (>60 v) and low voltage (≤60 v).

In terms of application, battery management systems segment to command 28.0% share in the electric vehicle dc contactor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA