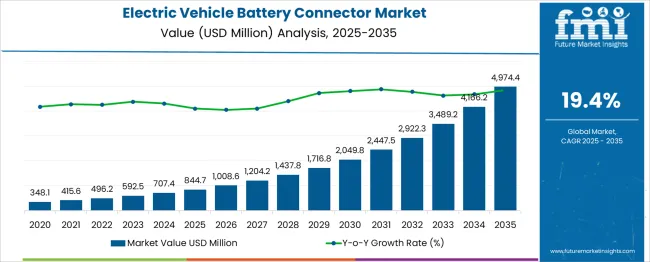

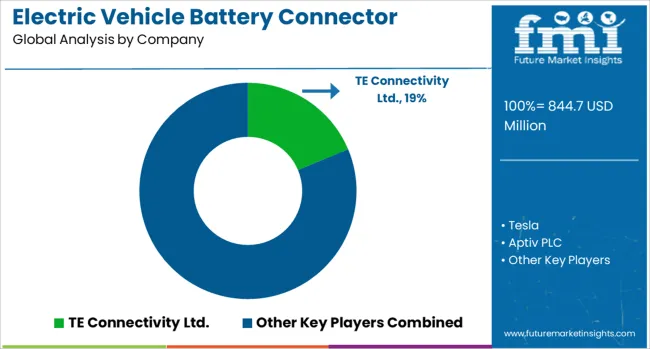

The Electric Vehicle Battery Connector Market is estimated to be valued at USD 844.7 million in 2025 and is projected to reach USD 4974.4 million by 2035, registering a compound annual growth rate (CAGR) of 19.4% over the forecast period.

| Metric | Value |

|---|---|

| Electric Vehicle Battery Connector Market Estimated Value in (2025 E) | USD 844.7 million |

| Electric Vehicle Battery Connector Market Forecast Value in (2035 F) | USD 4974.4 million |

| Forecast CAGR (2025 to 2035) | 19.4% |

As automakers scale up production of electric vehicles, the demand for efficient, durable, and standardized connectors has surged. These connectors play a critical role in ensuring safe and rapid charging, reliable energy transmission, and optimal battery performance.

Governments worldwide are incentivizing electric mobility through infrastructure development and subsidies, accelerating demand for advanced charging solutions. The market outlook remains strong, with innovations in fast-charging technology and connector standardization expected to improve interoperability across EV models.

Increased emphasis on reducing charging times, improving energy efficiency, and enhancing consumer convenience continues to shape product design and deployment. The push for zero-emission transportation, coupled with advancements in vehicle electrification, positions the battery connector market for sustained growth and technological refinement.

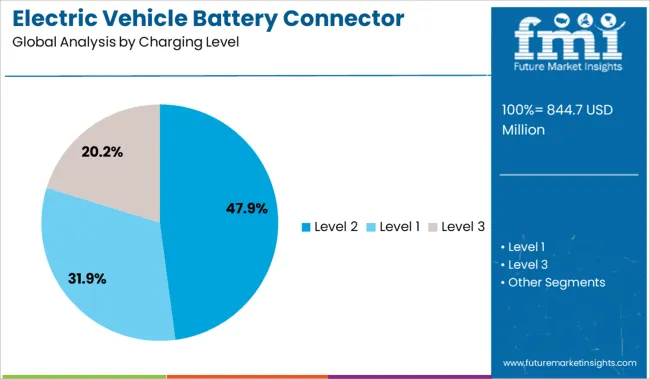

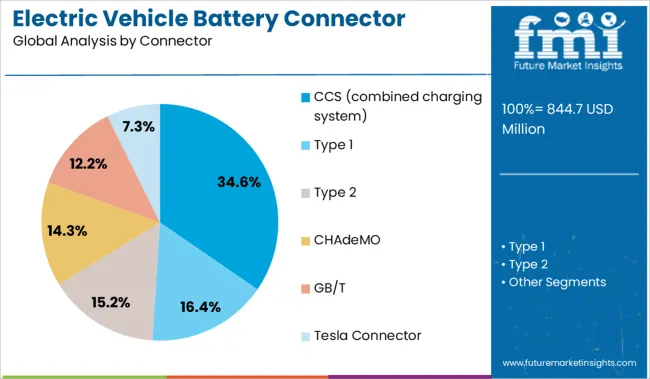

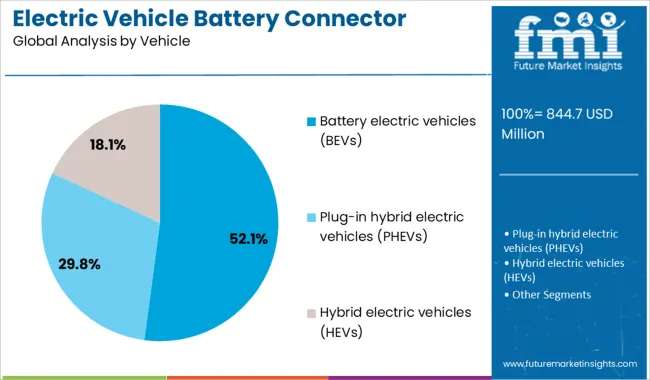

The electric vehicle battery connector market is segmented by charging level, connector, vehicle, and voltage and geographic regions. The charging level of the electric vehicle battery connector market is divided into Level 2, Level 1, and Level 3. In terms of the connector of the electric vehicle battery, the market is classified into CCS (combined charging system), Type 1, Type 2, CHAdeMO, GB/T, and Tesla Connector. The electric vehicle battery connector market is segmented into Battery electric vehicles (BEVs), Plug-in hybrid electric vehicles (PHEVs), and Hybrid electric vehicles (HEVs). The electric vehicle battery connector market is segmented by voltage into DC charging and AC charging. Regionally, the electric vehicle battery connector industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Level 2 charging segment accounts for 47.9% of the electric vehicle battery connector market, indicating its widespread adoption among residential, workplace, and public charging environments. Level 2 systems offer a balanced solution between speed and cost, making them a practical choice for everyday EV charging.

Their compatibility with a wide range of electric vehicles and ease of installation have positioned them as the preferred standard in many regions. As EV penetration increases, demand for Level 2 charging infrastructure continues to grow, driving parallel growth in connector technologies that support these systems.

Enhanced safety features, standardized designs, and integration with smart grid networks have made Level 2 connectors essential for scalable charging ecosystems. Future growth is expected to be driven by increasing investments in semi-fast charging networks and consumer preference for convenient overnight and workplace charging solutions.

The CCS connector segment holds a 34.6% share of the market, driven by its growing acceptance as a universal charging standard across Europe, North America, and emerging EV markets. The CCS platform enables both AC and high-power DC charging through a single port, offering significant convenience and efficiency for users and manufacturers alike.

Automakers have increasingly adopted CCS due to its support for rapid charging capabilities and compliance with international safety standards. This segment is further reinforced by policy mandates favoring connector standardization and the integration of CCS-compatible infrastructure in public and highway charging stations.

Technological advancements aimed at improving charging speed, thermal management, and durability have strengthened the appeal of CCS connectors. The segment is poised for continued expansion as global interoperability and fast-charging requirements become central to EV infrastructure strategies.

Battery electric vehicles (BEVs) represent 52.1% of the electric vehicle battery connector market, affirming their role as the primary driver of demand in this space. BEVs rely exclusively on electricity for propulsion, making reliable and efficient battery connectors essential to their performance and safety. The absence of internal combustion engines places greater emphasis on energy management systems, which depend on high-quality connectors for current transmission, voltage regulation, and thermal control.

This segment has experienced significant momentum due to increasing model availability, regulatory emissions targets, and declining battery costs. BEVs are central to national decarbonization plans, and the growing availability of fast-charging infrastructure supports their broader adoption.

As vehicle designs evolve to include higher energy density batteries and faster charging rates, demand for advanced connector technologies is expected to rise proportionally. The segment will continue to lead market expansion as BEVs gain mainstream acceptance globally.

Electric vehicle battery connector demand continues to accelerate as automakers advance next-generation platforms with greater emphasis on high-voltage safety, modularity, and fast-charging support. In 2024, approximately 28 % of new EV models incorporated upgraded connector systems designed for 800V platforms. Engineering focus is shifting toward improved current-carrying capacity, heat tolerance, and automated alignment systems in both consumer and commercial vehicle applications.

Automotive OEMs rolling out 800V electric vehicle architectures now require connectors that can consistently manage loads exceeding 600 A, especially for fast-charging and modular battery pack use cases. The industry is moving toward standardized interfaces that simplify interchangeability between inverters and battery systems. Connector producers report a 19 % reduction in thermal stress levels when liquid-cooled housings are applied, especially in high-cycle fleets. Automation-integrated vehicles using robotic docking have recorded a 14 % drop in mating failures, enabling faster throughput during assembly. Cross-platform use of the same connector interface within vehicle families has cut SKU counts by 23 %. Leading Tier 1 suppliers have begun integrating infrared temperature monitoring and torque sensors to verify secure connections, feeding this data into battery management systems for real-time diagnostics and safety checks.

Despite rapid design enhancements, high-performance battery connector adoption faces resistance from elevated material input costs and complex qualification workflows. The use of high-current copper alloys and integration of liquid-cooled shells raises the component price by 12 % over older standard-grade connectors. Certification protocols for UL, IEC, and automotive isolation standards typically add 4 to 6 weeks to development timelines. Connector assembly tolerance issues continue to affect production throughput, with 9 % of panel-mounted receptacle batches requiring rework due to alignment failures. Automatic latching features in robotic installs still report a 7 % calibration failure rate. Battery OEMs with smaller teams often experience delays linked to insufficient documentation for torque application and safe handling guidelines. These issues continue to affect volume adoption, particularly in lower-cost EV segments where connector reliability remains crucial but tolerance for added design complexity and cost is limited.

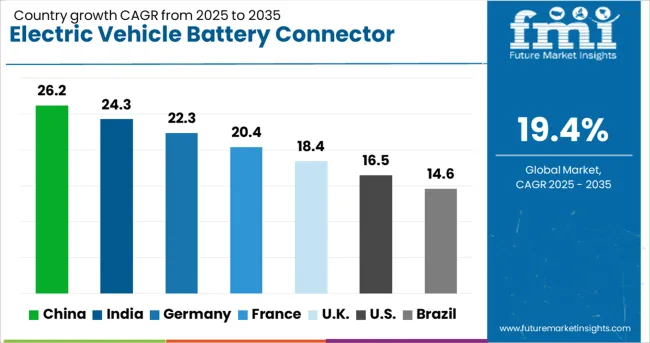

| Country | CAGR |

|---|---|

| China | 26.2% |

| India | 24.3% |

| Germany | 22.3% |

| France | 20.4% |

| UK | 18.4% |

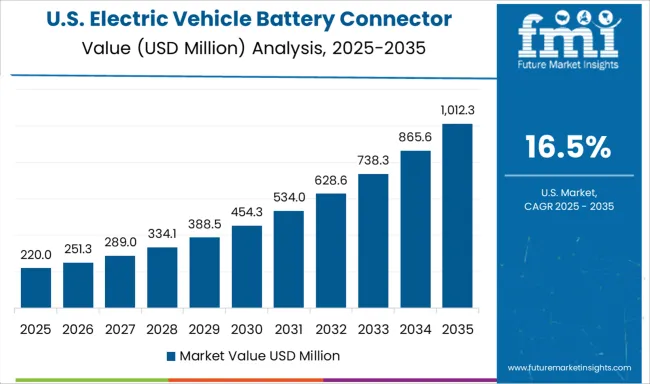

| USA | 16.5% |

| Brazil | 14.6% |

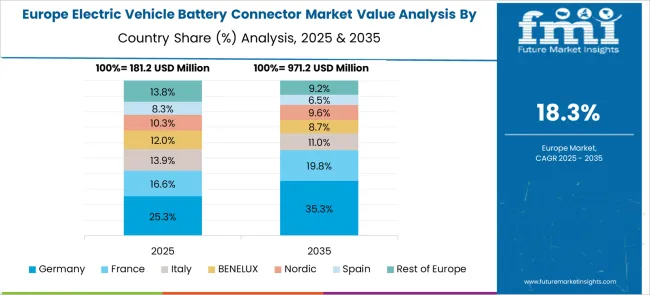

Global electric vehicle battery connector market demand is forecast to expand at a 19.4% CAGR from 2025 to 2035. China leads at 26.2%, delivering a 35% growth premium over the global average, driven by aggressive EV production scaling and dense charging network deployment. India follows at 24.3%, offering a 25% gain due to accelerated electrification of two- and three-wheelers and strong local manufacturing incentives. Germany, at 22.3%, benefits from OEM alignment on connector standardization and high-voltage architecture adoption.

The UK records 18.4%, 5% below the global trend, shaped by hybrid vehicle preferences and compact EV rollout. The US market, growing at 16.5%, falls 15% below the average due to extended validation timelines and slower qualification of next-generation connectors by legacy OEMs. These countries illustrate contrasting adoption patterns across infrastructure maturity, regulatory alignment, and supply chain integration.

Demand for EV battery connectors in China is expanding at a 26.2% CAGR, driven by high-volume domestic vehicle manufacturing and the push to support rapid charging and battery swap networks. Automakers are integrating high-voltage connector assemblies with reinforced thermal stability for multi-module battery packs. Connector makers are designing modular configurations for compatibility with battery swapping infrastructure used by logistics fleets and ride-hailing operators. Scaled production of 800 V copper-alloy connectors is underway across multiple provinces to meet demand for performance EV platforms. Connector designs increasingly feature liquid-cooling jackets and embedded diagnostics, aligned with national quality standards.

India posts a 24.3% CAGR, indicating strong growth in mid-segment EVs, particularly two- and three-wheelers, where space-efficient connectors play a critical role.Compact connector formats with sealed IP67 housings are being adopted to withstand dust and vibration in urban fleets. Tier 1 firms are investing in automated plating lines and crimping tools for small-batch connector production. Government-supported procurement of electric buses under FAME-II has mandated compliance with AIS-038 connector specifications, raising demand for fire-retardant, vibration-tested connectors. Component localizations and strategic connector-joint manufacturing in Tamil Nadu and Maharashtra have expanded output capacity across domestic plants.

The UK shows an 18.4% CAGR, driven by increasing demand for space-constrained EV applications such as taxis, fleet vans, and compact passenger vehicles. Fleet operators are prioritizing compact connectors with high-cycle durability, resistant to corrosion and thermal cycling. British EV startups are collaborating with European connector firms to co-develop low-profile layouts for dense battery compartments. Pre-assembled wiring harnesses and plug-and-play modules are gaining adoption to simplify final assembly and reduce labor dependency. New automotive-grade connectors are targeting B2B electrification use-cases, including depot-based delivery services and municipal vehicle replacements.

Germany reports a 22.3% CAGR, supported by premium EV OEMs adopting EMI-shielded, high-precision connectors as standard across battery module platforms.Skateboard battery architectures are prompting higher pin density and customized shielding to handle thermal drift and electromagnetic interference. Tier 1 connector suppliers are embedding micro-sensors to monitor real-time connector performance across charge cycles. Materials such as aluminum composites and fiber-reinforced polymers are being used to reduce weight while maintaining structural integrity. Quality audits across German production lines now require connector mating consistency at torque ranges within 5 % tolerance to pass factory acceptance testing.

The USA market is advancing at a 16.5 % CAGR, anchored by large-format EV production and the need for connector solutions in electric trucks, SUVs, and crossovers. OEMs are transitioning to SAE-compliant high-voltage connector platforms, particularly in long-range and off-road applications. Overmolded connector assemblies are being deployed to limit EMI risk and improve water ingress protection. Joint development between battery pack integrators and connector specialists is accelerating rollout of single-piece high-current interfaces. Despite innovation, adoption speed remains tempered by long connector validation cycles, which prolong model launch timelines in the USA compared to Asia and Europe.

The EV battery connector market is led by TE Connectivity Ltd. with a significant share, offering high-current, liquid-cooled connectors across global platforms. Aptiv PLC, HUBER+SUHNER, and Amphenol follow, supplying modular assemblies for automotive OEMs transitioning to 800 V architectures. Tesla continues to invest in proprietary connector formats for battery and supercharger systems. Siemens AG and ABB are expanding their portfolios of high-voltage, ruggedized connectors for power electronics and charging infrastructure. Material trends include reduced-copper designs using lightweight alloys and thermally stable polymers.

Smart connector systems with integrated IR sensors and EMI shields are emerging as standard in battery management applications. The global market is projected to reach USD 12 billion by 2027, with future gains tied to modularity, thermal performance, and connector standard harmonization. Manufacturers face pressure to balance connector durability with sustainable sourcing as EV output strains copper supply chains and certification delays slow rollout in newer EV segments.

In May 2024, Amphenol finalized its acquisition of Carlisle Interconnect Technologies (CIT) from Carlisle Companies for approximately USD 2 billion. The deal strengthens Amphenol’s connector offerings in high-voltage, harsh-environment applications across the EV, aerospace, industrial, and defense sectors. This acquisition expands Amphenol’s global production footprint and design capabilities for automotive-grade battery connectors. CIT’s expertise in EMI-shielded, thermally resilient connectors is expected to integrate into Amphenol’s EV connector programs starting Q1 2025, targeting both OEM and aftermarket supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 844.7 Million |

| Charging Level | Level 2, Level 1, and Level 3 |

| Connector | CCS (combined charging system), Type 1, Type 2, CHAdeMO, GB/T, and Tesla Connector |

| Vehicle | Battery electric vehicles (BEVs), Plug-in hybrid electric vehicles (PHEVs), and Hybrid electric vehicles (HEVs) |

| Voltage | DC charging and AC charging |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity Ltd., Tesla, Aptiv PLC, Siemens AG, HUBER+SUHNER, Amphenol, Bosch, ABB, Schneider Electric, and ITT Inc. |

| Additional Attributes | Dollar sales by connector type (high-voltage, signal, charging inlet) and application (battery management systems, drive units, thermal controls), demand dynamics across battery swapping, modular pack design, and fast-charging compatibility, regional trends led by Asia‑Pacific with Europe expanding EV platform standardization, innovation in high-current density contacts and EMI shielding, and operational impact of connector durability, thermal resistance, and voltage surge protection. |

The global electric vehicle battery connector market is estimated to be valued at USD 844.7 million in 2025.

The market size for the electric vehicle battery connector market is projected to reach USD 4,974.4 million by 2035.

The electric vehicle battery connector market is expected to grow at a 19.4% CAGR between 2025 and 2035.

The key product types in electric vehicle battery connector market are level 2, level 1 and level 3.

In terms of connector, ccs (combined charging system) segment to command 34.6% share in the electric vehicle battery connector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA