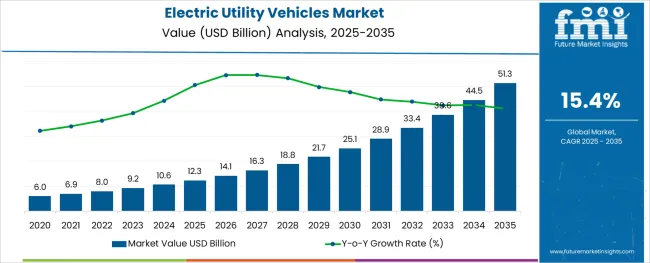

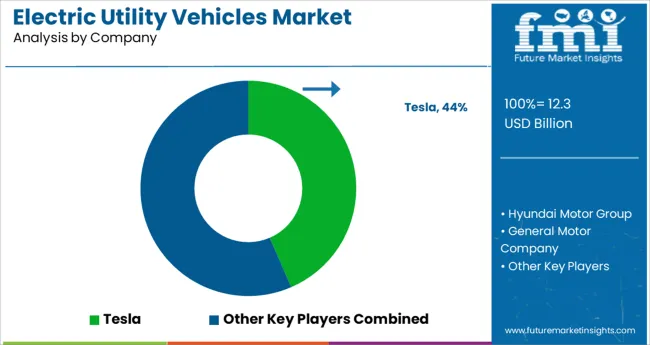

The Electric Utility Vehicles Market is estimated to be valued at USD 12.3 billion in 2025 and is projected to reach USD 51.3 billion by 2035, registering a compound annual growth rate (CAGR) of 15.4% over the forecast period.

The electric utility vehicles market is experiencing sustained growth as electrification trends, regulatory pressures, and advancements in battery technology reshape the mobility landscape. Rising concerns over urban air quality, coupled with stringent emission standards, have accelerated the shift toward electric alternatives for utility vehicles.

Automakers and fleet operators are prioritizing electric options to align with sustainability objectives and reduce long-term operating costs. Innovations in vehicle design, charging infrastructure, and battery efficiency are enhancing the performance and appeal of electric utility vehicles, making them increasingly viable across diverse use cases.

Future growth is expected to be supported by expanding urbanization, government incentives for zero-emission fleets, and continued investment in smart mobility solutions. These dynamics are paving the path for broader market penetration and encouraging adoption across both public and private sectors.

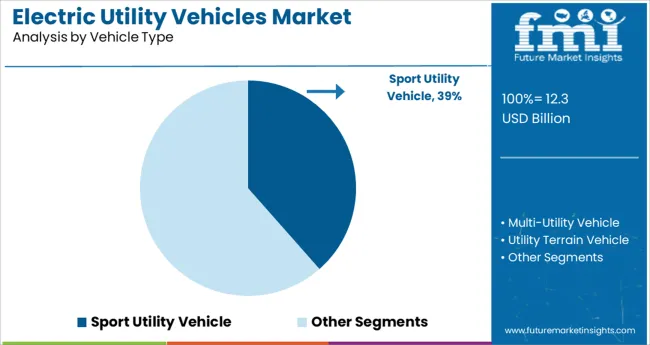

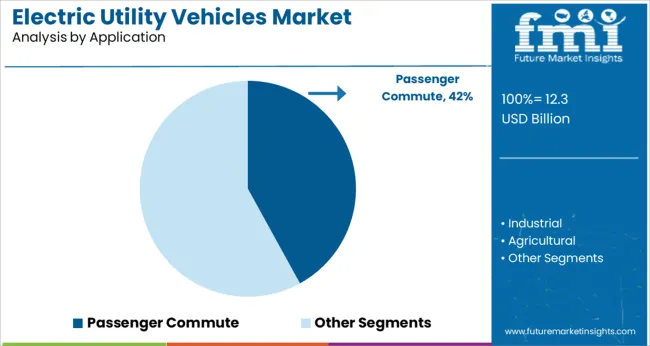

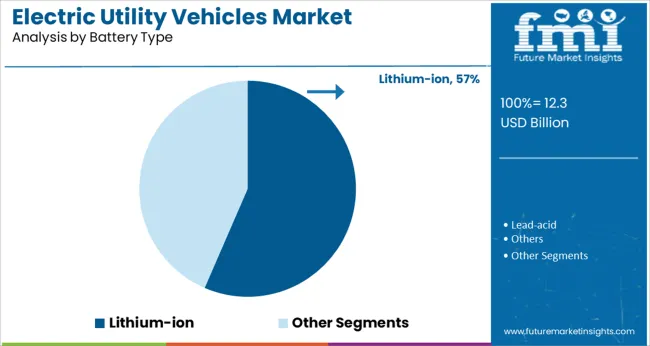

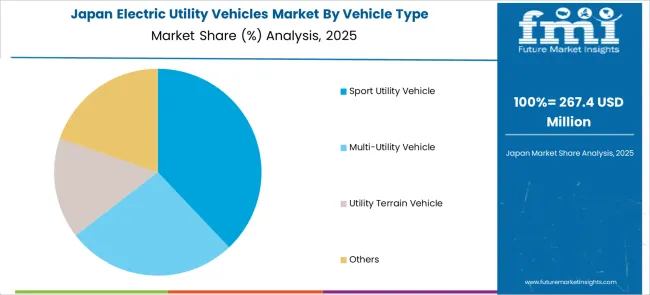

The market is segmented by Vehicle Type, Application, and Battery Type and region. By Vehicle Type, the market is divided into Sport Utility Vehicle, Multi-Utility Vehicle, Utility Terrain Vehicle, and Others. In terms of Application, the market is classified into Passenger Commute, Industrial, Agricultural, Sports, and Others. Based on Battery Type, the market is segmented into Lithium-ion, Lead-acid, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by vehicle type, the sport utility vehicle segment is anticipated to capture 38.5% of the total market revenue in 2025, making it the leading category. This leadership is attributed to its versatility, robust design, and ability to meet diverse operational demands ranging from urban commuting to rugged off-road utility.

The segment’s dominance has been reinforced by its higher passenger capacity, enhanced comfort features, and adaptability to fleet and individual needs. Manufacturers have focused on equipping electric sport utility vehicles with improved drivetrains and durable components that withstand intensive usage while maintaining energy efficiency.

The rising preference for vehicles that blend functionality with sustainability has strengthened its adoption, while advancements in modular platforms and competitive pricing strategies have further consolidated its leadership within the market.

In terms of application, the passenger commute segment is projected to account for 42.0% of the market revenue in 2025, positioning it as the top application category. This prominence has been driven by increasing demand for clean and efficient transport solutions in densely populated areas.

The segment’s growth has been facilitated by the alignment of electric utility vehicles with urban mobility needs, offering quiet operation, lower emissions, and reduced running costs. Organizations and municipalities have been deploying electric vehicles for passenger transport to meet sustainability targets and to enhance public transport offerings.

Additionally, innovations in seating layouts, enhanced safety features, and improved range have made these vehicles more attractive for daily commuting purposes. The ability to seamlessly integrate into shared and private transport systems has further cemented the passenger commute segment’s leadership position.

Segmenting by battery type shows that the lithium ion segment is forecast to command 56.5% of the market revenue in 2025, securing its position as the leading battery technology. This dominance has been supported by lithium ion batteries’ superior energy density, faster charging capabilities, and longer lifecycle compared to alternative chemistries.

Manufacturers have increasingly adopted lithium ion technology to deliver vehicles with extended range and reliable performance, meeting consumer expectations for both efficiency and durability. The segment’s leadership has also been reinforced by ongoing cost reductions through scale production and continuous improvements in battery management systems.

The combination of lightweight design, enhanced safety profiles, and compatibility with fast-charging infrastructure has strengthened its position as the preferred choice for powering electric utility vehicles in both commercial and personal applications.

If we compare the historical CAGR with the anticipated CAGR, we would get an idea of the massive jump that the market is expected to go through. While the historical CAGR for the market was 8.9%, the anticipated CAGR during the forecast period is expected to be 15.4%.

Increasing awareness regarding the benefits of making use of electric utility vehicles is surging the market. Furthermore, increased usage of these vehicles across sectors is expected to surge the demand for electric utility vehicles.

High convenience

One of the major factors driving the market is the high convenience that is being offered by electric utility vehicles. These are easy to recharge, and we do not have to visit the fuel station repeatedly.

More savings

The cost associated with charging electric utility vehicles is much less as compared to spending on petrol and diesel. Thus, they offer a great way to save money.

Safe to drive

Electric utility vehicles are safe to drive as well. Owing to the low center of gravity associated with them, these are much more stable on the road if they meet with a collision.

High battery life and reduction in battery cost

A good quality battery that is used in electric utility vehicles should last effectively for a decade. Apart from that, with the application of better technologies, the cost of batteries is expected to come down in the future.

Lower distance range than the ICE vehicles

The distance covered by charging an electric utility vehicle is quite less as compared to the distance covered by an ICE vehicle which runs on fuel. Users generally prefer traveling longer distances without worrying much about charging. This might challenge market growth during the forecast period.

Lack of charging stations

The biggest hindrance to the growth of the market is the lack of charging stations. The users need to charge the electric utility vehicles in their houses. Once these start plying on the road, there would be hardly any charging stations on the way, which can be quite risky at times.

The E-commerce market heavily depends on logistics. The sector is looking for ways to either strike a deal with the key players in the market of electric utility vehicles or acquire them.

If we have a look at the E-commerce business model, we would observe that there is a customized vehicle architecture designed especially for the E-commerce sector. Apart from that, the sector has also been making use of IoT, which works perfectly in sync with electric utility vehicles, thereby making them autonomous in nature. This as well represents huge prospects for the market of electric utility vehicles.

Apart from that, the concept of battery swapping is also expected to represent a lot of prospects for the market. This is because the customers just need to replace their battery, instead of waiting for nearly an hour in order to get it charged. This might well lead to the development of what is called a Battery as a Service market.

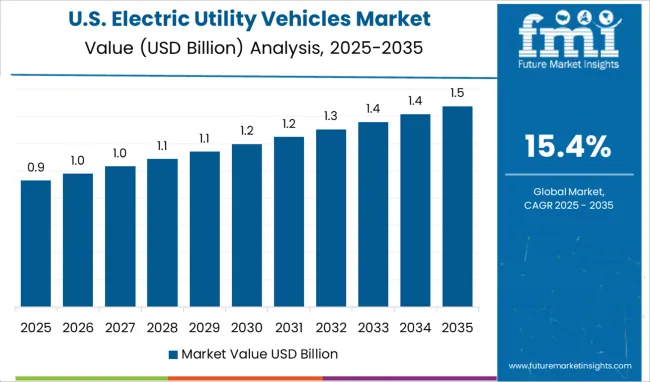

The USA is currently the largest market for electric utility vehicles. Based on the research conducted by FMI, the USA market has a share of 26.8%. A massive E-commerce market in the country, which operates on the basis of the hub and spoke model is the main driving factor of the market.

The fragmentation of the supply chain due to government policies is expected to assist the growth of the market during the forecast period.

Germany is one of the most crucial markets for electric utility vehicles. The country has a share of 13.7% in the market.

Based on the statistics released by Statista, the country is the fifth-largest producer of passenger cars as of 2024. This coupled with the presence of a majority of automobile manufacturers makes Germany one of the largest markets for smart utility vehicles.

Technologically advanced Japan is one of the largest markets for electric utility vehicles. Japan has a market share of 1.4%.

The key players operating in the electric utility vehicles market are investing huge amounts in Research and Development for upgrading the existing vehicles. Furthermore, owing to massive technological developments, the price of electric utility vehicles has come down in Japan, which might surge sales.

Australia holds a share of 0.6% in the electric utility vehicles market.

The market in Australia is mainly driven by rising fuel prices in Australia. Apart from that, incentives and subsidies being provided by the Australian government pertaining to the usage of electric utility vehicles are also expected to surge sales.

The NSW government removed stamp duty from electric vehicles under USD 78,000 in September 2024. This has certainly increased the demand for electric utility vehicles in Australia.

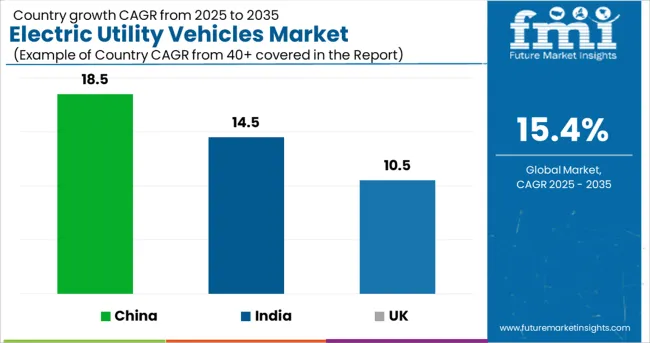

The China electric utility vehicles market is expected to grow at a massive CAGR of 18.5% through 2035. Based on the research conducted, China was the largest market for electric vehicles in 2024, occupying more than half of the global share.

The battery segment of electric utility vehicles is being heavily utilized in China. Possessing huge quantities of rare earth materials makes China one of the largest markets.

The presence of huge market players like Tesla, Hong Guang Mini, etc. also makes China a huge market.

The electric utility vehicles market in India is expected to grow at a robust CAGR of 14.5% during the forecast period.

The Indian automobile industry has been witnessing an exponential increase in fuel prices over the past few years.

Even the Indian government has been taking steps like the introduction of BS VI emission standards, which might surge the market growth during the forecast period. This is expected to surge the usage of electric utility vehicles in India.

The UK market is projected to grow at a CAGR of nearly 10.5% during the forecast period.

The Green Transport Innovation Program started by the Northern Transport Acceleration Council is expected to surge the demand for electric utility vehicles in the UK. Furthermore, the key players are also working on the development of charging stations, which is backed by £1.6 billion in funding. This might increase the adoption of electric utility vehicles in the UK during the forecast period.

Based on the battery type, the lithium-ion segment currently has the largest market share of a huge 73.4%. This is mainly owing to the fact that these are easy to use.

Apart from that, these weigh nearly 60% less than lead-acid batteries. The manufacturers are mainly counting upon the long battery life, which is nearly 12 times higher than the lead-acid battery.

Based on the application, the commercial segment currently has the largest market share. This is mainly because of the growing demand for shuttle carts in urban areas, and the increased usage of electric passenger vehicles.

The availability of a wide range of products with the manufacturers of electric utility vehicles is expected to further surge the market growth. A lot of them have been specifically designed for cargo services as well.

Based on the propulsion, the pure electric segment currently has the largest market share. Key players like Daimler, Toyota, John Deere, etc. have been investing mainly in the pure electric segment.

Apart from that, the application of a less complex engine structure in the pure electric segment as compared to the hybrid electric segment is expected to further surge the market growth.

The start-ups operating in the electric utility vehicles market are developing architectures that could satisfy the power output needs. Furthermore, they are also working on the durability aspects of heavy-duty applications.

Some of the start-ups are:

Sun Mobility: Sun Mobility has been an operator of swappable battery solutions for electric vehicles. It has been into offering lithium-ion batteries. It has also been offering mobile applications to find stations in its vicinity.

In 2024, Sun Mobility raised USD 12.3 million in a funding round that was led by Vitol. Through this funding, the company aims to set up 12.30 SWAP points in India by the end of 2025.

Altigreen: Altigreen was started in 2013. The start-up is a developer of electric utility vehicles. The company has developed different models of three-wheeled utility vehicles like neEV High Deck, neEV Flatbed, etc. with features like GPS-based diagnostics, 48 V LiFePO4 battery, etc.

In February 2025, the start-up raised INR 300 crore in a funding round led by Sixth Sense Ventures. Altigreen announced that the amount will be utilized mainly for boosting the manufacturing capacity and launching light commercial vehicles.

The key players operating in the electric utility vehicles market are mainly focusing on developing strategic partnerships with players from other niches. The key factor behind this happens to be accessing the capabilities offered by other niches.

Apart from that, there is also an increased focus on acquisitions. The dominant players operating in the market are acquiring small players in a bid to kill competition and expand their market.

Some of the recent developments in the electric utility vehicles market are:

Mahindra electric mobility is the pioneer of electric vehicle technology. The company has been offering a wide variety of electric vehicles, and also plans to increase the range in the future. The products offered by Mahindra electric mobility span personal and commercial segments, and are designed to support shared, electric, and connected mobility.

Mahindra electric’s vision of mobility aims to bring together the entire ecosystem to make India’s vision for 2035 closer to reality. With this in mind, the company has developed the NEMO platform to address the opportunities and challenges specific to E-mobility. NEMO is a cloud-based platform that enables a new generation of shared, connected, and electric services which would revolutionize urban mobility.

On 4th May’22, Mahindra Electric partnered with Terrago Logistics for pollution-free last-mile delivery.

General Motors Company’s goal is to deliver world-class customer experiences at every touchpoint with a foundation of trust and transparency. They are working on their vision of developing a world with zero crashes, zero emissions, and zero congestion.

The company has developed a new Ultium platform, which would help put everyone in an EV, bringing the world to an all-electric future. Research, technology, and advocacy are the basis of engineering safety at General Motors. The company is committed to becoming the most inclusive company in the world.

On 2nd November’22, General Motors and Microvast announced to development of a specialized EV battery separator.

Hyundai Motor Group has been successful in achieving sustainable growth while following a unique corporate spirit. The company has been relentlessly working on the philosophy of realizing the dream of mankind by creating a new future through ingenious thinking and challenging new frontiers.

Management has always been working on the philosophy of an unlimited sense of responsibility, the realization of possibilities, and respect for mankind.

The global electric utility vehicles market is estimated to be valued at USD 12.3 billion in 2025.

It is projected to reach USD 51.3 billion by 2035.

The market is expected to grow at a 15.4% CAGR between 2025 and 2035.

The key product types are sport utility vehicle, multi-utility vehicle, utility terrain vehicle and others.

passenger commute segment is expected to dominate with a 42.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Electric Distribution Utility Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA