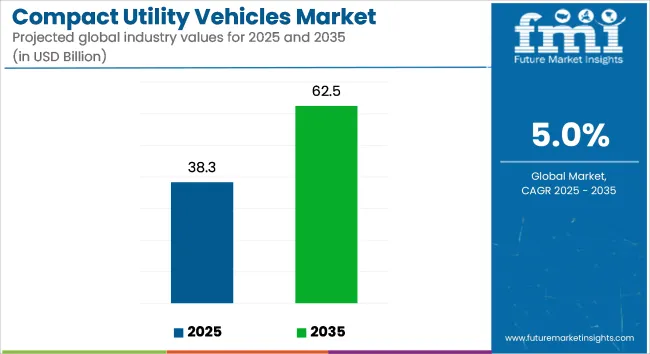

The global compact utility vehicle market is projected to grow from USD 38.3 billion in 2025 to USD 62.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5%.

This growth is being driven by rising demand for multifunctional, fuel-efficient, and electrified construction equipment in both developed and emerging economies. Compact utility vehicles-including skid steer loaders, mini excavators, and compact track loaders-are increasingly being adopted for urban infrastructure, agriculture, and landscaping applications due to their maneuverability and compatibility with smart attachments.

At Bauma 2025, Hyundai Construction Equipment is expected to launch a new line of skid steers and a compact track loader. These machines have been designed for heavy-duty performance in confined worksites and are equipped with enhanced operator ergonomics. The announcement was confirmed by Hyundai’s construction division via Compact Equip, where the company emphasized the strategic focus on expanding its compact segment to serve evolving contractor needs.

Electrification trends have also impacted product development across this segment. A new range of battery-powered mini excavators was introduced by leading OEMs in 2024, showcasing extended runtimes and zero-emission operations. According to Compact Equip, these electric variants are being targeted for municipalities and indoor demolition sites where noise and emissions restrictions are stringent.

| Attributes | Key Insights |

|---|---|

| Industry Size (2025E) | USD 38.3 billion |

| Industry Value (2035F) | USD 62.5 billion |

| CAGR (2025 to 2035) | 5% |

Bobcat, in a 2024 update, introduced nine new attachment options compatible with compact equipment, including grapples, angle brooms, and stump grinders. These modular attachments were developed to increase equipment utilization and productivity across seasonal and task-specific applications. As per the Equipment Journal, Bobcat’s portfolio expansion reflects a growing shift toward equipment customization and operator versatility.

The growth of rental fleets, urban redevelopment projects, and emission regulations are also contributing to increased adoption of compact utility vehicles. As OEMs introduce intelligent control interfaces, remote monitoring, and electric variants, the segment is expected to experience continued innovation and market expansion through 2035.

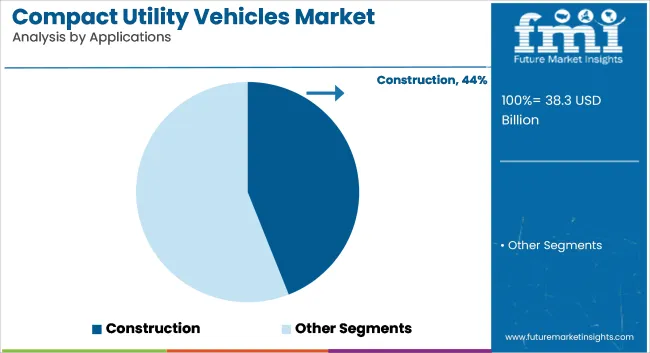

Construction held 44% of the global market share in 2025 and is projected to grow at a CAGR of 5.3% through 2035. The segment’s performance was supported by ongoing public and private investments in transportation, housing, and utility infrastructure across Asia-Pacific, the Middle East, and parts of Africa.

In 2025, compact and mid-sized machinery was widely adopted in roadwork, site preparation, and foundation tasks. Equipment designed for mobility and load-handling was deployed at mixed-use construction sites, with demand driven by earthmoving, grading, and excavation requirements.

Contractors and fleet operators prioritized reliability and cost-per-hour efficiency, resulting in steady procurement of durable construction-grade machinery. Product standardization and compliance with emission norms were emphasized across Europe and North America, prompting manufacturers to align with EN and EPA Tier IV standards for new builds.

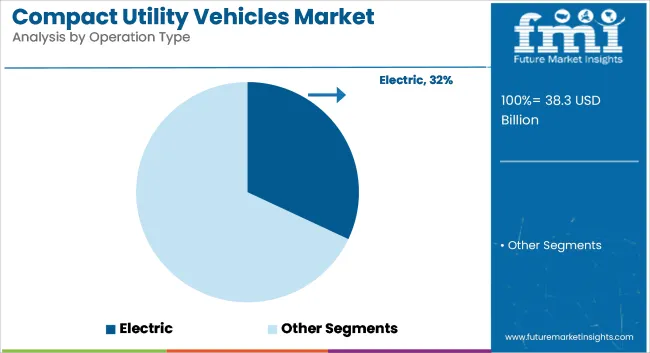

Electric-powered equipment accounted for 32% of global sales in 2025 and is projected to grow at a CAGR of 6.2% through 2035. The shift toward electric operation was influenced by regulatory pressure to reduce emissions, along with incentives for clean energy adoption across municipal, gardening, and small industrial applications.

Battery-powered systems were integrated into compact tools and machinery for noise-sensitive and enclosed-area operations. In 2025, European cities introduced procurement mandates favoring electric operation in civic utility and landscaping services, boosting market visibility.

Total cost of ownership considerations, including reduced fuel expense and lower maintenance requirements, supported uptake in the light-duty segment. Diesel remained dominant in high-load applications, but demand for hybrid and fully electric formats continued to expand with improvements in energy density and charging infrastructure.

Challenge

High Production Costs and Supply Chain Disruptions

Rising raw material prices, semiconductor shortages, and global supply chain disruptions are driving up production costs for the CUV manufacturers. The continuous demand for fuel-efficient, technologically-advanced and sustainable vehicles have prompted the car makers to integrate high-performance components, hybrid powertrains and advanced safety features that have added to the cost.

Logistical issues also continue to cause challenges, with transport bottlenecks and rising fuel prices both affecting vehicle availability and pricing. By doing so, businesses will need to produce locally, obtain materials from suppliers in their areas and refine production practices to be more efficient and lower the prices to be suitable for consumers.

Opportunity

Rising Demand for Fuel-Efficient and Electric CUVs

The general trend toward fuel efficiency and electrification creates a large opportunity for growth within the compact utility segment. With flaring fuel prices, EV government incentives and an increase in environmental awareness, consumers are increasingly prioritizing hybrid and electric CUVs. Companies that try lightweight materials, streamline their designs, or are able to enhance battery technology will get ahead of the pack.

As charging infrastructure expands and range efficiency continues to improve, consumer confidence in electric CUVs will rise. Versatile, tech-integrated and energy-efficient models will contribute to these brands targeting this expanding market segment.

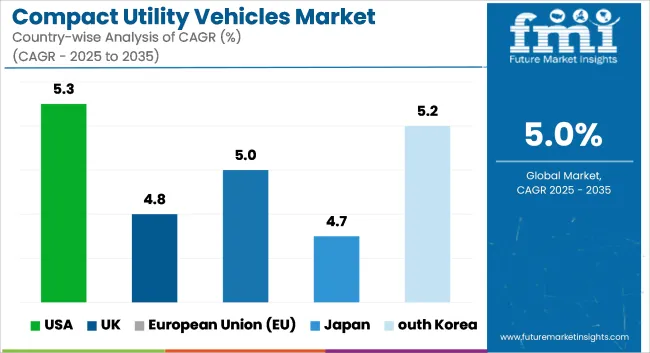

The market is expected to expand at a significant rate during the forecast period owing to increasing demand for compact utility vehicles in the agriculture, landscaping, construction, and municipal sectors in the USA Adoption across multiple industry verticals, thanks to compact utility vehicles' versatility in terms of terrain adaptability, towing capacity and payload efficiency.

Private solutions for zero emission XUVs with low clearance in the form of electric and hybrid compact utility vehicles are also driving adoption, and are currently supported by government initiatives for low-emission off road vehicles. Moreover, intelligent telematics and GPS-based fleet management solutions are further streamlining the operational efficiency of businesses that deploy utility vehicles in their daily operations.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

The UK compact utility vehicles market is expanding on the back of rising demand from farmers, logistics companies, and urban maintenance services. Low-emission and fuel-efficient vehicles are also trending, leading to a preference for electric and hybrid models for eco-friendly operations.

Market growth is further supported by the increasing popularity of multi-purpose vehicles capable of functioning in agriculture, construction, and outdoor recreation. Moreover, the rising inclination towards smaller, agile vehicles in overcrowded city landscapes is paving the way for innovative smaller, performance-oriented utility models.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

There's also growing demand for compact utility vehicles across the EU, with Germany, France, and Italy driving growth. The Sustainable Transport Solutions push in agriculture, municipal services and logistics is driving the transition towards Electric and Autonomous Compact Utility Vehicles.

Fierce EU emissions and fuel efficiency regulations are driving manufacturers to make nice green high-performance utilities. Moreover, more businesses & government are implementing smart fleet management systems & putting AI-assisted driving technology in place that makes vehicles more capable & efficient.

| region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Portfolio of Compact Utility Vehicles Continues to Expand in Japan Industry Continues to See Growth Demand for utility vehicles in varied settings -Be it urban single-family sustainability or rural landscape is one of the key factor contributing to growth in the compact utility vehicles in Japan. Post-automotive evolution driven by integrated use of automated driving technology and electric drivetrains.

This is one of the factors driving the demand for compact AI-assisted utility vehicles is also fuelled by the growth of smart agriculture and autonomous farming solutions. As such, the increase in the use of low-noise and low-emission electric utility models is growing for use in urban operation for municipal and delivery.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

Advancements in battery technology, smart mobility solutions, and high-performance compact vehicle designs are driving an expansion of South Korea's compact utility vehicles market. A significant factor driving the utility vehicles market is the increasing adoption of electric and hydrogen-powered utility vehicles.

For greater operational flexibility, the construction and logistics industries are increasingly depending on compact, highly efficient utility vehicles. Beyond, the emphasis on autonomous and AI-integrated vehicles is driving the next-gen compact utility vehicles, paving way for organizations to streamline their fleet management while minimizing their OPEX.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Industry Overview

Steady market growth in compact utility vehicles emerges from industry-wide need for multifunctional vehicles that serve agriculture and construction as well as landscaping and municipal services. The market selects compact utility vehicles because these vehicles combine excellent manoeuvrability with efficient fuel performance together with their capability to handle hauling between other activities.

The compact utility vehicles market experiences growth mainly because of developments in electric and hybrid powertrain technologies alongside advancing levels of agricultural and construction automation together with rising requirements for off-road mobile solutions. The industry leaders dedicate their efforts toward product durability and smart integration and increased load handling capacity for diverse sector needs.

John Deere (Deere & Company) (18-22%)

John Deere leads the market for compact utility vehicles by delivering performance-leading vehicles that incorporate hydraulic innovation coupled with adjustable accessories alongside data-driven farming solutions.

Kubota Corporation (15-19%)

The vehicle maker Kubota produces energy-efficient electric and fuel-efficient compact utility vehicles suitable for agricultural workers and those in landscaping services as well as municipal employees.

Bobcat Company (Doosan Group) (12-16%)

The engineering division from Bobcat Company produces rugged compact utility vehicles which excel at heavy-duty work including construction projects and excavation tasks as well as material handling requirements.

Caterpillar Inc. (9-13%)

Caterpillar develops high-capacity rugged compact utility vehicles for industrial applications besides mining operations and includes smart telematics systems for better performance.

Mahindra & Mahindra Ltd. (7-11%)

Mahindra delivers cost-effective heavy-duty compact utility vehicles which combine resistant material quality with efficient fuel economy and intelligence-based transmission systems for agricultural and commercial tasks.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the compact utility vehicles market by offering industry-specific models, electric variants, and innovative features. Notable players include:

The overall market size for Compact Utility Vehicles Market was USD 38.3 billion in 2025.

The Compact Utility Vehicles Market is expected to reach USD 62.5 billion in 2035.

The demand for the compact utility vehicles market will grow due to increasing urbanization, rising demand for versatile and fuel-efficient vehicles, expanding applications in agriculture and construction, and advancements in electric and hybrid vehicle technologies, driving sustainability and performance improvements.

The top 5 countries which drives the development of Compact Utility Vehicles Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Skid Steer Loaders and Tracked Platforms Restaurants Form to command significant share over the forecast period.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Vehicle Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 5: Global Market Value (US$ Billion) Forecast by Platform, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Platform, 2018 to 2033

Table 7: Global Market Value (US$ Billion) Forecast by Operation Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 9: Global Market Value (US$ Billion) Forecast by Rated Power , 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Rated Power , 2018 to 2033

Table 11: Global Market Value (US$ Billion) Forecast by Applications, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Applications, 2018 to 2033

Table 13: Global Market Value (US$ Billion) Forecast by Sales Channel, 2018 to 2033

Table 14: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 17: North America Market Value (US$ Billion) Forecast by Vehicle Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 19: North America Market Value (US$ Billion) Forecast by Platform, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Platform, 2018 to 2033

Table 21: North America Market Value (US$ Billion) Forecast by Operation Type, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 23: North America Market Value (US$ Billion) Forecast by Rated Power , 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Rated Power , 2018 to 2033

Table 25: North America Market Value (US$ Billion) Forecast by Applications, 2018 to 2033

Table 26: North America Market Volume (Units) Forecast by Applications, 2018 to 2033

Table 27: North America Market Value (US$ Billion) Forecast by Sales Channel, 2018 to 2033

Table 28: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 31: Latin America Market Value (US$ Billion) Forecast by Vehicle Type, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Billion) Forecast by Platform, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Platform, 2018 to 2033

Table 35: Latin America Market Value (US$ Billion) Forecast by Operation Type, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 37: Latin America Market Value (US$ Billion) Forecast by Rated Power , 2018 to 2033

Table 38: Latin America Market Volume (Units) Forecast by Rated Power , 2018 to 2033

Table 39: Latin America Market Value (US$ Billion) Forecast by Applications, 2018 to 2033

Table 40: Latin America Market Volume (Units) Forecast by Applications, 2018 to 2033

Table 41: Latin America Market Value (US$ Billion) Forecast by Sales Channel, 2018 to 2033

Table 42: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 43: Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Europe Market Value (US$ Billion) Forecast by Vehicle Type, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: Europe Market Value (US$ Billion) Forecast by Platform, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast by Platform, 2018 to 2033

Table 49: Europe Market Value (US$ Billion) Forecast by Operation Type, 2018 to 2033

Table 50: Europe Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 51: Europe Market Value (US$ Billion) Forecast by Rated Power , 2018 to 2033

Table 52: Europe Market Volume (Units) Forecast by Rated Power , 2018 to 2033

Table 53: Europe Market Value (US$ Billion) Forecast by Applications, 2018 to 2033

Table 54: Europe Market Volume (Units) Forecast by Applications, 2018 to 2033

Table 55: Europe Market Value (US$ Billion) Forecast by Sales Channel, 2018 to 2033

Table 56: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 58: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Billion) Forecast by Vehicle Type, 2018 to 2033

Table 60: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 61: Asia Pacific Market Value (US$ Billion) Forecast by Platform, 2018 to 2033

Table 62: Asia Pacific Market Volume (Units) Forecast by Platform, 2018 to 2033

Table 63: Asia Pacific Market Value (US$ Billion) Forecast by Operation Type, 2018 to 2033

Table 64: Asia Pacific Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 65: Asia Pacific Market Value (US$ Billion) Forecast by Rated Power , 2018 to 2033

Table 66: Asia Pacific Market Volume (Units) Forecast by Rated Power , 2018 to 2033

Table 67: Asia Pacific Market Value (US$ Billion) Forecast by Applications, 2018 to 2033

Table 68: Asia Pacific Market Volume (Units) Forecast by Applications, 2018 to 2033

Table 69: Asia Pacific Market Value (US$ Billion) Forecast by Sales Channel, 2018 to 2033

Table 70: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: MEA Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: MEA Market Value (US$ Billion) Forecast by Vehicle Type, 2018 to 2033

Table 74: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 75: MEA Market Value (US$ Billion) Forecast by Platform, 2018 to 2033

Table 76: MEA Market Volume (Units) Forecast by Platform, 2018 to 2033

Table 77: MEA Market Value (US$ Billion) Forecast by Operation Type, 2018 to 2033

Table 78: MEA Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 79: MEA Market Value (US$ Billion) Forecast by Rated Power , 2018 to 2033

Table 80: MEA Market Volume (Units) Forecast by Rated Power , 2018 to 2033

Table 81: MEA Market Value (US$ Billion) Forecast by Applications, 2018 to 2033

Table 82: MEA Market Volume (Units) Forecast by Applications, 2018 to 2033

Table 83: MEA Market Value (US$ Billion) Forecast by Sales Channel, 2018 to 2033

Table 84: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Platform, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) by Operation Type, 2023 to 2033

Figure 4: Global Market Value (US$ Billion) by Rated Power , 2023 to 2033

Figure 5: Global Market Value (US$ Billion) by Applications, 2023 to 2033

Figure 6: Global Market Value (US$ Billion) by Sales Channel, 2023 to 2033

Figure 7: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Global Market Value (US$ Billion) Analysis by Vehicle Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 16: Global Market Value (US$ Billion) Analysis by Platform, 2018 to 2033

Figure 17: Global Market Volume (Units) Analysis by Platform, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 20: Global Market Value (US$ Billion) Analysis by Operation Type, 2018 to 2033

Figure 21: Global Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 22: Global Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 24: Global Market Value (US$ Billion) Analysis by Rated Power , 2018 to 2033

Figure 25: Global Market Volume (Units) Analysis by Rated Power , 2018 to 2033

Figure 26: Global Market Value Share (%) and BPS Analysis by Rated Power , 2023 to 2033

Figure 27: Global Market Y-o-Y Growth (%) Projections by Rated Power , 2023 to 2033

Figure 28: Global Market Value (US$ Billion) Analysis by Applications, 2018 to 2033

Figure 29: Global Market Volume (Units) Analysis by Applications, 2018 to 2033

Figure 30: Global Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 31: Global Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 32: Global Market Value (US$ Billion) Analysis by Sales Channel, 2018 to 2033

Figure 33: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 34: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 35: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 37: Global Market Attractiveness by Platform, 2023 to 2033

Figure 38: Global Market Attractiveness by Operation Type, 2023 to 2033

Figure 39: Global Market Attractiveness by Rated Power , 2023 to 2033

Figure 40: Global Market Attractiveness by Applications, 2023 to 2033

Figure 41: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 42: Global Market Attractiveness by Region, 2023 to 2033

Figure 43: North America Market Value (US$ Billion) by Vehicle Type, 2023 to 2033

Figure 44: North America Market Value (US$ Billion) by Platform, 2023 to 2033

Figure 45: North America Market Value (US$ Billion) by Operation Type, 2023 to 2033

Figure 46: North America Market Value (US$ Billion) by Rated Power , 2023 to 2033

Figure 47: North America Market Value (US$ Billion) by Applications, 2023 to 2033

Figure 48: North America Market Value (US$ Billion) by Sales Channel, 2023 to 2033

Figure 49: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 50: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 51: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 52: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 53: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 54: North America Market Value (US$ Billion) Analysis by Vehicle Type, 2018 to 2033

Figure 55: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 58: North America Market Value (US$ Billion) Analysis by Platform, 2018 to 2033

Figure 59: North America Market Volume (Units) Analysis by Platform, 2018 to 2033

Figure 60: North America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 61: North America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 62: North America Market Value (US$ Billion) Analysis by Operation Type, 2018 to 2033

Figure 63: North America Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 64: North America Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 65: North America Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 66: North America Market Value (US$ Billion) Analysis by Rated Power , 2018 to 2033

Figure 67: North America Market Volume (Units) Analysis by Rated Power , 2018 to 2033

Figure 68: North America Market Value Share (%) and BPS Analysis by Rated Power , 2023 to 2033

Figure 69: North America Market Y-o-Y Growth (%) Projections by Rated Power , 2023 to 2033

Figure 70: North America Market Value (US$ Billion) Analysis by Applications, 2018 to 2033

Figure 71: North America Market Volume (Units) Analysis by Applications, 2018 to 2033

Figure 72: North America Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 73: North America Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 74: North America Market Value (US$ Billion) Analysis by Sales Channel, 2018 to 2033

Figure 75: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 76: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 77: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 78: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 79: North America Market Attractiveness by Platform, 2023 to 2033

Figure 80: North America Market Attractiveness by Operation Type, 2023 to 2033

Figure 81: North America Market Attractiveness by Rated Power , 2023 to 2033

Figure 82: North America Market Attractiveness by Applications, 2023 to 2033

Figure 83: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 84: North America Market Attractiveness by Country, 2023 to 2033

Figure 85: Latin America Market Value (US$ Billion) by Vehicle Type, 2023 to 2033

Figure 86: Latin America Market Value (US$ Billion) by Platform, 2023 to 2033

Figure 87: Latin America Market Value (US$ Billion) by Operation Type, 2023 to 2033

Figure 88: Latin America Market Value (US$ Billion) by Rated Power , 2023 to 2033

Figure 89: Latin America Market Value (US$ Billion) by Applications, 2023 to 2033

Figure 90: Latin America Market Value (US$ Billion) by Sales Channel, 2023 to 2033

Figure 91: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 92: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 93: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 96: Latin America Market Value (US$ Billion) Analysis by Vehicle Type, 2018 to 2033

Figure 97: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 98: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 99: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 100: Latin America Market Value (US$ Billion) Analysis by Platform, 2018 to 2033

Figure 101: Latin America Market Volume (Units) Analysis by Platform, 2018 to 2033

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 104: Latin America Market Value (US$ Billion) Analysis by Operation Type, 2018 to 2033

Figure 105: Latin America Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 106: Latin America Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 107: Latin America Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 108: Latin America Market Value (US$ Billion) Analysis by Rated Power , 2018 to 2033

Figure 109: Latin America Market Volume (Units) Analysis by Rated Power , 2018 to 2033

Figure 110: Latin America Market Value Share (%) and BPS Analysis by Rated Power , 2023 to 2033

Figure 111: Latin America Market Y-o-Y Growth (%) Projections by Rated Power , 2023 to 2033

Figure 112: Latin America Market Value (US$ Billion) Analysis by Applications, 2018 to 2033

Figure 113: Latin America Market Volume (Units) Analysis by Applications, 2018 to 2033

Figure 114: Latin America Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 115: Latin America Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 116: Latin America Market Value (US$ Billion) Analysis by Sales Channel, 2018 to 2033

Figure 117: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 118: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 119: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 120: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 121: Latin America Market Attractiveness by Platform, 2023 to 2033

Figure 122: Latin America Market Attractiveness by Operation Type, 2023 to 2033

Figure 123: Latin America Market Attractiveness by Rated Power , 2023 to 2033

Figure 124: Latin America Market Attractiveness by Applications, 2023 to 2033

Figure 125: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 126: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 127: Europe Market Value (US$ Billion) by Vehicle Type, 2023 to 2033

Figure 128: Europe Market Value (US$ Billion) by Platform, 2023 to 2033

Figure 129: Europe Market Value (US$ Billion) by Operation Type, 2023 to 2033

Figure 130: Europe Market Value (US$ Billion) by Rated Power , 2023 to 2033

Figure 131: Europe Market Value (US$ Billion) by Applications, 2023 to 2033

Figure 132: Europe Market Value (US$ Billion) by Sales Channel, 2023 to 2033

Figure 133: Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 134: Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 135: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 136: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 137: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 138: Europe Market Value (US$ Billion) Analysis by Vehicle Type, 2018 to 2033

Figure 139: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 140: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 141: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Europe Market Value (US$ Billion) Analysis by Platform, 2018 to 2033

Figure 143: Europe Market Volume (Units) Analysis by Platform, 2018 to 2033

Figure 144: Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 145: Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 146: Europe Market Value (US$ Billion) Analysis by Operation Type, 2018 to 2033

Figure 147: Europe Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 148: Europe Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 149: Europe Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 150: Europe Market Value (US$ Billion) Analysis by Rated Power , 2018 to 2033

Figure 151: Europe Market Volume (Units) Analysis by Rated Power , 2018 to 2033

Figure 152: Europe Market Value Share (%) and BPS Analysis by Rated Power , 2023 to 2033

Figure 153: Europe Market Y-o-Y Growth (%) Projections by Rated Power , 2023 to 2033

Figure 154: Europe Market Value (US$ Billion) Analysis by Applications, 2018 to 2033

Figure 155: Europe Market Volume (Units) Analysis by Applications, 2018 to 2033

Figure 156: Europe Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 157: Europe Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 158: Europe Market Value (US$ Billion) Analysis by Sales Channel, 2018 to 2033

Figure 159: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 160: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 161: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 162: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 163: Europe Market Attractiveness by Platform, 2023 to 2033

Figure 164: Europe Market Attractiveness by Operation Type, 2023 to 2033

Figure 165: Europe Market Attractiveness by Rated Power , 2023 to 2033

Figure 166: Europe Market Attractiveness by Applications, 2023 to 2033

Figure 167: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: Europe Market Attractiveness by Country, 2023 to 2033

Figure 169: Asia Pacific Market Value (US$ Billion) by Vehicle Type, 2023 to 2033

Figure 170: Asia Pacific Market Value (US$ Billion) by Platform, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Billion) by Operation Type, 2023 to 2033

Figure 172: Asia Pacific Market Value (US$ Billion) by Rated Power , 2023 to 2033

Figure 173: Asia Pacific Market Value (US$ Billion) by Applications, 2023 to 2033

Figure 174: Asia Pacific Market Value (US$ Billion) by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific Market Value (US$ Billion) by Country, 2023 to 2033

Figure 176: Asia Pacific Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 177: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 178: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 179: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 180: Asia Pacific Market Value (US$ Billion) Analysis by Vehicle Type, 2018 to 2033

Figure 181: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 182: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 183: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 184: Asia Pacific Market Value (US$ Billion) Analysis by Platform, 2018 to 2033

Figure 185: Asia Pacific Market Volume (Units) Analysis by Platform, 2018 to 2033

Figure 186: Asia Pacific Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 187: Asia Pacific Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 188: Asia Pacific Market Value (US$ Billion) Analysis by Operation Type, 2018 to 2033

Figure 189: Asia Pacific Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 190: Asia Pacific Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 191: Asia Pacific Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 192: Asia Pacific Market Value (US$ Billion) Analysis by Rated Power , 2018 to 2033

Figure 193: Asia Pacific Market Volume (Units) Analysis by Rated Power , 2018 to 2033

Figure 194: Asia Pacific Market Value Share (%) and BPS Analysis by Rated Power , 2023 to 2033

Figure 195: Asia Pacific Market Y-o-Y Growth (%) Projections by Rated Power , 2023 to 2033

Figure 196: Asia Pacific Market Value (US$ Billion) Analysis by Applications, 2018 to 2033

Figure 197: Asia Pacific Market Volume (Units) Analysis by Applications, 2018 to 2033

Figure 198: Asia Pacific Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 199: Asia Pacific Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 200: Asia Pacific Market Value (US$ Billion) Analysis by Sales Channel, 2018 to 2033

Figure 201: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 202: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 203: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 204: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 205: Asia Pacific Market Attractiveness by Platform, 2023 to 2033

Figure 206: Asia Pacific Market Attractiveness by Operation Type, 2023 to 2033

Figure 207: Asia Pacific Market Attractiveness by Rated Power , 2023 to 2033

Figure 208: Asia Pacific Market Attractiveness by Applications, 2023 to 2033

Figure 209: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Billion) by Vehicle Type, 2023 to 2033

Figure 212: MEA Market Value (US$ Billion) by Platform, 2023 to 2033

Figure 213: MEA Market Value (US$ Billion) by Operation Type, 2023 to 2033

Figure 214: MEA Market Value (US$ Billion) by Rated Power , 2023 to 2033

Figure 215: MEA Market Value (US$ Billion) by Applications, 2023 to 2033

Figure 216: MEA Market Value (US$ Billion) by Sales Channel, 2023 to 2033

Figure 217: MEA Market Value (US$ Billion) by Country, 2023 to 2033

Figure 218: MEA Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 219: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 220: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 221: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 222: MEA Market Value (US$ Billion) Analysis by Vehicle Type, 2018 to 2033

Figure 223: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 226: MEA Market Value (US$ Billion) Analysis by Platform, 2018 to 2033

Figure 227: MEA Market Volume (Units) Analysis by Platform, 2018 to 2033

Figure 228: MEA Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 229: MEA Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 230: MEA Market Value (US$ Billion) Analysis by Operation Type, 2018 to 2033

Figure 231: MEA Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 232: MEA Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 233: MEA Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 234: MEA Market Value (US$ Billion) Analysis by Rated Power , 2018 to 2033

Figure 235: MEA Market Volume (Units) Analysis by Rated Power , 2018 to 2033

Figure 236: MEA Market Value Share (%) and BPS Analysis by Rated Power , 2023 to 2033

Figure 237: MEA Market Y-o-Y Growth (%) Projections by Rated Power , 2023 to 2033

Figure 238: MEA Market Value (US$ Billion) Analysis by Applications, 2018 to 2033

Figure 239: MEA Market Volume (Units) Analysis by Applications, 2018 to 2033

Figure 240: MEA Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 241: MEA Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 242: MEA Market Value (US$ Billion) Analysis by Sales Channel, 2018 to 2033

Figure 243: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 244: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 245: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 246: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 247: MEA Market Attractiveness by Platform, 2023 to 2033

Figure 248: MEA Market Attractiveness by Operation Type, 2023 to 2033

Figure 249: MEA Market Attractiveness by Rated Power , 2023 to 2033

Figure 250: MEA Market Attractiveness by Applications, 2023 to 2033

Figure 251: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Wheel Loaders Market Size and Share Forecast Outlook 2025 to 2035

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Compact Recloser Replacement Market Size and Share Forecast Outlook 2025 to 2035

Compact Pick-up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Compact Track and Multi-Terrain Loader Market Size and Share Forecast Outlook 2025 to 2035

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Compact E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Compact Road Sweepers Market

Compaction equipment Market

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Refuse Compactor Market

Germany Compact Construction Equipment Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA