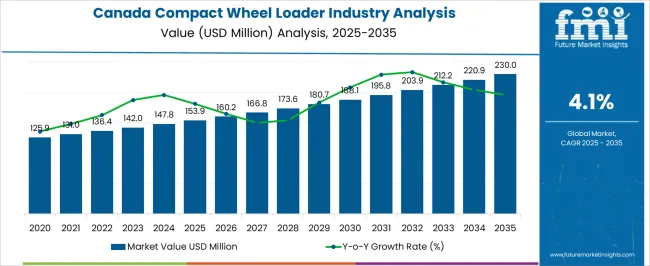

The Canada Compact Wheel Loader Industry Analysis is estimated to be valued at USD 153.9 million in 2025 and is projected to reach USD 230.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Canada Compact Wheel Loader Industry Analysis Estimated Value in (2025 E) | USD 153.9 million |

| Canada Compact Wheel Loader Industry Analysis Forecast Value in (2035 F) | USD 230.0 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The Canada compact wheel loader industry is demonstrating healthy growth, driven by increased construction activities, infrastructure modernization, and expanding applications in landscaping and agricultural support. Compact wheel loaders offer versatility, maneuverability, and cost efficiency, making them attractive for projects where space is limited.

The market is supported by growing adoption among rental operators and contractors who require adaptable equipment for diverse tasks. Technological enhancements in engine efficiency, operator comfort, and hydraulic systems have further strengthened demand.

The current industry scenario reflects robust investment in urban infrastructure and road maintenance, with compact machinery gaining traction for its operational flexibility. Looking forward, the integration of telematics and hybrid propulsion technologies is expected to enhance efficiency and regulatory compliance, supporting long-term market expansion.

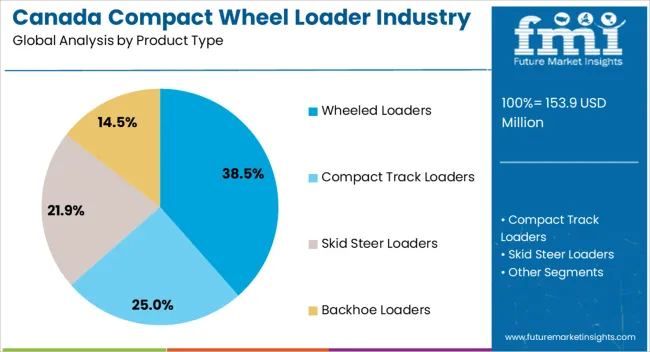

The wheeled loaders segment dominates the product type category with approximately 38.5% share, benefiting from its reliability and suitability for a wide range of construction and material handling applications. These machines offer strong productivity, mobility, and adaptability across urban and semi-urban projects.

Their lower maintenance requirements compared to tracked equipment and ability to operate on paved surfaces make them highly attractive in Canada’s infrastructure landscape. Rental fleet operators increasingly favor wheeled loaders for their high utilization and versatility, further supporting the segment’s prominence.

With steady investment in infrastructure and construction, the wheeled loaders segment is expected to maintain its leadership.

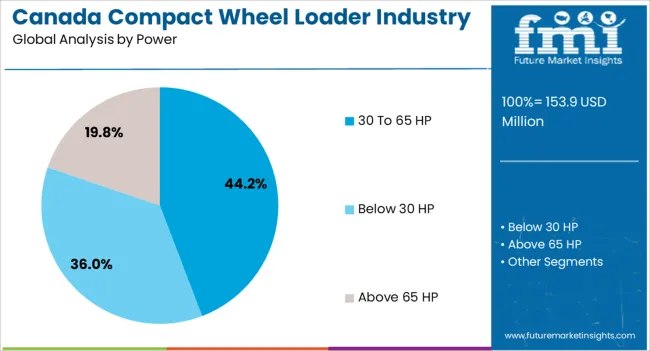

The 30 to 65 HP segment leads the power category with approximately 44.2% share, reflecting its suitability for mid-range projects that require a balance between efficiency and performance. Compact loaders within this range are well-suited for general construction, municipal maintenance, and landscaping, offering flexibility without excessive fuel consumption.

Contractors value this category for its cost-effectiveness and operational agility in smaller-scale projects.

With the rising preference for compact, efficient machinery capable of handling diverse tasks, the 30 to 65 HP segment is projected to remain dominant.

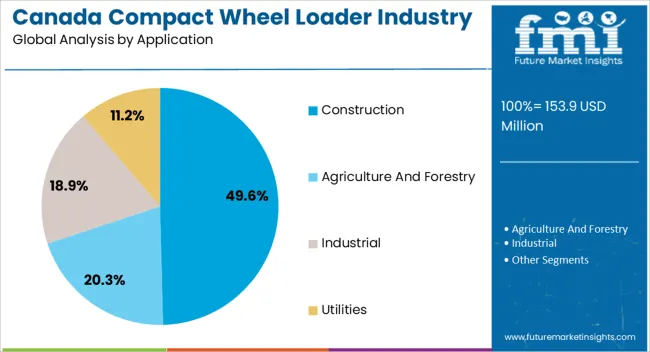

The construction segment holds approximately 49.6% share in the application category, underscoring its role as the primary driver of demand for compact wheel loaders in Canada. Increased urban development, infrastructure upgrades, and housing projects have significantly boosted the requirement for versatile, mobile equipment.

Compact wheel loaders are widely utilized for material handling, earthmoving, and site preparation, making them integral to construction workflows.

With government investment in infrastructure and the consistent activity in residential and commercial construction, the segment is set to sustain its leading position in the forecast period.

Industry to Expand Over 1.5X through 2035

Canada’s compact wheel loader industry is expected to expand over 1.5X through 2035, amid a 2.5% increase in expected CAGR compared to the historical one. This is due to the growing demand for high-speed construction equipment and the requirement for small-sized wheel loaders. By 2035, the industry is set to reach USD 211.9 million.

Demand for Wheeled Loaders in Canada to Remain High Across Diverse Sectors

The wheeled loader segment is expected to dominate Canada’s compact wheel loader industry with a volume share of 39.2% in 2025. This is attributable to the rising usage of wheeled loaders in construction work, agriculture & forestry activity, and industrial use.

Wheeled loaders are in high demand in Canada due to their versatility, efficiency, and adaptability to several terrains. Their ability to handle multiple tasks, such as excavation, loading, and material transport, makes them valuable in construction, where they can easily navigate diverse job sites and handle larger volumes of materials.

The high travel speeds of wheeled loaders compared to compact track loaders and skid steer loaders contribute to their efficiency, especially in tasks that require frequent movement over larger distances across construction sites. In agriculture, wheeled loaders are vital in handling bulk materials like grains and in forestry for transporting logs.

Sales of compact wheel loaders in Canada grew at a CAGR of 1.6% between 2020 and 2024. The industry was valued at USD 153.9 million in 2025. By 2035, Canada’s compact wheel loader industry is expected to thrive at a CAGR of 4.1%.

| Historical CAGR (2020 to 2024) | 1.6% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.1% |

As the industrial and construction industries embraced automation in the late 2024s, the compact wheel loader industry experienced substantial expansion. During this time, motorized equipment replaced manual labor and conventional building techniques.

Technological developments, including hydraulic systems, more efficient engines, and ergonomic designs, have been key factors in expanding the compact wheel loader industry. These developments have improved operator comfort, productivity, and fuel efficiency.

The introduction of tough emissions regulations in Canada has impacted the development and production of compact wheel loaders. As a result of manufacturers' attention to environmental regulations, cleaner and more fuel-efficient models of wheel loaders have been introduced.

Compact wheel loaders with several attachment options have become more in demand. Producers have introduced quick-change attachment systems that let users rapidly transition between different instruments, including grapples, forks, and buckets.

Over the forecast period, the Canada compact wheel loader industry is poised to exhibit healthy growth, totaling a valuation of USD 230 million by 2035. This is due to the increasing demand for downstream products, technological advancements in production processes, a shift toward sustainability, and the robust expansion of end-use industries.

Integrating smart technologies, such as sensors and data analytics in compact wheel loaders, is a game-changing advancement, offering manufacturers new opportunities. Expanding infrastructure and industrial activities in emerging economies are expected to drive demand for construction equipment, including compact wheel loaders.

Increasing Emphasis on Electric Compact Wheel Loaders

Canada's compact wheel loader industry is experiencing a notable upswing, driven by a growing emphasis on electric models. The popularity of electric compact wheel loaders is attributed to their innovative features, designed to address environmental concerns and enhance operational efficiency. These eco-friendly loaders prioritize reduced noise emissions, making them ideal for urban and residential construction projects.

Methane-powered Wheel Loaders Reduce the Fuel Consumption

Innovative machines like compact wheel loaders demonstrate a commitment to environmental sustainability and deliver substantial benefits in terms of fuel efficiency. Methane-powered wheel loaders contribute to a greener and more eco-friendly construction sector in Canada by significantly reducing fuel consumption compared to their diesel counterparts.

Canada’s compact wheel loaders embrace cutting-edge technologies, prioritizing efficiency and environmental responsibility. As the industry continues to evolve, these wheel loaders stand as a testament to the construction sector's commitment to reducing its carbon footprint.

Technological Advancements

Construction equipment manufacturers are introducing the technology of smart assistant systems in wheel loaders that enable the operator to steer comfortably with one hand. The compact wheel loader industry is experiencing a significant growth surge, propelled by technological advancements introduced by manufacturers.

Road Capabilities and Improved Visibility Provide Better Safety

In the construction landscape of Canada, compact wheel loader stands out not only for its exceptional speed and mobility but also for its road capabilities and for safety and productivity. The machine’s road capabilities ensure efficient transportation between job sites, allowing for seamless project management.

The table below highlights key regions’ compact wheel loader revenues. Central Canada, West Canada, and Atlantic Canada are expected to remain the top three consumers of compact wheel loaders, with expected valuations of USD 230 million, USD 71.9 million, and USD 26.1 million, respectively, in 2035.

| Region | Revenue (2035) |

|---|---|

| Central Canada | USD 230 million |

| West Canada | USD 71.9 million |

| Atlantic Canada | USD 26.1 million |

| North Canada | USD 16.6 million |

The table below shows the estimated growth rates of the top four countries. Atlantic Canada, North Canada, and West Canada are set to record high CAGRs of 5.6%, 4.8%, and 4.2% respectively, through 2035.

| Region | CAGR (2025 to 2035) |

|---|---|

| Atlantic Canada | 5.6% |

| North Canada | 4.8% |

| West Canada | 4.2% |

| Central Canada | 3.5% |

West Canada’s compact wheel loader industry size is projected to reach USD 71.9 million by 2035. Over the assessment period, demand for compact wheel loaders in West Canada is set to rise at 4.2% CAGR.

The region's economy is influenced by oil, gas, and mining industries, which is expected to drive the demand for compact wheel loaders, material handling, and site maintenance. There is substantial growth in infrastructure development spurred by urban expansion. The versatile nature of these machines makes them essential on construction sites.

West Canada's flourishing agricultural sector and expansive forestry resources also contribute to the increased need for compact wheel loaders. Region-challenging weather conditions, including heavy snowfall, boost sales as compact wheel loaders become crucial for snow removal and general maintenance.

Rising emphasis on environmental conservation and adherence to strict regulations are prompting companies to invest in more eco-friendly compact wheel loaders. The diverse terrain, encompassing mountainous regions, adds to the appeal of these machines due to their maneuverability in challenging landscapes.

The growth of compact wheel loaders in Central Canada is driven by their versatility, all-terrain performance, increased productivity, operator comfort, and compatibility with a wide range of attachments. Despite the presence of other machines, such as compact track loaders and skid steer loaders, compact wheel loaders stand out due to their lower ground pressure and higher lifting capacities.

The ability to handle heavy-duty lifting tasks, navigate tight spaces, and provide operator comfort contributes to the increased usage of compact wheel loaders in Central Canada. Sales of compact wheel loaders in Central Canada are projected to soar at a CAGR of around 3.5% during the assessment period. Total valuation in the country is anticipated to reach USD 230 million by 2035.

The factor contributing to compact wheel loaders' popularity in Atlantic Canada is their ease of use. Operators find them intuitive and user-friendly, enabling quick adaptation to several tasks on the construction site. Their compatibility with multipurpose attachments adds to their versatility, allowing them to transition between different job requirements seamlessly.

The compact wheel loader industry in Atlantic Canada is anticipated to reach USD 26.1 million in 2035. Over the forecast period, compact wheel loader demand is set to increase at a robust CAGR of 5.6%.

The below section shows the compact track loaders segment dominating based on product type. It is forecast to thrive at 3.8% CAGR between 2025 and 2035. Based on power, the 30 to 65 HP segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 4.3% during the forecast period.

| Top Segment (Product Type) | Compact Track Loaders |

|---|---|

| Predicted CAGR (2025 to 2035) | 3.8% |

Compact track loaders (CTLs) are becoming immensely popular in Canada owing to their remarkable versatility and adaptability across several industries. These machines stand out for their exceptional performance in diverse terrains and challenging weather conditions.

The compact size of CTLs allows them to navigate tight spaces efficiently, making them well-suited for urban construction sites and residential areas. Their high productivity and efficiency in tasks such as material movement, digging, and lifting in the construction and agricultural sectors are set to drive the industry’s growth.

Technological advancements, including improved operator comfort and advanced control systems, further enhance the appeal of compact track loaders as modern and efficient equipment. Over the forecast period, demand for compact track loaders is expected to rise at a CAGR of 3.8%.

| Top Segment (Power) | 30 to 65 HP |

|---|---|

| Projected CAGR (2025 to 2035) | 4.3% |

The demand for compact track loaders, skid steer loaders, backhoe loaders, and wheeled loaders in Canada's 30 to 65-horsepower range is driven by their versatile and efficient performance. In agriculture, they prove valuable for diverse tasks such as material handling and trench digging.

The adaptability of compact track loaders across seasons, fuel efficiency, and potential compliance with regulations further contribute to their popularity in Canada. The 30 to 65 HP segment is projected to thrive at 4.3% CAGR during the forecast period.

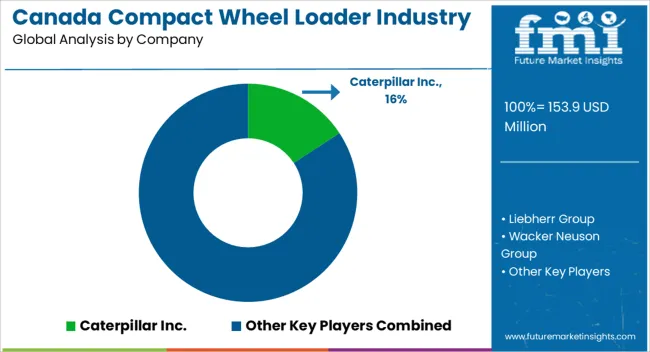

Canada’s loader industry is fragmented, with leading players accounting for a significant industry share. Caterpillar Inc., KUBOTA Corporation, CNH Industrial N.V., Doosan Bobcat, Hitachi Construction Machinery Co. Ltd., and Volvo Construction Equipment are the leading manufacturers and suppliers of compact wheel loaders listed in the report.

Key compact wheel loader companies are investing in continuous research to introduce new products and increase their production capacity to meet end-user demand. They are also inclined toward adopting strategies to strengthen their footprint, including acquisitions, partnerships, mergers, and facility expansions.

Recent Developments

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 142.0 million |

| Projected Value (2035) | USD 211.9 million |

| Anticipated Growth Rate (2025 to 2035) | 4.1% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (metric tons) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Power, Application, Region |

| Regions Covered | West Canada, Central Canada, Atlantic Canada, North Canada |

| Key Companies Profiled | Liebherr Group; Wacker Neuson Group; Deere & Company; Volvo Construction Equipment; Hitachi Construction Machinery Co. Ltd.; Doosan Bobcat; CNH Industrial N.V.; KUBOTA Corporation; Caterpillar Inc. |

The global Canada compact wheel loader industry analysis is estimated to be valued at USD 153.9 million in 2025.

The market size for the Canada compact wheel loader industry analysis is projected to reach USD 230.0 million by 2035.

The Canada compact wheel loader industry analysis is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in Canada compact wheel loader industry analysis are wheeled loaders, compact track loaders, skid steer loaders and backhoe loaders.

In terms of power, 30 to 65 hp segment to command 44.2% share in the Canada compact wheel loader industry analysis in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compact Wheel Loaders Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Compact Track and Multi-Terrain Loader Market Size and Share Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

Molded Fiber Pulp Packaging industry Analysis in USA and Canada - Size, Share, and Forecast Outlook 2025 to 2035

Compacted Strand Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Compact Rotary Actuator Market Size and Share Forecast Outlook 2025 to 2035

Compact Pneumatic Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Compact Resin Type Silencer Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Loader Bucket Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA