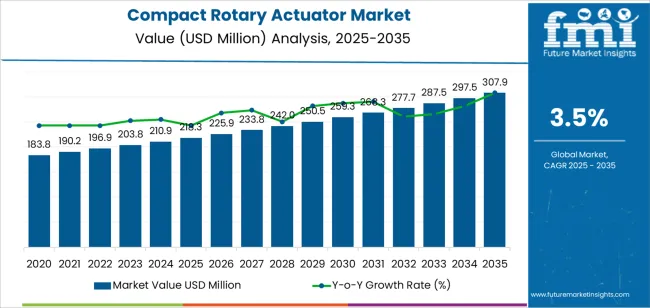

The global compact rotary actuator market is projected to grow from USD 218.3 million in 2025 to approximately USD 308.0 million by 2035, recording an absolute increase of USD 89.7 million over the forecast period. This translates into a total growth of 41.1%, with the market forecast to expand at a CAGR of 3.5% between 2025 and 2035. The market size is expected to grow by nearly 1.4X during the same period, supported by increasing automation requirements across industrial manufacturing operations, growing precision control demands in medical device applications, and expanding robotics integration driving advanced motion control procurement across various mechanical engineering applications.

The market exhibits distinct regional dynamics with Asia Pacific emerging as the fastest-growing region, led by China's manufacturing expansion programs and India's industrial modernization initiatives. North America and Europe maintain substantial market presence through established automation infrastructure and advanced robotics applications. The compact rotary actuator segment demonstrates particular strength in applications requiring space-efficient motion solutions, including automated assembly systems, surgical equipment positioning, and collaborative robot joint mechanisms. Technology evolution continues toward electric actuation systems offering superior control precision and energy efficiency compared to conventional pneumatic and hydraulic alternatives. Market participants increasingly focus on miniaturization capabilities, integration compatibility with digital control systems, and compliance with industry-specific performance standards across automotive, aerospace, and medical sectors.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 218.3 million |

| Market Forecast Value (2035) | USD 308.0 million |

| Forecast CAGR (2025-2035) | 3.5% |

| AUTOMATION EXPANSION TRENDS | PRECISION CONTROL REQUIREMENTS | TECHNOLOGY ADVANCEMENT DRIVERS |

|---|---|---|

| Industrial Manufacturing Automation Growth Manufacturing operations implementing automated motion control systems requiring compact actuation solutions for space-constrained applications. Robotics Integration Acceleration Collaborative robotics deployment expanding across manufacturing facilities driving demand for precision rotary positioning mechanisms. Assembly System Modernization Production line upgrades incorporating advanced motion control requiring reliable compact actuation technologies. | Medical Device Precision Demands Surgical equipment and diagnostic systems requiring accurate angular positioning with minimal space requirements. Aerospace Component Control Aircraft system applications demanding lightweight actuation solutions with precise angular control capabilities. Quality Control Enhancement Automated inspection systems implementing precision positioning for accurate measurement and verification operations. | Electric Actuation Evolution Development of servo-motor-based rotary actuators offering superior control accuracy and energy efficiency compared to fluid power alternatives. Miniaturization Capabilities Advanced engineering enabling smaller actuator footprints while maintaining torque output and reliability performance. Digital Integration Standards Smart actuators incorporating sensor feedback and network connectivity supporting Industry 4.0 implementation requirements. Performance Optimization Enhanced sealing technologies and bearing systems extending operational life and reducing maintenance requirements across applications. |

| Category | Segments Covered |

|---|---|

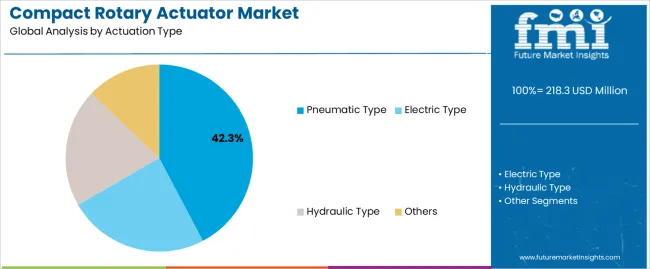

| By Actuation Type | Pneumatic Type, Electric Type, Hydraulic Type, Others |

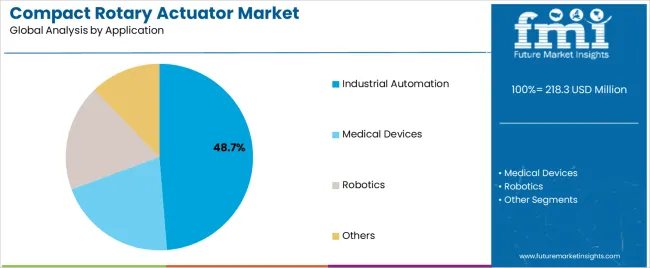

| By Application | Industrial Automation, Medical Devices, Robotics, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Pneumatic Type |

|

| Electric Type |

|

| Hydraulic Type |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Industrial Automation |

|

| Medical Devices |

|

| Robotics |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Factory Automation Expansion Continuing implementation of automated manufacturing systems across global production facilities driving demand for compact motion control solutions. Robotics Deployment Acceleration Collaborative robot adoption expanding requirements for precision rotary actuators in joint mechanisms and end-effector positioning. Space Optimization Requirements Equipment miniaturization trends requiring actuators delivering performance in reduced footprint dimensions. | Initial Cost Considerations Electric actuator systems requiring higher capital investment compared to conventional pneumatic alternatives affecting adoption in cost-sensitive applications. Technical Complexity Management Advanced control systems necessitating specialized engineering expertise and integration capabilities. Standardization Limitations Varied mounting interfaces and control protocols across manufacturers complicating equipment interchangeability and supplier transitions. | Servo Technology Integration Electric actuators incorporating closed-loop control systems enabling precise positioning and force control capabilities. Condition Monitoring Capabilities Smart actuators integrating sensor feedback for predictive maintenance and operational optimization. Energy Efficiency Focus Development of low-power electric actuators reducing operational costs and supporting eco-friendly objectives. Modular Design Approaches Standardized actuator platforms with configurable options accelerating specification selection and reducing custom engineering requirements. |

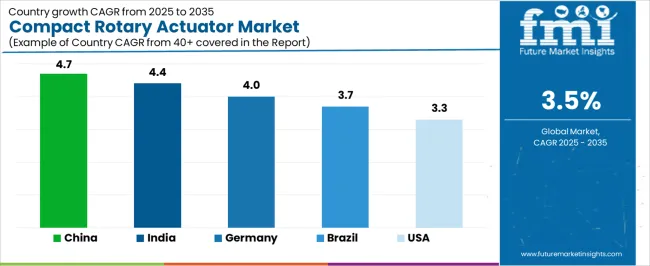

| Country | CAGR (2025-2035) |

|---|---|

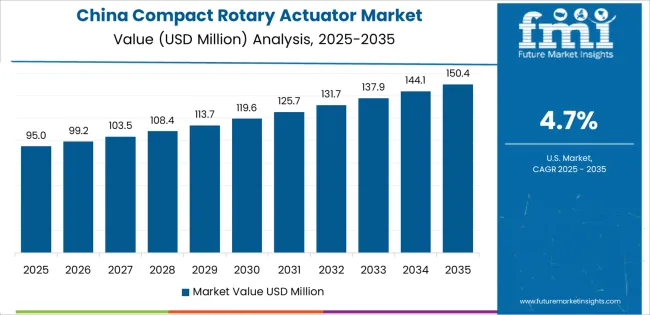

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| United States | 3.3% |

Compact rotary actuator market in China is projected to grow at a CAGR of 4.7% from 2025 to 2035. Revenue from compact rotary actuators in China is expected to exhibit strong growth, with a market value reaching significant levels by 2035, driven by expanding industrial automation infrastructure and comprehensive manufacturing modernization programs creating substantial opportunities for motion control suppliers across automotive production operations, electronics assembly facilities, and machinery manufacturing sectors. The country's established production capabilities and expanding robotics integration are creating significant demand for both cost-effective and precision-engineered actuator solutions.

Major automation equipment manufacturers and robotics companies are establishing comprehensive local production facilities to support large-scale manufacturing operations and meet growing demand for efficient motion control solutions. Manufacturing excellence initiatives are supporting widespread adoption of automated positioning systems across production operations, driving demand for reliable compact actuators. Industrial robot deployment expansion and automated assembly line development are creating substantial opportunities for actuator suppliers requiring competitive pricing and performance reliability. Electronics manufacturing growth and precision equipment development are facilitating adoption of compact rotary actuators throughout major industrial regions.

Compact rotary actuator market in India is anticipated to expand at a CAGR of 4.4% from 2025 to 2035. Revenue from compact rotary actuators in India is expanding substantially by 2035, supported by extensive manufacturing sector development and comprehensive automation technology adoption creating continued demand for motion control solutions across diverse industrial categories and equipment manufacturing segments. The country's growing manufacturing base and expanding technical capabilities are driving demand for actuator solutions that provide consistent performance while supporting cost-effective automation requirements.

Equipment manufacturers and automation system integrators are investing in local capabilities to support growing industrial operations and component demand. Automotive industry expansion and manufacturing modernization programs are creating opportunities for compact actuators across diverse assembly applications requiring reliable performance and competitive costs. Government manufacturing initiatives and industrial development programs are driving investments in automation technologies supporting motion control requirements throughout major manufacturing regions. Machinery production growth and equipment modernization efforts are enhancing demand for rotary actuators throughout industrial centers.

Compact rotary actuator market in Germany is growing at a CAGR of 4.0% from 2025 to 2035. Demand for compact rotary actuators in Germany is expected to reach substantial levels by 2035, supported by the country's leadership in industrial automation and advanced manufacturing technologies requiring sophisticated motion control systems for machinery production and automotive manufacturing applications. German equipment manufacturers are implementing high-precision actuator systems that support advanced control algorithms, operational efficiency, and comprehensive quality protocols. The market is characterized by focus on operational excellence, engineering sophistication, and compliance with stringent industrial standards.

Premium machinery industry investments are prioritizing advanced motion control technologies that demonstrate superior positioning accuracy and reliability while meeting German engineering and quality standards. Automotive manufacturing technology leadership programs and operational excellence initiatives are driving adoption of precision-engineered actuators that support advanced production systems and quality optimization. Research and development programs for automation enhancement are facilitating adoption of specialized actuation technologies throughout major industrial centers.

Compact rotary actuator market in the United States is expanding at a CAGR of 3.3% from 2025 to 2035. Revenue from compact rotary actuators in the United States is growing to reach substantial levels by 2035, driven by advanced manufacturing development programs and increasing automation adoption creating continued opportunities for motion control suppliers serving both industrial equipment manufacturers and specialty automation contractors. The country's extensive manufacturing technology base and expanding robotics awareness are creating demand for actuator solutions that support diverse performance requirements while maintaining operational standards. Equipment manufacturers and automation service providers are developing procurement strategies to support operational efficiency and technical specifications.

Medical device manufacturing programs and precision equipment production are facilitating adoption of compact actuators capable of supporting stringent performance requirements and regulatory compliance standards. Aerospace component manufacturing and advanced industrial equipment development programs are enhancing demand for high-precision actuators that support operational efficiency and performance reliability. Collaborative robotics expansion and advanced automation system development are creating opportunities for sophisticated actuation capabilities across American manufacturing facilities.

Compact rotary actuator market in Brazil is projected to grow at a CAGR of 3.7% from 2025 to 2035. Demand for compact rotary actuators in Brazil is expected to reach meaningful levels by 2035, driven by automotive industry development and manufacturing modernization programs supporting industrial automation expansion and equipment upgrade applications. The country's established automotive production tradition and growing automation market segments are creating demand for cost-effective actuator solutions that support operational performance and reliability standards. Equipment suppliers and automation technology providers are maintaining development capabilities to support diverse manufacturing requirements.

Automotive assembly automation and industrial equipment modernization programs are supporting demand for compact actuators that meet contemporary performance and cost standards. Manufacturing facility upgrades and automation system implementations are creating opportunities for motion control components that provide operational support and reliability. Industrial development initiatives and manufacturing technology enhancement programs are facilitating adoption of automated positioning capabilities throughout major production regions.

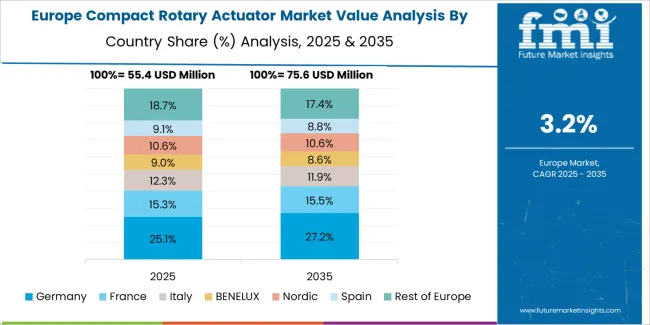

The compact rotary actuator market in Europe is projected to grow from USD 75.1 million in 2025 to USD 91.4 million by 2035, registering a CAGR of 2.0% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.8% by 2035, supported by its advanced industrial automation infrastructure and precision engineering capabilities in machinery manufacturing and automotive production.

France follows with a 19.4% share in 2025, projected to reach 19.7% by 2035, driven by comprehensive manufacturing modernization programs and robotics integration across automotive and aerospace sectors. The United Kingdom holds a 16.8% share in 2025, expected to decrease to 16.3% by 2035 due to manufacturing sector adjustments and automation investment patterns. Italy commands a 15.1% share, while Spain accounts for 12.3% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.2% to 6.0% by 2035, attributed to increasing automation adoption in Nordic countries and emerging Eastern European manufacturing facilities implementing modernization programs.

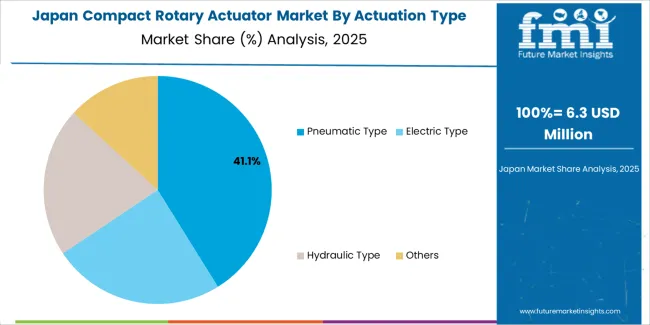

Japanese compact rotary actuator operations reflect the country's exacting precision standards and sophisticated manufacturing requirements. Major equipment manufacturers including Fanuc, Yaskawa, and Mitsubishi Electric maintain rigorous supplier qualification processes that emphasize positioning accuracy, repeatability specifications, and comprehensive reliability testing. This creates high barriers for new suppliers but ensures consistent performance that supports premium automation equipment positioning.

The Japanese market demonstrates unique application preferences, with significant demand for ultra-compact actuators designed for space-constrained robotic applications and precision assembly equipment. Companies require specific torque-to-size ratios and control interface compatibility that align with Japanese industrial automation standards, driving demand for customized engineering capabilities.

Regulatory oversight emphasizes comprehensive safety certifications and electromagnetic compatibility requirements that exceed many international standards. The industrial equipment certification system requires detailed performance documentation and long-term reliability validation, creating advantages for suppliers with established track records and comprehensive testing capabilities.

Supply chain management focuses on long-term partnership models rather than transactional procurement approaches. Japanese manufacturers typically maintain multi-decade supplier relationships, with annual contract negotiations emphasizing technological collaboration and continuous improvement initiatives over price competition. This stability supports investment in application-specific actuator development tailored to Japanese automation requirements.

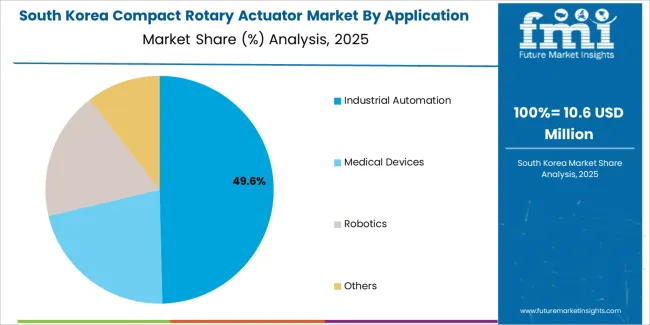

South Korean compact rotary actuator operations reflect the country's advanced manufacturing sector and export-oriented industrial model. Major automation equipment manufacturers including Doosan Robotics, Hyundai Robotics, and Samsung Electronics drive sophisticated component procurement strategies, establishing direct relationships with global suppliers to secure consistent quality and performance specifications for their robotic systems and automated production equipment targeting both domestic and international markets.

The Korean market demonstrates particular strength in applying compact actuators to semiconductor manufacturing equipment and display production systems, with companies integrating precision rotary positioning into wafer handling mechanisms and panel assembly operations. This specialization approach creates demand for ultra-clean actuator designs and vacuum-compatible configurations that differ from general industrial applications, requiring suppliers to adapt sealing technologies and material specifications.

Regulatory frameworks emphasize industrial safety certifications and cleanroom compatibility standards, with Korean Occupational Safety and Health Agency requirements creating barriers for suppliers unfamiliar with local compliance protocols. This environment particularly favors actuator manufacturers with comprehensive testing documentation and established certification capabilities for specialized manufacturing environments.

Supply chain efficiency remains critical given Korea's geographic concentration of electronics and semiconductor manufacturing. Companies increasingly pursue strategic partnerships with actuator suppliers capable of supporting rapid prototype development and volume production transitions while managing stringent quality specifications. Clean manufacturing logistics and contamination control requirements support premium positioning for suppliers demonstrating process excellence.

Profit pools consolidate around suppliers demonstrating application-specific engineering capabilities and established customer relationships in industrial automation and robotics segments. Value migrates from commodity pneumatic actuators toward precision electric servo systems where control accuracy, digital integration, and operational efficiency command premiums. Several operational models define competitive positioning: global automation conglomerates leveraging broad product portfolios and established distribution networks; specialized motion control manufacturers focusing on precision engineering and custom solutions; pneumatic component suppliers defending traditional automation applications through cost competitiveness; and emerging electric actuator developers capturing growth in robotics and medical device applications through superior control capabilities.

Switching costs remain significant due to mechanical interface standardization requirements, control system integration complexity, and performance qualification cycles that typically span 6-12 months for industrial applications and extend to 18-24 months for medical device implementations. These barriers stabilize incumbent positions in established applications while creating opportunities for differentiated solutions in emerging automation categories. Supply chain advantages accrue to manufacturers maintaining vertical integration across motor production, gearbox assembly, and control electronics, enabling faster customization response and cost structure optimization.

Market consolidation continues as larger automation equipment manufacturers acquire specialized actuator producers to secure component supply and capture engineering capabilities. Price pressure intensifies in standard pneumatic applications while premium electric actuator segments maintain margin stability through performance differentiation. Digital transformation gradually penetrates industrial procurement, with online configurators and automated quotation systems gaining adoption for standard specifications while engineered solutions remain relationship-dependent. Technical service capabilities and application engineering support increasingly influence supplier selection, particularly in robotics and medical device segments where system integration expertise provides competitive advantage beyond component specifications alone.

| Items | Values |

|---|---|

| Quantitative Units | USD 308.0 million |

| Actuation Type | Pneumatic Type, Electric Type, Hydraulic Type, Others |

| Application | Industrial Automation, Medical Devices, Robotics, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Key Countries Covered | United States, Germany, China, India, Brazil, and other countries |

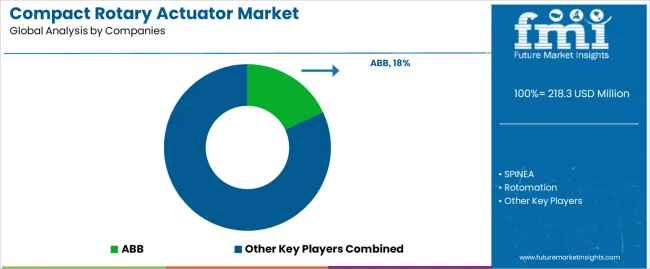

| Key Companies Profiled | ABB, SPINEA, Rotomation, DESTACO, HKS Dreh-Antriebe GmbH, IAI Corporation, Micromatic LLC, Curtiss-Wright, Johnson Electric, Hoerbiger Holding AG |

| Additional Attributes | Dollar sales by actuation type and application, regional demand distribution, competitive landscape analysis, technology adoption patterns, manufacturing integration trends, and precision engineering innovations driving automation advancement, operational efficiency, and performance optimization |

The global compact rotary actuator market is estimated to be valued at USD 218.3 million in 2025.

The market size for the compact rotary actuator market is projected to reach USD 307.9 million by 2035.

The compact rotary actuator market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in compact rotary actuator market are pneumatic type, electric type, hydraulic type and others.

In terms of application, industrial automation segment to command 48.7% share in the compact rotary actuator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compact Pneumatic Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Compact Resin Type Silencer Market Size and Share Forecast Outlook 2025 to 2035

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Wheel Loaders Market Size and Share Forecast Outlook 2025 to 2035

Compact Recloser Replacement Market Size and Share Forecast Outlook 2025 to 2035

Compact Pick-up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Compact Track and Multi-Terrain Loader Market Size and Share Forecast Outlook 2025 to 2035

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Compact E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Compact Road Sweepers Market

Compaction equipment Market

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA