The Compact Track and Multi-Terrain Loader Market is estimated to be valued at USD 30.1 billion in 2025 and is projected to reach USD 49.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

This steady expansion underscores the increasing demand for versatile construction machinery that can operate efficiently across challenging terrains and confined job sites. Between 2025 and 2030, growth will be shaped by infrastructure development, roadwork, and residential construction, where compact machines with high maneuverability and lower ground pressure are favored, pushing the market value past USD 38 billion.

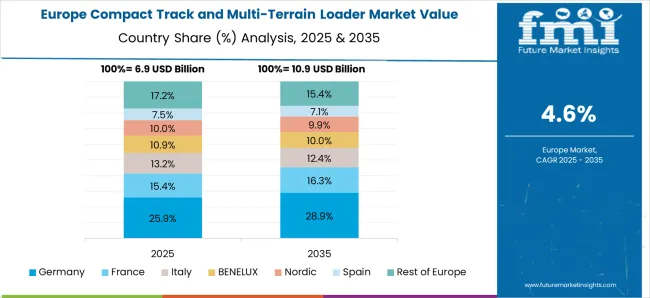

From 2030 to 2035, demand is expected to remain strong as rental fleets expand and contractors prioritize fuel efficiency, operator comfort, and equipment durability. The incremental rise of USD 18.9 billion over the ten years highlights the importance of equipment replacement cycles and technology upgrades, including telematics integration and hybrid drive systems. The Asia-Pacific region will dominate demand due to extensive construction and agricultural activities, while North America and Europe will experience consistent growth through modernization and fleet renewal.

| Metric | Value |

|---|---|

| Compact Track and Multi-Terrain Loader Market Estimated Value in (2025 E) | USD 30.1 billion |

| Compact Track and Multi-Terrain Loader Market Forecast Value in (2035 F) | USD 49.0 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The compact track and multi-terrain loader market is witnessing strong growth driven by the increasing focus on jobsite productivity, operator comfort, and all-terrain adaptability. These loaders are gaining preference across construction, agriculture, and landscaping applications due to their ability to operate efficiently in soft, wet, or uneven ground conditions. Growth is being further supported by advancements in hydraulic systems, fuel-efficient engines, and telematics integration, which allow enhanced machine control and predictive maintenance.

Regulatory push toward Tier IV and Stage V compliance has prompted manufacturers to develop more powerful yet environmentally compliant engines. Urbanization and rising demand for space-constrained equipment in tight jobsite locations are promoting the shift from large machinery to compact, maneuverable solutions.

Enhanced cab ergonomics, joystick control systems, and safety upgrades are also playing a critical role in accelerating equipment replacement cycles As equipment rental businesses and fleet operators increasingly prioritize multi-purpose machines with high resale value and low total cost of ownership, compact track and multi-terrain loaders are expected to remain a strategic asset in equipment portfolios.

The compact track and multi-terrain loader market is segmented by type, operating capacity, power range, application, and geographic regions. By type, the compact track and multi-terrain loader market is divided into Compact Track Loaders (CTLs) and Multi-Terrain Loaders (MTLs). In terms of operating capacity, the compact track and multi-terrain loader market is classified into 2,000–3,000 lbs, Less than 2,000 lbs, and More than 3,000 lbs.

Based on power range, the compact track and multi-terrain loader market is segmented into 70–100 HP, Less than 70 HP, and More than 100 HP. By application, the compact track and multi-terrain loader market is segmented into Commercial Construction, Residential Construction, Agriculture and Farming, Industrial, Municipal Services, and Others. Regionally, the compact track and multi-terrain loader industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Compact track loaders are projected to account for 51.2% of the total revenue share in the compact track and multi-terrain loader market in 2025, reflecting their strong market dominance. This segment's leadership has been driven by the machine's superior stability, traction control, and ability to handle various surfaces, including mud, sand, and snow. CTLs are widely adopted due to their lower ground pressure and minimal soil disturbance, making them well-suited for sensitive ground applications.

The integration of advanced load-sensing hydraulics, user-friendly digital control panels, and remote monitoring capabilities has further enhanced their value proposition. Their adaptability to multiple attachments, such as augers, trenchers, and buckets, through quick coupler systems has supported year-round utility in construction and landscaping operations.

Additionally, the rising availability of compact track loaders through rental channels and dealer networks has facilitated broader access to end users. Their durability, reduced machine downtime, and high resale value are contributing to the segment’s continued leadership across global markets.

The 2,000–3,000 lbs operating capacity segment is expected to account for 38.6% of the total revenue share in the compact track and multi-terrain loader market in 2025. This segment's strength lies in its optimal balance between payload performance and equipment maneuverability, making it a preferred choice for small to mid-sized projects.

Loaders in this category are extensively utilized across utility, light construction, and landscape operations due to their ability to handle moderate loads without compromising ground speed or fuel efficiency. Manufacturers have increasingly focused on optimizing the lift height, breakout force, and auxiliary hydraulic flow for this capacity range, thereby enhancing attachment versatility.

These machines are favored by rental companies for their broad applicability and ease of use by operators with varied skill levels. Furthermore, reduced transportation costs, improved access to narrow work areas, and compliance with operator safety standards have reinforced their position as a core offering in the equipment lineups of OEMs and rental providers.

The 70–100 HP power range segment is expected to account for 41.2% of the total revenue share in the compact track and multi-terrain loader market by 2025. This segment has gained traction due to its ability to deliver enhanced engine performance, superior torque output, and compatibility with high-flow hydraulic attachments. Equipment within this power band is being increasingly selected for heavy-duty applications that demand continuous operation, including grading, forestry mulching, and utility trenching.

The integration of Tier IV-compliant diesel engines with electronic fuel injection, advanced cooling systems, and reduced exhaust emissions has bolstered adoption among environmentally regulated markets. These machines offer a high power-to-weight ratio, ensuring efficient operation even on challenging terrains.

Extended maintenance intervals, fuel-saving eco modes, and advanced telematics have further contributed to lowering the total cost of ownership. The 70–100 HP segment is expected to retain its competitiveness as end users prioritize durability, performance consistency, and advanced operator-assist features in high-utilization applications.

The compact track and multi-terrain loader market is driven by regulatory compliance, increasing demand from construction and landscaping, enhanced loader versatility, and cost efficiency. These factors contribute to the continued expansion of the market, supporting diverse industry applications.

The compact track and multi-terrain loader market is increasingly influenced by stringent regulatory standards aimed at improving safety and reducing environmental impact. Regulations governing noise levels, emissions, and equipment safety are pushing manufacturers to enhance their machines to comply with evolving local and international laws. In regions like North America and Europe, compliance with emissions regulations such as Stage V in Europe and Tier 4 in the USA is essential for market access. As regulations tighten, manufacturers are focusing on producing machines that meet or exceed the required environmental standards, driving demand for cleaner and more efficient loaders in various industries.

The construction and landscaping industries are key drivers for the compact track and multi-terrain loader market. These sectors require versatile equipment that can perform efficiently on challenging terrain while ensuring productivity in confined spaces. The ability of these loaders to work on soft, uneven surfaces without compromising performance or stability makes them ideal for tasks like material handling, earthmoving, and site preparation. The rise in infrastructure development projects, coupled with increasing urban and rural development, is boosting the demand for compact loaders. The growth of landscaping projects, including parks and residential developments, supports continued market expansion.

The increasing demand for high-performance, versatile loaders is another critical factor driving market growth. Compact track and multi-terrain loaders offer the ability to operate efficiently in both rough and confined environments. These loaders are widely used for tasks such as digging, lifting, grading, and material transport across diverse sectors, including agriculture, construction, and landscaping. Their versatility allows operators to use different attachments for a wide range of tasks, further enhancing their appeal to contractors and business owners. This multi-functional capability ensures that these machines remain in high demand for various applications, from construction to agriculture.

Cost efficiency remains a primary driver in the adoption of compact track and multi-terrain loaders. These machines offer excellent performance and low operating costs compared to larger, more expensive machinery. They provide businesses with an affordable option for handling multiple tasks on job sites without the need for multiple pieces of equipment. The ease of operation of these loaders, with user-friendly controls and ergonomic designs, increases their attractiveness to operators and companies alike. Reduced maintenance costs and the ability to work in challenging environments without needing specialized machines make them a cost-effective choice for businesses seeking flexibility in equipment.

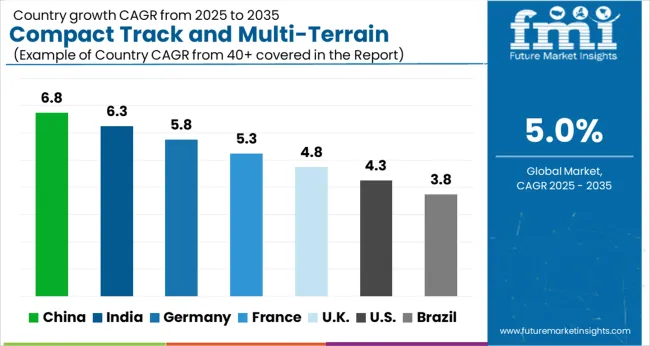

| Countries | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The compact track and multi-terrain loader market is projected to grow globally at a CAGR of 5.0% from 2025 to 2035, driven by demand across construction, landscaping, and agriculture sectors. China leads with a CAGR of 6.8%, fueled by robust industrial growth, increasing infrastructure projects, and a growing adoption of compact machinery in construction. India follows closely at 6.3%, supported by rapid industrialization, the demand for versatile construction machinery, and government incentives for infrastructure development. France sees a 5.3% growth rate, supported by its ongoing infrastructure projects and the adoption of energy-efficient machinery. The UK records a 4.8% growth, driven by the need for compact and reliable equipment in both the residential and commercial sectors, while the USA shows a 4.3% growth, supported by increasing demand in construction and land management. This analysis spans over 40 countries, with these five serving as key benchmarks for market expansion, innovation, and investment strategies in the global compact track and multi-terrain loader market..

The UK compact track and multi-terrain loader market is projected to grow at a CAGR of 4.8% during 2025–2035, up from 4.1% during 2020–2024. The market during the earlier period faced challenges such as high equipment costs and slow adoption due to economic uncertainties. However, the next decade will witness stronger growth driven by increased demand for compact, efficient machinery in the construction, landscaping, and agriculture sectors. This growth will be supported by rising infrastructure development, government regulations favoring compact machinery, and technological improvements in equipment reliability and fuel efficiency. The UK's continued push for modernizing construction and landscape operations will further spur demand for versatile and efficient track loaders.

China is expected to achieve a CAGR of 6.8% during 2025–2035, up from 5.9% recorded between 2020 and 2024. The earlier growth phase was impacted by limited availability of high-performance models and slower infrastructure development. However, China's market is now gaining momentum due to accelerated industrialization, the expansion of urban construction projects, and the increased need for versatile and durable equipment in harsh terrains. The country’s growing focus on energy-efficient and cost-effective construction machinery solutions will further boost the demand for compact track and multi-terrain loaders. Government initiatives supporting infrastructure projects will also provide a significant boost to the market.

India is projected to grow at a CAGR of 6.3% from 2025 to 2035, up from 5.5% between 2020 and 2024. The earlier period witnessed slower adoption due to infrastructure limitations, high costs, and limited awareness of compact equipment. However, India's market for compact track and multi-terrain loaders is accelerating, fueled by rapid urbanization, expansion of the construction industry, and government incentives for modernizing infrastructure. The growing need for high-performance machinery that can handle diverse terrain, along with the rise of government-backed projects and agricultural advancements, will further drive market growth in the coming years.

The French compact track and multi-terrain loader market is projected to grow at a CAGR of 5.3% during 2025–2035, compared to 4.5% during the 2020–2024 period. This growth is primarily driven by the increasing demand for machinery capable of working in various environments, especially in the agricultural, construction, and landscaping sectors. The earlier period faced challenges due to high initial equipment costs and economic factors. However, the market is now gaining momentum as the French government invests in infrastructure projects and focuses on modernizing agricultural machinery. The rise of eco-friendly and fuel-efficient loader technologies will also contribute to growth in the coming years.

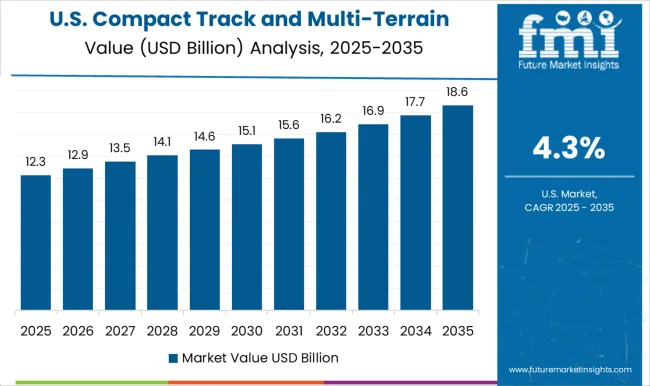

The USA compact track and multi-terrain loader market is projected to grow at a CAGR of 4.3% from 2025 to 2035, up from 3.8% during the 2020–2024 period. The market growth was slower in the earlier phase due to higher equipment costs and economic uncertainties, which limited widespread adoption. However, in the next decade, demand is expected to increase driven by the construction industry’s ongoing recovery and the rising popularity of compact machinery in landscaping and agricultural applications. The USA market will benefit from government infrastructure initiatives, increasing urban and rural construction projects, and growing demand for efficient, low-maintenance equipment. Additionally, the trend toward sustainable construction and operations will drive the need for more eco-friendly, fuel-efficient loaders, further accelerating market growth.

The compact track and multi-terrain loader market is characterized by a competitive mix of global manufacturers and specialized producers offering advanced, versatile, and cost-effective machinery for various industries such as construction, landscaping, and agriculture. Caterpillar Inc. leads the market with a wide range of high-performance track loaders, renowned for their durability, reliability, and excellent performance in harsh conditions.

Bobcat Company is a strong competitor, known for its innovative compact track loaders that offer unmatched versatility and efficiency in confined spaces and challenging terrains. Deere & Company follows with its reliable range of multi-terrain loaders, emphasizing powerful performance, user-friendly operation, and fuel efficiency. Kubota Corporation provides compact loaders with advanced engineering designed for smaller construction and agricultural applications, offering excellent fuel efficiency and low operational costs. J.C. Bamford Excavators Ltd. (JCB) is a significant player, offering versatile track loaders with high lifting capacities and rugged designs, suited for heavy-duty applications.

CNH Industrial N.V. offers advanced loaders under the Case and New Holland brands, providing powerful, energy-efficient solutions for the agricultural and construction sectors. Komatsu Ltd. is recognized for its high-tech, user-friendly machines, built for tough environments and offering enhanced productivity in material handling and earthmoving applications. Competitive strategies in the market revolve around offering innovative, fuel-efficient, and durable machines that meet the growing demand for productivity and cost-effectiveness. Manufacturers are investing in new technologies, expanding product lines, and strengthening dealer networks to cater to diverse market needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.1 Billion |

| Type | Compact Track Loaders (CTLs) and Multi-Terrain Loaders (MTLs) |

| Operating Capacity | 2,000–3,000 lbs, Less than 2,000 lbs, and More than 3,000 lbs |

| Power Range | 70–100 HP, Less than 70 HP, and More than 100 HP |

| Application | Commercial Construction, Residential Construction, Agriculture and Farming, Industrial, Municipal Services, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Bobcat Company, Deere & Company, Kubota Corporation, J.C. Bamford Excavators Ltd., CNH Industrial N.V., and Komatsu Ltd. |

| Additional Attributes | Dollar sales, projected growth rates, and market share of key players. Insights on regional demand, especially in construction and agriculture, are crucial. |

The global compact track and multi-terrain loader market is estimated to be valued at USD 30.1 billion in 2025.

The market size for the compact track and multi-terrain loader market is projected to reach USD 49.0 billion by 2035.

The compact track and multi-terrain loader market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in compact track and multi-terrain loader market are compact track loaders (ctls), _high-performance ctls, _standard ctls, _vertical lift ctls, _radial lift ctls, _mini ctls, multi-terrain loaders (mtls), _standard mtls, _suspension-enhanced mtls, _specialized mtls for soft ground, _compact mtls and _heavy-duty mtls.

In terms of operating capacity, 2,000–3,000 lbs segment to command 38.6% share in the compact track and multi-terrain loader market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Recloser Replacement Market Size and Share Forecast Outlook 2025 to 2035

Compact Pick-up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Compact E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Compact Road Sweepers Market

Compaction equipment Market

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Compact Wheel Loaders Market Size and Share Forecast Outlook 2025 to 2035

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Refuse Compactor Market

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Germany Compact Construction Equipment Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA