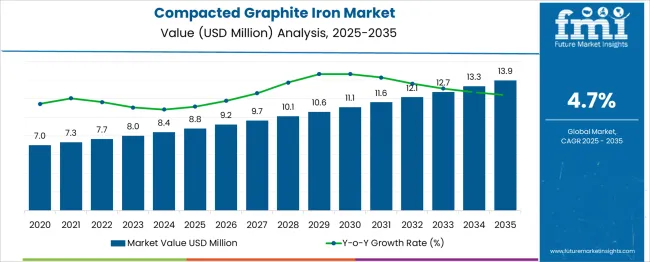

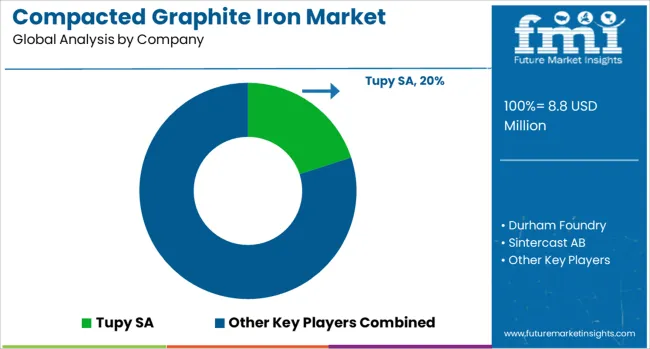

The Compacted Graphite Iron Market is estimated to be valued at USD 8.8 million in 2025 and is projected to reach USD 13.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. This growth highlights rising demand for high-performance materials in automotive, machinery, and industrial applications where strength and durability are critical. The absolute dollar opportunity over the 15-year period amounts to USD 6.9 million, signaling a significant market expansion for manufacturers and suppliers specializing in compacted graphite iron products. Between 2020 and 2025, the market is expected to increase from USD 7.0 million to USD 8.8 million, reflecting growing adoption in sectors focused on improving engine performance and reducing emissions.

From 2025 to 2035, the market sees growth, expanding by USD 5.1 million to reach USD 13.9 million. This surge is supported by continuous advancements in material technology and rising industrial production worldwide. Overall, the compacted graphite iron market offers promising opportunities for sustained growth and innovation throughout the forecast period.

| Metric | Value |

|---|---|

| Compacted Graphite Iron Market Estimated Value in (2025 E) | USD 8.8 million |

| Compacted Graphite Iron Market Forecast Value in (2035 F) | USD 13.9 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

Current market dynamics are shaped by advancements in metallurgy and manufacturing processes that enable cost-effective production of high-strength iron components. Press releases from automotive manufacturers and foundries indicate a growing preference for compacted graphite iron due to its superior thermal conductivity and higher tensile strength compared to traditional cast iron. Investor presentations and trade journals have highlighted the material’s contribution to reducing vehicle weight and enhancing engine performance, aligning with stricter emission and efficiency regulations.

The future outlook remains positive as industries continue to prioritize fuel efficiency, durability, and compliance with evolving environmental standards. These factors are expected to sustain demand for compacted graphite iron, with innovations in casting technologies and increased application in commercial vehicles and industrial equipment supporting long-term market expansion.

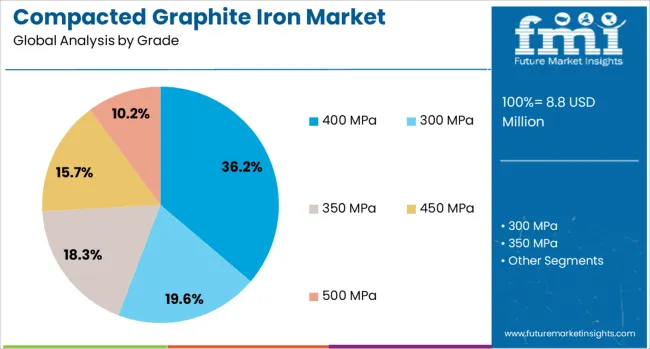

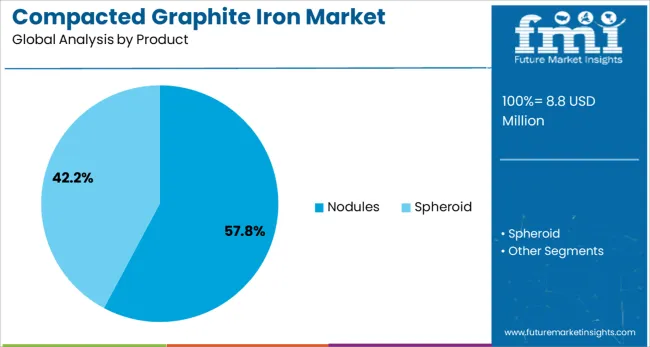

The compacted graphite iron market is segmented by grade, product application, and geographic regions. The compacted graphite iron market is divided into 400 MPa, 300 MPa, 350 MPa, 450 MPa, and 500 MPa. In terms of the product, the compacted graphite iron market is classified into nodules and spheroids.

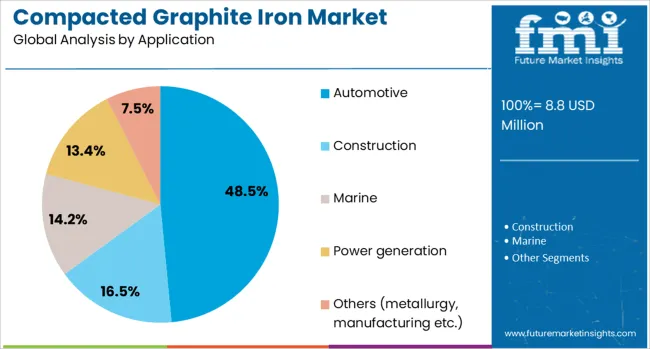

The compacted graphite iron market is segmented into Automotive, Construction, Marine, Power generation, and others (metallurgy, manufacturing, etc.). Regionally, the compacted graphite iron industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 400 MPa grade is projected to hold 36.2% of the Compacted Graphite Iron market revenue share in 2025, making it the leading grade segment. This prominence is being attributed to its optimal balance of strength, machinability, and cost-effectiveness as cited in technical datasheets and corporate product announcements.

The 400 MPa grade has been widely adopted for engine blocks, cylinder heads, and other critical automotive components due to its ability to withstand high mechanical loads while maintaining manufacturing efficiency. Investor briefings have noted that this grade supports higher performance standards required by modern engines without significant changes to existing foundry infrastructure.

Additionally, trade publications have emphasized its favorable thermal and fatigue properties, which align with industry efforts to improve durability and reduce maintenance costs. These advantages have made the 400 MPa grade the preferred choice for manufacturers aiming to enhance product performance while controlling production expenses, solidifying its leading position.

The nodules product segment is anticipated to account for 57.8% of the Compacted Graphite Iron market revenue share in 2025, maintaining its leadership. This dominance is being supported by the superior material properties imparted by nodular microstructures, as highlighted in metallurgical journals and manufacturer disclosures. The nodules form during solidification, providing enhanced strength, wear resistance, and thermal conductivity compared to other forms of graphite iron.

Industry experts have observed that manufacturers prefer nodular products because they enable better machinability and dimensional stability in complex components. Statements from automotive and heavy machinery producers indicate that the nodules product type supports the stringent quality standards demanded in high-performance applications while remaining cost competitive.

Furthermore, the widespread availability of technology to control nodule formation during casting has ensured consistency and reliability, which has reinforced confidence among end users. These factors have collectively contributed to the segment’s continued growth and leading market share.

The automotive application segment is forecasted to contribute 48.5% of the Compacted Graphite Iron market revenue share in 2025, securing its position as the largest application segment. This leadership is being driven by the rising need for lightweight, durable materials in engine components and structural parts, as stated in industry news and automaker press releases.

Automotive manufacturers have been increasingly utilizing compacted graphite iron for its ability to deliver higher strength-to-weight ratios while meeting emission and efficiency standards. Investor presentations have outlined how the material enables manufacturers to produce engines that are more efficient and longer-lasting without significantly increasing production costs.

Additionally, trade journals have noted that its compatibility with existing manufacturing processes and superior fatigue resistance make it highly suitable for demanding automotive applications. These advantages have solidified its role as a critical material in the automotive industry, ensuring the segment’s dominance in the overall market landscape.

The compacted graphite iron (CGI) market is growing steadily as industries seek materials combining strength, thermal conductivity, and fatigue resistance for demanding engine and heavy equipment applications. CGI offers superior mechanical properties compared to traditional grey iron, making it ideal for automotive engine blocks, turbocharger housings, and industrial machinery components. Increasing emphasis on lightweight, high-performance materials to improve fuel efficiency and durability supports market expansion. The automotive sector remains the largest end-user, followed by heavy machinery and power generation. Asia-Pacific leads growth due to automotive manufacturing hubs, while Europe and North America focus on advanced CGI applications.

CGI’s unique microstructure, featuring compacted graphite morphology, delivers higher tensile strength and stiffness with improved thermal conductivity compared to grey iron. This allows thinner wall sections and lighter components without sacrificing durability. Production involves precise control of alloying elements and solidification conditions to achieve desired graphite shape. Casting and machining CGI require specialized expertise due to material hardness and brittleness. Advances in melting and molding technologies improve yield and consistency. Manufacturers with strong metallurgical capabilities and process control produce high-quality CGI parts meeting stringent industry standards.

The automotive industry drives CGI demand for lightweight, fuel-efficient engine components able to withstand high combustion pressures and temperatures. Turbocharger housings, cylinder heads, and exhaust manifolds benefit from CGI’s performance attributes. Heavy equipment applications, including construction machinery and agricultural vehicles, also utilize CGI for durability under harsh operating conditions. Rising production of commercial vehicles and engines with stricter emission standards fuels growth. OEMs increasingly specify CGI to replace heavier or less durable materials, supporting market expansion.

CGI production is more complex and costly compared to traditional cast irons due to stringent process controls and higher alloying costs. Machining CGI components demands specialized tooling and expertise, increasing manufacturing expenses. Variability in raw material quality and casting parameters can lead to defects affecting mechanical performance. Limited availability of skilled metallurgists and technicians constrains some manufacturers. To maintain competitiveness, producers invest in R&D, process automation, and workforce training. Balancing cost with material benefits remains a key consideration for end-users evaluating CGI adoption.

The CGI market features established foundries and emerging regional players competing on quality, price, and customization capabilities. Sourcing of raw materials like scrap metal and alloying elements affects production costs and availability. Geopolitical factors and logistics disruptions influence supply chain stability. Manufacturers strengthening supply partnerships and localizing production reduce lead times and costs. Growing demand for aftermarket replacement parts opens additional revenue streams. Companies emphasizing product certification, quality assurance, and technical collaboration with OEMs enhance market positioning amid increasing competitive pressures.

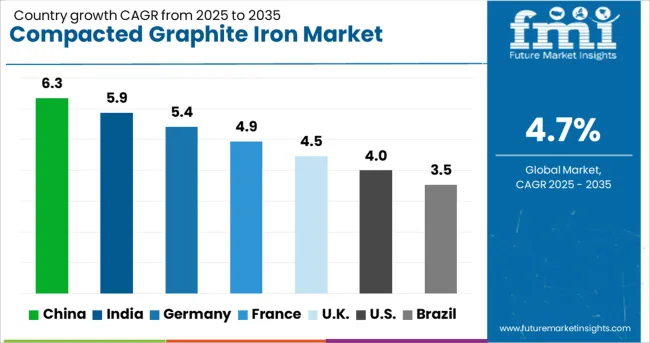

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global compacted graphite iron market is expanding at a 4.7% CAGR, driven by growing demand in automotive, heavy machinery, and industrial applications. Among BRICS nations, China leads with 6.3% growth, supported by extensive manufacturing capacity and raw material availability. India follows at 5.9%, fueled by rising industrial production and infrastructure projects. In the OECD region, Germany records 5.4% growth, reflecting advanced metallurgical processes and quality standards. The United Kingdom grows at 4.5%, driven by demand in automotive and engineering sectors. The United States, a mature market, shows 4.0% growth, shaped by stringent regulations and high-performance application needs. These countries collectively influence market trends through production scale, regulatory oversight, and industrial demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the compacted graphite iron market with a growth rate of 6.3%, driven by rising demand in automotive and heavy machinery manufacturing sectors. The expanding industrial base supports the need for high-performance materials that combine strength with durability. Compared to India, China benefits from advanced foundry technologies and larger-scale production capabilities, which enable competitive pricing and faster innovation cycles. The market growth is also supported by infrastructure development and increasing investments in transportation equipment. Manufacturers are focusing on improving the thermal conductivity and mechanical properties of compacted graphite iron to meet stringent engine performance requirements.

India compacted graphite iron market expands at 5.9%, supported by growing automotive and construction equipment industries. Compared to Germany, India’s market faces challenges related to technological maturity but gains momentum through increasing adoption of durable materials for engine components and heavy-duty parts. The government’s push for manufacturing growth and Make in India initiatives further encourage market expansion. Local foundries are upgrading production techniques to improve quality and reduce costs. Demand is fueled by rising exports and domestic consumption in commercial vehicles and agricultural machinery.

Germany’s compacted graphite iron market grows at 5.4%, driven by the strong automotive manufacturing sector and precision engineering industries. Compared to the United Kingdom, Germany emphasizes high quality and reliability, with suppliers focusing on improving material consistency and performance under high stress. The market benefits from demand in diesel engine components and industrial machinery that require superior thermal conductivity and fatigue resistance. Investment in research and development supports innovation and cost-effective production methods. Export opportunities to emerging markets also contribute to steady growth.

The United Kingdom compacted graphite iron market grows at 4.5%, with demand mainly from automotive and industrial machinery sectors. Compared to the United States, the United Kingdom market experiences moderate growth due to smaller scale manufacturing but maintains a focus on high-quality and application-specific material properties. Suppliers are enhancing product offerings to meet environmental and emission standards in engine components. The market is influenced by the need for lightweight yet durable materials to improve fuel efficiency. Collaboration between manufacturers and end users supports continuous product improvement.

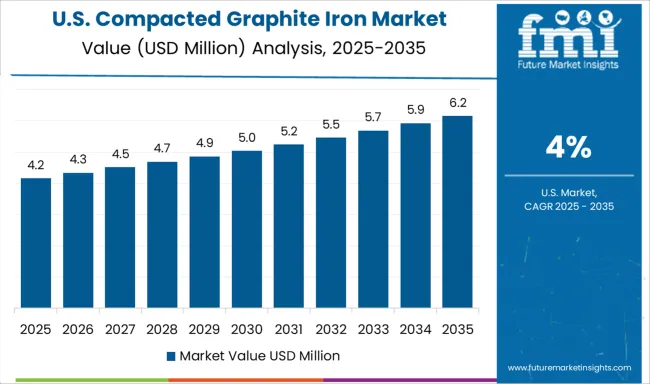

United States compacted graphite iron market grows at 4.0%, reflecting steady demand from automotive and heavy equipment manufacturers. Compared to China, the United States market has slower growth due to diverse material options and advanced alternative technologies. The market focuses on high-strength materials to improve engine efficiency and reduce emissions. Investments in research help develop applications for commercial vehicles and industrial engines. Aftermarket demand and replacement parts provide additional revenue streams. The growing emphasis on environmental compliance continues to influence material selection and product innovation.

The compacted graphite iron (CGI) market is shaped by specialized foundries and casting technology providers focused on delivering high-strength, thermally efficient materials for automotive, heavy machinery, and industrial applications. Tupy SA stands out as a global leader with extensive expertise in CGI casting, offering solutions that improve engine performance and reduce weight in diesel engines. Durham Foundry and Sintercast AB emphasize advanced casting technologies and quality control, ensuring consistent CGI properties for high-demand applications. Teksid Iron is recognized for its integrated manufacturing processes and collaborations with major automotive OEMs, producing CGI components optimized for durability and thermal conductivity.

Silbitz Group and Saguenay Foundry provide tailored CGI casting solutions that cater to diverse industrial needs, focusing on precision and material consistency. Waupaca Foundry offers a broad portfolio of CGI products with a focus on innovative alloys and sustainable manufacturing practices. ASI International, Ltd. and Eisengiesserei Baumgarte GmbH contribute niche expertise in complex CGI castings and engineering services, supporting customized applications across sectors. Competition in this market revolves around material innovation, casting precision, and the ability to meet increasingly stringent performance and environmental standards in engine and heavy equipment manufacturing.

In June 2024, Tafalla Iron Foundry upgraded its CGI production system by installing the SinterCast System 3000 Plus, enhancing its capacity to produce high-quality CGI components for commercial vehicles and industrial engines. This upgrade includes the installation of base treatment by cored wire to improve productivity.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Million |

| Grade | 400 MPa, 300 MPa, 350 MPa, 450 MPa, and 500 MPa |

| Product | Nodules and Spheroid |

| Application | Automotive, Construction, Marine, Power generation, and Others (metallurgy, manufacturing etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tupy SA, Durham Foundry, Sintercast AB, Teksid Iron, Silbitz Group, Saguenay Foundry, Waupaca Foundry, ASI International, Ltd., and Eisengiesserei Baumgarte GmbH |

| Additional Attributes | Dollar sales in the Compacted Graphite Iron Market vary by product type including castings and pipes, application across automotive, machinery, and industrial sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by demand for lightweight, durable materials, enhanced engine performance, and expanding industrial manufacturing activities. |

The global compacted graphite iron market is estimated to be valued at USD 8.8 million in 2025.

The market size for the compacted graphite iron market is projected to reach USD 13.9 million by 2035.

The compacted graphite iron market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in compacted graphite iron market are 400 mpa, 300 mpa, 350 mpa, 450 mpa and 500 mpa.

In terms of product, nodules segment to command 57.8% share in the compacted graphite iron market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compacted Strand Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Graphite Materials Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Graphite Market Growth – Trends & Forecast 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA