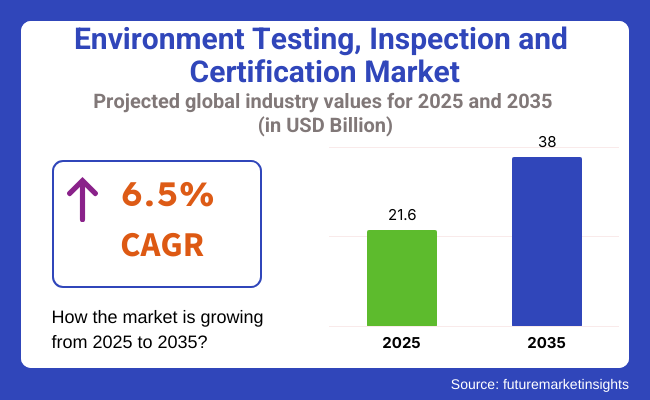

The environment testing, inspection and certification market worldwide is anticipated to grow extensively with an estimated industry size of USD 21.6 billion by 2025, expected to reach around USD 38 billion by 2035, growing at a CAGR of approximately 6.5%.

It grows due to intensifying regulatory necessities, sustainability campaigns, and corporate accountability. One of the key drivers of growth is the growing environmental footprint of industrialization, especially in developing economies. Governments are introducing tougher pollution control regulations, necessitating regular environmental testing and third-party audit for sectors like manufacturing, chemicals, oil & gas, and agriculture.

Air and water monitoring are significant areas of application. Industrial effluent, wastewater releases, and contamination of resources are subject to stringent oversight globally. Testing laboratories and inspection agencies have sophisticated equipment such as spectroscopy, chromatography, and remote sensing technologies to provide accurate, regulatory-compliant environmental testing.

Challenges facing them include cost sensitivity in developing nations, as environmental regulation is yet to develop. Small business is often not in a position to conduct thorough testing or maintain certification. In addition, the scattered nature of global regulatory systems might make cross-border operation difficult for TIC service providers.

Europe and North America dominate the industry because of stringent environmental policies and enforcement. Yet, Asia-Pacific is growing most rapidly due to rapid industrialization, pollution reduction requirements, and global pressure to meet sustainable development objectives.

The industry is more and more at the center of a world that values sustainability, regulatory compliance, and risk mitigation. As environmental responsibility becomes both a business imperative and societal norm, TIC services are poised to drive a cleaner, more transparent industrial future.

The environment testing, inspection, and certification (ETIC) market is witnessing strong growth, fueled by growing demand for environmental protection and strict government regulations. The growth is driven by reasons like the growing need to enhance product quality and meet strict government regulations.

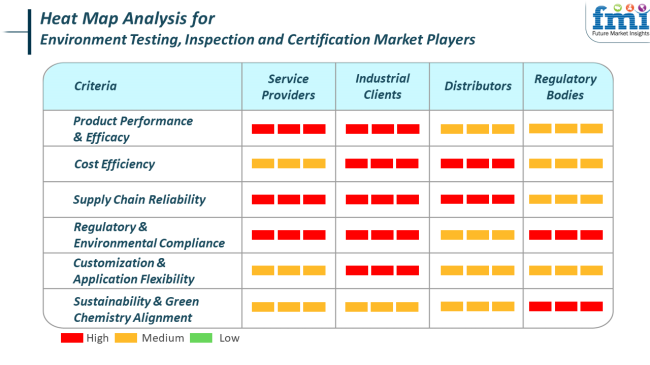

Service providers emphasize providing quality testing, inspection, and certification services that align with the challenging demands of environmental regulations. They promote sustainable practices and strive to maintain a consistent supply chain to meet increasing global demand.

Industrial clients, comprising sectors such as agriculture, construction, and manufacturing, are interested in cost-efficient and durable ETIC solutions that deliver maximum performance across multiple applications.

They desire services with high efficacy, adherence to environmental standards, and customization to precise operational requirements. Distributors stress the need for a reliable supply chain to serve the needs of industrial customers. They cater to various applications by offering a diverse portfolio of services with timely delivery and competitive prices.

During 2020 to 2024, the ETIC industry experienced strong growth, being primarily led by increasing environmental protection and sustainability regulation pressures. Post-COVID-19, there was increased sensitivity to health and safety standards, and as a result, increased demand for testing water, air, and soil.

Regulatory agencies across the globe implemented more stringent environmental regulations, and additional industries had to conform to sustainability standards. The era also saw increasing demand for carbon footprint and sustainability certifications, primarily in the manufacturing, energy, and construction industries. There was a growing trend towards digitalization, with the use of remote testing and virtual site inspections gaining more relevance due to the limitations imposed by the pandemic.

Forecasting to 2025 to 2035, the industry will be subject to even greater integration of advanced technology. Automation and artificial intelligence-driven testing will transform the ETIC industry, increasing efficiency and precision. Environmental testing will become ever more data-led, with smart sensors used across a broad base to monitor continuously.

There will be higher demand in the emerging economies, particularly in the Asia-Pacific, were industrialization conflicts with environmental necessities. Carbon footprint reporting and green building and waste management guidelines will be cutting-edge because companies want to achieve global sustainability objectives. Climate change regulation will also drive stricter and more frequent environmental analysis requirements.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased regulatory demands, heightened focus on environmental security post-COVID, and rising awareness. | Emerging testing technologies (AI, automation), industrialization in emerging economies, and stricter international regulations. |

| Remote testing technologies are becoming digital, and air and water monitoring technologies are using sensors. | Test systems based on AI, environmental monitoring in real time through IoT devices, and self-propelled test solutions. |

| Energy, automotive, manufacturing, construction, and consumer goods industries. | Carbon footprint certifications, climate-related evaluations , waste treatment, and water cleaning sectors. |

| Solid expansion in North America, Europe, and Asia-Pacific as a result of compliance with regulatory requirements. | Strong growth in Asia-Pacific, Africa, and Latin America as a consequence of industrialization, sustainability activities, and environmental policies. |

| Growing emphasis on compliance with country and global environmental standards. | Increased regulations with climate change, carbon reduction requirements, and worldwide sustainability campaigns. |

| Diversification into remote services and digital certifications, eco-labels, and waste management certifications. | Transition towards computerized, real-time testing, permanent monitoring systems, and eco-certifications of green buildings and products. |

The ETIC industry is essential for regulatory compliance, public health, and environmental sustainability across various industries. Nonetheless, in 2024, the industry is confronted with several key risks that will undermine its efficiency in operation and long-term growth.

Precise measurement equipment for environmental testing, such as gas chromatography, mass spectrometry, and real-time sensors for air and water, requires significant capital investment. This costs restricts entry by small and medium-sized suppliers into the industry and limits their ability to expand or diversify services.

Additionally, variations in environmental laws across geographies impose operational complexity on multinational ETIC companies. There can be varying norms across countries or jurisdictions regarding pollutants, level of emissions, and testing methods, necessitating localized expertise, compliance mechanisms, and tailored delivery of services.

An ever-increasing digitalization and data security challenge await the sector industry for tomorrow. An escalation in automation and off-site environmental testing would leave industries vulnerable to leakage of information and cyberattack. Unlawful obtaining of information can degrade customer confidence and lead to legal consequences

Moreover, dependence on complex equipment and authorized reagents is a global disruption for the ETIC sector in the supply chain. Testing activity can be affected by shortages of raw materials and by geopolitical tensions, and that can in turn influence customer satisfaction.

The industry can be divided into various product types, among which Testing and Inspection will cover the major part. It is expected that by 2025, the testing segment will account for 45% of the industry, while Inspection will take up a 40% share.

This huge segment tests the standard and safety of different environmental parameters. Testing services evaluate the pollutants found in the atmosphere or water, soil, noise, temperature, and various environmental conditions as industrialization grows with urbanization. The need for accuracy in testing to meet regulatory standards and comply with environmental legislation has become imperative.

One result of this has been the growth of companies like Eurofins Scientific, the industry leader in the world in environmental testing, that have built testing facilities across different industries, including chemicals, food, pharmaceuticals, and environmental monitoring.

These companies cater to major testing services such as air quality, water contamination, and soil toxicity to ensure that environmental standards have been met. Another player in the segment includes the company SGS, whose specialized environmental testing assists organizations in determining the ecological influence of their operations, further substantiating the growth of the segment.

On the contrary, inspection covers the physical and visual checking of environmental conditions concerning possible hazard identification. It includes services like waste management inspection, hazardous materials handling Inspection, and energy use inspection.

Intertek is one of these companies that provide inspection services and help businesses assess environmental risk and compliance with safety regulations, as well as reductions in environmental footprints. Inspection service will also be a great requirement for construction, manufacturing, and mining sectors, where companies always need to do routine checks on their equipment, buildings, and waste disposal processes to ensure they follow environmental guidelines.

The environmental testing industry is also segmented by Sample Type, with two primary categories: Water Testing and Air Testing. By 2025, Water Testing is projected to capture 40% of the industry share, while Air Testing is expected to hold 30%.

Water testing remains the dominant segment due to the increasing concerns around water pollution and contamination from industrial, agricultural, and urban runoff. As water quality standards become stricter across the globe, there is a rising demand for testing to ensure safe drinking water and assess the impact of pollutants on aquatic ecosystems.

Eurofins Scientific and SGS are key players offering water testing services, analyzing parameters such as pH levels, turbidity, bacteria, heavy metals, and other contaminants in both potable and wastewater systems. With rising industrialization and increased water scarcity in some regions, the demand for water testing is expected to continue to grow, especially as regulatory bodies tighten water quality standards.

Air testing, with a projected industry share of 30% by 2025, is also gaining traction due to growing environmental concerns over air pollution and its impact on human health. Air testing services are essential for monitoring pollutants like carbon dioxide, nitrogen oxides, particulate matter, and volatile organic compounds (VOCs) in industrial and urban areas.

Companies such as Intertek and Bureau Veritas provide air quality testing services, focusing on the detection of hazardous gases and emissions from industrial facilities and monitoring air quality in urban spaces. With governments worldwide implementing stricter air quality regulations and more industries seeking to comply with sustainability goals, the demand for air testing is expected to rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.6% |

| UK | 5.9% |

| France | 5.7% |

| Germany | 6.4% |

| Italy | 5.4% |

| South Korea | 5.2% |

| Japan | 5 % |

| China | 7.5% |

| Australia-NZ | 5.6% |

The USA industry will advance at 6.6% CAGR during the study period. Greater enforcement of environmental regulations, especially in manufacturing, oil and gas, and construction sectors, is boosting demand for advanced testing, inspection, and certification services. Stricter standards from regulatory bodies for water, air, and soil quality testing are creating consistent demand across states.

Increased awareness regarding climatic impacts, coupled with company sustainability initiatives, is driving voluntary environmental certification and auditing in the private sector. Increased investment in ecological monitoring centers and the high lab density of accredited laboratories are also driving the adoption of advanced technology for real-time environmental monitoring and test compliance.

The Uk industry will also register growth at 5.9% CAGR over the forecast period. The transition to a low-carbon economy and the adoption of environmental stewardship across industry segments are strong growth drivers. The green initiatives and regulatory measures by the British government are improving the demand for stringent inspection and certification services.

Growth is evident in energy, waste management, and construction segments, where environmentally friendly practices are being accorded priority. Further, growing consumer aspirations for environmental concern are pushing firms to adopt certified practices, hence fueling industry penetration. There is a rising demand for environmental product declarations, ISO certifications, and online monitoring of pollution in the private sector as well as public establishments.

During the study period, the industry is expected to grow by 5.7% CAGR in France. The strong regulatory environment adopted by France, particularly on environmental impact and climate condition resilience, is driving the demand for testing as well as certification services. Compliance with the environment has become a requirement for most industry and infrastructure development projects.

With growing emphasis on carbon neutrality and biodiversity preservation, companies are approaching third-party service providers for complete audits and assessments. The use of technology in emission monitoring, wastewater testing, and soil quality testing is increasing in accredited laboratories. The government's focus on sustainable urban development is also creating new avenues for environmental monitoring solutions in residential and commercial development projects.

Germany's industry is expected to grow at 6.4% CAGR during the period under review. Sustainability norms and environmental engineering leadership in Germany foster a robust industry for testing, inspection, and certification services. Organizations are incorporating ecological management systems to meet domestic as well as EU-level expectations.

Growth in green buildings, renewable energy, and automotive sectors has driven rising demand for life cycle analysis, analysis of hazardous substances, and energy audits. Technological innovation and integration of AI-powered monitoring solutions are improving test accuracy and process efficiency. Institutional organizations and environmental authorities across the country are also actively involved in monitoring programs requiring professional validation and documentation.

The Italian industry is expected to increase at 5.4% CAGR during the study period. With Italy establishing its environmental regulatory compliance according to EU directives, third-party certification, laboratory testing, and environmental auditing are increasing. Manufacturing sectors such as chemicals, construction, and food manufacturing are increasingly employing certified agencies to conduct interval inspections and sustainability evaluations.

Government contracts for monitoring air and water levels in urban municipalities are also fueling expansion. Colleges and research institutions are collaborating with environmental testing firms to create new technologies and methods. Further, increasing public awareness and community-based green initiatives are encouraging openness in the form of accredited certifications.

The South Korean industry will advance at 5.2% CAGR during the study. Government-led sustainability policies and increasing urbanization are fueling environmental risk evaluation and inspection services across construction and industrial projects. Leadership in the electronics and semiconductor industries in South Korea has necessitated the monitoring of toxic substances and waste disposal audits as business-critical priorities.

The use of electronic measurement for monitoring emissions, water usage, and energy efficiency performance is enhancing the efficiency of certification processes. With growing public concern regarding air quality and environmental conservation, compliance has been at the forefront of industries' agendas to maintain reputational trust. National and international export standards are also forcing companies to adapt to world environmental certification standards.

The Japanese industry is expected to grow at 5% CAGR during the study. Environmental conservation in Japan and its focus on technological advancement encourage consistent demand for extensive testing and certification services. Effective waste control during manufacturing and detection of radiation in public infrastructures is imperative throughout the nation.

Government bodies and enterprises are tightly synchronized to achieve sustainability levels through third-party audits. The use of automated testing and real-time data analysis tools is improving transparency and compliance. With the rising emphasis on ESG factors in business governance, the need for environmental audits and certificates is on the rise across business ecosystems.

China's industry is expected to grow at a 7.5% CAGR during the period under study. With increasing industrialization and consumer awareness regarding pollution, China is heavily investing in environmental monitoring and governing systems. Implementing tighter environmental regulations is pushing industries to undergo rigorous inspections and testing at each stage of production.

Government initiatives such as the "Blue Sky" campaign are boosting demand for air and soil testing, waste audit services, and emission compliance certifications. Technological advances in IoT-based environmental sensors and AI-powered test platforms are being extensively deployed across manufacturing and smart city ecosystems. The expansion of domestic and foreign green supply chains also raises the necessity of following well-known environmental standards.

Australia-New Zealand's industry will grow at 5.6% CAGR over the forecast period. Environmental compliance by regulations in the mining, agricultural, and energy sectors is creating a steady demand for inspection and certification services. Regulatory requirements in Australia with respect to land rehabilitation, emission management, and water usage are improving growth in this industry.

New Zealand's strong green culture and biodiversity conservation policy drive the need for environmental risk assessment and green building certifications. Both countries have active public-private partnerships that boost environmental testing in community and industrial development projects. Technology integration is also in progress, with drones, real-time testing, and cloud-based systems utilized for environmental monitoring and reporting.

The industry largely consists of firms concentrating on regulatory compliance, environmental safety, and quality assurance across industries. SGS SA, Intertek Group, and Bureau Veritas are global leaders with a worldwide network offering the full range of TIC services for air, water, soil and waste testing. They apply advanced analytical technologies and digital reporting systems to expedite the testing process as well as increase accuracy.

Regional players, including APAL Agriculture, EnviroLab and SESL Australia, respond to local demand for environmental testing services, primarily in agriculture, water quality, and industrial emissions. They maintain their position in the industry by offering services cost-effectively, providing a faster turnaround time as well as providing customized solutions to meet regional legislative requirements.

Strategic acquisitions and partnerships are examples of how Eurofins Scientific expands its competitive advantage through portfolio diversification by laboratory acquisition. At the same time, ALS Ltd enhanced its environmental testing presence through merger activity. In the same way, GE Healthcare and Life Sciences, followed by Danaher, have diversified into environmental monitoring with specialized water and air quality testing solutions.

Innovative technologies such as artificial intelligence-based analytical tools, remote monitoring, and real-time compliance reporting are taking the industry in a new direction. TUV Nord AG and Agrolab Group enhance their clients' efficiency with digital solutions and data transparency in TIC services for industrial, agricultural and governmental sectors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SGS SA | 22-27% |

| Intertek Group | 15-20% |

| Bureau Veritas | 12-16% |

| Eurofins Scientific | 10-14% |

| ALS Ltd | 7-11% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

| SGS SA | Offers comprehensive environmental TIC services, including air and water quality testing. |

| Intertek Group | Specializes in industrial emissions monitoring and compliance testing solutions. |

| Bureau Veritas | Provides regulatory-driven environmental certification and risk management. |

| Eurofins Scientific | Focuses on advanced laboratory-based testing services with rapid turnaround. |

| ALS Ltd | Expands through acquisitions, strengthening its environmental testing services. |

Key Company Insights

SGS SA (22-27%)

SGS leads the industry with a vast global network, providing advanced TIC solutions for air, water, and soil testing, ensuring regulatory compliance.

Intertek Group (15-20%)

Intertek is a pioneer in industrial emissions monitoring, offering real-time testing solutions and regulatory certification for environmental safety.

Bureau Veritas (12-16%)

Bureau Veritas strengthens its competitive edge with robust environmental compliance services, catering to governmental and industrial clients.

Eurofins Scientific (10-14%)

Eurofins expands its laboratory testing capabilities through strategic acquisitions, delivering precision-driven environmental TIC services.

ALS Ltd (7-11%)

ALS Ltd focuses on mergers and acquisitions to expand its footprint in environmental and agricultural testing, enhancing service capabilities.

Other Key Players (30-40% Combined)

By product type, the industry is segmented into testing, inspection, and certification.

By end user, the industry is segmented into agriculture industry, construction industry, government institutes and R&D laboratories, industrial product manufacturers, and other end users.

By sample type, the industry is segmented into water testing, air testing, soil testing, building materials, waste testing, fuel/oil testing.

By test type, the industry is segmented into toxins, chemicals, pathogens, physical properties, metal, organic matter, nutrients/elements/minerals, inorganics, pH test, and other types.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is estimated to reach USD 21.6 billion by 2025.

The industry is projected to grow to USD 38 billion by 2035.

China is expected to witness a growth rate of 7.5.

Testing and Inspection services are leading the industry, owing to their critical role in ensuring regulatory compliance and environmental safety.

Major players include SGS SA, Intertek Group, Bureau Veritas, Eurofins Scientific, ALS Ltd, Yara International ASA, Exova Group, SCS Global, RJ Hills Laboratories, APAL Agriculture, TUV Nord AG, GE Healthcare and Life Sciences, Danaher, Agrolab Group, SAI Global Limited, Cawood Scientific, HRL Holdings Ltd, EnviroLab, and SESL Australia.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End User, 2023 to 2033

Figure 23: Global Market Attractiveness by Sample Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Test Type, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Sample Type, 2023 to 2033

Figure 49: North America Market Attractiveness by Test Type, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Sample Type, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Test Type, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Sample Type, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Sample Type, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Sample Type, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Test Type, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Sample Type, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Test Type, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Sample Type, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Test Type, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

Environment Health & Safety Market Share, Trend & Forecast 2024-2034

AI In Environmental Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Server Operating Environments Market

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Soil Testing, Inspection, and Certification Market Growth – Forecast 2017-2027

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Leather Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Shock Testing System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA