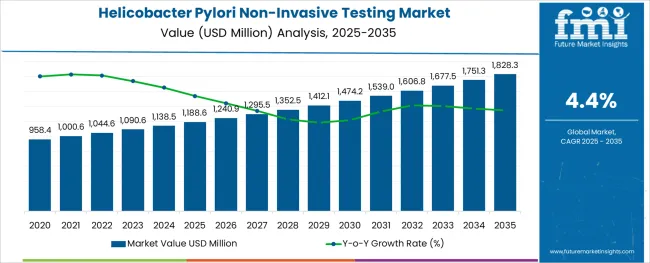

The Helicobacter Pylori Non-Invasive Testing Market is estimated to be valued at USD 1188.6 million in 2025 and is projected to reach USD 1828.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Non-invasive Test Type, Test Type, and End-user and region. By Non-invasive Test Type, the market is divided into Serology Test, Stool Antigen Test, and Urea Breath Test. In terms of Test Type, the market is classified into Laboratory-based Tests and Point-of-Care Tests. Based on End-user, the market is segmented into Hospitals, Diagnostic Labs, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0 % of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

Immunoassays are biochemical tests that determine how much of an analyte is present. It doesn't matter what size the analyte is; it might be a huge protein, an antibody the body has created in response to an illness or a little molecule. The accuracy and reliability of immunoassays are unparalleled. They are very specific since antibodies and purified antigens are used as reagents. Diseases can be diagnosed more precisely using this assay since it measures antigen presence. It is a highly selective bioanalytical approach that uses an antibody or antigen as a biorecognition agent to quantify the presence or quantity of analytes ranging from tiny molecules to macromolecules in solution.

Due to the presence of several advanced technologies, such as the enzyme immunoassays, which are used for the detection of antibodies, the immunoassay segment currently holds a significant market share in the helicobacter pylori non-invasive testing market and is expected to show a similar trend over the forecast period. Key factors propelling the immunoassay market are the growing incidence of gastritis and infections caused by Helicobacter pylori, as well as technical developments.

For instance, in 2024, the worldwide prevalence of gastritis was estimated to be between 50.0% and 56.0%, according to a study titled "Diagnosis of Helicobacter pylori Infection and Recent Advances," with the prevalence of chronic atrophic gastritis falling within that range between 20% and 30%. Helicobacter pylori infection was shown to be proportional to gastritis prevalence, and cases of Helicobacter pylori-positive gastritis were found to account for more than 80.0% of all cases. Since such illnesses are typically detected by immunoassays, rising instances of Helicobacter pylori infection and gastritis are expected to drive the segment growth throughout the forecast period.

Increased Patient Requirement for POC Increases the Demand for H. pylori Tests Drives the Development of the Industry as a Whole

The National Institutes of Health (NIH) research states that IgG serology, the C-Urea Breath Test (UBT), and the monoclonal stool antigen test are all non-invasive, Point-of-care (POC) diagnostic options for primary care settings that can detect H. pylori. UBT is the only one of these that reliably verifies whether an infection is present or has been eradicated. According to the research published in Gut and Liver, UBT is an accurate, non-invasive option that is safe for use on both children and pregnant women.

In addition, H. pylori laboratory test results can now be obtained in a shorter amount of time owing to Point-of-care Testing (POCT), a tried-and-true method. Popularity, the number of people getting tested, and the variety of therapeutic uses for POCTs have all increased as leading companies keep releasing new models. In addition, Point-of-care Testing (POCT) is now widely used in all hospitals and is increasingly being adopted as the norm in other types of healthcare facilities. The global helicobacter pylori non-invasive testing market is expected to expand because of the aforementioned factors throughout the forecast period. This means that the increasing number of H. pylori sufferers is a key factor propelling the helicobacter pylori non-invasive testing market forward.

The industry's growth may be hampered by a lack of educated doctors to perform intrusive tests.

To accurately diagnose Helicobacter pylori infection and determine the best course of therapy, a surgeon or medical professional must perform an invasive procedure that often includes a biopsy and endoscopy. Market growth could be stymied, however, if countries with fewer healthcare resources and a corresponding shortage of trained professionals saw a decline in the number of people getting their diseases checked out. Unfortunately, many nations with low or middle income lack the hospital and medical training infrastructure necessary to produce highly qualified physicians. However, there are additional difficulties for doctors when treating Helicobacter pylori, as no first-line therapy is effective for everyone.

The helicobacter pylori non-invasive testing market is expected to expand at a modest rate worldwide. Although testing has become more common, diagnosis has been hindered by the fact that HIV infection often has no outward symptoms. This is a major factor in the market's slow expansion. It is also expected that h. pylori non-invasive testing is expected to decrease as attention is redirected to ending the current coronavirus pandemic.

From 2025 to 2035, the clinic market is expected to grow at a CAGR of over 6%, as more people choose clinics over hospitals because of their lower costs and higher quality of care. The reason for this is that people are more likely to seek help from clinics since they offer high-quality care and respond quickly to patient needs, resulting in effective treatment at an affordable price. The premium services provided by clinics as a result of efficient disease management tactics are also expected to fuel market growth.

Due to its non-invasive nature and its ability to offer speedy findings, the POC testing segment accounted for more than 35% of the business. This is due, in large part, to rising Research and Development spending and joint research activities amongst industry heavyweights that are fostering innovation and new product development.

The helicobacter pylori non-invasive testing market may be broken down into two distinct subsegments: invasive helicobacter pylori tests and non-invasive helicobacter pylori tests. Since quick urease tests are both effective and inexpensive, this market subsegment is expected to grow at a CAGR of 6.5% between 2025 and 2035. Patients who do not respond well to antibiotic medication, who have symptoms of severe gastrointestinal issues, and who require gastric endoscopy have a significant demand for invasive diagnostic methods.

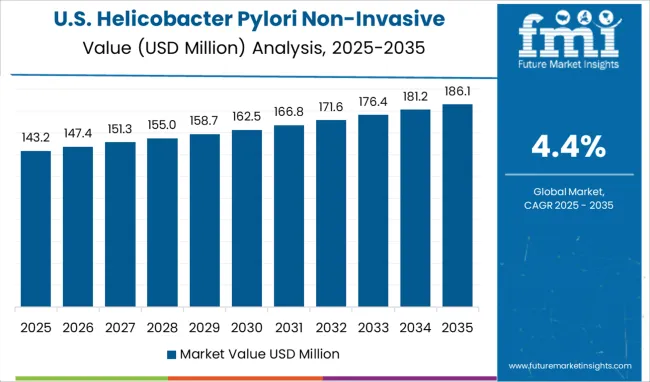

Globally, North America accounts for the largest helicobacter pylori non-invasive testing market. The expansion of healthcare infrastructure in addition to the rising incidence of stomach cancer, duodenal ulcers, and gastric ulcers in North America are driving forces behind the helicobacter pylori non-invasive testing market's expansion.

The NIH found that 5 percent of USA youngsters under the age of 10 have H. pylori in their systems. In addition, 30% to 40% of Americans have H. pylori infection, according to research from the USA Department of Health and Human Services. Furthermore, socioeconomic variables such as poor income, less education, home crowding, and immigration all contribute to a higher prevalence of H. pylori infection in the USA's Hispanic and Black populations. In order to treat H. pylori, the FDA recommends either Proton Pump Inhibitors (PPI) and two antibiotics or bismuth subsalicylate, acid suppressors, and two antibiotics, as detailed in a paper available from the ClinMed International Library.

There is resistance to effectiveness with the currently available first-line medication regimens. Due to resistance in H. pylori to common antibiotics, the USA, for example, observed 75% eradication rates utilizing these regimens. The largest rates of resistance are shown with Clarithromycin and Metronidazole and characteristics related to resistance include race, age, location, and the presence or absence of ulcer disease.

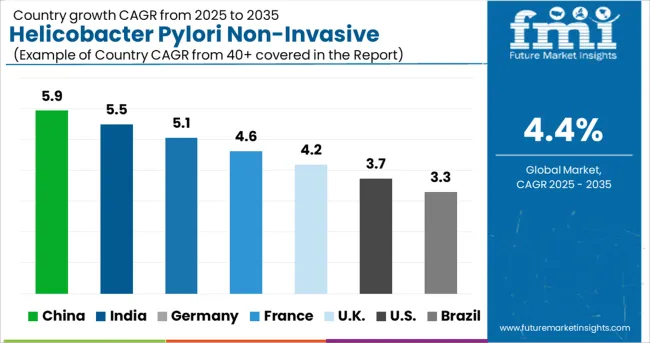

The market for non-invasive testing for Helicobacter Pylori (H. pylori) in Asia and the Pacific is dominated by China. When it comes to healthcare and pharmaceuticals, China is a developing powerhouse in the Asia-Pacific region. Many international manufacturers of medical, pharmaceutical, and biotechnology products are based in China. High rates of H. pylori infection and gastric (stomach) cancer cases have spurred the development of diagnostic testing kits and technologies for H. pylori detection by pharmaceutical and biotechnology firms.

The Japanese medical industry is among the world's most advanced markets. Due to widespread infection with H. pylori and a penchant for consuming smoked and salted foods, Roswell Park Comprehensive Cancer Center reports that Japan has an alarmingly high incidence of stomach cancer. In Japan, 50,000 individuals each year are killed by stomach cancer, making it the third deadliest form of the disease. In addition, 98% of gastric cancer in Japan can be attributed to H. pylori, according to a study published in 2024 by Wiley Online Library.

Recent investigations have indicated that H. pylori infection is the primary cause of stomach cancer, while it is one of many factors. The expansion of the helicobacter pylori non-invasive testing market in Japan is anticipated to benefit from the aforementioned factors over the forecast period.

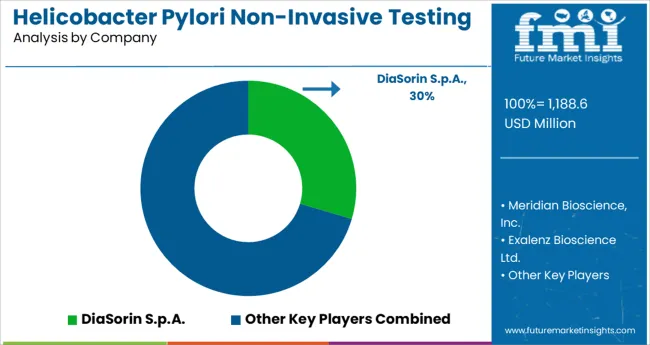

Companies like DiaSorin S.p.A., Meridian Bioscience, Inc., Exalenz Bioscience Ltd., Alere, Thermo Fisher Scientific, Biomerica, Inc., Certest Biotec S.L., Sekisui Diagnostics, CorisBioconcept SPRL, and Shenzhen Zhonghe Headway Bio-Sci & Tech Co., Ltd. are all major players in the global helicobacter pylori market. These leaders are anticipated to retain their positions of prominence during the prediction horizon.

Some recent developments in the helicobacter pylori non-invasive testing market include:

The global helicobacter pylori non-invasive testing market is estimated to be valued at USD 1,188.6 million in 2025.

It is projected to reach USD 1,828.3 million by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are serology test, stool antigen test and urea breath test.

laboratory-based tests segment is expected to dominate with a 54.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Helicobacter Pylori Infections Treatment Market Size and Share Forecast Outlook 2025 to 2035

Helicobacter Pylori Testing Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA