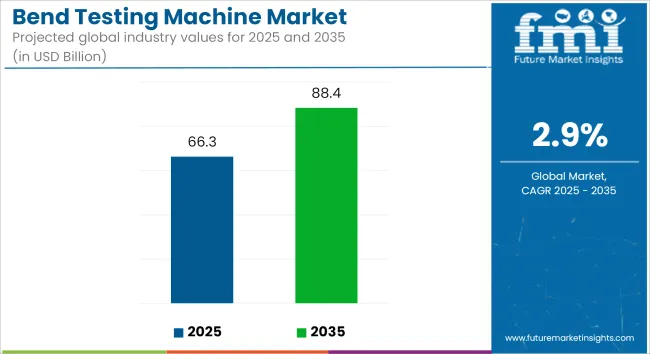

The global Bend Testing Machine Market was valued at USD 58.8 billion in 2020 and is projected to reach USD 66.3 billion by 2025. From 2025 to 2035, the market is expected to grow at a compound annual growth rate (CAGR) of 2.9%, reaching approximately USD 88.4 billion by the end of the forecast period.

This growth is being driven by the increasing deployment of bend testing systems across diverse sectors such as construction materials testing, pipeline quality verification, and steel integrity assessment.

Higher requirements for weld joint validation and tensile strength assessment have led to the incorporation of bend tests into standard compliance certification workflows. Systems offering real-time digital analysis and consistent load-displacement accuracy are being preferred by quality assurance teams.

In July 2024, a new generation of LW bend testers was introduced by ABB for mechanical evaluation of paper and fiberboard materials in laboratory settings. As reported in the company’s official press release, this device was designed to offer faster cycle times, enhanced ergonomics, and automatic cloud-based reporting. Similar advancements are anticipated to be applied to metallic and structural component testing.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 66.3 Billion |

| Market Value (2035F) | USD 88.4 billion |

| CAGR (2025 to 2035) | 2.9% |

Patent CN221038458U, published in 2024, disclosed a bend testing apparatus equipped with multi-angle deformation analysis and smart encoder-based displacement tracking. This patent has reflected the growing industry emphasis on automation and high-precision measurements.

Digital transformation trends have led to the increasing integration of bend testing machines with enterprise resource planning (ERP) systems and digital twin environments. With the rise in traceability demands and remote audit practices, equipment featuring cloud-enabled dashboards and IoT diagnostics is being adopted by testing laboratories worldwide.

Innovations such as modular probe systems and adaptive clamping solutions have also been introduced to accommodate irregular geometries. This flexibility has enabled the testing of advanced materials including high-strength low-alloy (HSLA) steels, composites, and hybrid weld joints.

As regulatory bodies such as ASTM and ISO continue to tighten procedural requirements, manufacturers of bend testing machines are expected to focus on improving accuracy, repeatability, and smart functionality to serve critical industries such as infrastructure, automotive, and pressure vessel fabrication.

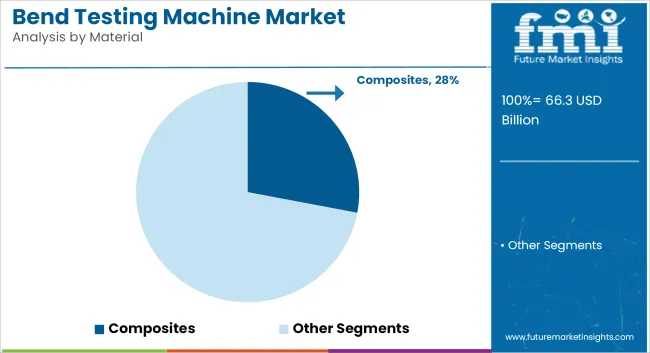

Composites are expected to dominate the global market across modular structural systems and formwork applications, accounting for approximately 28% of the total material share in 2025. The segment is forecast to grow at a CAGR of 3.2% between 2025 and 2035, exceeding the global market growth rate of 2.9%.

Their superior mechanical properties, including high tensile strength, corrosion resistance, and low weight, make composites particularly suitable for prefabricated structures, infrastructure components, and heavy-duty modular systems.

Ongoing trends toward green building practices and sustainable construction have accelerated the shift toward fiber-reinforced composites, especially glass fiber and carbon fiber-reinforced variants. These materials are increasingly deployed in modular bridges, tunnel linings, marine structures, and formwork panels where durability and lifecycle cost reduction are key considerations.

Additionally, advancements in pultrusion and resin infusion techniques are enabling scalable, high-performance composite production for structural applications. Integration with digital fabrication and BIM (Building Information Modeling) tools is also expanding their role in modern modular architecture and transport infrastructure.

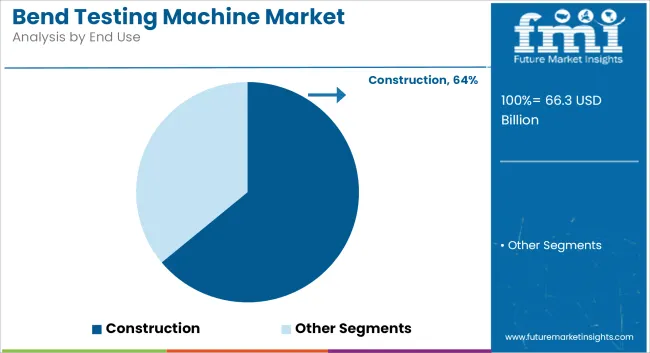

The construction sector is projected to be the leading end-use segment, contributing around 64% of total market revenue in 2025, with an anticipated CAGR of 3.1% through 2035. Modularization in construction has gained momentum as developers seek faster project execution, reduced labor dependency, and enhanced material efficiency.

Prefabricated building components-ranging from façade panels and staircases to structural reinforcements and MEP (mechanical, electrical, and plumbing) assemblies-are increasingly being produced using advanced materials like polymers, engineered wood, and high-strength ceramics.

Urban infrastructure programs and housing initiatives, especially in Asia-Pacific and the Middle East, are driving demand for reliable and durable modular systems. Governments are also endorsing modular building codes and offering tax benefits for off-site construction methods, reinforcing the material demand from the sector.

Challenges

High Cost of Testing Equipment: The sophisticated testing equipment is designed with automation systems, AI-driven analysis, and precision coil sensors integrated into bend testing machines, making it expensive, which can be a problem for small scale manufacturers and testing laboratories.

The issues relating to standardization of the material testing procedures, this complexity in testing and compliance in other regions leads to regulatory challenges for manufacturers.

Technical End comes Testing of Extra-evolved Materials: While the metal press and compounding devices are successful for compound materials and metal composites, exceptional composites, based on nanoscale components or bio-engineering, require literally millimetre-sized experiences, due to individual mechanics properties.

Nice intrusion into their operating system as it presents a host of maintenance and calibration-related issues such as need for regular recalibration, sensor maintenance etc. which adds to the operational costs required to achieve accurate and precise testing results.

Opportunities

Emerging Trends and AI Integration for Intelligent Testing. The rhythm of the bend testing machine can be opened to new markets.

Growth in Demand for Strong and Lightweight Materials: The aerospace, automotive, and construction sectors are shifting towards lightweight construction materials such as composite materials and high-strength alloys, driving the need for advanced bend testing solutions to validate the performance of these materials.

The expansion of the nation and big city projects is driving 7 concrete testing equipment maintain structural integrity and activity code standard, expected to Lorem 5 Lorem 12 Lorem 0 8 and meet the unmet 5 Lorem 12 Lorem 0 8 7 activity code standard.

Increasing Adoption of Additive Manufacturing and 3D Printing Applications: Due to the ongoing increase in the usage of the 3D printed components in aerospace, medical, and industrial, among others, the demand for specialized bend testing solutions, mostly used for quality verification and performance assessment, is being further fuelled. Bottom of Form

USA Bending Testing Machine Market is expected to witness impressive growth primarily because of rising investments in manufacturing, aerospace, construction, and automotive industries. They are critical to the structural integrity and mechanical properties of materials in industries ranging from metal fabrication to pipeline construction to aerospace engineering.

Kuwait's construction industry is one of the major growth drivers due to fast-track mega infrastructure projects. The Infrastructure Investment and Jobs Act (IIJA) provides more than USD 1.2 trillion for building roads, bridges and pipe in the USA and places a premium on rigorous testing of materials. Bending testing machines are widely used on these projects to test the ductility and strength of all lengths of steel, rebar, and concrete components.

The automotive and aerospace industries are also major consumers. The USD automotive market is projected to hit USD 900 billion by 2030, where vehicle frame designs require high strength capabilities to provide crash safety and durability. In the aerospace domain as well, companies like Boeing and Lockheed Martin use bend testing machines to ensure that the flexibility and tensile strength of the aircraft components are in accordance with specifications.

In addition, rising adherence towards the ASTM & ISO standard for testing materials has also encouraged organizations to deploy advanced automated bend Testers to cater to stringent quality control needs. Additionally, the increasing implementation of Industry 4.0 and AI-driven test systems is also transforming the industry, enabling manufacturers to attain real-time substance examination and procedure optimization.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The United Kingdom Bend Testing Machines Market Bend testing machine in the United Kingdom are used for assessing the mechanical properties of materials during or after production, providing vital insights for various industries. The UK government’s Net Zero Strategy has pushed industries towards the use of high-performance materials process, which in turn drives demand for bend testing machines as a part of the quality assurance processes.

Rising needs for sustainable building materials is a key driver of market growth. The bend testing process is essential to the UK’s infrastructure sector, including some of the largest projects such as HS2 (High-Speed Rail 2) and smart city developments.

In particular, the automotive sector, where companies such as Jaguar Land Rover and Aston Martin are transitioning to electric vehicle (EV) manufacture, is driving the need for bend testing machines to assess battery casings, chassis parts, and lightweight materials.

The UK is also subject to BS EN ISO 7438 and ASTM standards, which lay down the safety and quality guidelines and require industries to perform regular bend testing of metals and composites. Digital and AI-integrated machines are gaining wide acceptance, as they make the process more efficient and accurate.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

Growth factors for the EU Bend Testing Machine Market include industrial automation, stringent norms for material testing, and green infrastructure investments. However, countries such as Germany, France, and Italy dominate market growth with their robust automotive, construction, and aerospace industries.

Over the past century, the automotive industry in the EU has reached a staggering €1.3 trillion in size with traditional vehicles dominating the roster. However, with a recent focus on the rapid evolution of electrification, the automotive sector has placed an increasing importance on lightweight materials like fiberglass and carbon fiber composites for manufacturers such as Volkswagen, BMW, and Renault. They are also essential for testing EV battery enclosures, chassis components, and high-strength alloys.

In addition, the EU's renewable energy projects, including offshore wind farms and solar energy initiatives, rely on bend testing machines to evaluate the mechanical endurance of the metals used in turbines, transmission towers, and photovoltaic panels.

In addition, strict adherence to CE marking regulations, EN ISO 15614, and EU material-testing standards mean manufacturers are utilizing high-level bend-testing methods to uphold quality many manufacturers utilize advanced bend testing solutions during manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

The Japanese bend testing machine market is being driven by factors such as high-precision manufacturing, cutting-edge infrastructure initiatives, and strict standards for material testing. Japan is known for its top-notch engineering and its automotive, electronics, and aerospace industries demand high-quality testing of materials. Automotive giants Toyota, Honda, and Nissan, lead Japan’s technologically advanced EV and hybrid vehicle manufacturing industry.

In lightweight vehicles, for example, pushback testing machines are increasingly used to assess the bending characteristics of components, in order to boost fuel efficiency and safety. Japan is also investing in earthquake-resistant buildings in construction sector, which is driving the requirement for bend test for reinforced steel, concrete structures, and composite materials. This ensures the rigor of material testing under JIS (Japanese Industrial Standards), a requirement of the government that guarantees resilience in infrastructure.

Moreover, high-tech electronics and semiconductor industries also need bend testing machines to evaluate the mechanical durability of printed circuit boards (PCBs) and micro components due to Japan being one of the leaders in chip manufacturing and electronics production.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

So, the South Korea Bend Testing Machine market is expanding owing to the technological advancements in automotive manufacturing such as steel, and plastics, the construction of infrastructure, and semiconductor industries. From its vibrant automotive supply chain to advanced electronics, the country boasts a high-tech industrial base where precision material testing is paramount for quality assurance. South Korea’s automotive sector produces more than four million cars a year and is quickly pivoting to electric and hydrogen-powered vehicles.

This shift makes the bendable physical integrity testing of light-weight aluminium alloys, high-strength steel and battery components imperative. In addition, the construction segment is booming due to the increasing need for smart city infrastructure, high-speed rail systems, and sustainable structures, all of which can benefit from advanced bend-testing machines for quality assurance purposes.

In addition to, South Korea’s semiconductor industry, which is worth more than USD 150 billion, is a huge consumer of bend testing machines, especially for PCB testing and high-precision electronic component analysis. The government is also investing in Industry 4.0 technologies, which can involve AI-integrated, automated material testing systems that are being adopted across industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

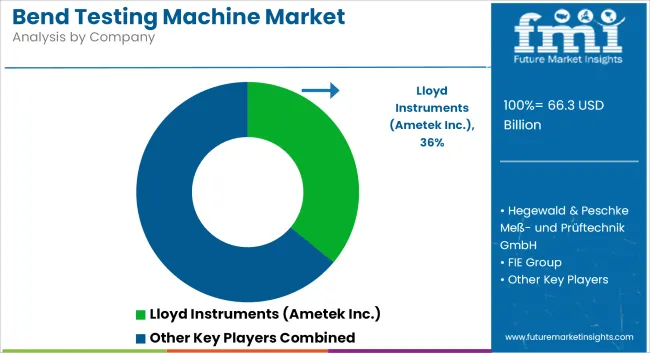

(Illinois Tool Works Inc.) 12-17%

Remains the market leader for bend testing machines, offering fully automated testing solutions for metals, polymers and composite materials. Using real-time digital monitoring and AI-based material analysis, the company improves testing accuracy.

ZwickRoell Group (10-14%)

A three- and four-point bend testing systems provider for construction, automotive and metal fabrication industries, ZwickRoell is also an expert in tensile testing systems. Due to its emphasis on precise measurement and automated testing compliance, the business is a go-to choice for everyone looking to evaluate industrial materials.

MTS Systems Corporation (8 -12%)

MTS Systems has developed its own high-capacity machines, including bend testing machines for heavy and structural engineering and aerospace applications. Specifically, the company combines advanced sensors and machine learning-powered failure prediction for higher reliability.

Tinius Olsen Ltd. (7-11%)

Universal bend machine manufacturers include Tinius Olsen, Programmable Software Control: Option Non-Destructive Test. Its wide possibility material provides the sine qua non for R&D verification and industrial material.

Shimadzu Corporation (5-9%)

Shimadzu teams up with 6nano to provide compact, high-speed bend test equipment focusing on durable material analysis for plastics, ceramics and metals. This special solution assists companies that prioritize quality testing at a low cost and ease of use.

There are multiple providers for low-cost bend testing equipment, automated compliance testing, and precision force measurement apparatuses. These include:

The totals market size for Bend Testing Machine Market was USD 66.3 Billion in 2025.

Bend Testing Machine market is projected to reach USD 88.4 billion by 2035.

The Bend Testing Machine Market by geography covers major regions such as North America, South America, Asia, and others.

Rising demand for bending testing machine would be driven by the growing construction and manufacturing industries, strict quality control regulations, and increased applications in material testing in automotive, aerospace, and infrastructure sectors to ensure structural integrity and compliance with safety standards.

The 5 key Players which consists of most of the Bend Testing Machine Market are USA, UK, Europe Union, Japan and South Korea.

The type segment is expected to lead in Bend Testing Machine Market.

Composites to hold a substantial share throughout the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Material, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Material, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edge Bending Machine Market - Trends & Forecast 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Metal Sheet Bending Machine Market Size, Growth, and Forecast 2025 to 2035

Automotive Tube Bending & Assembly Parts Market

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA