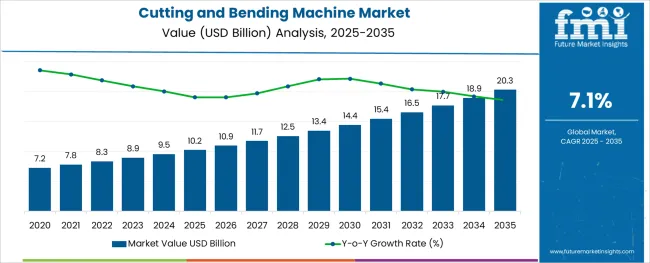

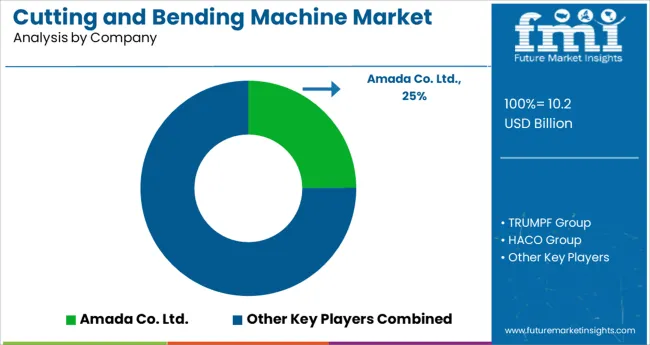

The Cutting and Bending Machine Market is estimated to be valued at USD 10.2 billion in 2025 and is projected to reach USD 20.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Product Type, Operation, and End Use and region. By Product Type, the market is divided into Cutting Machine and Bending Machine. In terms of Operation, the market is classified into Automatic, Semi-automatic, and Manual.

Based on End Use, the market is segmented into Automotive, Aerospace, Electrical and Electronics, Marine & Construction, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

Demand for cutting and bending machines increased at a CAGR of about 2.6% during the historical period from 2020 to 2024. However, with the rapid growth of end-use industries such as automotive and aerospace, and increasing penetration of automation, the overall sales of cutting and bending machines are poised to accelerate at 7.1% CAGR through 2035.

Increasing urbanization and infrastructural development in emerging economies have led to an increase in total spending in industries such as metalworking, automotive, and aerospace. This is expected to create demand for cutting and bending machines.

Cutting and bending machines are undergoing digital transformation, which entails the use of cutting and bending machines equipped with the latest technologies to overcome all business challenges and reshape existing operations. Thus, the development of new and advanced cutting and bending machines will further boost the market during the next ten years.

Some of the countries are expected to emerge as new manufacturing hubs and see potential growth in the export manufacturing sector. In addition to this, there is a shift in global economic power that is boosting urbanization in most of these countries. Overall economic growth, coupled with prompt urbanization and changing global demographics, is expected to elevate the demand for cutting and bending machines through 2035.

Growing Trend of Industry 4.0 to Boost Cutting and Bending Machine Sales

Industry revolution 4.0 is rapidly expanding and is changing the way companies manufacture and perform. Because of a scarcity of skilled workers, every manufacturing sector is embracing automation. End users are giving preference to machines with automation and efficiency. Energy consumption accounts for a significant portion of industrial operating costs, fuelling the trend toward low-energy machines.

Trends are changing across the region, such as in developed nations, where trends include machine connectivity to the internet and robots to reduce machine cycle time. Investment in associated sectors such as cloud computing, artificial intelligence, the internet of things, automation, and their integration into metal processing machines will enhance the competitiveness of market participants. The development of additive technologies is a major area for the market manufacturers and helps them to continuously adopt technological developments in their product portfolio.

Thus, the growing penetration of industry 4.0 across the world will continue to generate demand for advanced machinery like cutting and bending machines during the projected period.

Flourishing Automotive Industry Pushing Demand for Cutting and Bending Machines in the USA

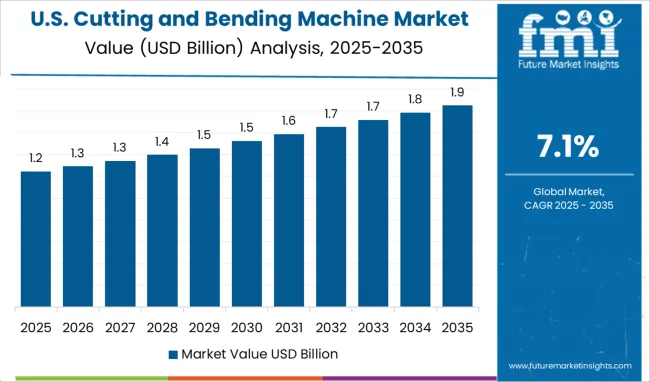

As per FMI, the USA cutting and bending machine market holds around 70% share of the North American market and it is predicted to expand by 1.9x through 2035. The rapid expansion of the automotive industry, increasing penetration of automation, and the strong presence of leading manufacturers are some of the key factors driving the USA market.

The automobile industry in the USA is the 12th-ranked industry and is a very dynamic industry with advanced technological developments and innovation. Rapid growth in the automobile sector across the USA is expected to generate high demand for cutting and bending machines during the forecast period.

The industry requires precision cutting and strict cutting tolerance, which are well served by the new product innovations in these machines. The market is expected to be further driven by evolving automobile designs coupled with the multiple bending and cutting operations performed by these machines, which greatly facilitate the operation process and ensure the efficiency of the operation and the uniformity of the product. Hence, the USA market is expected to increase steadily over the forecast period, making it one of the prominent markets worldwide.

Growing Penetration of Industry 4.0 Boosting Market in Germany

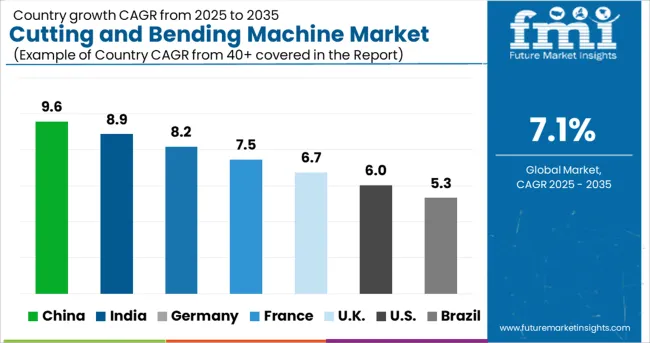

Germany’s cutting and bending machine market is anticipated to expand at a robust CAGR of 6.8% over the forecast period. Sales in the country are projected to increase by two times by the end of 2035.

Growth in Germany’s market is attributed to the rising adoption of Industry 4.0 across traditional manufacturing and industrial practices. The ongoing factory automation trend is fuelling demand for and the deployment of more innovative and advanced technologies in manufacturing processes to enhance productivity, improve product quality, and manage the workforce better. This is the primary driving force behind the expansion of the cutting and bending machine industry in majority of the European countries, including the United Kingdom.

Growing Demand for Consumer Electronics Propelling Sales in China

According to FMI, the overall market for cutting and bending machines across China is expected to reach a valuation of USD 1,317.0 Million by the end of 2035. The rapid growth of the consumer electronics industry, availability of high-tech cutting and bending machinery at affordable prices, and favorable government support are some of the factors driving the China market.

In global consumer electronics manufacturing, China’s production accounts for more than 30% of the market. Similarly, in electronic circuit component production, China accounts for around 33% worldwide, which is higher than that of other electronics manufacturing hubs.

China's information technology sector claims that by boosting value-added output by 13.9% annually, the country's electronic industry aids in China's industrial upgrade. China is a prominent country that has heavily invested in smart robotics, cloud data, and automated factory technologies to optimise its manufacturing prowess, in which advanced or innovative cutting and bending machines play an important role as the foundation for industrial upgrades. Hence, China remains the go-to destination for the market growth of cutting and bending machines to meet the large-scale production of consumer electronics.

Cutting Machines to Remain the Top Selling Product Type Through 2035

As per FMI, the cutting machine segment is expected to generate an absolute incremental opportunity of USD 7,062.9 Million during the forecast period (2025 to 2035). This growth can be attributed to the rising usage of various cutting machines across several industries.

In the cutting machine segment, laser cutting machines are estimated to account for the highest share of the overall market owing to their wide machining range. Right from fabrication to the medical industry, laser-cutting machines have gained immense traction during the last few years and the trend is expected to continue during the forecast period.

Laser-cutting technology has a broad range of applications and is emerging as a technology that will continue to grow consistently. For instance, it plays a vital role in the medical industry, where tight dimensional tolerances and accuracy are a must in devices such as cardiovascular and orthopedic devices so that components for surgical implants can be made with the required rapidity and extreme precision. Hence, this segment is expected to create an absolute $ opportunity of USD 3,956.7 Million between 2025 and 2035.

The majority of Sales Remain Concentrated in Automotive Industry

According to Future Market Insights, the automotive industry holds around 30% of the global market for cutting and bending machines and it is expected to generate an absolute $ opportunity of more than USD 2,578.7 Million between 2025 and 2035. This can be attributed to the increasing demand for automotive vehicles along with the rising usage of cutting and bending machines across the thriving automotive industry.

The automotive sector covers everything from the designing, developing, producing, and manufacturing of automotive vehicles and their parts and components in which cutting and bending machines have a wide range of applications. The laser cutting machine is one of the most frequently used machines during various stages of automotive manufacturing that ensures the reliability and safety of the end product.

Key manufacturers of cutting and bending machines are highly focused on introducing new products integrated with advanced technologies to strengthen their product portfolios. Besides this, they are adopting strategies such as mergers, acquisitions, facility expansions, and collaborations to gain a competitive edge in the market. For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 10.2 billion |

| Projected Market Size (2035) | USD 20.3 billion |

| Anticipated Growth Rate (2025 to 2035) | 7.1% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Mn Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia Pacific; and The Middle East and Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, Netherlands, RUSSIA, Sweden, Hungary, Czechia, Poland, Portugal, Rest of Europe China, Japan, South Korea, India, ASEAN, Australia, and New Zealand, Turkey, South Africa, GCC Countries, Northern Africa. |

| Key Segments Covered | Product Type, Operation, End Use, and Region |

| Key Companies Profiled | Amada Co. Ltd.; TRUMPF Group; Bystronic Group; Han's Laser Technology Industry Group Co., Ltd.; Coherent Inc.; Prima Industrie S.p.A.; Durmazlar Machinery Inc; Ermaksan; Nissan Tanaka Corporation; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global cutting and bending machine market is estimated to be valued at USD 10.2 billion in 2025.

It is projected to reach USD 20.3 billion by 2035.

The market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types are cutting machine, _laser cutting machine, _waterjet cutting machine, _plasma cutting machine, _flame cutting machine, bending machine, _electric, _hydraulic, _pneumatic and _others.

automatic segment is expected to dominate with a 41.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Die Cutting Machine Market

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Frame Cutting Jib Miner Market Size and Share Forecast Outlook 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Laser Cutting Machine Market Growth – Trends & Forecast 2024-2034

Cloth Cutting Machines Market

Manual cutting equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Plasma Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Timber Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA