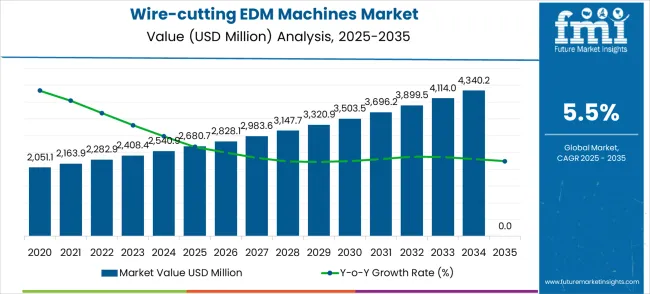

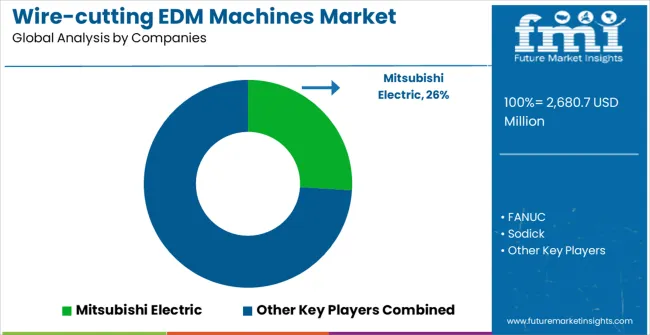

The wire-cutting EDM machines market is set to expand from USD 2,680.7 million in 2025 to USD 4,578.9 million by 2035, advancing at a CAGR of 5.5%. The long-term value accumulation curve demonstrates a steady buildup of market size, driven by strong demand across precision engineering, automotive, aerospace, and mold-making applications. Early in the decade, growth is propelled by adoption of automated and digital-controlled systems that enhance production efficiency and machining accuracy. Investments in upgrading manufacturing lines and expanding capacity contribute to the initial steep portion of the accumulation curve.

From 2030 onward, value continues to accumulate steadily as replacement cycles, system upgrades, and expanding applications in complex component manufacturing support sustained revenue growth. Advances in control technologies, sensor integration, and energy-efficient machine designs maintain momentum across both mature and emerging markets. The curve reflects consistent, incremental accumulation rather than sudden spikes, indicating a market grounded in ongoing industrial adoption and continuous technological improvements. The long-term accumulation pattern provides insights into the market’s sustained expansion, highlighting opportunities for manufacturers to align production planning, R&D, and regional deployment strategies with evolving demand over the decade.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,680.7 million |

| Forecast Value in (2035F) | USD 4,578.9 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

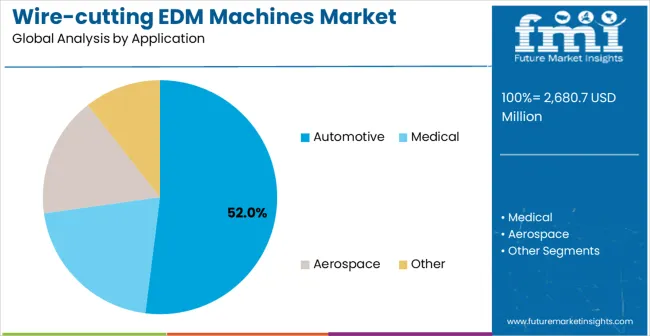

The wire-cutting EDM machines market is segmented into automotive component manufacturing (34%), aerospace and defense precision parts (26%), medical device production (18%), electronics and semiconductor tooling (13%), and specialized mold and die applications (9%). Automotive manufacturers use these machines for producing complex engine and transmission parts with tight tolerances. Aerospace and defense sectors depend on them for high-strength alloys and critical safety components. Medical device producers leverage wire-cutting EDM for precision implants and surgical instruments. Electronics and semiconductor industries apply them in tooling for miniaturized components, while mold and die applications benefit from accuracy in intricate shapes.

Recent progress includes automation integration, adaptive control systems, and hybrid EDM technologies for higher throughput and reduced operational costs. Manufacturers are advancing fine-wire capabilities and high-speed cutting to meet complex industry requirements. Growing use in electric vehicle components, lightweight aerospace materials, and micromachining is boosting adoption. Partnerships between EDM machine builders and end-use industries enable customized solutions that enhance precision, efficiency, and productivity, fueling consistent market growth.

The wire-cutting EDM machines market represents a strategic growth opportunity driven by the evolution of precision manufacturing, automotive industry transformation, and the shift toward complex component geometries in advanced materials. With the market projected to expand from USD 2.7 billion in 2025 to USD 4.6 billion by 2035 at a 5.5% CAGR, manufacturers are positioned to capitalize on the convergence of electric vehicle production, aerospace component complexity, and Industry 4.0 automation requirements across diverse precision manufacturing applications.

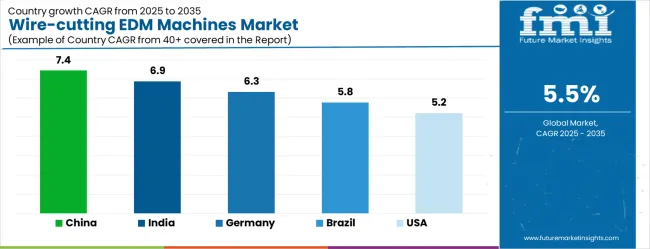

The automotive sector's dominant 52% market share, combined with servo motor technology's 48% leadership in drive systems, creates clear focal points for strategic investment. High-growth markets like China (7.4% CAGR) and India (6.9% CAGR) offer substantial volume expansion opportunities, while developed markets provide premium positioning potential through advanced automation, AI integration, and smart manufacturing capabilities.

Market expansion is being supported by the increasing global demand for precision manufacturing solutions and the corresponding need for advanced machining technologies that can deliver superior accuracy and surface finish while maintaining consistent performance across various automotive, aerospace, and medical device manufacturing applications. Modern manufacturing facilities are increasingly focused on implementing machining solutions that can produce complex geometries, achieve tight tolerances, and provide reliable results in high-precision component production. Wire-cutting EDM machines' proven ability to deliver exceptional accuracy, superior surface quality, and versatile material processing capabilities makes them essential equipment for contemporary precision manufacturing and advanced tooling applications.

The growing focus on electric vehicle production and aerospace component manufacturing is driving demand for wire-cutting EDM machines that can support advanced material processing, enable complex component geometries, and reduce manufacturing lead times through enhanced machining efficiency. Manufacturing operators' preference for equipment that combines precision capabilities with operational reliability and automation integration is creating opportunities for innovative machining technology implementations. The rising influence of Industry 4.0 trends and smart manufacturing demands is also contributing to increased adoption of EDM machines that can provide reliable precision manufacturing solutions without compromising production efficiency or quality consistency.

The market is segmented by drive motor type, application, and region. By drive motor type, the market is divided into stepper motor type, servo motor type, linear motor type, and other types. Based on application, the market is categorized into automotive, medical, aerospace, and other. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The servo motor type segment is projected to account for 48.0% of the wire-cutting EDM machines market in 2025, reaffirming its position as the leading drive motor type category. Manufacturing facilities increasingly utilize servo motor-driven EDM machines for their superior precision control, enhanced positioning accuracy, and optimal performance in high-precision machining applications across automotive, aerospace, and medical device production. Servo motor technology's advanced feedback control systems and precise motion capabilities directly address the manufacturing requirements for reliable precision machining and operational efficiency in demanding production environments.

This drive motor type segment forms the foundation of modern precision machining operations, as it represents the motor technology with the greatest accuracy and established market demand across multiple manufacturing sectors and precision applications. Manufacturer investments in enhanced servo control technologies and automation integration continue to strengthen adoption among precision manufacturing facilities. With manufacturing companies prioritizing machining accuracy and production efficiency, servo motor-driven EDM machines align with both operational performance objectives and quality assurance requirements, making them the central component of comprehensive precision manufacturing strategies.

Automotive manufacturers are projected to represent 52.0% of the demand for wire-cutting EDM machines in 2025, underscoring their critical role as the primary consumers of precision machining equipment for automotive component production, tooling manufacturing, and prototype development applications. Automotive production facilities prefer wire-cutting EDM machines for their exceptional precision capabilities, ability to machine complex geometries, and capacity to enhance manufacturing efficiency while reducing tooling costs and production lead times. Positioned as essential equipment for modern automotive manufacturing, wire-cutting EDM machines offer both machining advantages and productivity benefits.

The segment is supported by continuous innovation in automotive manufacturing technologies and the growing availability of specialized machining solutions that enable advanced component production with enhanced precision and automation capabilities. The automotive manufacturers are investing in advanced machining systems to support electric vehicle production and lightweight component manufacturing requirements. As automotive technology becomes more complex and precision requirements increase, automotive applications will continue to dominate the application market while supporting advanced machining technology utilization and manufacturing optimization strategies.

The wire-cutting EDM machines market is advancing steadily due to increasing precision manufacturing requirements and growing demand for advanced machining solutions that provide superior accuracy and surface finish capabilities across diverse automotive, aerospace, and medical device manufacturing applications. The market faces challenges, including high equipment costs, complex programming requirements, and the need for skilled operators and maintenance expertise. Innovation in automation technologies and intelligent machining systems continues to influence product development and market expansion patterns.

The growing adoption of automated machining systems and Industry 4.0 connectivity is enabling machine manufacturers to produce advanced wire-cutting EDM machines with enhanced automation capabilities, intelligent process monitoring, and predictive maintenance features. Automated machining systems provide improved productivity while allowing more efficient production workflows and consistent machining quality across various manufacturing applications. Manufacturers are increasingly recognizing the competitive advantages of automation integration for product differentiation and premium market positioning.

Modern wire-cutting EDM machine producers are incorporating artificial intelligence and smart control technologies to enhance machining precision, optimize cutting parameters, and provide real-time process monitoring and adjustment capabilities. These technologies improve manufacturing efficiency while enabling new capabilities, including adaptive machining control and automated quality assurance. Advanced AI integration also allows manufacturers to support premium product positioning and enhanced functionality beyond traditional manual machining processes.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

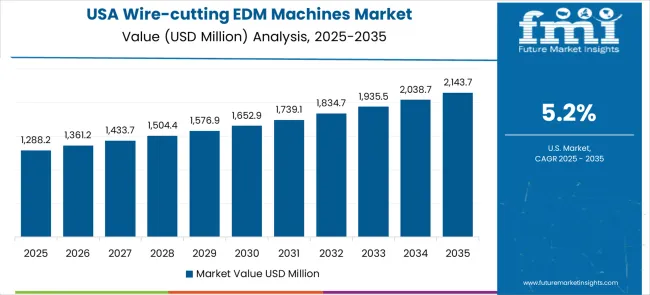

| USA | 5.2% |

| U.K. | 4.7% |

| Japan | 4.1% |

The wire-cutting EDM machines market is experiencing moderate growth globally, with China leading at a 7.4% CAGR through 2035, driven by the expanding automotive manufacturing sector, growing precision manufacturing capabilities, and significant investment in advanced machining technology infrastructure. India follows at 6.9%, supported by rapid industrial development, increasing automotive production, and growing adoption of precision machining technologies in manufacturing facilities. Germany shows growth at 6.3%, prioritizing technological innovation and premium machining equipment development. Brazil records 5.8%, focusing on automotive manufacturing expansion and industrial modernization. The USA demonstrates 5.2% growth, prioritizing advanced manufacturing technologies and aerospace applications. The U.K. exhibits 4.7% growth, with a focus on precision engineering and manufacturing automation. Japan shows 4.1% growth, supported by advanced manufacturing processes and precision machining technology innovation.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The market for wire-cutting EDM machines in China is expanding at a CAGR of 7.4%, above the global average. Growth is driven by high demand from automotive, aerospace, and precision tool manufacturing industries. Domestic manufacturers are investing in advanced multi-axis EDM machines with improved precision and energy efficiency. Industrial zones and electronics clusters benefit from local production and technology adoption. Pilot programs in high-precision mold and die making demonstrate enhanced productivity using wire-cutting EDM technology. Suppliers focus on scalability, reliability, and post-sale service to support both domestic and export markets. Government incentives for industrial automation further encourage adoption.

India is projected to grow at a CAGR of 6.9%, above the global average. Growth is driven by expansion in automotive, electronics, and tooling industries. Precision engineering and metalworking facilities increasingly rely on EDM machines for fine tolerances and complex geometries. Industrial clusters in metropolitan regions prioritize high-performance wire-cutting EDM technology. Manufacturers invest in automation and advanced control systems to maintain consistency and efficiency. Pilot installations in industrial training centers demonstrate improved output and reduced scrap. Collaboration between private and public sectors accelerates adoption in semi-urban industrial zones.

Germany grows at a CAGR of 6.3%, above the global average. Growth is driven by automotive and aerospace industries, which require high-precision machining. Wire-cutting EDM machines are deployed in advanced tool-making and prototyping facilities. Suppliers focus on energy-efficient machines with multi-axis control and automated features. Industrial partnerships support material research and process optimization. High-value manufacturing clusters focus on integrating EDM machines into assembly and production lines to enhance efficiency. Regulatory standards ensure consistent quality and safety in industrial applications.

The market in Brazil grows at a CAGR of 5.8%, slightly above the global average. Growth is supported by automotive, aerospace, and general engineering sectors adopting precision machining solutions. Wire-cutting EDM machines are used for mold making, die fabrication, and high-accuracy prototyping. Industrial parks and workshops integrate EDM technology for consistent performance. Suppliers focus on cost-effective, durable machines suitable for tropical climates and large-scale manufacturing. Pilot projects in high-precision tooling demonstrate improved productivity and reduced downtime. Collaboration with local distributors ensures reliable maintenance and training support.

The United States grows at a CAGR of 5.2%, slightly below the global average. Slower growth is influenced by mature industrial infrastructure and existing machinery installations. EDM machines are deployed in automotive, aerospace, and precision tooling sectors. Suppliers focus on high-performance machines with consistent accuracy and energy efficiency. Advanced control systems and multi-axis EDM machines enhance component quality. Industrial hubs adopt EDM machines for prototyping, tool maintenance, and production of complex geometries. R&D initiatives improve material handling and reduce cycle times, while supply chains ensure timely machine delivery to key industrial zones.

The UK market grows at a CAGR of 4.7%, below the global average. Slower adoption is influenced by limited industrial expansion and reliance on imported machines. EDM machines are primarily used in aerospace, automotive, and specialized tooling industries. Suppliers focus on reliable, high-precision machines with energy-efficient features. Pilot installations demonstrate improved component accuracy and process stability. Industrial clusters prioritize maintenance support and operator training to maximize utilization. Adoption is gradually increasing in R&D labs and precision engineering workshops.

Japan grows at a CAGR of 4.1%, below the global average. Slower growth results from a mature manufacturing sector and high local competition. EDM machines are widely deployed in automotive, electronics, and high-precision tooling industries. Suppliers focus on consistent performance, durability, and precise control systems. Pilot projects demonstrate improved process reliability and reduced waste in complex component production. Industrial clusters prioritize integration of EDM machines into assembly lines for automation and efficiency. R&D initiatives continue to optimize material removal rates, energy efficiency, and machine lifespan.

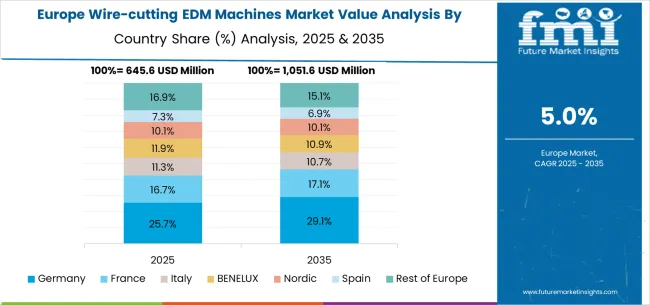

The wire-cutting EDM machines market in Europe is estimated to grow from USD 589.8 million in 2025 to USD 1,007.4 million by 2035, registering a CAGR of 5.5% over the forecast period. Germany is expected to maintain its leadership position with a 33.0% market share in 2025, declining slightly to 32.5% by 2035, supported by its strong machine tool industry, advanced automotive manufacturing sector, and comprehensive precision machining technology supply network serving major European markets.

France follows with a 17.0% share in 2025, projected to reach 17.5% by 2035, driven by robust demand for precision machining in automotive production, aerospace manufacturing, and advanced tooling applications, combined with established engineering traditions incorporating advanced manufacturing technologies. The United Kingdom holds a 14.5% share in 2025, expected to decrease to 14.0% by 2035, supported by strong precision engineering demand but facing challenges from economic conditions and competitive pressures from continental suppliers. Italy commands a 12.5% share in 2025, projected to reach 12.7% by 2035, while Spain accounts for 8.5% in 2025, expected to reach 8.8% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to maintain steady growth, with its collective share remaining at 10.5% to 10.3% by 2035, attributed to consistent adoption of precision manufacturing technologies in Nordic countries and growing automotive production activities across Eastern European markets implementing manufacturing modernization programs.

The wire-cutting EDM machines market is characterized by competition among established machine tool manufacturers, specialized precision machining equipment providers, and integrated manufacturing technology companies. Companies are investing in advanced control system development, automation technology integration, manufacturing process optimization, and comprehensive product portfolios to deliver precise, reliable, and efficient machining solutions. Innovation in servo motor technologies, automated wire handling systems, and intelligent machining control is central to strengthening market position and competitive advantage.

Mitsubishi Electric leads the market with a strong market share, offering comprehensive EDM solutions with a focus on automotive and precision manufacturing applications. FANUC provides specialized automation and control technologies with an emphasis on advanced servo systems and intelligent machining capabilities. Sodick delivers innovative wire-cutting EDM machines, focusing on precision control and high-speed machining. Makino specializes in advanced machining centers and EDM equipment for aerospace and automotive applications. GF Machining Solutions (AgieCharmilles) focuses on comprehensive EDM solutions with integrated automation and process optimization. AccuteX offers precision wire-cutting systems with attention on cost-effective solutions and reliable performance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,680.7 million |

| Drive Motor Type | Stepper Motor Type, Servo Motor Type, Linear Motor Type, Other |

| Application | Automotive, Medical, Aerospace, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Mitsubishi Electric, FANUC, Sodick, Makino, GF Machining Solutions (AgieCharmilles), and AccuteX |

| Additional Attributes | Dollar sales by drive motor type and application category, regional demand trends, competitive landscape, technological advancements in control systems, automation integration innovation, precision machining optimization, and supply chain optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global platycladus orientalis leaf extract market is estimated to be valued at USD 76.9 million in 2025.

The market size for the platycladus orientalis leaf extract market is projected to reach USD 140.3 million by 2035.

The platycladus orientalis leaf extract market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in platycladus orientalis leaf extract market are partially soluble in water and insoluble in water.

In terms of application, chinese medicine segment to command 33.0% share in the platycladus orientalis leaf extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EDM Oils/Fluids Market

Sinker Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Slow Wire Cutting EDM Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dance Music (EDM) Market Analysis - Trends, Growth & Forecast 2025 to 2035

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA