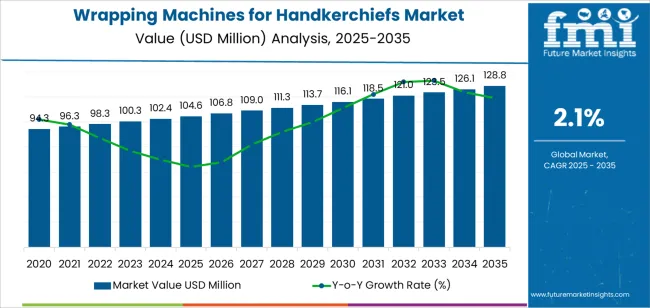

The global wrapping machines for handkerchiefs market is projected to reach USD 128.8 million by 2035, recording an absolute increase of USD 24.2 million over the forecast period. The market is valued at USD 104.6 million in 2025 and is set to rise at a CAGR of 2.1% during the assessment period. The overall market size is expected to grow by nearly 1.2 times during the same period, supported by increasing demand for automated packaging solutions in tissue manufacturing operations worldwide, driving demand for efficient wrapping systems and increasing investments in production line modernization and hygiene compliance improvement projects globally. However, high initial capital investment requirements and slower adoption rates in emerging markets may pose challenges to market expansion.

The market expansion between 2025 and 2035 reflects fundamental shifts in tissue manufacturing automation and packaging efficiency optimization across handkerchief production facilities. Wrapping machine manufacturers are developing integrated systems that combine high-speed wrapping capabilities, quality inspection features, and flexible format handling that enable tissue producers to optimize production throughput and packaging consistency. The transition from manual wrapping processes to automated machinery addresses manufacturer challenges related to labor costs, packaging quality standardization, and production speed requirements in markets where consumer hygiene product demand continues expanding across retail and institutional segments.

Technology advancement in servo motor control systems, precision folding mechanisms, and integrated sealing technologies creates opportunities for enhanced wrapping accuracy and operational reliability improvements. Wrapping machine providers are incorporating programmable logic controllers for format changeover flexibility, real-time monitoring systems for quality assurance, and modular design architectures that accommodate diverse handkerchief sizes and packaging specifications. The market benefits from tissue industry consolidation trends in major manufacturing regions where large-scale producers invest in comprehensive production line automation to maintain competitive cost structures. Distribution channels through packaging machinery suppliers, tissue equipment specialists, and technology integrators expand deployment across tissue mills and converting facilities serving consumer retail markets.

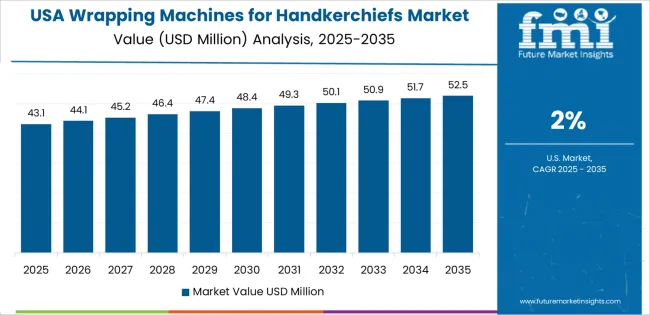

Between 2025 and 2030, the wrapping machines for handkerchiefs market is projected to expand from USD 104.6 million to USD 116.1 million, resulting in a value increase of USD 11.5 million, which represents 47.5% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for production automation and packaging efficiency solutions, product innovation in servo-driven wrapping systems and integrated quality inspection technologies, as well as expanding adoption across large-scale tissue manufacturing facilities and converting operations. Companies are establishing competitive positions through investment in advanced wrapping technologies, flexible format changeover capabilities, and strategic market expansion across consumer tissue, institutional supply, and private label production applications.

From 2030 to 2035, the market is forecast to grow from USD 116.1 million to USD 128.8 million, adding another USD 12.7 million, which constitutes 52.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized wrapping systems, including high-speed multi-lane configurations and integrated packaging line solutions tailored for specific production requirements, strategic collaborations between machinery manufacturers and tissue producers, and an enhanced focus on energy efficiency and changeover speed optimization. The growing emphasis on packaging sustainability and production cost reduction will drive demand for advanced, high-performance wrapping machines across diverse handkerchief manufacturing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 104.6 million |

| Market Forecast Value (2035) | USD 128.8 million |

| Forecast CAGR (2025-2035) | 2.1% |

The wrapping machines for handkerchiefs market grows by enabling tissue manufacturers to achieve superior packaging consistency and production efficiency while reducing labor dependency in wrapping operations. Tissue producers face mounting pressure to improve output rates and packaging quality standards, with automated wrapping solutions typically providing 40-60% improvement in production speed over manual methods, making wrapping automation essential for competitive manufacturing economics. The tissue industry's need for reliable high-speed packaging creates demand for advanced wrapping systems that can maintain consistent fold quality, ensure proper seal integrity, and accommodate multiple handkerchief formats across production runs.

Consumer demand for hygienically packaged tissue products and regulatory requirements for product protection standards drive adoption in retail consumer goods, hospitality supply, and food service applications, where packaging quality has a direct impact on brand perception and product shelf life. The global expansion of organized retail channels and increasing disposable income in developing markets accelerates wrapping machine demand as tissue manufacturers scale production capacity to serve growing consumer bases. However, high capital costs for automated wrapping equipment and technical complexity of integration with existing production lines may limit adoption rates among smaller tissue converters and regional manufacturers with constrained capital budgets.

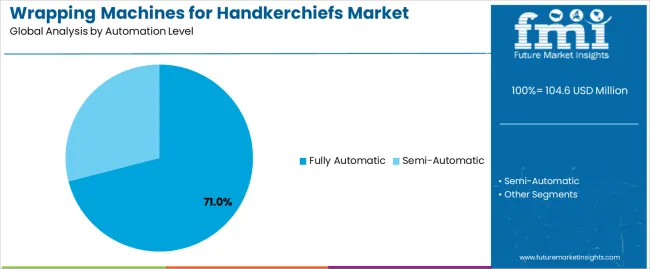

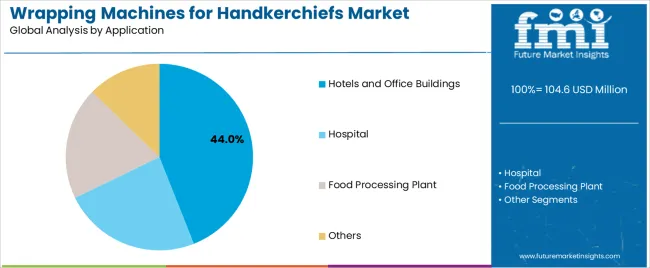

The market is segmented by automation level, application, and region. By automation level, the market is divided into fully automatic and semi-automatic. Based on application, the market is categorized into hotels and office buildings, hospital, food processing plant, and other. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

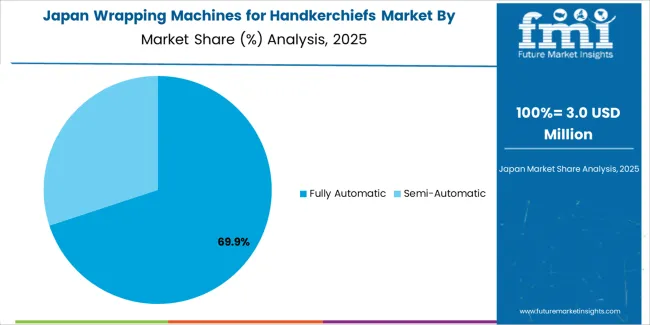

The fully automatic segment represents the dominant force in the wrapping machines for handkerchiefs market, capturing approximately 71% of total market share in 2025. This advanced category encompasses systems featuring integrated feeding mechanisms, automated folding units, high-speed sealing systems, and programmable control platforms, delivering comprehensive wrapping capabilities with minimal operator intervention requirements. The fully automatic segment's market leadership stems from its exceptional productivity advantages, consistent packaging quality output, and compatibility with large-scale tissue manufacturing operations that prioritize throughput maximization and labor cost optimization.

The semi-automatic segment maintains a 29.0% market share, serving manufacturers who require flexible wrapping solutions through operator-assisted loading, manual format adjustment capabilities, and lower initial investment thresholds. This segment benefits from reduced capital requirements and operational flexibility for smaller production volumes and frequent product changeovers in regional tissue converting facilities.

Key advantages driving the fully automatic segment include high-speed operation capabilities enabling 100-200 packages per minute throughput in advanced configurations, labor reduction eliminating 3-5 operators per production line compared to manual wrapping processes, quality consistency ensuring uniform fold patterns and seal integrity across production runs, integration compatibility with upstream tissue production equipment and downstream packaging automation systems.

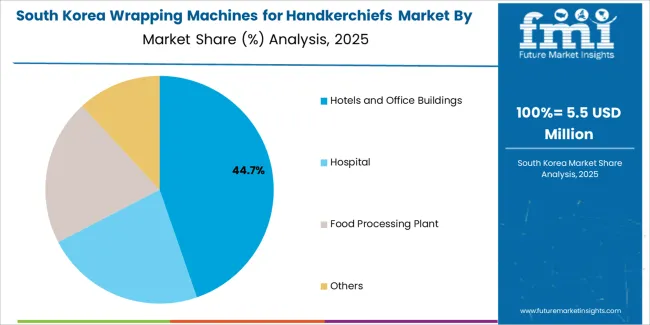

Hotels and office buildings dominate the wrapping machines for handkerchiefs market with approximately 44.0% market share in 2025, reflecting the substantial consumption of individually wrapped handkerchief products in hospitality and commercial building applications where hygiene presentation and convenience packaging are essential service attributes. The hotels and office buildings segment's market leadership is reinforced by steady demand for premium packaged tissue products in guest room supplies, restroom facilities, and conference venues where individually wrapped handkerchiefs convey quality positioning and sanitation standards.

The hospital segment represents 26.0% market share through specialized requirements for sterile packaging and infection control compliance where wrapped handkerchiefs serve clinical and patient care applications. The food processing plant segment accounts for 18.0% market share, serving facilities requiring hygienic hand-wiping solutions for food safety compliance. Other applications represent 12.0% market share, including airline services, transportation facilities, and retail consumer products requiring portable tissue packaging formats.

Key market dynamics supporting application preferences include hospitality industry standards requiring individually wrapped tissue products for guest amenity programs and premium service differentiation, healthcare facility regulations mandating hygienic packaging for patient care supplies and clinical environment contamination control, food industry sanitation protocols necessitating convenient hand-wiping solutions for worker hygiene compliance programs, consumer retail growth expanding demand for portable handkerchief formats in travel and personal care product categories.

The market is driven by three concrete demand factors tied to manufacturing efficiency and product quality outcomes. First, labor cost escalation accelerates automation adoption, with manual wrapping operations requiring 5-8 workers per production line while automated systems reduce staffing to 1-2 operators, creating compelling return on investment in high-wage markets where labor accounts for 30-40% of tissue converting costs. Second, production capacity expansion drives tissue manufacturers toward high-speed wrapping equipment, with modern machines achieving 150-250 packs per minute compared to 20-30 packs manually, enabling manufacturers to meet growing retail and institutional demand without proportional facility expansion. Third, packaging quality requirements from major retail chains and hospitality customers accelerate adoption of automated systems that ensure consistent fold patterns and seal integrity critical for brand positioning and product shelf presentation.

Market restraints include high capital investment requirements affecting adoption rates, with fully automatic wrapping lines costing 200,000-500,000 USD per installation, posing barriers for small and medium tissue converters operating with limited capital budgets and uncertain demand forecasts. Technical complexity of equipment integration creates additional challenges, as wrapping machines require coordination with upstream tissue folding equipment and downstream case packing systems, necessitating specialized engineering expertise and production line reconfiguration investments. Maintenance requirements and spare parts availability concerns impact operational continuity, particularly in developing markets where technical support infrastructure and qualified service technicians remain scarce, creating downtime risks that affect production scheduling reliability.

Key trends indicate growing adoption of multi-lane wrapping configurations that increase throughput density within existing floor space constraints, enabling manufacturers to achieve 300-400 packs per minute through parallel wrapping lanes served by common feeding systems. Technology advancement trends toward servo motor drive systems replacing pneumatic actuation for improved positioning accuracy, integrated vision inspection systems for real-time quality verification, and modular machine architectures enabling rapid format changeover for diverse handkerchief sizes are driving next-generation equipment development. However, the market thesis could face disruption if alternative packaging formats such as bulk dispensing systems gain acceptance in institutional applications, reducing demand for individually wrapped handkerchiefs, or if tissue industry consolidation trends slow capital equipment investment cycles as manufacturers focus on operational optimization rather than capacity expansion.

| Country | CAGR (2025-2035) |

|---|---|

| China | 2.8% |

| India | 2.6% |

| Germany | 2.4% |

| Brazil | 2.2% |

| U.S. | 2.0% |

| U.K. | 1.8% |

| Japan | 1.6% |

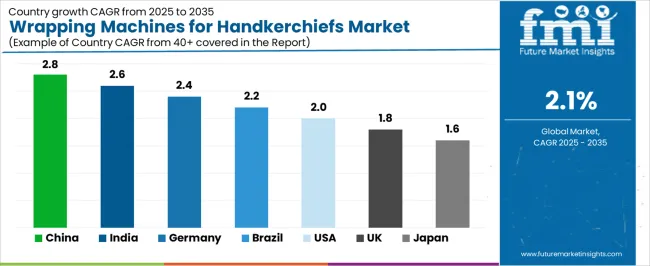

The wrapping machines for handkerchiefs market is gaining momentum worldwide, with China taking the lead thanks to aggressive tissue production capacity expansion and growing consumer tissue product demand. Close behind, India benefits from rising disposable income levels and expanding hospitality infrastructure, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where precision engineering capabilities and established tissue manufacturing base strengthen its role in European equipment supply.

The U.S. demonstrates steady growth through production automation initiatives and premium tissue product segment development, signaling continued investment in packaging efficiency improvement. Meanwhile, the U.K. stands out for its mature tissue market and hospitality sector focus, while Brazil and Japan continue to record consistent progress driven by retail tissue consumption growth and manufacturing modernization programs. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

China demonstrates the strongest growth potential in the wrapping machines for handkerchiefs market with a CAGR of 2.8% through 2035. The country's leadership position stems from comprehensive tissue production capacity expansion, intensive consumer tissue product market development, and aggressive manufacturing automation initiatives driving adoption of advanced wrapping systems. Growth is concentrated in major manufacturing regions, including Zhejiang, Guangdong, Fujian, and Shandong provinces, where tissue producers are implementing automated wrapping lines for domestic market supply and export production capacity. Distribution channels through domestic machinery manufacturers, international equipment suppliers, and packaging automation integrators expand deployment across tissue mills and converting facilities. The country's tissue industry development policies provide support for production modernization, including preferential financing for equipment purchases and technical training programs.

Key market factors include tissue production concentration in coastal manufacturing zones with comprehensive supply chain infrastructure supporting equipment deployment, domestic machinery manufacturing capabilities enabling cost-competitive wrapping equipment supply for price-sensitive market segments, comprehensive labor cost escalation driving automation adoption with wages increasing 8-10% annually in manufacturing regions, technology advancement featuring integration of domestic control systems and sensor technologies adapted for local production requirements.

In major manufacturing states, tissue production hubs, and urban consumption centers, the adoption of automated wrapping systems is accelerating across organized tissue manufacturers, hospitality suppliers, and institutional product converters, driven by production scaling requirements and labor cost considerations. The market demonstrates strong growth momentum with a CAGR of 2.6% through 2035, linked to comprehensive tissue consumption growth and increasing focus on production efficiency enhancement. Indian manufacturers are implementing semi-automatic and fully automatic wrapping equipment to improve output consistency while addressing skilled labor availability constraints in manufacturing regions. The country's Make in India program creates demand for domestic equipment manufacturing capabilities, while increasing emphasis on hygiene product quality drives adoption of automated packaging systems that ensure product protection standards.

Leading manufacturing development regions, including Gujarat, Tamil Nadu, Maharashtra, and Karnataka, driving wrapping machine adoption across tissue converting operations. Investment support programs enabling capital equipment financing through industrial development schemes and technology upgrade incentives. Technology collaboration agreements accelerating deployment with international wrapping machine manufacturers establishing assembly operations and service networks. Policy support through tissue industry development initiatives and hygiene product promotion programs linked to sanitation improvement campaigns.

Germany's advanced tissue manufacturing sector demonstrates sophisticated implementation of wrapping automation systems, with documented installations showing 50-70% labor reduction through fully automatic wrapping line integration in major tissue production facilities. The country's tissue industry infrastructure in key manufacturing regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony, showcases integration of precision wrapping technologies with existing production systems, leveraging expertise in mechanical engineering and automation control systems. German manufacturers emphasize quality engineering and reliability standards, creating demand for robust wrapping machines that support continuous production schedules and stringent packaging quality requirements. The market maintains steady growth through focus on production optimization and private label tissue manufacturing expansion, with a CAGR of 2.4% through 2035.

Key development areas include precision engineering capabilities enabling high-speed wrapping with dimensional accuracy tolerances below 0.5 millimeters for premium tissue products, technical service infrastructure providing comprehensive equipment maintenance and spare parts supply with documented 95% uptime achievement, strategic partnerships between wrapping machine manufacturers and tissue producers enabling customized equipment development for specific production requirements, integration of Industry 4.0 technologies and comprehensive data monitoring systems for predictive maintenance and production optimization.

The Brazilian market demonstrates growing wrapping automation adoption based on tissue consumption expansion and hospitality sector development driving demand for packaged handkerchief products. The country shows solid potential with a CAGR of 2.2% through 2035, driven by retail tissue market growth and increasing investment in production modernization across major manufacturing regions, including São Paulo, Paraná, Santa Catarina, and Minas Gerais states. Brazilian manufacturers are adopting wrapping equipment to scale production capacity for domestic retail chains and regional export markets requiring consistent packaging quality. Technology deployment channels through equipment importers, local machinery suppliers, and tissue industry service providers expand coverage across converting operations.

Leading market segments include retail tissue production implementing wrapping automation for private label product manufacturing serving major supermarket chains, technology partnerships with international equipment suppliers enabling financing arrangements and technical training programs for equipment operation, strategic collaborations between tissue producers and hospitality suppliers ensuring consistent product quality for hotel and restaurant distribution channels, focus on production cost reduction and operational efficiency improvement supporting capital investment in automation equipment.

The USA market demonstrates established wrapping automation adoption based on mature tissue manufacturing infrastructure and emphasis on production efficiency optimization across consumer and institutional product segments. The country shows solid potential with a CAGR of 2.0% through 2035, driven by private label tissue manufacturing expansion and replacement cycles for aging equipment in major production regions, including Wisconsin, Pennsylvania, Georgia, and California states. American manufacturers are implementing advanced wrapping systems that integrate with comprehensive production line automation and real-time quality monitoring platforms. Technology deployment channels through established packaging machinery suppliers, tissue equipment specialists, and automation integrators expand deployment across tissue mills serving retail and commercial markets.

Key market characteristics include private label manufacturing operations requiring cost-competitive wrapping solutions for retail chain tissue products and consumer brand production, technology partnerships between wrapping machine manufacturers and tissue producers enabling equipment customization for specific format requirements and production speeds, strategic collaborations with packaging material suppliers ensuring optimal film compatibility and sealing performance across wrapping applications, emphasis on energy efficiency and reduced changeover times supporting operational cost reduction and production flexibility requirements.

In major tissue manufacturing regions and hospitality supply centers, tissue producers are implementing wrapping systems that deliver consistent packaging quality for premium consumer products and institutional supplies, with documented integration achieving 30-40% throughput improvement in modernized converting facilities. The market shows steady growth potential with a CAGR of 1.8% through 2035, linked to established tissue consumption patterns, hospitality sector supply requirements, and emphasis on product presentation standards. British manufacturers are adopting wrapping equipment that ensures proper seal integrity and fold consistency to meet retail customer specifications and brand positioning requirements.

Market development factors include hospitality industry supply chains requiring individually wrapped handkerchief products for hotel guest amenities and service applications, quality compliance requirements driving investment in automated wrapping systems that ensure consistent packaging performance for retail distribution, strategic partnerships between tissue converters and equipment suppliers enabling equipment financing and technical support arrangements, emphasis on compact machine footprints and operational flexibility supporting installation in existing production facilities with space constraints.

Japan's wrapping machines market demonstrates mature implementation focused on precision equipment engineering and integration with established tissue production infrastructure serving domestic consumer and institutional markets. The country maintains steady growth momentum with a CAGR of 1.6% through 2035, driven by replacement demand for aging equipment and incremental production capacity additions in major tissue manufacturing regions including Shizuoka, Ehime, Kagawa, and Hokkaido prefectures. Major production facilities showcase deployment of high-precision wrapping systems that achieve stringent dimensional tolerances and packaging quality standards required for Japanese consumer product expectations.

Key market characteristics include precision folding capabilities and seal quality standards meeting Japanese consumer expectations for product presentation and hygiene assurance, technology development by domestic machinery manufacturers incorporating advanced servo control systems and sensor technologies for quality verification, collaboration between tissue producers and equipment manufacturers enabling long-term service relationships and continuous equipment improvement programs, emphasis on operational reliability and maintenance efficiency supporting continuous production schedules in large-scale manufacturing facilities.

The wrapping machines for handkerchiefs market in Europe is projected to grow from USD 37.5 million in 2025 to USD 42.9 million by 2035, registering a CAGR of 1.4% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, declining slightly to 31.8% by 2035, supported by its extensive tissue manufacturing infrastructure and major production centers, including North Rhine-Westphalia, Bavaria, and Baden-Württemberg regions.

The United Kingdom follows with a 18.6% share in 2025, projected to reach 18.3% by 2035, driven by established tissue converting operations and hospitality sector supply requirements. Italy holds a 16.2% share in 2025, expected to maintain 16.1% by 2035 through tissue product manufacturing specialization. France commands a 12.8% share in both 2025 and 2035, backed by consumer tissue production capacity. Spain accounts for 9.5% in 2025, rising to 9.6% by 2035 on tissue market expansion. The Netherlands maintains 4.3% in 2025, reaching 4.4% by 2035 on packaging technology innovation. The Rest of Europe region is anticipated to hold 6.2% in 2025, expanding to 6.5% by 2035, attributed to increasing wrapping automation adoption in Nordic countries and emerging Central and Eastern European tissue manufacturing investments.

The Japanese wrapping machines for handkerchiefs market demonstrates a mature and precision-focused landscape, characterized by sophisticated integration of high-speed wrapping systems and quality control technologies with existing tissue manufacturing infrastructure across large-scale production facilities and specialty tissue converters. Japan's emphasis on product quality consistency and operational efficiency drives demand for advanced wrapping equipment that supports stringent packaging standards and reliable production scheduling requirements in domestic tissue manufacturing operations. The market benefits from established relationships between domestic machinery manufacturers and tissue producers, creating service ecosystems that prioritize equipment reliability and technical support programs. Manufacturing centers in Shizuoka, Ehime, Kagawa, and other major tissue production regions showcase advanced wrapping implementations where automated systems achieve 98% operational efficiency through precision mechanical design and comprehensive preventive maintenance programs.

The South Korean wrapping machines for handkerchiefs market is characterized by growing international equipment provider presence, with companies maintaining significant positions through comprehensive technical services and machinery supply capabilities for tissue manufacturing applications. The market demonstrates increasing emphasis on production automation and packaging quality enhancement, as Korean tissue manufacturers increasingly demand advanced wrapping systems that integrate with modern converting equipment and production management platforms deployed across manufacturing facilities. Regional equipment suppliers are gaining market share through strategic partnerships with international machinery manufacturers, offering specialized services including equipment installation support and operator training programs for tissue production applications. The competitive landscape shows increasing collaboration between global wrapping machine manufacturers and Korean tissue industry specialists, creating hybrid service models that combine international equipment technology with local technical support capabilities and tissue manufacturing process knowledge.

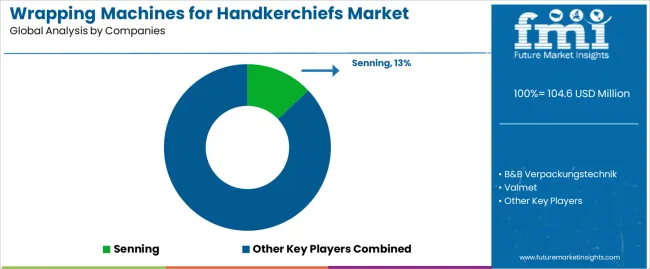

The wrapping machines for handkerchiefs market features approximately 12-15 meaningful players with moderate fragmentation, where the top three companies control roughly 28-35% of global market share through established engineering capabilities and comprehensive product portfolios. Competition centers on equipment reliability, wrapping speed capabilities, and format flexibility rather than price competition alone. Senning leads with approximately 13.0% market share through its comprehensive tissue packaging machinery portfolio.

Market leaders include Senning, B&B Verpackungstechnik, and Valmet, which maintain competitive advantages through proven wrapping technology platforms, global service networks, and deep expertise in tissue production line integration across multiple manufacturing applications, creating reliability advantages with tissue producers managing high-volume production operations. These companies leverage research and development capabilities in servo drive systems and ongoing technical support relationships to defend market positions while expanding into high-speed multi-lane configurations and integrated production line solutions.

Challengers encompass STAX Technologies and Unimax Group, which compete through specialized wrapping machine designs and regional market presence in key tissue manufacturing territories. Product specialists, including IMA, Infinity Machine & Engineering, and Hinnli, focus on specific automation levels or application segments, offering differentiated capabilities in compact machine designs, customization services, and specialized sealing technologies.

Regional players and emerging machinery manufacturers create competitive pressure through cost-competitive equipment offerings and local service advantages, particularly in high-growth markets including China and India, where domestic manufacturers including Jiangxi OK Science and Technology, Shanghai SoonTrue, Shantou IMAKO, Zhejiang Onepaper Smart Equipment, Foshan Baosuo Paper Machinery Manufacture, and Zhejiang Ding-Ye provide localized engineering support and favorable pricing structures. Market dynamics favor companies that combine reliable mechanical engineering with comprehensive after-sales service offerings that address the complete equipment lifecycle from installation through maintenance optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 104.6 million |

| Automation Level | Fully Automatic, Semi-Automatic |

| Application | Hotels And Office Buildings, Hospital, Food Processing Plant, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Senning, B&B Verpackungstechnik, Valmet, STAX Technologies, Unimax Group, IMA, Infinity Machine & Engineering, Hinnli, Jiangxi OK Science and Technology, Shanghai SoonTrue, Shantou IMAKO, Zhejiang Onepaper Smart Equipment, Foshan Baosuo Paper Machinery Manufacture, Zhejiang Ding-Ye |

| Additional Attributes | Dollar sales by automation level and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with wrapping machine manufacturers and tissue equipment suppliers, equipment specifications and performance capabilities, integration with tissue production lines and converting operations, innovations in servo drive systems and quality inspection technologies, and development of high-speed multi-lane configurations with enhanced changeover flexibility and energy efficiency capabilities. |

The global wrapping machines for handkerchiefs market is estimated to be valued at USD 104.6 million in 2025.

The market size for the wrapping machines for handkerchiefs market is projected to reach USD 128.8 million by 2035.

The wrapping machines for handkerchiefs market is expected to grow at a 2.1% CAGR between 2025 and 2035.

The key product types in wrapping machines for handkerchiefs market are fully automatic and semi-automatic.

In terms of application, hotels and office buildings segment to command 44.0% share in the wrapping machines for handkerchiefs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wrapping Tissues Market Size and Share Forecast Outlook 2025 to 2035

Wrapping Machine Market

Wrapping and Bundling Machines Market Size and Share Forecast Outlook 2025 to 2035

Overwrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Overwrapping Machine Manufacturers

Pipe Wrapping Machines Market

Cable Wrapping Tape Market

Candy Wrapping Machine Market

Sleeve Wrapping Machine Market

Shrink Wrapping Machine Market

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Shrink Wrapping Machines Providers

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Protective Wrapping Paper Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pallet Stretch Wrapping Machine Manufacturers

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Flow Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA