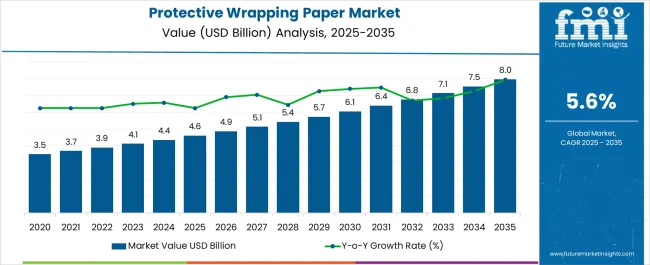

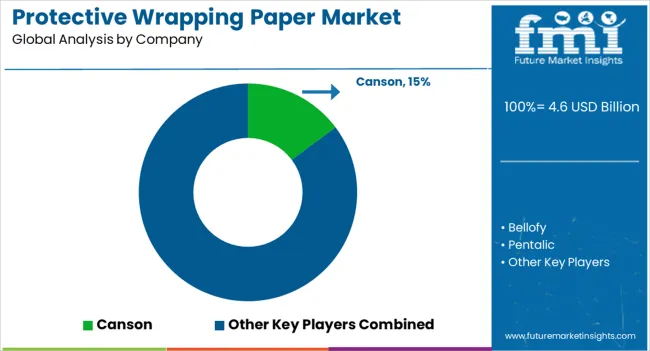

The Protective Wrapping Paper Market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Protective Wrapping Paper Market Estimated Value in (2025 E) | USD 4.6 billion |

| Protective Wrapping Paper Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The protective wrapping paper market is expanding steadily. Increasing demand from packaging industries, heightened eCommerce activities, and sustainability-driven consumer preferences are driving market growth.

Current dynamics reflect the shift from synthetic packaging materials toward recyclable and biodegradable paper-based alternatives, supported by regulatory frameworks encouraging eco-friendly packaging adoption. The sector is witnessing investment in innovative manufacturing processes that improve paper strength, tear resistance, and printability, enhancing product appeal for both industrial and retail applications.

Future outlook indicates strong demand as online retailing and cross-border trade continue to scale globally, creating consistent need for protective packaging solutions Growth rationale is further supported by rising environmental consciousness among businesses and consumers, technological advancements in coating and finishing processes, and the ability of manufacturers to provide lightweight yet durable wrapping paper that reduces overall shipping costs while maintaining product safety, ensuring a positive trajectory for the market over the forecast period.

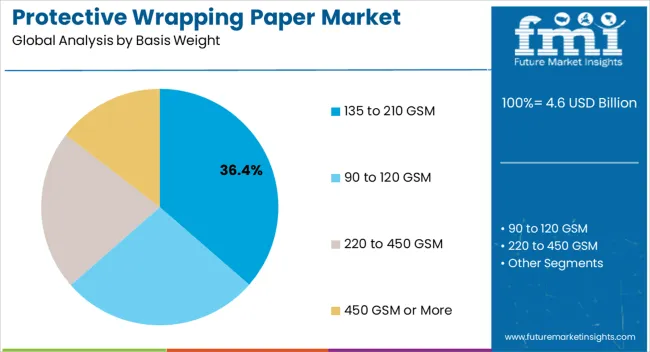

The 135 to 210 GSM segment, holding 36.40% of the basis weight category, has secured a leading position due to its versatility and balance between durability and cost-efficiency. Its adoption has been reinforced by strong demand from packaging applications that require moderate thickness to ensure product protection without adding excessive weight.

Market share has been sustained through consistent use in industries ranging from consumer goods to logistics, where reliable wrapping performance is essential. The segment benefits from advancements in paper processing technologies that improve tensile strength and provide resistance against tearing and puncturing.

Demand stability has also been influenced by the growing preference for recyclable and compostable wrapping options that meet sustainability requirements With expanding global trade and increasing emphasis on efficient shipping, the 135 to 210 GSM range is expected to maintain its market dominance through continued innovation and adoption across multiple end-use sectors.

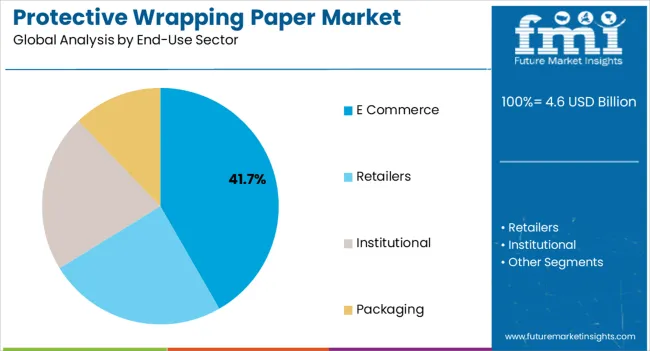

The eCommerce sector, representing 41.70% of the end-use category, has become the primary growth driver as rapid expansion of online retail platforms accelerates packaging requirements worldwide. Its leadership is supported by the rising volume of parcel shipments that demand durable, lightweight, and cost-effective protective wrapping solutions.

The segment has benefitted from strong investments in packaging innovation that enhance unboxing experiences while ensuring safety during transit. Sustainability considerations have further reinforced paper adoption, as eCommerce companies align packaging strategies with eco-friendly goals to reduce plastic usage.

Efficiency in warehousing and logistics operations has been improved by adopting standard-sized and customizable wrapping formats Market positioning of this segment is expected to strengthen further as global online shopping penetration increases, ensuring consistent demand for protective wrapping paper as an integral component of last-mile delivery and retail distribution networks.

Increasing end users' requirements for packaging solutions are raising the global protective wrapping paper demand. These end users, including food & beverages and cosmetics, are increasing the demand for protective wrapping paper. Consumers seeking high-quality, premium and sustainable packaging solutions are surging the adoption of protective wrapping paper, driving the global market.

Manufacturers use protective wrapping paper to reduce scratches on packaging products and protect them from outside moisture. Consumers are increasingly adopting protective wrapping paper for various arts and crafts to show their creative ideas through painting, driving the global protective wrapping paper demand. Increasing environmental concerns are stimulating sales of sustainable protective wrapping paper, contributing to market growth.

The rapidly rising eCommerce sector offers advanced quality, sizes, and a wide range of protective wrapping paper, increasing the demand for advanced packaging among consumers. Increasing transportation and logistics are raising the demand for effective packaging for long distances to secure goods and significantly increase their adoption. Electronic and automotive industries are driving the demand for protective wrapping paper to enhance their product safety.

Manufacturers are adopting material technology following sustainable methods of production to meet consumer requirements. Key players widely adopt protective wrapping paper to promote their brands with customized solutions, attracting consumers' attention. The growing focus on sustainability is expected to create opportunities in the market for the development of biodegradable protective wrapping paper. Shipping activities uplift market revenue by increasing sales of protective wrapping paper for trading goods.

The global protective wrapping paper market grew at a CAGR of 5% and reached a valuation of USD 4,102.7 million in 2025. The increased online sales and innovations have brought lucrative opportunities in the global market. Consumers are looking forward to convenient, water-resistant, and moisture-resistant packaging, increasing the demand for protective wrapping paper.

| Historical Market Value, 2025 | USD 4,102.7 million |

|---|---|

| Historical CAGR, 2020 to 2025 | 5% |

Ongoing technologies are expected to bring new ideas, packaging styles, and designs, stimulating the adoption of protective wrapping paper over the forecast period. Nowadays, manufacturers focus on producing protective wrapping paper through agricultural waste to promote sustainability and reduce carbon footprints.

On the other hand, key players offer these products for printing, creativity, protection, and designing purposes to ensure customers' desires. These players are estimated to implement new ideas for improving their packaging solutions.

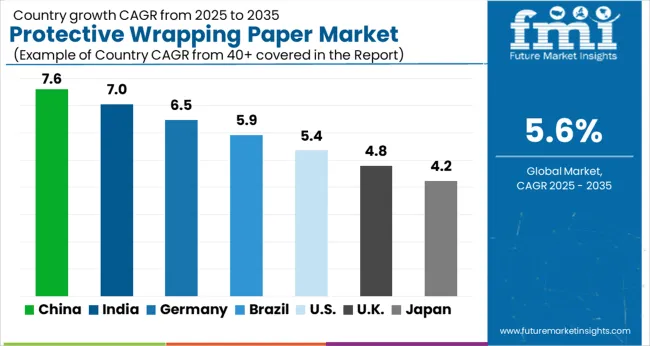

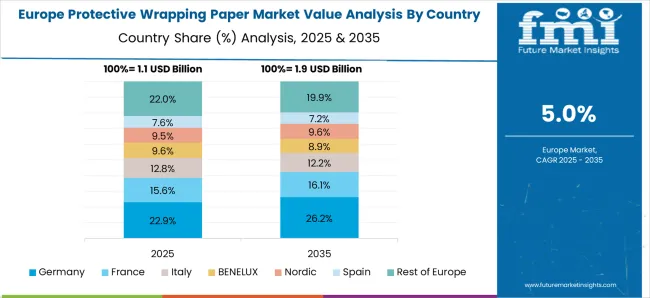

The market in Germany is likely to secure a CAGR of 2.20% during the forecast period. Increasing demand for protective, secure, safe, and reliable packaging is raising the adoption of protective wrapping paper among consumers. Changing lifestyles, rising demand for premium packaging, and rapid innovations are expanding Germany's protective wrapping paper market.

The rising automotive and electronic goods industries drive the demand for protective wrapping paper to maintain their product quality and safety. Key players are developing standardized products to reduce environmental impacts and carbon emissions. Germany is popular as an innovation hub that continuously makes new packaging solutions by adopting marketing strategies. On the flip side, the growing manufacturing sector is accepting vast quantities of protective wrapping paper to secure their durable products in Germany.

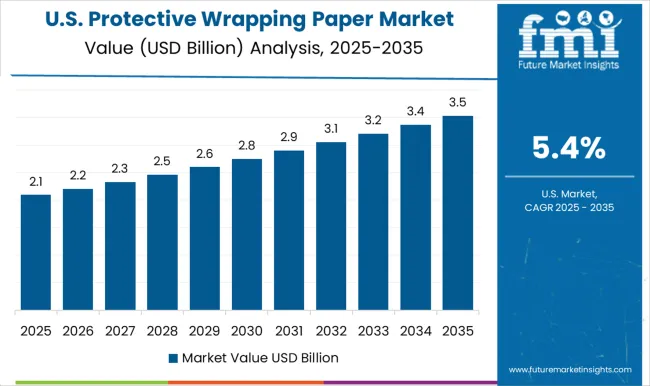

The United States Protective Wrapping Paper Market is anticipated to capture a CAGR of 3.30% through 2035. The surging eCommerce sector offers a wide range of products to increase sales of protective wrapping paper in the country. The eCommerce sector offers various discounts and coupons to engage more audiences, driving sales of protective wrapping paper in the United States.

Governments of the United States are focused on sustainable and eco-friendly packaging to protect the environment and increase the demand for protective wrapping paper. Rising demand for cost-effective, durable, and premium packaging solutions is upsurging the market. Key players’ initiatives to develop biodegradable and sustainable practices also contribute to the growth of the market.

The market in India is estimated to register a CAGR of 6.50% during the forecast period. The rising cost-effective, affordable, and advanced-quality packaging solutions are surging the demand for protective wrapping paper in the country. The growing industries, urbanization, and disposable incomes of people are driving India's protective wrapping paper market.

The growing retail and eCommerce are significantly boosting sales of protective wrapping paper for efficient and safe packaging to capture consumers' attention. Manufacturers are balancing consumers' desires with their affordability to increase the adoption of protective wrapping paper in India. The government implements rules on packaging to reduce carbon footprints and environmental toxicity.

The market in China is anticipated to grow at a CAGR of 5.90% over the forecast period. The rapidly growing manufacturing processes for efficient and high-quality packaging solutions generate vast revenue in China's protective wrapping paper market. Key players are adopting these papers to promote their brands through advanced printing. Using waterproof ink to maintain the quality of writing with effective designs is fueling the Chinese market.

Manufacturers are taking note to present innovative and sustainable options to expand the market in the country. Key players offer better quality protective wrapping paper for packaging to maintain product quality with reliable packaging in China.

The United Kingdom is estimated to register a CAGR of 2.70% during the forecast period. Increasing the demand for protective wrapping paper to reduce carbon emissions and protect the green environment fuels the United Kingdom market. Manufacturers design unique and advanced packaging solutions for convenient and hassle-free transportation and shipping activities in the country. Diverse industries are enhancing their packaging styles with these solutions to uplift the United Kingdom's protective wrapping paper market.

Technologies are bringing new ideas to make aesthetic packaging solutions to enhance packaging safety and efficiency in the country. A wide range of consumers are looking forward to safe and secure solutions that are significantly booming the market in the country. Key players maintain their position in the country through various tactics, innovations, and strategies.

| Top Basis Weight | 90 to 120 GSM |

|---|---|

| Market Share (2025) | 34.30% |

The 90 to 120 GSM segment dominates the global market by basis weight, capturing a share of 34.30% in 2025. The increasing consumer demand for suitable and sustainable packaging is driving sales of 90 to 120 GSM protective wrapping paper for practical solutions. The rising consumer attention for premium paper for creative work and printing purposes promotes the growth of the segment.

Manufacturers design influential weight-protective wrapping paper to maintain the quality of consumer products such as electronics and food packaging components. The rising consumer attention to eco-friendly packaging to reduce environmental toxicity is surging the demand for 90 to 120 GSM protective wrapping paper.

| Top End-use Sector | eCommerce |

|---|---|

| Market Share (2025) | 33.50% |

Based on the end-use sector, the eCommerce segment accounts for a significant share of 33.50% in 2025. The rising eCommerce sector demands protective wrapping paper for practical, versatile, and durable packaging. The eCommerce sector offers an abundance of packaging solutions to gain popularity among end users. Consumers seek suitable and effective solutions and prefer online shopping for better packaging with unique styles, designs, and paper quality.

Manufacturers are selling their products on eCommerce websites to maintain their brand identity to boost their sales. Many key players are contributing their role to stay ahead of competitors. The eCommerce sector is dominating the shopping industry with its product variety, quality, and discounts, gaining vast popularity among consumers.

The global market is highly competitive due to the presence of key players that establish their role to upsurge their brand reputation through various improved products. These players invest in research and development activities to create innovative products through new ideas and plans.

These players are collaborating with universities, research institutions, and manufacturers to develop better and more sustainable practices for packaging products. With all their efforts, key players are maintaining their position in the global market, which is likely to fuel market growth during the coming period.

Recent Developments in the Protective Wrapping Paper Market

The global protective wrapping paper market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the protective wrapping paper market is projected to reach USD 8.0 billion by 2035.

The protective wrapping paper market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in protective wrapping paper market are 135 to 210 gsm, 90 to 120 gsm, 220 to 450 gsm and 450 gsm or more.

In terms of end-use sector, e commerce segment to command 41.7% share in the protective wrapping paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protective Glove Market Forecast Outlook 2025 to 2035

Protective Film Market Size and Share Forecast Outlook 2025 to 2035

Protective Earth Resistance Meter Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Mask Market Size and Share Forecast Outlook 2025 to 2035

Protective Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

Protective Clothing Market - Trends, Growth & Forecast 2025 to 2035

Protective Eyewear Market Trends – Industry Growth & Forecast 2025 to 2035

Market Share Distribution Among Protective Packaging Manufacturers

Market Share Insights of Leading Protective Textiles Providers

Protective Relay Market

Protective Footwear Market

Protective Films Tapes Market

Protective Goggles Market

Protective Gowns Market

ESD Protective Signage Labels Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Protective Equipment Market - Growth, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA