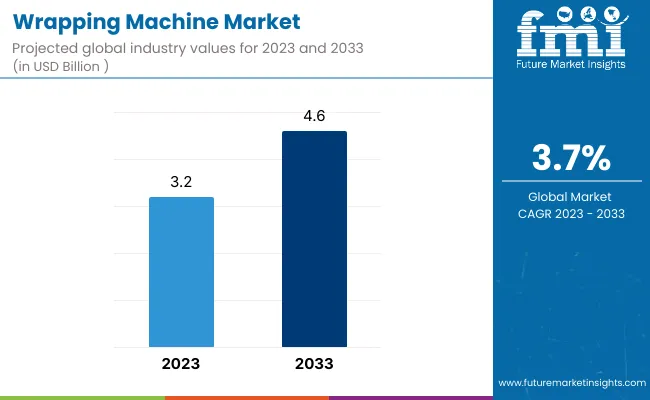

According to Future Market Insights research, during the projected period, the global wrapping machine market is set to enjoy a valuation of US$ 3.2 billion in 2023, and further expand at a CAGR of 3.7% to reach US$ 4.6 Billion by the year 2033. The sales of wrapping machines are anticipated to bolster with the top 5 companies estimated to hold around 15 to 20% of the market in 2022.

Based on the automation, the automatic machine is projected to remain the leading segment among the other material used for manufacturing wrapping machines. The automatic machine segment is estimated to expand 1.4 times the current market value from 2023 to 2033.

| Attributes | Details |

|---|---|

| Market Size 2023 | US$ 3.2 Billion |

| Market Size 2033 | US$ 4.6 Billion |

| Value CAGR (2023 to 2033) | 3.7% |

| Collective Value Share: Top 3 Countries (2023E) | 30 to 35% |

According to the FMI analysis, the wrapping machine market revenue totaled US$ 3.1 billion in 2022. With the propelling demand from the various end-users, the global wrapping machine market is projected to reach US$ 4.6 Billion by 2033, accelerating at a CAGR of 3.7% during the forecast period.

The wrapping machine market is estimated to experience a positive growth outlook during the forecast period. A new forecast by FMI anticipates that wrapping machine sales will rise from 2023 to 2033 and is projected to create an absolute incremental growth opportunity of US$ 1.5 Billion.

The modernization of the packaging machinery industry shapes the wrapping machine market growth. The wrapping machine market is anticipated to expand 1.5 times the current market value during the forecast period.

The global wrapping machine market witnessed a CAGR of 3.4% during the historic period with a market value of US$ 3.1 billion in 2022.

The wrapping machine is used to wrap products on a platform. Wrapping machines are specialized packaging equipment used for the selection and handling of pallet loads with varying weights and heights. Products and items are wrapped tightly before being loaded on the pallet to ensure that they remain in place throughout transportation. Both automated and semi-automatic types of this equipment are offered.

The continuously growing food & beverage and food service industry are projected to drive the demand for wrapping machines. The changes in the eating habits and lifestyle of the people have increased the usage of packed food which creates a growth opportunity for the Wrapping machine market. Overall, the global Wrapping machine market is anticipated to bolster at a faster pace during the forecast period.

The higher production cost causes low profit for the organization. Many manufacturers are strategizing to reduce operational costs to achieve high profits. The High production costs translate to lower profits. Efficiency in any operational process is an important aspect of an organization. Wrapping machine offers higher efficiency in a short time interval. Wrapping machine provides higher productivity in fewer time interval. There is less human intervention in the wrapping process with a wrapping machine. These will help to eliminate human error from the process. It offers low capital cost.

The wrapping machines have various of advantages, including less human involvement, less time consumption, and high operation speed. Consumer packaged goods (CPG) producers are constantly concentrating on improving efficiency in order to obtain a competitive edge, maintain market position, and grow their customer base. These producers frequently choose wrapping machines. These factors will create a positive growth outlook for the wrapping machine market.

Based on the machine segment, the wrapping machine segment holds the major portion of the global wrapping machine market. The targeted segment is projected to hold around 65% of the market share by the end of 2033.

Many large-scale industries are adopting automated manufacturing as well as packaging systems for increasing output. The automatic wrapping machine provides accuracy with a high productivity rate. It reduces labor demands and provides safety to all labor.

The food & beverages segment is projected to grow at a CAGR of 3.2% during the forecast period.

There is rising demand for packed food & beverages significantly. The demand for packed food and Beverage drinks are increasing due to changing lifestyle, increasing disposable income are key factors driving the growth of the food & beverages market. Consumption of food & beverages drives directly affects the sales of the wrapping machine.

China is expected to hold around 62% of the East Asia wrapping machine market by the end of the forecast period. As of June 2022, China produced about 25 lakh vehicles, including passenger and commercial vehicles, and as of June 2022, about 2.5 lakh vehicles were exported worldwide, according to key findings from the China Association of Automakers Manufacturers. Increasing demand for automobiles is expected to increase demand for end-of-line packaging to pack various automotive products.

As per The Association for Packaging and Processing Technologies (PMMI), the food sector emerged as the largest demand segment for packaging machinery across Mexico in 2020. Also, the U.S. holds a position as the third largest supplier with 17% of total imported packaging machinery in 2020 across Mexico.

The key players operating in the wrap machines market are trying to focus on increasing their sales and revenues by expanding their capabilities to meet the growing demand. The key players are trying to adopt a merger & acquisition strategy to expand their resources and are developing new technologies to meet customer needs. Also, the players are focusing on upgrading their facilities to cater to the demand. Some of the recent key developments by the leading players are as follows –

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.7% from 2023 to 2033 |

| Base Year for Estimation | 2022 |

| Historical Data | 2018 to 2022 |

| Forecast Period | 2023 to 2033 |

| Quantitative Units | Revenue in USD Million, Volume in Units, and CAGR from 2023 to 2033 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Machine, Orientation, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | The USA, Canada, Mexico, Brazil, Germany, The UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Redpack Packaging Machinery; Pfm Packaging Machinery Ltd.; Cavanna Packaging Group; EDL (A Massman Company); Gerhard Schubert GmbH; Mosca GmbH; A.M.P.-Rose; BRADMAN-LAKE GROUP LIMITED; Shandong Sapphire Packaging Machinery Co., Ltd; Movitec Wrapping Systems, SL; Technowrapp srl; Wulftec International Inc.; Robopac SPA; Phoenix Wrappers, Inc.; Perks Engineering; ULMA Packaging (ULMA Group) |

| Customization & Pricing | Available upon Request |

In 2022, the value of the global wrapping machine market was US$ 3.1 Billion.

During the forecast period, the global wrapping machine market is anticipated to expand at a CAGR of 3.7%.

The global wrapping machine market is expected to reach US$ 4.6 Billion by the end of 2033.

During the forecast period, Automatic machines are likely to be the fastest-growing material segment in the global wrapping machine market.

Redpack Packaging Machinery, Pfm Packaging Machinery Ltd, Cavanna Packaging Group, EDL (A Massman Company), Gerhard Schubert GmbH, Mosca GmbH, A.M.P.-Rose, BRADMAN-LAKE GROUP LIMITED, Movitec Wrapping Systems, SL, Technowrapp srl, Robopac SPA, Phoenix Wrappers, Inc. are the top players supplementing the sales of wrapping machine.

As per the FMI analysis, the Indian wrapping machine market is projected to expand at a CAGR of 4.4% from 2023 to 2033.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Wrapping and Bundling Machines Market Size and Share Forecast Outlook 2025 to 2035

Overwrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Overwrapping Machine Manufacturers

Pipe Wrapping Machines Market

Candy Wrapping Machine Market

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Shrink Wrapping Machines Providers

Sleeve Wrapping Machine Market

Shrink Wrapping Machine Market

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pallet Stretch Wrapping Machine Manufacturers

Horizontal Flow Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Wrapping Tissues Market Size and Share Forecast Outlook 2025 to 2035

Cable Wrapping Tape Market

Chocolate Wrapping Films Market from 2025 to 2035

Protective Wrapping Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA