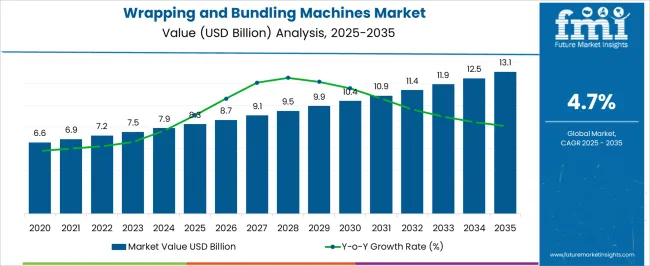

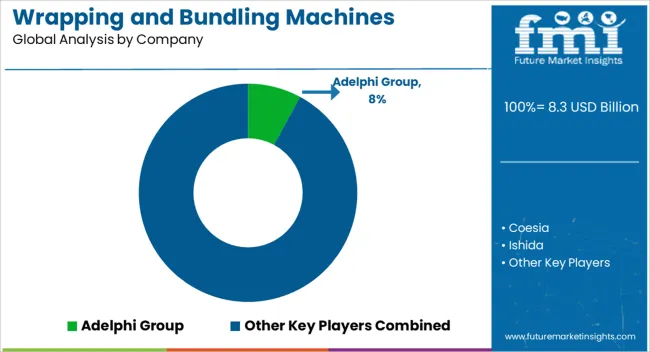

The wrapping and bundling machines market is estimated to be valued at USD 8.3 billion in 2025 and is projected to reach USD 13.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Annual increments reveal a steady expansion, with the market moving from USD 8.7 billion in 2026 to USD 12.5 billion in 2034. This compound absolute growth analysis indicates that demand for automated packaging solutions, enhanced operational efficiency, and labor cost optimization are driving the market. The market’s expansion is being reinforced by industrial sectors seeking reliable packaging machinery that supports higher throughput and reduced material waste, highlighting the strategic importance of the segment in manufacturing and logistics processes.

The wrapping and bundling machines market demonstrates a stable growth trajectory, supported by consistent investments in mechanized packaging and process optimization. Year-on-year increments emphasize that the market is absorbing evolving production needs and adapting to changing packaging standards. Equipment adoption trends indicate that automation, customization, and modularity are shaping purchasing decisions among manufacturers.

The market’s resilience is visible in its ability to respond to operational challenges and fluctuating demand cycles, establishing wrapping and bundling machines as a critical element for efficiency-focused industries and a steadily expanding segment for investors and machinery providers.

| Metric | Value |

|---|---|

| Wrapping and Bundling Machines Market Estimated Value in (2025 E) | USD 8.3 billion |

| Wrapping and Bundling Machines Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The wrapping and bundling machines market has been positioned as a significant contributor within its parent markets, accounting for approximately 18-20% of the packaging machinery market, around 12-14% of the material handling equipment market, close to 10-12% of the automated packaging solutions market, about 15-17% of the food and beverage processing equipment market, and roughly 8-10% of the industrial automation market. Collectively, the aggregated share across these parent categories is estimated in the range of 63-73%, reflecting the integral role that wrapping and bundling machines play in streamlining packaging operations, improving productivity, and reducing manual labor requirements.

The market has been driven by the need for efficient packaging of goods, enhanced protection during transportation, and the growing emphasis on operational consistency across industries such as food and beverage, consumer goods, and manufacturing. Factors including machine speed, compatibility with different packaging formats, reliability, and ease of integration with existing production lines have shaped adoption.

Market participants have focused on offering versatile solutions that meet varying industry demands, provide precise packaging control, and support high-throughput operations. As a result, the wrapping and bundling machines market has secured a meaningful footprint within packaging machinery, automation, and processing equipment segments, emphasizing its critical role in operational efficiency and industrial productivity.

The wrapping and bundling machines market is expanding steadily, supported by growing demand for efficient and automated packaging solutions across industries such as food and beverage, pharmaceuticals, logistics, and e-commerce. With global supply chains becoming increasingly complex and product safety gaining critical importance, manufacturers are investing in advanced packaging equipment to optimize operations and reduce manual intervention.

Automation is a key driving factor, offering improved throughput, consistency, and cost savings. Rising environmental awareness has also triggered interest in sustainable materials and energy-efficient machinery, pushing innovation in machine design and compatibility with recyclable films.

Looking forward, digital integration and smart factory adoption are expected to enhance machine performance monitoring and predictive maintenance, further increasing operational uptime. As production volumes rise and packaging standards evolve, the demand for high-speed, reliable, and material-versatile machines will remain strong across both established and emerging markets

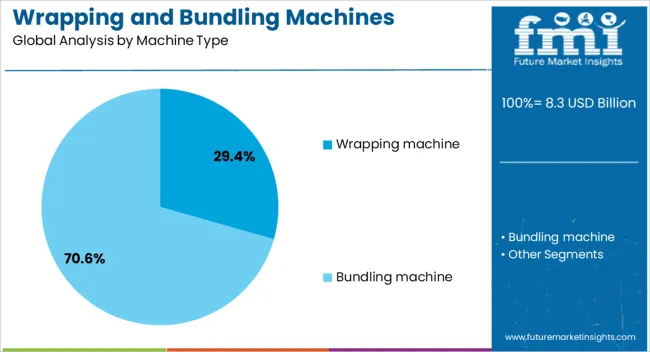

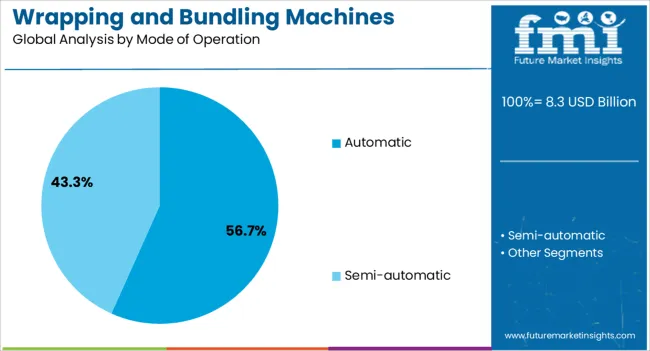

The wrapping and bundling machines market is segmented by machine type, mode of operation, material, packaging type, end use industry, and geographic regions. By machine type, the wrapping and bundling machines market is divided into Wrapping machines and bunding machines. In terms of mode of operation, wrapping and bundling machines market is classified into Automatic and Semi-automatic.

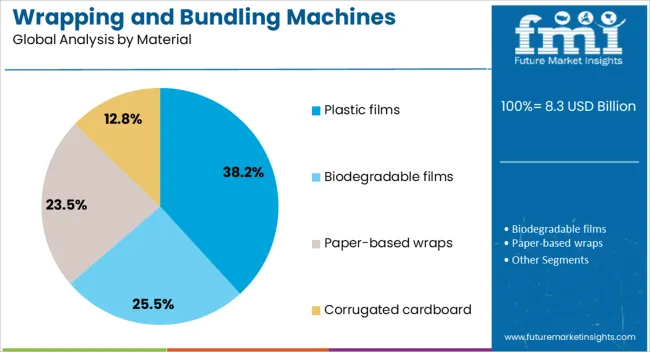

Based on material, wrapping and bundling machines market is segmented into Plastic films, Biodegradable films, Paper-based wraps, and Corrugated cardboard. By packaging type, wrapping and bundling machines market is segmented into Primary packaging, Secondary packaging, and Tertiary packaging.

By end use industry, wrapping and bundling machines market is segmented into Food & beverage, Pharmaceuticals, Personal care & cosmetics, Consumer electronics, Textiles, Logistics & warehousing, Chemicals, Industrial goods, and Others. Regionally, the wrapping and bundling machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wrapping machine segment dominates the machine type category with a 29.4% market share, driven by its widespread application in securing goods for storage and transportation. These machines are favored for their ability to tightly and uniformly wrap products, improving load stability and protecting goods from moisture, dust, and tampering.

The segment benefits from technological advancements such as multi-layer wrapping, adjustable tension control, and compatibility with various film types, allowing customization to specific packaging needs. Industries with high-volume packaging requirements, particularly in food processing and logistics, rely heavily on wrapping machines for operational efficiency.

Compact designs, reduced film waste, and integration with conveyor systems further contribute to their growing popularity. As industries continue to prioritize speed, safety, and sustainability, the adoption of versatile and automated wrapping solutions is expected to reinforce this segment's position in the market.

The automatic mode of operation segment leads the market with a commanding 56.7% share, underscoring the shift toward streamlined and labor-efficient packaging processes. Automatic machines offer higher consistency, reduced error rates, and minimal operator involvement, making them ideal for large-scale production environments.

Their integration with digital controls and smart sensors enhances precision and allows for real-time performance tracking, reducing downtime and material waste. The growing need for 24/7 operation in industries such as food and beverage, pharmaceuticals, and e-commerce has further accelerated the demand for fully automatic machines.

This segment is also benefitting from labor cost pressures and global trends favoring industrial automation. As manufacturers aim to boost productivity and meet stringent packaging standards, investment in automatic bundling and wrapping equipment is expected to remain a top priority, particularly in high-throughput and multi-shift operations

The plastic films segment holds a leading 38.2% share in the material category, reflecting its dominance in packaging applications due to its flexibility, durability, and cost-effectiveness. Plastic films are widely used in wrapping and bundling operations to provide moisture resistance, tamper evidence, and visual clarity, which are essential for product integrity during transportation and storage.

Innovations in bio-based and recyclable film compositions have helped address environmental concerns while maintaining performance standards. This segment has seen consistent demand across industries such as consumer goods, pharmaceuticals, and electronics, where precise and secure packaging is crucial.

The compatibility of plastic films with both semi-automatic and automatic machines enhances their versatility and supports their continued use despite growing regulatory scrutiny. As material suppliers and machine manufacturers collaborate to develop thinner, stronger, and more eco-friendly films, the segment is expected to retain its market leadership in the foreseeable future.

The wrapping and bundling machines market is being propelled by industrial growth, e-commerce expansion, and the need for operational efficiency. Opportunities are arising from automation, flexible packaging, and digital monitoring integration. Market trends highlight demand for adaptable, high-speed, and modular solutions capable of handling diverse product formats. Challenges related to high capital costs, maintenance complexities, and regulatory compliance continue to shape market strategies. Overall, the sector is expected to witness steady growth as businesses increasingly prioritize protective, efficient, and adaptable packaging solutions across industries.

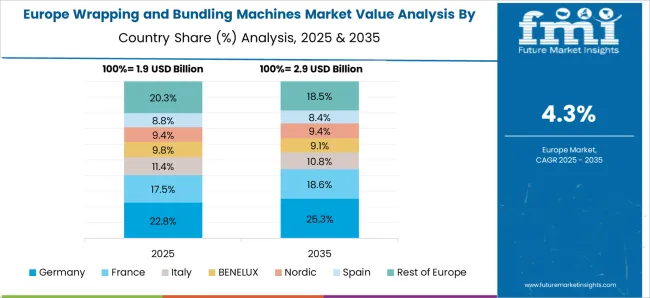

The wrapping and bundling machines market is experiencing robust demand driven by rapid expansion in industrial manufacturing, e-commerce, and logistics operations worldwide. Packaging efficiency and product protection have emerged as critical priorities for companies aiming to streamline supply chains and reduce damage-related losses. Demand is being particularly influenced by the increasing requirement for automated solutions in food and beverage, pharmaceuticals, consumer goods, and e-commerce packaging operations. Labor cost optimization is encouraging companies to adopt semi-automatic and fully automated wrapping and bundling systems to enhance operational efficiency. Regional variations are also notable, with North America and Europe showcasing established demand due to mature logistics networks, while Asia-Pacific and Latin America are witnessing accelerating adoption driven by industrial growth and rising e-commerce penetration. Furthermore, regulatory emphasis on secure packaging for transport-sensitive goods is shaping equipment adoption patterns. Overall, demand is being propelled by operational efficiency requirements, protection needs, and industrial throughput expectations.

Opportunities in the wrapping and bundling machines market are being significantly amplified by the increasing adoption of automation and advanced packaging technologies. Manufacturers and logistics providers are increasingly exploring automated systems to handle higher volumes while reducing labor dependency and operational errors. Customization in wrapping methods, material handling, and bundling configurations is creating lucrative niches for equipment providers. The surge in e-commerce has opened avenues for compact, high-speed, and flexible packaging solutions capable of handling variable product sizes and shapes. Collaborative ventures between packaging solution providers and material manufacturers are enabling bundled offerings that optimize machine efficiency. Emerging markets present additional opportunities as industries modernize operations and integrate mechanized packaging solutions to meet growing consumer demands. Digital monitoring and IoT-enabled machines are also being leveraged to enhance throughput visibility and predictive maintenance, creating value-added opportunities. These factors collectively underscore the evolving market potential shaped by automation adoption and operational enhancements.

Market trends in the wrapping and bundling machines sector are increasingly shaped by the demand for flexible packaging, operational efficiency, and precision handling. Adjustable speed, modular designs, and multi-format compatibility are gaining traction as businesses aim to process diverse product sizes and maintain packaging integrity. The adoption of eco-friendly and lightweight films, without compromising protection, is becoming a standard preference. Integration of digital control systems and real-time monitoring is being leveraged to reduce downtime and optimize workflow, while modular systems allow for rapid reconfiguration based on product throughput. Regions with high e-commerce activity are experiencing a trend toward compact and automated packaging solutions, while industrial sectors continue to demand robust, high-capacity machines. Furthermore, collaborative packaging strategies between manufacturers and logistics providers are redefining machine deployment, emphasizing flexibility, speed, and efficiency in modern packaging operations.

Challenges in the wrapping and bundling machines market are largely associated with high capital investment, maintenance requirements, and operational complexity. Initial acquisition costs for fully automated and high-speed systems can be prohibitive for small and medium enterprises, limiting adoption in certain regions. Regular maintenance, skilled operator training, and machine calibration are essential to prevent breakdowns and maintain packaging quality, which can increase operational expenditures. Compatibility issues with diverse packaging materials and product types require tailored solutions, creating logistical and technical hurdles for suppliers. Additionally, inconsistent quality standards across regions, coupled with supply chain disruptions for replacement parts, can constrain machine uptime and performance. Environmental regulations concerning packaging materials, disposal, and machine energy consumption further introduce compliance-related challenges. As a result, stakeholders are compelled to carefully balance investment, operational efficiency, and long-term performance to navigate these market obstacles effectively.

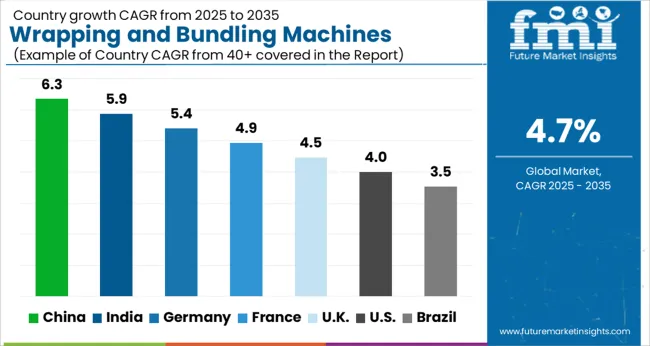

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global wrapping and bundling machines market is projected to grow at a CAGR of 4.7% from 2025 to 2035. China leads with the highest growth rate of 6.3%, followed by India at 5.9%, and Germany at 5.4%. The United Kingdom is expected to grow at 4.5%, while the United States shows the slowest growth at 4%. Market expansion is being driven by increasing industrial automation, demand for efficient packaging solutions, and growth in e-commerce and manufacturing sectors. Emerging economies such as China and India experience higher growth due to industrial expansion, rising consumer demand, and investment in automated packaging solutions, while developed markets focus on upgrading existing systems and improving operational efficiency. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wrapping and bundling machines market in China is growing at a CAGR of 6.3%, driven by rising demand from food and beverage, e-commerce, and manufacturing sectors. Chinese industries are rapidly adopting automated packaging solutions to enhance productivity and reduce labor costs. Government policies promoting industrial automation and smart manufacturing further encourage market growth. Manufacturers are investing in advanced wrapping and bundling technologies that ensure speed, precision, and reliability. With growing consumer demand and increasing exports, China’s market continues to expand as businesses focus on efficiency, quality, and compliance with packaging standards.

The wrapping and bundling machines market in India is expanding at a CAGR of 5.9%, supported by growth in manufacturing, FMCG, and e-commerce sectors. Industries are increasingly adopting automated solutions to improve productivity and ensure packaging consistency. Rising labor costs and government initiatives for industrial modernization are encouraging the installation of advanced machines. India’s market is further strengthened by the expansion of organized retail and increasing export requirements. The trend toward automation helps companies meet higher production targets while maintaining quality standards and reducing operational inefficiencies.

The wrapping and bundling machines market in Germany is projected to grow at a CAGR of 5.4%, driven by a mature industrial sector and increasing demand for automation. German manufacturers are focusing on precision, efficiency, and sustainable operations, investing in advanced wrapping and bundling equipment. The food and beverage sector, along with pharmaceutical and consumer goods industries, heavily utilize these machines to maintain high standards and productivity. Market growth is supported by strict regulatory compliance requirements, technological advancements in packaging, and a focus on reducing operational costs while improving output.

The wrapping and bundling machines market in the United Kingdom is expected to grow at a CAGR of 4.5%, with steady adoption in manufacturing, retail, and logistics sectors. Businesses are increasingly investing in automation to optimize packaging processes, reduce manual labor, and enhance production efficiency. The UK market is characterized by the replacement of older equipment with modern, energy-efficient machines that improve accuracy and reduce waste. Market growth is further supported by demand for faster packaging solutions in e-commerce and food industries, along with adherence to quality and safety standards.

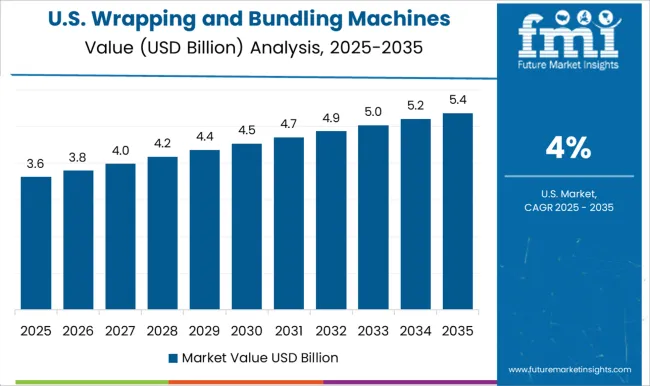

The wrapping and bundling machines market in the United States is growing at a CAGR of 4%, supported by demand from food and beverage, retail, and manufacturing industries. USA companies focus on upgrading packaging lines to improve speed, efficiency, and precision. Adoption is driven by the need to reduce labor dependency and meet consumer expectations for quality packaging. Market growth is further strengthened by investment in automated solutions that comply with safety and regulatory standards. While growth is moderate compared to emerging markets, the USAcontinues to adopt innovative packaging technologies to maintain competitiveness.

The wrapping and bundling machines market has experienced significant growth, driven by increasing demand for automated packaging solutions across diverse industries such as food and beverage, pharmaceuticals, consumer goods, and logistics. Leading players, including Adelphi Group, Coesia, Ishida, and Krones, are at the forefront, offering advanced packaging machinery that enhances efficiency, ensures product safety, and reduces operational costs. Companies such as Lantech, Multivac, Nichrome Packaging Solutions, and nVenia focus on innovation in machine design, integrating robotics, vision systems, and smart sensors to improve productivity and minimize material waste. Additionally, players like Omori Machinery, Optima Packaging Group, Robopac, and Signode Industrial Group provide specialized wrapping solutions, catering to customized industry needs, including stretch wrapping, shrink wrapping, and bundling applications. The competitive landscape is characterized by strategic mergers, acquisitions, and partnerships aimed at expanding technological capabilities, geographical reach, and market penetration. Continuous R&D initiatives are being undertaken to introduce energy-efficient machines, reduce downtime, and improve user-friendly interfaces, making the sector highly dynamic and innovation-driven. Market growth is further supported by the rising trend of e-commerce, which demands efficient, reliable, and high-speed packaging solutions to handle increasing order volumes and reduce shipping damage.

Companies such as Syntegon Technology, Tetra Laval Group, and Wulftec International are investing in smart packaging technologies that combine automation with digital connectivity, enabling real-time monitoring, predictive maintenance, and seamless integration into production lines. The adoption of eco-friendly and sustainable packaging materials is also prompting manufacturers to develop machines compatible with recyclable films and biodegradable wraps. Furthermore, globalization of supply chains and growing consumer expectations for product quality and presentation are compelling manufacturers to optimize packaging operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.3 Billion |

| Machine Type | Wrapping machine and Bundling machine |

| Mode of Operation | Automatic and Semi-automatic |

| Material | Plastic films, Biodegradable films, Paper-based wraps, and Corrugated cardboard |

| Packaging Type | Primary packaging, Secondary packaging, and Tertiary packaging |

| End Use Industry | Food & beverage, Pharmaceuticals, Personal care & cosmetics, Consumer electronics, Textiles, Logistics & warehousing, Chemicals, Industrial goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adelphi Group, Coesia, Ishida, Krones, Lantech, Multivac, Nichrome Packaging Solutions, nVenia, Omori Machinery, Optima Packaging Group, Robopac, Signode Industrial Group, Syntegon Technology, Tetra Laval Group, and Wulftec International |

| Additional Attributes | Dollar sales by machine type (automatic, semi-automatic, manual) and application (food & beverage, pharmaceuticals, logistics, consumer goods) are key metrics. Trends include rising demand for efficient packaging solutions, growth in e-commerce and manufacturing sectors, and increasing adoption of automated wrapping and bundling technologies. Regional deployment, technological advancements, and cost-efficiency are driving market growth. |

The global wrapping and bundling machines market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the wrapping and bundling machines market is projected to reach USD 13.1 billion by 2035.

The wrapping and bundling machines market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in wrapping and bundling machines market are wrapping machine, _stretch wrapping, _shrink wrapping, _other machines, bundling machine, _shrink bundling machines, _film bundling machines, _strap bundling machines and _sleeve bundling machines.

In terms of mode of operation, automatic segment to command 56.7% share in the wrapping and bundling machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wrapping Tissues Market Size and Share Forecast Outlook 2025 to 2035

Wrapping Machine Market

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Overwrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Overwrapping Machine Manufacturers

Pipe Wrapping Machines Market

Cable Wrapping Tape Market

Candy Wrapping Machine Market

Sleeve Wrapping Machine Market

Shrink Wrapping Machine Market

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Shrink Wrapping Machines Providers

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Protective Wrapping Paper Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pallet Stretch Wrapping Machine Manufacturers

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Flow Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA