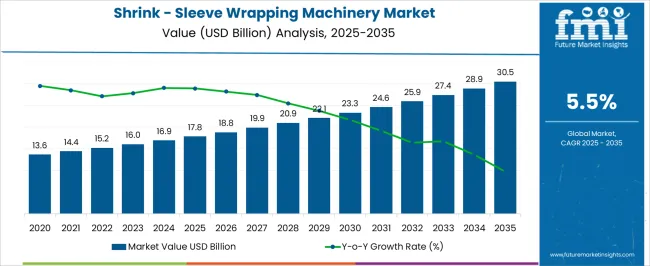

The Shrink - Sleeve Wrapping Machinery Market is estimated to be valued at USD 17.8 billion in 2025 and is projected to reach USD 30.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Shrink - Sleeve Wrapping Machinery Market Estimated Value in (2025E) | USD 17.8 billion |

| Shrink - Sleeve Wrapping Machinery Market Forecast Value in (2035F) | USD 30.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The shrink sleeve wrapping machinery market is witnessing steady expansion driven by the rising need for high-impact product labeling and tamper-evident packaging solutions. The increasing emphasis on visual appeal, shelf differentiation, and regulatory compliance in consumer product packaging is propelling demand for machines that offer high-speed, flexible, and precise shrink-sleeving capabilities.

The market has been further supported by rapid advancements in machine automation, sensor integration, and servo technology, enabling seamless changeovers and real-time monitoring. Industries such as food and beverages, cosmetics, pharmaceuticals, and household products are accelerating investments in shrink-sleeve machinery to enhance packaging aesthetics while maintaining security and hygiene standards.

Additionally, sustainability goals and the push toward recyclable and biodegradable sleeve materials are driving the development of machines that can accommodate a broader range of film substrates As production volumes increase and consumer demand shifts toward personalized and localized packaging, shrink sleeve systems that offer configurability, digital integration, and high uptime are expected to dominate future manufacturing lines.

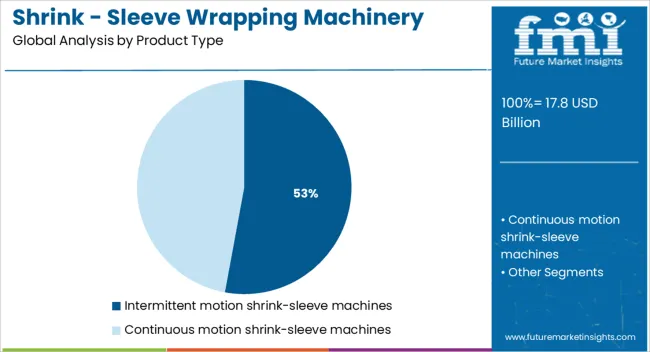

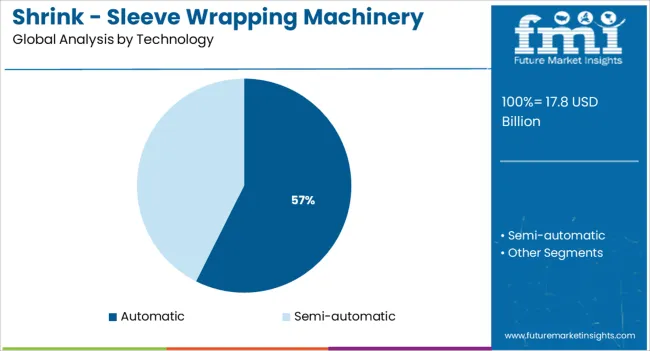

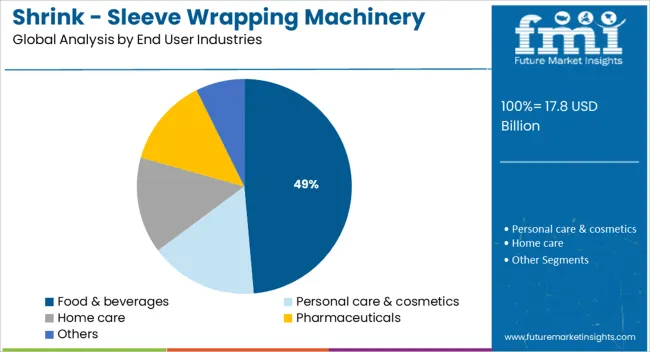

The market is segmented by Product Type, Technology, and End User Industries and region. By Product Type, the market is divided into Intermittent motion shrink-sleeve machines and Continuous motion shrink-sleeve machines. In terms of Technology, the market is classified into Automatic and Semi-automatic. Based on End User Industries, the market is segmented into Food & beverages, Personal care & cosmetics, Home care, Pharmaceuticals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The intermittent motion shrink sleeve machines segment is expected to contribute 52.9% of the total revenue share in the shrink sleeve wrapping machinery market in 2025, making it the leading product type. The strong position of this segment is attributed to its operational versatility, lower energy consumption, and suitability for small to medium-scale production runs.

These machines have been widely preferred in industries requiring frequent format changes, including personal care, nutraceuticals, and specialty beverages. Their ability to provide precise sleeve placement and controlled heat application has ensured product integrity and minimized material wastage.

The segment’s growth has also been supported by advancements in modular design, integrated inspection systems, and digital motion control, allowing for reduced downtime and simplified maintenance As packaging lines shift toward leaner operations with greater agility, intermittent motion machines have emerged as the optimal solution for manufacturers balancing customization needs with cost-efficiency and quality assurance across diversified product lines.

The automatic technology segment is projected to account for 57.4% of the revenue share in the shrink sleeve wrapping machinery market in 2025, driven by the increasing demand for production scalability, accuracy, and labor cost optimization. Automatic systems have gained preference due to their ability to operate at high speeds with minimal operator intervention, ensuring consistent sleeve application and higher throughput.

The segment’s growth has been influenced by developments in smart control panels, vision systems, and programmable logic controllers that enable real-time error detection and operational efficiency. Integration with Industry 4.0 frameworks and remote diagnostics has further enhanced machine reliability and reduced unplanned downtime.

The need for consistent packaging quality and traceability in highly regulated sectors such as food and pharmaceuticals has reinforced the adoption of automatic systems As global manufacturers focus on accelerating packaging timelines while maintaining precision, the automatic segment is expected to remain the backbone of modern shrink sleeve operations.

The food and beverages end-use industry is anticipated to contribute 48.6% of the overall revenue share in the shrink sleeve wrapping machinery market in 2025, reflecting its leading role in driving machinery adoption. The segment’s dominance is influenced by the widespread use of shrink sleeves for full-body labeling, tamper evidence, and branding enhancement in packaged food and drink products.

Demand has been driven by consumer preferences for visually appealing packaging, along with the need for clear labeling to meet regulatory standards. Shrink sleeve systems offer the flexibility to accommodate diverse container shapes and materials, making them ideal for dynamic product portfolios in beverages, dairy, sauces, and ready-to-eat categories.

The sector’s shift toward premiumization, product differentiation, and seasonal packaging has necessitated machinery that supports quick format changes and digital print compatibility As the food and beverage industry continues to expand in both developed and emerging economies, shrink sleeve machinery tailored to hygiene, speed, and customization is expected to see sustained investment.

Global FMCG market online sales grew by 26% in 2020, revealed by Kantar Worldpanel’s quarterly FMCG E-commerce Index. FMCG goods have limited shelf life and costs low. This necessity has led the global FMCG manufacturers to look for efficient and low-cost packaging and packaging systems.

The large volumes of FMCG goods have to be bundled in a faster way. Shrink-sleeve wrapping machines are used to wrap the polyethylene (PE) shrink films around the group of products both similar and non-similar. PE films can be printed or non-printed or clear or opaque.

When heat is applied the film will hold the bundle tightly. Global shrink-sleeve wrapping machinery market is growing at a healthy phase. In last decade the major innovations have happened to improve the performance and speed of these machines.

Manufacturers of shrink-sleeve machinery are striving to improve the machine’s performance furthermore. Growing worldwide consumer goods consumption levels directly or indirectly driving the shrink-sleeve machinery market.

Globally shrink - sleeve wrapping machinery market is witnessing a healthy growth due to increased demand for high speed and low-cost shrink-sleeve wrapping by FMCG industry players. FMCG industries are labor intensive and the labor cost constitutes the large part of the operating costs.

Shrink-sleeve wrapping machines help the FMCG manufacturers to cut down the labor cost. FMCG players may outsource the packaging to contract fillers or packaging companies. This may result in huge packaging cost charged by contract fillers or packaging companies.

To avoid this FMCG manufacturer started in-house packaging using machines such as high-speed shrink-sleeve wrapping machinery. Shrink-sleeve wrapping machinery available in the variety of models. The flexibility in bundling different products and the changeover times are still to be improved.

Still, more than 60% of the installed machines worldwide requires the manual placing of the products on the conveyer belt. A fully automated low-cost shrink-sleeve wrapping machines segment will be the next big opportunity for shrink-sleeve wrapping machinery manufacturers.

Growing raw material inflation is the restraint for the growth of shrink-sleeve machinery market. Steel, aluminum, and plastic are used as the major raw materials in the manufacturing of shrink-sleeve wrapping machines.

Shrink - sleeve wrapping machinery market has been segmented on the basis of the region into North America, Latin America Eastern Europe, Western Europe, Asia Pacific Excluding Japan (APEJ), Middle East & Africa (MEA), and Japan. Shrink - sleeve wrapping machinery market in Western Europe is dominating the global shrink-sleeve machinery market.

The matured markets like Germany, Italy, and France are contributing to this fact. In APEJ China and Korea are expected to drive the regional growth over the forecast period. Many APEJ countries like India and China have small players but large in number.

Some of the players in the global Shrink - Sleeve Wrapping Machinery market are Polypack, 3M Company, Texwrap, Packaging Systems, ARPAC LLC, Axon, Duravant, Eastey Enterprises, Kliklok-Woodman, Massman Automation Designs LLC, PakTech, PDC International Corp, Standard-Knapp Inc., Gebo Cermex and Tripack, Shrinkwrap Machinery Co. Ltd., etc.

The global shrink - sleeve wrapping machinery market is estimated to be valued at USD 17.8 billion in 2025.

The market size for the shrink - sleeve wrapping machinery market is projected to reach USD 30.5 billion by 2035.

The shrink - sleeve wrapping machinery market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in shrink - sleeve wrapping machinery market are intermittent motion shrink-sleeve machines and continuous motion shrink-sleeve machines.

In terms of technology, automatic segment to command 57.4% share in the shrink - sleeve wrapping machinery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrink Wrapper Market Size and Share Forecast Outlook 2025 to 2035

Shrink Label Machine Market Size and Share Forecast Outlook 2025 to 2035

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Shrink Bundling Film

Analyzing Shrink Label Machine Market Share & Industry Leaders

Shrink Bundling Film Market by Material Type from 2024 to 2034

Shrink Bundling Machine Market Trends & Forecast 2024-2034

Shrink Tanks Market

Shrink Bands Market

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Shrink Wrapping Machines Providers

Shrink Wrapping Machine Market

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Shrink Sleeve Labels Providers

Industry Share Analysis for Shrink Sleeve Label Applicator Manufacturers

Shrink Sleeve Labels Market Analysis by Flexographic and Digital Printing Through 2034

Shrink Sleeve Labeling Equipment Market

VCI Shrink Film Market Growth & Corrosion Protection Trends 2024-2034

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA