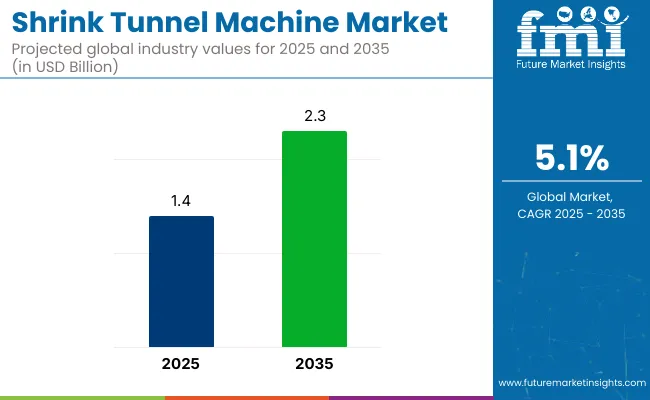

The global shrink tunnel machine market is estimated to record a valuation of USD 1.4 billion in 2025 and USD 2.3 billion by 2035, at a CAGR of 5.1% during the forecast period. Growth is driven by the increasing demand for efficient packaging solutions in industries such as food and beverage, pharmaceuticals, consumer goods, and electronics.

Shrink tunnel machines are widely used for packaging products in shrink film, ensuring product safety, freshness, and shelf appeal. The need for improved packaging solutions is accelerating the adoption of shrink tunnel machines across different sectors globally.

Technological advancements in automation and energy efficiency are fueling innovations in shrink tunnel machines. The increasing adoption of eco-friendly shrink films and energy-saving packaging technologies is positively influencing the industry dynamics.

The development of smart shrink tunnel machines, integrated with IoT technology, is enabling manufacturers to optimize production lines and monitor real-time performance. These advancements are driving the demand for high-speed packaging systems, especially in industries requiring mass production. Additionally, artificial intelligence and machine learning applications are improving operational efficiency and reducing waste.

Leading manufacturers such as Sealed Air, Duravant, Sato Holdings, Krones AG, Adpak Machinery Systems Ltd, American Film & Machinery (AFM), Beck Packautomaten, Eastey, and ULMA Packaging are focusing on product innovation, strategic partnerships, and global industry expansion.

The increasing demand for customized packaging solutions and automated packaging systems is expected to drive industry growth. “You’ve got product that potentially reaches a consumer’s porch and it’s fully contained, opaque, confidentially wrapped, and ready to take on any kind of weather elements that a package might see,” said Joe Morrissey, CEO of Conflex Incorporated.

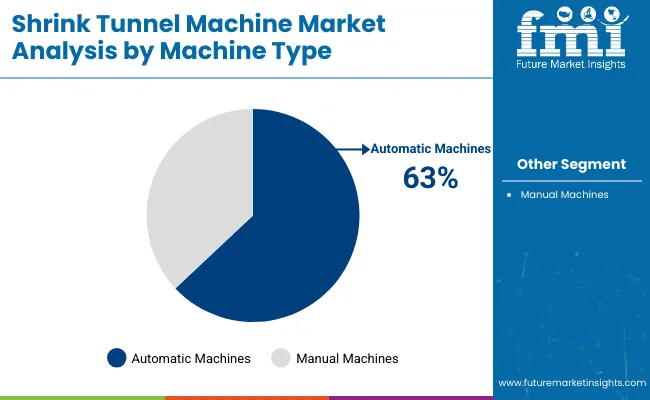

The industry is expected to see strong growth in 2025, driven by increasing demand for automated packaging solutions, with key focus areas including automatic machines, food and beverage end-use applications, and PVC shrink film.

Automatic shrink tunnel machines are projected to dominate the industry, capturing 63% of the industry share in 2025. Their high efficiency, speed, and ability to handle large-scale production make them ideal for industries requiring high-throughput packaging.

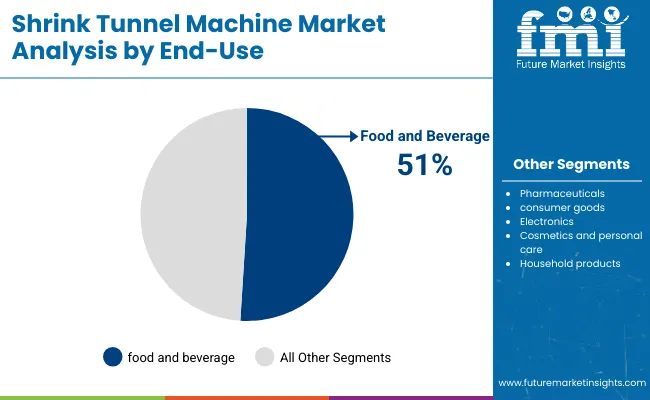

The food and beverage sector is anticipated to account for 51% of the shrink tunnel industry share in 2025, driven by the growing need for efficient, protective packaging solutions. Shrink tunnels are commonly used in food and beverage packaging for products like bottles, cans, and pouches, where product preservation and presentation are crucial.

PVC shrink film is projected to capture 35% of the industry share in 2025. Known for its excellent clarity, strength, and cost-effectiveness, PVC shrink film remains the preferred choice for packaging in several industries, particularly in food and beverage, retail, and pharmaceuticals.

The industry is being driven by increasing demand for efficient packaging solutions across industries. Technological advancements and e-commerce growth are propelling expansion, though high investment costs and labor requirements limit growth.

Increasing demand for efficient packaging solutions is driving industry growth.

The demand for efficient and cost-effective packaging solutions is being significantly boosted by the growing need across various industries. Shrink tunnel machines are being adopted for their ability to apply shrink films, ensuring secure and tamper-evident packaging. Industries such as food and beverage, pharmaceuticals, and consumer goods are increasingly utilizing shrink tunnel machines to meet their packaging needs.

These machines are being preferred for their versatility in handling different product sizes and shapes. As global trade and consumer goods production continue to rise, the adoption of shrink tunnel machines is expected to increase correspondingly.

High initial investment costs and the need for skilled labour are limiting industry expansion.

Despite the benefits, the adoption of shrink tunnel machines is being limited by high initial investment costs and the requirement for skilled labor. The substantial capital expenditure required for purchasing and installing these machines is creating a barrier for small and medium-sized enterprises.

Furthermore, operating and maintaining shrink tunnel machines require trained personnel, which adds to the overall operational costs. In regions with limited access to skilled labor, the adoption of these technologies is being slowed. To overcome these challenges, cost-effective solutions and training programs are being developed to facilitate broader adoption.

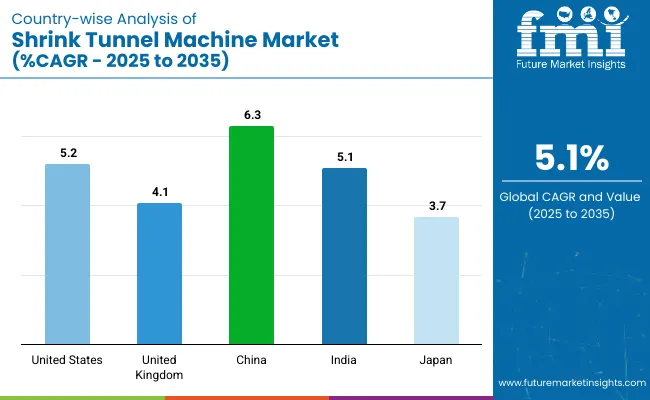

The shrink tunnel machine industry is expected to grow steadily through 2035, driven by increasing demand for packaging automation and efficiency. Rapid industrialization in China and India, along with innovation in the United States and United Kingdom, fuels industry expansion.

| Countries | CAGR (%) |

|---|---|

| United States | 5.2% |

| United Kingdom | 4.1% |

| China | 6.3% |

| India | 5.1% |

| Japan | 3.7% |

The United States shrink tunnel machine industry is projected to grow at a CAGR of 5.2% through 2035. Growth is supported by increasing demand for packaging automation in the food, beverage, and pharmaceutical industries. Leading companies such as Shrink Packaging Systems, PAC Machinery, and ProMach are enhancing shrink tunnel technology with innovations focused on efficiency.

The United Kingdom shrink tunnel machine industry is expected to grow at a CAGR of 4.1% through 2035. Companies like B&H Labeling Systems, UK Packaging, and Multivac are developing machines that offer higher efficiency and reduced environmental impact.

The industry in China is projected to grow at a CAGR of 6.3% through 2035. Expansion is being driven by rapid industrialization and increased demand for packaging automation. Domestic companies like Shanghai Ruian and Jinan Xintian Packaging Machinery are investing heavily in developing advanced shrink tunnel technology.

The shrink tunnel machine industry in India is expected to grow at a CAGR of 5.1% through 2035. The industry is being fueled by expanding industrial infrastructure and rising demand for efficient packaging solutions. Companies like Universal Packaging and Altech are providing advanced shrink tunnel solutions for food, beverage, and pharmaceutical sectors.

The industry in Japan is forecasted to grow at a CAGR of 3.7% through 2035. Growth is being driven by technological advancements and stringent environmental regulations.

The industry is a blend of established companies and emerging players. Leading suppliers like Accutek Packaging Company, Inc., Sealed Air, and nVenia dominate with their advanced packaging solutions. These companies focus heavily on R&D, regularly launching products with improved energy efficiency and automation features.

For example, Sealed Air has introduced sustainable packaging innovations, while ATW Manufacturing has optimized shrink tunnel machines for various industries. Emerging players such as RuiYouna and ISG PACK focus on regional expansion and offering specialized solutions to cater to niche markets.

The industry is fragmented, with both large-scale and small manufacturers competing for share. Entry barriers are moderate, driven by high initial capital investments and technological expertise. While consolidation is observed, with companies like minipack®-torre S.p.A. acquiring smaller firms, the industry remains dynamic. Ongoing R&D and strategic mergers are crucial to staying competitive in this ever-evolving landscape.

Recent Shrink Tunnel Machine Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 2.3 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Machine Types Analyzed (Segment 1) | Automatic machines; Manual machines |

| Shrink Film Types Analyzed (Segment 2) | PVC shrink film; PET shrink film; Polyolefin shrink film; Other materials (PE, PP) |

| End-Use Segments Covered (Segment 3) | Food and beverage, Pharmaceuticals, Consumer goods, Electronics, Cosmetics and personal care, Household products |

| Regions Covered | North America, Europe, Asia Pacific, Latin America |

| Countries Covered | United States; Canada; Mexico; Germany; France; United Kingdom; Italy; Spain; Netherlands; China; India; Japan; South Korea; Brazil; Argentina; Australia |

| Key Players Influencing the Industry | Accutek Packaging Company, Inc., NVenia, Sealed Air, ATW Manufacturing Company, Inc., Procus Machinery, XINHUA, Rui Youna, Hualian, ISG PACK, and minipack ®- Torre S.p.A. |

| Additional Attributes | Dollar sales by machine type (automatic vs manual); Growth of shrink film applications in green packaging; Trends in energy-efficient shrink tunnel machines; Regional adoption patterns in food, beverage, and pharmaceutical industries |

Automatic machines and manual machines.

PVC shrink film, PET shrink film, polyolefin shrink film, and other materials like PE and PP.

Food and beverage, pharmaceuticals, consumer goods, electronics, cosmetics, personal care, and household products.

North America, Europe, Asia Pacific, and Latin America.

The industry is expected to reach USD 2.3 billion by 2035.

The industry size is projected to be USD 1.4 billion in 2025.

The industry is expected to grow at a CAGR of 5.1% from 2025 to 2035.

Key players include Accutek Packaging Company, Inc., nVenia, Sealed Air, ATW Manufacturing Company, Inc., Procus Machinery, XINHUA, Rui Youna, Hualian, ISG PACK, and minipack®-torre S.p.A.

Key factors include the increasing demand for packaging solutions in various industries, advancements in machine technology, and the growing need for efficient packaging systems.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrink Wrapper Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Shrink Bundling Film

Market Share Distribution Among Shrink Sleeve Labels Providers

Industry Share Analysis for Shrink Sleeve Label Applicator Manufacturers

Shrink Sleeve Labels Market Analysis by Flexographic and Digital Printing Through 2034

Shrink Bundling Film Market by Material Type from 2024 to 2034

Shrink Sleeve Labeling Equipment Market

Shrink Tanks Market

Shrink Bands Market

Shrink Label Machine Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Shrink Label Machine Market Share & Industry Leaders

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Shrink Wrapping Machines Providers

Shrink Bundling Machine Market Trends & Forecast 2024-2034

Shrink Wrapping Machine Market

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Ops Shrink Label Market Size and Share Forecast Outlook 2025 to 2035

VCI Shrink Film Market Growth & Corrosion Protection Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA