The Shrink Wrapper Market is estimated to be valued at USD 529.0 million in 2025 and is projected to reach USD 664.1 million by 2035, registering a compound annual growth rate (CAGR) of 2.3% over the forecast period.

The Shrink Wrapper market is experiencing significant growth driven by the increasing demand for efficient packaging solutions across manufacturing, warehousing, and logistics industries. The future outlook for this market is influenced by the rising need for automation and operational efficiency, which enhances productivity and reduces labor costs. Growing emphasis on product safety, shelf appeal, and damage prevention is also fueling the adoption of shrink wrapping solutions.

Investments in modern packaging infrastructure, coupled with advancements in machinery and software-enabled control systems, are further supporting market expansion. The demand for sustainable and cost-effective packaging solutions is encouraging manufacturers to adopt advanced shrink wrapping technologies.

Additionally, the shift towards semi-automated and fully automated processes is expected to optimize throughput, reduce material wastage, and improve overall process reliability As businesses aim to enhance packaging efficiency and maintain product quality, the Shrink Wrapper market is poised for continued growth across industrial and commercial applications.

| Metric | Value |

|---|---|

| Shrink Wrapper Market Estimated Value in (2025 E) | USD 529.0 million |

| Shrink Wrapper Market Forecast Value in (2035 F) | USD 664.1 million |

| Forecast CAGR (2025 to 2035) | 2.3% |

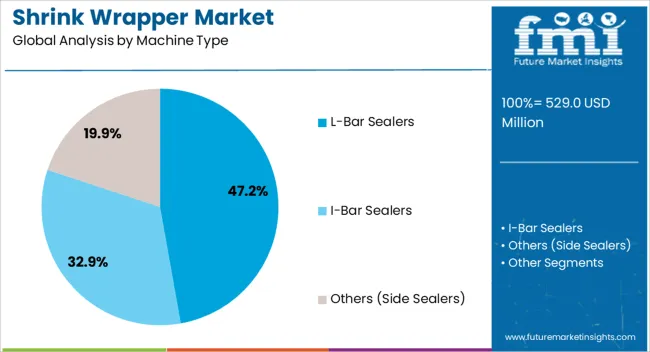

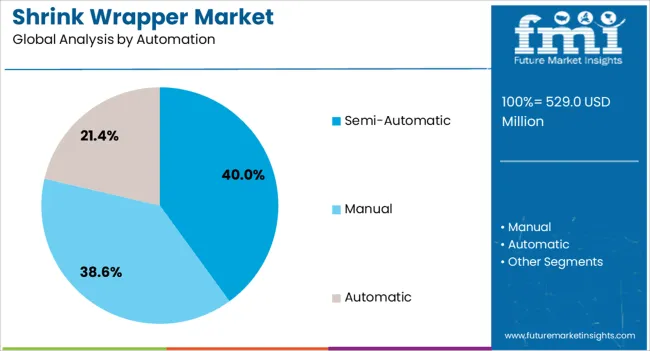

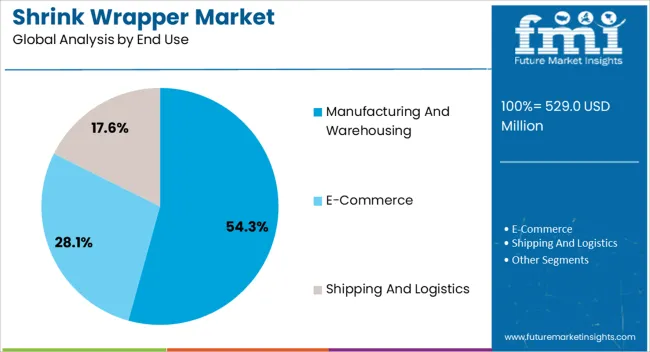

The market is segmented by Machine Type, Automation, and End Use and region. By Machine Type, the market is divided into L-Bar Sealers, I-Bar Sealers, and Others (Side Sealers). In terms of Automation, the market is classified into Semi-Automatic, Manual, and Automatic. Based on End Use, the market is segmented into Manufacturing And Warehousing, E-Commerce, and Shipping And Logistics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The L-Bar Sealers segment is projected to hold 47.20% of the Shrink Wrapper market revenue share in 2025, making it the leading machine type. The dominance of this segment is attributed to the versatility of L-Bar Sealers in handling various packaging formats and product sizes.

The segment has benefited from improvements in sealing precision and cycle efficiency, which enhance overall packaging quality. Growing adoption in industries requiring secure and attractive packaging solutions has reinforced the prominence of L-Bar Sealers.

Additionally, their compatibility with different shrink films and ease of operation have contributed to their widespread acceptance The segment’s growth is further supported by rising demand for efficient packaging workflows and the need to maintain product integrity during storage and transportation.

The Semi-Automatic automation segment is expected to capture 40.00% of the Shrink Wrapper market revenue share in 2025, positioning it as the leading automation type. The growth of this segment is driven by the balance it offers between operational efficiency and cost-effectiveness.

Semi-automatic systems allow businesses to achieve improved throughput while maintaining flexibility for varying production volumes. Their ease of integration with existing workflows and reduced requirement for specialized labor has accelerated adoption.

Additionally, the ability to customize operations and scale productivity without a complete transition to full automation has reinforced the prominence of semi-automatic systems The segment continues to benefit from demand in small and medium-scale manufacturing and warehousing facilities seeking efficient yet adaptable packaging solutions.

The Manufacturing and Warehousing end-use industry segment is anticipated to account for 54.30% of the Shrink Wrapper market revenue in 2025, making it the leading industry segment. This substantial share is driven by the high volume of packaged goods handled in manufacturing and storage environments, necessitating reliable and efficient shrink wrapping solutions.

The adoption of shrink wrappers enhances operational efficiency, reduces product damage, and improves inventory handling processes. Businesses are increasingly prioritizing packaging standardization, quality control, and process optimization, which has fueled demand for advanced shrink wrapping technologies.

Furthermore, the scalability, flexibility, and integration capabilities of shrink wrappers make them suitable for diverse industrial applications The growing focus on cost reduction, productivity improvement, and supply chain optimization continues to support the dominance of the manufacturing and warehousing segment in the market.

E-commerce Growth to Spur Global Shrink Wrapper Market Size and Share

E-commerce networks have been growing as consumer demand increases. Due to this trend, leading shrink-wrapper companies can supply a wider landscape, fueling their advancement. The shrink wrapper worldwide outlook fosters the trend as it supports several growth drivers for the shrink wrapper market.

The development of the e-commerce industry spurred the demand for effective transportation. To avoid any damage to products and goods, the organizations will become keener to pack such goods better.

During the transportation and storage of goods, products might get tampered with due to external effects. This can hamper the credibility of the organization.

To avoid the loss of brand image, key players focused on using shrink wrappers such that packaging films can help firms prevent damage to products. Various aspects of the supply chain use such films to provide an additional layer of safety to products.

Convenience Food to Raise Global Shrink Wrapper Market Size and Share

With the changing consumer lifestyle, consumer preferences have also changed. Due to the rapid urbanization, consumers are shifting toward convenience food and packaged consumables. This drives the demand for packaging material. As a result, this driver will elevate the shrink wrapper market valuation and size.

The rapid urbanization has accelerated the pace of lives of individuals. Due to the growing speed, people tend to spend lesser time on food preparation, which surges the demand for staple food. The food and beverage industry exploits the maximum benefits through this vertical, which capitalizes on the growing need for staple food items.

To pack such food items, shrink wrapper films are used. Such films also help food manufacturers to keep the food attractive and shelf-life of items can be increased. Despite health being a concern, the demand for such convenience food will likely increase in the forecasted period, and this will drive the industry.

Wastage Concern to Harm the Shrink Wrapper Market Valuation and Size

Plastic shrink wrap market size and trends suggest that plastic use is growing in the packaging sector. The threat of waste generation increases due to the lesser recyclability of this plastic. This threatens to reduce consumer attention, thus hampering industrial development.

Plastic wrappers or shrinkage wrappers are designed for use-and-throw purposes. This creates the chance for elevated wastage caused by such films or wrappers. As such factors do not help manufacturers adhere to sustainability policies, the prospects for key players might reduce due to the growing legal compliance issues.

The historical figures suggest that the global shrink wrapper market size and share progressed sluggishly at a CAGR of 1.4%. The last recorded shrink wrapper market valuation and size was USD 472.1 million, recorded in 2020.

The elevated demand for packaged goods and e-commerce businesses gaining traction during the period justify the growth of the global shrink wrapper market size and share. Despite the industry being affected due to various issues, the spurring demand for the transportation of pharmaceutical goods supported the leading shrink wrapper companies.

The growing reach of organizations in different parts increased the business scope. Due to this, the transportation and storage of goods became of growing concern for manufacturers.

Such needs drive the demand for efficient packaging solutions that can support the standards of packaging and storage of goods. The shelf-life of goods was also elevated using shrink wrappers, driving the demand in the historical period.

The forecasted period will encompass the increase in the shrink wrapper market valuation and size due to the growing inclination toward FMCG segments.

The transport and storage of such goods will spur the demand for shrink films. Due to the surging vertical in fast-moving consumer goods, the requirement for tight packaging to enhance transportation speed surged, driving the sales of shrink wrapper films.

Along with such factors, the growing food and beverage industry seeks better packaging solutions in terms of achieving better scalability. Many businesses aim to position a brand better through attractive packaging, which can be achieved using shrink wrapper films.

With better technology, shrink wrapper players in North America will likely benefit, contributing vastly to industrial progress. Similar to North America, the shrink wrapper demand in Europe will likely spur, helping the region to contribute to the global shrink wrapper market size and share. Emerging industries in Asia-Pacific will generate better prospects for the sector.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| The United Kingdom | 0.7% |

| The United States of America | 0.9% |

| India | 5.1% |

The overall shrink wrapper demand in Europe will elevate the shrink wrapper market valuation and size in the United Kingdom at a CAGR of 0.7% through 2035.

With the growing food and beverage sector in the United Kingdom, the demand for packaging solutions will spur. The consumer inclination toward convenience and staple food will also likely elevate due to changing lifestyles, requiring shrink films. Such factors will help the country contribute to the global shrink wrapper market size and share.

Compared to the shrink wrapper worldwide outlook, the industry in the United States will advance extremely sluggishly at a CAGR of 0.9% through 2035.

With the growing fast-moving consumer goods industry in the country, leading shrink wrapper companies are required to supply efficient packaging solutions to multiple sectors. Coupled with the growth of the e-commerce ecosystem in the country, the abovementioned prospects enlarge the shrink wrapper market valuation and size.

The shrink wrapper industry forecast predicts that India will likely lead the global landscape and will advance at a moderate CAGR of 5.1% through the forecasted period.

The development of the retail chain in India will capitalize on offline distribution channels. Marketers will seek better packaging alternatives to elevate brand positioning in retail outlets.

The wholesale industry in the country will also experience steady progress. Due to this, leading shrink-wrapper companies will be encouraged to supply products in the industry, shaping the shrink-wrapper industry forecast.

With growing technological innovation in the industry, shrink-wrapping films can be prepared using different machinery. The application of such films can be extended to various openings. Depending on the necessity of wrappers, leading shrink-wrapper companies can deliver films for varying purposes. This will likely elevate the industry progress rate.

| Category | Machine Type- I-bar Sealers |

|---|---|

| Industry Share in 2025 | 47.2% |

Leading shrink-wrapper companies highly emphasize product integrity. Due to this, organizations focus on tight seals, which can be accomplished with the help of I-bar sealers. The versatility of sealers helps the segment gain popularity in the industry, enlarging the shrink wrapper market valuation and size.

Due to the growing emphasis on the aesthetics of the product, the packaging of the product has gained more importance. With marketers being more attentive to product placement, elevated packaging standards are used. This drives the demand for I-bar sealers, which can deliver tamper-free yet attractive product packaging.

| Category | End Use- Manufacturing and Warehousing |

|---|---|

| Industry Share in 2025 | 54.3% |

Manufacturing companies have started to focus on optimization processes to meet sustainability standards. To achieve this, firms choose space optimization, which requires suitable packaging films.

Shrink wrappers can tightly pack goods, reducing space occupancy and enhancing sustainable storage. Such factors drive the demand for the segment, helping the sector contribute to the global shrink wrapper market size and share.

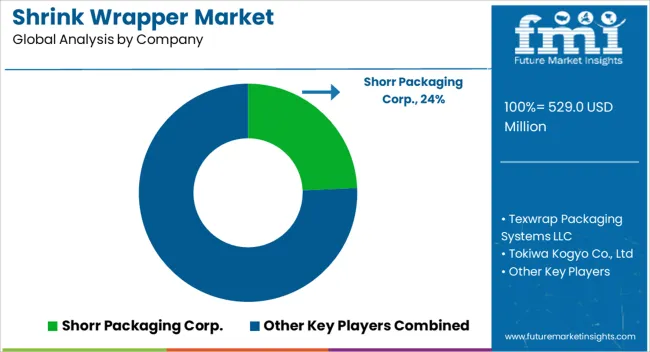

Leading shrink wrapper players worldwide have occupied a substantial industry share. With the higher negotiating force exerted, the competitive landscape is cluttered, hindering the smooth entrance of new entrants.

Such firms expand using expansion strategies like product launches, collaborations, partnerships, mergers, and acquisitions. New entrants can focus on process innovation to gain a larger industry share.

The following recent developments have been shaping the shrink wrapper worldwide outlook

Shorr Packaging Corp., Texwrap Packaging Systems LLC, nVenia LLC., Eastey Enterprises Inc., Standard-Knapp, Inc., Shrinkwrap Machinery Co. Ltd., Klikwood Corporation, Sidel Group, Robopac-Aetna Group S.p.A, Clearpack, Shivansh Packaging Machines, Sealers India Packing Solution, USA Packaging & Wrapping LLC., Xiamen Fushide Packing Machinery Co., Ltd., Tokiwa Kogyo Co., Ltd., Tufcoat ltd, aetna group uk, KALLFASS VERPACKUNGSMASCHINEN GMBH, and trepko are key competitors in the ecosystem.

Depending on the machine type, the industry is segmented into L-bar Sealers, I-bar Sealers, and Others (Side Sealers).

Manual, Semi-Automatic, and Automatic are key segments in the said category.

Manufacturing and Warehousing, E-commerce, and Shipping and Logistics are key end-users of shrink wrappers.

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and The Middle East and Africa are the key contributing regions to the industry.

The global shrink wrapper market is estimated to be valued at USD 529.0 million in 2025.

The market size for the shrink wrapper market is projected to reach USD 664.1 million by 2035.

The shrink wrapper market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in shrink wrapper market are l-bar sealers, i-bar sealers and others (side sealers).

In terms of automation, semi-automatic segment to command 40.0% share in the shrink wrapper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Shrink Label Machine Market Size and Share Forecast Outlook 2025 to 2035

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Shrink Bundling Film

Analyzing Shrink Label Machine Market Share & Industry Leaders

Market Share Insights for Shrink Wrapping Machines Providers

Market Share Distribution Among Shrink Sleeve Labels Providers

Industry Share Analysis for Shrink Sleeve Label Applicator Manufacturers

Shrink Sleeve Labels Market Analysis by Flexographic and Digital Printing Through 2034

Shrink Wrapping Machines Market by Automation Level Through 2034

Shrink Bundling Film Market by Material Type from 2024 to 2034

Shrink Bundling Machine Market Trends & Forecast 2024-2034

Shrink Sleeve Labeling Equipment Market

Shrink Wrapping Machine Market

Shrink Tanks Market

Shrink Bands Market

VCI Shrink Film Market Growth & Corrosion Protection Trends 2024-2034

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA