The shrink sleeve labeling machine is estimated to be valued at USD 676.8 million in 2025 and is projected to reach USD 992.2 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. This market follows a clear maturity curve and adoption lifecycle, transitioning through distinct growth phases. During the early adoption phase from 2020 to 2024, the market value rises from USD 559.0 million in 2020 to around USD 651.4 million by 2024.

Growth is driven by niche applications in beverage, food, and pharmaceutical packaging. Companies focus on pilot installations and targeting early adopters seeking high-quality labeling solutions. Expansion is gradual, reflecting cautious investment and growing awareness of automation benefits. Between 2025 and 2030, the market enters a scaling phase, increasing from USD 676.8 million in 2025 to approximately USD 788.7 million by 2030. Wider adoption occurs across mid-sized and large enterprises as the efficiency, speed, and reliability of shrink sleeve machines demonstrate clear return on investment. Manufacturers focus on research and development, modular solutions, and enhanced service networks to capture broader market share.

Revenue growth accelerates and technology penetration rises significantly. From 2030 to 2035, the market moves into consolidation, reaching USD 992.2 million by 2035. Growth moderates as competition stabilizes and the market consolidates around established global and regional players. Incremental improvements in energy efficiency, speed, and customization drive continued adoption while mergers and strategic partnerships strengthen market structure.

Packaging engineers evaluate shrink sleeve equipment specifications based on application speed, container compatibility, and heat tunnel performance when integrating labeling systems into existing production lines or designing new packaging facilities. Equipment selection involves analyzing sleeve feeding mechanisms, cutting precision, and shrinkage control while considering changeover requirements, maintenance accessibility, and operator safety features necessary for multi-product manufacturing environments. Procurement decisions balance initial capital investment against operational efficiency gains including reduced labor requirements, improved label placement accuracy, and enhanced production line flexibility that supports diverse container formats and sleeve materials.

Manufacturing processes require precise heat application systems, conveyor synchronization, and quality control mechanisms that ensure consistent sleeve placement and shrinkage characteristics across varying container geometries and production speeds. Production coordination involves managing sleeve material specifications, heat tunnel temperature profiles, and conveyor timing while maintaining consistent labeling quality throughout extended production runs. Equipment maintenance protocols establish inspection schedules, heating element replacement procedures, and calibration requirements that maximize machine availability while preventing unplanned downtime during critical production periods.

| Metric | Value |

|---|---|

| Shrink Sleeve Labeling Machine Estimated Value in (2025 E) | USD 676.8 million |

| Shrink Sleeve Labeling Machine Forecast Value in (2035 F) | USD 992.2 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

The shrink sleeve labeling machine market is witnessing sustained momentum driven by the growing demand for visually impactful packaging, product security features, and brand differentiation across fast-moving consumer goods. Shrink sleeve labels offer 360-degree design coverage, tamper evidence, and compatibility with a wide range of container shapes and materials.

These benefits have led to widespread adoption in sectors such as beverages, personal care, and household chemicals. The rise in small and mid-sized manufacturing units and the increasing emphasis on automation and packaging efficiency are also fueling demand.

Manufacturers are investing in energy-efficient systems with higher throughput and reduced material waste, aligning with sustainability goals. The market outlook remains optimistic as businesses prioritize packaging solutions that enhance shelf appeal, support regulatory compliance, and improve supply chain resilience.

The shrink sleeve labeling machine is segmented by type, container type, container diameter, sleeve capacity, end use industry, distribution channel, and geographic regions. By type, the shrink sleeve labeling machine is divided into Manual shrink sleeve machines, Semi-automatic shrink sleeve machines, and fully automatic shrink sleeve machines. In terms of container type, the shrink sleeve labeling machine is classified into Bottles, Cans, Jars, and Other containers.

Based on the container diameter, the shrink sleeve labeling machine is segmented into Up to 50 mm, 50 to 100 mm, 100 to 150 mm, and Above 150 mm. By sleeve capacity, the shrink sleeve labeling machine is segmented into up to 300 units/min, 300 to 400 units/min, 400 to 600 units/min, and above 600 units/min. By end use industry, the shrink sleeve labeling machine is segmented into Food & beverages, Pharmaceuticals, Cosmetics & personal care, Chemicals and fertilizers, Automotive, and Others (nutraceuticals, etc.).

By distribution channel, the shrink sleeve labeling machine is segmented into Direct sales and Indirect sales. Regionally, the shrink sleeve labeling machine is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual shrink sleeve machines segment is projected to account for 41.20% of total market revenue by 2025 within the type category, making it the leading sub-segment. This dominance is attributed to the segment's affordability, ease of setup, and suitability for small batch production environments.

Manual systems are particularly favored by emerging brands, craft product manufacturers, and businesses operating with limited automation requirements. The minimal capital investment and space efficiency of manual machines have also strengthened their presence in local and regional packaging operations.

As product personalization and niche market launches gain traction, the continued use of manual machines for short run applications is supporting their sustained relevance in the type segment.

The bottles sub-segment is expected to hold 47.60% of the market by 2025 within the container type category. This is driven by the widespread use of bottles across the beverage, personal care, and pharmaceutical sectors.

Bottles provide a large surface area for full-body shrink sleeve labels, allowing enhanced branding, regulatory content, and tamper evidence. Their uniform shape and compatibility with automated application systems make them a preferred choice for high-speed production lines.

In addition, the ongoing demand for visually distinct, recyclable packaging formats is supporting the integration of shrink sleeve labels on plastic, glass, and metal bottles. The versatility and wide applicability of bottles continue to reinforce their dominance in the container type category.

The up to 50 mm container diameter segment is anticipated to contribute 34.90% of total market revenue by 2025 under the container diameter category. This is due to the proliferation of compact product formats across cosmetics, beverages, and pharmaceuticals, where smaller diameter containers are widely used.

The demand for on-the-go products and single-serve packaging formats has further boosted the usage of smaller containers requiring precise and flexible labeling solutions. Machines catering to this diameter range are valued for their ability to handle small, lightweight containers with accuracy and speed.

Their adaptability to high-mix, low-volume production has solidified the segment’s strong market position.

The shrink sleeve labeling machine market is witnessing growth driven by rising demand for attractive, tamper-evident, and full-body labeling solutions across food & beverages, pharmaceuticals, personal care, and household products. These machines enable seamless branding, promotional graphics, and regulatory information on various container shapes and sizes. North America and Europe lead due to advanced packaging industries and high automation adoption, while Asia-Pacific shows significant growth owing to expanding FMCG sectors. Market trends include automation, high-speed operations, energy-efficient designs, and integration with smart manufacturing systems. Manufacturers are innovating for flexible formats, precise shrink control, and digital connectivity to enhance operational efficiency and reduce waste.

Shrink sleeve labeling machines involve complex mechanisms for sleeve feeding, application, and shrink tunneling, which can result in operational challenges. Frequent maintenance, calibration, and skilled labor requirements increase downtime risks. Variability in container shapes and sleeve materials necessitates machine adjustments, impacting production efficiency. Until user-friendly, automated, and self-adjusting solutions become widespread, manufacturers may face difficulties in ensuring consistent labeling quality, operational uptime, and cost-efficient operations, particularly in high-volume packaging lines.

Innovations in automation, servo-driven systems, digital controls, and IoT-enabled monitoring are enhancing machine performance. High-speed labeling, precise sleeve alignment, and advanced shrink tunnel designs reduce material waste and improve throughput. Integration with production line software allows real-time monitoring, predictive maintenance, and quality assurance. Companies investing in modular, energy-efficient, and customizable machines gain competitive advantage, enabling packaging operations to meet diverse container formats, sleeve materials, and compliance requirements while optimizing production costs.

Packaging industries, particularly pharmaceuticals and food & beverages, require labeling machines to comply with safety, hygiene, and quality standards. Machines must ensure tamper-evident and accurate labeling, while accommodating regulations for batch codes, barcodes, and nutritional or safety information. Non-compliance can lead to recalls, fines, and reputational risks. Manufacturers aligning equipment with international quality certifications, safety protocols, and industry standards enhance market acceptance and customer trust, especially in regulated markets like Europe and North America.

The market features established machine manufacturers and emerging regional players competing on performance, customization, and cost. Buyers often prioritize brand reputation, after-sales support, and machine reliability. Supply chain factors, including availability of high-quality components and technical service networks, impact market penetration. Competitive differentiation is driven by innovations in speed, energy efficiency, versatility for container shapes, and digital integration for smart factories. Companies offering comprehensive solutions with training, maintenance, and upgrade options gain preference among packaging industries seeking long-term operational efficiency.

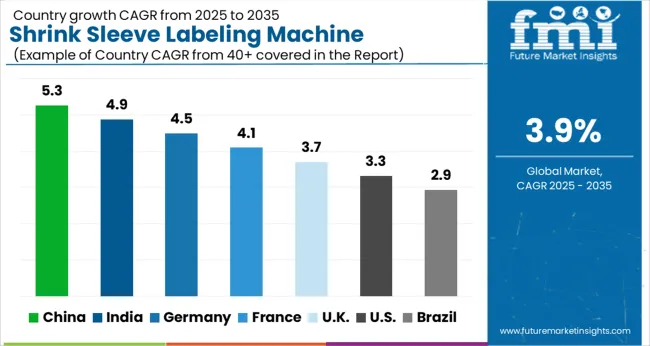

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The global Shrink Sleeve Labeling Machine Market is projected to grow at a CAGR of 3.9% through 2035, supported by increasing demand across packaging, beverage, and consumer goods applications. Among BRICS nations, China has been recorded with 5.3% growth, driven by large-scale production and deployment in packaging and labeling operations, while India has been observed at 4.9%, supported by rising utilization in beverage and consumer product packaging. In the OECD region, Germany has been measured at 4.5%, where production and adoption for industrial, beverage, and packaging sectors have been steadily maintained. The United Kingdom has been noted at 3.7%, reflecting consistent use in packaging and labeling applications, while the USA has been recorded at 3.3%, with production and utilization across consumer goods, beverage, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The shrink sleeve labeling machine market in China is growing at a CAGR of 5.3%, driven by rapid growth in the beverage, food, and personal care industries. Increasing demand for attractive packaging, branding, and product differentiation fuels adoption. Advanced labeling machines offer high-speed performance, precise application, and compatibility with various container shapes and sizes, making them essential for large-scale manufacturing. Automation, integration with production lines, and energy-efficient designs further support market growth. The country’s expanding e-commerce and retail sectors also drive the need for visually appealing packaging, promoting the use of shrink sleeve labeling. Manufacturers are investing in technologically advanced machines to improve efficiency, reduce waste, and meet regulatory packaging requirements, ensuring steady growth across China’s industrial sectors.

Shrink sleeve labeling machine market in India is expanding at a CAGR of 4.9%, fueled by increasing industrialization, rising consumer demand, and growth in FMCG and pharmaceutical sectors. The need for high-quality packaging and brand differentiation drives adoption of advanced labeling machines. Features such as speed, accuracy, versatility for different container types, and integration with automated production lines enhance operational efficiency. With the rise of modern retail formats, e-commerce, and consumer preference for attractive packaging, demand for shrink sleeve labeling machines is accelerating. Investments in technologically advanced machinery and adherence to packaging standards are supporting market expansion. The combination of industrial growth, packaging innovation, and automation ensures steady adoption of shrink sleeve labeling solutions across India.

Germany’s shrink sleeve labeling machine market is growing at a CAGR of 4.5%, supported by high standards in industrial packaging, automation, and efficiency requirements. The food, beverage, pharmaceutical, and cosmetic sectors drive demand for advanced labeling solutions that ensure accuracy, speed, and compliance with labeling regulations. Machines with energy-efficient designs, flexible operation, and integration capabilities are highly preferred. Germany’s focus on sustainable and precise manufacturing encourages the adoption of high-quality labeling equipment. The presence of strong industrial infrastructure and technological innovation ensures continuous improvement and adoption of shrink sleeve labeling machines across manufacturing sectors.

The shrink sleeve labeling machine market in the United Kingdom is expanding at a CAGR of 3.7%, driven by demand in food, beverage, pharmaceutical, and cosmetic packaging. Companies are increasingly seeking machines that provide high-speed, accurate, and versatile labeling solutions for different container types. Automation and integration with production lines enhance productivity while reducing operational costs. The growth of modern retail formats and e-commerce, along with consumer preferences for attractive packaging, supports adoption. Regulatory standards and quality assurance measures further drive demand for reliable and advanced labeling machinery. As packaging innovation continues to influence product presentation, the UK market is expected to witness steady growth in shrink sleeve labeling solutions.

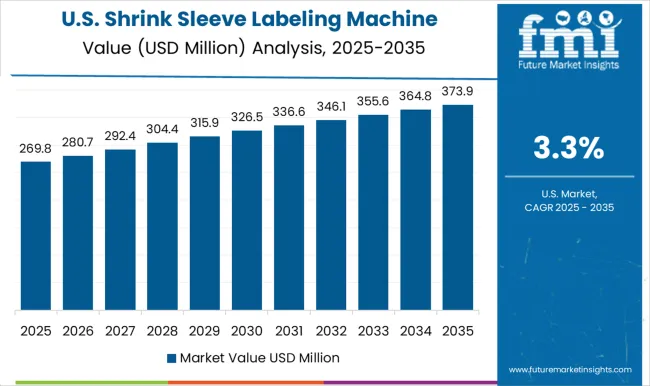

The USA shrink sleeve labeling machine market is growing at a CAGR of 3.3%, with demand coming from food, beverage, pharmaceutical, and cosmetic sectors. The need for efficient, precise, and visually appealing packaging drives adoption of advanced labeling machines. Automation, flexibility for various container types, and integration with production lines improve productivity and reduce operational costs. Consumer preference for high-quality packaging and regulatory standards for labeling accuracy further support growth. Retail expansion, e-commerce growth, and technological upgrades in manufacturing processes are expected to sustain market expansion in the USA

The shrink sleeve labeling machine market is growing due to the increasing demand for versatile, high-quality packaging solutions in industries such as food and beverage, pharmaceuticals, and consumer goods. Leading players in this market include Accutek Packaging Equipment Company Inc., Axon LLC, Bhagwati Labelling Technologies, BW Integrated Systems, Crown Packaging Corp., Dase-Sing Packaging Technology Co. Ltd., Esleeve Enterprise Co. Ltd., Fuji Seal International Inc., King Machine Co. Ltd., Magic Special Purpose Machineries Pvt. Ltd., Pack Leader USA LLC, PDC International Corp., Procus Machinery Pvt. Ltd., Quadrel Labeling Systems, and XH Labeling Machine Co. Ltd..

Accutek Packaging and Axon LLC offer high-performance shrink sleeve labeling machines designed for efficiency and flexibility in high-volume production environments. Bhagwati Labelling Technologies and BW Integrated Systems specialize in customizable solutions, catering to a wide range of packaging sizes and materials, ensuring precise application of shrink sleeves. Fuji Seal International and Crown Packaging focus on advanced labeling systems that offer durability and aesthetic appeal, commonly used in food and beverage packaging. Pack Leader USA LLC and PDC International Corp. provide reliable, automated shrink sleeve machines with integrated features to enhance productivity.

| Item | Value |

|---|---|

| Quantitative Units | USD 676.8 Million |

| Type | Manual shrink sleeve machines, Semi-automatic shrink sleeve machines, and Fully automatic shrink sleeve machines |

| Container Type | Bottles, Cans, Jars, and Other containers |

| Container Diameter | Up to 50 mm, 50 to 100 mm, 100 to 150 mm, and Above 150 mm |

| Sleeve Capacity | Up to 300 units/min, 300 to 400 units/min, 400 to 600 units/min, and Above 600 units/min |

| End Use Industry | Food & beverages, Pharmaceuticals, Cosmetics & personal care, Chemicals and fertilizers, Automotive, and Others (nutraceuticals etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Accutek Packaging Equipment Company Inc., Axon LLC, Bhagwati Labelling Technologies, BW Integrated Systems, Crown Packaging Corp., Dase-Sing Packaging Technology Co. Ltd., Esleeve Enterprise Co. Ltd., Fuji Seal International Inc., King Machine Co. Ltd., Magic Special Purpose Machineries Pvt. Ltd., Pack Leader USA LLC, PDC International Corp., Procus Machinery Pvt. Ltd., Quadrel Labeling Systems, XH Labeling Machine Co. Ltd. |

| Additional Attributes | Dollar sales vary by machine type, including automatic, semi-automatic, and manual shrink sleeve labeling machines; by application, such as food and beverages, pharmaceuticals, cosmetics and personal care, chemicals, and household products; by material type, including PET, PVC, OPS, and PLA sleeves; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for product customization and branding, growth in food and beverage and pharmaceutical industries, automation and IoT integration, packaging efficiency requirements, and sustainability initiatives. |

The global shrink sleeve labeling machine is estimated to be valued at USD 676.8 million in 2025.

The market size for the shrink sleeve labeling machine is projected to reach USD 992.2 million by 2035.

The shrink sleeve labeling machine is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in shrink sleeve labeling machine are manual shrink sleeve machines, semi-automatic shrink sleeve machines and fully automatic shrink sleeve machines.

In terms of container type, bottles segment to command 47.6% share in the shrink sleeve labeling machine in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrink Sleeve Labeling Equipment Market

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Shrink Sleeve Labels Providers

Industry Share Analysis for Shrink Sleeve Label Applicator Manufacturers

Shrink Sleeve Labels Market Analysis by Flexographic and Digital Printing Through 2034

Shrink Label Machine Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Shrink Label Machine Market Share & Industry Leaders

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Shrink Wrapping Machines Providers

Shrink Bundling Machine Market Trends & Forecast 2024-2034

Sleeve Wrapping Machine Market

Shrink Wrapping Machine Market

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stretch Sleeve and Shrink Sleeve Labels Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Tubing and Sleeves Market Growth - Trends & Forecast 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Tray and Sleeve Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA