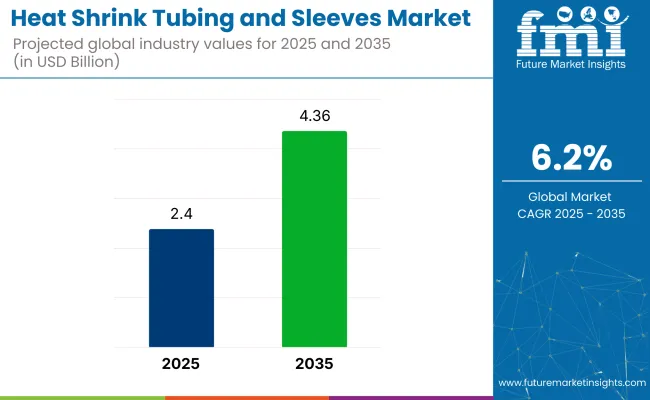

The Heat Shrink Tubing and Sleeves Market is poised for steady growth over the next decade, driven by rising demand for electrical insulation, improved cable protection, and increased infrastructure modernization. Valued at USD 2.4 Billion in 2025, the market is expected to reach USD 4.36 Billion by 2035, growing at a compound annual growth rate (CAGR) of 6.2% during the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.4 Billion |

| Industry Value (2035F) | USD 4.36 Billion |

| CAGR (2025 to 2035) | 6.2% |

The rise in demand for applications in the automotive, aerospace, electronics, telecommunications, and energy sectors fuels the upward trend. The increasing sophistication of tubing materials like cross-linked polyolefin and fluoropolymers and the implementation of stricter safety and performance mandates are elevating the place of heat shrink products in critical insulation and protection jobs.

The market is also influenced by changing safety standards, increasing electrification in the transportation sector, and growing investment in energy infrastructure. With the increasing adoption of electric vehicles (EVs), the need for high-performance heat shrink tubing for battery interconnections and power cable assemblies also grows. The telecommunications sector, driven by the expansion of 5G and fiber optics, requires advanced tubing and sleeves to protect connectors and maintain signal integrity.

Advancements in technology are making heat shrink tubing more durable, flame-resistant, and easier to install, thereby increasing its reliability and efficiency, especially in extreme environments. Maximizing fire safety and electrical performance is thus one of the primary drivers of adoption, as regulatory pressures influence the field in both developed and developing economies.

The North America heat shrink tubing and sleeves market is robust, thanks to the high demand due to applications in automotive, aerospace, defense, and telecommunications sectors. Due to stringent regulatory compliance requirements stipulating various fire safety, insulation, and environmental durability, the United States dominates the regional growth.

Further growth in electric vehicles (EVs), renewable power infrastructure, and 5G telecommunications fosters ongoing demand for dependable insulation and protection solutions. Industrial automation & smart grid modernization drive growth. Innovation growth factor is the major investment in R&D by key manufacturers, and the growing trend for high-performance fluoropolymers and specialty tubing. Additionally, strict UL and CSA standards help promote the wide use of certified, high-quality heat shrink materials in mission-critical applications in the region.

The European heat shrink tubing and sleeves market is a strong industrial base of the region. Germany, the UK, and France are all key nations at the forefront of automotive electrification, industrial automation, and renewable energy, all of which require high-performance insulation solutions.

The stringency in EU directives encompassing electrical safety, RoHS compliance, and hazardous materials lowers the hindrance for adoption. Furthermore, the region also emphasizes the use of eco-friendly materials, encouraging the use of recyclable and low-halogen tubing materials.

Demand stems from projects such as high-speed rail and wind energy installations across Northern and Western Europe. The European market exhibits stable long-term growth, with a preference for cutting-edge product offerings and environmentally friendly solutions.

The heat shrink tubing and sleeves market in the Asia-Pacific is expected to be the fastest-growing, driven by rapid industrialization, urbanization, and large-scale electrification. China, India, Japan, and South Korea play a major role, due in part to automotive manufacturing, increasing EV adoption, and large power grid construction. With the increasing number of data centers and 5G infrastructure, the demand for reliable cable management and electrical protection has risen significantly.

Government initiatives in both sectors drive this demand, as the government aims to increase renewable energy output and modernize the utility sector. Strong growth in the Asia-Pacific market segment is particularly notable for emerging economies in Southeast Asia, where infrastructure development is being enhanced and industrial automation is driving growth.

The Rest of the World, comprising Latin America, the Middle East, and Africa, has a market in this region that is slowly developing, with increasing investments in infrastructure and the modernization of the energy sector. In Latin America, most of the innovations directed towards power distribution networks and telecom infrastructure are led by Brazil and Mexico.

In the Middle East, smart cities, renewable energy projects, and transportation electrification are driven by demand for heat shrink film products even in high-temperature and corrosive environments. Africa is still in its early stages, but it is promising, particularly with its efforts in electrification and manufacturing.

Despite challenges in regulatory enforcement and supply chain constraints, global investments and the adoption of global standards are expected to create new opportunities in sectors such as construction, utilities, and telecommunications in emerging economies.

Fluctuating Raw Material Prices

One of the major challenges for the heat shrink tubing and sleeves market is the volatility of raw material prices. These materials are petroleum-derived and beholden to price fluctuations driven by the global crude oil market, geopolitical instability and supply chain delays. for many manufacturers, producing something that meets tight performance and regulatory targets while also being cost-effective presents significant challenges.

Uncertain costs can lead to higher product prices or lower margins, thereby undermining competitiveness, particularly in price-sensitive segments. It compounds the procurement challenges when niche applications require specialty materials.

To avoid such risks, enterprises need to diversify their own vendor networks and identify alternative materials, though the transition process would call for requalification and compliance with design validation and technical specifications.

Environmental and Regulatory Compliance

Manufacturers of heat shrink tubing and sleeves face increasingly rigorous environmental scrutiny and shifting regulatory landscapes. The release of such harmful substances during combustion raises concerns in the context of these products and often leads to restrictions on traditional materials (such as halogenated polymers) within frameworks like RoHS, REACH, and other environmental regulations at the global or regional level.

Escalating concerns about plastic waste and the environmental consequences of non-biodegradable products are driving companies to seek out greener alternatives. However, transitioning to sustainable or recyclable materials is no easy task, as they must meet high standards of insulation, heat resistance, and mechanical durability.

Preventing environmental impact without sacrificing performance requires a significant amount of R&D and costly certification, as well as higher production costs, especially in heavily regulated markets such as Europe and North America.

Electrification of Transportation and EV Growth

The transition to electric cars (EVs) is a significant growth opportunity for the heat shrink tubing and sleeves market globally. Electric vehicles (EVs) require a substantial amount of high-quality electrical insulation for their battery packs, powertrain wiring, and high-voltage connectors, ensuring safety, durability, and effective thermal management. As governments and automakers double down on plans to reduce carbon emissions, the global EV fleet is expected to grow rapidly in the coming decade.

This expansion translates to parallel market requirements for high-performance heat shrink materials that can withstand high temperatures, chemical interactions, and mechanical forces. Manufacturers that are developing products for specific use in EVs, such as lightweight, flame-retardant, and compact insulation solutions, are positioned to take advantage of the long-term momentum resulting from electric mobility and its accompanying charging infrastructure.

Expansion of Renewable Energy and Smart Grids

The growing deployment of renewable energy systems such as solar, wind, and battery storage, coupled with smart grid development, presents a considerable opportunity for the heat shrink tubing market. Such energy systems require long-lasting, weather-resistant, and superior insulation for cabling, junction boxes, and connectors, which are frequently exposed to harsh environmental conditions.

Heat shrink sleeves are essential for protecting against long-term exposure to moisture ingress and ensuring the reliability of the assembly system. Modernization of grid infrastructure, especially in developing regions, requires cost-effective and easily deployable insulation systems.

This transition supports the growth of low-halogen, UV-resistant, and flame-retardant tubing products. Focus on sustainability and energy resilience, heat shrink technologies now serve as critical enablers for securing next-generation power infrastructure.

Between 2020 and 2024, the Heat Shrink Tubing and Sleeves market also saw gradual expansion, fueled by the increasing need for electrical insulation, protection of wiring systems, and improved safety in high-performance environments. That growth was especially bolstered by the expansion of global automotive and aerospace industries as well as the installation of telecommunication networks and data centers.

Looking ahead to the period between 2025 and 2035, the market is expected to expand significantly due to the electrification of transportation, renewable energy integration and tightening sustainability mandates the market will grow tremendously As the demand for electric vehicles (EVs) continues to rise, so do investments in smart grid technologies, digital, and other infrastructures, which will drive the need for durable, high-performance insulation and bundling solutions such as heat shrink tubing and sleeves. Moving to recyclable and bio-based polymer materials, as well as AI-driven quality control in manufacturing, will redefine the competitive and technological environment in the industry.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with basic flame-retardant and RoHS standards, with increasing focus on fire safety. |

| Technological Advancements | Introduction of cross-linked polyolefin and fluoropolymer-based tubing for high-temp applications. |

| Industry-Specific Demand | Automotive wiring harnesses, aerospace cables, telecommunications, and electronics. |

| Sustainability & Circular Economy | Initial shift to low-smoke zero-halogen (LSZH) products. |

| Market Growth Drivers | Electrification of vehicles, telecom expansion, and infrastructure upgrades. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Enforcement of stricter global mandates for environmental requirements (REACH, WEEE) and halogen-free materials. |

| Technological Advancements | Bio-based, recyclable materials along with AI-driven extrusion processes for improved consistency |

| Industry-Specific Demand | Increasing demand from EV battery units, renewable energy cables, 5G facilities as well as robotics. |

| Sustainability & Circular Economy | Strong focus on not just recyclable polymers and closed-loop manufacturing but also on further reducing carbon footprints in production. |

| Market Growth Drivers | Electric Vehicle proliferation, smart grids, Industry 4.0 automation, and strict environmental policies. |

The USA heat shrink tubing and sleeves market is supported by the strong demand from the automotive, aerospace, and defense industries. The growth in electric vehicle production, along with demand for wire harness protection and thermal insulation, is accelerating product adoption.

Climate change is also encouraging growth at the opposite end via innovations around flame-retardant and dual-wall tubing. Compliance with UL and CSA regulatory standards will guarantee the continued integration of high-performance insulation materials. USA military and aerospace sectors require more robust shielding around critical components, which creates innovation avenues for opportunity.

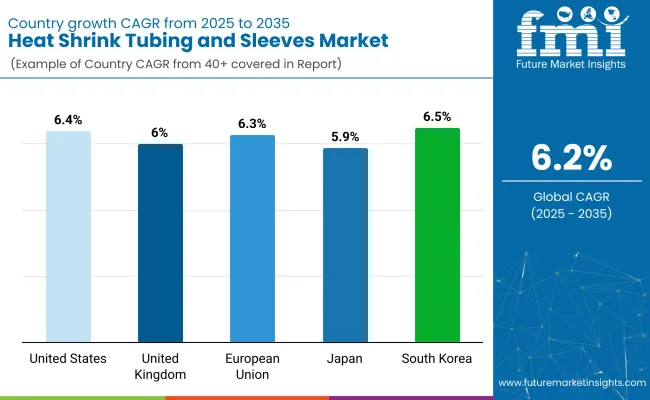

Sustainability efforts are encouraging interest in halogen-free and recyclable materials. During the forecast period of 2025 -2035, the USA market is anticipated to outperform the global average, recording a CAGR of 6.4%, primarily driven by high-value end-user applications and R&D investments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

In the UK, the heat shrink tubing and sleeves market is growing gradually, backed by modernization in railways, its electrification, and aerospace engineering. Government-supported green energy initiatives are driving demand for electrical insulation in wind and solar infrastructure.

The deployment of EV technology, combined with demand for lightweight, low-waste parasitic power components in automotive manufacturing, is driving the adoption of heat shrink products. British defense modernization programs contribute significantly not only to realizing the demand but also to increasing the demand for high-spec tubing.

Focus on eco-regulation and recycling compatible with EU law after Brexit. The UK market is forecasted to grow at a CAGR of 6.0% between 2025 and 2035 due to firm growth attributed to infrastructure upgrades and regulatory sustainability targets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

Rising safety regulations, digitized infrastructure, and increasing electrification of transportation are primarily driving the demand for heat shrink tubing and sleeves in the European Union. The push for sustainable materials, along with REACH compliance, is driving the demand for halogen-free, environmentally friendly products.

No less significant is the integration of industrial automation and renewable energy, which is experiencing stronger growth in countries such as Germany, France, and Italy. Demand is being amplified by investments in grid modernization and electric mobility across the bloc. Aerospace and high-speed rail projects provide additional impetus for the sector.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Innovation across electronics, robotics and high-speed rail sector, is some major growth for Japan heat shrink tubing and sleeves market. With robust semiconductor and precision engineering sector in the country, there is a need for compact, durable insulation solutions.

Steady growth from applications in EVs, industrial automation, and smart grid technologies are driving consistency. Electrical upgrades of Japan’s aging infrastructure lead to gradual market expansion. Low-smoke, halogen-free, and thermally resistant materials are gaining preference.

The Japan market is estimated to grow at a CAGR of 5.9% over the next 10 years (2025 to 2035) which is trending slightly below the global average due to a mature industrial base but will benefit from advanced manufacturing and export-oriented production.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The South Korean heat-shrink tubing and sleeves market is experiencing strong growth in tandem with the expansion of the electronics manufacturing, electric vehicle, and 5G infrastructure segments. Demand for precision insulation and component protection is bolstered by the country’s status as a leader in semiconductor and battery technologies.

Investments in sustainable energy and offshore wind farms need sound electrical insulating options. Innovation in tubing technology is driven by frugal gases, fire safety concerns, regulatory attention, and material efficiency. South Korea is expected to experience a CAGR of 6.5% from 2025 to 2035, higher than the global average due to the concentration of the high-tech industry in South Korea and government-led programs for industrial electrification.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

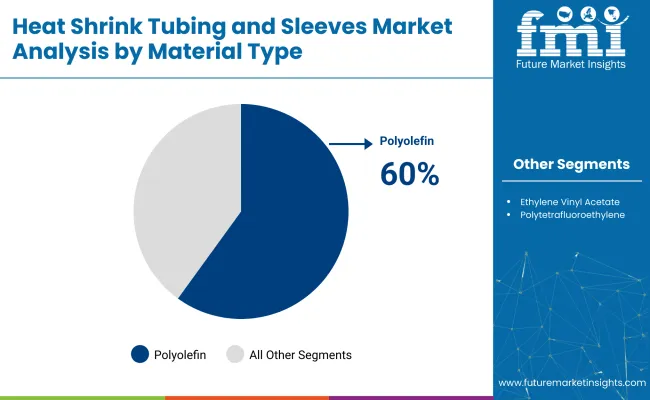

Polyolefin is a leading material segment due to its superior electrical insulation, flame retardancy, and low cost. Commonly utilized for automotive, electronics, and telecom, POE-based tubing provides long-lasting defense against abrasion, chemicals, and moisture.

The shrink ratio and operating temperature range make them suitable for both commercial and industrial use. RoHS compliance and UL certification encourage its penetration in the global market. Similar pto ast trends, the Asia-Pacific region, particularly China and India, is experiencing significant demand growth, attributed to an increase in automotive and electronics production. In particular, the shift to electric mobility and better cable management solutions will further enable polyolefins to continue to be the material of choice in heat shrink tubing.

PTFE is being increasingly recognised as the premium material for even the most corrosive tasks and those with high-temperature stability requirements. Used in aerospace, defense and advanced electronics, PTFE provides non-stick and low-friction properties that ensure a long-lasting performance in challenging environments.

Although often more expensive than plastic, its durability, as well as compliance with stringent aerospace and industrial safety standards (MIL and ASTM), makes it indispensable for mission-critical applications. North America and Europe remain vibrant markets, driven by robust aerospace infrastructure and regulations that prioritize safety. The demand for high-reliability materials in mission-critical systems continues to drive the adoption of PTFE.

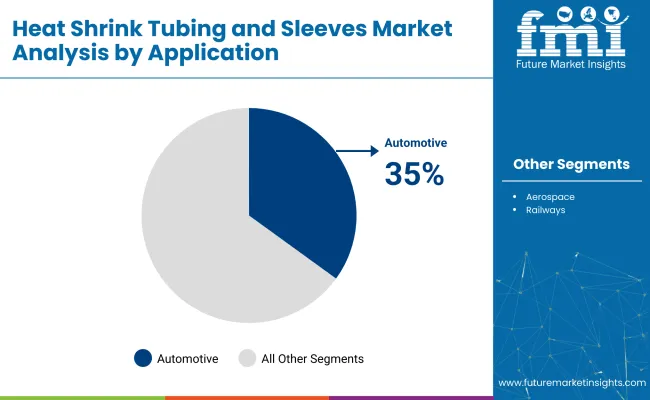

The automotive industry dominates application demand, driven by increased electrification, safety standards, and the rise of electric vehicles (EVs). Heat shrink tubing is essential when it comes to protecting wiring harnesses, battery components, and connectors from heat, chemicals, and vibration.

This has led OEMs towards the lightweight, RoHS-compliant, and cost-effective features of polyolefin tubing. As a result, advanced insulation and sealing solutions are experiencing increased demand due to the surge in global EV production, particularly in the Asia-Pacific and Europe.

The shift towards embedded technologies such as ADAS and connected vehicles is pushing the complexity of automotive wiring higher and higher, too, emphasizing the demand for dependable heat shrink solutions across automotive platforms.

Aerospace remains a critical application space that requires heat-shrink tubing to withstand extreme temperature fluctuations, fire exposure, and chemical attacks. PTFE and fluoropolymer-based sleeves have proven to be highly reliable for aircraft wiring, connectors, and hydraulic systems.

The need for exact and well-documented functionalities by regulatory bodies, such as the FAA and EASA, necessitates the use of highly specialized materials. The North American region accounts for the maximum share in this segment owing to the well-established aerospace ecosystem and safety. Aerospace is expected to experience stable growth for heat shrink tubing solutions with a gradual increase in aircraft production & retrofitting of older fleets.

The global Heat Shrink Tubing and Sleeves market is experiencing significant growth, driven by increasing demand across industries such as automotive, electronics, telecommunications, and aerospace.

The major companies for this market include TE Connectivity, 3M Company, Sumitomo Electric Industries, HellermannTyton, and Molex LLC. In turn, these companies are focusing on innovation in technology, sustainability, and product offerings to remain competitive. The market consolidation is occurring, with known players merging and acquiring, aiming to strengthen themselves in the marketplace. In developing regions, new entrants play an important role.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TE Connectivity | 15-20% |

| 3M Company | 12-16% |

| Sumitomo Electric Industries | 10-14% |

| HellermannTyton | 8-12% |

| Molex LLC | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| TE Connectivity | Covers a wide range of heat shrink tubing offerings with an emphasis on high-end performance materials and sustainability. |

| 3M Company | Specializes in electrical insulation products with an emphasis on innovation and eco-friendly solutions. |

| Sumitomo Electric Industries | Invests in high-purity production in order to provide advanced heat shrink tubing to the automotive and electronics industries. |

| HellermannTyton | Develops cable management solutions, including heat shrink tubing, with a focus on customization and regulatory compliance. |

| Molex LLC | Provides heat shrink products targeting niche markets, emphasizing efficiency and resource utilization. |

Key Company Insights

TE Connectivity

TE Connectivity is a leading force in the heat shrink tubing market, offering an extensive range of high-performance insulation and protection solutions tailored for electrical, automotive, aerospace, and industrial applications.

The company is renowned for creating advanced material solutions, and as such, manufactures heat shrink tubing with high-performance characteristics, including high abrasion resistance, chemical resistance, and high and low temperature resistance.

TE’s strategy is driven by sustainability, an emphasis on the use of eco-friendly materials, and recyclable packaging. TREK’s ability to leverage its global manufacturing network and deep OEM partnerships enables it to deliver on the supply chain resiliency it promises its customers with rapid delivery. TE Connectivity has also invested heavily in R&D over the past several years to develop thinner, lighter, and more robust tubing options, establishing itself as a technology innovation leader in insulation systems.

3M Company

3M, a leading global supplier of heat shrink tubing, is based on its dedication to innovation, safety and sustainability. With decades of experience in the fields of adhesives, polymers, and electronics, 3M offers a wide range of heat-shrinkable products designed to deliver optimal electrical insulation, mechanical protection, and strain relief.

Flame-retardant and halogen-free tubing is in high demand as regulations become stricter and environmental concerns escalate. 3M offers its customers close to individual customization services and technical support, which has made it one of the highly favoured partners of both OEMs and distributors across the globe. Some of its latest offerings incorporate both smart materials and digital labeling, evidencing 3M's forward movement toward intelligent, future-ready cable management solutions.

Sumitomo Electric Industries

Sumitomo Electric Industries is a leader with several decades of experience and deep expertise in materials engineering and polymer processing. The firm’s heat shrink tubing line is highly appreciated for its degree of precision, thermal stability and chemical resistance, particularly beneficial in the automotive, electronics and telecom industries. With vertical integration, Sumitomo can also control the quality of raw materials and conduct strict manufacturing standards.

The company also invested in combining advanced extrusion technologies to produce thin, lightweight tubing that meets the demands for compact electronic components. Sumitomo is also exploring lead-free, halogen-free products and cleaner production practices.

These telltale signs of the company's great command of Asia (and increasing exports to Europe and North America) signal that it is becoming an essential global supplier attuned to quality and reliability.

HellermannTyton

HellermannTyton is an expert in cable management and protection systems, providing a strong lineup of heat shrink tubing products for automotive, aerospace, and industrial applications. The company differentiates itself with product customization capabilities, providing application-specific solutions ranging from dual-wall tubing, high-temperature variants, and adhesive-lined options. Many products are compliant with UL, CSA, and MIL-SPEC standards for regulatory compliance.

HellermannTyton has focused on sustainable production by integrating recyclable materials and enhancing energy efficiency across its production facilities. Its strategic emphasis on regards automation and digital product inspiration (e.g., smart labeling systems) escalates user experience and setup versatility.

HellermannTyton has strong distribution networks and advanced manufacturing capabilities in more than 35 countries, allowing it to provide its customers with fast service in the regions they are located in, along with local expertise tailored to their specific needs.

Molex LLC

Molex (Koch Industries), also provides heat shrink tubing primarily for niche applications in medical devices, telecommunications, and consumer electronics. It specializes in compact, efficient, and durable tubing products to support the trending miniaturization of devices. Molex’s shrink wrap solutions are designed for uniform wall thickness with low dielectric characteristics and limited chemical susceptibility.

Through strategic investments in automation and precision tooling, Molex is able to provide highly customized tubing at competitive costs. With a focus on quality management, the company meets international standards such as ISO 13485 and RoHS. Although not the largest company by volume, Molex's emphasis on high-value, high-precision applications in specialized segments of the market provides a distinct competitive advantage.

In terms of Material Type, the industry is divided into Polyolefin (POE), Ethylene Vinyl Acetate (EVA), Polytetrafluoroethylene (PTFE)

In terms of Application, the industry is divided into Automotive, Aerospace, Railways

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Heat Shrink Tubing and Sleeves market is projected to reach USD 2.4 Billion by the end of 2025.

The market is anticipated to grow at a CAGR of 6.2% over the forecast period.

Heat Shrink Tubing and Sleeves market is expected to reach USD 4.36 Billion.

The Polyolefin (POE) segment is expected to dominate the market, due to its superior flexibility, high insulation properties, flame resistance, and widespread use in electrical, automotive, and industrial applications.

Key players in the Heat Shrink Tubing and Sleeves market include TE Connectivity, 3M Company, Sumitomo Electric Industries, HellermannTyton, Molex LLC

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Tubes Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Film Market Trends & Industry Forecast 2024-2034

Heat Shrink Terminations Market

POF Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Full Container Shrink Sleeves Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Vacuum Heat Shrink Film in UK Size and Share Forecast Outlook 2025 to 2035

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Shrink Wrapper Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA