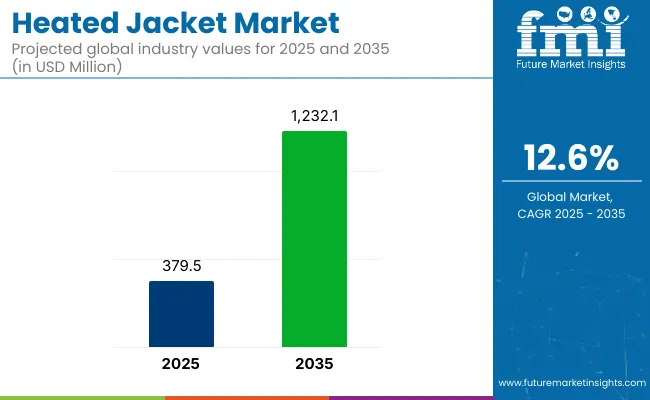

The global heated jacket market is valued at USD 379.5 million in 2025 and is poised to reach USD 1,232.1 million by 2035, which shows a CAGR of 12.6% over the forecast period. This rapid growth is being driven by increasing demand for wearable thermal technology across outdoor recreation, industrial safety, military, and urban mobility applications.

Heated jackets, which integrate battery-powered heating elements, are gaining popularity among hikers, motorcyclists, skiers, construction workers, and commuters facing harsh winter conditions. As consumer expectations shift toward functional, weather-adaptive apparel, manufacturers are developing versatile heated outerwear that blends warmth, comfort, and style.

Technological innovation is at the forefront of market expansion. Manufacturers are putting significant amounts in research and development to come up with innovative products. Companies are incorporating features such as carbon fiber heating panels, adjustable temperature settings, USB-charging capabilities, and smartphone-controlled interfaces.

Advancements in lightweight, flexible heating elements and energy-efficient batteries are enabling longer usage times without sacrificing mobility. The integration of waterproof and breathable fabrics, along with ergonomic design, is improving product durability and user comfort.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 379.5 million |

| Industry Value (2035F) | USD 1,232.1 million |

| CAGR (2025 to 2035) | 12.6% |

Both premium and mid-range brands are offering gender-specific designs, multi-zone heating, and modular components to meet growing lifestyle and performance expectations. E-commerce platforms and winter sports retailers are further boosting visibility and accessibility of heated jackets worldwide.

Supportive cold-weather gear standards, rising disposable income, and growing participation in outdoor activities are strengthening the heated jacket market outlook globally. Governments and employers in colder regions are also recommending or mandating heated gear for workers exposed to extreme temperatures, particularly in utilities, transportation, and construction sectors.

Asia Pacific, North America, and Europe are witnessing rapid adoption, supported by product innovation, urbanization, and climate variability. With rising consumer interest in smart textiles and wearable comfort technology, the market is expected to expand significantly, transforming how people adapt to cold environments in both recreational and occupational settings.

Per capita spending on heated jackets is steadily increasing across global markets, driven by growing consumer demand for comfort, warmth, and advanced wearable technology. In developed regions, colder climates and higher disposable incomes fuel strong adoption of feature-rich heated apparel. Meanwhile, emerging markets are witnessing rising interest as awareness of heated clothing benefits spreads and purchasing power improves. The trend reflects broader shifts toward functional fashion and outdoor lifestyle preferences, supported by expanding retail and e-commerce availability worldwide.

The global trade of heated jackets is expanding steadily, fueled by growing consumer demand for innovative winter wear that combines technology and comfort. Countries with advanced textile manufacturing capabilities and electronics integration, such as China, South Korea, and the United States, dominate exports. Import demand is particularly strong in colder regions like North America, Europe, and parts of Asia, where consumers seek functional apparel for outdoor activities and everyday use.

The below table presents the expected CAGR for the heated jacket industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 11.3% |

| H2 (2024 to 2034) | 13.5% |

| H1 (2025 to 2035) | 14.0% |

| H2 (2025 to 2035) | 11.2% |

The CAGR exhibits a fluctuating trend, initially increasing by 124 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. However, a slight increase of 140 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external constraints. Growth rebounds in H2 (2025 to 2035) with a 112 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

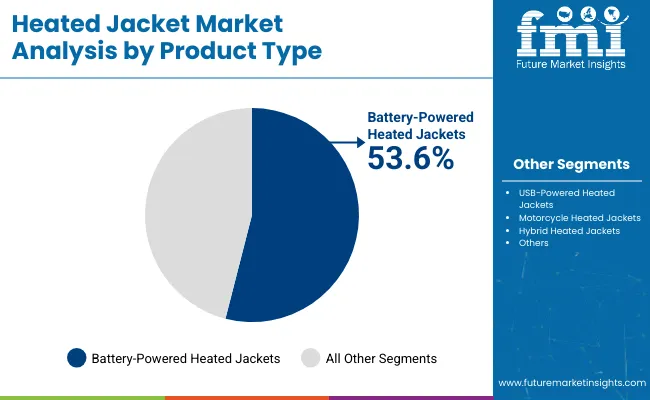

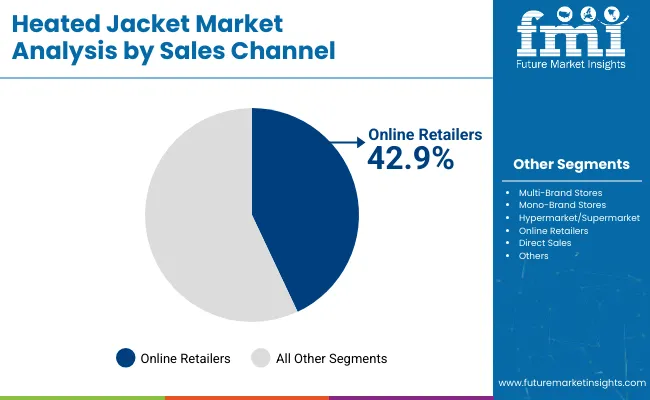

The market is segmented based on product type, sales channel, and region. By product type, the market includes battery-powered heated jackets, USB-powered heated jackets, motorcycle heated jackets, and hybrid heated jackets. In terms of sales channel, it is categorized into multi-brand stores, mono-brand stores, hypermarkets/supermarkets, online retailers, direct sales, and other sales channels (including department stores, sporting goods outlets, and pop-up shops). Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

| Product Type Segment | Market Share (2025) |

|---|---|

| Battery-Powered Heated Jackets | 53.6% |

Battery-powered heated jackets are expected to dominate the heated jacket market by product type in 2025, securing a 53.6% market share. These jackets are highly favored for their portability, long battery life, and effective heat distribution.

Users such as construction workers, commuters, outdoor enthusiasts, and winter athletes prefer this category for its high performance in cold environments and adaptability to different use cases. With advancements in lithium-ion technology, today's models offer extended runtime, lightweight design, and multiple heat zones for customized warmth.

Leading brands including ORORO, Milwaukee, and DEWALT have developed performance-grade battery-powered jackets with adjustable heat settings, wind-resistant fabrics, and integrated USB ports, which have made these jackets the go-to option in both industrial and recreational applications. This category continues to outperform USB and hybrid variants due to its superior heating efficiency and user convenience.

Battery-powered models are also being integrated with smart features such as mobile app control and adaptive heating based on external temperature. As winter wear evolves toward intelligent, functional garments, battery-powered jackets remain the most sought-after format, with the added advantage of high safety standards and compatibility with power tool ecosystems.

| Sales Channel Segment | Market Share (2025) |

|---|---|

| Online Retailers | 42.9% |

Online retailers are projected to lead the heated jacket market by sales channel, capturing a 42.9% share in 2025. E-commerce has transformed the winter wear landscape by offering consumers convenience, broad product selection, competitive pricing, and user-generated reviews. Heated jackets are particularly well-suited for digital platforms due to their tech-forward features and higher-than-average price points, which benefit from in-depth product descriptions and comparison tools provided by online stores.

Key players like Amazon, Walmart, and direct-to-consumer brands such as PROSmart and Venustas have made significant gains by optimizing their digital storefronts with influencer collaborations, seasonal promotions, and bundled product offerings. Social media campaigns showcasing real-use scenarios, such as hiking, skiing, and working in extreme cold are influencing buying decisions, especially among Gen Z and millennial shoppers.

The shift toward mobile shopping, coupled with flexible financing and return options, continues to drive consumer preference for online channels. Additionally, online retail supports long-tail product discovery, enabling niche and premium heated jacket models to find targeted customer segments without relying on physical shelf space. As consumers increasingly prioritize convenience, real-time feedback, and digital engagement, online retail is positioned to retain its leadership across the heated jacket buying experience.

Rising Demand for Advanced and Energy-Efficient Heated Apparel Fuels Heated Jacket Market Growth

Global heated jacket market expands rapidly owing to rising demand for energy-efficient winter wear solutions nationwide very quickly every day. Heated jackets offer a cost-effective solution for individuals seeking reliable warmth without excessive layering. The growing need for high-performance cold-weather gear, especially among outdoor workers, adventure enthusiasts, and urban commuters, is driving market adoption.

Heated jackets significantly reduce dependence on disposable solutions for warmth thereby boosting demand rapidly. Sophisticated jackets feature cutting-edge heating elements powered by batteries and clever temperature controls that provide comfort over extended periods making them pretty appealing. Heated jackets' affordability and durability significantly contribute to their rising popularity over time.

Growing Shift Toward Smart and Functional Winter Wear Propels Market Expansion

Heated jackets gain widespread acceptance among consumers due to growing demand for clothing that serves multiple purposes and boasts cutting-edge technology. Demand for smart clothing propels market growth rapidly in regions with harsh winters somehow. Consumers prioritize apparel integrating seamlessly with their lifestyles through jackets offering adjustable heating via USB charging and weather resistant features.

These jackets incorporate superlight materials enhancing insulation properties beneath multiple layers for optimum breathability. Sustainability gains prominence slowly over time manufacturers incorporate eco-friendly textiles and rechargeable battery systems in weird ways aligning roughly with global sustainable fashion trends. Rapidly growing demand for smart apparel fuels heated jacket market expansion across diverse age groups at incredible rates now.

E-Commerce Platforms and Online Marketplaces Drive Sales of Heated Jackets

E-commerce platforms rapidly rising has significantly boosted sales of heated jackets online lately. Digital platforms offer shoppers a plethora of brands and styles with cutting-edge features nearby allowing easy product comparisons somehow. Reviews facilitate informed purchasing decisions through transparent pricing thereby boosting market presence significantly every day.

Digital shopping offers numerous benefits and direct consumer strategies make heated jackets more accessible globally nowadays. Promotions online bundled with seasonal discounts typically boost sales during winter months. Browsing technical specs online boosts consumer confidence pretty significantly in heated jacket purchases via detailed customer testimonials.

Technological Advancements in Heated Clothing Enhance Product Appeal

Innovations in battery technology, heating elements, and fabric integration have significantly enhanced the performance of heated jackets. Modern designs feature longer-lasting battery life faster heating times and customizable temperature settings making jackets way more efficient.

Advancements in flexible heating tech facilitate remarkably even heat distribution through cleverly designed smart temperature control features that allow users adjust warmth. Extended battery warranties coupled with improved safety mechanisms bolster consumer confidence somewhat in these products. Heated apparel sees frequent upgrades thereby making such jackets preferred by folks seeking warmth and comfort in pretty harsh winter conditions.

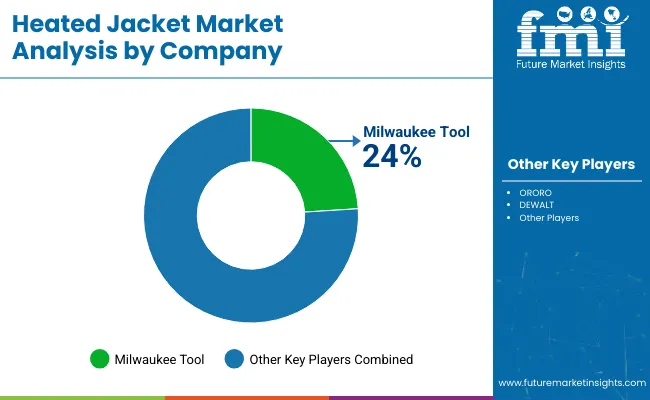

Tier-1 Players dominate the global heated jacket market, holding a market share of approximately 35-40%. These companies leverage cutting-edge heating technology and premium materials alongside strong brand recognition maintaining a fairly significant presence. Their focus offers high-performance heated jackets with remarkably extended battery life and advanced insulation for outdoor pros and extreme athletes. Customers seeking reliability and innovation are really drawn deeply into products offering premium features daily. Notable Tier-1 players in the heated jacket market include Columbia, The North Face, and Milwaukee Tool.

Tier-2 Players capture around 30-35% of the market, targeting mid-range consumers, outdoor workers, and casual users seeking a balance of affordability and quality. These firms prioritize budget-friendly heating systems beneath rather rugged conditions. Their jackets frequently boast decent battery life and heating efficiency with noticeably fewer cutting-edge features than high-end brands. Frugal shoppers seeking warm winter gear with heat features make up main clientele for such brands. Notable Tier-2 players include Dewalt, ORORO, and Venustas, alongside various regional brands.

Tier-3 Players primarily serve niche markets, offering budget-friendly heated jackets for cost-conscious buyers. These companies operate regionally or through online platforms, capturing roughly 15-20% of the market share. They prioritize affordability with simplified heating elements shorter battery life and pretty basic insulation overall. Their products somehow appeal directly to users needing occasional heating functionality at relatively low cost. Notable Tier-3 players include PROSmart, TIDEWE, and several independent online retailers specializing in heated apparel.

| Countries | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| India | 1,450.9 |

| United Kingdom | 67.2 |

| Germany | 84.0 |

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 12.50 |

| China | 9.20 |

| India | 6.50 |

| United Kingdom | 8.00 |

| Germany | 7.80 |

The USA heated jacket market, valued at USD 51.2 million, benefits from extremely strong consumer demand in freezing regions. Rise of winter sports hiking and outdoor work environments really fuels demand for incredibly durable heated apparel in cold climates daily. Bigger paychecks coupled with fondness for fancy outdoor equipment boost per capita spending significantly over time.

Canada's heated jacket market, valued at USD 8.3 million, experiences consistent demand due to its prolonged and harsh winters. Customers who work outside or engage in sports frequently buy heated clothing for added warmth during extremely cold weather conditions. High-quality heated jackets that boast impressive battery efficiency fuel market growth at relatively steady pace overall.

Germany’s heated jacket market, valued at USD 31.6 million, benefits from a strong focus on winter gear innovation and sustainability. Consumers generally favor heated jackets that boast energy efficiency longer battery life and pretty advanced insulation technology. Growing recognition of practical cold-weather gear across outdoor sports segments and workwear fuels market growth rapidly upwards now.

The UK’s heated jacket market, valued at USD 32.4 million, is driven by unpredictable winter conditions and increasing consumer interest in heated apparel for outdoor commuting. Demand runs extremely high particularly among sports enthusiasts and motorcyclists who work outdoors frequently. Sustainable and durable heated clothing options are gaining traction in the market.

China's heated jacket market valued at USD 43.9 million experiences rapid growth fueled by urbanization and rising outdoor recreation trends rapidly. Consumers seek pretty darn affordable heated clothing for everyday wear during freezing cold winter months. Local brands expand offerings rapidly beneath mounting pressure for reasonably priced heated jackets that perform exceptionally well outdoors.

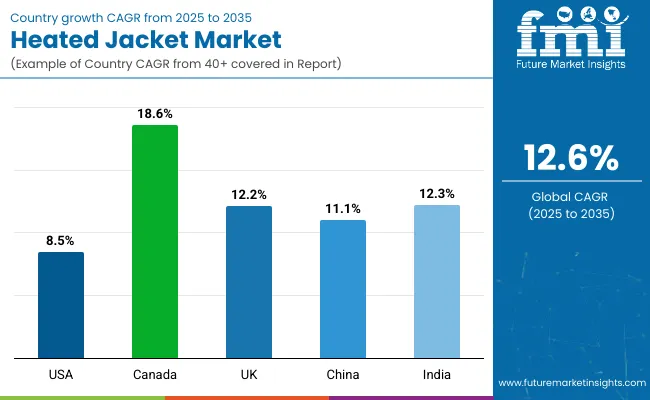

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| Canada | 18.6% |

| UK | 12.2% |

| China | 11.1% |

| India | 12.3% |

The USA heated jacket market will likely grow rapidly at 8.5% CAGR from 2025 till 2035 driven by rising demand for sophisticated winter wear solutions in outdoor recreational pursuits and harsh industrial work settings. Consumers desperately seek efficient heating apparel for battling brutal cold temperatures thus boosting adoption of battery-powered heated jackets rapidly.

Smart clothing with temperature control and rechargeable batteries fuels rapid market growth somehow. Rise in winter sports participation fuels demand rapidly alongside need for protective gear in cold-weather industries like construction. E-commerce platforms substantially increase revenue through myriad styles and functionalities that appeal directly to diverse consumer groups somehow. Eco-aware buyers drive adoption of green heated jackets boasting robust designs and power-savvy heating elements that last remarkably longer.

The UK heated jacket market is anticipated to grow at a CAGR of 12.2% over the next decade, driven by the increasing demand for smart wearable technology and sustainable winter clothing. Eco-conscious shoppers seek heated jackets offering high performance and energy efficiency amidst wildly popular sustainable fashion movements. Growing preference for outdoor pursuits like hiking and trekking under harsh weather conditions fuels demand for super lightweight heated jackets somehow.

The rising cost of conventional winter clothing and the appeal of technologically advanced alternatives encourage consumers to opt for rechargeable heated jackets with customizable heating levels. Strong e-commerce channels significantly boost product availability thereby driving adoption rates upward extremely quickly online. Sustainable practices drive market expansion as firms incorporate recycled materials and biodegradable fabrics into their products rapidly.

India’s heated jacket market will likely expand rapidly at a CAGR of 12.3% from 2025 till 2035 fueled by increasing adoption of heated apparel in extremely cold regions and soaring disposable incomes. Harsh winters in northern states fuel a growing demand for cost-effective winter wear solutions that propels market growth rapidly upwards. People really appreciate ridiculously warm heated jackets nowadays especially when outdoors in harsh weather conditions for extended periods.

E-commerce platforms facilitate market growth pretty aggressively offering customers a plethora of products at really low prices. Multinational corporations swiftly flood India's market with fierce competition greatly boosting overall product quality. Rapidly growing awareness of energy-efficient clothing prompts individuals buying increasingly more battery-powered heated jackets heating really long periods. Rapid urbanization fuels demand for high-tech winter gear nationwide via massive shifts towards outdoor pursuits daily

The global heated jacket market faces intense competition from key players like ORORO, Milwaukee Tool, DEWALT, and Bosch dominating the industry with unique offerings. ORORO utilizes pretty sophisticated heating tech thereby delivering remarkably long-lasting warmth and comfort through its top-notch heated jackets. Milwaukee Tool boasts incredibly durable heated jackets with robust battery-powered solutions for outdoor workers in harsh weather. Emerging brands like Ravean and Gobi Heat redefine market trends through innovative designs. Specialized heating solutions flooding market spaces rapidly gain traction amongst workers battling extreme cold.

Renowned brands now face stiff competition from these newcomers offering wonky yet effective heating solutions. Ravean offers ridiculously lightweight heated jackets featuring adjustable temperature controls that handle wildly different weather situations effortlessly. Gobi Heat offers ridiculously warm gear featuring super rapid heat somehow beneath ridiculously durable outer layers for winter thrill seekers. Brands prioritizing energy efficiency durability and user-friendly features in heated jackets experience fairly rapid substantial growth. Rising adoption of smart heating technologies rapidly positions industry leaders for market expansion alongside growing awareness of cold-weather safety

In terms of product type, the industry is divided into battery-powered heated jackets, USB-powered heated jackets, motorcycle heated jackets, and hybrid heated jackets.

The industry is further divided by a sales channel that are multi-brand stores, mono-brand stores, hypermarkets/supermarkets, online retailers, direct sales, and other sales channels.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The global heated jacket market is forecast to reach USD 1,232.1 million by 2035, expanding from USD 379.5 million in 2025, at a CAGR of 12.6% during the forecast period.

Battery-powered heated jackets lead the market by product type, capturing a 53.6% market share in 2025, due to their portability, longer battery life, and wide adoption across industrial and outdoor applications.

Online retailers dominate the sales channel segment with a 42.9% share in 2025, driven by e-commerce growth, mobile shopping preferences, and tech-forward consumer behavior across North America and Europe.

The market is driven by increased cold-weather occupational needs, rising interest in smart wearables, urban mobility in winter climates, and growing participation in outdoor recreation and winter sports.

Major companies include Ororo, Milwaukee Tool, Dewalt, Gobi Heat, Venture Heat, PROSmart, Bosch, Ravean, and ActionHeat, known for smart heating tech, ergonomic designs, and seasonal product innovations.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 42: Western Europe Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 76: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 78: East Asia Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 80: East Asia Market Volume (Units) Forecast by Size, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 82: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Power Type, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Units) Forecast by Power Type, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Units) Forecast by Size, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by End User, 2023 to 2033

Figure 32: Global Market Attractiveness by Power Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Size, 2023 to 2033

Figure 34: Global Market Attractiveness by Application, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by End User, 2023 to 2033

Figure 68: North America Market Attractiveness by Power Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Size, 2023 to 2033

Figure 70: North America Market Attractiveness by Application, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Power Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 120: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Power Type, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Power Type, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Power Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Size, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 228: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 232: East Asia Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 236: East Asia Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 240: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 244: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 247: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Power Type, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Power Type, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Size, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Power Type, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Power Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Power Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Power Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Power Type, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heated Eyelash Curler Market Size and Share Forecast Outlook 2025 to 2035

Heated Shelf Food Warmers Market - Efficient Hot Holding Solutions 2025 to 2035

Heated Shelving Parts and Accessories Market - Optimized Food Warmth 2025 to 2035

Heated Windshield Market Growth - Trends & Forecast 2025 to 2035

Heated Mattress Pads Market

Heated Steering Wheel Market

Electric Heated Shoes Market Analysis - Trends, Growth & Forecast 2025 to 2035

Automotive Heated Seat Market Size and Share Forecast Outlook 2025 to 2035

Banquet Carts and Heated Cabinets Market

Noise Insulation Jackets Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Wire Insulation & Jacketing Compounds Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA