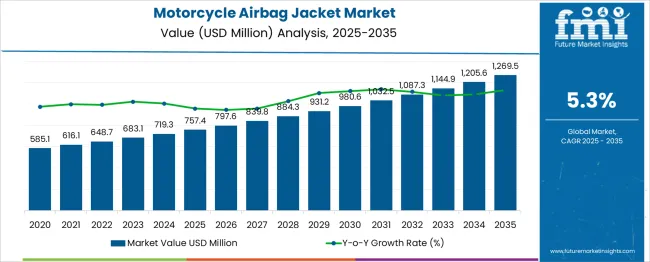

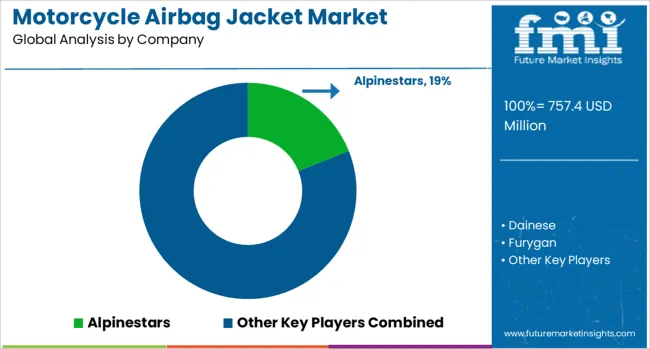

The Motorcycle Airbag Jacket Market is estimated to be valued at USD 757.4 million in 2025 and is projected to reach USD 1269.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. For investors and strategic decision-makers, the data points to a market that moves from early-stage premium adoption toward a broader commercial rollout, with the later years presenting the highest value capture potential.

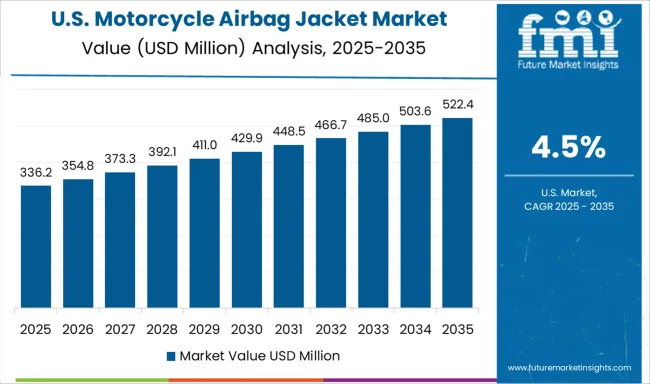

From 2025 to 2030, the market adds USD 223.2 million in value, reaching USD 980.6 million. This phase will be critical for establishing brand dominance and securing distribution networks, as adoption is concentrated among safety-conscious premium motorcycle owners. While the YoY growth rate averages around 5.3%, the opportunity here lies in building market share ahead of the expected volume ramp-up.

The period from 2030 to 2035 generates USD 288.9 million in additional value, accounting for nearly 57% of the decade’s opportunity. This acceleration is driven by competitive pricing strategies, lighter product designs, and integration with rider-assist electronics, making the technology more accessible to the mass market.

The sharpest single-year gain occurs between 2034 and 2035, adding nearly USD 64 million. This late-stage surge suggests that strategic positioning for scale, partnerships, and cost leadership will be decisive for capturing the market’s most profitable growth window.

| Metric | Value |

|---|---|

| Motorcycle Airbag Jacket Market Estimated Value in (2025 E) | USD 757.4 million |

| Motorcycle Airbag Jacket Market Forecast Value in (2035 F) | USD 1269.5 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The motorcycle airbag jacket market is viewed as a specialized yet steadily expanding category within its broader parent industries. It is estimated to account for about 1.9% of the global motorcycle safety gear market indicating rising adoption of protective apparel. Within the motorcycle apparel and accessories segment a share of approximately 3.2% is assessed reflecting demand for passive safety enhancements.

In the smart wearables and connected safety equipment industry around 2.5% is observed supported by sensor activated protective garments. Within the personal protective equipment and impact protection market a contribution of roughly 3.0% is evaluated as airbag jackets offer advanced injury mitigation. In the motorsport and premium riding gear sector about 2.7% is calculated due to interest in innovative safety clothing.

Trends in this market have been shaped by increasing demand for impact protection technologies that activate in milliseconds upon crash detection. Innovations have been focused on electronic sensor modules, CO₂ gas inflation systems and battery free mechanical activation mechanisms. Interest has increased in jackets combining airbag systems with abrasion resistant outer layers and ventilation features for comfort in varying conditions.

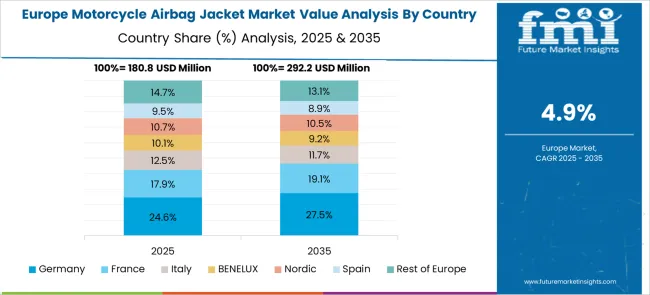

The Europe region has been observed to show fastest adoption while North America and Japan have maintained strong interest in premium safety gear. Strategic initiatives have included collaborations between motorcycle apparel brands and sensor technology firms to deliver modular jackets with detachable electronics, real time diagnostics and integration into rider telematics platforms.

Technological enhancements in wearable safety gear and heightened consumer readiness to invest in personal protection equipment have improved adoption rates across both emerging and developed economies. Insurance incentives for airbag-equipped riders and a growing ecosystem of safety-centric riding communities have also contributed to market acceleration. Product innovation focusing on comfort, sensor precision, and modular design has made the offerings more appealing for regular and long-distance riders.

With infrastructure and policy support in several high-risk traffic regions, the market outlook remains strongly positive.

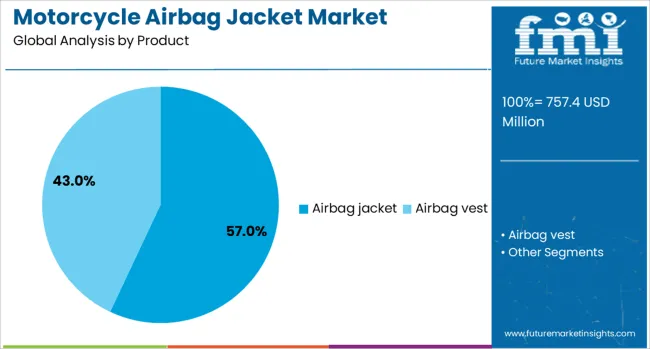

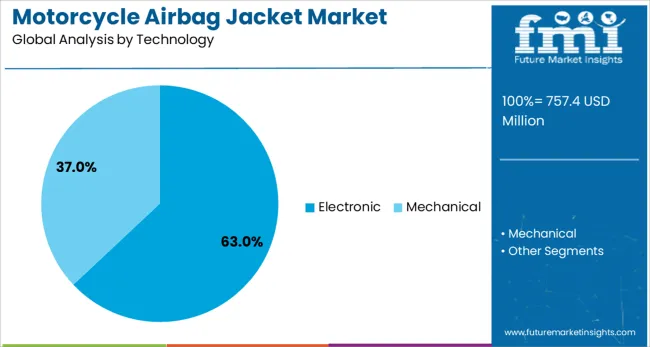

The motorcycle airbag jacket market is segmented by product, technology, distribution channel, end use, and geographic regions. The product of the motorcycle airbag jacket market is divided into Airbag jackets and Airbag vests. In terms of technology of the motorcycle airbag jacket market is classified into Electronic and Mechanical.

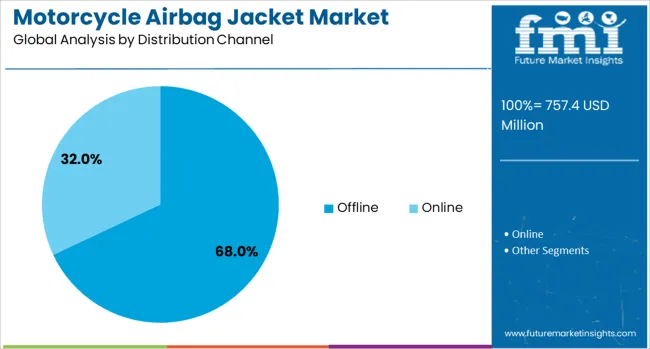

Based on the distribution channel, the motorcycle airbag jacket market is segmented into Offline and Online. The end use of the motorcycle airbag jacket market is segmented into Commuters, Professional motorcyclists, and Adventure & touring riders. Regionally, the motorcycle airbag jacket industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Airbag jackets are projected to hold a dominant 57.00% revenue share in the overall motorcycle airbag jacket market in 2025. The segment's leadership is being driven by increasing consumer awareness about spinal and thoracic protection during collisions, coupled with the rising affordability of these jackets across various income groups.

Continuous design optimization has enabled the integration of lightweight materials and aesthetic styles without compromising safety features. Industry efforts to standardize sizing and introduce gender-specific fits have broadened market accessibility.

Additionally, cross-promotional efforts with major motorcycle brands and rider training programs have elevated visibility and trust in airbag jackets as essential safety gear.

Electronic-based airbag jacket systems are expected to command a 63.00% share of the technology segment in 2025. This leadership is attributed to rapid advancements in sensor technology, real-time data processing, and microcontroller reliability.

The segment has benefited from the integration of accelerometers and gyroscopes that enhance impact prediction accuracy, enabling faster deployment during accidents. Increasing adoption of AI-enabled detection systems and seamless Bluetooth connectivity with smartphones or onboard computers have made electronic systems more adaptive and user-friendly.

Furthermore, consumers are valuing the reusability and automatic reset capabilities offered by electronic systems, reinforcing their long-term cost-effectiveness and reliability.

Offline retail is anticipated to dominate distribution channels with a 68.00% share in 2025. This segment has remained strong due to rider preference for in-person fitting, real-time product demonstrations, and after-sales service offered at dealerships and specialty safety gear stores.

The tactile assurance provided by physical trials is a major factor for first-time buyers and touring motorcyclists. Offline channels have also benefited from strategic partnerships with bike manufacturers, riding schools, and motorsport events, where on-ground marketing and bundled offers are commonplace.

As safety-conscious riders continue to prioritize personalized consultations, the offline segment is expected to maintain its market lead despite the digitalization trend.

Motorcycle airbag jackets have been increasingly adopted by riders seeking enhanced protection during accidents by reducing the risk of severe injuries to the chest, back, and neck. These jackets incorporate built-in airbags that deploy upon detecting sudden impact or abnormal movement. Demand has been supported by the rising focus on rider safety, adoption of advanced protective gear, and availability of both tethered and electronic activation systems. Manufacturers have been focusing on lighter materials, improved inflation mechanisms, and ergonomic designs to enhance comfort and usability for riders.

Increased awareness about motorcycle accident fatalities and injury prevention has been a major driver for the adoption of motorcycle airbag jackets. These jackets have been shown to reduce the severity of impact injuries, making them appealing for both commuting and long-distance touring riders. Road safety campaigns in Europe, Japan, and Australia have encouraged the use of advanced rider protective equipment. Riders participating in motorsport events and endurance rallies have widely adopted airbag jackets due to their proven safety benefits. Some insurance providers have offered premium discounts to riders using certified airbag systems, further promoting their use. The growing availability of these jackets through both physical and online retail channels has expanded accessibility, enabling more riders to integrate this technology into their safety gear.

Innovations in airbag activation systems have significantly improved the reliability and speed of deployment in motorcycle airbag jackets. Electronic sensors with gyroscopic and accelerometer technology have allowed real-time monitoring of rider movements, enabling deployment within milliseconds of an impact. Manufacturers have introduced wireless activation systems that remove the need for tethers, enhancing rider mobility. Lightweight and breathable materials have been integrated to improve comfort during long rides and in warmer climates. Brands in Italy, France, and Japan have developed modular designs that allow airbags to be fitted into different jacket styles, including leather racing suits and textile touring jackets. Enhanced battery life and improved charging options for electronic systems have further contributed to the practicality of these products for everyday use.

Motorcycle airbag jackets have seen strong uptake in professional motorsport, where organizations such as MotoGP have mandated their use for rider safety. Touring and adventure motorcycling communities have also been early adopters due to the high risk of accidents in varied terrain and weather conditions. Rental companies and training schools in Europe and Asia have introduced airbag jackets for students and customers to encourage safer riding practices. Manufacturers have partnered with motorcycle brands to offer factory-approved airbag jacket systems that integrate seamlessly with bike electronics. The strong influence of motorsport safety standards has accelerated awareness and acceptance among regular riders, driving sustained growth in this market segment.

Despite the clear safety advantages, motorcycle airbag jackets have faced limited penetration in cost-sensitive markets due to their higher price compared to conventional jackets. Electronic activation systems, in particular, have added to product costs, restricting adoption among casual riders. Limited awareness about proper maintenance, battery charging, and airbag replacement after deployment has also hindered broader use. In regions with low motorcycle safety enforcement, riders have prioritized cost over advanced protection technologies. Additionally, some riders perceive the jackets as bulky or uncomfortable despite design improvements. Without targeted education campaigns, cost reduction strategies, and retail expansion in developing markets, the adoption of motorcycle airbag jackets may remain concentrated in premium and safety-conscious rider segments.

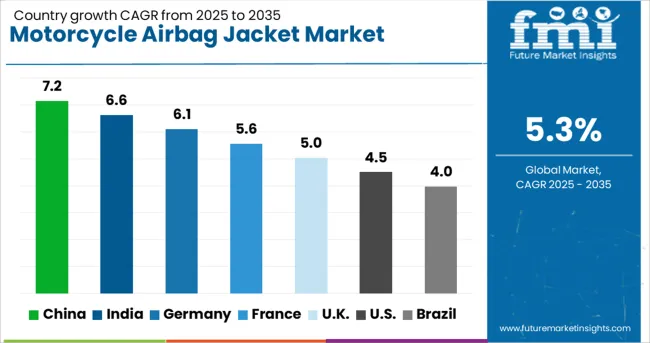

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The market is expected to grow at a global CAGR of 5.3% between 2025 and 2035, driven by rising awareness of rider safety, technological advancements in wearable protection, and increasing motorcycle usage in both commuting and leisure. China leads with a 7.2% CAGR, supported by large-scale apparel manufacturing and expanding domestic motorcycle market. India follows at 6.6%, fueled by rapid growth in two-wheeler sales and safety gear adoption. Germany, at 6.1%, benefits from premium protective gear innovations and strong motorcycle touring culture. The UK, projected at 5.0%, sees growth from regulatory emphasis on rider safety and demand from sport bike users. The USA, at 4.5%, reflects steady uptake among recreational riders and professional racers. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.2% from 2025 to 2035 in the motorcycle airbag jacket market, supported by an expanding community of motorcycling enthusiasts and rising safety awareness. Domestic brands such as Taichi China, Komine CN, and Scoyco are introducing airbag-equipped jackets in both premium and mid-range segments. International players are partnering with Chinese distributors to target sports bike and touring motorcycle owners. The adoption of electronic sensor-triggered airbag systems is increasing, particularly among younger riders. Government-led road safety campaigns and growing participation in motorcycle touring events are fueling demand.

India is forecasted to achieve a CAGR of 6.6% from 2025 to 2035, driven by the growth of the premium motorcycle market and increased focus on rider safety. Companies such as Rynox, TVS Racing Gear, and Royal Enfield are offering airbag jackets designed for long-distance touring and high-speed riding conditions. Rising popularity of adventure touring and racing leagues is creating opportunities for both domestic and imported brands. The affordability gap is being addressed through the launch of mechanical trigger-based jackets, which are less expensive than fully electronic systems.

Germany is projected to post a CAGR of 6.1% from 2025 to 2035, supported by a strong base of motorcycle sports culture and high safety equipment adoption rates. Brands such as Held, BMW Motorrad, and Alpinestars Germany are integrating advanced GPS and inertial measurement unit (IMU) technology into airbag systems for quicker deployment. The growing trend of combining premium leather craftsmanship with integrated safety systems is boosting demand in the luxury motorcycle gear segment. Partnerships between manufacturers and motorsport associations are helping to expand adoption among professional riders.

The United Kingdom is expected to record a CAGR of 5.0% from 2025 to 2035, driven by strong demand from commuter riders and touring enthusiasts. Brands such as RST, Knox, and Dainese UK are focusing on lightweight, weather-resistant airbag jackets suitable for the country’s variable climate. Motorcycle safety awareness programs are increasing adoption among younger riders entering the sport. Integration with smart helmets and Bluetooth-connected riding gear is becoming a notable trend in the market.

The United States is forecasted to grow at a CAGR of 4.5% from 2025 to 2035, supported by a large base of cruiser, touring, and sport motorcycle riders. Companies such as Harley-Davidson, Klim, and Helite USA are offering jackets with both tethered and electronic airbag systems. The adventure touring and long-distance riding communities are driving premium product sales. Integration of airbag jackets into full riding suits for track use is a growing trend, particularly among racing professionals. Increasing retail availability through motorcycle dealerships and e-commerce platforms is boosting consumer access.

The motorcycle airbag jacket market is led by premium motorcycle gear brands and safety technology specialists offering protective apparel with integrated or wearable airbag systems. Alpinestars and Dainese dominate the segment with advanced electronic and mechanical airbag technologies, often developed in collaboration with professional racing teams for maximum impact protection and reliability.

Furygan, Spidi, and Rev’It! integrate airbag systems into touring and sport jackets, balancing safety with rider comfort and style. Helite and Hit-Air specialize in mechanical tether-activated airbag vests and jackets, serving both everyday riders and competitive motorcyclists seeking lightweight, reusable systems. Klim focuses on adventure and off-road airbag-compatible jackets, often incorporating electronic detection units for quicker deployment.

Macna and RST target a broad range of riders with versatile designs that allow integration of third-party airbag systems. Manufacturers employ strategies such as partnering with airbag technology providers, expanding compatibility across jacket models, and offering modular systems for different riding disciplines.

Competitive advantage is shaped by deployment speed, coverage area, and system reusability after activation. Entry into this market is restricted by the need for rigorous crash testing, certification under motorcycle safety standards, and brand trust among safety-conscious riders.

| Item | Value |

|---|---|

| Quantitative Units | USD 757.4 Million |

| Product | Airbag jacket and Airbag vest |

| Technology | Electronic and Mechanical |

| Distribution Channel | Offline and Online |

| End Use | Commuters, Professional motorcyclists, and Adventure & touring riders |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alpinestars, Dainese, Furygan, Helite, Hit-Air, Klim, Macna, Rev'It!, RST, and Spidi |

| Additional Attributes | Dollar sales by product type and vehicle user segment, demand dynamics across racing/pro-sport riders, commuter, touring, and adventure segments, regional trends in automatic (cordless electronic) vs manual (tethered mechanical) systems and textile vs leather adoption across North America, Europe, and Asia‑Pacific, innovation in AI‑driven crash detection, wearable connectivity (Bluetooth/passive apps), modular reusable inflation units and ergonomic breathable materials, environmental impact of cartridge disposal, battery lifecycle, and high‑tech garment recycling, and emerging use cases in OEM safety package inclusion, aftermarket personalization, and smart wearable integration for fleet/taxi and adventure riding. |

The global motorcycle airbag jacket market is estimated to be valued at USD 757.4 million in 2025.

The market size for the motorcycle airbag jacket market is projected to reach USD 1,269.5 million by 2035.

The motorcycle airbag jacket market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in motorcycle airbag jacket market are airbag jacket and airbag vest.

In terms of technology, electronic segment to command 63.0% share in the motorcycle airbag jacket market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motorcycle Boots Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Chain Sprocket Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Insights for Motorcycle Boots Providers

Motorcycle Horn Market Analysis - Size, Share, and Forecast 2024 to 2034

Motorcycle Headlight Bracket Market Growth – Trends & Forecast 2024-2034

Motorcycle Exhaust Mounting Brackets Market

Motorcycle Side Box Market

Motorcycle Hub Motor Market

Motorcycle Sensors Market

Motorcycle Shock Absorbers Market

Motorcycle Start Stop Systems Market

Motorcycle Lighting Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA