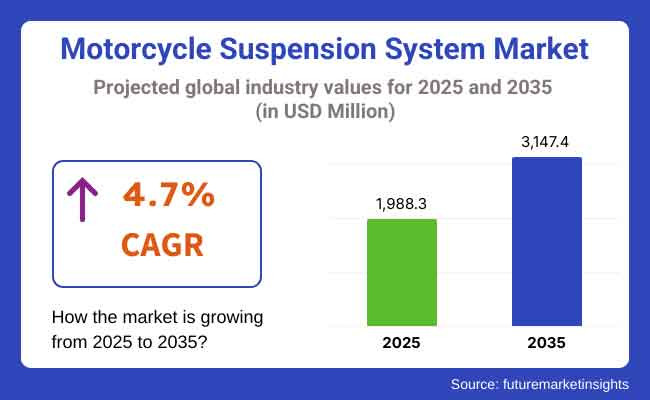

The global motorcycle suspension system market is projected to reach USD 1,988.3 million by 2025 and grow to USD 3,147.4 million by 2035, registering a CAGR of 4.7% over the forecast period. This growth is being driven by increasing demand for ride comfort, vehicle handling, and off-road performance-especially in electric and high-performance motorcycles.

In May 2024, Yamaha filed a patent for a next-generation anti-dive suspension system, designed to stabilize motorcycles during heavy braking without compromising ride quality. According to RideApart, the system leverages hydraulic actuators and electronic controls to counter front-end dive, a common challenge in traditional telescopic fork setups. This advancement aligns with the industry's growing interest in electronically adaptive suspension systems that enhance rider control and safety.

Luxury electric motorcycle maker Curtiss Motorcycles has also been investing in suspension innovation. Matt Chambers, CEO of Curtiss Motorcycles, stated in an interview dated March 21, 2018, “The geometry and ergonomics are classic as well, empowering the rider with effortless control, speed, handling, and comfort. Curtiss suspension is all-new and state-of-the-art. We’re promising a breakthrough in transparency, accuracy, and quality of information between the tarmac and the Curtiss rider. Whole new levels of safety have been designed into Curtiss, which has the goal of being the world leader in this key aspect.”

Electrification trends continue to influence suspension design. In 2024, Ampersand Energy introduced the Alpha motorcycle tailored for African roads, integrating improved rebound damping to handle rugged conditions more effectively.

Asia-Pacific remains the largest consumer of motorcycle suspension systems due to high vehicle density and growing urban congestion in India, China, and Southeast Asia. OEMs are responding with factory-fitted adjustable suspension solutions even in commuter categories, while aftermarket upgrades gain traction among performance enthusiasts.

Motorcycles have remained a long-standing mobility solution, particularly among younger populations, offering affordability, fuel efficiency, and ease of navigation through congested urban landscapes. In Asia-Pacific and Africa-regions with rapidly urbanizing economies and growing middle-class populations-motorcycles are used not only for daily commuting but also for small-scale logistics and rural transportation.

As consumer expectations evolve, ride comfort has emerged as a defining unique selling proposition (USP) among manufacturers. Suspension systems, which play a pivotal role in absorbing shocks, ensuring vehicle balance, and enhancing maneuverability, are now seen as a key performance differentiator. OEMs are aligning suspension upgrades with rising two-wheeler sales, especially in India, Indonesia, Nigeria, and Kenya, where both domestic manufacturing and import volumes are surging.

The market is further supported by innovation in adaptive damping, dual suspension modules, and off-road-specific setups designed for rugged terrains. With an increasing focus on rider safety, fatigue reduction, and handling performance, the demand for advanced suspension systems is expected to mirror the growth trajectory of global motorcycle sales, thereby substantially contributing to market expansion.

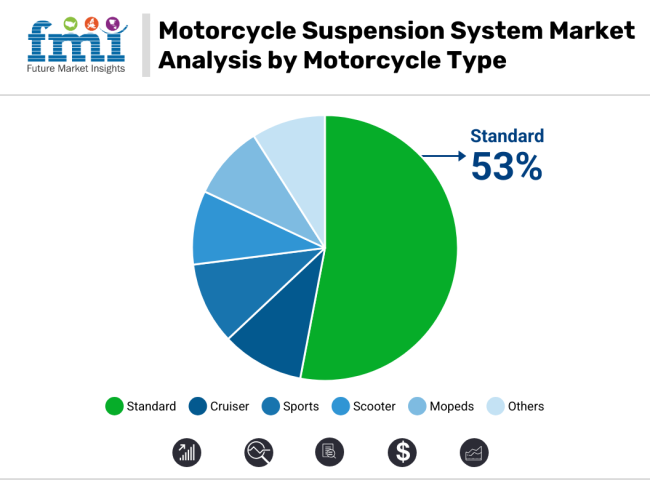

Standard motorcycles are expected to contribute 53% of the global motorcycle suspension system market by 2025. A CAGR of 4.5% has been projected for this segment over the forecast period from 2025 to 2035. Growth in this category has been strongly influenced by its role in supporting both first-time riders and utility-based users across semi-urban and rural geographies. Unlike performance or touring models, standard motorcycles operate under a broader range of payload and road conditions, necessitating robust and durable suspension setups.

Suspension suppliers are increasingly customizing spring rates and damping responses for this segment, where variations in rider weight, terrain roughness, and vehicle load are more frequent. Enhanced durability and simplified maintenance are being prioritized to support markets with limited service infrastructure. Additionally, as governments promote vehicle electrification in lower displacement categories, standard motorcycles are emerging as the first adopters of electric drivetrains, creating opportunities for new suspension geometries.

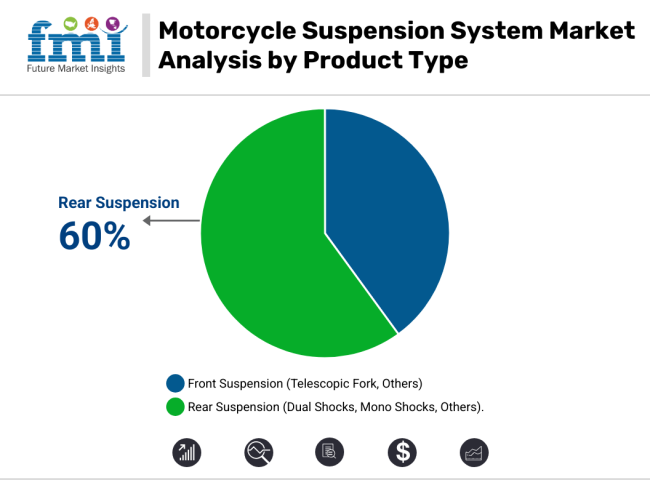

By the end of 2035, dual shock rear suspension systems are projected to occupy nearly 60% of the global rear motorcycle suspension system market. A compound annual growth rate (CAGR) of 3.6% has been forecast for this segment through the assessment period. This dominance has been sustained by the extensive application of dual shock absorbers in commuter and entry-level motorcycles, particularly in South and Southeast Asia, where rugged terrain and frequent load variations demand stable and mechanically simple solutions.

The dual shock configuration has been favored for its ease of installation, lower maintenance requirements, and compatibility with steel swingarm frames-commonly used in cost-sensitive vehicle categories. Manufacturers continue to utilize this setup in small-displacement motorcycles due to its consistent performance under varied road conditions and pillion use. Moreover, aftermarket customization in urban and semi-urban areas has further sustained interest in dual shock systems.

As global platforms continue to prioritize economies of scale, dual shocks are being retained in mid-range motorcycle architectures, even in markets witnessing the transition to electric drivetrains. Their ability to deliver durable suspension performance with minimal structural redesign has reinforced their role in long-term product planning and platform standardization.

North America stands as a driving force in motorcycle suspension systems, primarily owing to the increase in touring, adventure, and cruiser bikes. This region has a seasoned consumer with a major portion of higher spending, hence, the penetration of premium and electronically controlled suspension systems in the Harley-Davidson, Indian, and BMW brands is on the increase as well.

With the increase in off-road biking, dual-sport culture, and customization workshops, demand for suspension aftermarket upgrades is increasing. The USA market is supported by an interest in electric motorcycles, which require specific lighter weight suspensions developed for battery systems.

Flowing with creativity and technology of air suspensions, preload adjustability, and smart sensors, OEMs and suppliers working together now come up with performance-tuned alternatives to fit a variety of motorbike types.

Europe is a highly technologically-advanced region in which motorcycle suspension systems are strictly regulated due to bicycle modes. Germany, Italy, and the UK are main countries home to famous motorcycle manufacturers and suspension system innovators like Öhlins, WP Suspension, and Marzocchi.

The focus on safety and emission regulations which is gaining traction in the region is the foremost cause behind the advanced functions of semi-active and electronically adjustable suspensions cars. These systems provide comfort to the drivers by letting them tune the dampening characteristics along the way depending on the conditions.

The motorsport culture in Europe is sports cars, motorbikes, and electromagnetic scooters, the popularity of which is on the rise and is leading to the need for performance-enhancing suspension. The electric scooters and compact motorcycles of the present time, which are energy-efficient, create new applications for the suspended, energy-efficient, compact ones.

The market of motorcycle suspension directly correlates with Asia-Pacific, as it is the biggest and fastest growing market that obtains a noticeable market share in the overall two-wheeler production and sales sector. Countries like India, China, Indonesia, Vietnam, and Thailand are increasing their demand for motorcycles, which will be supplied in a cost-efficient and urban transport-friendly manner, all of which will ease traffic.

In particular, this region's manufacturers are concentrating on the enhancement of commuter bike comfort by utilizing telescopic forks and dual-shock rear systems while joining monoshock and preload-adjusted systems in mid-category motorcycles. The bike sector in India is registering fast progress, companies like Hero MotoCorp, TVS, Bajaj, and Royal Enfield are modernizing the models by adding new suspension systems for both home and export markets.

As companies debunk new markets in electric and adventure motorcycles, the emphasis on lightweight and electronically integrated suspension solutions in the Asia-Pacific has increased.

The Middle East & Africa (MEA) region is positioned as a moderate-growth zone in motorcycle suspension systems. The primary reason is the increased usage of motorcycles in last-mile transportation, urban, and tourism sectors in the countries such as South Africa, UAE, and Egypt.

The motorcycle industry relies quite heavily on simple telescopic and twin devices but there is a face change thanks to the emerging high-quality suspension components on premium and adventure categories. This is the result of imported models and the growing importance of road safety and vehicle operating efficiency.

With the development of infrastructure and urban mobility bringing about an increase in demand, the MEA countries are bound to see gradual progress in demand for more efficient and adaptive suspension systems in both commuter and specialized motorcycles.

Cost Pressure on OEMs and Consumers

The most important problem in the motorcycle suspension system industry is the expense of upgrading to sophisticated suspension facilities. On the one side, electronically adjustable and semi-active suspension technologies can double the advantages of an engine in a vehicle, yet they also put the production and retail cost together.

In the case of price-sensitive countries like India, Indonesia, and Africa, where commuter vehicles are the major users of the road, the OEMs are the last to introduce the high-end suspension technologies since hypocritical profits and risky customer purchasing decisions are the major reasons. The lack of a mass-scale advanced production of the components hinders the situation since it would lower the cost and lead to better market absorption.

In response to this issue, they have focused on such things as modular suspension designs, platform-based integration, and local sourcing as parts of their program to maintain costs and affordability.

Durability and Maintenance in Harsh Conditions

Motorcycle suspension systems, particularly in developing countries, are subjected to extreme working conditions, very heavy loads, and erratic maintenance, which severely treats the longevity of components. The shock absorbers and fork seals are often the first ones that undergo wear in these rural areas with rugged terrain thus leading to ride comfort decline and handling risks.

The unhygienic attitude about suspension timing among the people, of which there are very few people who are certified technicians in the areas, has resulted in deferred maintenance, and posing safety problems.

Manufacturers should create such suspension systems that have better protection from rust and are less prone to wear out, which could be achieved among others by coating, dust-proof seals, and oil-retention invention as well as educating their dealers and supporting them with services to help with the extensions of the duration of products.

Adoption of Semi-Active and Smart Suspension Technologies

With the change in consumer behaviour, which is a ride’s customization as well as bike's intelligent answer to the road, they are accordingly showing more interest in semi-active suspension, which can control damping automatically based on the road, the load, and speed in real-time. The systems that were only used in luxury vehicles are now being drawn into the medium-range of the adventure and touring models.

In the interview with tier-1 suppliers it has been no surprising news that they are pinpointing the attachment of sensors to the damping systems, electronic control units (ECUs), and cloud ride settings that personalize it. The major benefit of this trend is that we can present suppliers with scalable smart suspension modules that can be sold on a variety of platforms.

In the future, smart suspension together with other "Connectivity" features will revolutionize the bike segment by improving handling, comfort, and safety.

Growth of Electric Motorcycles and Lightweight Suspension Demand

The global move towards electric mobility rakes in demand for even lighter, energy-saving systems. Electric Vehicles require weight distribution and rolling resistance that are lower than what is the standard; and, as a result, the R&D on technologically lighter parts such as aluminum alloy springs, air springs, and compact monoshock assemblies have been pushed ahead.

The producers who expand their range with urban electric bikes, scooters, and the performance versions of e-motorcycles are the companies that the custom-built suspension units with the battery layouts, regenerative braking systems, and the standard low-noise operations will be in use.

Those businesses that will surface with green solutions in off-the-shelf suspension parts, while yet maintaining low-cost and high-durability, will be more affirmatively balanced in this segment on the world market.

In the time frame of 2020 to 2024 motorcycle suspension systems had witnessed a stable growth rate propelled forward by a rise in global two-wheeler sales, a growing roar for ride comfort, and progression in suspension construction technologies. The main changes were more common with the use of telescopic forks, mono-shock systems, and upside-down (USD) forks, especially in performance and premium motorcycles.

The emergence of electric motorcycles, together with mobility trends in developing economies, contributed to demand inflow though there were such factors as cost pressure on the commuter segment, road infrastructure inconsistency, and end-user market for high-end suspensions in low-cost bikes that affected market equilibrium.

Over the period of 2025 to 2035, the motorcycle suspension systems will transform vigorously due to smart suspension tech like AI variable damping control, adaptive electro suspension, and lightweight smart components. The lifecycle of suspension products will shift from time-based to condition-based maintenance using AI technologies. Composites, 3D-printed structures, AI predictive maintenance, and other features will further bend the performance of both the commuter and performance sectors.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Type Evolution: Telescopic & Mono-Shock Dominance | Commuter motorcycles are absolutely in the hands of telescopic forks and the mid to high-end bikes are with mono-shocks. |

| Performance vs. Affordability | High-end motorcycles equipped with USD forks and high-performance mono-shocks were the first to delve into this technology while the budget-conscious segments stuck to the basics. |

| Electric Motorcycle Impact | EVs switched to lighter suspension systems with standard damping controls. |

| Materials & Weight Optimization | The adoption of aluminum alloy components and progressive springs for weight savings. |

| Smart Suspension Integration | Only high-end sport and adventure bikes have semi-active electronic suspension, which is an advanced feature. |

| Connectivity & Customization | Suspension was adjusted manually by the riders or only few electronic pre-sets were available. |

| Urban Mobility & Last-Mile Demand | There was a huge influx of demand for scooters and small-displacement motorcycles in urban markets. |

| Market Growth Drivers | Speeded up by motorcycle sales, urbanization, and comfort in rides. |

| Market Shift | 2025 to 2035 |

|---|---|

| Type Evolution: Telescopic & Mono-Shock Dominance | Installation of semi-active and fully active suspension systems with AI-based real-time damping adjustments. |

| Performance vs. Affordability | Software that promotes the reduction of manufacturing costs for electric vehicles by offering a combination of recyclable and modular suspension systems for platform sharing. |

| Electric Motorcycle Impact | Lightweight, resilient, and electronically-controlled suspension systems specifically designed for e-motorcycles. |

| Materials & Weight Optimization | Entrenching carbon composites, 3D-printed lattice designs, and self-healing damping fluids into next-gen systems. |

| Smart Suspension Integration | Introductory modification of mid and premium motorcycle designs to include AI-driven, terrain-adaptive, and easy suspension systems. |

| Connectivity & Customization | Bluetooth-enabled, App-controlled suspension settings with cloud-based ride profile storage and AI-assisted tuning. |

| Urban Mobility & Last-Mile Demand | Smart suspension for micro mobility, delivery EVs, and urban two-wheeler fleets with pre-load adjustment that is done automatically. |

| Market Growth Drivers | Growth is as a result of autonomous riding choices, EV platform subscription, AI-powered safety gears and better-suspension technology. |

The United States motorcycle suspension system market is witnessing steady growth, driven by the rising popularity of recreational and touring motorcycles, increased demand for premium bikes, and advancements in suspension technologies. The market is further fueled by the growth of adventure and dual-sport motorcycling, which requires high-performance suspension systems capable of handling diverse terrains.

Manufacturers have shifted their focus towards things like adjustable and electronically controlled suspension systems which function to improve ride quality and safety. The aftermarket segment is flourishing as well with users doing upgrades on their bikes to add custom and performance-enhancing parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

The United Kingdom motorcycle suspension system market, at a moderate growth rate, is shored up with the continuous use of motorcycles as a commuting mode, and the market's move to electric scooters, as well as a consumer preference for better ride comfort. The traffic problems and narrow roads in the country make the quality and handling of motorcycle suspension a decisive aspect of rider safety and comfort.

With the increase in motorcycle racing and off-road sports, the demand for high-performance suspension components is driven. The premium bike manufacturers are emphasizing on the sale of customizable suspension systems as a value-added feature.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The European Union motorcycle suspension system business is flourishing due to the high rates of motorcycle ownership, a strong motorsports presence, and ecomect regulations that protect the environment and force developers to create new devices. Germany, Italy, and Spain are standout countries here because of soaring demands for the sports, cruiser, and touring motorcycle segments.

OEMs in Europe are deploying their resources towards semi-active and smart suspension technologies that are capable of adapting to real-time road conditions. The trends ofered by materials that are not only durable but lighter such as Aluminum and carbon composites has had an impact on the market too.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

The Japan motorcycle suspension system market is moderately buoyant due to its solid two-wheeler manufacturing core, the increasing interest in high-end motorcycles, and demand from consumers for refined suspension performance. The pioneering Japanese OEMs like Honda, Yamaha, and Kawasaki integrate innovative Features such as inverted telescopic forks and gas-charged rear shocks.

The market also profits from the aging rider population, which needs long-distance ride comfort and stability from the systems. The growth in electric motorcycles, as well as the introduction of urban commuting bikes, is promoting the demand for designs that are both compact and energy-efficient.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The South Korea motorcycle suspension system domain is increasing at the rate of higher personal mobility as well as growing interest in leisure motorbikes along with increased electric scooters and bikes. The two-wheeler market in South Korea is smaller than in other areas, but a recent trend of scooter transport, logistics, and last-mile delivery has led to increased demand for cost-effective and durable suspension solutions.

The nation's focus on e-mobility as well as the reduction of vehicle weight is the primary reason for it being a point of development in the area of small, adjustable suspension systems that are climatically suitable for city driving.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The world motorcycle suspension system is on the rise, being propelled by the motorcycle industry, the electric bike fluctuation, as well as the lifestyles of consumers who are more performance and comfort-oriented. The suspension system are key elements in providing ride stability, shock absorption, and rider safety, in both commuter and high-end motorcycles they are directly responsible for the dynamic handling, comfort, and performance.

Incorporating technology in vehicles adaptive and electronically adjustable suspensions, are being favored by both recreational riding as well as the motorcycle segment. Still the dominant impulse spurring the market is the embrace of off-road biking as the most important pleasurable driver is adventure riding.

Upholding’s are concentrating their efforts on products such as electronically adjustable suspension (semi-active or active) and with the enhancement of the electronic components they are reducing the costs thus increasing the popularity of adventure riding and off-road biking.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| KYB Corporation | 13-15% |

| Showa Corporation | 12-14% |

| ZF Friedrichshafen AG (Sachs) | 10-12% |

| Tenneco Inc. (Öhlins Racing AB) | 8-10% |

| WP Suspension (KTM Group) | 6-8% |

| Other Companies (combined) | 45-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| KYB Corporation | Supplies front forks and rear mono-shock systems to leading OEMs; known for affordable, reliable suspension units for commuters and sports bikes. |

| Showa Corporation | Offers advanced damping control and dual-bending valve forks, widely used in mid to high-end motorcycles and off-road bikes. |

| ZF Friedrichshafen AG (Sachs) | Provides premium performance shocks and struts, focusing on racing, touring, and heavy-duty motorcycles. |

| Tenneco Inc. (Öhlins Racing AB) | Known for electronically adjustable suspensions and tunable fork systems, catering to superbikes and competitive racing. |

| WP Suspension (KTM Group) | Specializes in lightweight, high-performance forks and mono-shocks, standard on KTM, Husqvarna, and GasGas motorcycles. |

Key Market Insights

KYB Corporation

KYB Corporation KYB is a dominating figure in the motorcycle suspension systems sector, not only in the manufacturing of OEM but also in the supply of aftermarket-related parts to clients in Asia, Europe, and North America. The company is known for a 2-in-1 fork telescopic and rear mono-shock produced by them which are reasonable, long-lasting as well as low normal care necessary parts.

The companies which have integrated KYB technology include Yamaha, Honda, Suzuki, and Kawasaki, especially in commuter and mid-range motorcycle segments. The firm persists in pouring resources into hydraulic damping research and mass-customized shock absorber outlines for different market needs.

Showa Corporation

Showa is a very popular brand in the field of premium motorcycles, sport bikes, and off-road vehicles for its advanced suspension. And also find the newly launched bikes having the features such as SFF, the dual-bending valve technology as well as semi-active electronic damping systems which greatly enhance ride quality and terrain adaptability. As a major supplier for Honda and Harley-Davidson, Showa is continuously working on smart damping controls and lightweight components adaptation, which is in line with the growing electric motorcycle market.

ZF Friedrichshafen AG (Sachs)

Through its Sachs brand, ZF focuses high-performance motorcycle suspension systems, especially for touring, racing, and heavy-duty motorcycles. Sachs featured by BMW Motorrad and Ducati components through provision of-i specific damping characteristics, rebound/compression adjustable features and vibration isolation improved. ZF is at the forefront of semi-active damping and the integration of ride monitoring sensors, pushing the boundaries of intelligent suspension systems.

Tenneco Inc. (Öhlins Racing AB)

Öhlins, which is a subsidiary of Tenneco, is a standard in premium and racing-grade suspension systems. Öhlins products have gained popularity in superbikes, MotoGP, and performance road bikes for their precision-tunable shocks, cartridge kits, and next-generation electronic-controlled suspensions. The company is progressing in the development of the EC-TRAC technology, which is real-time adaptive damping and at the same time, is expanding the portfolio of aftermarket racing suspension globally.

WP Suspension (KTM Group)

WP Suspension is famed for its high-quality front forks and mono-shocks which are noticeably present on the KTM, Husqvarna, and GasGas motorcycles. The brand's XPLOR, XACT, and APEX suspension systems are designed specifically for motocross, enduro, and adventure bikes, making them the top choice for users requiring extreme off-road capability, custom tuning, and durability. WP continues its path of being innovative in air-sprung systems, and electronically assisted damping, and targets both OEM and aftermarket growth.

Front Suspension (Telescopic Fork, Others), Rear Suspension (Dual Shocks, Mono Shocks, Others).

OEM, Aftermarket.

Passive, Active/Semi-Active.

Standard, Cruiser, Sports, Scooter, Mopeds, Others.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA).

The global motorcycle suspension system market is projected to reach USD 1,988.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.7% over the forecast period.

By 2035, the motorcycle suspension system market is expected to reach USD 3,147.4 million.

The sports motorcycle segment is expected to dominate due to the increasing demand for high-performance bikes with advanced suspension technologies that enhance ride comfort, stability, and control at high speeds.

Key players in the market include SHOWA Corporation, KYB Corporation, Öhlins Racing AB, WP Suspension (a KTM subsidiary), and Tenneco Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Motorcycle Type, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Motorcycle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 28: Global Market Attractiveness by Technology, 2023 to 2033

Figure 29: Global Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 58: North America Market Attractiveness by Technology, 2023 to 2033

Figure 59: North America Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Motorcycle Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Motorcycle Type, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Motorcycle Type, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Motorcycle Type, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Motorcycle Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Motorcycle Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motorcycle Boots Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Chain Sprocket Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Insights for Motorcycle Boots Providers

Motorcycle Horn Market Analysis - Size, Share, and Forecast 2024 to 2034

Motorcycle Headlight Bracket Market Growth – Trends & Forecast 2024-2034

Motorcycle Exhaust Mounting Brackets Market

Motorcycle Side Box Market

Motorcycle Hub Motor Market

Motorcycle Sensors Market

Motorcycle Shock Absorbers Market

Motorcycle Lighting Market

Motorcycle Start Stop Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA