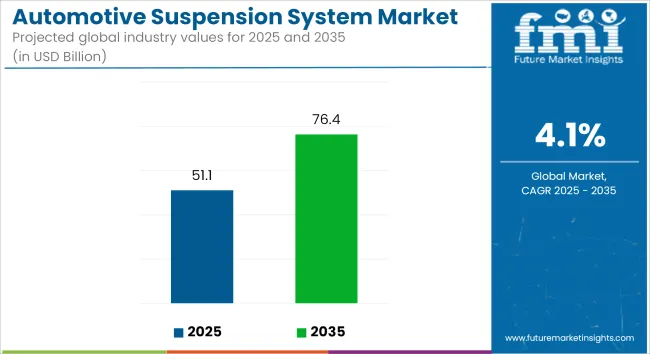

The global Automotive Suspension Systems Market has been projected to grow from USD 51.1 billion in 2025 to USD 76.4 billion by 2035, advancing at a CAGR of 4.1% during the forecast period. A valuation of USD 42.8 billion had been recorded in 2020.

Demand has been sustained by performance benchmarks centered around ride comfort and vehicle dynamics. Electrified and semi-active suspension architectures are being favored in modern platforms. Integration of electronically controlled dampers and mechatronic actuators has been accelerated in both luxury and electric vehicle (EV) segments.

In April 2024, Porsche confirmed a collaboration with ClearMotion to integrate the company’s high-speed road-sensing suspension across select EVs and performance models. According to Reuters, ClearMotion’s system uses predictive software to minimize vibrations caused by road imperfections, enhancing ride quality without compromising control. Production partnerships have already been formalized, with deployments expected across Porsche's high-end models.

ClearMotion’s prior agreement with NIO, disclosed in late 2023, had already positioned the startup as a key supplier for the Chinese OEM’s ET9 flagship electric sedan. A confirmed allocation of 750,000 units was reported, covering multiple upcoming models.

Major suppliers are simultaneously supporting global OEMs with advanced active suspension systems. In October 2023, Monroe Intelligent Suspension was selected by McLaren Automotive for integration into its 750S supercar. The CVSA2/Kinetic® technology had been implemented to optimize stability during high-performance driving, as reported by Automotive News.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 51.1 billion |

| Market Value, 2035 | USD 76.4 billion |

| Value CAGR (2025 to 2035) | 4.1% |

Modular and lightweight suspension subframes are being designed using aluminum and composites to lower vehicle mass. In India, Mahindra launched the BE.6 and XEV 9e in 2025 with modular front and rear suspension setups using Monroe’s adaptive damping components.

Simulation is further improving development cycles. AB Dynamics emphasized in its April 2024 whitepaper that “by simulating real-world scenarios, engineers can explore different design alternatives and fine-tune suspension performance before any physical prototypes are made.” The company highlighted that the method significantly cuts physical testing costs.

As EV platforms evolve, suspension systems are being recalibrated for software-defined control and tunable ride parameters-supporting personalized mobility and energy efficiency.

The table below presents the annual growth rates of the global automotive suspension system market from 2025 to 2035. With a base year of 2024 extending to 2025, the report explores how the market's growth trajectory develops from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders a comprehensive view of the industry’s performance, focusing on key developments and shifts that may shape the market moving forward.

The market is expected to grow at a CAGR of 4.1% from 2025 to 2035. In H2, the growth rate is anticipated to increase slightly.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.9% (2024 to 2034) |

| H2 2024 | 4.0% (2024 to 2034) |

| H1 2025 | 4.1% (2025 to 2035) |

| H2 2025 | 4.3% (2025 to 2035) |

From H1 2025 to H2 2025, the CAGR is expected to show a modest increase, moving from 4.1% in the first half to 4.3% in the second half. In H1, the sector is expected to see an increase of 20 BPS, with a further 30 BPS rise in the second half. This semi-annual update highlights the automotive suspension system market's growth potential, driven by advancements in adaptive technologies, lightweight materials, and increased demand for high-performance, durable solutions.

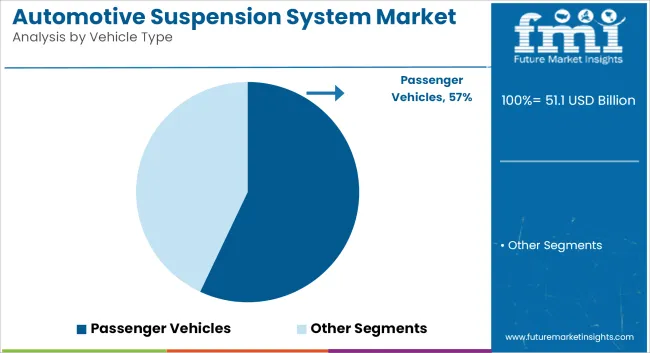

Passenger vehicles are expected to account for the largest share of the global automotive suspension system market, contributing approximately 57% of total revenue in 2025. The segment is projected to grow at a CAGR of 4.3% from 2025 to 2035, slightly above the global industry growth rate of 4.1%.

Increasing demand for ride comfort, vehicle stability, and handling precision is driving OEMs to integrate advanced suspension systems across both mid-range and high-end passenger vehicle models.

Suspension system upgrades are now being positioned as key differentiators in passenger vehicles, with a rising preference for electronically controlled dampers, multi-link setups, and modular chassis platforms.

The proliferation of electric vehicles (EVs) is also influencing suspension architecture, as battery placement and weight distribution require recalibrated shock absorption and ride control dynamics. Automakers are investing in adaptive suspension technologies to offer personalized ride modes and real-time road surface response, especially in luxury sedans and performance SUVs. Additionally, consumer expectations for smoother urban commuting and highway comfort continue to reinforce growth in this category.

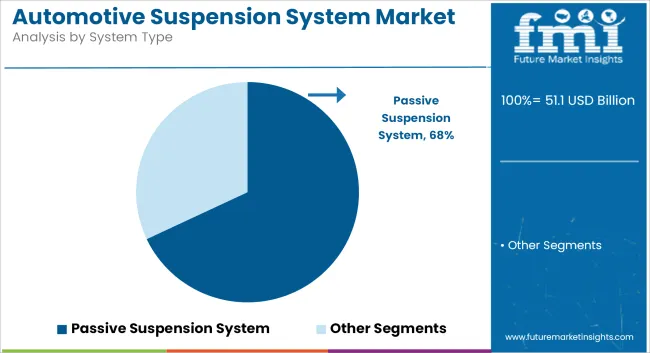

Passive suspension systems are projected to remain the dominant system type, accounting for approximately 68% of market share in 2025, with the segment forecast to grow at a CAGR of 4.0% through 2035. These systems are widely adopted across economy and mass-market vehicles due to their low cost, mechanical simplicity, and consistent performance in varied driving conditions.

Traditional shock absorbers, coil springs, and torsion bars continue to serve as the backbone of passive systems, especially in regions with price-sensitive automotive markets. While semi-active and active systems are gaining traction in premium and electric vehicles, the sheer volume of conventional vehicle production ensures passive systems retain a strong hold on global demand.

Advancements in damper materials, noise reduction technologies, and improved corrosion resistance have also enhanced the lifecycle performance of passive components. As manufacturers look to balance cost and comfort, passive suspension systems remain the preferred solution for mainstream automotive platforms worldwide.

Growing Vehicle Production in Emerging Markets Drives Demand for Suspension Systems

Growing world production for vehicles, particularly in developing countries, acts as a locomotive to propel the automotive suspension system market. As India, China, and Brazil record phenomenal economic growth, increasing ownership of vehicles will cater to the demand for automotive components such as suspension systems in the aforementioned markets. The growth of the automotive industry in this region has been bolstered by the increase in disposable income availability as well as urbanization and affordable vehicles.

As the level of production of vehicles increases, automotive manufacturers want to develop advanced suspension systems for safety, comfort, and stability for a wide customer base. Further growth of the market is driven by increased production of both passenger and commercial vehicles and rising demand for performance-oriented and rugged suspension solutions. This trend benefits the automotive suspension system market, and manufacturers focus on addressing various needs in emerging markets.

Performance-Oriented Vehicles Drive Demand for High-Quality Suspension Systems

Performance-oriented vehicles require advanced suspension systems in order to ensure superior handling, traction, and stability, thus driving their demand upwards. High-performance cars, sports cars, and luxury models require precision engineering in order to give drivers an optimal driving experience. It is vital in the management of the dynamics of a vehicle at high speed or during sharp turns. The suspension keeps tires planted on uncompromising surfaces thereby promoting traction and reducing body roll needed for stability.

These vehicles, powered by advanced technologies, call for adjustable dampers and multi-link suspension in order to enhance cornering capabilities and provide a smooth controlled ride. Thus, as consumers keep demanding more performance from their vehicles, the demand for advanced-quality suspension systems keeps increasing. To meet this performance segment of the automotive industry, manufacturers are focusing on developing lightweight, durable, and responsive suspension components.

Increasing Aftermarket Demand Drives Growth for High-Performance Suspension Components

The increased aftermarket demand for performance modifications is one of the primary factors anticipated to drive growth in this market. Consumers are increasingly looking to use suspension modifications to enhance the performance, handling, and comfort of their vehicles. Sports car, off-road, and luxury vehicle enthusiasts increasingly favor custom suspension systems for better ride comfort, stability, and overall driving dynamics. The aging of vehicles has also led many owners to replace or upgrade their suspensions to restore or enhance performance. This is reflected even more strongly in those markets where off-road and performance vehicles have increased quite a bit; as owners, they want more control and durability.

This particular type of suspension component such as coil overs, adjustable dampers, and lifted suspension kits will see a surge in demand. A wide range of advanced aftermarket suspension products gives consumers the ability to personalize their vehicles, further driving the growth of this market. With such demand for aftermarket upgrades has been noted easing the way for manufacturers to develop a whole variety of high-end performance suspension solutions.

Growth in Commercial Vehicle Fleets Drives Demand for Robust Suspension Systems

The expansion of commercial vehicle fleets is a major factor contributing to the growth of the automotive suspension system market. With global logistics, e-commerce, and transportation on the rise, companies are investing in bigger fleets to accommodate the increased needs in delivery and freight. These include trucks, buses, and delivery vans, which need to operate over longer distances and carry heavier loads. Ridged suspension systems help in minimizing wear and tear on vehicles while enhancing comfort to the drivers and ensuring safe transportation of goods.

The commercial vehicles, in general, utilize air suspension and multi-link systems to cope with the variable road conditions and heavy cargo. Though the market would expect pressure from various transport service utilities, the service fleets will continue to usher the industry toward growth.

From 2020 to 2024, the global automotive suspension system market experienced steady growth, fueled by advancements in vehicle technology and increasing consumer demand for enhanced comfort and performance. The growing emphasis on ride quality, handling, and vehicle stability spurred the development of sophisticated suspension systems, including adaptive and active suspensions, as well as air suspension systems.

The trend toward lightweight materials such as aluminum and composites, aimed at improving vehicle efficiency, further contributed to the growth of the market. Additionally, the increasing popularity of high-performance, off-road, and luxury vehicles drove demand for specialized suspension systems tailored to specific needs.

Looking ahead to 2025 to 2035, the automotive suspension system market is expected to see rapid growth, driven by innovations in suspension technologies, stricter safety standards, and rising demand for enhanced vehicle handling. As vehicles become more complex and diverse, the need for high-performance, adaptable suspension systems that meet safety and comfort requirements will continue to rise, particularly in emerging markets with growing automotive production.

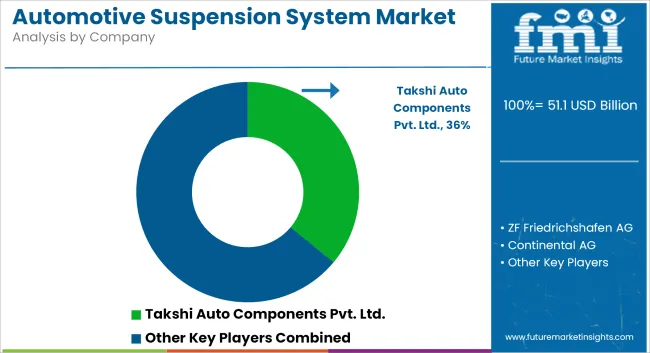

Tier-1 companies account for around 30 to 35% of the overall market with a product revenue from the automotive suspension system market of more than USD 130 million. Takshi Auto Components Pvt. Ltd., ZF Friedrichshafen AG, Continental AG, Hitachi Astemo, Ltd., and other players.

Tier-2 and other companies such as BWI Group, HL Mando, Bilstein and other players are projected to account for 65 to 70% of the overall market with the estimated revenue under the range of USD 100 million through the sales of automotive suspension system.

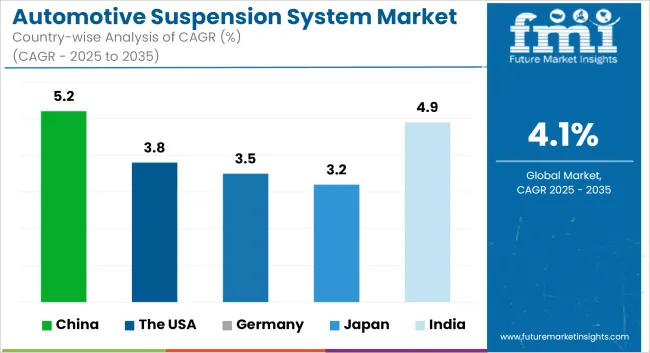

The section below covers the industry analysis for automotive suspension system in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 5.2% |

| The USA | 3.8% |

| Germany | 3.5% |

| Japan | 3.2% |

| India | 4.9% |

The factors boosting the growth of the automotive suspension system market are the established manufacturing base and growing automotive demand in China. With the rise in automobile production, the demand for advanced suspension systems offering stability, comfort, and safety under all conditions and types has been on the rise.

Rapid industrial development and vehicle production in China have impressed upon a higher demand for suspension systems in the domestic and international markets. In the soaring automotive market driving commercial and passenger vehicles in China, durable and high-performing suspension solutions are needed to enhance multi-faceted consumer needs. The adaptive suspension systems or air suspension systems are used to enhance their handling, ride quality, and vehicle dynamics. These help the vehicles react to stay stable in different road conditions, boost comfort, and provide better vehicle performance.

The increasing preference of luxury cars, and off-road vehicles demand for advanced suspension systems. There is a trend among consumers these days for cars that offer good performance while not compromising with comfort and versatility. Specialized suspension systems such as air suspension and multi-link setups are generally suited for such cars that need smooth rides and accurate handling on odd and tough terrains. Off-road vehicles are also gaining popularity as outdoor activities, adventure travels, and leisure drives become more popular in the USA.

The demand for cars that can tackle poor terrains while still being comfortable and stable has forced manufacturers to only fit them with advanced suspension solutions. This type of system offers better shock absorption, load management, and setting the appropriate ride height, making it an ideal for use in luxury and off-road vehicle segments.

Germany has become the epicenter of the EV transition, necessitating specific types of suspension systems. EVs' weight distribution differs from that of conventional ICE vehicles due to the heavier battery packs installed low in the chassis. Altered vehicle dynamics and handling need resultant suspension systems to offset these additional weight disparities. Such suspension solutions must include air suspension and adaptive suspension systems optimizing ride comfort, stability, and performance in EVs.

Adapting to changing road surfaces and load conditions allows for refined on-road comfort and vehicle handling. Meanwhile, owing to the gradual acceptance of EVs in Germany, an increase in regulation regarding vehicle performance has driven additional demand for lightweight and high-performance suspension systems to provide electric vehicles with an equally smooth and engaging ride as that offered by traditional products.

Technological developments of modern suspension systems for the automotive sector will further refine and enhance performance, comfort, and safety. There is a growing trend toward the use of modern light-weight suspension components made of aluminum and composite materials, supporting the industry's growing efforts to reduce vehicle weight. Application of advanced technologies like shock absorbers and dampers with new designs and materials will greatly enhance ride quality and handling under varying conditions.

Adaptive suspension provides for real-time tuning based on road conditions and driving style with some types of air suspension and magnetic ride control systems gaining traction. Technological breakthroughs in both coil spring and leaf spring designs mean load distributions and durability can be optimized for longevity under heavy use. Such advances in technology make replacement of suspension systems an important factor in modern automotive engineering as they become unavoidable for high-performance and luxury vehicles.

Recent Industry Developments

The components can be further categorized into shock absorbers, springs, control arms, ball joints & bushings, struts and others.

The vehicle type is classified into passenger vehicles, commercial vehicles, two-wheelers and off-road vehicles.

The system type is classified into passive suspension system, semi-active suspension system and active suspension system.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The automotive suspension system was valued at USD 49.1 billion in 2024.

The demand for automotive suspension system is set to reach USD 51.1 billion in 2025.

The automotive suspension system is driven by rising demand for advanced suspension systems in high-performance vehicles, along with the growing need for adaptive and active suspension technologies.

The automotive suspension system demand is projected to reach USD 76.4 billion in 2035.

The shock absorbers are expected to lead during the forecasted period due to their critical role in controlling vibrations, ensuring stability, enhancing ride comfort, and preventing bottoming out for improved safety.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Components, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Components, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Components, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Components, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Components, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Components, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Components, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Components, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Components, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Components, 2023 to 2033

Figure 17: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Components, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Components, 2023 to 2033

Figure 35: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Components, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Components, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Components, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Components, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Components, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Components, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Components, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Components, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Components, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Components, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Suspension System Market

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA