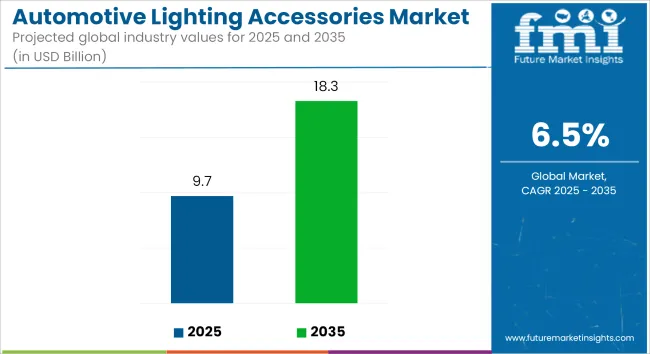

The global automotive lighting accessories market is valued at USD 9.7 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a CAGR of 6.5% over the forecast period. Growth is being driven by the integration of advanced lighting technologies in OEM and aftermarket channels, supporting safety, personalization, and visibility upgrades.

In 2024, OSRAM introduced a refined version of its OSLON Black Flat S LED series for automotive forward lighting. As per the company’s official release, the updated models deliver enhanced luminous efficacy and thermal resistance without altering their compact footprint. These LEDs have been positioned for applications across low-beam, high-beam, and DRL functions in both standard and adaptive systems.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 9.7 billion |

| Industry Value (2035F) | USD 18.3 billion |

| CAGR (2025 to 2035) | 6.5% |

Autolite, a recognized brand in ignition and aftermarket components, expanded into automotive lighting accessories in 2024. The new product line includes LED strips, interior ambient kits, and underglow solutions. The press release confirmed that all units underwent fitment validation and electrical compatibility testing to meet major OEM standards.

In the same year, Morimoto launched a specialized range of plug-and-play lighting accessories for Ford trucks. The lineup features LED reverse lights, fog light assemblies, and sequential turn indicators. According to the company’s product documentation, each unit was engineered with moisture-resistant housings and onboard thermal control modules to extend functional life and simplify retrofits.

North American and European markets have seen stronger regulatory momentum toward adaptive and LED-based lighting formats. In contrast, emerging markets have sustained high demand for universal-fit accessories, primarily distributed through online retail and customization garages.

From 2025 onward, lighting accessories are being designed with smart integration features such as CAN bus compatibility and Bluetooth-based control. According to OSRAM’s product roadmap, future-ready modules will include diagnostics-ready profiles and support for OTA firmware updates, enabling adaptive lighting to synchronize with vehicle electronics without manual reconfiguration.

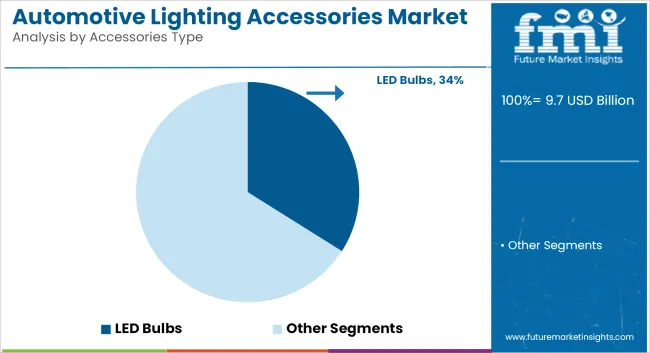

LED bulbs are estimated to account for approximately 34% of the global automotive lighting accessories market in 2025 and are projected to grow at a CAGR of 6.7% through 2035. Demand is driven by increased consumer preference for longer-lasting, low-power lighting upgrades in both interior and exterior vehicle applications.

LED accessories are widely adopted across retrofit markets for headlight conversion kits, daytime running lights, dome lights, and ambient interior accents. Their compact form factor, higher lumen output, and multi-color customization options support both aesthetic and safety enhancements. OEM-approved aftermarket kits and plug-and-play modules continue to drive sales, especially in North America, Europe, and Southeast Asia where regulatory and styling trends favor LED integration.

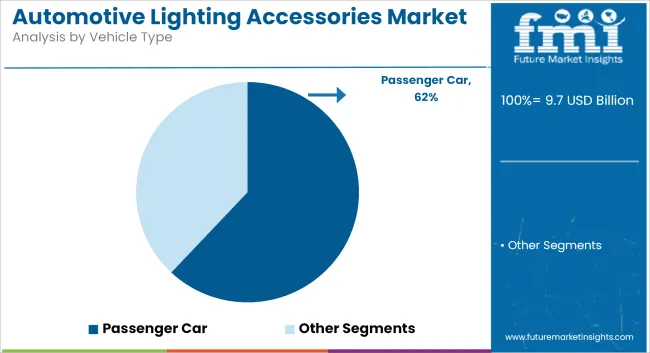

Passenger cars are projected to account for nearly 62% of the global lighting accessories market by vehicle type in 2025 and are expected to grow at a CAGR of 6.6% through 2035. Growth is supported by expanding use of lighting upgrades for personalization, safety enhancement, and improved vehicle visibility.

Accessory lighting-ranging from LED ambient interiors to underbody and grille kits-continues to gain traction among compact car and SUV owners. Rising aftermarket activity, along with a growing community of customization enthusiasts, fuels demand for both decorative and performance-oriented lighting solutions. Automakers and aftermarket brands also offer bundled lighting upgrade packages compatible with factory harnesses, accelerating product adoption in both developed and emerging markets.

Invest in Smart & Adaptive Lighting Solutions

Executives should prioritize R&D in AI-driven adaptive lighting, matrix LED, and laser-based solutions to align with evolving vehicle safety and efficiency standards. Investing in proprietary smart lighting technologies will enable differentiation in a competitive market while meeting growing regulatory requirements.

Align with Electrification & Autonomous Trends

With the rapid adoption of EVs and autonomous vehicles, stakeholders must integrate lighting technologies that enhance vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. Developing energy-efficient lighting systems tailored for EVs and self-driving cars will ensure long-term market relevance.

Expand Distribution & Aftermarket Engagement

Building strong partnerships with OEMs and aftermarket players will be critical to capturing demand for both factory-installed and retrofit lighting solutions. Strengthening e-commerce presence and expanding global distribution networks will drive revenue growth, particularly in emerging markets.

| Risk | Probability - Impact |

|---|---|

| Supply Chain Disruptions | High - Severe |

| Regulatory Changes & Compliance Costs | Medium - High |

| Consumer Shift to Alternative Lighting Technologies | Medium - Moderate |

| Priority | Immediate Action |

|---|---|

| Strengthen Supplier Resilience | Secure diversified sourcing for critical LED components |

| Enhance OEM Collaborations | Initiate strategic partnerships for smart lighting integration |

| Expand Aftermarket Reach | Develop digital-first sales channels and loyalty incentives |

To stay ahead in the rapidly evolving automotive lighting accessories market, companies must accelerate innovation in adaptive and energy-efficient lighting, aligning with EV and autonomous vehicle growth.

Strengthening supply chain resilience, ensuring regulatory compliance, and expanding aftermarket presence should be top priorities. Executives must act swiftly on R&D investments, OEM partnerships, and digital aftermarket channels to solidify their competitive edge in this high-growth sector.

| Countries/Region | Key Regulations & Certifications |

|---|---|

| United States | The Federal Motor Vehicle Safety Standards (FMVSS 108) regulate vehicle lighting, signaling, and reflective devices to ensure safety. The National Highway Traffic Safety Administration (NHTSA) enforces compliance with headlamp performance, DRL requirements, and adaptive lighting systems. Stricter energy efficiency and glare control regulations are being introduced to support vehicle automation and safety improvements. |

| European Union | The ECE Regulations (UN/ECE R48, R112, R113, R128) govern automotive lighting standards across Europe. The EU Green Deal is driving a shift toward sustainable and energy-efficient lighting materials. Stricter Euro 7 standards (effective 2025) include lighting efficiency mandates for EVs. CE certification is mandatory for automotive lighting products sold in Europe. |

| China | The GB Standards (GB 25991-2010, GB 5920-2008) regulate the design, performance, and installation of vehicle lighting. The China Compulsory Certification (CCC) mark is required for automotive lighting accessories before they can be sold in the domestic market. The government is tightening energy efficiency and glare reduction norms , especially for LED and adaptive lighting systems. |

| Japan | The Japan Light Vehicle Standards (JIS D5500, JIS D5701) regulate lighting brightness, visibility, and durability. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) enforces laws on intelligent lighting systems, aligning with the shift toward autonomous driving. Japan is also pushing anti-glare and adaptive headlight regulations for enhanced safety. |

| India | The Automotive Industry Standards (AIS-008, AIS-010, AIS-037) dictate mandatory requirements for headlights, taillights, and turn signals. The Bureau of Indian Standards (BIS) certification is required for domestically manufactured and imported lighting accessories. India is increasing LED adoption mandates to improve energy efficiency in commercial and passenger vehicles. |

| South Korea | The Korea Certification (KC Mark) is mandatory for vehicle lighting products sold in South Korea. The Ministry of Trade, Industry, and Energy (MOTIE) has introduced anti-glare regulations for high-beam lights and is encouraging OLED adoption for energy efficiency in EVs. |

| Brazil | The Brazilian National Institute of Metrology, Standardization, and Industrial Quality (INMETRO) requires certification for automotive lighting. The CONTRAN Resolution 667/17 sets safety and brightness limits for headlights, DRLs, and brake lights. Brazil is enforcing stricter energy efficiency laws to promote LED adoption. |

| Australia | The Australian Design Rules (ADR 13/00, ADR 45/01) set regulations for vehicle lighting performance and installation. The Department of Infrastructure and Transport enforces standards that align with UN/ECE regulations. Australia is expanding road safety-focused lighting laws , particularly for off-road and commercial vehicles. |

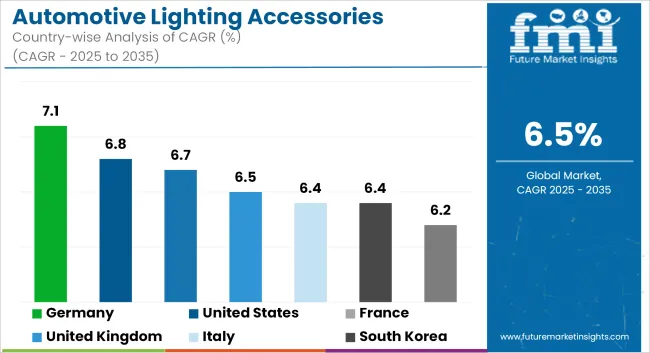

The automotive lighting accessories market in the United States is expected to grow at a CAGR of approximately 6.8% from 2025 to 2035, driven by increasing safety regulations, technological advancements, and rising consumer demand for high-performance lighting solutions.

The National Highway Traffic Safety Administration (NHTSA) continues to implement stricter vehicle lighting standards, pushing OEMs and aftermarket players to develop more efficient and adaptive lighting technologies. Automakers are rapidly adopting matrix LED, laser headlights, and OLED lighting solutions to enhance visibility, reduce energy consumption, and improve vehicle aesthetics.

The demand for aftermarket lighting solutions, including HID bulbs, accent lighting kits, and fog light upgrades, remains strong among consumers looking to enhance the aesthetics and functionality of their vehicles. The rise of electric vehicles (EVs) and autonomous driving technology is also fueling the adoption of AI-driven and adaptive lighting systems. Leading players such as Koito Manufacturing, Hella, and OSRAM continue to invest in R&D, ensuring that the USA remains a key hub for automotive lighting innovations.

The automotive lighting accessories market in the United Kingdom is projected to expand at a CAGR of approximately 6.5% from 2025 to 2035, driven by government-led sustainability initiatives and increasing adoption of smart lighting technologies.

The UK’s strict vehicle lighting regulations, governed by the Road Vehicles Lighting Regulations (RVLR), are pushing manufacturers toward energy-efficient and safety-focused lighting solutions. The transition from traditional halogen bulbs to LED and OLED lighting is accelerating, with automakers prioritizing adaptive lighting to enhance visibility in changing road conditions.

The aftermarket segment is witnessing a growing trend of customization, with vehicle owners investing in LED accent lighting, underbody lighting kits, and high-performance headlights. The increasing penetration of electric vehicles is also fostering the demand for energy-efficient lighting solutions, with British EV manufacturers focusing on integrating OLED and AI-powered adaptive headlights.

Leading European suppliers, such as Valeo and Hella, continue to expand their presence in the UK market, ensuring sustained growth through technological advancements and regulatory compliance.

The automotive lighting accessories market in France is expected to grow at a CAGR of approximately 6.7% from 2025 to 2035, fueled by strong government regulations on vehicle safety and sustainability.

The French government’s aggressive push toward electric vehicle adoption under its Green Mobility initiative is driving the demand for energy-efficient automotive lighting. The Euro 7 emissions regulations are further encouraging automakers to invest in advanced LED, OLED, and laser lighting technologies to improve energy efficiency.

The aftermarket sector in France is growing steadily, with consumers investing in performance lighting upgrades such as HID bulbs, fog light kits, and DRLs. French automakers, including Renault and Peugeot, are integrating intelligent lighting solutions, such as adaptive matrix LED and dynamic turn signals, to enhance driving safety.

Valeo, one of the leading automotive lighting manufacturers, continues to dominate the local market by investing in smart lighting R&D and expanding its production capabilities to meet increasing demand.

The automotive lighting accessories market in Germany is projected to grow at a CAGR of approximately 7.1% between 2025 and 2035, making it one of the most lucrative markets in Europe. As a global leader in automotive innovation, Germany is at the forefront of developing cutting-edge lighting technologies, with major automakers such as BMW, Mercedes-Benz, and Audi integrating laser and OLED lighting solutions into their vehicles. Stricter EU regulations on vehicle emissions and energy efficiency are further accelerating the transition toward sustainable and intelligent lighting solutions.

Germany's aftermarket segment is experiencing high demand for premium lighting upgrades, with consumers opting for performance headlights, ambient interior lighting, and off-road auxiliary lighting. Leading automotive lighting manufacturers, including Hella and OSRAM, continue to dominate the German market through ongoing R&D investments and strategic partnerships with OEMs. As autonomous driving technology advances, the integration of AI-powered lighting systems is expected to further drive market expansion.

The automotive lighting accessories market in Italy is expected to expand at a CAGR of approximately 6.4% between 2025 and 2035, driven by increasing safety regulations and consumer interest in performance lighting solutions.

The Italian government’s initiatives to improve road safety and energy efficiency are encouraging automakers to adopt advanced LED and adaptive lighting technologies. Luxury car manufacturers such as Ferrari and Lamborghini are at the forefront of integrating smart lighting systems to enhance vehicle performance and aesthetics.

The aftermarket segment in Italy is witnessing a rise in demand for decorative and high-performance lighting accessories, including underbody lighting kits, brake light upgrades, and custom LED installations.

The growing popularity of electric vehicles is also pushing lighting manufacturers to develop energy-efficient solutions that align with sustainability goals. Companies such as Magneti Marelli and Lumileds are expanding their presence in Italy to cater to the increasing demand for innovative lighting solutions.

The automotive lighting accessories market in New Zealand is projected to grow at a CAGR of approximately 5.9% from 2025 to 2035, driven by government incentives for electric vehicles and increasing consumer interest in LED and adaptive lighting technologies.

The New Zealand Transport Agency (NZTA) enforces strict vehicle lighting regulations, ensuring that aftermarket lighting modifications comply with road safety standards. The shift toward sustainable transportation is encouraging the adoption of energy-efficient lighting solutions, particularly in the electric and hybrid vehicle segments.

The aftermarket sector in New Zealand is thriving, with vehicle owners seeking high-performance lighting upgrades for off-road and adventure vehicles. LED light bars, fog light kits, and underbody lighting are particularly popular among consumers looking to enhance visibility and aesthetics.

As global players such as OSRAM and Lumileds expand their distribution networks, the availability of advanced automotive lighting solutions in New Zealand is expected to increase significantly.

The automotive lighting accessories market in South Korea is expected to grow at a CAGR of approximately 6.4% between 2025 and 2035, driven by technological advancements and increasing demand for smart lighting solutions.

South Korea’s automotive industry is highly advanced, with major manufacturers such as Hyundai and Kia integrating AI-powered adaptive lighting systems into their vehicles. The government’s support for electric and autonomous vehicle development is also driving the adoption of energy-efficient lighting solutions.

The aftermarket sector is expanding, with consumers investing in premium lighting upgrades such as DRLs, accent lighting kits, and laser headlights. South Korean companies, including ZKW and LG Electronics, are at the forefront of developing next-generation lighting solutions that align with global safety and environmental standards.

The integration of vehicle-to-vehicle (V2V) communication and smart lighting technology is expected to shape the future of South Korea’s automotive lighting market.

The automotive lighting accessories market in Japan is projected to expand at a CAGR of approximately 6.0% from 2025 to 2035, supported by increasing investments in intelligent lighting technologies. Japanese automakers, including Toyota, Honda, and Nissan, are leading the integration of AI-driven adaptive lighting systems to improve road safety and energy efficiency.

Government regulations under the Japan Light Vehicle Standards (JIS) are encouraging manufacturers to develop glare-free and high-performance lighting solutions.

The aftermarket segment in Japan is growing steadily, with consumers opting for LED headlight upgrades, accent lighting kits, and high-performance brake lights. Domestic lighting manufacturers such as Koito and Stanley Electric are focusing on OLED and laser lighting innovations to maintain their competitive edge. As Japan continues to prioritize sustainable and smart mobility solutions, the demand for advanced automotive lighting technologies is expected to rise significantly.

The automotive lighting accessories market in Australia is expected to grow at a CAGR of approximately 6.2% between 2025 and 2035, driven by strong demand for high-performance and off-road lighting solutions.

The Australian automotive marketplaces significant emphasis on road safety, with strict regulations governing headlight and auxiliary lighting installations. The growing popularity of off-road and adventure vehicles is fueling the demand for LED light bars, fog lights, and grille lighting kits.

The electric vehicle sector in Australia is also expanding, encouraging the adoption of energy-efficient lighting solutions. The aftermarket segment is witnessing increasing demand for customization, with consumers investing in performance lighting upgrades to enhance both aesthetics and functionality.

Leading global manufacturers such as OSRAM, Hella, and Lumileds are strengthening their presence in Australia, ensuring that the market continues to benefit from the latest innovations in automotive lighting technology.

HID/Xenon Bulbs, Accent Lighting Kits, Fog Light Kits, Turn Signal Lights, Brake Lights, License Plate Lights, Daytime Running Lights (DRL), Auxiliary/Off-road Lighting, Dome/Map/Footwell Lights, Underbody/Wheel Well/Grille Lighting Kits, LED Bulbs, Exterior Lighting, Interior Lighting, Performance Lighting, Safety Lighting, Decorative Lighting Accessories.

Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles.

OEM, Aftermarket.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, Middle East and Africa.

The increasing focus on vehicle safety, advancements in LED and adaptive lighting technology, and rising consumer preference for aesthetic and performance upgrades are major factors contributing to industry growth.

LED-based lighting solutions, including DRLs, accent lighting, and performance headlights, are experiencing the highest demand due to their energy efficiency, durability, and enhanced visibility.

The integration of smart lighting, adaptive headlights, and AI-driven illumination systems is enhancing vehicle safety, energy efficiency, and customization options for consumers.

Stringent road safety and environmental regulations worldwide are pushing manufacturers to develop energy-efficient and compliant lighting solutions, driving innovation in the industry.

Both OEM and aftermarket channels play a crucial role, with aftermarket sales gaining traction due to increasing consumer demand for personalization and performance upgrades.

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 15: Global Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 19: Global Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Accessories type, 2023 to 2033

Figure 28: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 32: North America Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 33: North America Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 45: North America Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 49: North America Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Accessories type, 2023 to 2033

Figure 58: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 62: Latin America Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 63: Latin America Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 75: Latin America Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 79: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Accessories type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 92: Western Europe Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 93: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Accessories type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Accessories type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 152: East Asia Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 153: East Asia Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 154: East Asia Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 157: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 161: East Asia Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 162: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 163: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: East Asia Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 165: East Asia Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 169: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 173: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 174: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 175: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Accessories type, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 182: South Asia Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 183: South Asia Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 184: South Asia Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 185: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 186: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 187: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 188: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 189: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 191: South Asia Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 192: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 193: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: South Asia Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 195: South Asia Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 196: South Asia Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 197: South Asia Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 198: South Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 199: South Asia Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 200: South Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 201: South Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 202: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 203: South Asia Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 204: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 205: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: South Asia Market Attractiveness by Accessories type, 2023 to 2033

Figure 208: South Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 209: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 212: MEA Market Value (US$ Million) by Accessories type, 2023 & 2033

Figure 213: MEA Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 214: MEA Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 215: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 217: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 221: MEA Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) Analysis by Accessories type, 2018 & 2033

Figure 225: MEA Market Volume (Units) Analysis by Accessories type, 2018 & 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by Accessories type, 2023 & 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Accessories type, 2023 to 2033

Figure 228: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 229: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 233: MEA Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Accessories type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 239: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 7: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 15: North America Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 16: North America Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 17: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 18: North America Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 26: Latin America Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 28: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 36: Western Europe Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 38: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 52: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 54: East Asia Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 56: East Asia Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 57: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 58: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 59: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 60: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 62: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 63: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 64: South Asia Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 65: South Asia Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 66: South Asia Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 67: South Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 68: South Asia Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 69: South Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 70: South Asia Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 72: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 73: MEA Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 74: MEA Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 75: MEA Market Value (US$ Million) Forecast by Accessories type, 2018 & 2033

Table 76: MEA Market Volume (Units) Forecast by Accessories type, 2018 & 2033

Table 77: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 78: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 79: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 80: MEA Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA