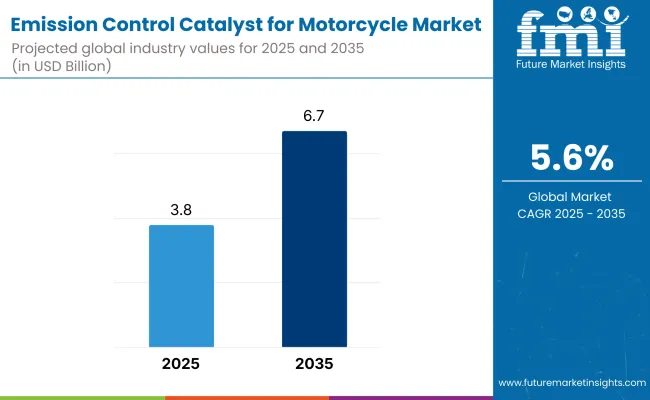

Demand for emission control catalysts for motorcycles is estimated to drive the market to a valuation of USD 3.8 billion in 2025. Sales is expected to grow at a CAGR of 5.6% from 2025 to 2035, reaching USD 6.7 billion by 2035. The market growth is being driven by increasingly stringent global emission regulations and adoption of advanced after-treatment systems in two-wheelers.

Regulatory mandates have intensified across Asia-Pacific, where motorcycles account for a major share of daily commuting. In 2024, the Indian Ministry of Road Transport and Highways extended the Bharat Stage VI norms to include two-wheelers under Real Driving Emission (RDE) conditions.

This move was followed by Indonesia’s Ministry of Environment and Forestry announcing in its February 2025 bulletin that Euro 5-equivalent norms for motorcycles would come into effect by mid-2026. These regulatory changes have compelled OEMs to integrate catalysts like palladium-based three-way catalysts into newer models.

OEMs are responding with updated engine platforms. Honda Motor Co. confirmed in a 2024 sustainability report that more than 80% of its motorcycles shipped to Southeast Asia are now equipped with emission catalysts. In a press release, Tetsuya Kobayashi, CEO of Cataler Corporation, stated that demand from Asia is being met with localized catalyst production to ensure quicker lead times and lower costs.

The use of platinum group metals (PGMs) in catalyst formulations has also advanced. A 2025 technical note by Heraeus Precious Metals stated that hybrid catalyst coatings, which combine rhodium and palladium layers, have improved conversion efficiency in compact engines under high heat conditions. These innovations help meet both emission and durability expectations. Manufacturers are also shifting toward washcoat technologies that reduce precious metal usage without compromising performance.

The electric vehicle transition remains a challenge in the automotive sector. However, industry leaders view emission control catalysts as critical for hybrid and small-engine motorcycles, particularly in countries where electrification is slower. In a 2025 earnings call, Umicore’s CEO Mathias Miedreich explained that legacy internal combustion motorcycles will dominate in emerging markets for another decade, and catalyst technologies will remain central to emission compliance strategies.

Efforts to stabilize supply chains and manage rising PGM costs have led to backward integration and recycling initiatives. Johnson Matthey’s 2025 corporate update highlighted its investment in PGM recycling facilities in Thailand to support catalyst production for two-wheelers.

Emission Control Catalyst for Motorcycle market is witnessing a growth at a very high rate as the environmental agencies has defined very restrictive regulations to control the emission of the vehicles. As emission norms tighten around the world, motorcycle and scooter makers are making the progression towards advanced catalytic converters. They function as catalysts to minimize detrimental compounds in exhaust gasses (such as CO, HC and NOx), helping with minimizing air pollution and being in compliance with regulations.

Increasing production of two wheel vehicles, especially in developing nations where motorcycles serve as the main source of transportation, also drives the demand for emission controls in motorcycles. More thermally stable catalyst formulations with enhanced conversion help manufacturers help meet evolving emission requirements. The rising shift in consumer preference towards the fuel-efficient and low-emission vehicles is also driving the market demand.

It is well known that there are different catalyst types, and the main part of market dominancy is that of palladium-based catalysts which have excellent oxidation properties that help reduce harmful emissions. Platinum-based catalysts also account for a significant share of the segments of high-performance motorcycles that need more advanced emission controls.

Rhodium-supported catalysts, the unsung forerunners of lower temperature NOx reduction, often account for a fraction of the expected production of oxidation catalysts and sustain overall higher performance of the catalyst. The manufacturers are seeking performance and economy, leading to other catalyst formulations.

The emerging solution is such hybrid catalyst systems consisting of multiple noble metals in one nanostructure achieving high conversion efficiency. Performance of the catalyst wash coat technology and the substrate materials are being aggressively developed further to comply with stringent adsorb emissions legislation such as Euro 5 and BS-VI. These changes will, in turn, lead to widespread use of emission control catalysts in current-day two-wheeler.

The prominent application segment of emission control catalysts is motorbikes owing to higher production volume compared to other vehicles and availability of these vehicles in urban as well as rural areas. As motorcycle emission regulations become more stringent, the need for fuel-efficient and environmentally friendly two-wheelers is rising, resulting in the use of high-tech catalytic converters in motorbikes.

Enabling them to establish a degree of market control within this segment and other products, scooter traffic is increasing as it becomes more popular among urban commuters. As governments impose stringent emission regulations, manufacturers are implementing advanced catalyst systems in their scooters to meet standards.

While electric scooters are becoming a larger portion of the market, they don't represent demand destruction in traditional catalyst markets as there is still robust demand for low-emission ICE scooters in a number of regions.

The emission control catalyst market is segmented into original equipment manufacturer (OEM) and aftermarket; the OEM segment is expected to dominate the market owing to the strict regulatory norm that governs the integration of such catalysts into vehicles by motorcycle manufacturers. With increased emphasis on sustainability and corporate social responsibility, OEMs are also feeling pressure to implement advanced emission control technologies in their production lines.

In addition, the retrofit segment is also growing, especially in areas with government initiatives that encourage existing motorcycles to be upgraded with more advanced emission control systems. A potential solution to an increasing urban air pollution including older two wheelers continuing to pollute is to retrofit these older motorcycles with an advanced catalyst which is found to be much cheaper than buying a new motorcycle with emission norm compliance.

The North American ECC market for motorcycles is primarily driven by strict emission regulations by the Environmental Protection Agency (EPA), along with increasing penetration of electric and hybrid motorcycles. In the US and Canada, we've been developing and testing more efficient versions of catalytic converters that meet federally mandated emission standards. Other factors driving the market are technological advancements and an ever-increasing awareness of the need for clean transportation among consumers.

Europe is a major market for ECCS for motorcycles, thanks to stringent Euro 5 and future Euro 6 emission regulations. So Germany, France and UK countries are stressing the use of high-performance catalysts to reduce pollution. Moreover, the growing presence of leading motorcycle manufacturers and regular innovations in emission reduction technology present lucrative opportunities for market growth. Demand is also further increased by government incentives for low-emission vehicles and other sustainable transportation solutions.

The ECC market is projected to be dominated by the Asia-Pacific region owing to the rapid growth of urbanization, increasing motorcycle manufacturing, and stringent emissions legislations in major nations like China, India, and Japan. India has also rolled out Bharat Stage VI (BS-VI) norms and this has led to a spike in demand for advanced catalytic converters. Increasing environmental consciousness and government programs to reduce air pollution will drive market growth.

ECCs are gradually gaining traction across Latin America, the Middle East and Africa, as governments enforce stronger environmental policies. Demand for catalytic converters are likely to increase in countries such as Brazil and Mexico, where stricter emission norms are being implemented

Challenge

Stringent Emission Regulations and Compliance Costs

The worldwide growing stringent emission regulations are anticipated to hinder the growth of the Emission Control Catalyst for Motorcycle Market. With regulations such as European Union (EURO 5) and Environmental Protection Agency (EPA) introducing stringent motorcycle emission limits, manufacturers are required to make big investments in advanced catalytic technologies. These evolving regulations also require strict compliance, which increases production costs and necessitates ongoing investments in research and development.

Material Cost Fluctuations and Supply Chain Constraints

The cost of precious metals such as platinum, palladium and rhodium, which are used in emission control catalysts, represents a key challenge for all stakeholders in the market Raw material costs are subject to variations in cost and supply disruptions, potentially impacting catalytic solutions' price and availability to manufacturers and end-users.

Opportunity

Advancements in Catalyst Technology and Efficiency

Innovation in emission control catalysts (like new high-efficiency low-cost alternatives) has huge opportunities. "Beyond less reliance on expensive materials, performance can also be improved through nanotechnology based catalysts, developed coating technologies, and hybrid catalytic converter systems."

Rising Demand for Sustainable and Electric-Hybrid Motorcycles

There is increasing demand for advanced emission control solutions with the trend towards hybrid-electric motorcycles and smart mobility. For the manufacturers, opportunities exist to combine low-emission catalysts and hybrid systems, so as slowly to bring their products up to date with the market for two-wheelers.

By 2020, stricter emission standards were adopted, leading to significant growth in the Emission Control Catalyst for Motorcycle Market between the years 2020 to 2024. Several top motorcycle manufacturers across Europe, North America, and Asia-Pacific have focused on complying with EURO 5 & Bharat Stage VI, which further hampered the demand for advanced catalyst solutions. Nonetheless, supply chain disruptions, volatile metal prices and the shift towards electric mobility hindered the growth of the market.

Now, analysing the 2025 to 2035 Period Key Trends, the market will undergo shifting towards next-generation catalytic technologies, alignment of alternative catalyst materials and transitions towards electric and hybrid motorcycles.

Market growth will be determined by the dissemination of urban air quality initiatives, government incentives for lower-emission vehicles and ongoing R&D into increasing catalyst efficiency. The next phase of growth in the market will be driven by manufacturers that invest in material sustainability, cost effective catalyst designs, and integration with hybrid motorcycle systems.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with EURO 5, Bharat Stage VI, and EPA regulations |

| Catalyst Technology | Platinum-group metal catalysts, conventional catalytic converters |

| Industry Adoption | Demand for Catalytic Converters in Gasoline-Powered Motorbikes |

| Supply Chain and Sourcing | Reliance on platinum, palladium, and rhodium |

| Market Competition | Established Catalyst Manufacturers Hold the Niche |

| Market Growth Drivers | Strict emission standards, growing motorcycle sales in developing markets |

| Sustainability and Cost Efficiency | Expensive Need to rely on precious metals |

| Integration of Digital Monitoring | This is because emission monitoring systems are rarely used in motorcycles. |

| Future of Emission Control Solutions | Conventional catalytic converters for internal combustion engines |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Introduction of stricter global emission norms, advancements in carbon-neutral catalyst technology |

| Catalyst Technology | Development of nanotechnology-based and hybrid catalytic solutions |

| Industry Adoption | Integration of catalyst technologies with hybrid-electric motorcycles |

| Supply Chain and Sourcing | Exploration of alternative catalyst materials to reduce cost dependency |

| Market Competition | Entry of new players focusing on sustainable and cost-efficient catalytic solutions |

| Market Growth Drivers | Increased investment in sustainable mobility, hybrid motorcycle adoption |

| Sustainability and Cost Efficiency | Development of low-cost, high-efficiency catalyst alternatives |

| Integration of Digital Monitoring | Expansion of real-time emission monitoring, smart catalysts, and IoT-based diagnostics |

| Future of Emission Control Solutions | Evolution of hybrid catalytic-electric solutions, regulatory-driven innovation in emission reduction |

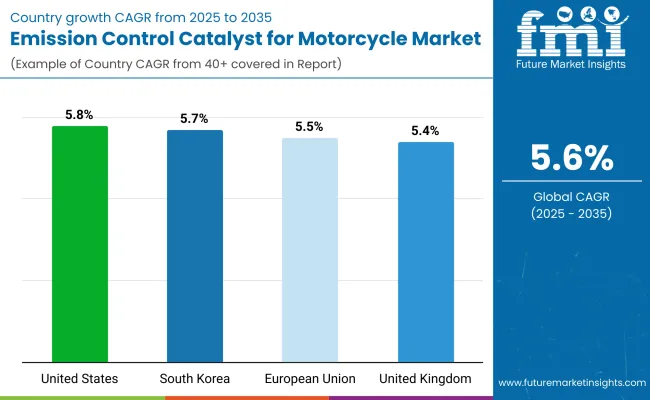

stringent emission regulations laid down by the Environmental Protection Agency (EPA) is a major driving force for the growth of the USA emission control catalyst market for motorcycles. Increasing usage of catalytic converters in motorcycles for lower harmful emissions is one of the major market driving factors. Demand is also being driven by increasing consumer awareness and government incentives for green vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The strict emission norms and increasing focus on controlling vehicular pollution are driving the UK. market. The increasing implementations of Euro 5 legislation governing motorcycles which promote the reduction of carbon monoxide and nitrogen oxide from motorcycles are expected to drive the demand for advanced emission control catalysts as a major factor driving the growth of advanced emission control catalytic components.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

Tired of not everyone reducing emissions in the EU, it now started taxing on motorcycles. Since the phase-in of Euro 5, manufacturers have been adopting more sophisticated and complex catalytic technologies. Growing consumer preference for fuel efficient and low emission motorcycles are also supporting the demand for motorcycles in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

The emission control catalyst market for motorcycle in South Korea is influenced by the expansion of clean transportation systems underpinned by government initiatives. Comprises high tie to mitigate air pollution in the country, deli technique in catalyst business, propelling producers to downsize of high-efficiency outflows control techniques in the two wheelers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

The motorcycle emission control catalyst market is expected to grow considerably owing to the surging environmental regulations, increasing demand for cleaner vehicles, and advancements in catalyst technology. Governments around the world have been tightening emission norms, and as such, manufacturers have had to switch to advanced catalytic converters to limit harmful exhaust emissions.

Catalyst materials are backbone for fuel cell systems, in which platinum, palladium and rhodium play a prominent role, is a factor driving the market along with adoption of electric motorcycles as supplementary zero-emission mobility solution.

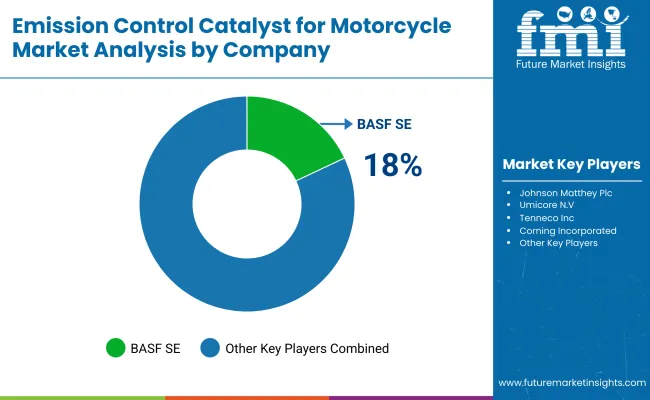

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Johnson Matthey Plc | 15-20% |

| Umicore N.V. | 12-16% |

| Tenneco Inc. | 8-12% |

| Corning Incorporated | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| BASF SE | Advanced emission control catalysts, three-way catalysts, and high-performance catalytic coatings. |

| Johnson Matthey Plc | High-efficiency catalytic converters with low-platinum group metal content and innovative emission solutions. |

| Umicore N.V. | Development of sustainable and energy-efficient catalysts for motorcycle emission reduction. |

| Tenneco Inc. | High-durability catalytic systems for two-wheelers with advanced pollution control technologies. |

| Corning Incorporated | Ceramic substrate solutions and high-performance catalyst support materials for emission reduction. |

Key Market Insights

BASF SE (18-22%)

Ingenious emission control technologies such as three-way catalysts and novel coating solutions position BASF as the world market leader in these product types.

Johnson Matthey Plc (15-20%)

Johnson Matthey has strong expertise in cost-competitive and high-performing catalysis with limited reliance on platinum group metals.

Umicore N.V. (12-16%)

About Umicore: Umicore is a global materials technology group focused on sustainable emission control technologies..

Tenneco Inc. (8-12%)

Tenneco's robust and efficient catalytic systems are tailored for the latest environmental regulations for two-wheelers.

Corning Incorporated (5-9%)

Corning designs ceramic substrates and catalyst support material, both vital to unlocking catalytic converter potential.

Other Key Players (30-40% Combined)

The emission control catalyst market is also driven by various other industry leaders and emerging players offering cutting-edge catalytic solutions, including:

The overall market size for emission control catalyst for motorcycle market was USD 3.8 billion in 2025.

The emission control catalyst for motorcycle market is expected to reach USD 6.7 billion in 2035.

The demand for emission control catalyst for motorcycle will be driven by increasing OEM adoption, rising retrofit demand, and expanding motorbike and scooter usage.

The top 5 countries which drives the development of emission control catalyst for motorcycle market are USA, European Union, Japan, South Korea and UK

Palladium-Based Catalysts demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emissions Management Market Size and Share Forecast Outlook 2025 to 2035

Emission Monitoring Software Market

Emission Monitoring Systems Market

Emission Control Catalyst Market Growth – Trends & Forecast 2024-2034

Emission Control Catalyst for Small Engines Market - Size, Share, and Forecast 2025 to 2035

Zero Emission Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Vehicle Market Growth - Trends & Forecast 2025 to 2035

Marine Emission Control Catalyst Market - Size, Share, and Forecast 2025 to 2035

Optical Emission Spectroscopy Market Report – Trends 2019-2027

Vehicle Emission Testers Market

The Positron Emission Tomography (PET) Scanners Market is segmented by Full-ring PET Scanner and Partial-ring PET Scanner from 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Continuous Emission Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Angle-Resolved Photoemission Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA