The Emissions Management Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 15.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Emissions Management Market Estimated Value in (2025 E) | USD 7.7 billion |

| Emissions Management Market Forecast Value in (2035 F) | USD 15.5 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The Emissions Management market is experiencing steady growth driven by increasing regulatory pressure on environmental compliance, the adoption of sustainability initiatives, and rising corporate focus on carbon footprint reduction. The market is shaped by the need for real-time monitoring, reporting, and analytics to meet emission standards across industries, particularly in energy, manufacturing, and transportation sectors.

Growing investments in digital transformation and environmental management systems are accelerating the adoption of software-based monitoring solutions, while organizations are increasingly prioritizing automation, data accuracy, and predictive insights to optimize emissions reduction strategies. The future outlook is strengthened by the convergence of cloud computing, Internet of Things, and AI-based analytics, which enable organizations to enhance operational efficiency while ensuring compliance.

Companies are expected to expand their use of integrated emissions management platforms that can monitor multiple sources and provide actionable insights for sustainability initiatives As environmental regulations continue to tighten globally and stakeholder expectations for sustainable operations rise, the market is positioned for consistent growth with software-driven solutions becoming increasingly central to organizational strategy.

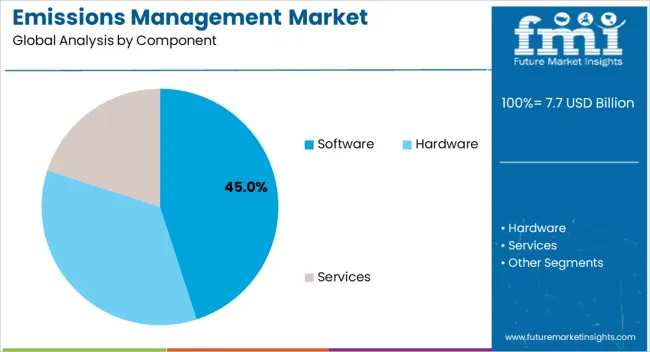

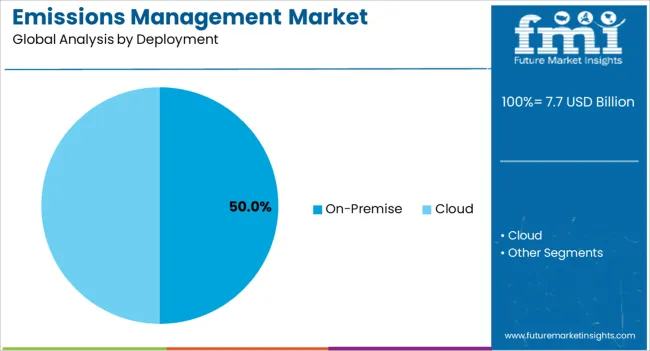

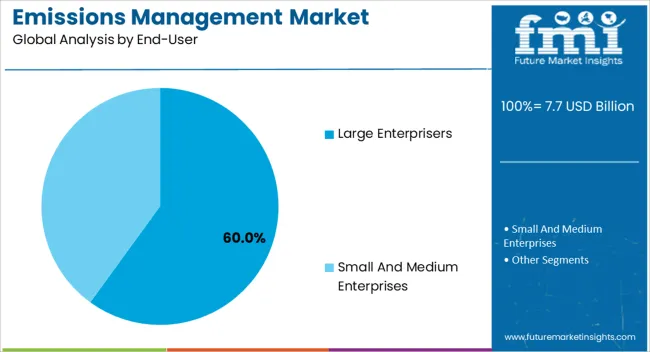

The emissions management market is segmented by component, deployment, end-user, vertical, and geographic regions. By component, emissions management market is divided into Software, Hardware, and Services. In terms of deployment, emissions management market is classified into On-Premise and Cloud. Based on end-user, emissions management market is segmented into Large Enterprisers and Small And Medium Enterprises. By vertical, emissions management market is segmented into Oil & Gas, Food & Beverages, Power Generation, Chemical & Mining, Leather & Textile, Coal & Mining, and Others. Regionally, the emissions management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component is projected to hold 45.0% of the Emissions Management market revenue share in 2025, making it the leading component. This dominance is driven by the flexibility and scalability offered by software solutions, which allow organizations to monitor, analyze, and report emissions in real time without frequent hardware upgrades. Adoption is further accelerated by the need for comprehensive data management, automated compliance reporting, and integration with existing enterprise resource planning systems.

The software component supports predictive analytics, scenario modeling, and decision-making processes that enable organizations to proactively manage emissions and optimize operational performance. The ability to update and expand functionalities through software releases rather than hardware replacement has reinforced its value proposition.

Additionally, software platforms offer customization options tailored to specific industry requirements, allowing large enterprises to align their sustainability strategies with organizational goals efficiently The increasing emphasis on corporate social responsibility and environmental accountability has further bolstered the adoption of software-driven solutions, making this component the primary driver of market growth.

On-premise deployment is expected to account for 50.0% of the Emissions Management market in 2025, representing the leading deployment model. This prevalence is attributed to organizations’ preference for retaining direct control over sensitive emissions data, ensuring security, and customizing system architecture to meet specific operational needs. On-premise solutions allow organizations to integrate emissions monitoring directly with their existing IT infrastructure, supporting advanced analytics and reporting without relying on external networks.

Adoption is supported by the demand for high data integrity, real-time monitoring, and rapid response to regulatory audits or compliance requirements. Enterprises with complex operations or multi-site facilities find on-premise deployment advantageous because it offers scalability and configurability tailored to organizational workflows.

Furthermore, organizations in heavily regulated industries often require on-premise systems to satisfy compliance and internal governance policies As digital infrastructure in large organizations evolves, on-premise deployment continues to attract preference due to its security, customization, and operational efficiency, making it a key contributor to market growth.

The large enterprise segment is anticipated to hold 60.0% of the Emissions Management market revenue share in 2025, positioning it as the dominant end-user category. This leadership is driven by the scale and complexity of operations in large organizations, which require robust monitoring and reporting systems to comply with stringent environmental regulations.

Adoption is fueled by the need to consolidate emissions data across multiple sites and processes, automate compliance reporting, and generate actionable insights to reduce environmental impact while improving operational efficiency. Large enterprises benefit from the integration of software-based emissions management platforms with broader sustainability strategies, including carbon accounting, energy optimization, and ESG reporting.

Investments in advanced analytics, AI-enabled forecasting, and enterprise-wide data management have further strengthened adoption, as these organizations are able to leverage technology to meet corporate sustainability goals and demonstrate regulatory compliance The rising focus on reputational risk management, stakeholder transparency, and global operational efficiency ensures continued growth of the large enterprise segment as the primary consumer of emissions management solutions.

The global management of atmospheric emission is creating new market opportunities for the emission management solution providers. The evolution of advanced emission control technologies such as catalytic converters, particulate filters, traps & adsorbers, and substrates are playing a crucial role in driving the growth of emissions management market.

Most of the countries are adopting emissions management for emission control through various sources in for environmental analysis. Also, emissions management provide complete emission management and streamline the process of collecting and calculating the emission data.

The emissions management helps companies to manage air quality requirements from advanced emission source modeling and calculation, to emissions forecasting and scenario analysis. Several innovations and technological advances in emission control and environmental control have generated the need for emissions management adoption across various countries.

In parallel, government policies for emission control in most of the countries is projected to drive the growth of the emission management market worldwide.

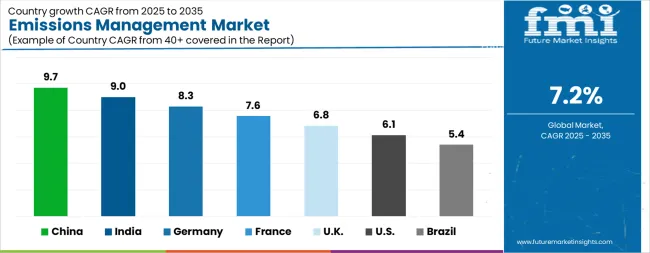

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The Emissions Management Market is expected to register a CAGR of 7.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.7%, followed by India at 9.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.4%, yet still underscores a broadly positive trajectory for the global Emissions Management Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.3%. The USA Emissions Management Market is estimated to be valued at USD 2.7 billion in 2025 and is anticipated to reach a valuation of USD 4.9 billion by 2035. Sales are projected to rise at a CAGR of 6.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 354.3 million and USD 235.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Component | Software, Hardware, and Services |

| Deployment | On-Premise and Cloud |

| End-User | Large Enterprisers and Small And Medium Enterprises |

| Vertical | Oil & Gas, Food & Beverages, Power Generation, Chemical & Mining, Leather & Textile, Coal & Mining, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

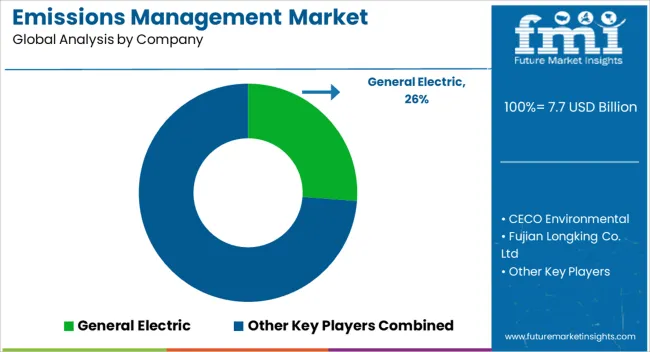

| Key Companies Profiled | General Electric, CECO Environmental, Fujian Longking Co. Ltd, Hamon Corporation, Ducon Technologies Inc., Thermax Ltd, CONFORMiT, Accuvio Software, iSystain, Johnson Matthey, Intelex Technologies, Babcock & Wilcox Co. Enablon, AMEC Foster Wheeler (John Wood Group), ERA Environmental, Mitsubishi Hitachi Power Systems Ltd., and Teck Resources |

The global emissions management market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the emissions management market is projected to reach USD 15.5 billion by 2035.

The emissions management market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in emissions management market are software, hardware and services.

In terms of deployment, on-premise segment to command 50.0% share in the emissions management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA