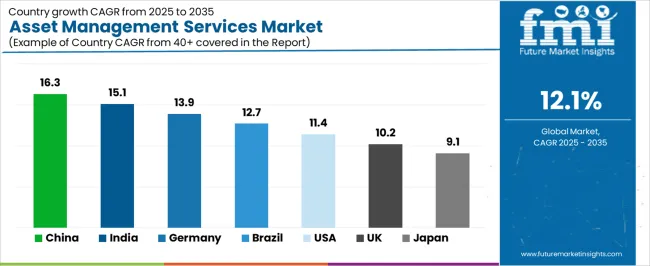

The asset management services market is forecast to expand from USD 104.6 billion in 2025 to USD 327.9 billion by 2035, at a CAGR of 12.1%, with regional dynamics playing a central role in shaping long-term growth. Asia Pacific leads global expansion, with China growing at 16.3% as rising household wealth, increased capital-market participation, and rapid digitalisation accelerate the adoption of managed portfolios and advisory platforms. India follows at 15.1%, supported by expanding retail-investor participation, strong uptake of systematic investment plans, and mobile-first wealth platforms used by a young, financially aware population. Japan contributes stable growth at 9.1%, driven by retirement-focused planning, institutional portfolio diversification and wider adoption of robo-advisory tools suited for long-term financial preservation.

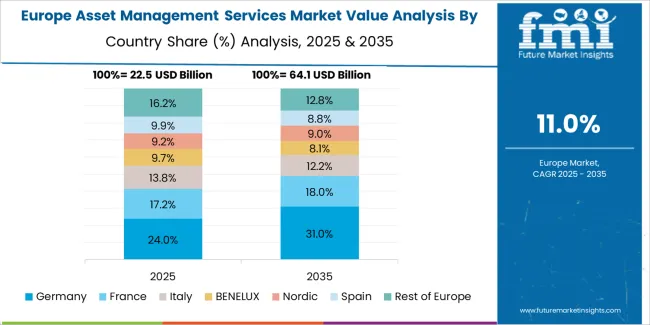

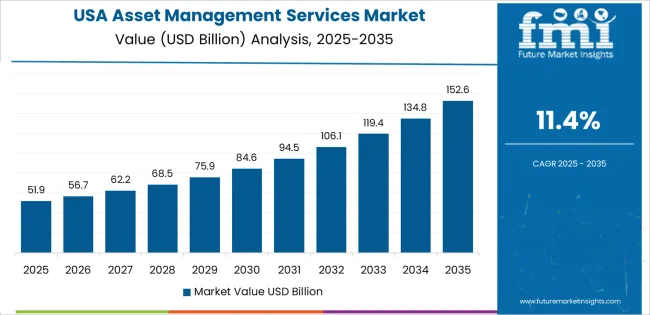

Europe records steady expansion led by Germany at 13.9%, reflecting strong demand for retirement solutions, ESG-linked investment strategies and digital advisory ecosystems aligned with stringent regulatory frameworks. The United Kingdom, at 10.2%, reinforces regional growth through its mature financial-services landscape, high penetration of pension funds and rapid adoption of hybrid advisory models combining digital and human-led portfolio management. North America contributes consistent momentum, with the United States advancing at 11.4% due to deep capital markets, strong institutional demand, and widespread use of data-driven and automated wealth solutions. Brazil anchors Latin America, growing at 12.7% as investors shift toward structured portfolios amid fluctuating economic conditions and rising use of digital investment apps across retail and institutional segments.

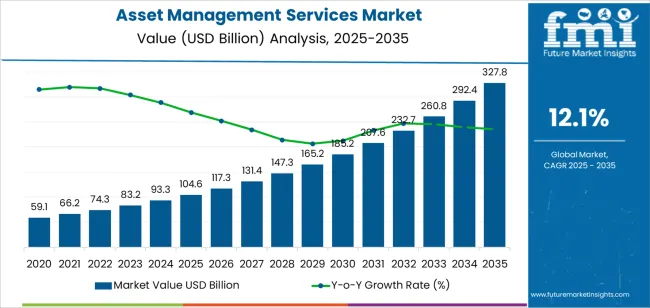

The early growth phase from 2025 to 2030 will see the market expand from USD 104.6 billion to USD 185.2 billion, a growth of USD 80.6 billion. This phase is characterized by rapid growth driven by digital transformation in the asset management industry, where innovations in AI-powered asset tracking, automated portfolio management, and personalized investment services will attract more investors. As the wealth management sector becomes more accessible due to technology integration, there will be strong demand from both institutional investors and individual clients seeking better investment solutions.

From 2030 to 2035, the market will continue growing, expanding from USD 185.2 billion to USD 327.9 billion, with an increase of USD 142.7 billion. This late growth phase will be driven by the maturation of asset management services, with greater emphasis on sustainability, regulatory compliance, and advanced risk management. While the market will still experience significant growth, the acceleration will slow compared to the earlier phase. As the industry evolves, more firms will incorporate innovative data-driven tools, but with a focus on refining existing solutions and addressing emerging global investment trends and market demands.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 104.6 million |

| Market Forecast Value (2035) | USD 327.9 million |

| Forecast CAGR (2025-2035) | 12.1% |

The asset management services market is expanding as institutional and retail investors increase their demand for professional investment solutions. Factors such as rising global wealth, expanding retirement savings and a growing high net worth individual population contribute significantly to market growth. Digital platforms and mobile access have made it easier for smaller investors to engage with managed and advisory services, broadening the customer base. At the same time, the trending focus on sustainable investing and environmental social governance (ESG) criteria has created new segments within asset management, with clients seeking managers that can navigate regulatory requirements and integrate responsible investment practices.

Another major driver is technological advancement and operational efficiency in asset management firms. The use of artificial intelligence, machine learning analytics and automated portfolio tools helps improve decision making, reduce costs and enhance scalability of services. Firms increasingly partner or merge to gain scale and access global markets, which supports growth in the services sector. However, challenges remain: fee structures are under pressure, regulatory complexity is rising, and competition from new entrants and passive investment vehicles is intensifying. Despite these challenges, the increasing complexity of financial markets and investor demand for expertise and diversification ensure that asset management services remain a critical industry segment.

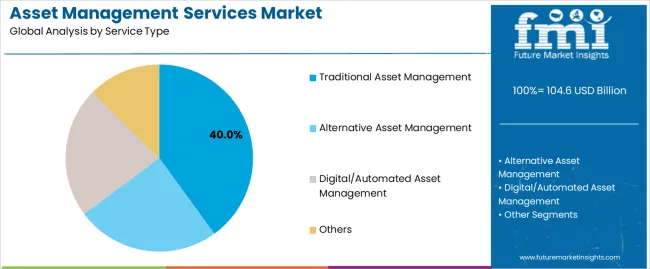

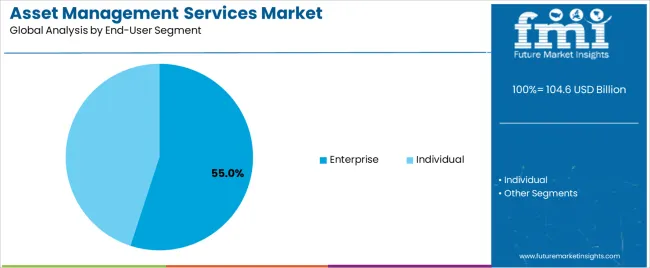

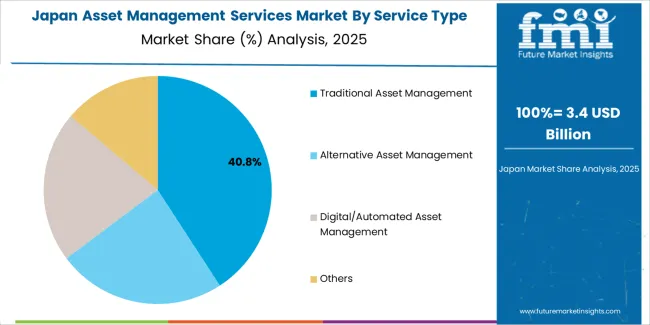

The asset management services market is segmented by service type and end-user segment. The leading service type is traditional asset management, holding 40% of the market share, while the dominant end-user segment is enterprise, accounting for 55% of the market. These segments are key drivers of the market's growth, fueled by the need for efficient management of financial assets and increasing adoption of digital solutions across industries.

The traditional asset management service type leads the asset management services market, capturing 40% of the market share. Traditional asset management involves the active management of assets by human fund managers, where investment decisions are made based on market analysis, research, and forecasting. This approach remains widely used by institutional investors, wealth management firms, and high-net-worth individuals who prefer a personalized strategy that includes human judgment and expertise.

The traditional asset management model continues to dominate despite the rise of digital and automated services due to its long-established practices, client trust, and ability to provide tailored, hands-on investment strategies. It is particularly preferred in more complex financial markets where market analysis and strategic decision-making are crucial for maximizing returns. As demand for wealth management and retirement planning services continues to grow, traditional asset management is expected to remain a dominant service type in the market.

The enterprise end-user segment holds the largest share in the asset management services market, accounting for 55% of the market share. Enterprises, ranging from large corporations to small and medium-sized businesses, are major consumers of asset management services as they manage vast amounts of financial assets, investments, and resources. The demand for asset management services in enterprises is driven by the need for efficient capital allocation, risk management, and regulatory compliance.

Enterprises, particularly in sectors like banking, insurance, and real estate, require sophisticated asset management solutions to optimize returns on their investments, manage portfolios, and meet their financial goals. The trend towards digitalization and automation has also led enterprises to adopt more advanced asset management systems, including digital and automated solutions. As businesses continue to seek effective management of their financial resources, the enterprise segment will remain a dominant driver of market growth.

The asset management services market is experiencing considerable expansion as institutions and individual investors seek professional expertise to manage increasingly complex portfolios. Growth is driven by rising assets under management (AUM) globally, heightened regulatory demands for transparency and risk control, and technology-enabled solutions that offer data-driven investment insights. At the same time, competitive pressure on fees, the shift toward passive and alternative investment products, and evolving investor preferences influence how firms operate and differentiate their offerings.

Several important drivers support this market’s growth. First, an expanding investor base, driven by growing wealth, longer life spans and rising retirement savings requirements, boosts demand for asset-management services that deliver reliable returns and tailored advisory. Second, technology adoption, including artificial intelligence, machine learning and advanced analytics, enables managers to offer smarter strategies, automate processes and enhance performance, making services more attractive. Third, the increasing emphasis on environmental, social and governance (ESG) investing and alternative asset classes encourages asset managers to develop new products and services to meet investor demand for sustainable and diversified portfolios. Fourth, regulatory and fiduciary pressures compel institutions and retail investors alike to outsource or upgrade asset-management services to ensure compliance, transparency and risk management, creating further opportunity.

Despite encouraging conditions, the market faces several restraints. The cost of implementing advanced technology platforms, training staff and integrating legacy systems presents a significant barrier for smaller firms or those transitioning to new models. Fee compression, driven by increased competition, passive investing and investor demand for lower-cost options, reduces margin potential for service providers. Regulatory fragmentation and complexity across jurisdictions also raise compliance costs and limit scalability. Additionally, rapid industry change and the threat of disintermediation, for example via direct-to-consumer platforms, create strategic risk for traditional asset-management firms.

Several notable trends are shaping the future of the asset-management services market. One is the growing use of digital platforms and robo-advisory models that lower entry-costs and broaden access to asset-management services for retail investors. Another is the increased integration of alternative assets, such as private equity, infrastructure, and real-assets, into mainstream portfolios, as managers seek higher returns and diversification in a low-yield environment. The rise of ESG and impact-investing frameworks is also influencing product development and client relationships. Meanwhile, big data and AI are being leveraged to improve risk-modelling, personalise advice and optimise portfolio construction. Finally, geographic expansion into emerging markets, where wealth levels and investor demand are rising, offers new growth fronts for asset-management firms.

The asset management services market is expanding rapidly as global investors seek more structured, technology driven, and professionally managed financial solutions. The rising complexity of financial markets, increasing wealth creation, and the need for diversified investment strategies are all fueling demand for asset management expertise. Businesses and individuals across sectors now rely on asset managers for strategic investment planning, portfolio optimization, risk management, and long term wealth preservation. Countries with strong financial infrastructure such as China, India, Germany, and the USA are leading this growth, supported by the rapid adoption of digital wealth platforms, robo advisory tools, and advanced analytics. As global financial markets continue to evolve, asset management services are becoming essential for navigating market volatility and achieving stable long term returns. This analysis explores the specific drivers shaping the asset management services market across key economies.

| Country | CAGR (2025-2035) |

|---|---|

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| Brazil | 12.7% |

| USA | 11.4% |

| United Kingdom | 10.2% |

| Japan | 9.1% |

China leads the asset management services market with a strong CAGR of 16.3 %. The country continues to experience rapid financial sector expansion, driven by rising household wealth and increasing investor participation in capital markets. The adoption of digital wealth management platforms, supported by advanced technologies such as AI based portfolio management and automated advisory tools, is accelerating market growth. China is also seeing increasing institutional investment activity as businesses seek efficient capital allocation and risk optimized investment solutions. The growing middle class, with a rising preference for systematic and professionally managed portfolios, further supports demand for asset management services. Strong government initiatives promoting financial sector modernization and increased foreign participation in China’s capital markets are also contributing to market expansion. As China continues to embrace financial innovation and long term wealth building strategies, the asset management services market will maintain strong upward momentum.

India is experiencing robust growth in asset management services, with a CAGR of 15.1 %. The rapid expansion of financial literacy, increasing retail investor participation, and the rise of systematic investment plans are key contributors to market growth. India’s strong economic performance and expanding middle class are driving interest in mutual funds, pension funds, and professionally managed portfolios. The digitalization of financial services, including mobile investment platforms and AI driven advisory tools, is empowering more investors to access structured investment solutions. Institutional demand is also rising as businesses adopt more strategic asset allocation practices to enhance long term financial stability. Government initiatives that promote transparent financial processes and encourage participation in capital markets further support the growth of the asset management industry. With rising disposable income and growing awareness of wealth management strategies, the asset management services market in India is set for long term expansion.

Germany’s asset management services market is projected to grow at a strong CAGR of 13.9 %. Germany has a mature financial ecosystem supported by institutional investors, corporate entities, and a financially conscious population. The demand for long term investment planning, retirement solutions, and risk managed portfolios is rising across the country. Digital transformation in financial services is playing a major role, with an increasing shift toward online wealth management platforms and automated advisory solutions. Germany’s emphasis on sustainable investing and ESG based portfolio strategies is also driving innovation within the asset management sector. Strong regulatory frameworks that promote transparency and investor protection further boost confidence in managed financial solutions. As Germany continues to emphasize financial stability, long term wealth preservation, and diversified investment strategies, the asset management services market will continue to expand consistently.

Brazil demonstrates steady growth in the asset management services market with a CAGR of 12.7 %. The country is witnessing greater participation in financial markets as investors seek structured investment options to navigate economic fluctuations. Brazil’s growing pension fund sector and increased focus on retirement planning are contributing significantly to the rising demand for asset management services. Digital wealth platforms and mobile investment applications are becoming more widespread, making investment solutions more accessible to retail investors. Institutional investors in Brazil are increasingly adopting diversified portfolio strategies to manage risk and enhance returns. As the country continues to modernize its financial infrastructure and promote investment participation, the asset management services market will see sustained growth supported by both retail and institutional demand.

The United States has a projected CAGR of 11.4 % in the asset management services market. The USA has one of the largest and most sophisticated financial markets globally, with strong demand for portfolio management, wealth advisory, and institutional investment solutions. The increased adoption of technology driven investment strategies, including robo advisory platforms and data analytics tools, is transforming the asset management landscape. The country’s high concentration of institutional investors, pension funds, and financial planning firms supports continuous market expansion. Growing interest in sustainable and diversified investment strategies further strengthens market demand. As USA investors continue to seek advanced wealth management solutions that address long term financial goals, the market for asset management services will remain strong and dynamic.

The United Kingdom’s asset management services market is projected to grow at a CAGR of 10.2 %. The UK is home to a highly developed financial services sector with strong demand for wealth management, pension fund management, and institutional investment strategies. The increasing adoption of digital investment platforms and the rising interest in diversified, long term portfolios are driving market growth. The UK’s strong regulatory framework ensures transparency and investor protection, contributing to increased trust in asset management solutions. Market demand is also supported by corporate entities seeking better risk management and capital allocation strategies. As the UK continues to strengthen its financial infrastructure and promote innovation in investment services, the asset management services market will experience steady growth.

Japan’s asset management services market is expected to grow at a CAGR of 9.1 %. Japan’s aging population and increasing focus on retirement planning are major drivers of demand for professionally managed investment solutions. Investors in Japan are increasingly seeking structured wealth management services to address long term financial needs. The expansion of digital wealth platforms and robo advisory tools is making asset management solutions more accessible to both younger and older demographics. Corporate demand is also rising as businesses adopt more strategic investment practices and risk management frameworks. Japan’s commitment to financial innovation, along with a strong regulatory environment, ensures continued adoption of asset management services. As Japanese investors continue to prioritize financial planning and wealth preservation, the market will maintain steady long term growth.

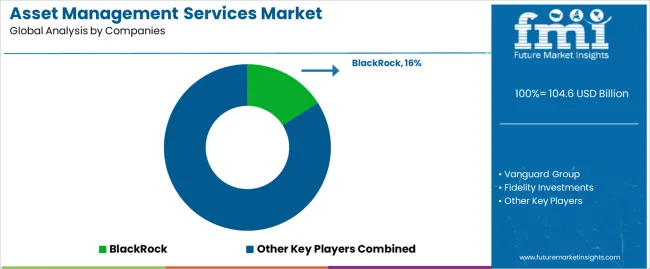

In the asset management services market, firms such as BlackRock (holding about 16% share), Vanguard Group, Fidelity Investments, State Street Global Advisors, J.P. Morgan Asset Management, Blackstone, Goldman Sachs Asset Management, Allianz Global Investors, Amundi Asset Management, UBS Asset Management, BNY Mellon Investment Management, Northern Trust Asset Management, BNP Paribas Asset Management, PIMCO, and Capital Group compete across a range of services and geographies. The market is growing as institutional and retail clients seek professional management of investments across multiple asset classes, driven by digital transformation in the industry.

These firms differentiate themselves through several strategic paths. Some prioritise scale and cost advantage by broadening passive investment offerings, achieving low fee structures and leveraging global distribution. Others emphasise active investment capabilities, alternative assets and bespoke client servicing for high net worth and institutional clients. A further strategy focuses on technological advantage: firms invest in artificial intelligence, data analytics and digital platforms to enhance portfolio management, risk modelling and client experience. Marketing materials and client facing brochures typically highlight factors such as assets under management, track record, investment philosophy, multi asset solutions, digital platform accessibility, global presence and regulatory compliance. By aligning their services with evolving client demands, such as transparency, cost efficiency and tailored advice, these companies aim to enhance their competitive positioning in the asset management services market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Service Type | Traditional Asset Management, Alternative Asset Management, Digital/Automated Asset Management, Others |

| End-User Segment | Enterprise, Individual |

| Key Companies Profiled | BlackRock, Vanguard Group, Fidelity Investments, State Street Global Advisors, J.P. Morgan Asset Management, Blackstone, Goldman Sachs Asset Management, Allianz Global Investors, Amundi Asset Management, UBS Asset Management, BNY Mellon Investment Management, Northern Trust Asset Management, BNP Paribas Asset Management, PIMCO, Capital Group |

| Additional Attributes | The market analysis includes dollar sales by service type and end-user segment categories. It also covers regional adoption trends across major markets. The competitive landscape focuses on key players in the asset management services market, with innovations in traditional, alternative, and digital/automated asset management solutions. Trends in the growing demand for asset management services in enterprise and individual sectors are explored, along with advancements in automation and digital technologies in the financial services industry. |

The global asset management services market is estimated to be valued at USD 104.6 billion in 2025.

The market size for the asset management services market is projected to reach USD 327.8 billion by 2035.

The asset management services market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in asset management services market are traditional asset management, alternative asset management, digital/automated asset management and others.

In terms of end‑user segment, enterprise segment to command 55.0% share in the asset management services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Asset Financing Platform Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Asset Tags Sector

Asset Management System Market

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asset And Liability Management Solutions Market

IT Asset Disposition Market Forecast and Outlook 2025 to 2035

IT Asset Management Market Size and Share Forecast Outlook 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Marine Asset Integrity Services Market

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Crypto Asset Management Market

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Asset Management Market

Ceiling Cassettes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA