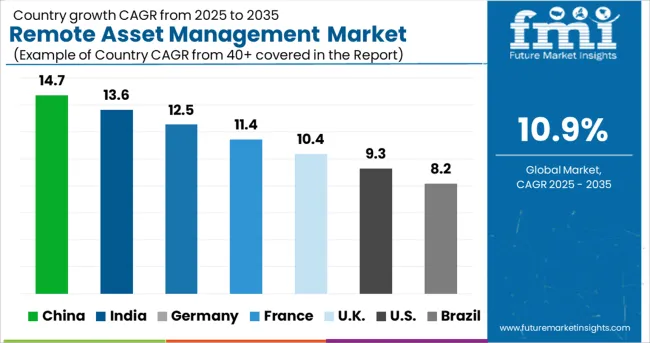

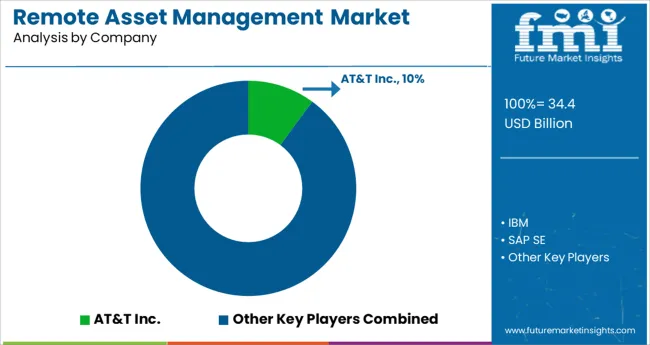

The Remote Asset Management Market is estimated to be valued at USD 34.4 billion in 2025 and is projected to reach USD 96.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.9% over the forecast period.

The remote asset management market is undergoing accelerated transformation as enterprises across industries seek real-time visibility, efficiency, and automation in managing dispersed assets. The convergence of IoT sensors, edge computing, and cloud-based analytics is enabling organizations to remotely monitor performance, detect anomalies, and execute corrective actions without manual intervention.

Growing focus on asset lifecycle extension, coupled with rising equipment maintenance costs, is encouraging adoption of intelligent monitoring solutions. Companies are increasingly integrating AI and machine learning algorithms to optimize uptime, reduce operational risks, and predict failures before they occur.

Regulatory demands for asset traceability and the rise of connected infrastructure in sectors like energy, transportation, and logistics are further shaping the market landscape. Future opportunities are expected to be defined by scalable platforms offering secure connectivity, integrated communication layers, and real-time analytics-making remote asset management a critical component of digital transformation across asset-intensive environments.

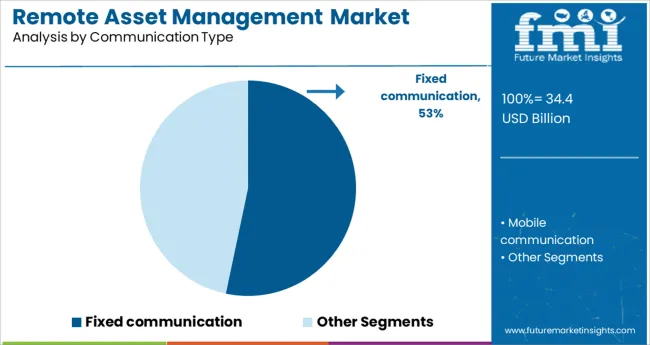

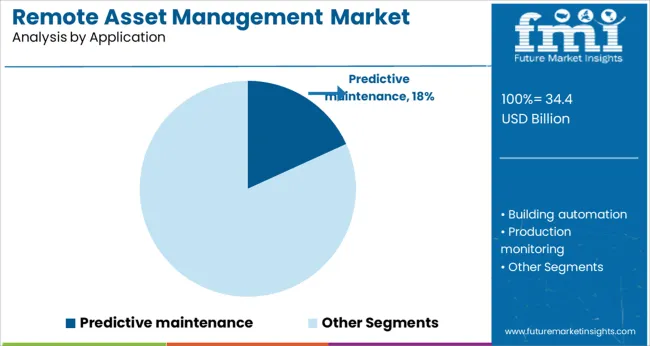

The market is segmented by Communication Type, Application, and End-User Industries and region. By Communication Type, the market is divided into Fixed communication and Mobile communication. In terms of Application, the market is classified into Predictive maintenance, Building automation, Production monitoring, Vehicle tracking, Analytics, Performance management, Remote programming of consumer devices, and Air conditioner monitoring.

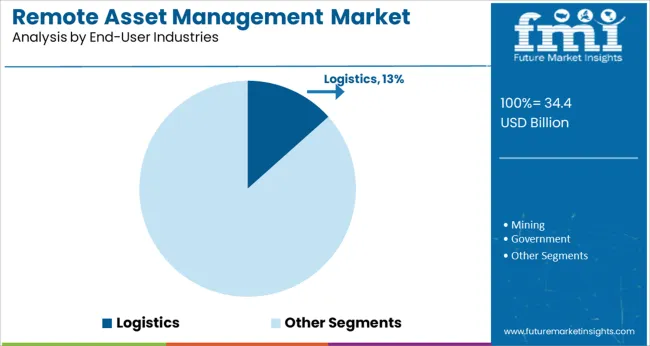

Based on End-User Industries, the market is segmented into Logistics, Mining, Government, Fisheries, Healthcare, Oil & gas, Utilities, BFSI, Manufacturing, Retail & consumer goods, Automobiles, Information technology, and Telecommunication. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Communication Type, Application, and End-User Industries and region. By Communication Type, the market is divided into Fixed communication and Mobile communication. In terms of Application, the market is classified into Predictive maintenance, Building automation, Production monitoring, Vehicle tracking, Analytics, Performance management, Remote programming of consumer devices, and Air conditioner monitoring.

Based on End-User Industries, the market is segmented into Logistics, Mining, Government, Fisheries, Healthcare, Oil & gas, Utilities, BFSI, Manufacturing, Retail & consumer goods, Automobiles, Information technology, and Telecommunication. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fixed communication is projected to account for 53.3% of total revenue within the communication type segment in 2025, making it the dominant mode of connectivity. This leading position is attributed to the reliability, bandwidth stability, and continuous data flow offered by fixed networks in industrial and commercial environments.

Fixed communication has been widely adopted for assets deployed in static locations such as factories, warehouses, and power plants where uninterrupted connectivity is critical. The ability to support high-frequency telemetry data transmission and seamless integration with SCADA systems has reinforced its value in critical operations.

Additionally, fixed communication systems provide stronger cybersecurity controls and reduced signal latency, factors that are particularly important in sectors requiring real-time monitoring and remote diagnostics. These capabilities have ensured sustained preference for fixed communication, particularly in mission-critical asset environments.

Predictive maintenance is anticipated to capture 18.2% of the remote asset management market revenue in 2025, positioning it as a high-impact application area. The segment’s growth has been fueled by the need to move from reactive to proactive maintenance strategies that minimize downtime and extend asset lifespan.

By leveraging real-time sensor data, machine learning models, and condition-based algorithms, predictive maintenance platforms enable early detection of component fatigue, wear, or misalignment. This has been especially valuable in reducing unplanned outages and optimizing maintenance schedules, thereby delivering operational cost savings.

As asset-heavy industries like manufacturing, utilities, and transportation digitize maintenance operations, the demand for predictive maintenance capabilities within remote asset management platforms continues to rise. Its integration with digital twin models and AI-powered forecasting tools is further amplifying adoption across sectors aiming to enhance operational continuity and asset performance.

The logistics industry is expected to contribute 13.4% of total revenue in 2025 within the end user industries category, marking it as a key growth segment. This performance is being driven by the sector’s rising dependence on real-time asset visibility, especially for fleet management, inventory tracking, and warehouse automation.

The adoption of remote asset management solutions in logistics has enabled companies to monitor vehicle conditions, cargo status, fuel usage, and route adherence across geographies. Enhanced route optimization, combined with predictive alerts and remote diagnostics, has significantly improved supply chain resilience and delivery efficiency.

Additionally, compliance with regulatory standards for asset traceability, cold chain monitoring, and driver safety has accelerated solution deployment across global logistics networks. As e-commerce expansion and just-in-time delivery models intensify, logistics providers are increasingly investing in connected asset ecosystems, ensuring sustained growth of remote asset management in this vertical.

The remote asset management market will benefit from an increase in the usage of IoT for efficient asset management, intelligent infrastructure, and real-time asset monitoring.

As sensor technology becomes more widely adopted, the need for remote asset management solutions will grow, as will the need for lower operational costs as a result of newer, more inventive solutions. This is leading to higher sales of remote asset management.

The remote asset management market's expansion is likely to be fuelled by an increase in the use of IoT-enabled remote asset management solutions. Predictive maintenance is likely to see an increase in demand if it is implemented more widely.

In the future, the remote asset management industry is likely to develop as IoT-based sensors become more affordable.

Using big data, GPS tracking, and other IoT devices, manufacturers are modernizing their supply chains in order to better manage supply, demand, and logistics challenges while also giving themselves an advantage over their competitors and staying one step ahead of their competitors in the remote asset management market.

A pharmaceutical company, Apotex, updated its manufacturing methods to automate manual processes. RFID tagging, sorting, and process flow tracking were all used to ensure consistent batch production. Real-time monitoring of production operations resulted as a result.

Because of their high scalability, connection with ERPs and corporate systems, and the ability to enable safe connectivity with corporate systems, remote asset management systems are becoming increasingly popular with corporate purchasers.

Costs can be reduced and a competitive advantage is gained by automating maintenance, supply management, and alarms management. While remote asset management systems are likely to develop during the forecast period, these advantages are expected to drive the remote asset management market expansion.

The mobile asset segment of the remote asset management market is expected to have a higher CAGR during the forecast period. The growth is due to the rising acceptance of disruptive technologies that let utilities deploy remote visual monitoring and alarm response management.

Mobile assets with GIS integration enable greater access to business and spatial data in a single view, improved asset management in the context of location, and the ability to visualize and search for assets on a map.

North America is likely to lead the remote asset management market due to its advanced transportation, logistics, and manufacturing industries. Government initiatives such as the Federal Highway Association (FHWA) in the leadership of AASHTO and DOTs are striving to integrate remote asset management in logistics and transportation.

Increasing cargo thefts lost items in transit, and real-time location solutions in the region will boost the remote asset management market.

Due to the growing acceptance of cloud-based solutions and emerging technologies, such as big data analytics, mobility, and the Internet of Things, Asia Pacific is likely to see substantial growth in the adoption of remote asset management (IoT).

A huge number of linked devices require asset management in this region, making it a major remote asset management market. There is also a growing need for remote asset management systems in areas like retail, building automation, logistics and transportation, utilities, and healthcare in various nations in the Asia-Pacific region.

Emerging economies like China and India are likely to fuel the expansion of the global remote asset management market.

In contrast, the remote asset management sector in Europe is experiencing significant expansion due to structural factors, such as monetary policy loosening, government intervention, and an emphasis on environmental, social, and governance (ESG) performance.

Middle East and Africa are predicted to grow significantly in the global remote asset management market because of their rapid expansion, which necessitates remote access management solutions rather than traditional asset management systems in the region.

Startup Ecosystem in the Remote Asset Management Market

In today's business climate, automation is essential. Dynamic and automated asset monitoring solutions provide organizations with real-time data and visibility into operational status. A quick response and a strong link between human capital and assets are possible because of this.

Increased productivity, regulatory compliance, threat mitigation, and asset monitoring are just some of the benefits of using a cloud-based platform. IoT technologies have already been utilized by more than two-thirds of manufacturers to increase their ROA. This is also leading the development of the startup ecosystem in the remote asset management market.

Many different companies are involved in the field of remote asset tracking, resulting in a fragmented remote asset management industry. There are several Research and Development activities being undertaken by solution providers in order to improve their present solutions and create new products that incorporate the most recent technology breakthroughs.

Global growth is also seen as a way to gain the most remote asset management market share.

The report consists of key players, contributing to the remote asset management market share. It also consists of organic and inorganic growth strategies adopted by market players to improve their market positions. This exclusive report analyzes the competitive landscape and remote asset management market share acquired by players to strengthen their market position.

Recent Developments

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 10.9% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Communication, Application, End-user industries, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Siemens AG. Cisco Systems Inc.; AT&T; Hitachi Ltd. Schneider Electric; Infosys Limited; PTC; Rockwell Automation Inc.; IBM Corporation; SAP; Bosch.IO; Verizon; Meridium Inc.; Rapid Value Solutions; Vodafone Group; EAMnrace; RCS Technologies; ROAMWORKS; Accruent; and Intellimation Pvt. Ltd among others. |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global remote asset management market is estimated to be valued at USD 34.4 billion in 2025.

It is projected to reach USD 96.8 billion by 2035.

The market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types are fixed communication and mobile communication.

predictive maintenance segment is expected to dominate with a 18.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote ICU Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Home Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA