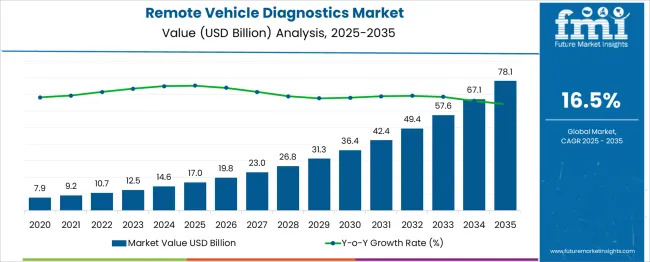

The Remote Vehicle Diagnostics Market is estimated to be valued at USD 17.0 billion in 2025 and is projected to reach USD 78.1 billion by 2035, registering a compound annual growth rate (CAGR) of 16.5% over the forecast period.

| Metric | Value |

|---|---|

| Remote Vehicle Diagnostics Market Estimated Value in (2025 E) | USD 17.0 billion |

| Remote Vehicle Diagnostics Market Forecast Value in (2035 F) | USD 78.1 billion |

| Forecast CAGR (2025 to 2035) | 16.5% |

The remote vehicle diagnostics market is expanding rapidly due to growing demand for real-time vehicle monitoring and proactive maintenance solutions. Advances in telematics and connectivity technologies have enabled efficient data transmission from vehicles to cloud platforms, facilitating remote diagnostics.

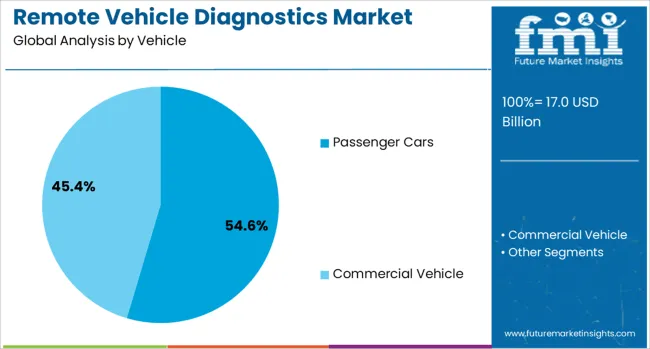

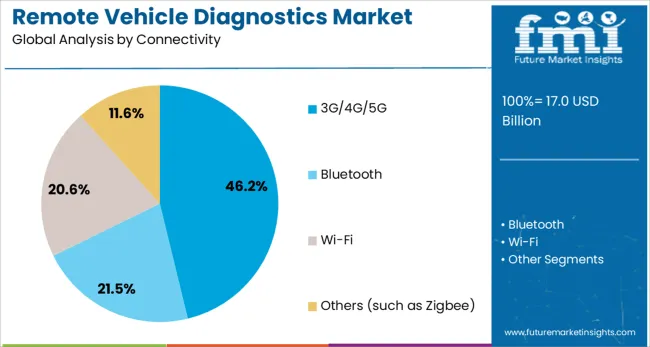

Increased adoption of 3G, 4G, and 5G networks has improved communication reliability and speed, enhancing diagnostic accuracy and timeliness. Passenger cars dominate the vehicle segment due to their widespread ownership and rising integration of advanced diagnostic systems.

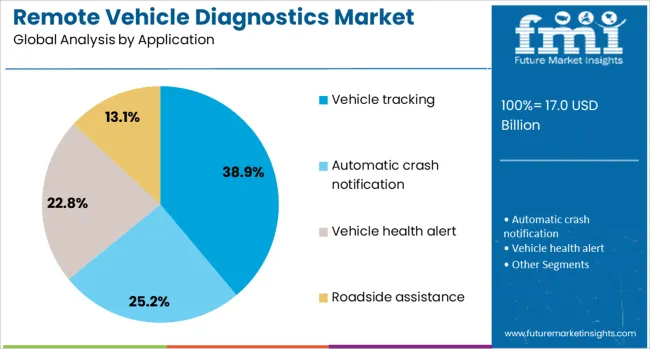

The increasing complexity of automotive electronics and stricter emission and safety regulations are driving vehicle manufacturers and service providers to adopt remote diagnostics for better fleet management and customer support. Additionally, vehicle tracking applications are gaining prominence as they offer enhanced security, route optimization, and operational efficiency for individual and commercial vehicle users.

The market is expected to grow further as connectivity infrastructure improves and automotive digitalization accelerates. Segmental growth is led by passenger cars in the vehicle segment, 3G/4G/5G in connectivity, and vehicle tracking as the main application.

The remote vehicle diagnostics market is segmented by vehicle, connectivity, application, and offering and geographic regions. By vehicle of the remote vehicle diagnostics market is divided into Passenger Cars and Commercial Vehicle. In terms of connectivity of the remote vehicle diagnostics market is classified into 3G/4G/5G, Bluetooth, Wi-Fi, and Others (such as Zigbee). Based on application of the remote vehicle diagnostics market is segmented into Vehicle tracking, Automatic crash notification, Vehicle health alert, and Roadside assistance. By offering of the remote vehicle diagnostics market is segmented into Software and Diagnostics equipment. Regionally, the remote vehicle diagnostics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment is projected to hold 54.6% of the remote vehicle diagnostics market revenue in 2025, maintaining its leading position. This growth is driven by the high volume of passenger vehicles equipped with onboard diagnostic systems and connectivity modules. Increasing consumer demand for preventive maintenance and enhanced vehicle safety features has encouraged the adoption of remote diagnostics in this segment.

Automotive manufacturers are increasingly integrating telematics hardware in passenger vehicles, enabling real-time monitoring and fault detection. The growing importance of connected car ecosystems further supports this segment’s expansion.

Passenger cars benefit from extensive aftermarket services and insurance programs that leverage diagnostic data to improve customer experience and reduce downtime.

The 3G/4G/5G connectivity segment is anticipated to account for 46.2% of the market revenue in 2025, dominating the connectivity options. This segment’s growth is fueled by the widespread availability and adoption of mobile broadband technologies that support seamless data transfer between vehicles and cloud platforms.

Enhanced network speeds and reduced latency of 4G and 5G have improved the efficiency of remote diagnostics, allowing for quicker response times and more comprehensive vehicle health monitoring.

The transition from legacy 3G networks to more advanced 4G and 5G infrastructure enables new functionalities such as predictive maintenance and over-the-air updates. As mobile network providers expand coverage and upgrade infrastructure, the reliance on cellular connectivity for vehicle diagnostics is expected to increase.

The vehicle tracking segment is expected to contribute 38.9% of the remote vehicle diagnostics market revenue in 2025, establishing itself as the leading application. Vehicle tracking offers critical benefits such as real-time location monitoring, theft prevention, and route optimization for both individual and fleet vehicles.

Increasing urbanization and demand for efficient logistics solutions have driven the adoption of tracking systems integrated with remote diagnostics. This application helps fleet operators reduce operational costs and improve asset utilization by providing actionable data on vehicle status and location.

Additionally, vehicle tracking supports safety and regulatory compliance by enabling remote monitoring of driver behavior and vehicle conditions. Growing demand for connected mobility services and smart transportation solutions is likely to further boost the growth of vehicle tracking applications within remote vehicle diagnostics.

Remote vehicle diagnostics are being used by fleet operators and OEMs to monitor real-time vehicle health, optimize maintenance schedules and reduce downtime. Onboard telematics units with fault code detection and remote data transmission are being implemented in commercial, passenger and electric vehicle segments. Integration with cloud-based platforms enables predictive alerts, remote troubleshooting and OTA software updates. Demand has been observed from leasing firms, ride-sharing fleets and service networks seeking to lower operational costs, improve uptime and deliver enhanced customer experience through proactive vehicle support.

Remote diagnostics have been adopted to enable early fault detection, allowing proactive intervention before breakdowns occur. Telematics modules are capturing engine parameters, battery metrics and system error codes which are transmitted over cellular or satellite networks to centralized platforms. Analytical systems apply machine learning to detect anomalies in coolant temperature, fuel pressure or electric drivetrain performance. Automated alerts are dispatched to technicians or fleet managers when thresholds are exceeded, enabling rapid scheduling of repairs or part replacement. Remote fault codes can guide on-site troubleshooting, eliminating time-consuming manual diagnostics. In commercial vehicle applications, remote diagnostics have provided uptime assurance and warranty tracking, while EV fleets benefit from battery management insights and charge cycle health assessments.

Adoption of remote diagnostics has been slowed by integration complexity across multiple onboard ECUs, proprietary fault code formats and OEM software interfaces. Platform interoperability has required custom middleware that harmonizes data streams from different vehicle manufacturers. Privacy and security concerns over vehicle data sharing have necessitated encryption, access control and compliance with regional data protection laws. Cellular connectivity gaps in remote locations can delay fault transmission and reduce effectiveness of real-time alerts. Fleet operators have expressed concern over data usage costs and network reliability, especially in cross-border operations. As OEM service networks handle diagnostic updates and manufacturer-specific protocols, third-party aftermarket support has faced barriers to entry due to software licensing restrictions.

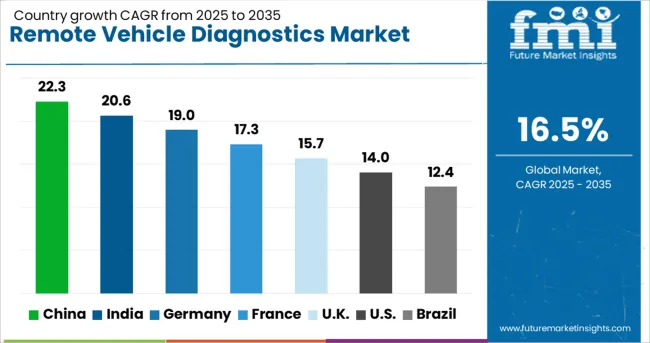

| Country | CAGR |

|---|---|

| China | 22.3% |

| India | 20.6% |

| Germany | 19.0% |

| France | 17.3% |

| UK | 15.7% |

| USA | 14.0% |

| Brazil | 12.4% |

The global remote vehicle diagnostics market is projected to grow at a 16.5% CAGR from 2025 to 2035, driven by advancements in telematics, predictive maintenance, and connectivity features in passenger and commercial vehicles. Of the 40 countries analyzed, China leads at 22.3%, followed by India at 20.6% and Germany at 19.0%, while France posts 17.3% and the United Kingdom records 15.7%. Growth is fueled by OEM integration of connected vehicle platforms, fleet management requirements, and government initiatives supporting vehicle safety compliance. BRICS countries focus on volume adoption through cost-effective telematics, while OECD nations prioritize high-end, data-driven diagnostics with advanced cybersecurity features. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 22.3% CAGR, supported by rapid adoption of connected vehicles and EV platforms. Automakers integrate advanced telematics and AI-based diagnostic systems to enhance predictive maintenance. Government mandates for real-time vehicle monitoring in commercial fleets boost demand across logistics and passenger transport. Domestic technology providers invest in 5G-enabled solutions for faster data transmission and OTA diagnostics. Expansion of aftermarket services using subscription-based models strengthens penetration in Tier II cities. Collaborations between OEMs and global tech firms enable development of cloud platforms for advanced analytics.

India is expected to grow at a 20.6% CAGR, driven by compliance regulations and growth in commercial fleet telematics. Government initiatives under AIS-140 mandate GPS and diagnostics for public transport, boosting installations. Domestic OEMs adopt embedded diagnostic sensors to reduce maintenance costs in passenger and light commercial vehicles. Logistics operators implement cloud-integrated platforms for real-time vehicle health data and route optimization. Startups are introducing low-cost telematics devices, increasing accessibility for small fleet owners. Demand from shared mobility and electric two-wheelers adds incremental opportunities in Tier I and II cities.

Germany is projected to grow at a 19.0% CAGR, led by premium vehicle OEMs integrating OTA-based diagnostic services. Advanced solutions enhance real-time system updates, predictive fault detection, and compliance with EU safety standards. Logistics companies adopt data-driven diagnostic tools for predictive maintenance to minimize operational downtime. German technology providers develop secure platforms emphasizing cybersecurity and encryption for telematics communication. Investments in R&D for autonomous and connected vehicle programs further stimulate adoption of diagnostics solutions across high-end automotive segments.

France is forecast to grow at a 17.3% CAGR, with strong adoption of telematics-driven diagnostics in EV fleets and shared mobility networks. Automakers integrate cloud-based systems to deliver predictive fault alerts and over-the-air updates. Urban delivery services and ride-hailing operators prioritize remote diagnostics for operational reliability. Domestic suppliers focus on compliance with EU data protection rules while expanding multi-brand diagnostic platforms. Growth of mobility-as-a-service models accelerates the need for real-time vehicle monitoring to optimize asset utilization.

The United Kingdom is expected to grow at a 15.7% CAGR, driven by rising integration of OTA diagnostics in connected and electric vehicles. OEMs develop telematics systems to deliver real-time fault detection and performance insights. Logistics and last-mile delivery firms adopt predictive maintenance solutions to improve efficiency and cut downtime costs. Collaborations between automotive manufacturers and insurers enable usage-based insurance models leveraging diagnostic data. Government-backed smart mobility initiatives encourage investment in connected car infrastructure and fleet monitoring technologies.

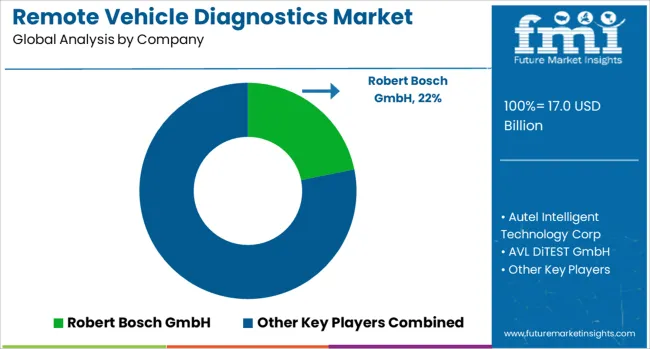

The remote vehicle diagnostics market is dominated by established automotive technology providers and diagnostic specialists. Robert Bosch GmbH leads with advanced telematics and cloud-enabled diagnostic platforms for OEMs and fleets. Continental AG and Denso Corporation focus on integrated solutions that combine real-time health monitoring with predictive maintenance for connected vehicles. BorgWarner, through Delphi Technologies, offers powertrain-focused diagnostic capabilities, while Marelli provides customized solutions for electric and hybrid vehicles. AVL DiTEST and Autel Intelligent Technology strengthen market presence with diagnostic tools for workshops and service centers. OnStar, a division of General Motors, offers embedded telematics-based diagnostics for passenger vehicles, ensuring proactive maintenance. Snap-on and ZF Friedrichshafen cater to aftermarket requirements with versatile tools and analytics platforms. Competition centers on connectivity, AI-driven fault detection, and over-the-air (OTA) software update capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.0 Billion |

| Vehicle | Passenger Cars and Commercial Vehicle |

| Connectivity | 3G/4G/5G, Bluetooth, Wi-Fi, and Others (such as Zigbee) |

| Application | Vehicle tracking, Automatic crash notification, Vehicle health alert, and Roadside assistance |

| Offering | Software and Diagnostics equipment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, Autel Intelligent Technology Corp, AVL DiTEST GmbH, BorgWarner (Delphi Technologies), Continental AG, Denso Corporation, Delphi Technologies (BorgWarner), Magneti Marelli (Marelli), OnStar (General Motors), Snap-on Incorporated, and ZF Friedrichshafen AG |

| Additional Attributes | Dollar sales in the remote vehicle diagnostics market are driven by the rising adoption of connected vehicles and demand for predictive maintenance. Growth is supported by telematics integration, AI-driven fault detection, and OTA update capabilities. North America leads adoption, while Asia-Pacific shows rapid expansion. Key players focus on cloud-based platforms, real-time data analytics, and enhancing diagnostic accuracy. |

The global remote vehicle diagnostics market is estimated to be valued at USD 17.0 billion in 2025.

The market size for the remote vehicle diagnostics market is projected to reach USD 78.1 billion by 2035.

The remote vehicle diagnostics market is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in remote vehicle diagnostics market are passenger cars, _hatchback, _sedan, _suv, _others, commercial vehicle, _trucks and _buses & coach.

In terms of connectivity, 3g/4g/5g segment to command 46.2% share in the remote vehicle diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Vehicle Remote Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Home Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Remote Healthcare Market - Growth & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA