The commercial vehicle remote diagnostics market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 22.1 billion by 2035, registering a compound annual growth rate (CAGR) of 17.8% over the forecast period. The market maturity curve illustrates a clear progression through adoption phases, starting with early adoption in the initial years leading up to 2025, when fleet operators and logistics companies began integrating basic telematics and diagnostic solutions primarily to reduce unplanned downtime and optimize maintenance schedules.

During this phase, adoption was limited to large fleets capable of investing in connected vehicle technologies, and awareness around predictive maintenance was still developing. The scaling phase, observed from 2025 to 2030, demonstrates rapid penetration of remote diagnostics solutions, driven by increasing regulatory pressure for vehicle safety, emissions compliance, and efficiency. Mid-sized and emerging fleet operators began deploying advanced telematics platforms, and integration with cloud-based analytics and AI-enabled predictive maintenance systems accelerated.

The compounded growth during this period is highlighted by the market value rising from USD 4.3 billion in 2025 to USD 11.5 billion in 2030, reflecting expanding adoption beyond early innovators. The consolidation phase from 2030 to 2035 marks widespread standardization of remote diagnostics in commercial vehicles, as both OEMs and third-party service providers enhance interoperability, data analytics capabilities, and integration with broader fleet management systems. By 2035, the market is expected to reach USD 22.1 billion, with near-saturation in key developed regions and significant traction in Asia-Pacific, indicating a mature adoption lifecycle with incremental technology enhancements shaping future growth.

| Metric | Value |

|---|---|

| Commercial Vehicle Remote Diagnostics Market Estimated Value in (2025 E) | USD 4.3 billion |

| Commercial Vehicle Remote Diagnostics Market Forecast Value in (2035 F) | USD 22.1 billion |

| Forecast CAGR (2025 to 2035) | 17.8% |

Increasing regulatory pressure around vehicle emissions and safety compliance is encouraging the adoption of remote diagnostic systems that offer real-time monitoring and proactive issue detection. The future outlook remains strong, supported by technological advancements in telematics, sensor integration, and mobile network connectivity.

As per recent automotive OEM announcements and digital fleet strategy briefings, there is a clear shift toward data-driven vehicle maintenance supported by cloud-enabled diagnostics platforms. Investments in connected commercial vehicles, combined with growing operational cost sensitivity among fleet operators, are further accelerating deployment.

Sustainability efforts are also playing a role, as remote diagnostics help reduce vehicle downtime, fuel consumption, and emissions. These dynamics are positioning remote diagnostics as a critical enabler in the evolution of intelligent transport ecosystems and are expected to unlock continued growth potential across global commercial fleets.

The commercial vehicle remote diagnostics market is segmented by vehicle, offering, connectivity, application, end use, and geographic regions. By vehicle, the commercial vehicle remote diagnostics market is divided into Trucks and Buses & coaches. In terms of offering, the commercial vehicle remote diagnostics market is classified into Software and Diagnostics equipment.

Based on connectivity, the commercial vehicle remote diagnostics market is segmented into 3G/4G/5G, Bluetooth, Wi-Fi, and Others. By application, the commercial vehicle remote diagnostics market is segmented into Vehicle health report & analytics, Automatic crash notification, Vehicle tracking, Roadside assistance, Engine diagnostics, and Others. By end use, the commercial vehicle remote diagnostics market is segmented into OEM and Aftermarket. Regionally, the commercial vehicle remote diagnostics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The trucks segment is projected to account for 67.3% of the Commercial Vehicle Remote Diagnostics Market revenue share in 2025, making it the dominant vehicle category. This leadership position is being driven by the high operational complexity and long-distance usage of trucks, which demand advanced monitoring and maintenance solutions. Fleet managers have increasingly prioritized remote diagnostics to reduce breakdown risk, optimize vehicle performance, and enhance driver safety.

Truck OEMs and logistics operators have integrated diagnostics platforms as a core feature in connected truck solutions, as highlighted in fleet modernization programs and technology adoption updates. The scale of truck fleets and their economic impact on logistics networks are reinforcing the need for real-time diagnostics tools.

The widespread availability of connectivity infrastructure across highways, combined with industry pressure to minimize downtime and maximize asset utilization, has supported the segment’s strong position. As the demand for freight movement grows, trucks will remain central to remote diagnostics adoption due to their operational intensity and cost structure.

The software segment is expected to hold 58.6% of the Commercial Vehicle Remote Diagnostics Market revenue share in 2025, reflecting its dominant role in enabling intelligent diagnostics systems. The segment’s growth is being driven by increasing integration of telematics platforms, cloud-based analytics, and artificial intelligence across fleet operations. Fleet operators have been adopting software-centric solutions to enable predictive diagnostics, automated alerts, and remote issue resolution, as outlined in recent transport technology news and platform launch announcements.

Software offerings provide the flexibility to update, scale, and customize diagnostics functions without modifying hardware, making them cost-effective and future-ready. The growing reliance on data-driven insights to improve maintenance scheduling and fleet efficiency has positioned software as the backbone of remote diagnostics ecosystems.

Additionally, the software segment supports cross-platform interoperability and seamless communication between vehicles, service centers, and OEMs. These capabilities have made it a preferred solution across both small and large commercial fleets, driving its continued dominance in the market.

The 3G/4G/5G connectivity segment is forecasted to account for 61.4% of the Commercial Vehicle Remote Diagnostics Market revenue share in 2025, emerging as the leading connectivity type. The dominance of this segment is supported by its ability to provide real-time data transmission, high-speed communication, and reliable coverage essential for remote diagnostics operations. As per recent telecom deployment reports and commercial vehicle connectivity announcements, widespread 4G adoption and increasing rollout of 5G infrastructure are enhancing the responsiveness and accuracy of diagnostics systems.

These technologies enable faster data collection from vehicle sensors and quicker transmission to analytics platforms, improving fault detection and resolution times. In addition, 3G/4G/5G networks support over-the-air software updates, reducing the need for physical service visits.

This has become especially valuable for fleet managers seeking to minimize downtime and reduce operational costs. The scalability and reliability of these networks have positioned them as the preferred connectivity standard in commercial vehicle diagnostics, further solidifying their market share in 2025.

The market has expanded due to the increasing need for real-time monitoring, predictive maintenance, and fleet optimization across transportation and logistics operations. Remote diagnostic systems allow fleet operators to detect engine faults, monitor fuel consumption, and analyze vehicle performance without manual inspections. Growth has been driven by advancements in telematics, IoT integration, and cloud-based analytics platforms that enhance operational efficiency and reduce downtime. Rising demand for connected vehicles, regulatory compliance, and data-driven fleet management has reinforced adoption in commercial trucking, delivery, and public transportation sectors globally.

Technological advancements in telematics and IoT solutions have strengthened the commercial vehicle remote diagnostics market. Vehicle sensors, embedded control units, and wireless connectivity enable continuous monitoring of engine performance, braking systems, fuel efficiency, and component health. Data collected is transmitted to cloud-based analytics platforms where predictive algorithms and machine learning models identify potential failures and maintenance requirements. Integration with fleet management software allows scheduling of proactive repairs, optimizing vehicle uptime, and reducing operational costs. Enhanced cybersecurity measures have been implemented to ensure data integrity and prevent unauthorized access. These innovations have made remote diagnostics a critical tool for fleet operators, supporting data-driven decisions, improved vehicle reliability, and optimized logistics operations across commercial vehicle networks globally.

Regulatory compliance and safety standards have played a crucial role in driving the adoption of remote diagnostics in commercial vehicles. Transportation authorities and safety agencies require periodic inspections, emissions monitoring, and adherence to operational standards to prevent accidents and environmental violations. Remote diagnostic systems allow continuous compliance tracking for engine emissions, vehicle telematics, and operational efficiency. Real-time monitoring of safety-critical parameters, including brake performance, tire pressure, and fuel consumption, reduces the risk of violations and incidents. The insurers and fleet operators have increasingly adopted diagnostics solutions to demonstrate compliance, lower liability, and support safer operations. Regulatory mandates combined with safety standards have reinforced market growth by highlighting the value of proactive maintenance, monitoring, and operational transparency across commercial vehicle fleets globally.

Fleet operators have increasingly adopted commercial vehicle remote diagnostics to optimize operations, reduce costs, and improve efficiency. Remote monitoring enables real-time tracking of vehicle utilization, fuel consumption, route performance, and driver behavior. Predictive maintenance minimizes unplanned downtime by identifying failing components before breakdowns occur, extending vehicle lifespan and reducing repair costs. Integration with logistics management systems allows fleet scheduling optimization, faster delivery cycles, and energy-efficient operations. Companies managing large fleets, including logistics providers, public transportation authorities, and courier services, have leveraged diagnostic data for performance benchmarking and operational planning. The ability to improve asset utilization, reduce maintenance expenditure, and enhance safety has reinforced the adoption of remote diagnostic systems across commercial vehicle operations globally.

The emergence of connected and autonomous vehicles has accelerated the demand for commercial vehicle remote diagnostics. Advanced driver assistance systems (ADAS), automated braking, and real-time navigation integration require continuous monitoring of vehicle health and system performance. Data connectivity across fleet management platforms allows seamless transmission of performance metrics, fault alerts, and predictive maintenance schedules. Remote diagnostic solutions support integration with vehicle-to-infrastructure and vehicle-to-cloud communication networks, enabling intelligent fleet operations. The growth of electric and hybrid commercial vehicles has increased the complexity of propulsion systems, requiring advanced diagnostics to monitor battery health, charging efficiency, and electric motor performance. Expansion of connected and semi-autonomous commercial vehicles has reinforced the relevance of remote diagnostics as an essential enabler of modern, efficient, and data-driven fleet management globally.

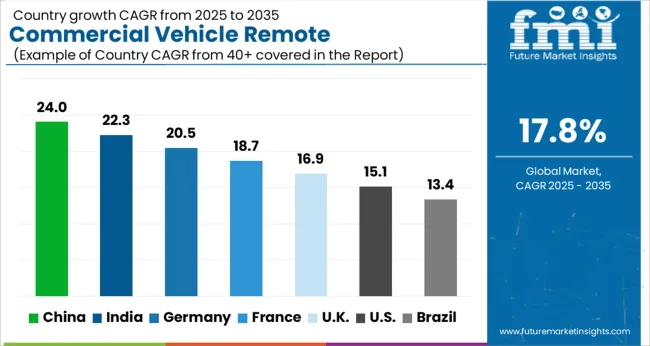

The market is projected to grow at a CAGR of 17.8% from 2025 to 2035, driven by increased fleet digitization, telematics integration, and predictive maintenance solutions. China leads with a 24.0% CAGR, supported by large-scale commercial vehicle fleets and government-backed smart transport initiatives. India follows at 22.3%, fueled by growing logistics networks and adoption of connected vehicle technologies. Germany, at 20.5%, benefits from advanced automotive engineering and integration of Industry 4.0 solutions. The UK, growing at 16.9%, focuses on regulatory compliance and vehicle uptime optimization. The USA, at 15.1%, experiences steady growth from widespread telematics adoption and fleet management innovation. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to expand at a CAGR of 24.0% in the industry from 2025 to 2035, driven by rapid digitization in the transportation sector, regulatory mandates for vehicle emissions monitoring, and growing adoption of telematics and AI-driven predictive maintenance platforms. Logistic companies are investing in connected vehicles to reduce downtime and optimize fleet performance. Domestic OEMs are increasingly integrating real-time diagnostic systems and cloud-based platforms to enhance operational efficiency and monitor vehicle health across regions. The rise of e-commerce and last-mile delivery services is also accelerating the need for advanced diagnostics and proactive maintenance strategies, positioning China as a global hub for connected commercial vehicle solutions.

India is anticipated to grow at a CAGR of 22.3% over 2025 to 2035 due to increasing commercial vehicle fleets, government initiatives to improve road safety, and stricter emission standards. Fleet operators are adopting connected vehicle solutions to reduce maintenance costs, optimize fuel consumption, and improve operational efficiency. OEMs are investing in IoT-enabLED diagnostic platforms, predictive analytics, and remote monitoring solutions to meet the rising demand from logistics, transportation, and e-commerce sectors. Urban centers and industrial corridors are witnessing high adoption rates, while rural connectivity improvements are driving broader implementation across regional fleets.

Germany is forecast to grow at a CAGR of 20.5% from 2025 to 2035, supported by advanced industrial logistics, automation trends, and stringent EU regulations on emissions and fleet efficiency. OEMs and service providers are focusing on AI-driven diagnostic solutions, real-time telematics, and predictive maintenance systems to minimize breakdowns and optimize fleet operations. The logistics and transport industry is increasingly integrating cloud-based monitoring platforms, enabling proactive maintenance scheduling, fuel optimization, and real-time alerts. Collaborative initiatives between technology providers and fleet operators are enhancing system interoperability and driving the adoption of next-generation diagnostics solutions across commercial vehicles.

The United Kingdom is expected to expand at a CAGR of 16.9% from 2025 to 2035, driven by adoption of connected vehicle technologies, government regulations, and digitalization of fleet management. Logistic firms and passenger transport operators are increasingly implementing cloud-enabLED diagnostic solutions and telematics platforms for real-time vehicle monitoring, predictive maintenance, and operational efficiency improvements. OEMs are collaborating with software providers to integrate AI-based diagnostics and fleet performance analytics. The growth of e-commerce and delivery services, combined with regulatory compliance pressures, is boosting adoption rates across regional and national fleets.

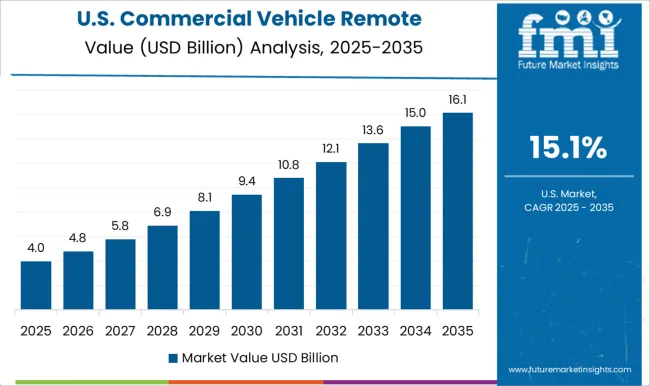

The United States is projected to grow at a CAGR of 15.1% from 2025 to 2035, driven by the expansion of long-haul logistics, adoption of telematics and IoT-based vehicle monitoring, and integration of AI-powered predictive maintenance systems. Fleet operators are investing in advanced diagnostic platforms to improve uptime, optimize fuel consumption, and reduce maintenance costs. Collaborations between OEMs and technology providers are enhancing adoption of real-time monitoring systems, cloud analytics, and fleet management software. The demand for intelligent, connected vehicle ecosystems is accelerating, particularly across e-commerce, logistics, and commercial transportation networks.

Continental and Robert Bosch leverage extensive expertise in automotive electronics and software integration to provide comprehensive remote diagnostics platforms that enhance vehicle uptime and operational efficiency. Cummins and Bendix Commercial Vehicle Systems focus on engine and braking system monitoring, offering real-time data analysis for early fault detection and performance optimization. Hino Motors, IVECO, Mercedes-Benz, and Scania emphasize connected vehicle solutions, integrating telematics, cloud-based analytics, and onboard diagnostics to streamline maintenance schedules and reduce unplanned downtime.

Volvo Trucks and ZF Friedrichshafen deploy scalable platforms tailored to commercial fleets, supporting predictive alerts, remote troubleshooting, and data-driven decision-making for fleet operators. Emerging players are focusing on specialized software and cloud-based platforms that enhance compatibility across diverse vehicle types, providing actionable insights for operators. Entry barriers in the market remain significant due to the need for advanced telematics infrastructure, compliance with regulatory standards, cybersecurity measures, and substantial R&D investments, making it challenging for new entrants while encouraging continuous innovation among established providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Vehicle | Trucks and Buses & coaches |

| Offering | Software and Diagnostics equipment |

| Connectivity | 3G/4G/5G, Bluetooth, Wi-Fi, and Others |

| Application | Vehicle health report & analytics, Automatic crash notification, Vehicle tracking, Roadside assistance, Engine diagnostics, and Others |

| End Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental, Bendix Commercial Vehicle Systems, Cummins, Hino Motors, IVECO, Mercedes-Benz, Robert Bosch, Scania, Volvo Trucks, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by solution type and vehicle segment, demand dynamics across heavy-duty trucks, buses, and light commercial vehicles, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in real-time telematics, predictive maintenance algorithms, and cloud-based monitoring platforms, environmental impact of optimized fuel usage and reduced maintenance-related emissions, and emerging use cases in fleet management optimization, autonomous vehicle readiness, and uptime maximization for logistics operations. |

The global commercial vehicle remote diagnostics market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the commercial vehicle remote diagnostics market is projected to reach USD 22.1 billion by 2035.

The commercial vehicle remote diagnostics market is expected to grow at a 17.8% CAGR between 2025 and 2035.

The key product types in commercial vehicle remote diagnostics market are trucks and buses & coaches.

In terms of offering, software segment to command 58.6% share in the commercial vehicle remote diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA