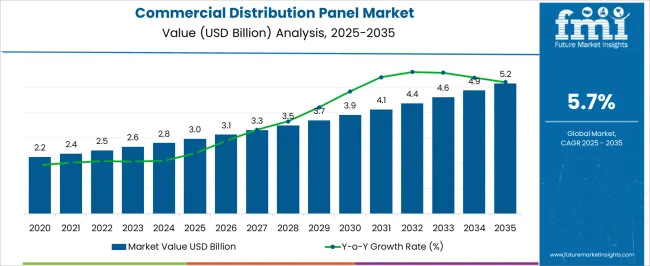

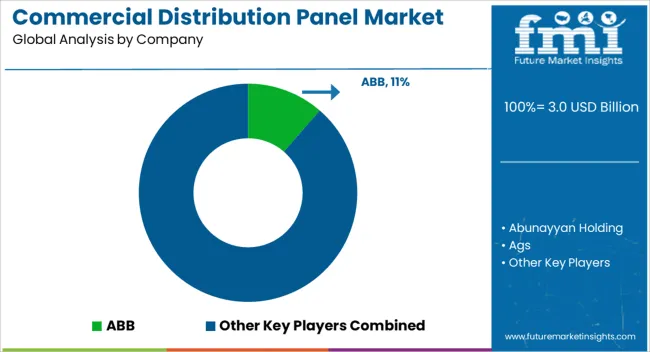

The commercial distribution panel market, valued at USD 3.0 billion in 2025 and projected to reach USD 5.2 billion by 2035 at a CAGR of 5.7%, demonstrates significant contributions from varied technological segments, each influencing overall market growth and adoption patterns. Traditional air-insulated switchgear systems maintain a steady share due to their established reliability, ease of maintenance, and widespread installation in commercial facilities. Their moderate cost and compatibility with existing infrastructure have sustained gradual growth, particularly in regions with mature electrical grids.

Vacuum and gas-insulated technologies have emerged as critical growth drivers, offering compact designs, higher operational efficiency, and enhanced safety characteristics. These systems are increasingly favored in urban commercial projects where space optimization and reliability under higher load densities are prioritized. The integration of smart panel technologies, incorporating IoT-enabled monitoring, predictive maintenance, and remote operation capabilities, contributes to an accelerating influence on market expansion, particularly in technologically advanced regions.

The adoption of hybrid solutions combining conventional and digitalized functionalities further diversifies technology contributions, balancing cost considerations with enhanced performance. Over the forecast period, technology-specific uptake patterns indicate that while legacy systems sustain steady revenue, advanced digital and compact designs are responsible for a growing proportion of market value. The market reflects a multi-technology contribution profile where traditional, vacuum, gas-insulated, and smart panels collectively shape growth, with emerging digital and compact solutions driving incremental value addition from 2025 to 2035.

| Metric | Value |

|---|---|

| Commercial Distribution Panel Market Estimated Value in (2025 E) | USD 3.0 billion |

| Commercial Distribution Panel Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The commercial distribution panel market represents a specialized segment within the electrical distribution and building infrastructure industry, emphasizing power management, safety, and energy efficiency. Within the broader electrical panel market, it accounts for about 5.2%, driven by demand in commercial buildings, offices, and industrial facilities. In the low and medium voltage distribution equipment segment, it holds nearly 5.8%, reflecting adoption for load control, fault protection, and energy monitoring. Across the smart building and automation solutions sector, the segment captures 4.3%, supporting integration with IoT devices and energy management systems. Within the power protection and safety devices category, it represents 3.9%, highlighting compliance with electrical codes and standards.

In the industrial and commercial electrical infrastructure sector, it secures 4.1%, emphasizing durability, modularity, and operational reliability. Recent developments in this market have focused on digital integration, modularity, and smart monitoring. Innovations include distribution panels with embedded sensors, remote monitoring capabilities, and IoT-enabled energy management features. Key players are collaborating with construction companies, electrical contractors, and building automation providers to enhance safety, energy efficiency, and real-time diagnostics. Adoption of pre-assembled, compact, and lightweight designs is gaining traction to reduce installation time and space requirements. Additionally, eco-efficient materials and arc-resistant designs are being deployed to improve durability and reduce environmental impact.

The commercial distribution panel market is experiencing sustained expansion, driven by rising electricity demand in commercial infrastructure and the modernization of building electrical systems. Industry updates and electrical equipment manufacturer reports have noted an increased focus on safety, energy efficiency, and compliance with evolving electrical standards, all of which have accelerated the adoption of advanced distribution panels.

Urban development, commercial real estate growth, and smart building initiatives have contributed to higher panel installation rates, while technological advancements such as integrated monitoring systems and modular designs have enhanced operational efficiency.

Additionally, the push for sustainable energy management has encouraged the integration of distribution panels with renewable energy sources and energy storage systems. Ongoing retrofitting of older buildings to meet updated codes and energy performance requirements has further stimulated demand. Over the forecast period, market momentum is expected to be led by the low voltage segment, flush mounting installations for space optimization, and office environments where operational reliability and energy control are critical.

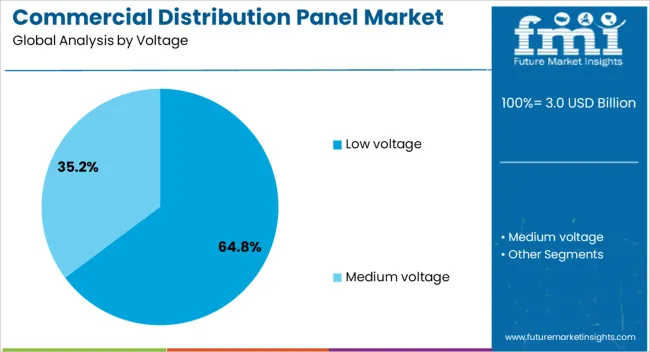

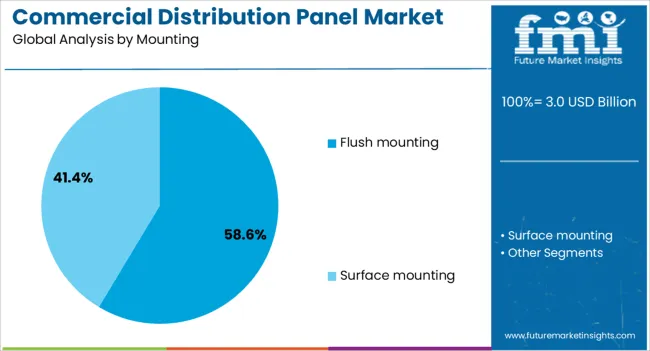

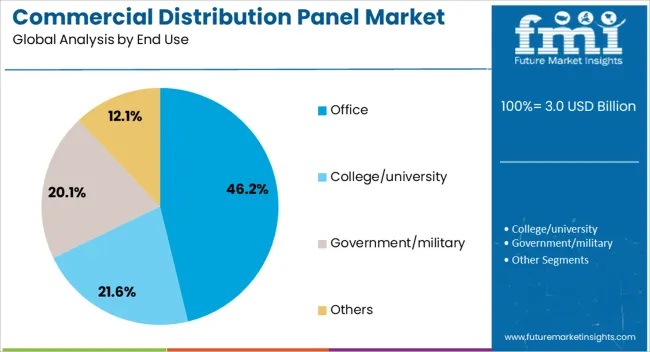

The commercial distribution panel market is segmented by voltage, mounting, end use, and geographic regions. By voltage, commercial distribution panel market is divided into Low voltage and Medium voltage. In terms of mounting, commercial distribution panel market is classified into Flush mounting and Surface mounting. Based on end use, commercial distribution panel market is segmented into Office, College/university, Government/military, and Others. Regionally, the commercial distribution panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment is projected to account for 64.8% of the commercial distribution panel market revenue in 2025, maintaining its dominant position due to its widespread suitability for commercial building electrical systems. Growth in this segment has been supported by the prevalence of low voltage distribution in lighting, HVAC, and small power applications.

Electrical engineering publications have highlighted low voltage panels as cost-effective, easier to install, and safer to operate compared to medium or high voltage alternatives in commercial environments.

Their compatibility with a wide range of protection devices and metering solutions has enhanced their adoption in both new constructions and retrofit projects. Furthermore, global trends in energy efficiency and the integration of smart controls have reinforced the demand for low voltage systems, enabling improved load management and reduced operational costs. This segment’s adaptability across diverse commercial applications is expected to sustain its leadership in the coming years.

The flush mounting segment is projected to hold 58.6% of the commercial distribution panel market revenue in 2025, making it the preferred installation type for modern commercial spaces. Growth has been driven by the need for space-efficient solutions that integrate seamlessly into building interiors without compromising aesthetics.

Flush-mounted panels are particularly favored in offices, retail complexes, and institutional buildings where concealed installation enhances safety and visual appeal.

Electrical equipment manufacturer reports have indicated that flush mounting facilitates better protection against accidental contact and environmental exposure, improving operational safety. Advances in panel design, including slimmer profiles and modular configurations, have further boosted adoption. Additionally, construction industry trends towards minimalistic interior layouts have reinforced the preference for flush-mounted systems, which can be installed without protruding into usable space. This combination of functional and aesthetic benefits is expected to maintain the segment’s strong market position.

The office segment is projected to contribute 46.2% of the commercial distribution panel market revenue in 2025, leading demand among end-use categories. This dominance has been driven by the rapid expansion of commercial office spaces, particularly in urban business districts and technology hubs.

Offices require reliable, safe, and efficient electrical distribution to support a wide array of equipment, from computing systems to lighting and HVAC.

Facility management priorities, such as minimizing downtime and enabling flexible space reconfiguration, have increased the demand for advanced distribution panels with integrated monitoring and circuit protection features. Additionally, the growth of green building certifications and energy performance standards has encouraged the use of panels compatible with smart energy management systems. As hybrid work models reshape office layouts and increase the need for adaptable electrical infrastructure, the office segment is expected to sustain strong demand for high-performance distribution panels.

The market has grown steadily as demand for reliable, safe, and efficient electrical distribution solutions increases across commercial, industrial, and institutional sectors. These panels are used to control and distribute electricity, protecting circuits from overloads and short circuits while supporting various building and facility operations. Growing construction activity, modernization of electrical infrastructure, and adoption of smart building technologies have reinforced demand. Technological advancements in modular designs, monitoring systems, and compact configurations enhance operational efficiency and space utilization. Compliance with international electrical safety standards and increasing focus on energy management in commercial establishments have further driven adoption.

The expansion of commercial construction projects, including offices, malls, hospitals, and educational institutions, has driven demand for commercial distribution panels. New constructions require advanced electrical systems to support lighting, HVAC, elevators, and IT infrastructure. Modular and scalable panels are preferred for future expansion and maintenance efficiency. Contractors and facility managers increasingly adopt smart panels integrated with monitoring and remote control features, allowing real-time fault detection, load balancing, and energy optimization. Regulatory compliance with electrical codes and safety standards mandates the use of certified panels. As urban infrastructure grows and modernization projects continue, commercial distribution panels are being deployed in greater numbers to ensure safe, reliable, and efficient electricity management in large-scale commercial facilities.

Technological innovations have enhanced the safety, efficiency, and functionality of commercial distribution panels. Intelligent panels equipped with monitoring systems, IoT-enabled sensors, and remote diagnostics allow facility managers to track energy usage, detect faults, and schedule preventive maintenance. Compact and modular designs optimize space utilization in electrical rooms while simplifying installation. Advanced circuit breakers and surge protection mechanisms improve resilience against overloads and electrical faults. Integration with building management systems enables automated load balancing, energy optimization, and emergency response. The use of high-quality materials and corrosion-resistant enclosures extends service life and reduces maintenance costs. These technological improvements make commercial distribution panels more reliable, efficient, and adaptable to diverse commercial applications.

Commercial distribution panels are increasingly adopted in industrial plants, manufacturing facilities, and institutional buildings to ensure safe and efficient power distribution. Facilities with high electrical loads require panels that can handle multiple circuits, complex loads, and frequent operational changes. Panels with monitoring, automation, and fault detection capabilities are integrated to minimize downtime and improve operational continuity. Regulatory compliance with safety standards, energy efficiency guidelines, and maintenance protocols is critical for industrial installations. The growing focus on renewable energy integration, such as solar and battery storage systems, further necessitates advanced distribution panels. Adoption in hospitals, airports, and universities demonstrates the versatility of these panels across diverse applications, reinforcing market growth and investment.

Despite strong demand, the commercial distribution panel market faces challenges related to installation complexity, supply chain constraints, and regulatory compliance. Procuring high-quality components, managing logistics for large or customized panels, and adhering to safety certifications can increase project timelines and costs. Skilled labor shortages for installation and maintenance add operational challenges, especially in developing regions. Variability in local electrical codes and certification requirements necessitates customized solutions. The high upfront investment for advanced panels with smart monitoring capabilities can be a barrier for smaller projects.

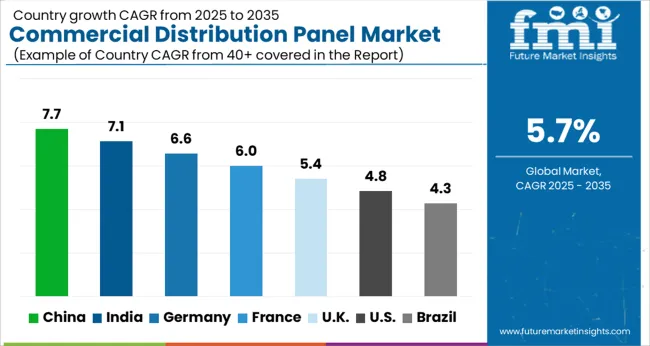

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The market is witnessing steady growth, with Germany expanding at 6.6% as adoption rises across industrial and commercial infrastructure projects. China leads with 7.7%, driven by large-scale urban and industrial electrification initiatives. India follows at 7.1%, supported by increased investments in smart buildings and energy management systems. The United Kingdom records 5.4%, reflecting integration of advanced electrical distribution solutions in commercial facilities. The United States posts 4.8%, where modernization of electrical networks and commercial construction demand sustains market momentum. Collectively, these nations demonstrate a strong mix of production, deployment, and technological advancement influencing the global commercial distribution panel market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 7.7%, driven by rapid expansion of commercial infrastructure and increasing investments in industrial and office buildings. The rising adoption of modern electrical distribution solutions to improve energy efficiency, reliability, and safety is encouraging market growth. Industrial upgrades, smart building initiatives, and technological innovations in panel design and functionality are contributing to higher adoption. Increasing urban construction, alongside government initiatives for safe and efficient power distribution, is supporting the demand for advanced commercial distribution panels. The growing emphasis on industrial automation and smart electrical infrastructure further positions China as a key market for commercial distribution solutions.

India’s market is projected to grow at a CAGR of 7.1%, fueled by rising urbanization and the rapid development of commercial and industrial infrastructure. Increased demand for energy-efficient and reliable electrical distribution systems is driving adoption of modern distribution panels. Smart building trends and government incentives for infrastructure upgrades are supporting market growth. Technological advancements in safety features, modular designs, and automation are enhancing the utility of panels across commercial establishments. The focus on industrial electrification and improved power reliability in office spaces and commercial complexes is further boosting the market for commercial distribution panels in India.

Germany is anticipated to expand at a CAGR of 6.6%, supported by demand for energy-efficient and reliable electrical distribution systems. Focus on industrial automation, smart factories, and modern commercial buildings is driving the adoption of advanced distribution panels. Technological innovations in monitoring, safety, and modularity improve operational efficiency and adaptability for diverse applications. Regulatory standards emphasizing energy conservation and electrical safety are further encouraging the deployment of commercial distribution panels. German companies are increasingly investing in upgrading electrical infrastructure, which positions the country as a prominent market for high-quality distribution solutions.

The United Kingdom’s market is projected to grow at a CAGR of 5.4%, driven by modernization of commercial and industrial electrical systems. Rising demand for energy-efficient, reliable, and safe distribution solutions is supporting the market. Technological improvements in automation, monitoring, and modular panel designs enhance adaptability and operational efficiency. Investments in retrofitting older infrastructure and constructing smart commercial buildings further encourage market growth. Increasing awareness of sustainability and adherence to stringent electrical safety regulations are influencing adoption trends. These factors collectively position the United Kingdom as a growing market for modern commercial distribution panels.

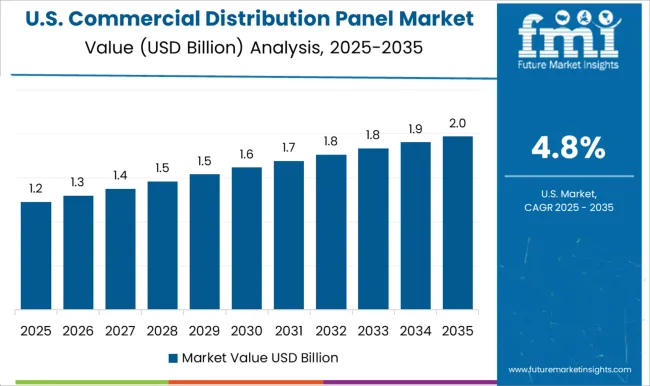

The United States is expected to expand at a CAGR of 4.8%, supported by demand for reliable, safe, and energy-efficient distribution systems in commercial and industrial sectors. Investments in upgrading electrical infrastructure in office complexes, retail centers, and manufacturing facilities are increasing market penetration. Technological advancements in automation, smart monitoring, and modular panel design are enhancing usability and safety. Sustainability concerns and compliance with strict electrical codes are further encouraging adoption. The growing focus on modernizing aging electrical networks and improving energy efficiency positions the United States as a significant market for commercial distribution panels.

The market is characterized by the presence of established global and regional manufacturers offering solutions for safe and efficient electrical power distribution across commercial, industrial, and institutional facilities. ABB, Eaton, and Schneider Electric are recognized for their technologically advanced panels featuring integrated protection, modularity, and smart monitoring capabilities, supporting energy management and operational reliability. Siemens and General Electric provide a wide range of commercial distribution panels designed for scalability and high performance, catering to large-scale commercial complexes and industrial installations.

Legrand, Hager, and NHP focus on flexible, modular panels with enhanced safety features suitable for mid-size commercial and institutional applications. Regional players such as Alfanar, Abunayyan Holding, CSE Solutions, EAMFCO, and ESL Power Systems provide tailored solutions addressing specific regional standards and infrastructure requirements. Paneltronics, RBaker, Meba Electric, Symbiotic Systems, Industrial Electric MFG, and Norelco extend offerings with custom panel solutions designed to integrate with modern building automation systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Voltage | Low voltage and Medium voltage |

| Mounting | Flush mounting and Surface mounting |

| End Use | Office, College/university, Government/military, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Abunayyan Holding, Ags, Alfanar, CSE Solutions, Eaton, EAMFCO, ESL Power Systems, General Electric, Hager, Industrial Electric MFG, Larsen & Toubro, Legrand, Meba Electric, NHP, Norelco, Paneltronics, RBaker, Schneider Electric, Siemens, and Symbiotic Systems |

| Additional Attributes | Dollar sales by panel type and capacity, demand dynamics across commercial buildings, industrial facilities, and infrastructure projects, regional trends in electrical distribution adoption, innovation in safety, compact design, and digital monitoring, environmental impact of material use and disposal, and emerging use cases in smart building integration, renewable energy distribution, and energy management systems. |

The global commercial distribution panel market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the commercial distribution panel market is projected to reach USD 5.2 billion by 2035.

The commercial distribution panel market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in commercial distribution panel market are low voltage and medium voltage.

In terms of mounting, flush mounting segment to command 58.6% share in the commercial distribution panel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA