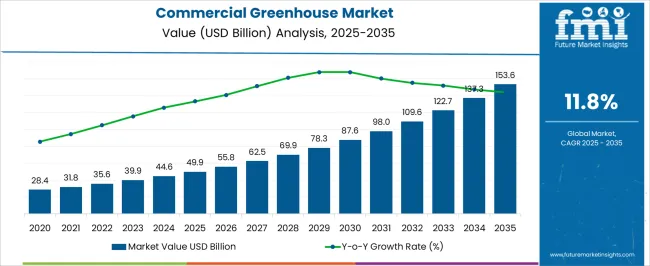

The Commercial Greenhouse Market is estimated to be valued at USD 49.9 billion in 2025 and is projected to reach USD 153.6 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Greenhouse Market Estimated Value in (2025 E) | USD 49.9 billion |

| Commercial Greenhouse Market Forecast Value in (2035 F) | USD 153.6 billion |

| Forecast CAGR (2025 to 2035) | 11.8% |

The commercial greenhouse market is expanding significantly, supported by rising global demand for controlled-environment agriculture and the need to ensure consistent, year-round crop production. Adoption is driven by technological advancements in greenhouse design, including climate control, automated irrigation, and energy-efficient systems.

The market is also benefiting from increased awareness of food security, urbanization pressures, and consumer preference for pesticide-free and locally grown produce. Current growth is reinforced by investments in sustainable farming practices, with governments and private investors encouraging greenhouse adoption to optimize land and resource use.

Future expansion is expected through integration of smart farming technologies, renewable energy-based heating, and data-driven precision agriculture tools. With the ability to maximize yields and mitigate environmental variability, the commercial greenhouse market is positioned as a cornerstone of modern agricultural production.

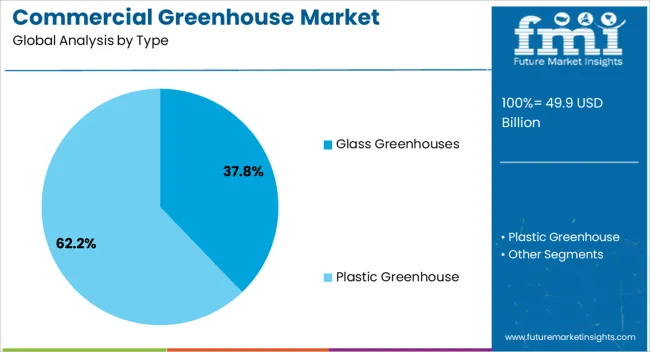

The glass greenhouses segment leads the type category, holding approximately 37.8% share of the commercial greenhouse market. Its prominence is supported by superior light transmission capabilities, long-term durability, and suitability for high-value crop cultivation.

Glass structures are particularly favored for research facilities and large-scale commercial growers seeking to optimize growing conditions. The segment benefits from established construction expertise and technological integration, including advanced heating and ventilation systems.

While initial installation costs are higher compared to alternatives, the long operational lifespan and ability to support a wide range of crops sustain demand. With rising investments in advanced greenhouse projects, the glass greenhouses segment is projected to remain a leading category.

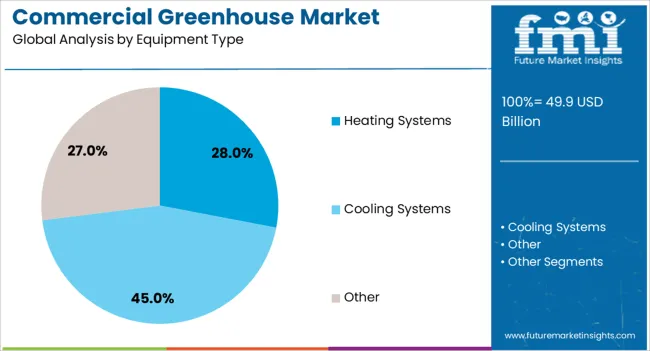

The heating systems segment represents approximately 28.0% share in the equipment type category, underscoring its essential role in enabling year-round cultivation. Heating systems ensure stable temperature conditions, critical for maintaining plant growth cycles during colder climates and seasonal shifts.

The segment’s growth is supported by increasing adoption of renewable and energy-efficient heating solutions, such as biomass boilers and geothermal systems, which align with sustainability goals. Rising demand for high-value crops and the need to optimize yields in temperate regions further reinforce its importance.

With greenhouse operators prioritizing energy management and production consistency, heating systems are expected to retain a critical role in overall market growth.

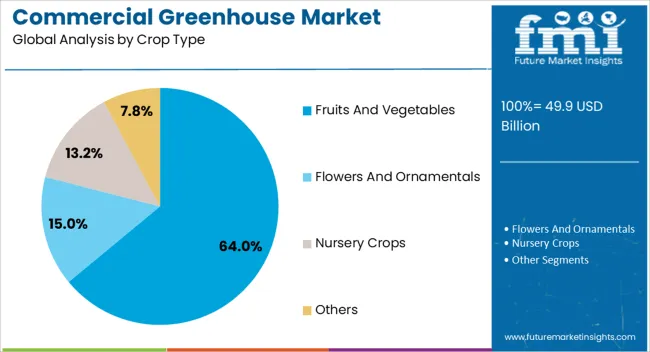

The fruits and vegetables segment dominates the crop type category, accounting for approximately 64.0% share of the commercial greenhouse market. This dominance is attributed to strong consumer demand for fresh, pesticide-free, and locally sourced produce.

Greenhouses enable controlled cultivation of tomatoes, cucumbers, peppers, and leafy greens, ensuring reliable supply irrespective of seasonal variations. Rising urban populations and growing supermarket demand for consistent quality have further boosted this segment.

Additionally, fruits and vegetables offer higher profit margins compared to other crop categories, encouraging growers to invest in greenhouse technologies. With ongoing dietary shifts toward healthier and plant-based nutrition, the fruits and vegetables segment is expected to maintain its leadership throughout the forecast period.

The current section thoroughly examines the sector throughout the preceding five years, emphasizing the anticipated trends in the commercial greenhouse market's growth.

A solid 15.8% historical compound annual growth rate suggests the market is gradually declining. Through 2035, the industry is expected to endure growth at a stable 11.9% CAGR.

| Historical CAGR | 15.8% |

|---|---|

| Forecast CAGR | 11.9% |

Economic downturns, customer preferences shifting toward outdoor farming and traditional methods, and new problems such as shifting market dynamics or external causes such as disease and climate change are all likely to reduce the demand for commercial greenhouses.

Crucial factors that are anticipated to affect the demand for industrial greenhouse through 2035.

Popularity of the Horticultural Crops in the Majority Demand

Horticultural crops are in high demand for various factors in the commercial greenhouse business. Fresh, locally produced fruit is becoming increasingly important to consumers, so year-round growing in regulated circumstances is required. Growers are implementing greenhouse technology due to growing public awareness of environmentally friendly and sustainable farming techniques.

Greenhouse-regulated environments promote optimal development, increased yield, and less environmental impact. This increased need is consistent with trends toward better eating habits, requiring the commercial greenhouse sector to play an important part in supplying the rising demand for high-quality horticulture crops.

Reduced Amount of Water and Land Improves Greenhouse Yields

Greenhouse farming offers a significant advantage over conventional farming methods by utilizing less water and land to produce the same food. Since urbanization displaces arable land and diminishes the total quantity of agricultural area, greenhouse farming may help meet the growing population's demand for food. Water is wasted less in organic farming than in standard agriculture.

Greenhouse farming requires 95% less water than conventional agriculture for the same amount of crops. Farmers may reuse the water for irrigation in vertical greenhouses since transpiration occurs during the production of goods or plants. Less water and land consumption in greenhouse farming promotes market growth.

Increasing Demand for Controlled Environment Agriculture

The industry is experiencing increased demand for controlled environment agriculture (CEA) due to various causes. Controlled environment agriculture optimizes crop growth and resource usage by giving farmers exact control over temperature, humidity, and light. Because of this technology, fresh food can be grown all year round, providing a consistent and dependable supply regardless of the weather.

Controlled environment agriculture (CEA) minimizes environmental influence and focuses on sustainable practices and efficient resource management. Moreover, it is becoming increasingly popular as customers prefer high-quality, pesticide-free, and locally-produced produce.

In-depth analyses of certain commercial greenhouse industry segments are presented in this section. The two main subjects of the current research are the heating systems equipment market and the crops that produce fruits and vegetables.

| Attributes | Details |

|---|---|

| Top Equipment Type | Heating Systems |

| CAGR from 2025 to 2035 | 11.7% |

The heating systems types of equipment category are estimated to rule the commercial greenhouse market, with an impressive CAGR of 11.7%. There are several reasons for this inclination for heating systems for the commercial greenhouses:

| Attributes | Details |

|---|---|

| Top Crop Type | Fruits and Vegetables |

| CAGR from 2025 to 2035 | 11.6% |

With a noteworthy CAGR of 11.6%, fruit and vegetables emerged as a popular crop category. The following is a description of this supremacy:

This section examines the markets for commercial greenhouses in many important nations, such as the United States, China, Japan, South Korea, and the United Kingdom. The section explores the aspects influencing commercial greenhouses' demand, acceptance, and sales in particular countries.

| Country | CAGR from 2025 to 2035 |

|---|---|

| United States | 24.7% |

| Japan | 15.4% |

| United Kingdom | 5.6% |

| South Korea | 8.2% |

| China | 20.8% |

In the United States, the demand for commercial greenhouses is anticipated to expand at a staggering compound annual growth rate of 24.7% through 2035. The following factors fuel this rapid growth:

Japan is experiencing a surge in demand for commercial greenhouses for farming, with a predicted CAGR of 15.4% through 2035. Some of the primary drivers include:

China is seeing an increase in demand for commercial greenhouses, with a predicted CAGR of 20.8% through 2035. Among the main trends are:

The market for commercial greenhouses is expanding in the United Kingdom with an estimated CAGR of 5.6% through 2035. Here are a few of the key trends:

Through 2035, the market for commercial greenhouses in South Korea is anticipated to increase at a promising CAGR of 8.2%. Several of the key trends are as follows:

The leading players in the market are expanding their businesses, creating a standardization of the best practices in greenhouse farming. Industry leaders such as Sotrafa and Berry Global prioritize sustainability by adopting eco-friendly practices, promoting resource-efficient technologies, and adhering to environmental standards, thus influencing the overall outlook of greenhouse agriculture.

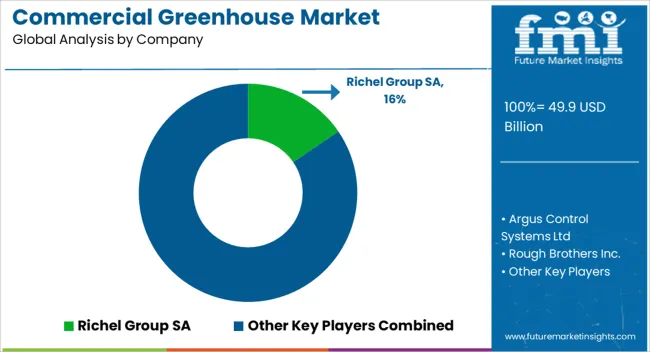

Influential companies such as Richel Group and Argus Control Systems Ltd are also crucial in educating stakeholders, including farmers and consumers, about the advantages of commercial greenhouses, influencing market perceptions, and driving acceptance.

Investments in research and development activities contribute to developing advanced greenhouse solutions, crop varieties, and cultivation methods, which positively impact the industry's overall productivity and sustainability.

The top players in the market, such as Certho and Logiq 's BV, are driving the adoption of innovative technologies, including precision farming, automation, and climate control systems, shaping the industry's modernization and efficiency.

Collaborations and partnerships with technology providers, agricultural research institutions, and government bodies facilitate knowledge exchange, driving advancements and industry growth.

Leading players are also actively advocating supportive policies at national and international levels, influencing regulatory frameworks that impact the growth and development of the commercial greenhouse industry.

Recent Developments in the Commercial Greenhouse Industry:

The global commercial greenhouse market is estimated to be valued at USD 49.9 billion in 2025.

The market size for the commercial greenhouse market is projected to reach USD 153.6 billion by 2035.

The commercial greenhouse market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in commercial greenhouse market are glass greenhouses and plastic greenhouse.

In terms of equipment type, heating systems segment to command 28.0% share in the commercial greenhouse market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA