The commercial high-speed oven market stands at the threshold of a decade-long expansion trajectory that promises to reshape foodservice equipment technology and rapid cooking solutions. The market's journey from USD 3.2 billion in 2025 to USD 6.6 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced cooking technology and speed-to-service optimization across restaurant facilities, convenience retail operations, and institutional foodservice sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 3.2 billion to approximately USD 4.7 billion, adding USD 1.5 billion in value, which constitutes 44% of the total forecast growth period. This phase will be characterized by the rapid adoption of built-in high-speed ovens, driven by increasing quick-service restaurant expansion and the growing need for labor-efficient cooking solutions worldwide. Enhanced cooking capabilities and automated menu control systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 4.7 billion to USD 6.6 billion, representing an addition of USD 1.9 billion or 56% of the decade's expansion. This period will be defined by mass market penetration of smart cooking technologies, integration with comprehensive kitchen management platforms, and seamless compatibility with existing foodservice infrastructure. The market trajectory signals fundamental shifts in how foodservice facilities approach cooking speed and labor productivity, with participants positioned to benefit from growing demand across multiple product types and power capacity segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New equipment sales (built-in, counter-top) | 52% | Capex-led, expansion-driven purchases |

| Replacement & upgrade cycles | 24% | Technology refresh, capacity enhancement | |

| Service & maintenance contracts | 14% | Preventive maintenance, calibration support | |

| Parts & accessories | 10% | Cooking racks, filters, control panels | |

| >Future (3-5 yrs) | Smart connected ovens | 45-48% | IoT integration, remote menu management |

| Digital monitoring & analytics | 16-20% | Real-time cooking tracking, energy optimization | |

| Equipment-as-a-service models | 12-16% | Performance guarantees, throughput-based pricing | |

| Replacement & upgrades | 10-14% | Ventless conversions, smart retrofits | |

| Service subscriptions | 8-12% | Remote diagnostics, predictive maintenance | |

| Data & menu services | 5-8% | Recipe optimization, consistency benchmarking |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.2 billion |

| Market Forecast (2035) | USD 6.6 billion |

| Growth Rate | 6.7% CAGR |

| Leading Technology | Built-in Ovens |

| Primary Application | Restaurants Segment |

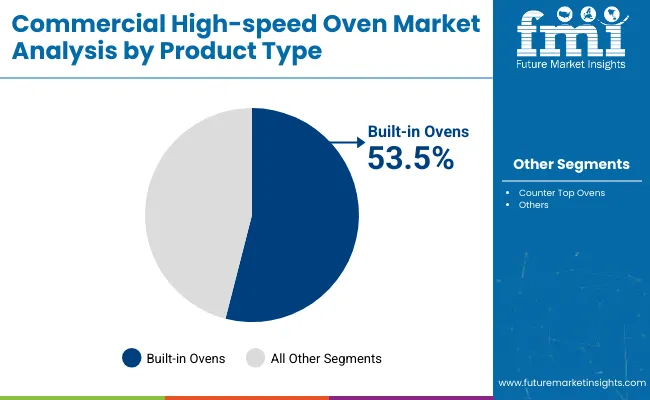

The market demonstrates strong fundamentals with Built-in Ovens capturing a dominant 53.5% share through advanced cooking capabilities and foodservice operation optimization. Restaurant applications drive primary demand with 40.2% market share, supported by increasing quick-service expansion and throughput requirements. Geographic expansion remains concentrated in developed markets with established foodservice infrastructure, while emerging economies show accelerating adoption rates driven by QSR franchise initiatives and rising speed-to-service standards.

Primary Classification: The market segments by product type into Built-in Ovens (with power ranges of 1000-2000W, 2000-4500W, 4500-6000W, and Above 6000W) and Counter-top Ovens, representing the evolution from portable cooking equipment to sophisticated integrated solutions for comprehensive foodservice cooking optimization.

Secondary Classification: End-use segmentation divides the market into Restaurants (Independent and Franchise), Convenience Stores, Commercial/Central Kitchens, Healthcare Facilities, Travel & Leisure, Business & Industry, K-12 Schools & Universities, and Others sectors, reflecting distinct requirements for cooking speed, menu variety, and operational efficiency standards.

Tertiary Classification: Sales channel segmentation spans Offline (Authorized Dealers, Specialty Stores, and Hypermarket/Supermarket) and Online channels, each with unique distribution characteristics and customer service standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by foodservice expansion programs.

The segmentation structure reveals technology progression from standard counter-top equipment toward sophisticated built-in systems with enhanced speed and automation capabilities, while application diversity spans from independent restaurants to institutional foodservice operations requiring precise cooking performance solutions.

Market Position: Built-in Ovens systems command the leading position in the commercial high-speed oven market with 53.5% market share through advanced cooking features, including superior speed performance, operational efficiency, and foodservice production optimization that enable kitchen facilities to achieve optimal throughput across diverse restaurant and institutional environments.

Value Drivers: The segment benefits from foodservice facility preference for reliable cooking systems that provide consistent food quality performance, reduced cook time, and operational efficiency optimization without requiring significant ventilation infrastructure. Advanced design features enable automated cooking control systems, multi-stage programming capabilities, and integration with existing kitchen equipment, where operational performance and food safety represent critical facility requirements.

Competitive Advantages: Built-in Ovens systems differentiate through proven operational reliability, consistent cooking characteristics, and integration with automated kitchen management systems that enhance facility effectiveness while maintaining optimal quality standards suitable for diverse restaurant and institutional applications.

Key market characteristics:

The 2000-4500W power segment maintains the leading position within built-in ovens with 28% overall market share due to balanced cooking performance and energy efficiency properties. These systems appeal to facilities requiring optimal cooking speed with competitive operating costs for mainstream restaurant applications. Market growth is driven by QSR expansion, emphasizing reliable cooking solutions and operational efficiency through optimized power consumption designs.

The 4500-6000W power segment captures 14% market share through high-volume cooking requirements in busy restaurant locations, high-throughput QSR operations, and commercial kitchen applications. These facilities demand powerful cooking systems capable of handling peak service periods while providing rapid food preparation and operational flexibility capabilities.

The 1000-2000W power segment accounts for 7% market share, including small-footprint locations, convenience retail installations, and limited-menu operations requiring compact cooking capabilities for operational efficiency and space optimization.

The Above 6000W power segment captures 4.5% market share through specialized high-volume requirements in central kitchens, large-scale catering operations, and institutional facilities requiring maximum cooking capacity for operational throughput and production efficiency.

Counter-top Ovens maintain a 46.5% market position in the commercial high-speed oven market due to their installation flexibility and cost advantages. These systems appeal to facilities requiring portable cooking equipment with competitive pricing for small to mid-scale foodservice applications. Market growth is driven by convenience retail expansion, emphasizing flexible cooking solutions and space efficiency through compact system designs.

Market Context: Restaurants segment dominates the market with 40.2% market share, reflecting the primary demand source for high-speed cooking technology in quick-service and fast-casual dining operations where rapid food preparation represents critical competitive requirements.

Business Model Advantages: Restaurant facilities provide direct market demand for advanced cooking equipment, driving technology innovation and throughput optimization while maintaining food quality and labor efficiency requirements. Quick-service operations require consistent cooking speed for optimal customer service and operational productivity.

Operational Benefits: Restaurant applications include front-of-house cooking, back-of-house preparation, and menu diversification systems that drive consistent demand for high-speed cooking equipment while providing access to latest culinary technologies. Dining facilities require reliable cooking equipment to maintain service speed and product consistency.

Independent restaurant operations capture 22% market share through diverse menu requirements, customized cooking needs, and entrepreneurial foodservice applications requiring flexible high-speed cooking for operational differentiation and quality control.

Franchise restaurant operations maintain 18.2% market share through standardized menu requirements, multi-location consistency demands, and corporate procurement programs requiring uniform cooking equipment for brand standards and operational efficiency.

Convenience Stores segment captures 12% market share through grab-and-go food programs, hot food service requirements, and retail foodservice operations requiring compact cooking equipment for merchandising effectiveness and operational simplicity.

Commercial/Central Kitchens applications maintain 12.8% market position through high-volume production requirements, multi-location supply operations, and commissary facilities requiring maximum cooking capacity for production efficiency and quality consistency.

Healthcare Facilities segment accounts for 9.5% market share through patient meal service, cafeteria operations, and nutritional care requirements demanding reliable cooking equipment for meal quality and service efficiency.

Travel & Leisure facilities capture 8.5% market share through hotel foodservice, airport concessions, and entertainment venue operations requiring versatile cooking equipment for diverse menu offerings and service flexibility.

Business & Industry segment accounts for 8% market share through employee cafeterias, corporate dining facilities, and workplace foodservice operations requiring efficient cooking equipment for meal service and operational productivity.

K-12 Schools & Universities applications capture 8.5% market share through student meal programs, cafeteria operations, and educational dining facilities requiring reliable cooking equipment for nutritional standards and service efficiency.

Other applications account for 0.5% market share through specialized foodservice requirements in unique venues, temporary installations, and specialized catering operations requiring flexible cooking capabilities.

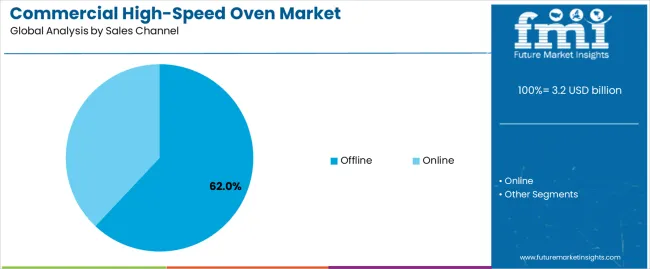

Market Context: Offline channel demonstrates dominant market position in the commercial high-speed oven market with 62% market share due to widespread preference for hands-on equipment evaluation and comprehensive installation support across foodservice operators prioritizing personal consultation and technical guidance that maximize equipment selection and operational deployment success.

Appeal Factors: Offline channel operators prioritize equipment demonstration, installation coordination, and direct technical support that enables effective equipment selection across foodservice applications. The segment benefits from substantial dealer investment and service network programs that emphasize the deployment of authorized distribution channels for equipment sales and operational support applications.

Growth Drivers: Equipment complexity and installation requirements support offline channel preference as standard procurement approach for cooking equipment purchases, while service network availability increases demand for local dealer capabilities that comply with installation standards and minimize operational risk.

Market Challenges: Digital transformation and direct purchasing trends may gradually shift some transactions toward online channels, particularly for replacement equipment where specifications are already known.

Application dynamics include:

Authorized Dealers capture 28% market share through manufacturer relationships, technical expertise requirements, and full-service support operations providing installation coordination and warranty administration capabilities for foodservice equipment procurement.

Specialty Stores maintain 16% market position through category expertise, product selection focus, and foodservice industry specialization providing targeted equipment solutions and technical consultation capabilities.

Hypermarket/Supermarket channel accounts for 18% market share through broad customer reach, competitive pricing strategies, and retail convenience providing accessible equipment purchase options for small to mid-scale foodservice operators.

Online channel captures 38% market share through digital convenience, price transparency benefits, and direct procurement capabilities providing efficient equipment research and purchase processes for informed foodservice operators.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | QSR expansion & speed-to-service requirements | ★★★★★ | Fast-casual and quick-service formats demand sub-5-minute ticket times; high-speed ovens become mandatory for throughput; vendors offering menu-specific presets gain advantage. |

| Driver | Labor shortage & productivity imperatives | ★★★★★ | Chronic staffing gaps drive automation adoption; ovens with one-touch controls reduce training needs; labor cost per meal becomes key ROI metric. |

| Driver | Ventless technology & real estate constraints | ★★★★☆ | Urban sites and mall locations lack ventilation infrastructure; ventless high-speed ovens unlock non-traditional venues; regulatory approvals expand addressable market. |

| Restraint | High equipment investment & ROI uncertainty | ★★★★☆ | Premium ovens cost USD 10,000-30,000; small operators defer purchases; increases reliance on entry-level or used equipment. |

| Restraint | Menu limitations & cooking versatility gaps | ★★★☆☆ | Not all items cook optimally at high speed; menu engineering required; operators face trade-offs between speed and quality perception. |

| Trend | IoT connectivity & remote menu management | ★★★★★ | Smart ovens enable cloud-based recipe updates, multi-site consistency, and real-time diagnostics; connectivity becomes baseline expectation for chains. |

| Trend | Energy efficiency & sustainability mandates | ★★★★☆ | Rising utility costs and ESG commitments drive demand for energy-efficient models; low-power, high-output designs gain competitive edge. |

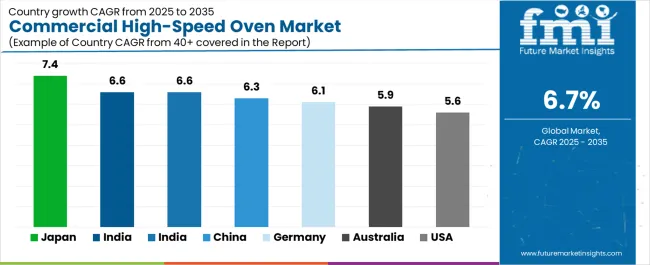

The commercial high-speed oven market demonstrates varied regional dynamics with Growth Leaders including Japan (7.4% growth rate) and India (6.6% growth rate) driving expansion through QSR format initiatives and convenience retail development. Steady Performers encompass United Kingdom (6.6% growth rate), China (6.3% growth rate), and developed regions, benefiting from established foodservice infrastructure and menu innovation adoption. Emerging Markets feature Germany (6.1% growth rate) and United States (5.6% growth rate), where foodservice modernization and labor productivity initiatives support consistent growth patterns.

Regional synthesis reveals Asian markets leading adoption through QSR expansion and urban foodservice development, while European countries maintain robust expansion supported by energy efficiency requirements and compact kitchen design trends. North American markets show steady growth driven by fast-casual format evolution and labor optimization applications.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| Japan | 7.4% | Lead with ventless compact units | Space constraints; conservative operators |

| India | 6.6% | Focus on power-efficient QSR models | Infrastructure gaps; price sensitivity |

| United Kingdom | 6.6% | Provide speed-to-service solutions | Real estate costs; Brexit impacts |

| China | 6.3% | Offer multi-technology platforms | Local competition; menu adaptation |

| Germany | 6.1% | Push energy-efficient systems | Over-specification; regulatory complexity |

| United States | 5.6% | Target labor productivity gains | Technology refresh cycles; cost pressures |

| Australia | 5.9% | Focus on ventless compliance | Remote service logistics; skilled labor |

Japan establishes fastest market growth through aggressive QSR format programs and comprehensive urban foodservice development, integrating advanced high-speed ovens as standard components in convenience stores and quick-service restaurant installations. The country's 7.4% growth rate reflects industry initiatives promoting speed-to-service optimization and labor efficiency capabilities that mandate the use of compact ventless systems in urban foodservice facilities. Growth concentrates in major metropolitan areas, including Tokyo, Osaka, and Nagoya, where dense QSR formats showcase integrated high-speed cooking systems that appeal to foodservice operators seeking advanced throughput capabilities and space optimization applications.

Japanese manufacturers are developing compact cooking solutions that combine domestic engineering advantages with advanced operational features, including automated menu systems and enhanced ventless capabilities. Distribution channels through foodservice equipment dealers and chain purchasing organizations expand market access, while industry support for automation adoption supports deployment across diverse restaurant and convenience retail segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, restaurant facilities and convenience stores are implementing advanced high-speed ovens as standard equipment for speed optimization and menu expansion applications, driven by increasing QSR franchise investment and foodservice expansion programs that emphasize the importance of throughput capabilities. The market holds a 6.6% growth rate, supported by franchise development initiatives and urban foodservice infrastructure programs that promote advanced cooking systems for restaurant and retail facilities. Indian operators are adopting cooking systems that provide consistent operational performance and energy efficiency features, particularly appealing in Tier-2 and Tier-3 cities where speed-to-service and operational costs represent critical competitive requirements.

Market expansion benefits from growing QSR franchise capabilities and international brand partnerships that enable deployment of standardized cooking systems for restaurant and convenience applications. Technology adoption follows patterns established in foodservice infrastructure, where reliability and efficiency drive procurement decisions and operational deployment.

Market Intelligence Brief:

United Kingdom's advanced foodservice market demonstrates sophisticated high-speed oven deployment with documented operational effectiveness in QSR applications and convenience retail through integration with existing kitchen systems and service infrastructure. The country leverages operational expertise in fast-casual dining and speed-to-service optimization to maintain a 6.6% growth rate. Urban centers, including London, Manchester, and Birmingham, showcase premium installations where high-speed ovens integrate with comprehensive kitchen platforms and service management systems to optimize throughput operations and labor effectiveness.

British operators prioritize system speed and space efficiency in cooking equipment selection, creating demand for premium systems with advanced features, including ventless operation capabilities and automated menu controls. The market benefits from established QSR infrastructure and a willingness to invest in advanced cooking technologies that provide long-term labor savings and compliance with compact kitchen requirements.

Market Intelligence Brief:

China's market expansion benefits from diverse foodservice demand, including convenience chain deployments in Shanghai and Shenzhen, tea/coffee shop expansion, and mall food-hall developments that increasingly incorporate high-speed cooking solutions for menu flexibility applications. The country maintains a 6.3% growth rate, driven by rising convenience retail activity and increasing recognition of multi-technology oven benefits, including versatile cooking capabilities and enhanced operational efficiency.

Market dynamics focus on versatile cooking solutions that balance advanced operational performance with menu adaptation considerations important to Chinese foodservice operators. Growing urban foodservice development creates continued demand for modern cooking systems in new retail infrastructure and restaurant expansion projects.

Strategic Market Considerations:

Germany's advanced foodservice technology market demonstrates sophisticated high-speed oven deployment with documented operational effectiveness in bakery applications and ready-to-eat programs through integration with existing kitchen systems and facility infrastructure. The country leverages engineering expertise in energy efficiency and food quality standards to maintain a 6.1% growth rate. Urban centers, including Berlin, Munich, and Hamburg, showcase premium installations where high-speed ovens integrate with comprehensive bakery platforms and facility management systems to optimize baking operations and energy effectiveness.

German operators prioritize system efficiency and EU compliance in cooking equipment selection, creating demand for premium systems with advanced features, including energy management integration and automated bake-off controls. The market benefits from established bakery technology infrastructure and a willingness to invest in advanced cooking technologies that provide long-term energy savings and compliance with sustainability standards.

Market Intelligence Brief:

United States establishes market leadership through comprehensive fast-casual programs and advanced foodservice infrastructure development, integrating high-speed ovens across restaurant, convenience, and institutional applications. The country's 5.6% growth rate reflects established foodservice relationships and mature cooking technology adoption that supports widespread use of rapid cooking systems in QSR and fast-casual facilities. Growth concentrates in major metropolitan areas, including New York, Los Angeles, and Chicago, where fast-casual expansion showcases mature high-speed cooking deployment that appeals to foodservice operators seeking proven throughput capabilities and labor efficiency applications.

American equipment providers leverage established distribution networks and comprehensive service capabilities, including installation programs and maintenance support that create customer relationships and operational advantages. The market benefits from mature foodservice standards and labor productivity requirements that support cooking equipment adoption while enabling technology advancement and operational optimization.

Market Intelligence Brief:

Australia's market development emphasizes ventilation compliance and convenience retail expansion, driven by stringent building codes and foodservice diversification in hospitality venues. The country maintains a 5.9% growth rate, supported by ventless technology requirements and quick-cook menu trends that drive high-speed oven adoption.

Market characteristics include preference for compliant equipment, operational simplicity, and emphasis on food safety standards that appeal to Australian foodservice operators prioritizing regulatory compliance and service flexibility.

Strategic Market Indicators:

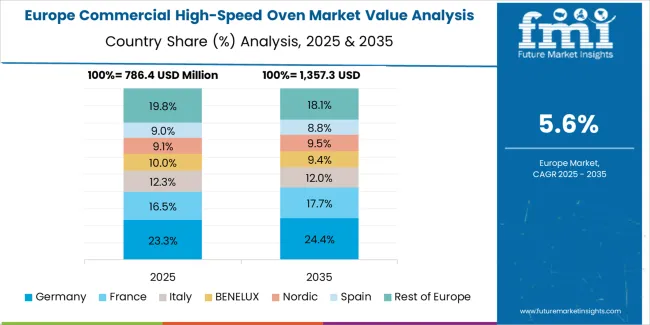

Europe accounts for 31% of global revenue, approximately USD 1 billion in 2025. The sub-regional mix shows Western Europe at 58%, Nordics/UK & Ireland at 27%, Southern Europe at 10%, and Central & Eastern Europe at 5%. Product mix in Europe skews to built-in ovens at 56% with the 2000-4500W segment dominant, while end-use distribution includes restaurants at 42%, convenience retail at 15%, healthcare/education at 18%, and travel & leisure at 12%. Channel split shows offline at 66% (authorized dealers and specialist distributors) and online at 34% (direct and marketplace). Energy-efficiency regulations and compact back-of-house footprints sustain demand for ventless, multi-technology ovens with smart controls across European markets.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, comprehensive product portfolios, service networks | Broad availability, proven reliability, multi-region support | Local menu adaptation; emerging market service density |

| Technology innovators | R&D capabilities; smart systems; multi-technology platforms | Latest features first; attractive labor ROI | Service network gaps; customization complexity |

| Regional specialists | Local compliance, rapid installation, nearby service | Close-to-site support; pragmatic pricing; local regulations | Technology refresh cycles; scale limitations |

| Service-focused ecosystems | Installation support, maintenance contracts, menu consulting | Lowest real downtime; comprehensive support | Service costs if overpromised; technology obsolescence |

| Niche specialists | Specialized applications, custom programs, ventless solutions | Win compliance-driven applications; flexible configurations | Scalability limitations; narrow market focus |

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Built-in Ovens (1000-2000W, 2000-4500W, 4500-6000W, Above 6000W), Counter-top Ovens |

| End-Use | Restaurants (Independent, Franchise), Convenience Stores, Commercial/Central Kitchens, Healthcare Facilities, Travel & Leisure, Business & Industry, K-12 Schools & Universities, Others |

| Sales Channel | Offline (Authorized Dealers, Specialty Stores, Hypermarket/Supermarket), Online |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Australia, France, Spain, Italy, and 25+ additional countries |

| Key Companies Profiled | Ali Group (ACP/Merrychef), Middleby (TurboChef), Electrolux Professional, UNOX S.p.A., Rational AG, Panasonic Corporation, Alto-Shaam Inc., Prática Klimaquip, Atollspeed, Midea Commercial |

| Additional Attributes | Dollar sales by product type and power capacity categories, regional adoption trends across East Asia, Western Europe, and North America, competitive landscape with foodservice equipment manufacturers and distribution partners, restaurant operator preferences for cooking speed control and menu versatility, integration with kitchen management platforms and POS systems, innovations in ventless technology and smart cooking enhancement, and development of connected oven solutions with enhanced performance and operational optimization capabilities. |

The global commercial high-speed oven market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the commercial high-speed oven market is projected to reach USD 6.1 billion by 2035.

The commercial high-speed oven market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in commercial high-speed oven market are built-in ovens and counter-top ovens.

In terms of sales channel, offline segment to command 62.0% share in the commercial high-speed oven market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA