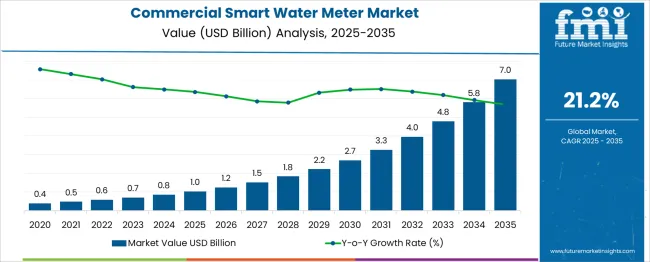

The Commercial Smart Water Meter Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 21.2% over the forecast period.

Year-on-year growth demonstrates consistent acceleration with values moving from USD 1.2 billion in 2026 (20%) to 1.5 billion in 2027 (25%), 1.8 billion in 2028 (20%), and 2.2 billion in 2029 (22%), before reaching 2.7 billion in 2030 (23%).

The trend continues through the second half of the decade with 3.3 billion in 2031 (22%), 4.0 billion in 2032 (21%), 4.8 billion in 2033 (20%), 5.8 billion in 2034 (21%), and a terminal value of 7.0 billion in 2035 (21%). The average YOY rate remains at 21.5%, while volatility is extremely low as percentage changes fluctuate within a tight band of 20%–25%, confirming a predictable and scalable growth trajectory.

Absolute annual additions accelerate from USD 0.2 billion in early years to over USD 1.2 billion by the end of the forecast period, highlighting significant momentum. This sustained expansion creates a high-value opportunity for companies to scale IoT-based infrastructure, integrate advanced metering infrastructure (AMI), and deploy cloud-enabled analytics for real-time water usage monitoring and efficiency optimization.

| Metric | Value |

|---|---|

| Commercial Smart Water Meter Market Estimated Value in (2025 E) | USD 1.0 billion |

| Commercial Smart Water Meter Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 21.2% |

The commercial smart water meter market holds a critical yet specialized share across several infrastructure and IoT-driven segments. In the smart metering and advanced utility meters market, its share stands at 10–12 %, since electric and gas smart meters dominate in overall deployment. Within the water utility infrastructure and management solutions market, commercial smart meters account for 8–10 %, as utilities focus heavily on distribution network upgrades and SCADA systems.

In the IoT-enabled building automation and facility management market, the contribution is smaller, about 4–5 %, because smart water meters compete with HVAC, lighting control, and energy optimization systems for investment priority. Across the water monitoring and analytics services market, the share reaches 12–14 %, given that accurate consumption and leak data from smart meters underpin most predictive and billing services.

Within the urban water efficiency and smart city solutions market, the share is 6–8 %, as investments are spread across broader smart infrastructure like intelligent drainage and water recycling systems. Despite modest shares in some segments, adoption is rising sharply due to regulatory mandates, water

The commercial smart water meter market is witnessing robust growth, driven by the global push toward water conservation, digital transformation in utilities, and stricter regulatory compliance for commercial water usage. Utilities and commercial property operators are increasingly deploying smart metering infrastructure to monitor real-time consumption, detect leakages, and optimize billing accuracy.

The integration of cloud-based analytics, low-power wide-area networks, and IoT platforms has catalyzed the shift from traditional mechanical systems to intelligent digital meters. Rising concerns about water scarcity and the increasing cost of municipal water supply have compelled stakeholders to adopt smart metering systems with greater transparency and efficiency.

Additionally, the need for automated data collection and reduced operational costs is pushing adoption in sectors such as commercial buildings, hotels, hospitals, and shopping centers. Future growth is expected to be influenced by government incentives, smart city rollouts, and utility modernization programs, further reinforcing the value of data-driven water management in commercial settings.

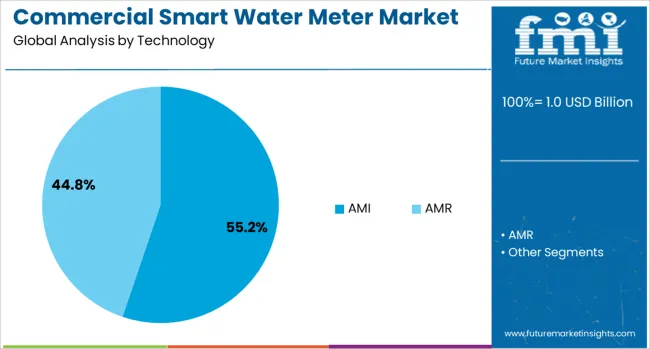

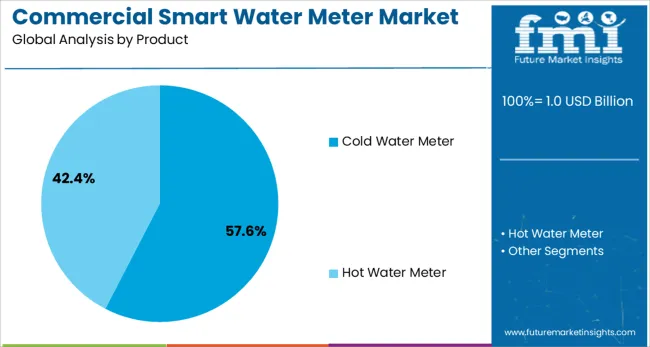

The commercial smart water meter market is segmented by technology, product, and geographic regions. The commercial smart water meter market is divided into AMI and AMR. In terms of the product, the commercial smart water meter market is classified into Cold Water Meter and Hot Water Meter. Regionally, the commercial smart water meter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The advanced metering infrastructure (AMI) segment is expected to account for 55.2% of the revenue share in the commercial smart water meter market in 2025. This leadership is being driven by the ability of AMI systems to offer two-way communication, real-time data transmission, and advanced analytics functionalities that enhance water usage visibility and operational efficiency.

AMI-enabled meters allow utilities and commercial end-users to monitor consumption patterns, receive automated alerts, and remotely disconnect or reconnect services, which significantly reduces labor costs and service delays. Integration with cloud dashboards and utility billing software has supported seamless data interpretation and usage trend forecasting.

The growing demand for proactive leak detection, predictive maintenance, and compliance reporting has made AMI a preferred solution across large commercial facilities. Its scalability across wide geographical areas and compatibility with emerging LPWAN and 5G communication technologies has further solidified its role in digital water infrastructure transformation.

The cold water meter segment is projected to capture 57.6% of the revenue share in the commercial smart water meter market by 2025, making it the dominant product category. This prominence can be attributed to the widespread need for accurate measurement of potable water in commercial establishments where cold water usage is predominant.

Cold water meters have been widely implemented due to their structural simplicity, long service life, and compatibility with smart modules that support digital upgrades without requiring complete system overhauls. Their adaptability across a range of pipe sizes and commercial building architectures has allowed for faster deployment and easier maintenance.

The segment has also benefited from rising demand in urban commercial zones, where water consumption data is being actively used to optimize supply chains and improve sustainability reporting. The ability to support real-time monitoring, tamper alerts, and system diagnostics has reinforced their importance in commercial water governance frameworks.

Commercial smart water meters are being installed in retail, hospitality, and industrial facilities to improve metering accuracy, resource management, and operational oversight. Devices with pulse output, AMR or AMI communication and automated leak detection have been deployed in buildings with high water consumption. The need for accurate billing, system transparency and compliance with water usage regulations has enabled adoption by utilities and commercial property owners. Manufacturers offering robust meters compatible with enterprise data platforms, calibration-validated readings and remote reading capabilities are poised to lead as the commercial metering segment shifts toward digital utility solutions.

Commercial smart water meters are being implemented to provide real-time consumption data and identify usage anomalies in high-volume facilities such as hotels, hospitals and manufacturing sites. Automatic meter reading systems with remote connectivity (cellular, RF or IoT-enabled) have enabled utilities and facility managers to track usage trends, detect leaks and schedule maintenance proactively. Data platforms with dashboards, alert functions and reporting tools have supported efficient billing, regulatory compliance and sustainability reporting. Analytics tools have enabled benchmarking against consumption targets and identification of inefficiencies in irrigation or process water use. As cost transparency and accountability have become priorities, smart metering solutions have strengthened operational efficiency and resource management in commercial water networks.

Commercial smart water meter deployment has been constrained by connectivity challenges in areas with limited wireless coverage or signal interference in built environments. Integration with legacy billing systems and enterprise resource planning platforms has required custom middleware or software adaptation. Device calibration must be validated periodically, increasing operational overhead for facilities managing large meter fleets. Installation of meters has required access to pipework and shut-off points, which may require service interruption in occupied structures. The additional capital cost of IoT-enabled meters and network infrastructure has deterred small-to-mid-size commercial operators. As data privacy and cybersecurity concerns grow, secure transmission protocols and user authentication layers have become essential, adding further complexity to system integration.

Significant opportunities have emerged through global initiatives focused on replacing legacy metering systems with advanced smart water meters in commercial and industrial facilities. Deployment of automated meter reading solutions has improved accuracy in billing, leak detection, and water usage analysis. Large scale retrofit programs supported by municipal utilities and regulatory authorities are accelerating adoption in campuses, hospitals, hotels, and manufacturing sites. Enterprises prioritizing conservation efforts are adopting intelligent metering for real time consumption monitoring and performance optimization. Integration with IoT based platforms and building management systems is enabling predictive maintenance and anomaly detection services. Strategic partnerships with utility operators and specialized technology providers are creating opportunities for complete installation, monitoring, and data management solutions.

Current trends show increased integration of smart water meters with IoT infrastructure to enable real time data acquisition and centralized management. Advanced analytics platforms are being adopted to identify consumption trends, forecast demand, and detect inefficiencies. Cloud connected dashboards and mobile interfaces are providing actionable insights and alerts to facility managers. Meters featuring embedded pressure and temperature sensors are gaining attention for multi parameter monitoring and predictive maintenance applications. Communication technologies such as NB IoT and LoRaWAN are being implemented to enable secure and low energy data transmission over long distances. Remote calibration and firmware updates are becoming standard, reducing downtime and maintenance costs while improving operational efficiency in commercial water distribution systems.

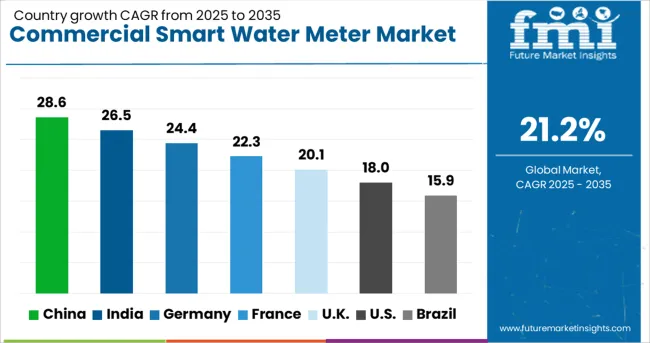

| Country | CAGR |

|---|---|

| China | 28.6% |

| India | 26.5% |

| Germany | 24.4% |

| France | 22.3% |

| UK | 20.1% |

| USA | 18.0% |

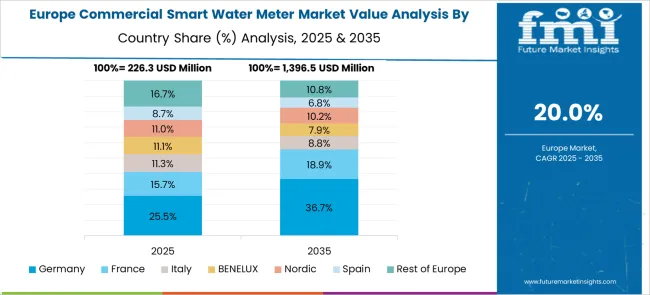

| Brazil | 15.9% |

The global commercial smart water meter market is projected to grow at a 21.2% CAGR from 2025 to 2035, fueled by the integration of digital metering systems, automated data collection, and cloud-based analytics. China leads at 28.6%, driven by government-backed smart utility upgrades and large-scale urban infrastructure projects. India follows at 26.5%, supported by water conservation mandates and digitization of municipal water networks. Among OECD nations, Germany records 24.4%, leveraging Industry 4.0 frameworks for real-time consumption monitoring. France grows at 22.3%, aided by regulatory programs encouraging two-way communication-enabled meters, while the UK, at 20.1%, benefits from the integration of advanced metering infrastructure in commercial buildings. The analysis includes insights from over 40 countries, with the top five detailed below.

China is projected to grow at a 28.6% CAGR, supported by extensive smart city projects and government directives for digital water management in commercial sectors. The commercial smart water meter market in China is characterized by high-volume procurement for business complexes and industrial parks. Domestic manufacturers are investing in ultrasonic and electromagnetic metering technologies integrated with advanced leak detection systems. Partnerships between municipal utilities and IoT solution providers are expanding real-time data transmission and predictive analytics capabilities. High-rise commercial buildings are adopting AMI (Advanced Metering Infrastructure) to optimize water distribution efficiency and minimize losses.

India is forecast to expand at a 10.3% CAGR, supported by energy access programs and microgrid adoption in rural and semi-remote areas. Demand is increasing in telecom towers, healthcare facilities, and commercial establishments seeking uninterrupted power. National electrification schemes encourage hybrid setups combining solar, wind, and diesel for a stable supply. Local OEMs and EPC firms are collaborating to deliver containerized hybrid solutions for rapid deployment. Financing models such as build-own-operate agreements are improving affordability for institutional consumers.

France is expected to grow at 8.7% CAGR, supported by rural grid reinforcement projects and reliance on hybrid energy for critical infrastructure. Hybrid power systems are being implemented in defense facilities, remote construction sites, and municipal projects. Manufacturers are advancing control technologies to ensure stable operations in variable wind and solar conditions. Deployment of modular hybrid power units is accelerating, supported by funding from energy transition programs. The shift toward off-grid capability for resilience in emergency scenarios is strengthening adoption in public sector projects.

Germany is projected to grow at a 24.4% CAGR, supported by EU water efficiency directives and strong adoption of IoT-based utility systems. The commercial smart water meter market in Germany benefits from the integration of AMR (Automated Meter Reading) and AMI frameworks in office complexes and commercial properties. Manufacturers are focusing on high-precision ultrasonic meters with extended battery life to meet stringent operational requirements. AI-driven consumption analytics and integration with building automation systems are gaining popularity. Government-backed digital utility programs and incentives for reducing water wastage are promoting deployment across the retail and hospitality sectors.

The UK is expected to grow at a 20.1% CAGR, driven by the modernization of water distribution systems and efficiency requirements for commercial establishments. The commercial smart water meter market in the UK is witnessing increased adoption of AMI systems integrated with cloud-based dashboards for real-time usage monitoring. Demand for meters compatible with BREEAM and other green building standards is rising among developers. Compact ultrasonic meters are gaining popularity for retrofit projects in older commercial structures. Partnerships between utilities and technology firms are enabling the deployment of advanced metering solutions with predictive analytics for leak detection and automated alerts.

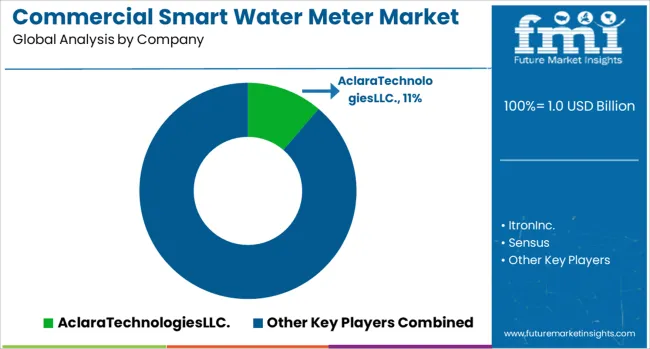

The commercial smart water meter market is highly competitive and innovation-focused, dominated by leading players such as Aclara Technologies LLC, Itron Inc., Sensus, Badger Meter Inc., Landis+Gyr, Honeywell International Inc., Schneider Electric, Siemens, and Kamstrup, all of which leverage advanced metering infrastructure, IoT connectivity, and cloud-based analytics to provide real-time consumption monitoring and leak detection. Companies like Arad Group, Neptune Technology Group Inc., and Diehl Stiftung & Co. KG strengthen their positions by offering interoperable meters that integrate with existing utility networks, while ZENNER International, BMETERS Srl, Sontex SA, and Apator S.A. focus on modular and cost-effective solutions for regional markets. Emerging manufacturers such as Ningbo Water Meter Co., Ltd. compete on pricing to capture share in developing economies. The market structure exhibits high entry barriers due to stringent regulatory compliance, long-term utility contracts, and significant R&D investment requirements, reducing the threat of new entrants. Porter’s Five Forces analysis shows low substitution risk, moderate supplier influence, and increasing buyer power as utilities demand advanced, secure, and scalable metering systems. Strategic differentiation revolves around battery longevity, data accuracy, wireless communication protocols such as NB-IoT and LoRaWAN, and integration with smart city frameworks. Leading firms are investing in AI-driven predictive maintenance, digital twin technology, and cybersecurity to enhance value propositions. Competitive intensity is rising as municipalities and commercial establishments adopt smart water management for efficiency and conservation goals. Future growth will be driven by innovations in low-power networks, real-time data solutions, and service-based models, positioning technology-oriented players to dominate this evolving global market.

In December 2024, Itron partnered with Water Corporation in Perth to modernize water distribution using 16,000 smart meters integrated with its Temetra® cloud-based platform. The pilot aims to enhance data collection, deliver actionable analytics, and improve water conservation efforts amid persistent drought conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Technology | AMI and AMR |

| Product | Cold Water Meter and Hot Water Meter |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AclaraTechnologiesLLC., ItronInc., Sensus, BadgerMeter,Inc., Landis+Gyr, HoneywellInternationalInc., SchneiderElectric, Siemens, AradGroup, Kamstrup, NeptuneTechnologyGroupInc., DiehlStiftung&Co.KG, ZENNERInternationalGmbH&Co.KG, BMETERSSrl, SontexSA, ApatorS.A., and NingboWaterMeterCo.,Ltd. |

| Additional Attributes | Dollar sales are segmented by meter type (ultrasonic, magnetic, mechanical), connectivity mode (AMR, AMI), and application (commercial, municipal, industrial). Demand growth is supported by stricter water management regulations, enhanced billing accuracy requirements, and infrastructure modernization. North America and Europe lead adoption, while Asia-Pacific shows rapid expansion through urban projects. Innovation targets acoustic leak detection, advanced data platforms, and metering-as-a-service business models for utilities. |

The global commercial smart water meter market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the commercial smart water meter market is projected to reach USD 7.0 billion by 2035.

The commercial smart water meter market is expected to grow at a 21.2% CAGR between 2025 and 2035.

The key product types in commercial smart water meter market are ami and amr.

In terms of product, cold water meter segment to command 57.6% share in the commercial smart water meter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA