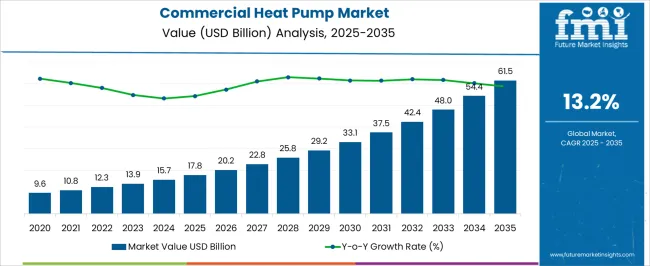

The commercial heat pump market is projected to grow from USD 17.8 billion in 2025 to USD 61.5 billion in 2035, reflecting a CAGR of 13.2%. This represents an absolute dollar opportunity of USD 43.7 billion over the decade. The market is expected to expand rapidly, reaching USD 20.2 billion in 2026, USD 25.8 billion in 2029, USD 33.1 billion in 2031, and USD 54.4 billion in 2034. The strong growth trajectory highlights rising adoption across commercial buildings, offering manufacturers and investors significant opportunities to capture incremental revenue and strengthen their presence in this expanding market over the ten-year period.

From an absolute dollar perspective, annual incremental growth starts at approximately USD 2.4–2.5 billion in the early years and accelerates to over USD 7 billion in the later stages. Intermediate benchmarks, such as USD 15.7 billion in 2025, USD 29.2 billion in 2030, and USD 48.0 billion in 2033, illustrate major inflection points along the growth path.

| Metric | Value |

|---|---|

| Commercial Heat Pump Market Estimated Value in (2025 E) | USD 17.8 billion |

| Commercial Heat Pump Market Forecast Value in (2035 F) | USD 61.5 billion |

| Forecast CAGR (2025 to 2035) | 13.2% |

Between 2025 and 2027, the market rises from USD 17.8 billion to USD 20.2 billion, marking the early adoption phase where initial installations and expanding commercial applications drive moderate incremental gains. Another important breakpoint occurs around 2029–2031, as the market grows from USD 25.8 billion to USD 33.1 billion, reflecting a period of faster expansion and higher absolute dollar growth. These stages are critical for manufacturers and investors to align production, secure supply chains, and capture revenue during periods of accelerating market demand.

A major breakpoint is observed between 2033 and 2035, when the market surges from USD 54.4 billion to USD 61.5 billion, representing the largest absolute dollar increase in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 29.2 billion to USD 48.0 billion, acting as bridging periods that maintain momentum.

The market is experiencing robust growth driven by the rising demand for energy-efficient and sustainable heating and cooling solutions in commercial buildings. The shift toward reducing carbon footprints and complying with stricter environmental regulations is encouraging the adoption of heat pumps as a cleaner alternative to traditional HVAC systems.

Increasing investments in green building infrastructure, coupled with advancements in heat pump technology, are paving the way for greater market penetration. Additionally, the growing awareness of operational cost savings through energy efficiency and government incentives for eco-friendly technologies further support market expansion.

As the global commercial sector embraces sustainable practices, the outlook for heat pump adoption remains strong, with continuous innovation expected to unlock new application areas and improve system performance.

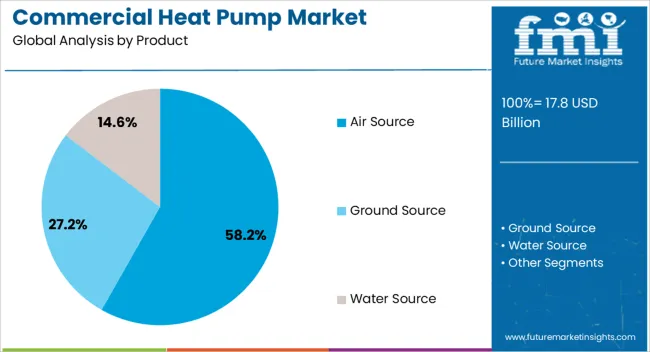

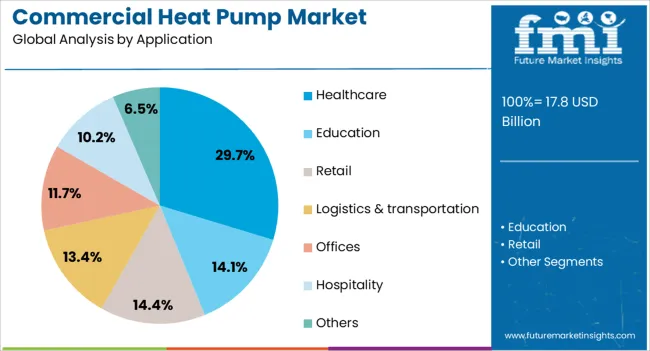

The commercial heat pump market is segmented by product, application, and geographic regions. By product, commercial heat pump market is divided into Air Source, Ground Source, and Water Source. In terms of application, commercial heat pump market is classified into Healthcare, Education, Retail, Logistics & transportation, Offices, Hospitality, and Others. Regionally, the commercial heat pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Air Source product type is anticipated to hold 58.2% of the Commercial Heat Pump market revenue share in 2025, establishing it as the dominant product segment. This position is attributed to the versatility and relatively lower installation complexity of air source heat pumps compared to other types.

Their ability to efficiently provide heating and cooling across a broad range of commercial environments has accelerated adoption. The segment’s growth has been further supported by improvements in system reliability and efficiency under diverse climatic conditions.

As commercial operators increasingly prioritize scalable and maintainable solutions, air source heat pumps have been favored for their cost-effectiveness and ease of integration with existing infrastructure Additionally, the ability to reduce greenhouse gas emissions aligns with corporate sustainability goals, further driving market preference for this product segment.

The Healthcare application segment is projected to capture 29.7% of the Commercial Heat Pump market revenue in 2025, marking it as a leading application sector. This prominence is driven by the critical need for precise temperature control, air quality management, and energy efficiency in healthcare facilities.

Hospitals and clinics demand reliable heating and cooling systems that support patient comfort and meet strict regulatory standards for sanitation and ventilation. The deployment of commercial heat pumps in healthcare settings has been accelerated due to their ability to maintain stable indoor environments while reducing energy consumption.

Furthermore, the growing emphasis on sustainable healthcare infrastructure and cost containment has supported the adoption of heat pumps in this segment. The segment is expected to sustain growth as healthcare providers continue investing in advanced building management technologies.

The commercial heat pump market is expanding as businesses and industrial facilities adopt energy-efficient heating and cooling solutions to reduce operational costs and carbon emissions. Commercial heat pumps transfer heat between air, water, or ground sources, providing sustainable climate control for offices, hotels, hospitals, and manufacturing facilities.

Rising adoption of HVAC modernization, renewable energy integration, and government incentives for energy efficiency are driving growth. Manufacturers offering high-capacity, low-noise, and smart-controlled heat pumps gain a competitive advantage. Trends toward variable refrigerant flow systems, modular designs, and IoT-enabled monitoring enhance energy optimization and predictive maintenance. Increasing corporate sustainability initiatives, green building certifications, and decarbonization goals further reinforce demand for commercial heat pump systems worldwide.

The commercial heat pump market is witnessing growth as organizations prioritize reducing carbon emissions and achieving sustainability goals. Heat pumps enable efficient heating and cooling by transferring thermal energy rather than generating it, reducing reliance on fossil fuels. Companies in hospitality, healthcare, and industrial sectors are increasingly investing in low-carbon HVAC solutions to meet corporate sustainability targets and green building certifications. Integration with renewable energy sources such as solar or geothermal further amplifies efficiency and environmental benefits. Manufacturers offering customizable, energy-optimized systems with advanced monitoring capabilities gain a competitive advantage. Rising corporate and municipal initiatives to retrofit existing infrastructure with low-emission technologies are driving steady adoption of commercial heat pumps in regions with strong regulatory support for decarbonization.

Growth in the commercial heat pump market is moderated by the high upfront costs and the complexity of integrating systems into existing infrastructure. Installation requires careful assessment of building design, energy sources, and HVAC compatibility, which increases engineering and planning requirements. Large-scale systems necessitate investment in compressors, heat exchangers, pumps, and control systems, leading to high capital expenditure. Maintenance of advanced components and periodic system optimization further increase operational costs. Smaller businesses or retrofit projects may struggle to justify these investments despite long-term energy savings. Until manufacturers provide modular, scalable, and simplified installation options, adoption is likely to remain focused on large commercial buildings, industrial facilities, and organizations with dedicated energy management teams.

Technological innovation is redefining the commercial heat pump market. Smart controllers, IoT-enabled monitoring, and predictive maintenance systems allow real-time performance tracking and energy optimization. Variable refrigerant flow, inverter-driven compressors, and hybrid systems combining heat pumps with solar thermal or energy storage improve efficiency and adaptability across diverse applications. Modular designs enable scaling to meet specific load requirements, and quieter, low-vibration operation enhances suitability for office and healthcare environments. Integration with building automation systems allows centralized control of heating, ventilation, and cooling, reducing energy wastage. These developments reflect a shift toward intelligent, adaptable, and eco-friendly HVAC solutions that enhance operational efficiency and support organizations’ sustainability and cost-reduction objectives.

Opportunities in the commercial heat pump market are being driven by regulatory incentives, energy efficiency mandates, and green building certifications. Programs promoting reduced energy consumption, carbon neutrality, and renewable energy integration encourage adoption of advanced heat pump systems. Emerging markets investing in commercial infrastructure modernization present additional growth potential. Sectors such as education, healthcare, and hospitality are increasingly deploying energy-efficient systems to optimize operational costs and meet sustainability goals. Manufacturers offering energy-optimized, modular, and digitally connected heat pumps can capitalize on this demand.

Collaboration with energy service companies, facility management providers, and government-backed programs further expands market opportunities. Adoption is poised to grow as environmental awareness and policy support incentivize energy-efficient commercial heating and cooling solutions.

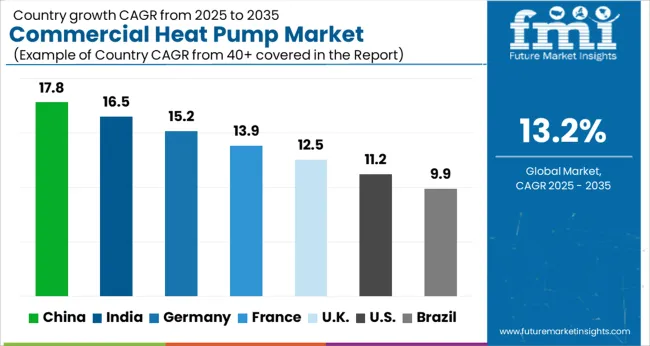

| Country | CAGR |

|---|---|

| China | 17.8% |

| India | 16.5% |

| Germany | 15.2% |

| France | 13.9% |

| UK | 12.5% |

| USA | 11.2% |

| Brazil | 9.9% |

The global medical styrenic polymers market was projected to grow at a 5.7% CAGR through 2035, driven by demand in medical devices, packaging, and healthcare applications. Among BRICS nations, China recorded 7.7% growth as large-scale production facilities were commissioned and compliance with chemical and medical safety standards was enforced, while India at 7.1% growth saw expansion of manufacturing units to meet rising regional consumption in healthcare and medical device applications. In the OECD region, Germany at 6.6% maintained substantial output under strict industrial and healthcare regulations, while the United Kingdom at 5.4% relied on moderate-scale operations for medical and laboratory applications. The USA, expanding at 4.8%, remained a mature market with steady demand across healthcare, diagnostics, and packaging segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The commercial heat pump market in China is growing at a CAGR of 17.8% due to rising demand for energy efficient heating and cooling solutions in commercial buildings, hotels, hospitals, and industrial facilities. Organizations are adopting heat pumps to reduce operational costs, improve energy efficiency, and meet environmental and energy efficiency regulations. Growth is supported by urban infrastructure development, government incentives for energy efficient technologies, and increasing awareness of cost effective heating and cooling solutions. Manufacturers provide advanced commercial heat pumps with high efficiency, reliability, and flexible capacity suitable for large buildings and industrial applications. Distribution through HVAC service providers, equipment suppliers, and contractors ensures market accessibility. Adoption is further driven by rising commercial construction projects, energy efficiency mandates, and operational cost reduction initiatives. China remains a leading market due to its rapid urban expansion, commercial infrastructure growth, and focus on energy efficiency.

The United Kingdom market is expanding at a CAGR of 12.5% due to increasing demand for energy efficient heating and cooling solutions in commercial buildings, hospitals, hotels, and industrial facilities. Organizations are adopting commercial heat pumps to reduce energy consumption, operational costs, and environmental impact. Manufacturers provide systems with high energy efficiency, reliability, and flexible capacity suitable for large scale operations. Growth is supported by rising commercial construction, government energy efficiency initiatives, and increased focus on cost effective building operations. Distribution through HVAC service providers, contractors, and equipment suppliers ensures widespread accessibility. Adoption is further driven by the need for sustainable, reliable, and energy efficient heating and cooling solutions in the commercial sector. The United Kingdom continues to see steady market growth as businesses prioritize operational efficiency and regulatory compliance.

India is witnessing growth at a CAGR of 16.5% in the commercial heat pump market due to increasing demand for efficient heating and cooling solutions in commercial and industrial sectors. Hotels, hospitals, office buildings, and manufacturing facilities are adopting heat pumps to reduce energy consumption and operational costs. Growth is supported by infrastructure expansion, rising commercial construction, and government initiatives promoting energy efficient technologies. Manufacturers provide advanced systems with high energy efficiency, flexible capacity, and reliable performance for large buildings. Distribution through HVAC service providers, equipment dealers, and contractors ensures accessibility across urban and semi-urban regions. Adoption is further driven by increasing focus on energy cost savings, operational efficiency, and sustainability in commercial operations. India continues to see strong market growth due to urban development, commercial infrastructure expansion, and demand for cost effective heating and cooling solutions.

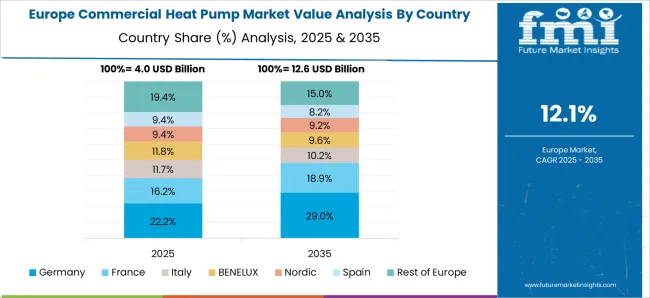

Germany is growing at a CAGR of 15.2% in the commercial heat pump market due to rising demand from commercial buildings, hotels, hospitals, and industrial facilities seeking energy efficient heating and cooling solutions. Growth is supported by energy efficiency regulations, environmental awareness, and increasing adoption of cost effective heating technologies. Manufacturers provide high performance heat pumps with flexible capacity, reliability, and advanced control systems for large commercial and industrial applications. Distribution through HVAC service providers, contractors, and equipment suppliers ensures market availability. Adoption is further driven by government programs promoting energy efficiency, cost reduction goals, and modernization of commercial and industrial infrastructure. Germany remains a key market in Europe due to strong commercial building construction, industrial efficiency standards, and focus on sustainable and reliable heating and cooling solutions.

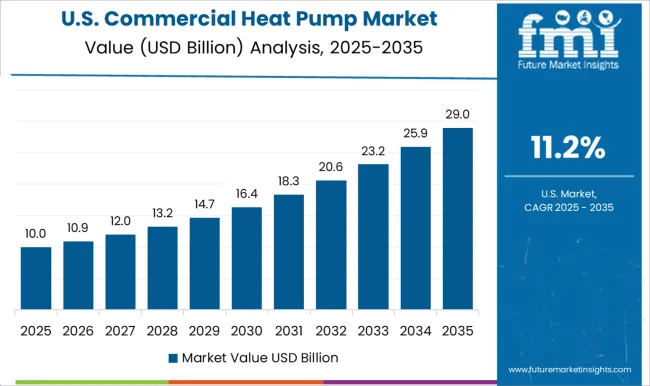

The United States market is growing at a CAGR of 11.2% due to rising adoption of commercial heat pumps in office buildings, hospitals, hotels, and industrial facilities. Organizations are implementing these systems to improve energy efficiency, reduce operational costs, and meet building energy standards. Manufacturers provide high performance heat pumps with flexible capacity, reliability, and advanced control systems for large scale commercial applications. Growth is supported by energy efficiency regulations, incentive programs, and increasing awareness of cost effective heating and cooling solutions. Distribution through HVAC service providers, contractors, and equipment suppliers ensures accessibility for commercial and industrial users. Adoption is further driven by operational cost reduction goals, sustainability initiatives, and demand for reliable and energy efficient building systems. The United States remains a significant market due to commercial infrastructure expansion and focus on energy efficient technologies.

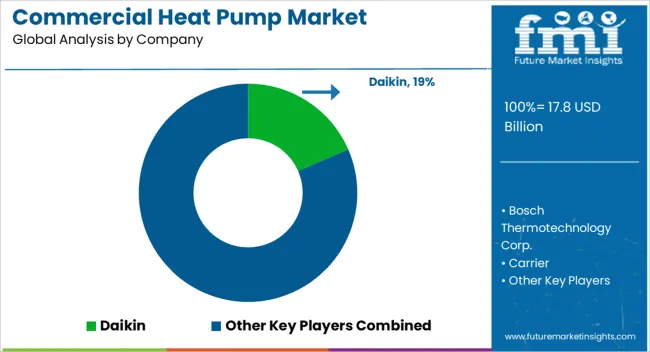

The commercial heat pump market is supplied by Daikin, Bosch Thermotechnology Corp., Carrier, Finn Geotherm UK Limited, FUJITSU GENERAL, GREE Commercial, LG Electronics, MESTEK, INC., Mitsubishi Electric Corporation, OCHSNER, Panasonic Corporation, Rheem Manufacturing Company, Rinnai UK Ltd., SAMSUNG, Swegon Ltd, and Trane. Product literature highlights variable capacity heat pumps, water-to-air and air-to-water configurations, COP ratings, noise levels, refrigerant compatibility, and smart control integration. Technical brochures emphasize modular installation options, energy efficiency ratings, and integration with building management systems. Competition is largely based on efficiency performance, system flexibility, and installation adaptability.

Daikin, Mitsubishi Electric, and Carrier focus on high-efficiency inverter-driven units and large-capacity commercial applications. Bosch Thermotechnology and FUJITSU GENERAL emphasize modular and scalable solutions suitable for office buildings and industrial facilities (observed industry pattern). LG Electronics, Samsung, and Panasonic are observed to leverage smart control systems and IoT connectivity for energy management. Partnerships with HVAC integrators and contractors are used to enhance distribution reach and service reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.8 Billion |

| Product | Air Source, Ground Source, and Water Source |

| Application | Healthcare, Education, Retail, Logistics & transportation, Offices, Hospitality, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin, Bosch Thermotechnology Corp., Carrier, Finn Geotherm UK Limited, FUJITSU GENERAL, GREE Commercial, LG Electronics, MESTEK, INC., Mitsubishi Electric Corporation, OCHSNER, Panasonic Corporation, Rheem Manufacturing Company, Rinnai UK Ltd., SAMSUNG, Swegon Ltd, and Trane |

| Additional Attributes | Dollar sales vary by heat pump type, including air-to-air, air-to-water, and water-to-water systems; by application, such as commercial buildings, hotels, hospitals, and industrial facilities; by end-use industry, spanning construction, hospitality, healthcare, and industrial sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for energy-efficient HVAC solutions, government incentives, and sustainability initiatives. |

The global commercial heat pump market is estimated to be valued at USD 17.8 billion in 2025.

The market size for the commercial heat pump market is projected to reach USD 61.5 billion by 2035.

The commercial heat pump market is expected to grow at a 13.2% CAGR between 2025 and 2035.

The key product types in commercial heat pump market are air source, ground source and water source.

In terms of application, healthcare segment to command 29.7% share in the commercial heat pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA