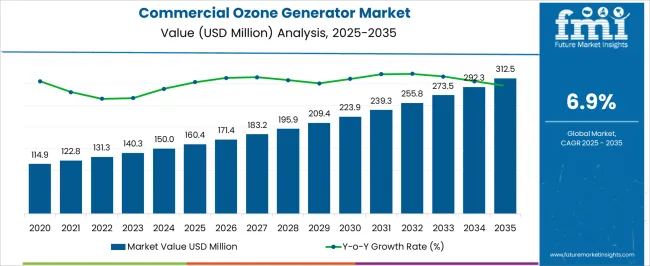

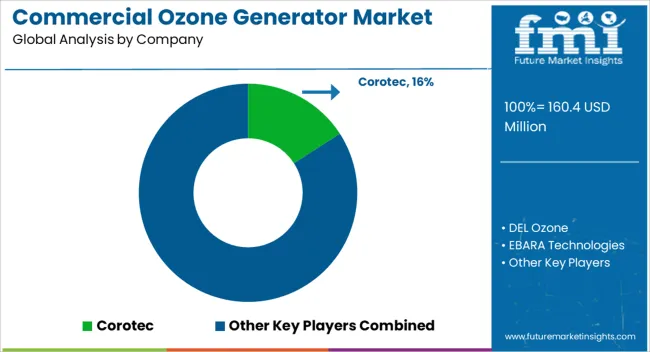

The commercial ozone generator market is estimated to be valued at USD 160.4 million in 2025 and is projected to reach USD 312.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. The early stage increase to USD 195.9 million by 2028 is expected to be led primarily by the Asia Pacific, where rapid industrial development and rising water treatment demand enhance adoption. The region benefits from expanding commercial facilities, high urban air purification needs, and supportive manufacturing bases, enabling faster market penetration compared with Western counterparts.

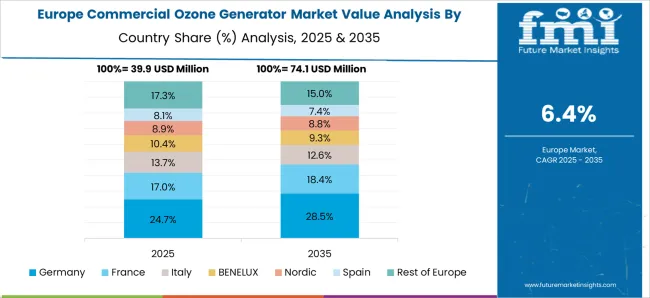

Europe demonstrates moderate but steady growth through stricter air quality and wastewater directives. By 2031, when the global market is forecast to hit USD 239.3 million, Europe’s contribution will likely be significant in municipal and healthcare facilities. The focus on ecological compliance and reliance on sustainable disinfection solutions supports growth, but higher equipment costs and stricter installation standards limit adoption.

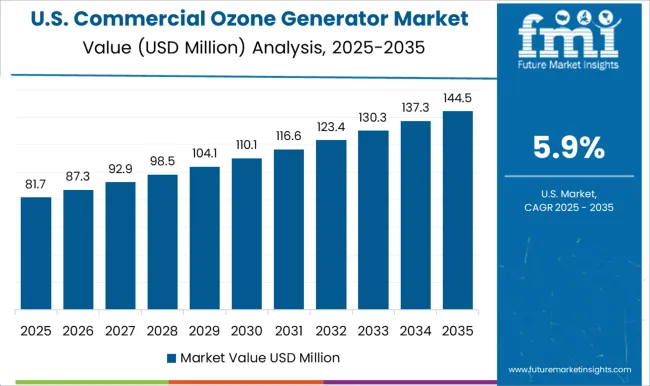

North America shows consistent adoption across food safety, hospitality, and healthcare. By 2035, as the market reaches USD 312.5 million, the region is expected to maintain strong demand driven by advanced commercial infrastructure. The growth trails Asia Pacific’s pace due to relatively saturated industrial markets, while Europe’s growth remains regulation-driven.

| Metric | Value |

|---|---|

| Commercial Ozone Generator Market Estimated Value in (2025 E) | USD 160.4 million |

| Commercial Ozone Generator Market Forecast Value in (2035 F) | USD 312.5 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The commercial ozone generator market plays a vital role in the environmental technology and air purification industries, with applications spanning water treatment, food processing, and healthcare facilities. Within the global air purification systems market, it holds a share of about 4.1%, emphasizing its growing use in large-scale applications. In the water and wastewater treatment industry, it contributes nearly 3.5%, as ozone is used effectively for disinfection and odor control.

Across the food and beverage processing segment, it accounts for close to 2.9%, being applied in sanitation and shelf-life extension processes. In the commercial HVAC and indoor air quality segment, its market presence is around 2.6%, due to its ability to neutralize airborne contaminants. Within the healthcare sterilization sector, it represents 1.8%, supporting the demand for non-chemical sterilization technologies. Recent developments in the commercial ozone generator market are centered on energy-efficient designs, advanced corona discharge technology, and enhanced control systems. Manufacturers are introducing modular systems with higher ozone output, catering to industrial and municipal-scale requirements. The integration of digital monitoring and automated controls is improving reliability and reducing operational costs. Increased adoption is being observed in commercial kitchens and cold storage facilities to manage microbial growth and food safety.

Environmental regulations and restrictions on chemical disinfectants are driving the demand for ozone-based solutions across North America and Europe. The research is being conducted on portable and hybrid systems that combine ozone with UV technology, expanding applications in hospitality, healthcare, and transport sectors.

The commercial ozone generator market is experiencing consistent growth, driven by rising demand for effective disinfection, sterilization, and odor control solutions across various industries. Growing environmental regulations and public health awareness are prompting businesses to adopt ozone-based systems as chemical-free alternatives for air and water treatment. The ability of ozone to eliminate bacteria, viruses, and organic contaminants is encouraging its use in commercial settings such as hospitality, food processing, healthcare, and water purification facilities.

Technological advancements in ozone generation and distribution systems are improving energy efficiency, control precision, and operational safety, making the technology more accessible to a broader range of commercial users. The expanding need for sustainable and environmentally friendly sanitization methods, particularly in densely populated urban centers, is expected to support long-term market growth.

Additionally, increasing concerns regarding indoor air quality and the growing need for decentralized water treatment in commercial buildings are reinforcing demand. As awareness around microbial threats and environmental sustainability continues to grow, commercial ozone generators are expected to play an increasingly important role in institutional and industrial hygiene practices.

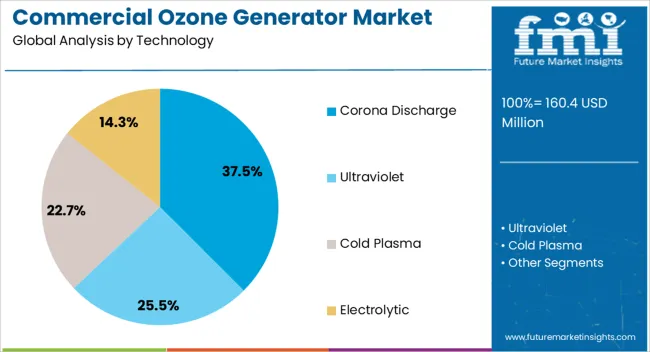

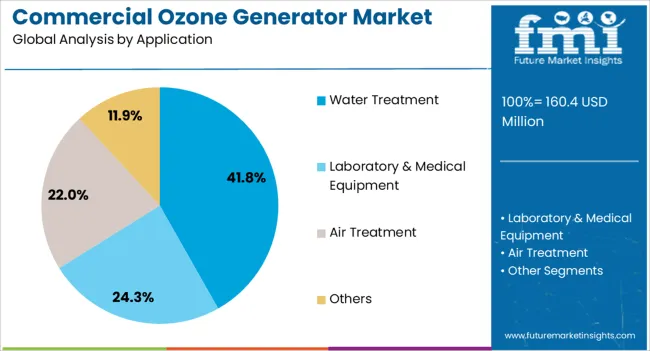

The commercial ozone generator market is segmented by technology, application, capacity, and geographic regions. By technology, commercial ozone generator market is divided into Corona Discharge, Ultraviolet, Cold Plasma, and Electrolytic. In terms of application, commercial ozone generator market is classified into Water Treatment, Laboratory & Medical Equipment, Air Treatment, and Others.

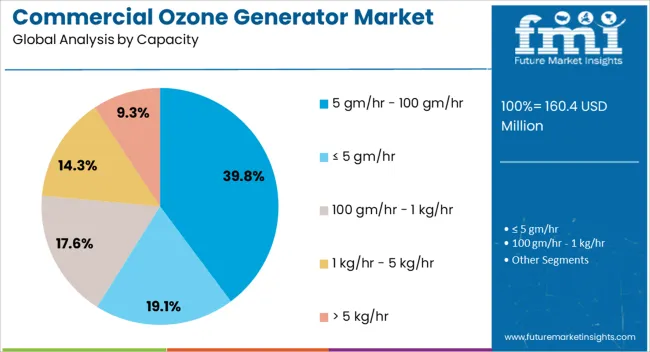

Based on capacity, commercial ozone generator market is segmented into 5 gm/hr - 100 gm/hr, ≤ 5 gm/hr, 100 gm/hr - 1 kg/hr, 1 kg/hr - 5 kg/hr, and > 5 kg/hr. Regionally, the commercial ozone generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corona discharge segment is expected to hold 37.5% of the commercial ozone generator market revenue share in 2025, establishing it as the leading technology type. This dominance is being driven by the efficiency and cost-effectiveness of corona discharge systems, which generate high ozone output with relatively low energy consumption. The ability to produce ozone on demand without requiring chemical precursors makes this technology highly attractive for commercial users focused on reducing operational costs and chemical waste.

Corona discharge generators are well-suited for continuous operations and are compatible with various feed gases, including ambient air and oxygen-enriched inputs, enhancing their versatility. Their compact design and ease of integration into existing systems also support widespread deployment across multiple commercial applications.

Continuous improvements in dielectric materials and cooling mechanisms are increasing reliability and performance consistency. As demand grows for durable, low-maintenance, and scalable ozone generation solutions, corona discharge technology is expected to maintain its leadership position due to its operational flexibility and proven efficiency in diverse commercial environments.

The water treatment segment is projected to contribute 41.8% of the commercial ozone generator market revenue share in 2025, making it the leading application area. This leadership is attributed to the growing global emphasis on water quality, sustainability, and regulatory compliance across commercial facilities. Ozone’s strong oxidizing properties make it highly effective in removing pathogens, organic matter, and chemical residues from water without leaving harmful by-products.

Its use in commercial water treatment systems supports disinfection processes in industries such as hospitality, beverage production, pharmaceutical manufacturing, and public infrastructure. Rising concerns about microbial contamination and emerging pollutants are driving increased adoption of ozone-based solutions as an alternative to chlorine and other chemical disinfectants.

The ability to improve taste, odor, and overall water safety without affecting pH levels further enhances ozone’s appeal. As demand for decentralized, compact, and energy-efficient water treatment systems increases in commercial establishments, ozone generators are expected to remain central to water purification strategies due to their effectiveness and environmental compatibility.

The 5 gm/hr to 100 gm/hr capacity segment is anticipated to capture 39.8% of the commercial ozone generator market revenue share in 2025, positioning it as the leading capacity category. This dominance is being driven by the segment’s suitability for a wide range of commercial applications that require moderate ozone output with high reliability and control. Units within this capacity range are favored for their compact form, manageable installation requirements, and operational flexibility, making them ideal for applications such as air purification, surface sanitation, and localized water treatment.

These systems offer a practical balance between performance and energy efficiency, supporting cost-effective disinfection in environments such as office buildings, food processing areas, spas, and swimming pools. The growing demand for decentralized sanitation systems, particularly in urban commercial centers, is encouraging businesses to adopt medium-capacity generators that offer sufficient output without the complexities of industrial-scale systems.

Enhanced digital controls and modular designs are further increasing adoption by enabling system customization based on specific commercial needs. As the market matures, this capacity range is expected to remain the preferred choice for businesses seeking scalable, efficient, and eco-friendly ozone solutions.

The market is influenced by rising demand for effective air and water purification solutions across industries. These systems are utilized in hotels, food processing, healthcare, and wastewater treatment due to their ability to eliminate bacteria, viruses, and odors. Growing awareness about indoor air quality and stricter hygiene regulations have expanded adoption in public spaces and commercial facilities. Energy efficiency and safety compliance remain central to product development, as operators prioritize cost savings and regulatory adherence. Challenges such as equipment maintenance, operational safety, and concerns about overexposure are addressed through design innovation and automated monitoring systems.

Commercial ozone generators are widely applied in air purification, particularly in enclosed commercial facilities such as hotels, gyms, and office complexes. Their effectiveness in eliminating airborne pathogens and removing persistent odors enhances their importance for maintaining healthy indoor environments. Increased awareness of air quality standards has strengthened regulatory pressure on commercial establishments, driving adoption of ozone-based technologies. Product innovations now integrate advanced control systems to regulate ozone output, ensuring safe indoor applications. End users in hospitality and public facilities prioritize these systems to meet customer safety expectations. Growing demand for odor management in rental properties, commercial kitchens, and vehicle service stations also supports consistent market expansion in air purification applications.

Another significant driver for commercial ozone generator adoption is water and wastewater treatment. Ozone technology is recognized as a powerful oxidizing agent, effectively breaking down contaminants, disinfecting water, and reducing chemical usage in treatment facilities. Municipal water plants, food and beverage processors, and bottled water industries increasingly employ ozone-based systems to meet stringent safety standards. Regulatory frameworks promoting environmentally responsible disinfection methods reinforce the shift from chlorine-based treatment to ozone systems. Reduced chemical residues and higher operational efficiency make ozone generators an attractive choice for industrial users. Continuous investments in municipal infrastructure and industrial water recycling projects ensure steady demand growth in this application segment worldwide.

In food processing, ozone generators are utilized for equipment sterilization, surface cleaning, and extending product shelf life without chemical residues. Adoption in meat, seafood, and beverage industries is steadily rising due to stricter food safety regulations. Healthcare facilities also rely on ozone-based sterilization to maintain hygiene in patient care environments and medical equipment. Automated ozone systems offer scalable solutions for both large and small operations, ensuring compliance with global health standards. Market growth is reinforced by increasing preference for chemical-free sterilization methods. The dual utility in food safety and healthcare provides resilience to market fluctuations, as both industries remain essential and continue to adopt high-standard hygiene technologies.

The commercial ozone generator market benefits from diverse regional dynamics. Asia Pacific leads with large-scale deployment in water treatment and food industries, supported by strong manufacturing infrastructure. North America and Europe exhibit higher adoption rates in healthcare, hospitality, and municipal applications due to stricter air quality and disinfection regulations. Competitive strategies focus on developing compact, energy-efficient units with integrated safety features to expand accessibility for small and medium businesses. Distribution partnerships, after-sales service networks, and compliance with safety certifications enhance brand positioning. Continuous R&D investments in sustainable ozone technology are expected to support broader adoption across regions. This interplay of regional demand patterns and innovation ensures long-term global market growth.

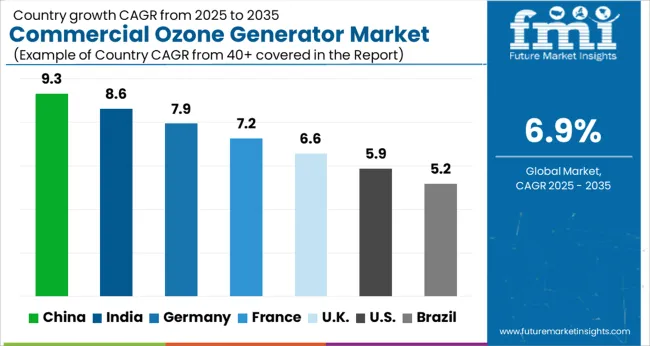

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

The market is projected to grow at a CAGR of 6.9% between 2025 and 2035. India registered 8.6%, influenced by expanding industrial water treatment and food processing applications. China led with 9.3%, driven by rapid adoption in manufacturing and municipal sectors. Germany accounted for 7.9%, supported by strong emphasis on environmental management and healthcare applications. The United Kingdom recorded 6.6%, where adoption in air purification and commercial facilities has grown. The United States followed with 5.9%, reflecting consistent use across wastewater treatment and food safety operations. These countries are shaping the market through expansion, engineering advancements, and innovative applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 9.3%, supported by rising adoption of ozone systems in water treatment, food processing, and air purification industries. The government’s investments in municipal water treatment and industrial wastewater management create strong demand. Domestic manufacturers are scaling up production capacities to meet both domestic and export requirements. Increasing integration of ozone generators in commercial kitchens, beverage processing, and public facilities further broadens application. Partnerships with international technology providers also enhance product efficiency and reliability.

India is projected to grow at a CAGR of 8.6%, driven by rapid adoption in water treatment, packaged drinking water units, and hospitality industries. Rising concerns over water quality and hygiene standards have increased demand from hotels, hospitals, and food processing firms. Local companies are developing compact, energy-efficient ozone units suitable for small and medium enterprises, while imports cater to high-capacity systems. Expanding urban infrastructure and stricter regulatory compliance in effluent treatment encourage wider adoption.

Germany, with a CAGR of 7.9%, demonstrates rising adoption in advanced wastewater treatment, food processing, and cleanroom environments. Strong regulatory frameworks on industrial emissions and hygiene drive demand for reliable and efficient ozone solutions. German manufacturers emphasize precision-engineered ozone systems with superior durability and integration into automated facility management. Demand is supported by industries such as pharmaceuticals, breweries, and dairy processing, which prioritize consistent sterilization.

The United Kingdom is forecast to grow at a CAGR of 6.6%, led by rising utilization of ozone systems in hospitality, packaged water, and healthcare facilities. Growing awareness of chemical-free sterilization methods boosts market adoption. Imports from European and Asian manufacturers dominate supply, while local firms concentrate on niche markets such as indoor air quality and smaller-scale water treatment solutions. Increasing food safety regulations further stimulate demand for ozone-based sterilization.

The United States, growing at a CAGR of 5.9%, is shaped by applications in large-scale water treatment, food safety, and indoor air quality improvement. Stricter guidelines on disinfection and chemical usage in food and beverage production enhance the appeal of ozone systems. Domestic companies focus on energy efficiency and modular scalability to meet both industrial and commercial needs. Rising adoption in aquaculture and cold storage facilities adds to growth.

The market is shaped by a mix of global technology providers and specialized regional manufacturers, each emphasizing distinct strengths such as innovation, water treatment applications, and customized ozone solutions. Toshiba and EBARA Technologies hold strong positions through their engineering expertise, advanced technology integration, and established presence in large-scale industrial and municipal applications. Their focus on durability and automation makes them preferred partners for high-capacity installations. Specialized players such as DEL Ozone, Ozone Solutions, and Faraday Ozone are recognized for their strong application portfolios in commercial water treatment, aquaculture, food processing, and sanitation systems. Their ability to offer compact, reliable, and energy-efficient designs provides them with a competitive edge in small to medium-scale projects.

Lenntech Water Treatment leverages its water treatment solutions expertise, integrating ozone generators into comprehensive purification and disinfection systems, thereby enhancing its value proposition across industries. Regional companies such as Corotec, ORAIPL, and Oxyzone strengthen market accessibility by focusing on cost-effective solutions, tailored configurations, and local distribution networks. Oxidation Technologies specializes in modular and scalable ozone systems, serving both niche and general commercial requirements. Competitive strategies in this market are centered on efficiency improvements, compliance with safety regulations, and sustainability. As demand rises for eco-friendly disinfection and odor control solutions, manufacturers are expected to invest more in automation, IoT-enabled monitoring, and enhanced energy efficiency to strengthen long-term positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 160.4 Million |

| Technology | Corona Discharge, Ultraviolet, Cold Plasma, and Electrolytic |

| Application | Water Treatment, Laboratory & Medical Equipment, Air Treatment, and Others |

| Capacity | 5 gm/hr - 100 gm/hr, ≤ 5 gm/hr, 100 gm/hr - 1 kg/hr, 1 kg/hr - 5 kg/hr, and > 5 kg/hr |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Corotec, DEL Ozone, EBARA Technologies, Faraday Ozone, Lenntech Water Treatment, Oxidation Technologies, ORAIPL, Oxyzone, Ozone Solutions, and Toshiba |

| Additional Attributes | Dollar sales by generator type and application, demand dynamics across water treatment, food processing, and air purification sectors, regional trends in ozone-based disinfection adoption, innovation in energy efficiency, output control, and safety mechanisms, environmental impact of ozone emissions and equipment lifecycle, and emerging use cases in healthcare sterilization, cold storage preservation, and industrial odor control. |

The global commercial ozone generator market is estimated to be valued at USD 160.4 million in 2025.

The market size for the commercial ozone generator market is projected to reach USD 312.5 million by 2035.

The commercial ozone generator market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in commercial ozone generator market are corona discharge, ultraviolet, cold plasma and electrolytic.

In terms of application, water treatment segment to command 41.8% share in the commercial ozone generator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA