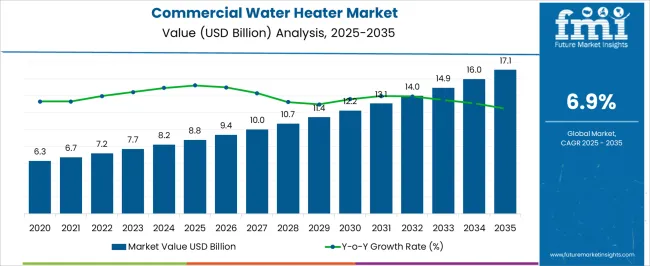

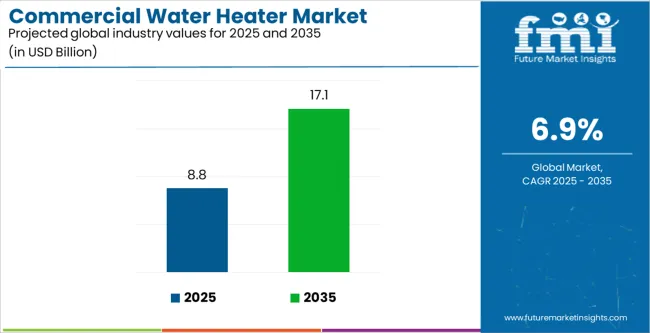

The Commercial Water Heater Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 17.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The commercial water heater market is expanding steadily, driven by increasing demand from hotels, hospitals, educational institutions, and manufacturing facilities. Rapid urbanization, infrastructure development, and the need for energy-efficient heating solutions are key factors supporting growth.

Manufacturers are focusing on advanced technologies, such as condensing and heat pump systems, to improve performance and comply with stringent energy regulations. The market is witnessing rising adoption of electric and hybrid systems due to ease of installation and reduced emissions.

Government incentives promoting energy-efficient appliances and the growing preference for smart water heating controls are further strengthening demand. With ongoing commercial construction activities and increasing replacement rates of conventional systems, the market outlook remains highly positive for the forecast period.

| Metric | Value |

|---|---|

| Commercial Water Heater Market Estimated Value in (2025 E) | USD 8.8 billion |

| Commercial Water Heater Market Forecast Value in (2035 F) | USD 17.1 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

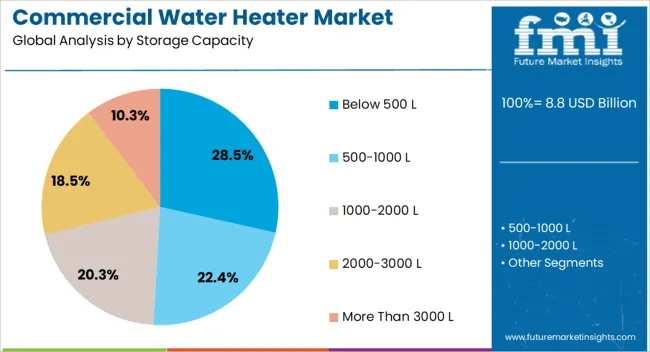

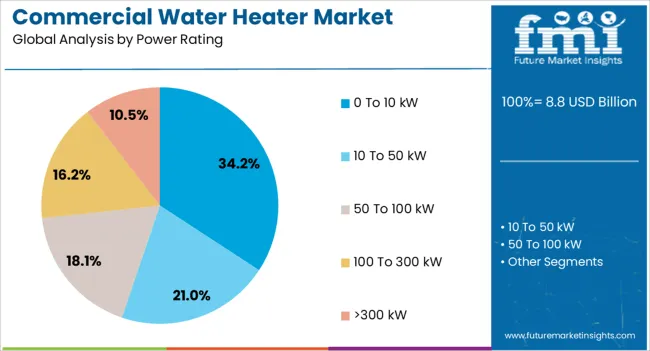

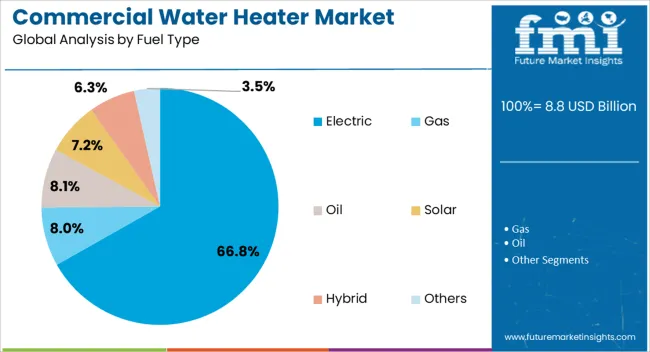

The market is segmented by Storage Capacity, Power Rating, Fuel Type, and Application and region. By Storage Capacity, the market is divided into Below 500 L, 500-1000 L, 1000-2000 L, 2000-3000 L, and More Than 3000 L. In terms of Power Rating, the market is classified into 0 To 10 kW, 10 To 50 kW, 50 To 100 kW, 100 To 300 kW, and >300 kW. Based on Fuel Type, the market is segmented into Electric, Gas, Oil, Solar, Hybrid, and Others. By Application, the market is divided into Offices, Healthcare, Restaurants, Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

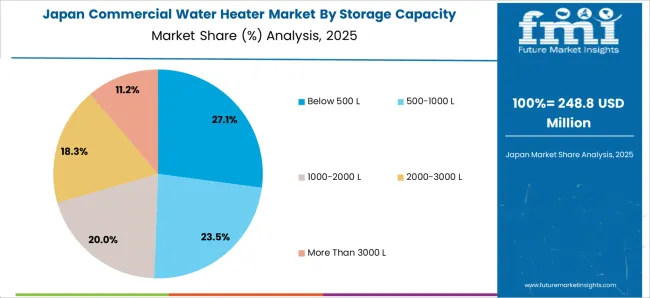

The below 500 L segment leads the storage capacity category with approximately 28.50% share, driven by its suitability for small to medium-scale commercial facilities such as restaurants, clinics, and educational buildings. This capacity range offers a balance between energy efficiency and operational flexibility, making it ideal for moderate daily hot water needs.

Compact design and easy installation have enhanced adoption in retrofit applications. The segment also benefits from its compatibility with both electric and gas heating systems, offering versatility in usage.

With continuous development of space-saving designs and high-performance insulation technologies, the below 500 L segment is expected to maintain its strong position within the market.

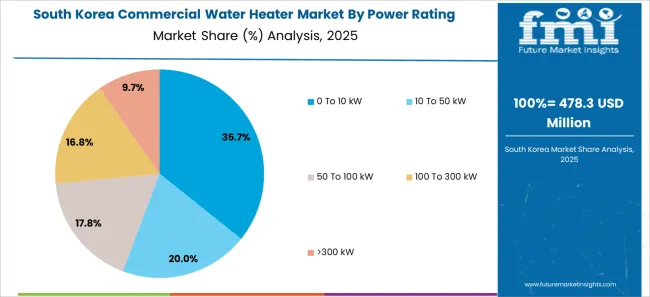

The 0 to 10 kW segment dominates the power rating category with approximately 34.20% share. This segment’s growth is supported by its energy-efficient operation and widespread applicability across small-scale commercial units.

Low power consumption, minimal maintenance, and easy integration into existing power systems make it the preferred choice for decentralized heating applications. The rising emphasis on green building standards has also increased the adoption of low-power-rated systems.

As advancements in smart control systems enhance operational efficiency, the 0 to 10 kW segment is expected to retain its leadership in the power rating category.

The electric segment commands approximately 66.80% share in the fuel type category, reflecting the growing global shift toward sustainable and low-emission energy solutions. Electric water heaters are favored for their high energy conversion efficiency, ease of installation, and lower operational costs in regions with stable power infrastructure.

The segment’s growth is further supported by government policies promoting electrification and carbon reduction. Manufacturers are innovating with faster heating technologies and smart connectivity features to optimize energy use.

With the ongoing transition toward cleaner energy systems, the electric segment is anticipated to maintain its dominant position throughout the forecast period.

From 2020 to 2025, the commercial water heater industry experienced a CAGR of 8.6% in market value. Commercial water heaters find applications across various industries, including hospitality, healthcare, manufacturing, and education. The growth of these industries, along with infrastructure development and urbanization, influences the demand for commercial water heaters on a global scale.

Businesses are increasingly prioritizing sustainability, leading to a demand for water heaters with lower environmental impact. This includes the use of renewable energy sources, heat pump technology, and overall eco-friendly designs. Projections indicate that the global commercial water heater market is expected to experience a CAGR of 6.9% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 8.6% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 6.9% |

The following table shows the top five countries by revenue, led by Japan and South Korea. The demand for commercial water heaters in Japan is influenced by the needs of sectors such as hospitality, healthcare, manufacturing, and more. The growth of commercial buildings, hotels, and industrial facilities contributes to a sustained demand for commercial water heating solutions in South Korea.

| Countries | The Forecast CAGRs from 2025 to 2035 |

|---|---|

| United States | 7.2% |

| United Kingdom | 8.1% |

| China | 7.7% |

| Japan | 8.0% |

| South Korea | 9.0% |

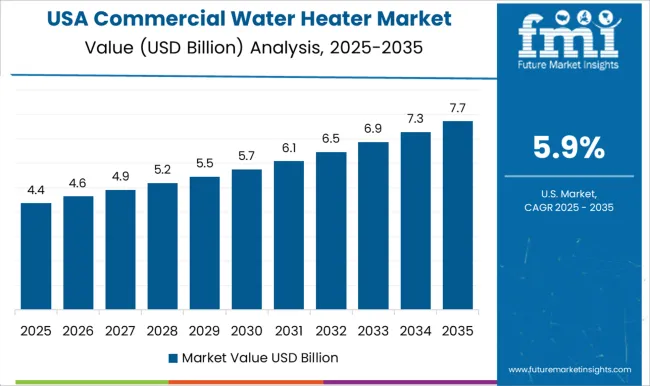

The commercial water heater market in the United States is expected to grow with a CAGR of 7.2% from 2025 to 2035. The growth of the market is attributed to the growth in commercial construction and infrastructure projects, there is an increased need for reliable and energy-efficient water heating solutions.

The United States has been placing a growing emphasis on energy efficiency and environmental sustainability. Federal and state regulations promoting the use of energy-efficient appliances, including water heaters, have driven the adoption of high-efficiency models in the commercial sector.

The commercial water heater market in the United Kingdom is expected to grow with a CAGR of 8.1% from 2025 to 2035. The United Kingdom has been actively working to reduce carbon emissions and improve energy efficiency. Regulations and initiatives aimed at promoting sustainable practices and reducing the carbon footprint influence the adoption of energy-efficient commercial water heaters.

The government has implemented various energy performance standards for commercial buildings. These standards often influence the choice of heating systems, including water heaters, to meet the required energy efficiency criteria.

The commercial water heater market in China is expected to grow with a CAGR of 7.7% from 2025 to 2035. China's ongoing urbanization and infrastructure development contribute significantly to the demand for commercial water heaters. As new commercial buildings, hotels, and industrial facilities are constructed, there is a growing need for efficient water heating systems.

Government initiatives in China play a crucial role in driving market growth. Policies promoting energy efficiency, environmental sustainability, and the use of clean technologies encourage the adoption of advanced and eco-friendly commercial water heaters.

The commercial water heater market in Japan is expected to grow with a CAGR of 8.0% from 2025 to 2035. Japan's interest in renewable energy sources may lead to increased adoption of solar thermal water heaters and other eco-friendly technologies in the commercial sector. Government incentives and initiatives to promote renewable energy can drive this trend.

Different industries in Japan have specific requirements for hot water. The demand for commercial water heaters is influenced by the needs of sectors such as hospitality, healthcare, manufacturing, and more.

Government incentives and subsidies for businesses adopting energy-efficient technologies can stimulate the commercial water heater market. Financial support from the government may encourage businesses to invest in more sustainable heating solutions.

The commercial water heater market in South Korea is expected to grow with a CAGR of 9.0% from 2025 to 2035. South Korea has experienced rapid urbanization and construction activities. The growth of commercial buildings, hotels, and industrial facilities contributes to a sustained demand for water-heating solutions in these spaces.

South Korea is known for its advanced technology and innovation. The integration of smart features, energy-efficient technologies, and improved control systems in commercial water heaters can contribute to market growth as businesses seek modern and efficient solutions.

The below section shows the leading segment. The below 500 L segment is to grow at a CAGR of 6.6% from 2025 to 2035. Based on power rating, the 0 to 10 kW segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 6.3% from 2025 to 2035.

| Category | CAGR |

|---|---|

| Below 500 L | 6.6% |

| 0 to 10 kW | 6.3% |

Based on storage capacity, the below 500 L segment is anticipated to grow at a CAGR of 6.6% from 2025 to 2035. Businesses with limited space, such as small restaurants, cafes, or offices, may not have the physical space to accommodate larger water heaters.

Water heaters with capacities below 500L are often more compact and can be installed in areas with space restrictions. Smaller capacity water heaters are generally more energy-efficient for businesses with lower hot water demand. Operating a larger water heater for a small-scale operation could lead to energy wastage, making smaller-capacity heaters more cost-effective and environmentally friendly.

Some regions or industries may have regulations or standards that recommend or mandate the use of water heaters with specific capacities based on the scale of the business. Choosing a below 500L capacity aligns with compliance requirements in such cases.

Based on power rating the 0 to 10 kW segment is anticipated to register a CAGR of 6.3% from 2025 to 2035. Businesses with relatively low hot water requirements, such as small offices, clinics, or retail shops, often find water heaters with 0 to 10 kW power ratings sufficient for their needs. These businesses may not need the high capacities or power outputs of larger heaters.

Smaller commercial water heaters are generally more energy-efficient when the hot water demand is modest. Operating a lower power rating heater for applications with lower requirements helps businesses optimize energy usage and reduce operational costs.

Commercial water heaters with power ratings in the 0 to 10 kW range are often more affordable both in terms of the initial purchase cost and ongoing operational expenses. For businesses with lower hot water demands, investing in a smaller and less powerful unit can be a cost-effective solution.

Businesses with limited physical space for equipment installation may find smaller water heaters more suitable. Water heaters with lower power ratings tend to be more compact, making them easier to install in tight spaces.

Market players invest in research and development to introduce energy-efficient, smart, and environmentally friendly commercial water heaters. Market players collaborating with other industry players, technology providers, or energy efficiency organizations can help market players enhance their offerings and broaden their market reach.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 8.2 billion |

| Projected Market Valuation in 2035 | USD 16 billion |

| Value-based CAGR 2025 to 2035 | 6.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Storage Capacity, Power Rating, Fuel Type, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

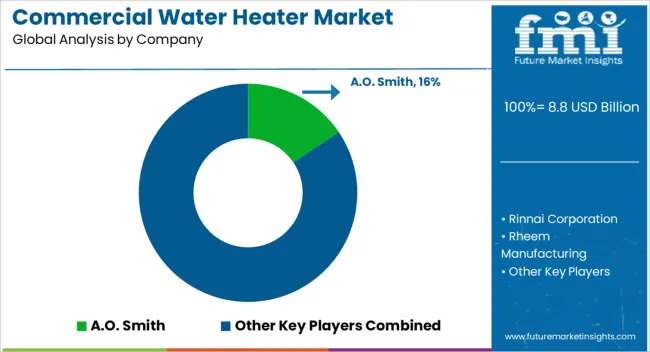

| Key Companies Profiled | A.O. Smith; Rinnai Corporation; Rheem Manufacturing; Ariston Thermo S.p.A; Racold; Midea Group; Nibe Corporation; Nortiz Corporation; Hubbell; Valliant; Lowe’s; Bradford White Corporation; Flexiheat UK Ltd; Daikin Industries |

The global commercial water heater market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the commercial water heater market is projected to reach USD 17.1 billion by 2035.

The commercial water heater market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in commercial water heater market are below 500 l, 500-1000 l, 1000-2000 l, 2000-3000 l and more than 3000 l.

In terms of power rating, 0 to 10 kw segment to command 34.2% share in the commercial water heater market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Gas Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Smart Water Meter Market Size and Share Forecast Outlook 2025 to 2035

Commercial Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Instant Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Electric Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Commercial Hot Water Boiler Market Size and Share Forecast Outlook 2025 to 2035

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Demand for Industrial Solar Water Heaters in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Solar Water Heaters in USA Size and Share Forecast Outlook 2025 to 2035

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA