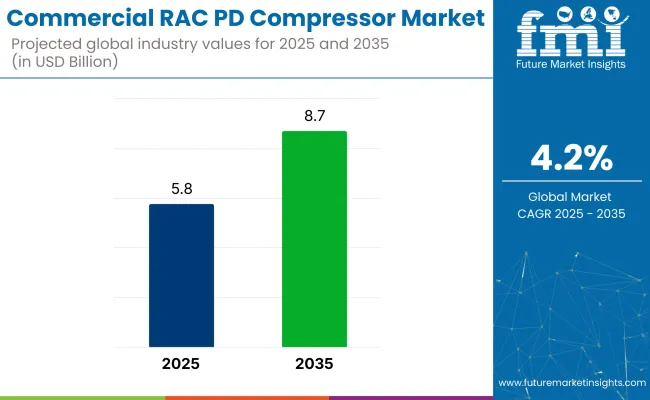

The Commercial Refrigeration and Air Conditioning (RAC) Positive Displacement (PD) Compressor market is projected to grow steadily between 2025 and 2035, driven by increasing demand for energy-efficient cooling solutions across commercial buildings, retail, hospitality, and cold chain logistics. The market is expected to expand from USD 5.8 billion in 2025 to USD 8.7 billion by 2035, registering a CAGR of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.8 billion |

| Industry Value (2035F) | USD 8.7 billion |

| CAGR (2025 to 2035) | 4.2% |

PD compressors, which are displacement compressors and among them are reciprocating, rotary, and scroll types, are some of the fundamental parts in commercial RAC systems, which provide increased efficiency, reliability, and diversity in different applications of temperature control. Since the global temperature continues to grow and the demand for conditioned offices increases drastically, the function of air conditioning units with compressor technologies is becoming more crucial in HVAC-R systems.

The commercial RAC PD compressor market is profiting from investments on food retail and cold storage sectors most especially in developing countries. The rotary screw system has become a staple of inverter drive technology as environmental concerns and government regulations push industries into making changes.

HVAC manufacturers are looking at the next-generation of rotary screw compressors that utilize low-GWP refrigerants such as R-290 and R-32 alongside the increasing uptake of refrigerants that are environmental friendly. Varied and smart technologies to compressors are further facilitating the realization of energy efficiency through greater control and performance improvements.

The widespread online retailing and the sprouting of urban centers have triggered the need for additional data centers, shopping plazas, hospitals, and transport facilities, backing thereby their advanced HVAC-R requirements. Improved air quality is being sought after by a focus on total cost of ownership being an incentive for upgrading old cooling systems with the latest high-efficiency PD compressors.

North America Commercial refrigerant RAC PD compressors are experiencing serious expansion in the North American market as the company's launches are gaining traction in the market. The major driving factors include the need for energy-efficient solutions, regulatory requirements, and incentives such as the USA EPA's Energy Star program. The increasing popularity of environmental cooling systems in supermarkets, cold storage facilities, and HVAC medical centers is the fastest growing factor for the need for these systems.

Companies are facilitating the use of PD compressors as part of their development towards a eco-friendlier refrigeration market and to respond to the external regulatory pressure that obliges them to use electric power more discerningly. Makers of the PD compressors are concentrating on alternative refrigerants along with augmenting the efficiencies of the compressors to target these problems.

Europe is still the most developed region in energy-efficient and environmentally friendly refrigeration technologies and has continuously been at the forefront in this transition. The quick turnaround in the adoption of low-GWP refrigerants and compressor technologies along with the EU's F-Gas Regulation is driving this change.

States like Germany, France, and the UK are the first adopters of state-of-the-art PD compressors to comply with the requirements entailed in energy performance. The uptrend in the use of green solutions in retail, medical, and cold stores arising out of carbon neutrality and efficiency dimension has contributed to market expansion.

The commercial RAC PD compressor market in the Asia-Pacific is tremendously increasing due to the ongoing process of industrialization, urbanization and the demand for refrigeration equipment among food, beverage, and healthcare sectors. Among the countries, China, India, and Japan, the manufacturers first target to boost compressor efficacy, lower electricity consumption, and the implementation of green reorients. Simultaneously, the demand for refrigerated transport, along with the growth of cold storage in the emerging markets is the continuation of this trend.

The overall picture in Latin America, the Middle East, and Africa is that of an increase in the demand for commercial RAC PD compressors, although the pace is relatively low in these regions as compared to others. The regions of Latin America are namely Brazil and Mexico which have reported faster adoption of refrigeration systems in retail, markets, and food distribution chain recycles.

The Middle East, particularly the UAE and Saudi Arabia, has emerged as a point of demand creation for cooling systems since the heat level is pushing these countries to attain expansion in retail and hospitality sectors. In Africa, even if the market is at an earlier stage regarding product offerings, the need for dependable refrigeration and air conditioning systems in commercial entities is penetrating.

High Energy Consumption

One major challenge confronting the commercial RAC PD compressor market remains the energy seepage of these machines. Although PD compressors generally use less energy than some of the other types, however, the need to operate within the regulatory framework and to meet sustainability ambitions entails that they must reduce energy consumption further. The persistent effort of manufacturing sites to create compressors that are both energy-efficient and technical but this is still a challenge for all the compressor companies.

Refrigerant Transition

The low-GWP refrigerant switch is a serious barrier to commercial RAC PD compressor manufacturers. The traditional refrigerant is often used in the current setups, and the adjustment to the new environmental-friendly refrigerants may turn to be expensive and technically arduous. The need to tailor refrigerants, therefore, are the pairing of very high efficiency in chillers and compressors, which is the knockout that producers must put in in order to accomplish worldwide aims in terms of sustainability.

Energy-Efficient Solutions

Sustainable development orientation on energy efficiency has become one of the most important opportunities for the commercial RAC PD compressor market. Engine manufacturers are venturing in incorporating more advanced compressor technology with integrated control systems, variable speed drives, and energy recovery features that are capable of curbing energy consumption and improving system performance. These innovations seem to be the driving force behind the increased use of PD compressors in commercial applications across the board.

Cold Chain and Pharmaceutical Applications

The surging need for temperature-sensitive products in the pharmaceutical and food sectors makes PD compressors the great opportunity. Refrigeration systems that deliver precisely the required temperature, life reliability, and energy efficiency are the must-have product for these applications. Producers can take pride in developing specific PD compressors for pharmaceutical industries and other areas where a high degree of reliability and efficiency in refrigeration systems are required.

Growth in the Food and Beverage Industry

The food and beverage industry's rise in the requirement for quick-frozen and refrigerated items is the one driving factor for in-depth production of refrigeration systems. As the supermarket chains, convenience stores, and cold storage facilities start rising across the world, the demand for PD compressors with time is bound to go upward. The food industry is set to rise with the growth of e-commerce platforms it creates more opportunities for refrigerated transportation, making the demand for reliable and energy-efficient compressors hike.

The segment of commercial refrigeration and air conditioning (RAC) positive displacement (PD) compressors has greatly evolved during the period from 2020 to 2024, and it is the leading edge of food retail, hospitality, cold chain logistics, and commercial HVAC sectors that are driving it through the rising demand for energy-efficient cooling systems. PD compressors which can be, for example, reciprocating and rotary types, are chosen because of their reliability, versatility, and aptness to small and medium-capacity refrigeration systems.

The manufacturers have switched to developing eco-friendly refrigerants that could cut down the environmental impact. More than ever, the focus has been on increasing the coefficient of performance (COP), decreasing environmental impact, and better integration with variable-speed drives (VSDs) and inverter technology.

The growth of cold chain infrastructure, electrification of HVAC systems, and international agreements promoting the phase-out of hydrofluorocarbons (HFCs) will be the most important value drivers for the market from 2025 to 2035. New technological innovations, such as scrolling and screw compressor designs, as well as the refurbishment of old facilities, are likely to present lucrative market pathways.

Market Shift Analysis (2020 to 2035)

| Market Aspect | 2020 to 2024 |

|---|---|

| Compressor Technology | Fixed-speed reciprocating and rotary compressors are the mainly used. |

| Refrigerant Trends | HFCs like R-404A and R-410A are usually used in almost all of attached devices. |

| Energy Efficiency Focus | Respecting the minimum energy performance standards (MEPS). |

| Market Drivers | Development in the cold storage, food retail, and commercial HVAC sectors. |

| Manufacturing & Supply Chain | Mainly distributed across Asia-Pacific manufacturing hubs. |

| Regulatory Framework | Kigali Amendment and local bans on high-GWP fluorinated gases proposed. |

| Market Aspect | 2025 to 2035 |

|---|---|

| Compressor Technology | Shift to inverter-driven, scroll, and oil-free screw compressors for even better efficiency. |

| Refrigerant Trends | Entering of low-GWP refrigerants such as R-290, R-32 and solutions based on CO2. |

| Energy Efficiency Focus | Deployment of intelligent controls and IoT-based diagnostics for energy optimization. |

| Market Drivers | Need a factor for retrofitting facilities using low-carbon cooling along with sustainability requirements. |

| Manufacturing & Supply Chain | Compressor production is diversified and regionalized to mitigate logistical risks. |

| Regulatory Framework | Full implementation of the HFC phase-down, Eco-design compliance, and refrigerant recycling required. |

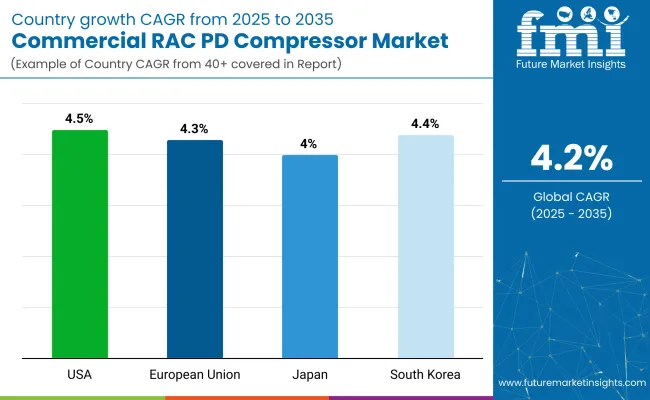

Owing to significant demand from supermarkets, convenience stores, foodservice outlets, and data centers, the USA Commercial RAC PD Compressor Market is experiencing steady growth. The cold storage warehousing growth that comes along with e-commerce grocery delivery and vaccine distribution further boosts the adoption of high-efficiency scroll and reciprocating compressors.

Compliance to energy-saving norms set by the Department Of Energy-DOE and the Environmental Protection Agency-EPA regulations in place for refrigerants is propelling the shift towards low-GWP-compatible compressor systems. Emerson, Copeland, and Carrier are the main suppliers that join variable-speed and smart control integration development not only to meet demands in the advanced refrigeration sector but also to stay on track with regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The EU Commercial RAC PD Compressor Market is formed under the pressure of stringent energy-saving regulations, F-Gas rule compliance, and determined support for climate-friendly cooling agents. Dominantly, Europe leads the way in moving towards natural refrigerants (CO2, propane, ammonia) and low-GWP mixtures, a fact that ultimately affects the design and adoption of compressors.

The key markets in Germany, France, and Italy for food retail refrigeration and district cooling, form the backbone for the demand for the high-efficiency scroll and rotary PD compressors that can be deployed in the environmentally regulated area.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japan is the leading commercial RAC PD compressor market that lives on extremely high energy efficiency norms, small-sized equipment, and super-fast development of inverter technology. Due to the narrow space in retail and strict energy regulations, the Japanese producers mainly focus on ultra-quiet, power-saving, and smart compressor systems that are optimal for small and medium commercial scales.

Big players like Panasonic, Daikin, and Mitsubishi Electric are on top with their scroll compressor innovations like for instance the use of high-efficiency applications in vending machines at convenience stores and in central air-conditioners in commercial buildings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The South Korean Commercial RAC PD Compressor Market is growing faster due to the increased demand for inverter-based, low-noise HVAC and refrigeration systems. Pro-purposing of smart-integrated buildings, retail spaces, and medical refrigeration is the trigger for the rise of scroll and rotary compressors.

Energy-saving and green building policies are the fundamental forces that build demand for smart PD compressors, which coordinate seamlessly with building management systems (BMS) and IoT platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Reciprocating Compressors Continue to be Popular in Mid-Cap Applications

Reciprocating compressors are among the classic and most popular compressor types used for positive displacement in the RAC sector. They use pistons that are driven by a crankshaft to compress refrigerant, which is why they are suitable for small to mid-sized commercial refrigeration systems such as walk-in coolers, display cases, and rooftop AC units.

Their strong points are the durability, easy maintenance, and a vast operational range. The trend toward more commercial facilities looking for dependable, cost-effective cooling solutions has led to reciprocating compressors continuing to account for a considerable part of the market, especially in the applications that have variable load requirements.

Ball-Type Compressors Will Be the Choice for Efficiency and Low Noise

Ball-type compressors are being used in commercial air conditioning systems since they are more compact, have quieter operations, and are more energy efficient than other compressors. These compressors use two spiral elements-one fixed and one orbiting-to compress the refrigerant. Ball type compressors are perfect for variable-speed applications and are used in split systems, heat pumps, and packaged rooftop units.

With energy regulations becoming stricter and end-users setting higher standards for noise reduction and performance, ball compressors are broadening their market penetration in offices, hospitality, and retail environments.

Compressors of 6 kW and Below Are Coolers for Light Commercial Applications

PD compressors with cooling capacities below 6 kW mostly find application in small commercial air conditioning units, beverage coolers, under-counter refrigerators, and compact HVAC systems. These are most useful for light-duty applications as their small size, energy efficiency, and cost-effectiveness are students' considerations.

The demand for low-capacity cooling systems that are efficient comes from the expansion of small-format retail outlets, and quick-service restaurants that run co-working space with technological developments, such as inverter-driven compressors and green refrigerants, which bring progress to this capacity segment.

7-10 kW Cooling Capacity Segment is the Go-To for Mid-Size Commercial Installations

Compressors with 7 to 10 kW cooling capacities are commonly found in mid-sized commercial settings such as supermarkets, server rooms, small manufacturing companies, and multi-zone HVAC systems. These compressors are the best bet as they provide energy efficiency and performance that is needed by companies to cope with the climate control demand without the high operational cost of industrial systems.

The mid-size range of refrigeration and air conditioning units is likely to develop in urban areas and temperature-sensitive applications where the demand for more is increasing;this segment is expected to see substantial growth.

The market for Commercial Refrigeration and Air Conditioning Positive Displacement (RAC PD) Compressors is continuing to expand steadily under the influence of the increased application of energy-efficient cooling systems primarily in commercial facilities, hospitality, food retail, and cold storage areas.

PD compressors like reciprocating, rotary, and scroll types are favored due to their durability, less space requirement, and ability to operate under variable load conditions. The growth of urbanization, the impact of climate change, and the worldwide rise of food and beverage industries serve as the major reasons for the higher penetration of PD compressors.

The manufacturers are mainly directed towards the production of green refrigerants, cutting-edge smart compressor technologies, and modular designs which comply with energy standards and environmental regulations. Apart from that, the mix with IoT platforms and the addition of predictive maintenance features to the equipment are the main constituent parts that are boosting not only the operational efficiency but also the lifespan of the equipment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Emerson Electric Co. | 24-28% |

| Danfoss A/S | 18-22% |

| Daikin Industries, Ltd. | 14-18% |

| Panasonic Corporation | 10-14% |

| Mitsubishi Electric Corporation | 7-10% |

| Other Companies (combined) | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Emerson Electric Co. | Offers Copeland scroll and reciprocating compressors with advanced modulation and smart system integration. |

| Danfoss A/S | Provides high-efficiency scroll compressors optimized for low-GWP refrigerants and commercial HVAC systems. |

| Daikin Industries, Ltd. | Manufactures variable-speed scroll and rotary compressors for energy-saving commercial cooling systems. |

| Panasonic Corporation | Develops compact rotary and scroll compressors for commercial refrigerators and packaged AC units. |

| Mitsubishi Electric Corp. | Focuses on inverter-driven compressors designed for high-efficiency air conditioning and heat pump systems. |

Key Company Insights

Emerson Electric Co.

Emerson Electric Co. has the first spot in the global PD compressor market and is also known for Copeland branded scroll and reciprocating compressors built for maximum efficiency and reliability. Emerson is a pioneer in developing, variable-speed and digital modulation technologies to meet customer needs in different commercial HVACR that is heating, cooling and refrigeration. All company's compressors support low-GWP refrigerants and are melded with authentic smart system controls like remote monitoring and diagnostics that results in increased uptime and lower service costs.

Danfoss A/S

Danfoss A/S is a provider of vacuum-tight scroll compressors benefiting from the operation with greenhouse gas (GWP) refrigerants that are of low global warming potential, thus accompanying global climate objectives. Its commercial compressors are employed in the machines used in roof-mounted air conditioning units, chillers, and refrigerated display cases.

Danfoss is a company that prioritizes system integration, thus providing an inverter technology and controllers to optimize the overall system performance. The effort towards sustainability and innovation is what elevates Danfoss in the top-tier bracket in this segment.

Daikin Industries, Ltd.

Daikin Industries, Ltd. is a dedicated fan of a wide range of rotary ac and scroll compressor and also builds these models of air conditioning systems and foists to OEMs all over the world. This company deals with energy-saving technologies and is a forerunner in the inverter-controlled compressor systems.

Daikin is the first choice for businesses needing commercial-grade compressors due to their whisper quiet operation, reliability, and capability to work with new-generation refrigerants. Daikin is inclined to invest in R&D purposes in order to produce the PD compressors with superior efficiency and a minor environmental footprint.

Panasonic Corporation

Panasonic Corporation is committed to offering rotary and scroll compressors that are compact, reliable, and suitable for both commercial refrigeration and packaged air conditioning systems. Space-constrained applications derivatives of the company's compressors are whereby they have high efficiency and are compact. Panasonic is into the eco-friendly design using R32 refrigerants and integrating inverter control systems for better energy savings. Its entry into the emerging markets is the main reason it has a strong global presence in the compressor business.

Mitsubishi Electric

Mitsubishi Electric is synonymous with energy-efficient inverter-driven scroll compressors that often find use in commercial air conditioners and heat pumps. The company is on the noise-reduction, long life operating, and achieving high seasonal efficiency (SEER) targets. Mitsubishi's research and development policies are centered on programmable compressors that change with load conditions to conserve energy. In the field of HVAC innovation and reliability, Mitsubishi is a household name, and they are progressively increasing their hold on the PD compressor sector.

The global Commercial RAC PD Compressor market is projected to reach USD 5.8 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.2% over the forecast period.

By 2035, the Commercial RAC PD Compressor market is expected to reach USD 8.7 billion.

The Scroll Compressor segment is expected to dominate due to its high energy efficiency, compact size, and low noise operation, making it ideal for commercial air conditioning systems.

Key players in the market include Emerson Electric Co., Danfoss A/S, Panasonic Corporation, BITZER SE, Copeland LP, Hitachi Ltd., Tecumseh Products Company LLC, and GMCC & Welling.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA