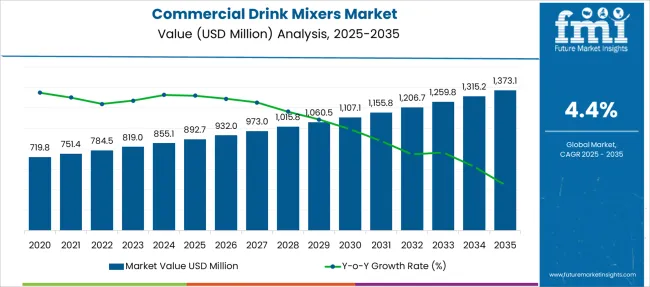

The Commercial Drink Mixers Market is estimated to be valued at USD 892.7 million in 2025 and is projected to reach USD 1373.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Drink Mixers Market Estimated Value in (2025 E) | USD 892.7 million |

| Commercial Drink Mixers Market Forecast Value in (2035 F) | USD 1373.1 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The Commercial Drink Mixers market is witnessing notable expansion, driven by the evolving preferences of consumers and the continuous innovation within the beverage and hospitality industries. Increased demand for premium cocktails, flavored beverages, and non-alcoholic alternatives has significantly contributed to the rising adoption of drink mixers across commercial establishments. Hospitality chains and bars are increasingly relying on consistent, high-quality mixers to deliver standardized taste experiences, supported by growing urbanization and changing consumer lifestyles.

Product innovation, including low-calorie and botanical-infused variants, has further attracted health-conscious consumers and opened new revenue streams. In recent product announcements and commercial beverage launches, manufacturers have emphasized clean-label formulations, natural ingredients, and sustainability, aligning with global consumer trends.

Strategic investments by beverage conglomerates into mixer manufacturing and partnerships with restaurants and hotels are also expected to reinforce future market momentum As these factors converge, the market outlook remains strong, supported by expanding commercial beverage demand and sustained consumer interest in premium drink offerings.

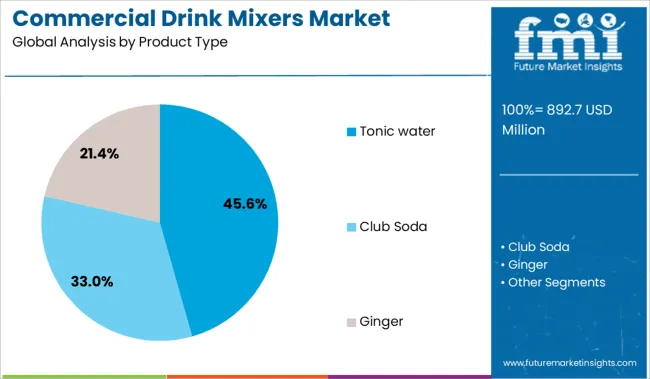

The market is segmented by Product Type and region. By Product Type, the market is divided into Tonic water, Club Soda, and Ginger. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tonic water segment is expected to hold 45.6% of the Commercial Drink Mixers market revenue share in 2025, making it the leading product type. This dominant position is being driven by the increased popularity of gin-based cocktails and the wider use of tonic water in both alcoholic and non-alcoholic beverages across hospitality venues. Tonic water’s crisp flavor profile and compatibility with a wide range of spirits have made it a preferred choice among bartenders and beverage professionals.

In corporate product updates and beverage trend coverage, tonic water has consistently been highlighted for its versatility, premium positioning, and appeal to health-aware consumers through low-sugar and botanical-based variants. Growth in urban nightlife culture, coupled with rising demand for ready-to-serve mixers in bars, hotels, and catering services, has further elevated its market relevance.

The segment has also benefited from strong brand investments, product line diversification, and global distribution expansions These factors have supported tonic water’s sustained leadership in the product category.

During the 2020 to 2024 historical period, the global commercial drink mixers industry is estimated to have expanded significantly, especially after most of the world eased lockdown restrictions.

By this time, consumers had already started to use commercial drink mixers at home, which had given the market a much-needed boost. As public drinking establishments started to operate again, consumers rushed to them and as a result, demand for commercial drink mixers skyrocketed.

During the forecast period, FMI expects the market to keep expanding as consumers of alcohol are set to fuel demand for commercial drink mixers. Also, packaging innovations and clever marketing strategies are likely to promote the use of commercial drink mixers at home.

Online delivery platforms are anticipated to contribute immensely to market expansion in the next ten years as these platforms make it easy for consumers to purchase their preferred products. For instance, Swiggy, a prominent online food delivery service in India, offers commercial drink mixers in Swiggy Instamart. Consumers can opt for quick 15-minute deliveries on the platform, which makes shopping for commercial drink mixers convenient.

According to FMI, several crucial factors are responsible for driving the commercial drink mixers industry. FMI’s leading analysts have evaluated emerging opportunities, market restraints, and potential threats that are likely to impact market expansion.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

“Increasing Demand for Cocktails Set to Drive Sales of Commercial Drink Mixers in the USA”

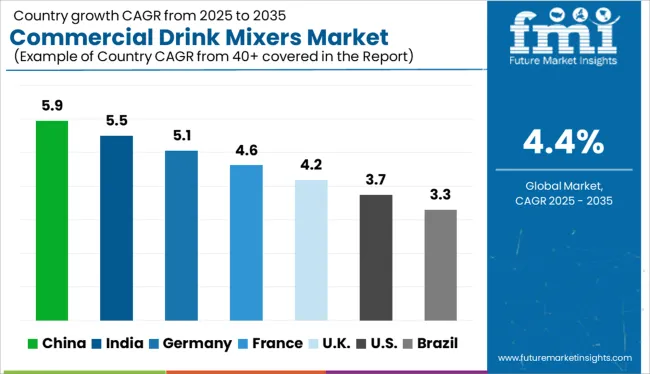

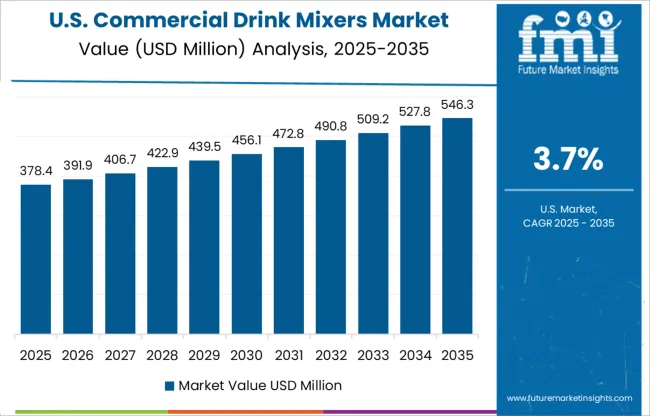

North America holds approximately 38% of the global commercial drink mixers market share. The USA market accounts for around 68% of the North American commercial drink mixers industry.

The USA is home to thousands of bars, restaurants, and nightclubs. The majority of commercial drink mixers are used across these public drinking establishments owing to the high demand for cocktails.

“Cultural Significance of Alcohol Consumption to Impact Demand for Commercial Drink Mixers in the UK”

Europe accounts for approximately 40% of the global commercial drink mixers market, and the UK is predicted to spearhead the European market during the forecast period. The UK has a 22% share in the Europe commercial drink mixers industry, and its market is valued at USD 69.1 Million.

In the UK, the consumption of alcoholic beverages is slated to increase in the coming years due to their cultural significance. As a result, the UK commercial drink mixers industry is poised to benefit.

“Expansion of French Tourism Help Broaden the Field of Commercial Drink Mixers”

France’s commercial drink mixers market is predicted to experience expansion during the forecast period owing to factors such as bars and pubs promoting the combination of liquor with mixers and the rising popularity of cocktails.

The country also happens to be one of the most popular tourist destinations in Europe. Over the next ten years, the French tourism industry is set for rapid growth, and this would have a positive impact on the country’s commercial drink mixers industry.

“Rising Disposable Income and Increasing Popularity of Mixers to Drive India”

In recent years, India’s growth in the commercial drink mixers industry has been significant. This is due to a number of factors including the growing popularity of mixed drinks and the increasing disposable income in the country.

There are a wide variety of commercial drink mixers available in the Indian market, ranging from simple fruit juices to more complex syrups and liqueurs. The most popular type of drink mixer in India is fruit juice, which is used to make a wide variety of mixed drinks.

The growing popularity of mixed drinks in India has led to an increasing demand for commercial drink mixers. As a result, many companies have started to produce and sell commercial drink mixers specifically for this market.

“Growing Use of Club Soda as a Mixer with Various Alcoholic Beverages to Boost Sales”

Club soda is predicted to experience the largest growth by product category between 2025 and 2035, registering a steady 4.4% CAGR. The growing popularity of club soda among consumers around the globe is promoting market expansion.

The significant use of cocktail mixers with alcoholic beverages such as vodka and gin is the segment's main driver. In addition, the industry growth of club soda is attributed to the resurgence of cocktail traditions among young people in both developed and emerging economies, as well as the increased demand for premium spirits.

“Rising Public Awareness of Tonic Water’s Health Benefits to Increase its Popularity as a Drink Mixer”

The segment that sold tonic water had the biggest revenue share in 2025. The expansion of the industry is being driven by the global trend toward utilizing more tonic water in beverages. The fact that tonic water contains the medicine quinine, which is used to treat malaria and babesiosis, further contributes to its widespread use as a healthy beverage.

Additionally, the market is expected to grow in the approaching years due to a variety of tonic water's health advantages. The manufacturers of tonic water also offer diverse product ranges with flavoring and sweeteners.

The global market for cocktail mixers is highly fragmented and houses a large number of international and local companies. Many companies are focusing on providing unique options to their consumers by launching new products. Some of the renowned companies are focusing on technological developments to strengthen their positions.

For instance

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 892.7 million |

| Projected Market Valuation (2035) | USD 1373.1 million |

| Value-based CAGR (2025 to 2035) | 4.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Europe; Asia Pacific; Middle East & Africa (MEA); Central & South America |

| Key Countries Covered | The USA, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Region |

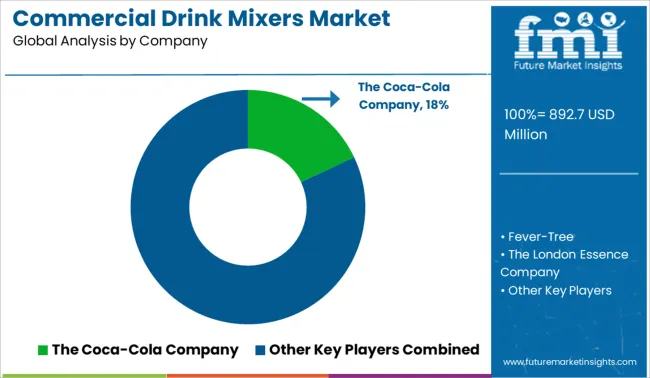

| Key Companies Profiled | Fever-Tree; The London Essence Company; Keurig Dr. Pepper, Inc.; The Coca-Cola Company; THOMAS HENRY GMBH; East Imperial; Fentimans; Q MIXERS; Britvic; White Rock Products Corporation; Bartisans; Three Cents |

| Report Coverage | Market forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global commercial drink mixers market is estimated to be valued at USD 892.7 million in 2025.

The market size for the commercial drink mixers market is projected to reach USD 1,373.1 million by 2035.

The commercial drink mixers market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in commercial drink mixers market are tonic water, club soda and ginger.

In terms of , segment to command 0.0% share in the commercial drink mixers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Mixers Market Size and Share Forecast Outlook 2025 to 2035

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA