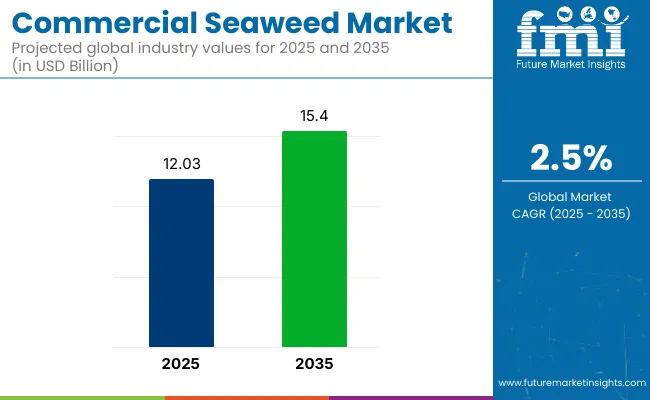

In 2025, the global commercial seaweed market size is assessed at USD 12.03 billion and is forecasted to witness steady growth, reaching USD 15.40 billion by 2035, reflecting a CAGR of 2.5%. Demand has remained persistent across diverse industries, ranging from food and beverages to personal care and agriculture.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.03 billion |

| Industry Value (2035F) | USD 15.40 billion |

| CAGR (2025 to 2035) | 2.5% |

Red seaweed, particularly utilized for carrageenan and agar production, continues to be highly preferred due to its gelling and thickening characteristics. The market has been steadily transitioning into a more organized industrial structure, marked by scaling up of cultivation practices and integration of seaweed-derived actives in sustainable consumer products.

Seaweed applications have been gaining momentum as the demand for plant-based ingredients, marine-sourced bioactives, and eco-friendly solutions accelerates. The food & beverage industry has seen wider adoption of seaweed for its umami flavor profile, texturizing ability, and nutritional properties, while fertilizer and bio-stimulant categories have leveraged its growth-promoting capabilities.

However, the market continues to face obstacles such as variability in raw material supply due to seasonal harvesting patterns, and lack of standardized cultivation techniques in emerging economies. Innovations in processing methods, regulatory recognition of seaweed as a sustainable ingredient, and expanding product development pipelines in personal care and functional foods are shaping the commercial landscape. Players have adopted seaweed valorization models to extract multiple components and reduce production waste.

Over the next decade, commercial seaweed production is anticipated to transition toward climate-resilient aquaculture and circular economy-aligned systems. By 2035, value-added formulations based on seaweed polysaccharides and extracts are expected to gain a larger market footprint across dietary supplements, pet nutrition, and pharmaceutical excipients.

Market stakeholders will be required to address sustainability, traceability, and quality standardization to gain competitive edge. Continued investments in offshore farming infrastructure and vertical integration strategies are likely to further elevate production efficiency and global accessibility of commercial seaweed-derived inputs.

Seaweed-based materials are anticipated to capture over 6.4% of the commercial seaweed market by 2025, as demand for eco-alternatives to plastic escalates. This segment has evolved from niche innovations into pilot-scale production, with companies seeking biodegradable and edible packaging formats from brown and green seaweed varieties.

Adoption has been accelerated by stringent regulations banning single-use plastics, especially across the EU under Directive (EU) 2019/904 and similar mandates across Canada and parts of Southeast Asia. Seaweed-derived biopolymers like alginate and ulvan are being explored for their film-forming, hydrophilic, and oxygen-barrier properties, especially in food packaging and single-use sachets.

Notably, UK-based startup Notpla, which won the Earthshot Prize in 2022, continues to scale its seaweed-based film and coating solutions for takeaway packaging. Meanwhile, Indonesia’s Evoware has commercialized seaweed cups and wraps using locally sourced seaweed, creating value for coastal farming communities.

Despite the segment’s nascency, it reflects strong alignment with circular economy principles, zero-waste goals, and marine ecosystem resilience. Commercialization success will depend on cost reduction through scale, barrier property enhancements, and clearer end-of-life standards for compostability and biodegradability. Manufacturers will also need to navigate supply variability and integrate traceability in sourcing, especially for exports to regulated markets.

Albeit accounting for just 1.9% of market share in 2025, seaweed for biofuel applications represents a long-term strategic diversification area within the commercial seaweed market. Macroalgae’s rapid biomass accumulation, lack of lignin, and non-dependence on arable land offer distinct advantages for third-generation biofuel production. R&D has particularly centered on converting brown seaweed species such as Saccharina japonica and Laminaria digitata into bioethanol and biobutanol via enzymatic and microbial fermentation.

Government-funded initiatives in South Korea, Japan, and the EU continue to support pilot-scale developments, with the European Marine Energy Centre (EMEC) in Scotland conducting seaweed-to-fuel demonstration projects. However, significant technical barriers remain, including high dewatering costs, seasonal biomass fluctuations, and low conversion efficiencies.

The USA Department of Energy’s ARPA-E MARINER program has highlighted offshore macroalgae farming for bioenergy as a strategic opportunity, though commercial viability remains distant. Industry players are evaluating co-products such as biochar and digestate fertilizers to enhance project economics.

Integration into blue carbon strategies and carbon credit systems could further support financial models. As sustainability becomes a central narrative, biofuel-grade seaweed valorization may not drive short-term revenue but positions suppliers for long-term participation in the renewable energy transition.

Worldwide, commercial seaweed sales are expanding strongly, driven by rising demand for plant-derived food, functional foods, and green raw materials. Food and beverages account for the maximum revenue share, where seaweed extracts like agar, carrageenan, and alginate are used as thickeners, stabilizers, and natural preservatives in processed foods, milk products, and beverages.

Seaweed is also finding increasing use in agriculture and animal feed with its high nutritional value, soil conditioning effects, and as a natural plant growth stimulant. The pharmaceutical sector utilizes the bioactive seaweed compounds for wound care, digestion, and anti-inflammatory drugs.

Cosmetics and personal care manufacturers also employ seaweed for its moisturizing, anti-aging, and detoxing properties, particularly in hair care and skincare. With an increasing focus on sustainability, organic stamps of approval, and traceable supply, manufacturers are now investing in sustainable harvesting practices and formulation innovation to meet increasing demand.

The global commercial seaweed market is currently witnessing a spurt in sales and profitability due to the increasing demand for seaweed, a plant-derived ingredient in food, pharmaceuticals, and cosmetic products. Nevertheless, the associated compliance challenges are primarily due to the stringent environmental regulatory laws governing harvesting, processing, and sustainability.

The diverged supply line is another cause of concern. Climate change has reduced seaweed cultivation, and ocean pollution is a further problem. In addition, inconsistent yields from the suppliers have been the other factor causing setbacks in production stability. Insistent reliance on wild harvesting has resulted in increased susceptibility, which has necessitated the investment in controlled farming methods along with resilient sourcing strategies to achieve a consistent supply and long-term sustainability.

The demand for seaweed alternatives is increasing due to rising competition from synthetic and alternative ingredients, as well as the fluctuation of raw material costs. Consumers are turning to organic options, sustainably harvested seaweed, and non-GMO products as alternatives. An innovative and premium-oriented portfolio, together with clean and transparent sourcing of materials, will thus form the core strategy for the manufacturers to stay ahead of the evolving consumer preferences.

The issue of heavy metal contamination, allergens, and product purity also misses the mark when making purchasing decisions. In a health association sector, the essentials attached to implementing rigorous quality control measures, third-party certifications, and clear labeling are the main steps in maintaining trust and credibility.

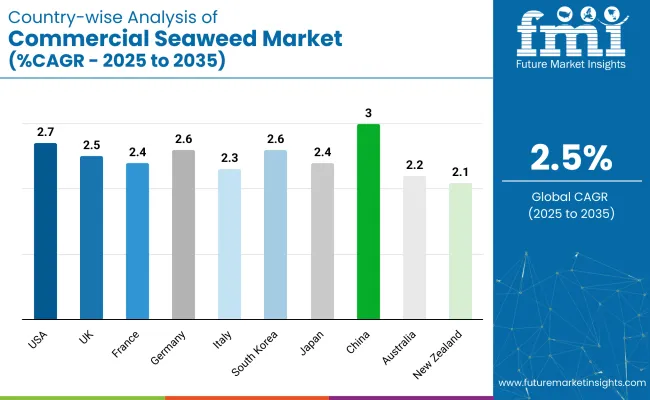

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 2.7% |

| UK | 2.5% |

| France | 2.4% |

| Germany | 2.6% |

| Italy | 2.3% |

| South Korea | 2.6% |

| Japan | 2.4% |

| China | 3.0% |

| Australia | 2.2% |

| New Zealand | 2.1% |

The USA seaweed sales are growing with increasing consumer demand for plant-based substitutes for food and expansion of sustainable aquaculture. Functional foods, which are highly nutritious and high in vitamins and minerals, are a focus of the country, and this is supporting seaweed as part of healthy eating.

Government-led initiatives for sustainable farming are also supporting the industry. Aside from this, the cosmetic and pharmaceutical industries are utilizing the bioactive potential of seaweed for formulation. The rapidly growing demand for substitute biofuels also presented new opportunities, notably for brown seaweed species. Supply chain limitations and advancements toward mass cultivation are, however, posing challenges.

UK's seaweed industry is growing modestly, supported by rising applications in food, cosmetics, and bioplastics. With increasing consumer awareness about sustainability, seaweed packaging options are becoming increasingly popular. The country's cold-water coastline is a perfect habitat for indigenous sea life, including kelp, and investment in seaweed farm cooperatives is driving the industry.

The British government is encouraging research initiatives to find new means of extraction for bioactive compounds that are used in medicine. In spite of these opportunities, the industry is faced with regulatory impediments and the development of infrastructure to improve efficiency in production and address increasing demand.

France's seaweed industry has a long history of utilization of marine resources, especially in Brittany. France leads the world in algae-based biotechnology and is increasingly used in the pharmaceutical, food additive, and agricultural industries.

French companies are investing in environmentally friendly harvesting methods to minimize environmental issues and comply with organic certification requirements. The largest user of seaweed extracts is the cosmetics industry, which utilizes it in skincare and anti-aging treatments. Nevertheless, changing ocean conditions and regulatory complexity challenge volume increases.

Germany's seaweed industry is growing because of its emphasis on renewable energy, bioplastics, and functional foods. The nation is actively investigating seaweed-based biofuel options through government-sponsored research programs.

Hydrocolloids derived from seaweed for food processing and pharmaceutical applications are also gaining popularity. Germany's investment in controlled-environment aquaculture systems improves production efficiency by reducing the risks associated with wild harvesting. The industry, however, has to counter challenges introduced by high production costs and strict environmental regulations.

Italy's seaweed industry is primarily driven by its use in food applications, especially in traditional Mediterranean cuisine. Increasing demand for plant-based meals has spurred interest in seaweed-added pasta as well as seasonings.

The cosmetics industry is also adding seaweed extracts to cosmetics because of their moisturizing actions. Sustainable collection is being encouraged along coastal areas for the preservation of marine biodiversity. Supply chain constraints and processing plants need to be addressed by the industry in a quest to boost further growth.

South Korea dominates in terms of seaweed consumption and production, with nori (gim) an everyday food. South Korea is developing seaweed-based nutraceuticals from its rich marine biodiversity for high-value extracts. Government incentives are supporting research in bioactive compounds from seaweed for pharmaceutical applications. Food technology innovation is spurring seaweed snack and supplement development. Coastal pollution's environmental impacts are pushing for tougher regulations on cultivation practices.

Japan's seaweed sector is strong thanks to its centuries-old cultural tradition favoring sea-based products. Wakame and kombu are subjected to growing domestic and international demand. Japanese companies are leading research in new patterns of cultivation to increase output and improve efficiency. The government is investing in algal medicine and biofuels to expand applications. However, the sector is confronting climate occurrences that will hit seaweed yields and create supply chain disruption risks.

China is the world's biggest producer and consumer of commercial seaweed. Its extensive coastline and favorable climatic conditions have facilitated the mass production of red and brown seaweeds. Government subsidies and technical support have further given the industry much-needed muscle.

China's seaweed industry is set to grow at an accelerating pace, subject to enhanced use in food, medicine, and agriculture. However, environmental factors and conservation agriculture pressures are driving change towards more environmentally conscious farming practices.

The Australian seaweed industry is expanding with its focus on sustainable aquaculture and carbon capture. Seaweed is researched for livestock methane emission reduction, offering an emerging growth prospect. The cosmetics and nutraceuticals sector utilizes seaweed-based products. Large-scale agricultural plans are supported by public and business investment funding. There are challenges in terms of high cost of production and low domestic end-use compared to Asian markets.

New Zealand's seaweed industry is still in its infancy but has massive potential due to the cleanliness of its marine environment. Local inhabitants are adopting eco-friendly harvesting methods, which are creating economic returns.

The food and beverage industry is exploring seaweed-based food items. Seaweed's ability to provide environmental rehabilitation and carbon sequestration is being researched more and more. Poor infrastructure and awareness of the industry are preventing massive development.

The global commercial seaweed market is growing rapidly, with the food, pharmaceutical, and cosmetic industries increasingly consuming sources of natural, functional ingredients. As these products are being identified for their benefits in nutrition and the environment, strategic players are increasing production and investment in R&D, besides innovative applications for competitiveness.

Strong supply chains, innovations in processing, and strategic partnerships with leading players such as Cargill, DuPont (IFF), CP Kelco, Acadian Seaplants, and Ocean Harvest Technology create groves where these companies focus on diversified seaweed-based ingredients ranging from hydrocolloids (agar, carrageenan, and alginate) to bioactive compounds and plant-based nutritional solutions.

The industrial scenario is changing due to sustainability concerns, regulatory shifts, consumer pull for clean-label plant-based alternatives, and advancement in cultivation techniques whereby controlled ocean farming and land-based aquaculture have helped steady the supply chain with positive impacts on environment affordability. The utility of seaweed continues expanding opportunities, from biofuels to biodegradable packaging and pharmaceutical innovations.

Raw material sourcing, following regulatory frameworks, and technological advancements in seaweed extraction and refinement influence competition. They use sustainable harvest methods, proprietary processing technologies, and direct partnerships with seaweed farmers to offer differentiation. The expansion of this industry will consolidate eco-friendly cultivation and diversification of product applications with regional developments for many years.

The industry is slated to reach USD 12.03 billion in 2025.

The industry is predicted to reach a size of USD 15.40 billion by 2035.

Key companies include Cargill, Incorporated, DuPont de Nemours, Inc., CP Kelco, Gelymar S.A., Acadian Seaplants Limited, Qingdao Gather Great Ocean Algae Industry Group, Seasol International Pty Ltd, Ocean Harvest Technology, Algaia S.A., and FMC Corporation.

China, slated to grow at 3.0% CAGR during the forecast period, is poised for the fastest growth.

Red Seaweed is among the most widely used product types.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brown Commercial Seaweed Market Size and Share Forecast Outlook 2025 to 2035

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA