The brown commercial seaweed market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 47.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. The market maturity curve demonstrates a transition through early adoption, scaling, and consolidation phases, reflecting evolving industry dynamics and increasing global demand for brown seaweed across food, pharmaceutical, and cosmetic applications.

During the early adoption phase leading up to 2025, the market was characterized by selective uptake among niche manufacturers focusing on high-value products such as hydrocolloids and bioactive compounds. Limited processing infrastructure and variability in raw material quality restrained large-scale adoption, keeping the market at USD 20.5 billion. The scaling phase from 2025 to 2030 shows rapid expansion, with the market reaching approximately USD 31.2 billion by 2030. This growth was propelled by technological improvements in extraction and processing, rising awareness of seaweed-derived bioactives, and increasing integration in functional foods and nutraceuticals. Producers expanded operations, while new entrants leveraged innovations to capture growing regional demand, particularly in Asia-Pacific and Europe.

The consolidation phase spanning 2030 to 2035 reflects maturation of production and supply chains, with the market anticipated to reach USD 47.3 billion by 2035. During this period, established players are expected to optimize scale efficiencies, standardize quality, and enhance product portfolios, while emerging markets witness increased participation. This phase underscores broad acceptance of brown seaweed across multiple industrial segments, marking a stabilized adoption lifecycle with incremental innovation driving sustained growth.

| Metric | Value |

|---|---|

| Brown Commercial Seaweed Market Estimated Value in (2025 E) | USD 20.5 billion |

| Brown Commercial Seaweed Market Forecast Value in (2035 F) | USD 47.3 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

Growing awareness of seaweed's nutritional profile, particularly its fiber, antioxidants, and iodine content, has led to increased incorporation in food, pharmaceuticals, and cosmetics. Industry journals and corporate disclosures have pointed to the rising demand for sustainable, plant-based ingredients as a core influence, alongside shifting dietary preferences globally. Additionally, advancements in seaweed processing technologies and vertical farming practices are improving both yield and quality, thus boosting supply capabilities.

Regulatory encouragement for marine-based food innovation and a surge in seaweed-based product development, especially in Asian and European economies, are further contributing to the market’s forward momentum. As environmental sustainability becomes a central theme in food and agricultural policy, the market outlook for brown seaweed remains optimistic, with new opportunities emerging in high-value applications such as nutraceuticals and biodegradable packaging.

The brown commercial seaweed market is segmented by form, end-use, and geographic regions. By form, the brown commercial seaweed market is divided into Dry and Wet. In terms of end-use, the brown commercial seaweed market is classified into Food, Animal Feed, Pharmaceutical, Cosmetics & Personal Care, Biofuels, Bioplastics, Biochemicals, and Biorefineries. Based on form, the brown commercial seaweed market is segmented into Powder and Liquid. Regionally, the brown commercial seaweed industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dry form segment is projected to account for 57.8% of the Brown Commercial Seaweed Market revenue share in 2025, positioning it as the leading form type. This dominance is being driven by the ease of storage, extended shelf life, and cost-efficiency associated with dried seaweed products.

Companies involved in seaweed processing have emphasized the stability of dried forms in logistics and bulk trading, which reduces spoilage and lowers transportation costs. Additionally, the versatility of dried seaweed in downstream processing makes it suitable for further refinement into powder or extract, enhancing its value in multiple applications.

Industry news sources have noted increased usage of dry brown seaweed in the food and animal feed sectors, where consistent quality and long-term usability are essential. These characteristics, combined with scalability in commercial production and compatibility with industrial processing systems, have contributed to the dry form's dominant market share and continued expansion across global supply chains.

The powder form segment is expected to hold 61.2% of the Brown Commercial Seaweed Market revenue share in 2025, making it the dominant processed format. Its leadership is attributed to its high solubility, ease of formulation, and suitability across a range of applications, including functional foods, cosmetics, and pharmaceuticals.

Manufacturers have favored powdered seaweed for its uniform particle size and enhanced bioavailability, which are critical for consistent product performance. The ability to standardize concentrations of bioactive compounds in powdered form has made it preferable for high-value end-use sectors, particularly in personal care and dietary supplements.

Investor presentations and product press materials have identified powder as a key format for export markets due to its compact nature and compatibility with automated manufacturing systems These factors, combined with rising demand for clean-label and plant-based ingredients, have reinforced the segment’s prominent role in shaping market direction.

The food end-use segment is anticipated to lead with 32.4% of the Brown Commercial Seaweed Market revenue share in 2025. This leadership is being supported by growing consumer demand for natural, functional ingredients that contribute to health and wellness. Seaweed’s inherent nutritional value, including essential minerals, low-calorie content, and dietary fiber, has driven its incorporation into soups, snacks, condiments, and meat alternatives.

Food manufacturers are increasingly leveraging brown seaweed to meet clean-label requirements and cater to vegetarian and vegan preferences. Additionally, government programs and food safety authorities have encouraged the inclusion of seaweed in diets for its potential role in addressing iodine deficiency and promoting digestive health.

The scalability of brown seaweed farming and its compatibility with diverse food systems have further strengthened its position in the food segment. These trends have underpinned the segment’s sustained growth and confirmed its central role in commercial seaweed utilization.

The market has expanded due to increasing utilization in food, pharmaceuticals, cosmetics, and bioindustrial applications. Brown seaweeds, including kelp, wakame, and kombu, are valued for alginate extraction, high mineral content, and functional properties in dietary supplements, thickening agents, and bio-based materials. Growth has been driven by rising consumer preference for natural ingredients, health-focused products, and sustainable sourcing. Technological advancements in harvesting, processing, and value-added product formulation have enhanced product quality and usability, reinforcing adoption across global industrial, nutritional, and cosmetic sectors.

Brown commercial seaweed has been increasingly adopted due to its functional versatility in industrial, food, and pharmaceutical applications. Alginates, fucoidans, and laminarins extracted from brown seaweeds are used as thickeners, stabilizers, and gelling agents in processed foods, confectionery, and beverages. Pharmaceutical applications leverage bioactive compounds for anti-inflammatory, antioxidant, and prebiotic properties in dietary supplements and nutraceuticals. Cosmetic formulations utilize brown seaweed extracts for moisturizing, anti-aging, and skin-soothing properties. Additionally, bio-based materials derived from brown seaweed, including biodegradable films and hydrogels, are applied in packaging and medical industries. Continuous research in extraction techniques and functional optimization has increased solubility, purity, and bioavailability of brown seaweed derivatives. These applications have reinforced market demand, highlighting the importance of brown seaweed as a multifunctional raw material across diverse industrial sectors.

Sustainable cultivation and harvesting practices have been pivotal in the growth of the brown commercial seaweed market. Seaweed farms utilize coastal waters and offshore cultivation systems, requiring minimal freshwater and land resources compared to terrestrial crops. Environmental benefits include carbon sequestration, nutrient absorption, and reduced ocean acidification, making brown seaweed a preferred sustainable raw material. Regulations and certifications promoting eco-friendly harvesting and traceability have strengthened consumer and industrial confidence. In addition, partnerships between farmers, processors, and product manufacturers have optimized supply chains, ensuring consistent availability of high-quality raw materials. Sustainability practices have reinforced market growth by aligning brown seaweed production with environmental, social, and governance principles while meeting rising demand for natural and eco-conscious products globally.

Health and nutrition trends have significantly influenced adoption of brown commercial seaweed. Rich in dietary fibers, minerals, and bioactive compounds, brown seaweed is incorporated into functional foods, beverages, dietary supplements, and nutraceutical products. Increasing awareness of gut health, immunity support, and metabolic benefits has elevated consumer preference for seaweed-based formulations. Prebiotic and antioxidant properties of alginates and fucoidans have driven inclusion in health-focused products such as protein bars, smoothies, and capsules. Population segments seeking plant-based, low-calorie, and nutrient-dense protein alternatives have further contributed to demand. Nutritional labeling, health endorsements, and clinical studies have reinforced product credibility. The rising health-conscious consumer base has positioned brown seaweed as a vital ingredient in functional nutrition and wellness applications globally.

Technological innovations have enhanced processing, extraction, and value-added product development in the brown commercial seaweed market. Automated harvesting techniques, drying technologies, and cold-water extraction methods have increased yield, purity, and bioactive retention. Enzymatic and membrane-based extraction processes have improved solubility, functional properties, and stability of seaweed-derived ingredients. Formulation technologies have enabled incorporation into beverages, gels, supplements, and biodegradable packaging materials while maintaining efficacy and sensory quality. Quality control, traceability, and certification systems have strengthened industrial adoption and reduced contamination risks. Integration of processing technologies with supply chain management has ensured scalable production and consistent product standards. These technological improvements have expanded applications, reinforced market competitiveness, and supported sustainable growth across food, pharmaceutical, cosmetic, and bioindustrial sectors globally.

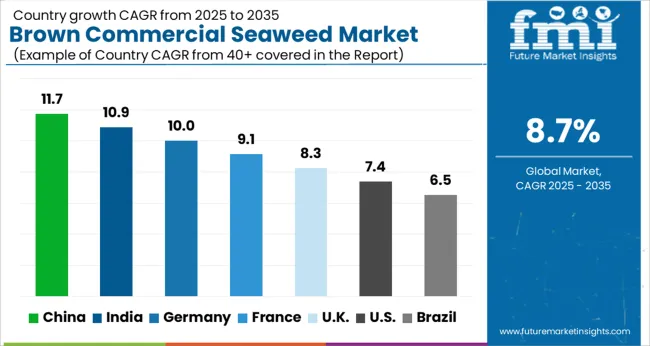

The market is expected to grow at a CAGR of 8.7% between 2025 and 2035, driven by rising demand in food, pharmaceuticals, and cosmetic applications, along with sustainable aquaculture practices. China leads with an 11.7% CAGR, propelled by large-scale seaweed farming and processing innovations. India follows at 10.9%, supported by expanding coastal cultivation and industrial utilization. Germany, at 10.0%, benefits from advanced extraction technologies and bio-based product applications. The UK, growing at 8.3%, focuses on research-driven product development and sustainable sourcing. The USA, at 7.4%, sees steady demand from nutraceuticals and functional food sectors. This report covers 40+ countries, with the top markets highlighted here for reference.

The industry in China is expected to expand at a CAGR of 11.7% from 2025 to 2035, driven by high demand in food additives, biofuels, and pharmaceutical applications. Investments in large-scale cultivation and sustainable harvesting techniques are supporting supply chain efficiency. Domestic manufacturers are adopting automated processing technologies and high-yield seaweed strains to meet industrial requirements. The expansion of nutraceuticals and functional foods is further boosting demand for alginates and other seaweed derivatives. China’s strategic focus on marine biotechnology and export-oriented production positions the country as a global hub for brown commercial seaweed applications.

India is forecast to grow at a CAGR of 10.9% during 2025 to 2035, supported by expanding coastal aquaculture and increasing utilization in food, feed, and cosmetic industries. Regional initiatives are promoting cultivation in eastern and southern coastal zones, while companies are adopting processing techniques for higher extraction yields. Rising interest in plant-based proteins and bioactive compounds is driving industrial uptake. Export opportunities and collaborations with biotechnology firms are enhancing market potential.

Germany is expected to expand at a CAGR of 10.0% from 2025 to 2035, propelled by high adoption in food processing, pharmaceuticals, and bio-based materials. Manufacturers are investing in eco-friendly extraction and purification methods to ensure product quality. The demand for plant-based gelling agents and thickeners is rising in processed foods and dietary supplements. Collaborative research projects between marine institutes and biotechnology companies are accelerating product innovation and enhancing application in functional foods and sustainable packaging solutions.

The United Kingdom is anticipated to grow at a CAGR of 8.3% from 2025 to 2035, driven by research on marine biomass and increased incorporation into food, cosmetic, and nutraceutical products. Coastal aquaculture expansion and government-backed sustainable harvesting initiatives are boosting supply. Companies are focusing on premium quality seaweed extracts and novel formulations to meet consumer and industrial demand. Strategic collaborations with European biotech firms are fostering product development and market diversification.

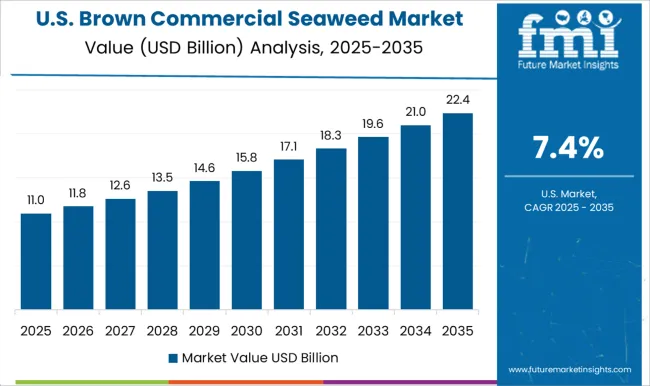

The United States market is projected to expand at a CAGR of 7.4% over 2025 to 2035, supported by growing interest in sustainable food additives, dietary supplements, and bio-based materials. Investment in processing technologies and large-scale cultivation along the Atlantic and Pacific coasts is enhancing supply. The demand for carrageenan, alginates, and other derivatives in functional foods and cosmetic products is increasing. Research in marine biotechnology and collaborations with domestic and international suppliers are expected to drive long-term growth.

Acadian Seaplants Ltd. and CP Kelco are recognized for large-scale extraction and production of hydrocolloids such as alginate and carrageenan, delivering consistent quality for industrial clients. W Hydrocolloids, Inc. and Marcel Carrageenan specialize in high-purity extracts, catering to specific functional requirements in food stabilization and pharmaceutical formulations.

Biostadt India Limited, Algea AS, and Mara Seaweed emphasize sustainable sourcing practices and regional cultivation strategies to expand supply chains, targeting both domestic and international markets. Pacific Harvest and Aquatic Chemicals focus on product diversification, offering powdered, granulated, and liquid seaweed extracts to meet agricultural and aquaculture demands. Chase Organics GB Limited, Seaweed Energy Solutions AS, and Seasol International concentrate on high-value applications, including bio-stimulants, nutrient-rich fertilizers, and functional additives.

Emerging players are increasingly investing in research and development to optimize extraction techniques and improve product functionality, enhancing market competitiveness. Entry barriers remain moderate due to cultivation complexities, regulatory compliance, and processing technology requirements, encouraging established players to maintain technological superiority and expand market share while new entrants explore niche applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.5 Billion |

| Form | Dry and Wet |

| End-use | Food, Animal Feed, Pharmaceutical, Cosmetics & Personal Care, Biofuels, Bioplastics, Biochemicals, and Biorefineries |

| Form | Powder and Liquid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Acadian Seaplants Ltd., W Hydrocolloids, Inc., Marcel Carrageenan, CP Kelco, Biostadt India Limited, Algea AS, Mara Seaweed, Pacific Harvest, Aquatic Chemicals, Chase Organics GB Limited, Seaweed Energy Solutions AS, Seasol International, and Indigrow Ltd. |

| Additional Attributes | Dollar sales by seaweed type and end-use application, demand dynamics across food, pharmaceuticals, cosmetics, and biofuel industries, regional trends in cultivation and consumption across Asia-Pacific, Europe, and North America, innovation in extraction techniques, value-added processing, and functional ingredient development, environmental impact of large-scale harvesting, marine ecosystem balance, and sustainable farming practices, and emerging use cases in plant-based food products, nutraceutical formulations, and biodegradable packaging solutions. |

The global brown commercial seaweed market is estimated to be valued at USD 20.5 billion in 2025.

The market size for the brown commercial seaweed market is projected to reach USD 47.3 billion by 2035.

The brown commercial seaweed market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in brown commercial seaweed market are dry and wet.

In terms of end-use, food segment to command 32.4% share in the brown commercial seaweed market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Brown Rice Market

Brown HT Market

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA