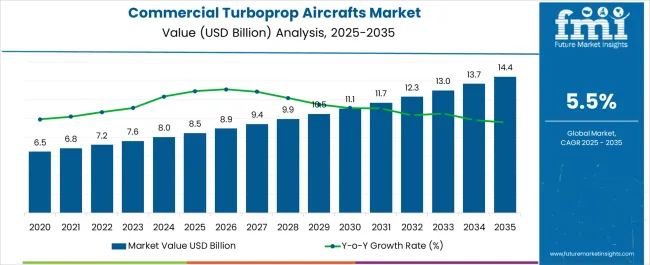

The Commercial Turboprop Aircrafts Market is estimated to be valued at USD 8.5 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Turboprop Aircrafts Market Estimated Value in (2025 E) | USD 8.5 billion |

| Commercial Turboprop Aircrafts Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Commercial Turboprop Aircrafts market is witnessing steady expansion, primarily driven by the growing demand for regional connectivity, fuel-efficient operations, and cost-effective air travel. Turboprops are increasingly favored in short-haul and regional routes due to their lower fuel consumption compared to jets, providing airlines with a competitive edge in operational cost management. Rising passenger traffic in emerging economies and government initiatives supporting regional aviation infrastructure are further supporting market development.

Additionally, fleet modernization programs undertaken by carriers are accelerating the adoption of next-generation turboprop aircrafts equipped with advanced avionics, improved aerodynamics, and enhanced passenger comfort. Environmental concerns and strict emission regulations are also influencing the shift toward turboprop aircrafts, as they deliver lower carbon footprints compared to jet engines.

Growing interest from leasing companies in turboprop models is further boosting accessibility for regional operators As demand for efficient, reliable, and sustainable air travel grows, the Commercial Turboprop Aircrafts market is expected to maintain positive momentum, positioning itself as a crucial contributor to global regional aviation over the next decade.

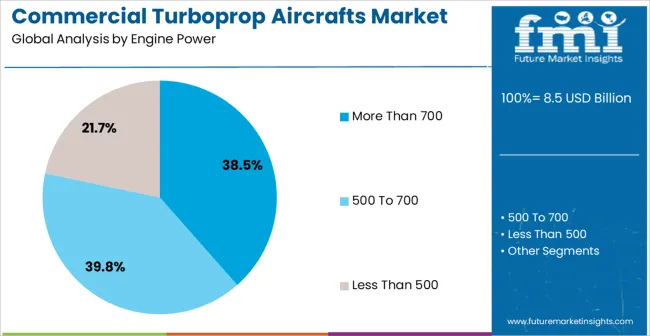

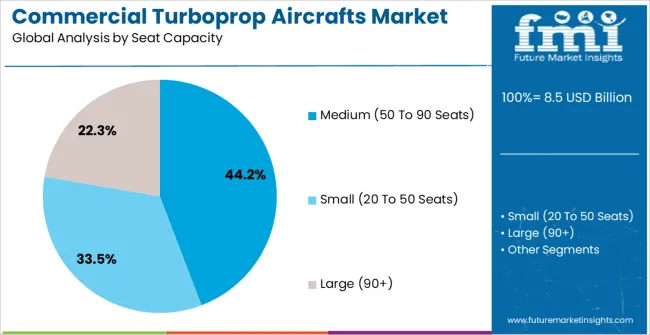

The commercial turboprop aircrafts market is segmented by engine power, seat capacity, and geographic regions. By engine power, commercial turboprop aircrafts market is divided into More Than 700, 500 To 700, and Less Than 500. In terms of seat capacity, commercial turboprop aircrafts market is classified into Medium (50 To 90 Seats), Small (20 To 50 Seats), and Large (90+). Regionally, the commercial turboprop aircrafts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The more than 700 engine power segment is projected to hold 38.5% of the Commercial Turboprop Aircrafts market revenue in 2025, highlighting its significant contribution. This segment is gaining traction due to its ability to support aircraft operations on longer regional routes while maintaining efficiency and reliability. Higher engine power enhances payload capacity, operational flexibility, and performance in diverse climatic and geographical conditions, which is vital for regional operators serving remote and underserved airports.

Airlines are increasingly preferring turboprop aircrafts with higher engine power to optimize fleet utilization, ensure fuel efficiency, and improve operational profitability. Moreover, the segment’s growth is supported by rising demand for turboprops in both developed and emerging markets, where reliability and performance in short-haul networks are key requirements.

The ability to balance strong power output with lower operational costs makes this category especially attractive for regional carriers As air travel demand continues to expand globally, aircrafts in the more than 700 engine power segment are expected to maintain a strong position in the market.

The medium seat capacity segment, ranging from 50 to 90 seats, is anticipated to account for 44.2% of the market revenue in 2025, making it the leading category in terms of passenger capacity. Airlines are increasingly adopting aircrafts in this segment due to their suitability for regional routes, where balancing passenger demand with cost efficiency is essential. The medium seat capacity turboprops are ideal for short-haul connectivity, particularly in regions with growing urbanization and rising middle-class populations seeking affordable travel options.

These aircrafts provide airlines with flexibility to operate on both high-demand routes and underserved areas, ensuring optimal load factors and profitability. Enhanced cabin comfort, modern in-flight amenities, and efficient operating costs are further supporting their widespread adoption.

The segment’s dominance is also reinforced by the active replacement of aging fleets with newer, technologically advanced turboprops designed to reduce emissions and enhance fuel economy As regional air travel demand expands, the medium seat capacity segment is expected to remain at the forefront of the market, providing sustainable growth opportunities for operators worldwide.

In recent years, the regional aviation industry has evolved rapidly, both from a technological and geographical point of view and from a business perspective as well. Not only are mega cities connecting the world, but there is immense potential from tertiary and secondary airports as well.

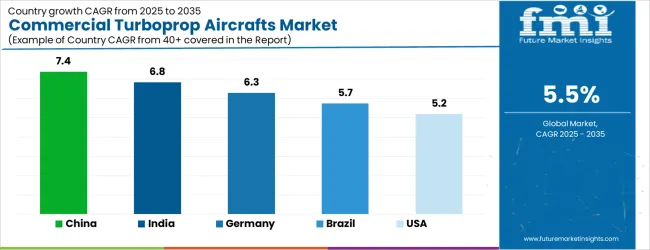

Consequently, turboprops aircrafts play an important role in developing and exploring new routes, thereby promoting local community development. A turboprop is a turbine engine that drives an aircraft propeller. These type of engines are used for short distances and also help in reducing aviation emissions. In the next twenty years, China is expected to possess a significant market opportunity for commercial turboprop aircrafts.

These aircrafts require relatively simpler infrastructure as compared to jets. In many small countries across the world, poor airstrip/airport infrastructure prohibits the use of big planes. Additionally, regional airports are often the only choice for turboprop operators as many big/major airports suffering from congestion and delays have prohibited turboprop aircrafts in favor of jet aircrafts.

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.8% |

| Germany | 6.3% |

| Brazil | 5.7% |

| USA | 5.2% |

| UK | 4.6% |

| Japan | 4.1% |

The Commercial Turboprop Aircrafts Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Commercial Turboprop Aircrafts Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Commercial Turboprop Aircrafts Market is estimated to be valued at USD 3.0 billion in 2025 and is anticipated to reach a valuation of USD 3.0 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 400.2 million and USD 290.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.5 Billion |

| Engine Power | More Than 700, 500 To 700, and Less Than 500 |

| Seat Capacity | Medium (50 To 90 Seats), Small (20 To 50 Seats), and Large (90+) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

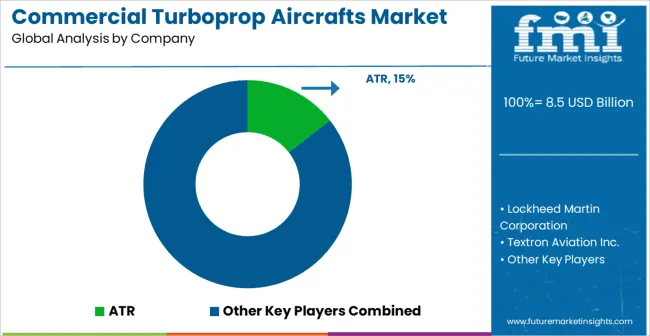

| Key Companies Profiled | ATR, Lockheed Martin Corporation, Textron Aviation Inc., Pilatus Aircraft Ltd., Airbus SE, Embraer S.A., De Havilland Aircraft of Canada Limited, DAHER, PiaggioAero Industries S.p.a., Piper Aircraft, Inc., Air Tractor Inc., and Thrush Aircraft, LLC |

The global commercial turboprop aircrafts market is estimated to be valued at USD 8.5 billion in 2025.

The market size for the commercial turboprop aircrafts market is projected to reach USD 14.4 billion by 2035.

The commercial turboprop aircrafts market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in commercial turboprop aircrafts market are more than 700, 500 to 700 and less than 500.

In terms of seat capacity, medium (50 to 90 seats) segment to command 44.2% share in the commercial turboprop aircrafts market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA