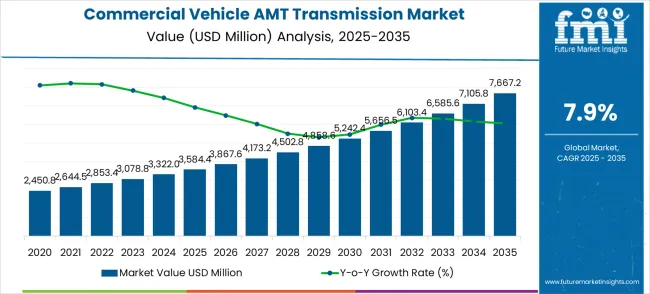

The commercial vehicle AMT transmission market is expected to reach USD 3,584.4 million in 2025 and expand to USD 7,667.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.9%. This robust growth is driven by increasing adoption of automated manual transmissions in commercial vehicles to improve fuel efficiency, reduce driver fatigue, and enhance overall vehicle performance. Rising demand for logistics and transportation services, coupled with stricter emission regulations in emerging and developed markets, is encouraging fleet operators to transition from manual to AMT systems. The market trajectory indicates that AMT technology will become a standard feature in commercial vehicles, offering a balance between performance, cost-effectiveness, and compliance with environmental norms.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3,584.4 million |

| Forecast Value in (2035F) | USD 7,667.2 million |

| Forecast CAGR (2025 to 2035) | 7.9% |

A key factor fueling market expansion is the focus on operational efficiency, fuel savings, and driver comfort in commercial fleets. Year-on-year (YoY) growth demonstrates a steady upward trend, with market values rising from USD 2,450.8 million in 2023 to USD 3,584.4 million in 2025, and continuing to increase significantly over the forecast period. The adoption of AMT systems reduces gear shifting errors and maintenance costs while improving vehicle uptime, which is critical for fleet profitability. Partnerships between transmission manufacturers and vehicle OEMs are accelerating the availability of AMT-equipped vehicles across various commercial segments, including buses, trucks, and delivery vans. Technological improvements in clutch control, software calibration, and integration with telematics further strengthen market adoption.

Looking ahead, the commercial vehicle AMT transmission market is expected to maintain strong growth, with market values reaching USD 5,242.4 million by 2030 and eventually USD 7,667.2 million by 2035, reflecting a CAGR of 7.9%. Market growth curve analysis indicates a consistent and accelerating upward trajectory driven by increasing fleet modernization, rising fuel costs, and regulatory incentives for low-emission vehicles. The shift toward AMT in commercial vehicles is supported by the combination of cost efficiency, reduced emissions, and enhanced driver productivity. Overall, the market outlook points to substantial long-term opportunities, with AMT systems increasingly becoming the preferred transmission choice for commercial vehicles globally, fostering safer, more efficient, and environmentally friendly transportation networks.

Market expansion is being supported by the exponential growth of commercial vehicle electrification and the corresponding demand for advanced transmission technologies that can support efficient power delivery, enhanced fuel economy, and improved driver experience in commercial vehicle operations. Modern fleet operators are increasingly focused on transmission solutions that provide automated operation benefits without the complexity and cost of fully automatic transmissions. AMT transmissions' proven ability to deliver efficiency, reliability, and cost-effectiveness makes them essential drivetrain components for commercial vehicle performance optimization and fleet operational efficiency initiatives.

The growing emphasis on driver shortage mitigation and operational efficiency is driving demand for transmission systems that can reduce driver fatigue, improve vehicle handling, and support automated driving assistance technologies. Fleet preference for transmission solutions that combine manual transmission durability with automatic transmission convenience is creating opportunities for innovative AMT implementations. The rising influence of environmental regulations and fuel economy standards is also contributing to increased adoption of AMT transmissions that can provide optimized gear shifting patterns and improved fuel consumption performance.

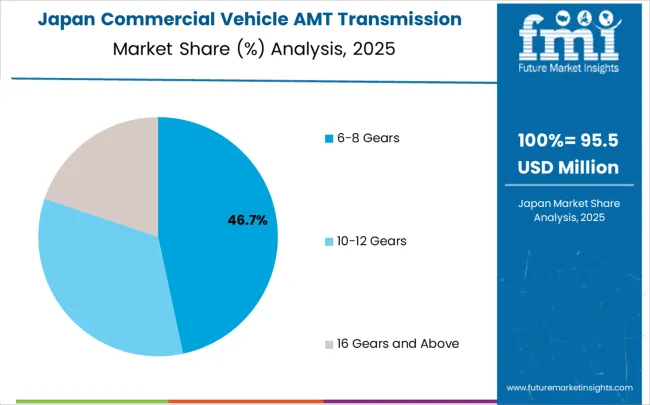

The market is segmented by gear configuration and application. By gear configuration, the market is divided into 6-8 gears, 10-12 gears, 16 gears and above, and others. Based on application, the market is categorized into medium and heavy trucks, buses, and light commercial vehicles.

The 6-8 gears segment is projected to account 55% market share of the commercial vehicle AMT transmission market in 2025, reaffirming its position as the leading gear configuration category. 6-8 gear AMT systems increasingly attract commercial vehicle manufacturers for their optimal balance between performance characteristics, fuel efficiency benefits, and cost-effectiveness for various commercial vehicle applications. This gear configuration's versatility and proven reliability directly address the operational and economic requirements for commercial vehicle transmission systems across different vehicle categories.

This gear configuration segment forms the foundation of AMT adoption, as it represents the transmission category with the greatest appeal for medium-duty commercial vehicles requiring efficient power delivery without excessive complexity. Fleet investments in balanced performance and cost optimization strategies continue to strengthen adoption among 6-8 gear AMT users. With operators prioritizing reliable and efficient transmission options, 6-8 gear systems align with both performance requirements and budget constraints, making them the central component of commercial vehicle AMT market growth strategies.

Medium and heavy trucks are projected to represent 65% market share for the application segment of commercial vehicle AMT transmission demand in 2025, underscoring their critical role in driving market growth and technology adoption. Medium and heavy truck operators prefer AMT solutions for their operational efficiency, fuel economy benefits, and ability to reduce driver training requirements while maintaining transmission durability. Positioned as essential drivetrain technology for commercial transportation, AMT transmissions offer both performance advantages and operational cost benefits for freight and logistics applications.

The segment is supported by continuous expansion in freight transportation demand and the growing recognition of AMT benefits that enable optimized vehicle performance and reduced operational costs. Additionally, transmission manufacturers are investing in heavy-duty AMT development to support commercial vehicle requirements and long-haul transportation applications. As commercial transportation becomes more efficiency-focused and driver-centric, medium and heavy trucks will continue to dominate AMT utilization while supporting market expansion and technology advancement.

The commercial vehicle AMT transmission market is advancing rapidly due to changing commercial vehicle technology requirements and increasing demand for automated transmission solutions that support operational efficiency and driver comfort. However, the market faces challenges, including higher initial costs compared to manual transmissions, concerns about system complexity and maintenance requirements, and resistance from traditional commercial vehicle operators accustomed to manual transmission systems. Innovation in transmission control technology and integration capabilities continues to influence market development and adoption patterns.

The expanding commercial vehicle electrification trends and adoption of automated driving assistance technologies are enabling AMT transmissions to support advanced vehicle systems where traditional manual transmissions cannot provide optimal integration with electric powertrains and autonomous driving features. Electrification trends provide enhanced market opportunities while allowing more sophisticated transmission control and energy management across various commercial vehicle configurations. Organizations are increasingly recognizing the competitive advantages of AMT systems for electric and hybrid commercial vehicle applications.

Modern AMT transmission providers are incorporating advanced connectivity features and predictive maintenance capabilities to enhance system appeal and address fleet operator concerns about maintenance costs and system reliability. These technological enhancements improve transmission value while enabling new market segments, including telematics-enabled fleets and data-driven transportation operations requiring enhanced system monitoring and optimization capabilities. Advanced connectivity integration also allows AMT systems to differentiate from traditional transmissions while supporting fleet management and operational efficiency initiatives.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| Brazil | 8.3% |

| USA | 7.5% |

| UK | 6.7% |

| Japan | 5.9% |

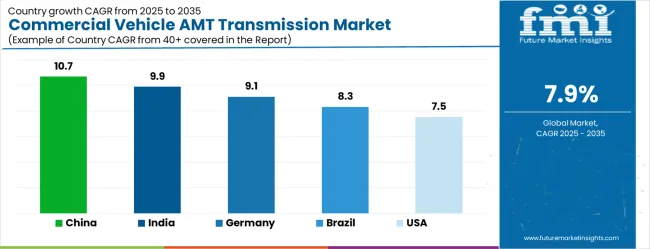

The commercial vehicle AMT transmission market is experiencing robust growth globally, with China leading at a 10.7% CAGR through 2035, driven by massive commercial vehicle production expansion, government support for advanced transmission technologies, and rapidly growing logistics and transportation infrastructure development. India follows closely at 9.9%, supported by expanding commercial vehicle manufacturing, increasing adoption of automated transmission technologies, and growing emphasis on fuel efficiency and driver comfort. Germany shows strong growth at 9.1%, emphasizing advanced transmission technology development and premium commercial vehicle applications. Brazil records 8.3%, focusing on commercial vehicle market expansion and transmission technology adoption. The United States shows 7.5% growth, prioritizing advanced transmission systems and fleet efficiency optimization. The United Kingdom demonstrates 6.7% growth, supported by commercial vehicle modernization and efficiency standards. Japan shows 5.9% growth, emphasizing precision engineering and technology integration.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The commercial vehicle AMT transmission market in China is expected to experience strong growth with a CAGR of 10.7 percent through 2035., driven by massive commercial vehicle manufacturing expansion and advancing infrastructure development requiring efficient transportation solutions. The country's leadership in commercial vehicle production and strong government support for advanced automotive technologies are creating significant demand for sophisticated AMT transmission systems. Major domestic and international transmission manufacturers are establishing comprehensive AMT production capabilities to serve both domestic markets and global export opportunities.

Commercial vehicle AMT transmissions market in India is expanding at a CAGR of 9.9%, supported by the rapidly developing commercial vehicle manufacturing sector, expanding transportation infrastructure, and increasing adoption of advanced transmission technologies among domestic vehicle manufacturers. The country's growing logistics industry and strong commercial vehicle demand are driving requirements for efficient transmission solutions. International transmission companies and domestic manufacturers are establishing comprehensive development and production capabilities to address the growing demand for AMT transmission systems.

Commercial vehicle AMT transmissions market in Germany is projected to grow at a CAGR of 9.1% through 2035, emphasizing advanced transmission technology development and premium commercial vehicle applications within Europe's leading automotive engineering hub. The country's established automotive industry and commitment to technological excellence are driving sophisticated transmission system requirements. German commercial vehicle manufacturers and transmission specialists consistently demand high-precision AMT systems that meet stringent performance standards and provide superior integration capabilities with advanced vehicle management systems.

Revenue from commercial vehicle AMT transmissions in Brazil is expanding at a CAGR of 8.3% through 2035, focusing on commercial vehicle market expansion and transmission technology adoption across Latin America's largest automotive market. Brazilian organizations value cost-effective transmission solutions, operational reliability, and proven performance characteristics, positioning AMT systems as essential components for modern commercial vehicle applications. The country's expanding logistics sector and increasing commercial vehicle demand are creating sustained requirements for advanced transmission technologies.

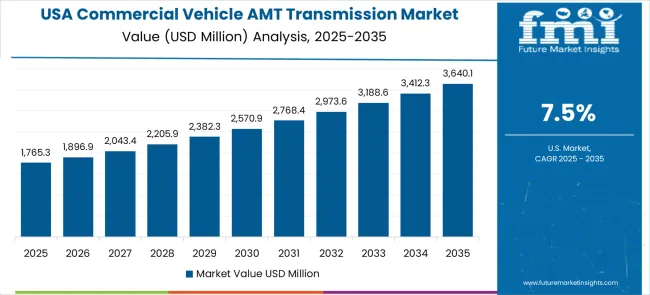

Demand for commercial vehicle AMT transmissions in the United States is projected to grow at a CAGR of 7.5% through 2035, driven by advanced transmission system development, comprehensive fleet efficiency optimization programs, and established regulatory frameworks supporting commercial vehicle performance standards. American companies prioritize operational efficiency, technological advancement, and regulatory compliance, making AMT transmission systems a strategic choice for commercial fleet applications. The market benefits from mature commercial vehicle infrastructure and sophisticated technology requirements.

Commercial vehicle AMT transmissions market in the United Kingdom is expanding at a CAGR of 6.7% through 2035, supported by commercial vehicle modernization programs, established automotive industry expertise, and growing commitment to transportation efficiency and emissions reduction. British organizations value regulatory compliance, technological sophistication, and operational reliability, positioning AMT transmission systems as essential technology for modern commercial vehicle applications.

Commercial vehicle AMT transmissions in Japan is projected to grow at a CAGR of 5.9% through 2035, emphasizing precision engineering excellence, advanced quality control standards, and comprehensive technology integration aligned with Japanese automotive manufacturing traditions. Japanese organizations prioritize technological precision, reliability performance, and long-term operational durability, making AMT transmission systems a strategic choice for premium commercial vehicle applications. The market is supported by sophisticated automotive infrastructure and established engineering expertise.

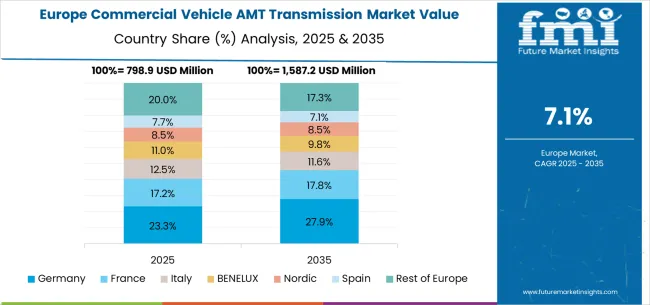

The commercial vehicle AMT transmission market in Europe is projected to grow from USD 892.4 million in 2025 to USD 1,647.3 million by 2035, registering a CAGR of 6.3% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, projected to reach 32.1% by 2035, supported by its advanced automotive engineering capabilities and major commercial vehicle manufacturers including MAN, Mercedes-Benz, and Scania operations.

The United Kingdom follows with a 19.8% share in 2025, projected to reach 20.4% by 2035, driven by comprehensive fleet modernization programs and increasing adoption of automated transmission technologies in commercial transportation sectors. France holds a 16.9% share in 2025, expected to reach 17.2% by 2035 due to expanding commercial vehicle production and transmission technology development initiatives. Italy commands a 13.7% share, while Spain accounts for 9.1% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 9.3% to 10.1% by 2035, attributed to increasing AMT adoption in Nordic countries and emerging Eastern European commercial vehicle markets implementing advanced drivetrain technologies.

The commercial vehicle AMT transmission market is characterized by competition among established automotive transmission manufacturers, specialized commercial vehicle drivetrain providers, and emerging technology-focused transmission companies. Companies are investing in advanced transmission control systems, electrification integration, connectivity technology development, and comprehensive commercial vehicle-focused solutions to deliver efficient, reliable, and technologically advanced AMT transmission experiences. Innovation in gear control algorithms, integration with vehicle management systems, and predictive maintenance capabilities is central to strengthening market position and customer loyalty.

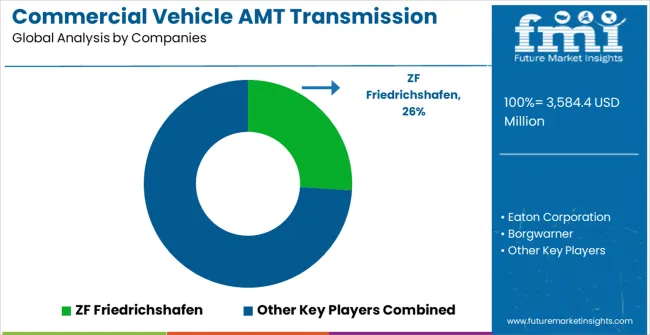

ZF Friedrichshafen leads the market with significant global presence, offering comprehensive AMT transmission solutions with a focus on advanced engineering capabilities and extensive commercial vehicle application expertise. Eaton Corporation provides robust commercial-focused AMT systems with emphasis on durability and fleet operational requirements. Borgwarner delivers innovative transmission technologies with a focus on electrification integration and advanced control systems. Allison Transmission specializes in heavy-duty automatic and AMT solutions with premium performance positioning.

HYUNDAI TRANSYS focuses on integrated powertrain solutions with emphasis on commercial vehicle applications and cost-effectiveness. SAIC provides comprehensive automotive transmission systems with a focus on domestic market leadership and technology development. Chongqing Tsingshan offers specialized transmission solutions for commercial vehicle manufacturers. Zhejiang Wanliyang focuses on gear technology and transmission component manufacturing. Fast Gear specializes in heavy-duty transmission solutions with emphasis on reliability and performance optimization.

Automated Manual Transmission (AMT) technology is transforming commercial vehicle operations by bridging the gap between manual transmission durability and automatic transmission convenience. With the market projected to grow from USD 3.58 billion in 2025 to USD 7.67 billion by 2035 at a 7.9% CAGR, AMT systems offer critical advantages, including improved fuel efficiency, reduced driver fatigue, lower maintenance costs compared to full automatics, and seamless integration with emerging electric and autonomous vehicle technologies. Accelerating market adoption requires coordinated efforts across government policy makers, industry standards organizations, OEMs and technology developers, suppliers and fleet operators, and financial enablers.

How Governments Could Accelerate AMT Adoption and Industry Development?

Fleet Modernization Incentives: Establish tax credits, depreciation benefits, or grants for commercial fleet operators upgrading to AMT-equipped vehicles, particularly targeting small and medium logistics companies that represent significant adoption potential but face capital constraints.

R&D and Skills Development: Fund research programs focused on AMT integration with electric powertrains, autonomous driving systems, and predictive maintenance technologies. Invest in technical education programs, training mechanics and fleet technicians on AMT diagnostics, maintenance, and optimization procedures.

Infrastructure and Testing Support: Develop specialized testing facilities for AMT validation under various commercial vehicle operating conditions, and create regulatory frameworks that expedite approval processes for new AMT technologies while ensuring safety and emissions compliance.

Public Procurement Leadership: Mandate or incentivize AMT adoption in government commercial vehicle fleets (postal services, municipal trucks, public transportation) to demonstrate technology benefits and create early-stage market demand that supports economies of scale.

Trade and Export Facilitation: Establish favorable trade policies for AMT component imports/exports and provide support for domestic manufacturers to access global markets, particularly in high-growth regions like China (10.7% CAGR) and India (9.9% CAGR).

How Industry Bodies Could Strengthen Market Development?

Technical Standards and Certification: Develop comprehensive AMT performance standards covering fuel efficiency metrics, durability benchmarks, connectivity protocols, and integration requirements with telematics systems to enable consistent quality comparisons across suppliers.

Market Intelligence and Education: Lead industry research on total cost of ownership benefits, driver productivity improvements, and fleet operational efficiency gains from AMT adoption. Publish case studies demonstrating successful implementations across different commercial vehicle applications.

Cross-Industry Collaboration: Facilitate partnerships between AMT manufacturers, commercial vehicle OEMs, fleet management software providers, and telematics companies to accelerate integrated solution development and market-ready offerings.

Global Market Access: Organize international trade missions and buyer-supplier forums connecting AMT manufacturers with fleet operators in emerging markets, particularly focusing on the Asia-Pacific region, which shows the strongest growth potential.

Technology Roadmapping: Coordinate industry-wide planning for next-generation AMT features, including AI-powered shift optimization, vehicle-to-vehicle communication integration, and compatibility with hydrogen fuel cell commercial vehicles.

How OEMs and Technology Developers Could Strengthen the Ecosystem?

Integrated Powertrain Solutions: Develop AMT systems specifically optimized for electric and hybrid commercial vehicles, including regenerative braking integration, battery management coordination, and thermal management systems that maximize overall powertrain efficiency.

Smart Transmission Technology: Incorporate machine learning algorithms that adapt shifting patterns based on route conditions, load characteristics, and driver preferences, while integrating with fleet management systems for predictive maintenance and performance optimization.

Modular Design Platforms: Create scalable AMT architectures that can be efficiently adapted across different gear configurations (6-8, 10-12, 16+ gears) and vehicle applications (light commercial, medium/heavy trucks, buses) to reduce development costs and accelerate time-to-market.

Connectivity and Data Analytics: Develop comprehensive telematics integration that provides real-time transmission performance monitoring, fuel efficiency tracking, and predictive failure analysis to help fleet operators maximize AMT value and minimize operational disruptions.

Cost Engineering: Focus on manufacturing process innovations and component standardization to reduce AMT system costs compared to traditional automatic transmissions while maintaining superior performance characteristics that justify a premium over manual transmissions.

How Suppliers and Fleet Operators Could Navigate Market Evolution?

Service and Support Infrastructure: Establish comprehensive service networks with AMT-trained technicians, diagnostic equipment, and parts availability to address fleet operator concerns about maintenance complexity and ensure minimal vehicle downtime.

Flexible Financing Solutions: Develop leasing programs, performance-based contracts, and total-cost-of-ownership models that help fleet operators access AMT technology without significant upfront capital investment, particularly important for smaller operators.

Application-Specific Optimization: Offer customized AMT configurations for different commercial vehicle segments - prioritizing fuel economy for long-haul trucking, durability for construction vehicles, and smooth operation for passenger buses and delivery vans.

Data-Driven Value Propositions: Implement comprehensive monitoring systems that track and report AMT performance benefits including fuel savings, driver productivity improvements, reduced maintenance costs, and extended vehicle life to demonstrate clear ROI to fleet decision-makers.

Training and Change Management: Provide comprehensive driver training programs, maintenance workshops, and operational best practices to ensure successful AMT adoption while addressing traditional operator resistance to automated transmission technologies.

How Investors and Financial Enablers Could Unlock Market Value?

Technology Innovation Funding: Support startups and established companies developing next-generation AMT technologies, including AI-powered control systems, advanced materials for improved durability, and integration solutions for autonomous commercial vehicles.

Market Expansion Capital: Finance AMT manufacturing capacity expansion in high-growth markets, particularly in China and India, where commercial vehicle production is rapidly expanding and government policies favor advanced drivetrain technologies.

Fleet Modernization Financing: Develop specialized lending products and lease structures that help commercial fleet operators upgrade to AMT-equipped vehicles, with financing terms reflecting improved fuel efficiency and operational cost benefits.

Supply Chain Investment: Support development of AMT component supplier networks, particularly in emerging markets, to reduce system costs and improve local content capabilities for manufacturers serving domestic and export markets.

ESG-Aligned Investments: Structure investment vehicles that tie returns to measurable outcomes including fleet fuel efficiency improvements, emission reductions, and driver safety enhancements enabled by AMT adoption across commercial transportation sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3,584.4 million |

| Gear Configuration | 6-8 Gears, 10-12 Gears, 16 Gears and Above, Others |

| Application | Medium and Heavy Trucks, Buses, Light Commercial Vehicles |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ZF Friedrichshafen, Eaton Corporation, Borgwarner, Allison Transmission, HYUNDAI TRANSYS, SAIC, Chongqing Tsingshan, Zhejiang Wanliyang, Fast Gear |

| Additional Attributes | Dollar sales by gear configuration and application, regional demand trends, competitive landscape, fleet preferences for automated versus manual transmission systems, integration with vehicle telematics and management systems, innovations in transmission control technology and electrification compatibility for diverse commercial vehicle applications |

The global commercial vehicle AMT transmission market is estimated to be valued at USD 3,584.4 million in 2025.

The market size for the commercial vehicle AMT transmission market is projected to reach USD 7,667.2 million by 2035.

The commercial vehicle AMT transmission market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in commercial vehicle AMT transmission market are 6–8 gears, 10–12 gears, 16 gears & above, and others.

In terms of application, medium and heavy trucks segment to command 65.0% share in the commercial vehicle AMT transmission market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA