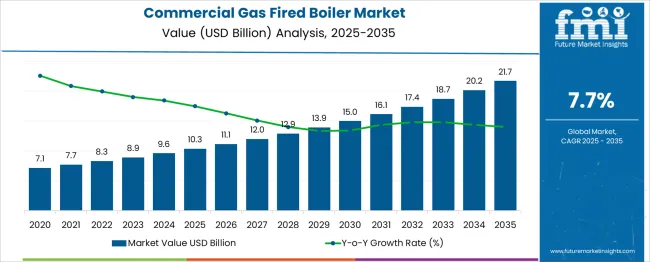

The commercial gas fired boiler market is projected to grow steadily from USD 7.1 billion in 2020 to USD 21.7 billion by 2035, with a compound annual growth rate (CAGR) of 7.7%. This growth is driven by increasing demand for efficient and reliable heating solutions in commercial buildings, supported by rising urbanization and industrialization. The absolute dollar opportunity, representing the incremental market value over the 15-year period, amounts to USD 14.6 billion. This significant rise reflects expanding infrastructure investments and the replacement of older heating systems with more energy-efficient gas fired boilers.

Between 2020 and 2025, the market grows from USD 7.1 billion to USD 10.3 billion, marking an early growth phase fueled by favorable government policies and the push towards reducing carbon emissions. From 2025 to 2035, the market sees even greater expansion, increasing by USD 11.4 billion to reach USD 21.7 billion. This period is characterized by technological advancements, improved boiler efficiency, and increasing adoption in emerging economies.

| Metric | Value |

|---|---|

| Commercial Gas-Fired Boiler Market Estimated Value in (2025 E) | USD 10.3 billion |

| Commercial Gas-Fired Boiler Market Forecast Value in (2035 F) | USD 21.7 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The current market environment is being shaped by a shift toward high-efficiency and low-emission boilers as businesses seek to comply with environmental standards while reducing operational costs.

This trend is further reinforced by government incentives and sustainability initiatives encouraging the adoption of cleaner technologies. Advances in condensing technology and smart control systems have been observed in industry announcements to enhance boiler performance and lifecycle value significantly.

As highlighted in corporate presentations and press statements, rising demand from healthcare, education, and commercial real estate sectors has contributed to consistent market expansion. Future opportunities are expected to emerge from the growing emphasis on building energy codes and the replacement of outdated heating infrastructure with advanced systems capable of meeting both economic and environmental objectives.

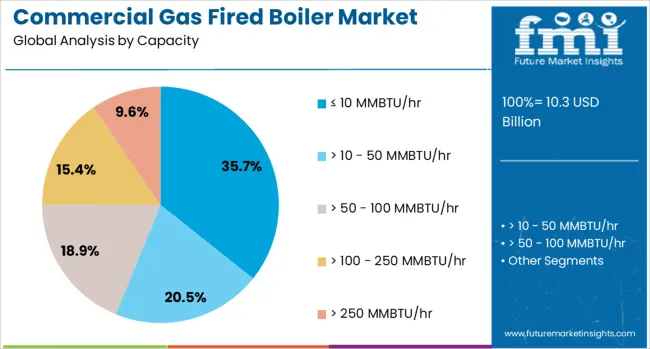

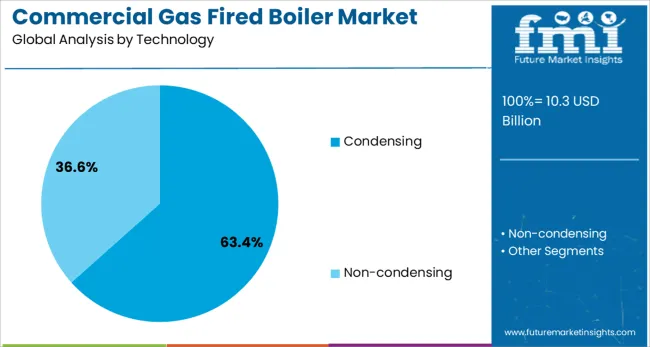

The commercial gas-fired boiler market is segmented by capacity, technology application, and geographic regions. By capacity, the commercial gas-fired boiler market is divided into ≤ 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, > 100 - 250 MMBTU/hr> 250 MMBTU/hr. In terms of technology of the commercial gas-fired boiler market is classified into CondensingNon-condensing.

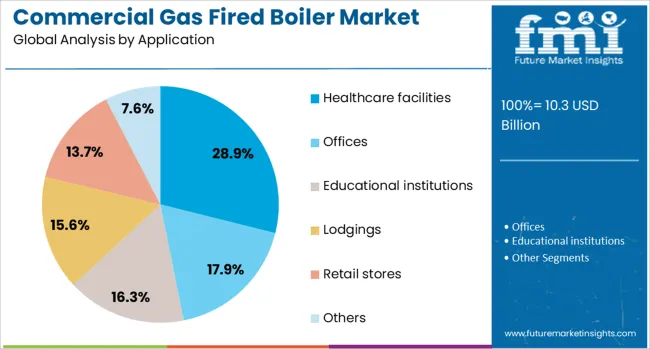

Based on application, the commercial gas-fired boiler market is segmented into Healthcare facilities, Offices, Educational institutions, Lodgings, Retail stores, and others. Regionally, the commercial gas-fired boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 10 MMBTU/hr capacity segment is projected to capture 35.7% of the market revenue share in 2025, maintaining its lead as the largest capacity segment. This prominence is being attributed to its suitability for a broad range of small to medium-sized commercial facilities where space and energy requirements are moderate.

Industry publications and product specifications have indicated that this capacity range offers optimal operational efficiency and cost effectiveness for localized heating needs. Additionally, it has been observed that ease of installation, lower upfront investment, and the ability to meet stringent efficiency standards have further supported its preference in commercial settings.

Investor briefings and corporate updates have also highlighted that the segment’s widespread adoption is facilitated by its flexibility in retrofitting older buildings and compatibility with advanced control systems. These characteristics have collectively ensured its dominant position in the market by addressing both performance and compliance demands.

The condensing technology segment is anticipated to hold 63.4% of the market revenue share in 2025, establishing itself as the leading technology segment. This leadership has been driven by its superior thermal efficiency and ability to recover latent heat from exhaust gases, significantly reducing energy consumption and emissions.

Technical whitepapers and industry updates have reported that condensing boilers align with increasingly strict environmental regulations and help lower operating costs, making them an attractive choice for commercial facilities. Further, company announcements have underscored that innovations in heat exchanger designs and control mechanisms have enhanced reliability and extended equipment lifespan in this segment.

The segment’s growth has also been supported by rising awareness of lifecycle savings and the availability of government rebates for high-efficiency installations. These factors have reinforced condensing technology’s leadership by meeting customer expectations for both sustainability and economic performance.

The healthcare facilities application segment is expected to contribute 28.9% of the Commercial Gas Fired Boiler market revenue share in 2025, making it the leading application segment. This leadership is being supported by the critical need for reliable and continuous heating solutions in hospitals, clinics, and long term care facilities.

Industry communications and press releases have highlighted that healthcare environments demand high indoor air quality, consistent temperatures, and compliance with strict energy codes, which gas fired boilers are well positioned to deliver. Further, it has been observed that the segment benefits from ongoing construction and modernization of healthcare infrastructure aimed at enhancing patient comfort and operational efficiency.

Corporate presentations have also indicated that the preference for low emission, high efficiency systems in sensitive healthcare environments has accelerated adoption. These drivers have positioned healthcare facilities at the forefront of market demand by combining operational reliability, regulatory compliance, and energy cost savings.

The commercial gas fired boiler market is experiencing steady growth as businesses and institutions seek efficient, reliable heating solutions with lower emissions. These boilers are widely used in commercial buildings such as offices, schools, hospitals, and hotels for space heating and hot water supply. Increasing urban development and stringent regulations targeting reduction of carbon emissions drive demand. North America and Europe are key markets due to regulatory focus on cleaner energy, while Asia-Pacific presents significant growth opportunities fueled by expanding commercial infrastructure and energy modernization initiatives.

Commercial gas fired boilers vary in design such as condensing and non-condensing models affecting fuel efficiency and emission levels. Condensing boilers recover heat from exhaust gases, achieving higher efficiency compared to traditional units. Variations in boiler capacity and control systems cater to diverse building sizes and heating demands. Advances in burner technology enhance combustion efficiency and reduce nitrogen oxide emissions. Fuel quality and supply stability also impact operational performance. Manufacturers offering boilers tailored to regional fuel standards and climate conditions provide competitive advantages. Proper sizing and system integration are essential to maximize efficiency and operational lifespan.

Increasing energy costs and environmental regulations motivate commercial users to adopt gas fired boilers with superior efficiency and lower pollutant output. Programs promoting energy audits and green certifications encourage upgrades or replacements with condensing boilers and advanced control systems. Enhanced thermal insulation and smart thermostatic controls contribute to overall system efficiency. Integration with building automation systems enables optimized heating schedules and reduced fuel consumption. These developments support operational cost savings and compliance with emission limits, aligning with corporate sustainability goals and governmental policies targeting carbon footprint reduction.

Commercial gas fired boiler installation involves considerations such as space availability, venting requirements, and compliance with local building codes. Retrofitting existing systems may require upgrades to flue gas exhaust and fuel supply infrastructure. Regular maintenance, including burner tuning, heat exchanger cleaning, and safety inspections, is critical to maintain efficiency and prevent breakdowns. Skilled technicians and access to certified spare parts influence operational reliability. Equipment downtime during servicing impacts commercial operations, increasing demand for rapid response services and remote diagnostics. Manufacturers offering comprehensive maintenance contracts, training, and technical support improve customer satisfaction and system longevity.

Strict regulations governing emissions, fuel quality, and safety standards impact product design and market accessibility. Certifications from recognized bodies, such as UL, CE, and local environmental agencies, are often mandatory. Compliance with evolving policies on greenhouse gas reduction and air quality requires continuous product innovation and documentation. Variability in regional regulations necessitates tailored product offerings and marketing strategies. High initial capital investment and complex approval processes may deter smaller manufacturers from entering the market.

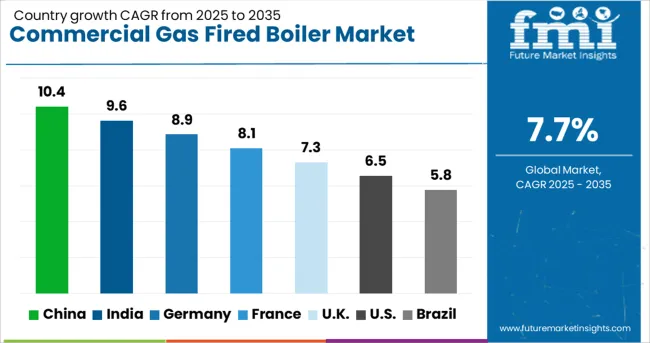

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

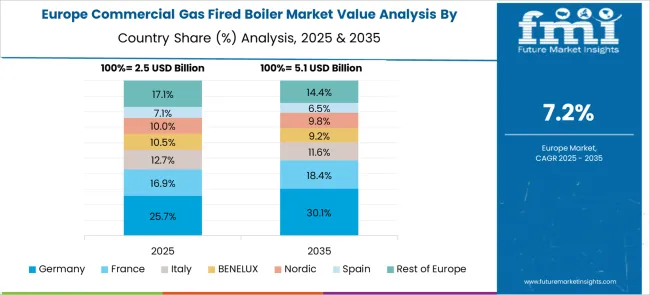

The global commercial gas fired boiler market is expanding at a 7.7% CAGR, driven by rising demand for efficient heating solutions in commercial buildings. Among BRICS nations, China leads with 10.4% growth, supported by large-scale construction and modernization activities. India follows at 9.6%, fueled by growing commercial infrastructure and energy needs. In the OECD region, Germany records 8.9% growth, reflecting strict emissions regulations and focus on energy efficiency. The United Kingdom grows at 7.3%, driven by replacement of aging heating systems. The United States, a mature market, shows 6.5% growth, shaped by regulatory standards and demand for reliable boiler systems. These countries collectively influence market trends through production capacity, regulatory oversight, and commercial heating demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

The commercial gas fired boiler market in China is expanding rapidly with a 10.4% growth rate, driven by rising demand for energy efficient heating solutions in commercial buildings. Compared to India, China benefits from strong government support for cleaner energy sources and strict environmental regulations, which accelerate adoption of gas fired boilers. The market sees increasing investments in upgrading old heating infrastructure to reduce emissions. Manufacturers in China are focusing on producing boilers with enhanced fuel efficiency and lower maintenance costs to meet growing commercial sector needs. Expansion in hospitality, office spaces, and retail complexes is boosting demand for reliable heating systems.

The market for commercial gas fired boilers in India is growing at 9.6%, fueled by rising commercial infrastructure and increasing awareness of energy efficient heating options. Compared to Germany, India faces challenges such as inconsistent gas supply but benefits from growing industrialization and urban development. The government encourages cleaner fuels to reduce pollution in major cities, boosting interest in gas fired boilers. Local manufacturers are developing cost-effective products tailored for Indian conditions. The hospitality and healthcare sectors are notable contributors to the market expansion.

Growth in the commercial gas fired boiler market in Germany stands at 8.9%, supported by strict environmental regulations and demand for energy saving solutions. Compared to the United Kingdom, Germany emphasizes high efficiency and low emission boilers for commercial use. Market growth is propelled by retrofitting older buildings and expanding new commercial projects that require advanced heating systems. Manufacturers focus on integrating digital controls to optimize boiler operation. The hospitality industry and office buildings remain key sectors for commercial boiler installations.

The commercial gas fired boiler market in the United Kingdom is growing steadily at 7.3%, driven by increasing regulatory pressure on emissions and a focus on energy cost reduction. Compared to the United States, the UK market prioritizes cleaner heating technologies and smart energy management solutions. Demand is boosted by upgrades in commercial properties and new constructions adopting modern boilers. Energy service companies offer maintenance and upgrade packages to improve system performance. The retail and education sectors are prominent users of gas fired boilers.

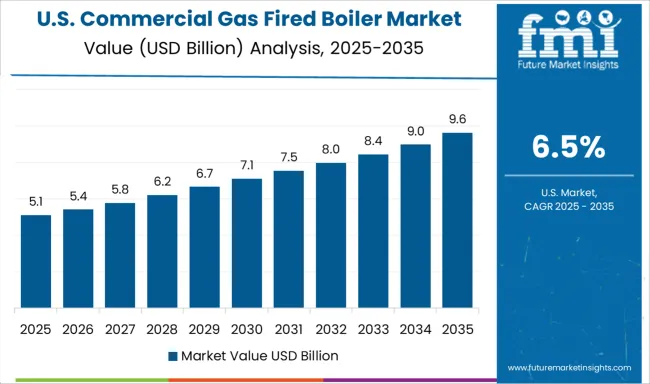

The United States commercial gas fired boiler market is expanding at 6.5%, driven by ongoing modernization in commercial heating systems. Compared to China, growth is more gradual due to a diversified energy mix and varying regional regulations. There is rising interest in boilers that offer high efficiency and easy integration with building automation systems. Commercial sectors such as healthcare, hospitality, and education are increasing their adoption of gas fired boilers to reduce energy costs. Manufacturers provide a wide range of models to meet diverse operational needs.

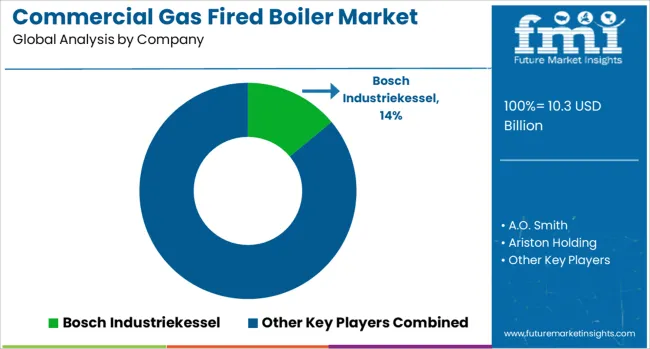

The commercial gas fired boiler market features a blend of global and regional manufacturers known for delivering efficient, reliable, and environmentally conscious heating solutions for commercial and industrial applications. Bosch Industriekessel and A.O. Smith are prominent players offering technologically advanced boilers that emphasize energy efficiency and compliance with stringent emissions regulations. Ariston Holding and BDR Thermea Group focus on innovation in compact, modular boiler designs that simplify installation and maintenance, catering to diverse building types. Babcock & Wilcox Enterprises and Cleaver-Brooks specialize in large-scale, custom-engineered boiler systems designed for heavy industrial use and power generation, ensuring high performance under demanding conditions.

Bradford White Corporation and Burnham Commercial Boilers provide durable and cost-effective solutions tailored for commercial buildings and institutional facilities. Daikin, Ferroli, Fondital, and Hoval emphasize integrated heating systems that incorporate advanced controls and eco-friendly technologies, appealing to sustainability-conscious customers. Immergas, Lochinvar, Remeha, Vaillant Group, Viessmann, and Weil-McLain round out the competitive landscape with a wide range of boilers offering varying capacities and efficiencies, supported by strong service networks. The market competition hinges on innovation in fuel efficiency, emissions reduction, and digital integration, responding to the growing demand for sustainable heating solutions in commercial infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Capacity | ≤ 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, > 100 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Technology | Condensing and Non-condensing |

| Application | Healthcare facilities, Offices, Educational institutions, Lodgings, Retail stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Industriekessel, A.O. Smith, Ariston Holding, Babcock & Wilcox Enterprises, BDR Thermea Group, Bradford White Corporation, BURNHAM COMMERCIAL BOILERS, Cleaver-Brooks, Daikin, FERROLI, FONDITAL, Hoval, Immergas, Lochinvar, Remeha, Vaillant Group, VIESSMANN, and Weil-McLain |

| Additional Attributes | Dollar sales in the Commercial Gas Fired Boiler Market vary by type (condensing, non-condensing), application (commercial buildings, industrial facilities, hospitals), capacity (low, medium, high), and region (North America, Europe, Asia-Pacific). Growth is driven by increasing demand for energy-efficient heating solutions, strict emission regulations, and expanding commercial infrastructure. |

The global commercial gas-fired boiler market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the commercial gas-fired boiler market is projected to reach USD 21.7 billion by 2035.

The commercial gas-fired boiler market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in commercial gas-fired boiler market are ≤ 10 mmbtu/hr, > 10 - 50 mmbtu/hr, > 50 - 100 mmbtu/hr, > 100 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of technology, condensing segment to command 63.4% share in the commercial gas-fired boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA